A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

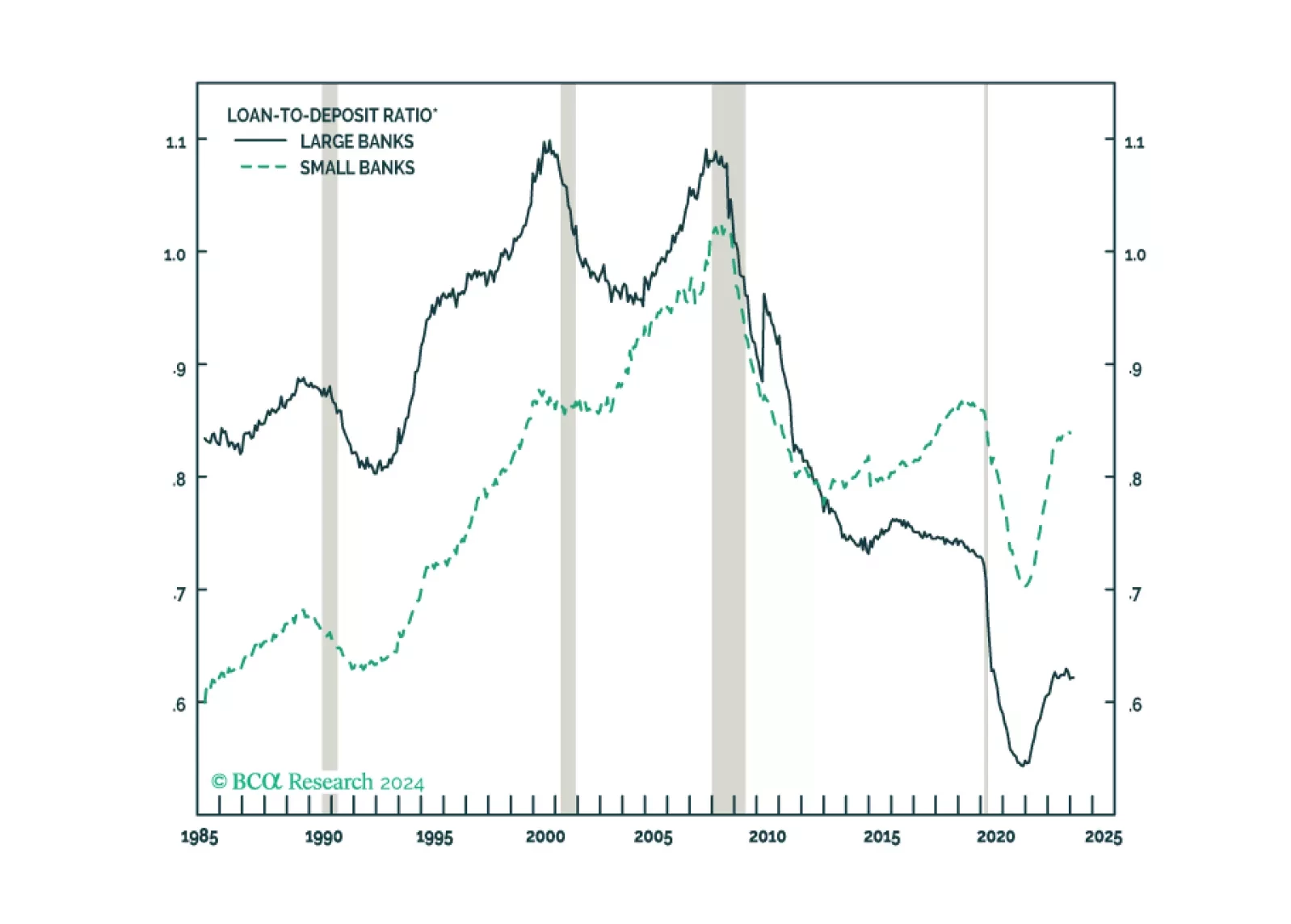

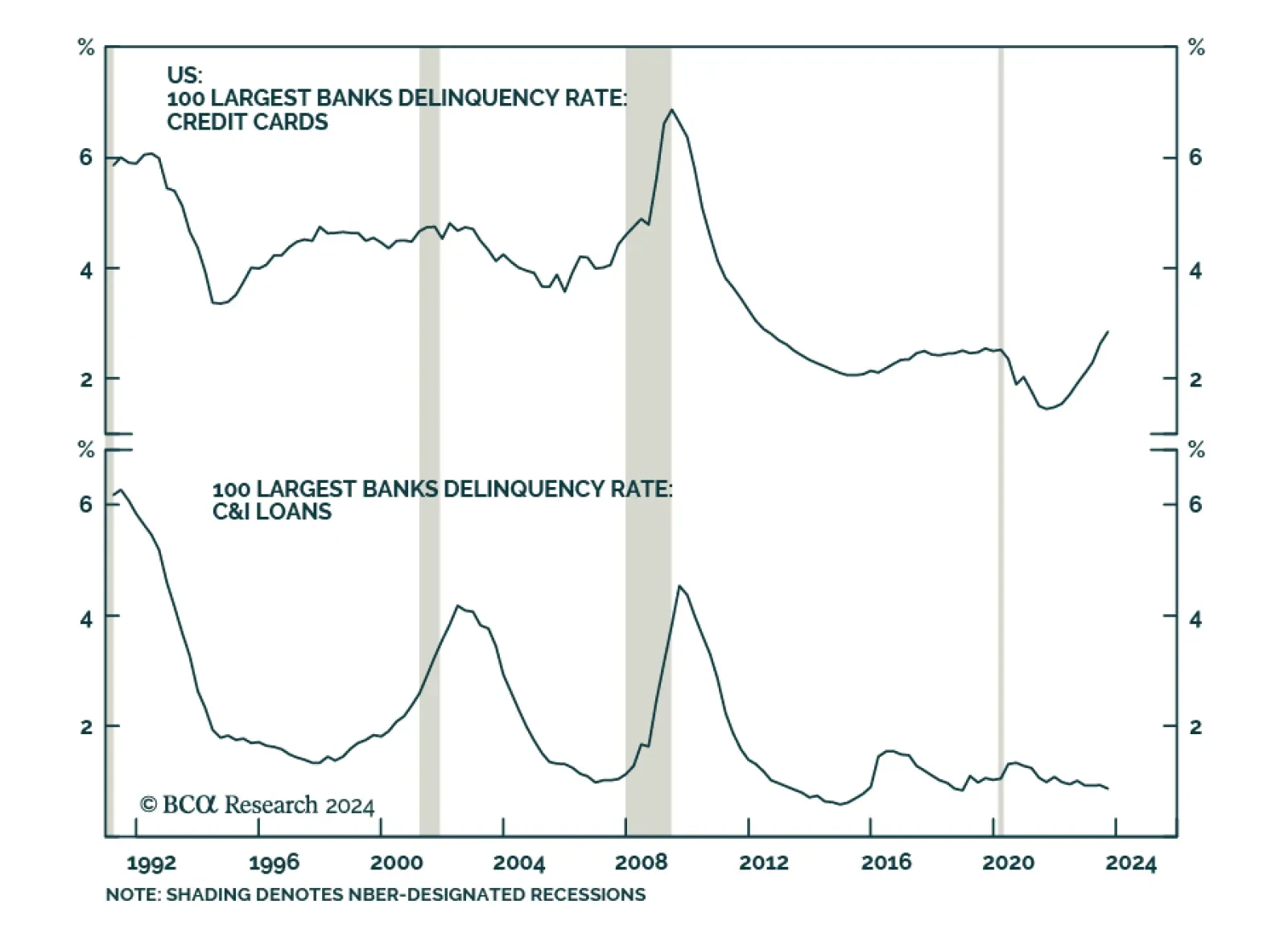

The SIFI banks (BAC, C, JPM and WFC) kicked off the fourth-quarter US reporting season on January 12th. As usual, our US Investment Strategists studied the SIFI’s earnings calls looking for macroeconomic insights from…

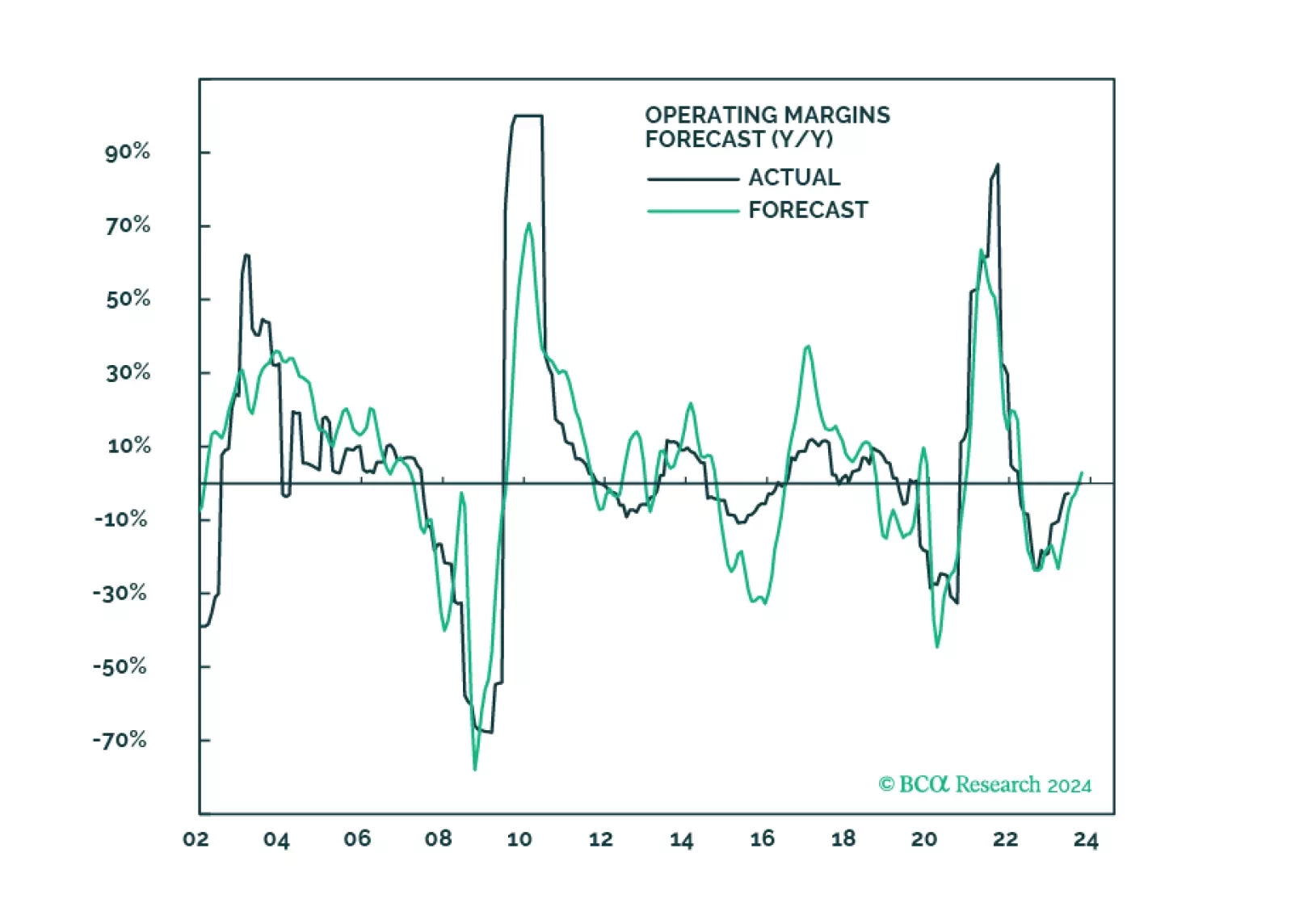

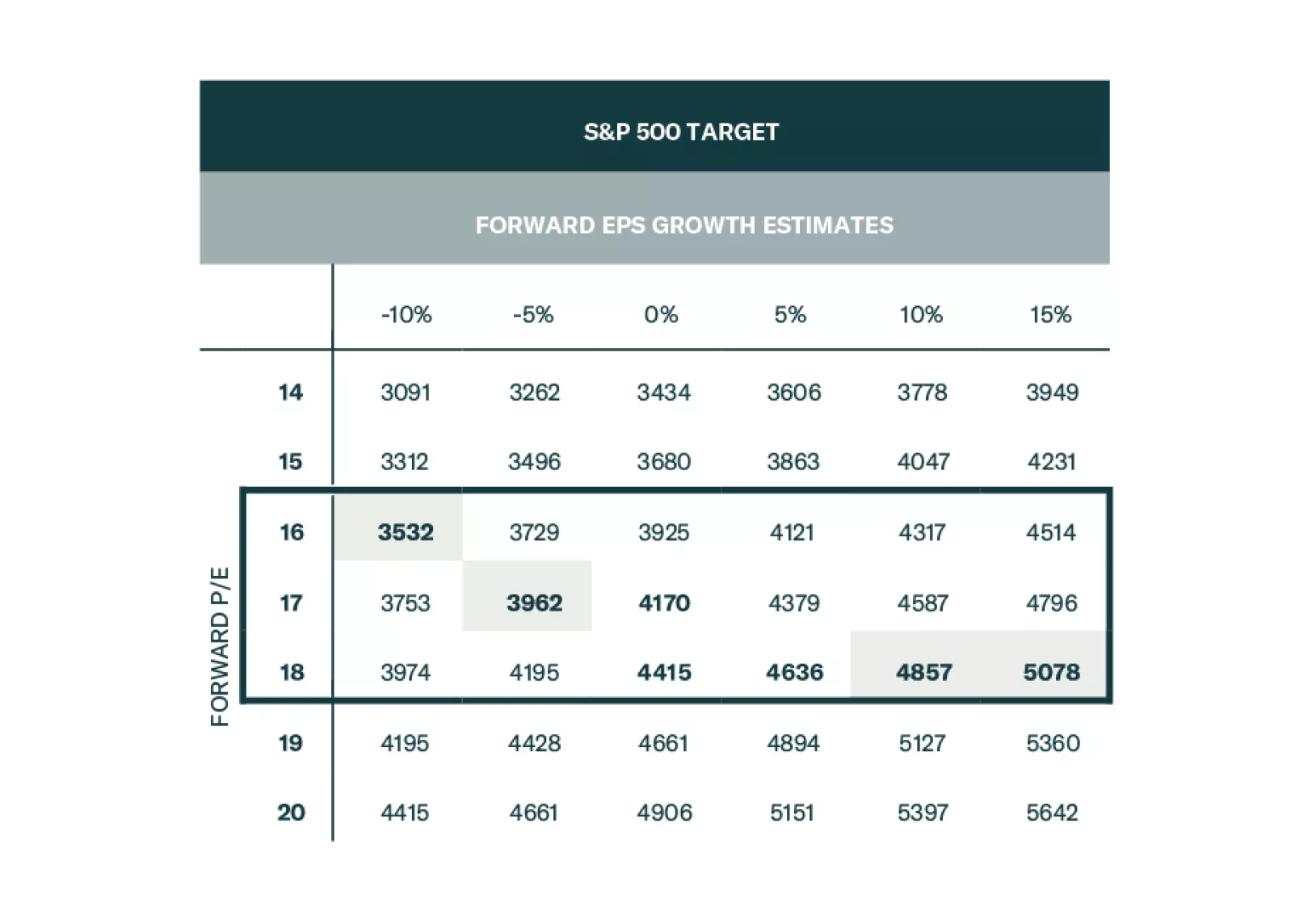

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

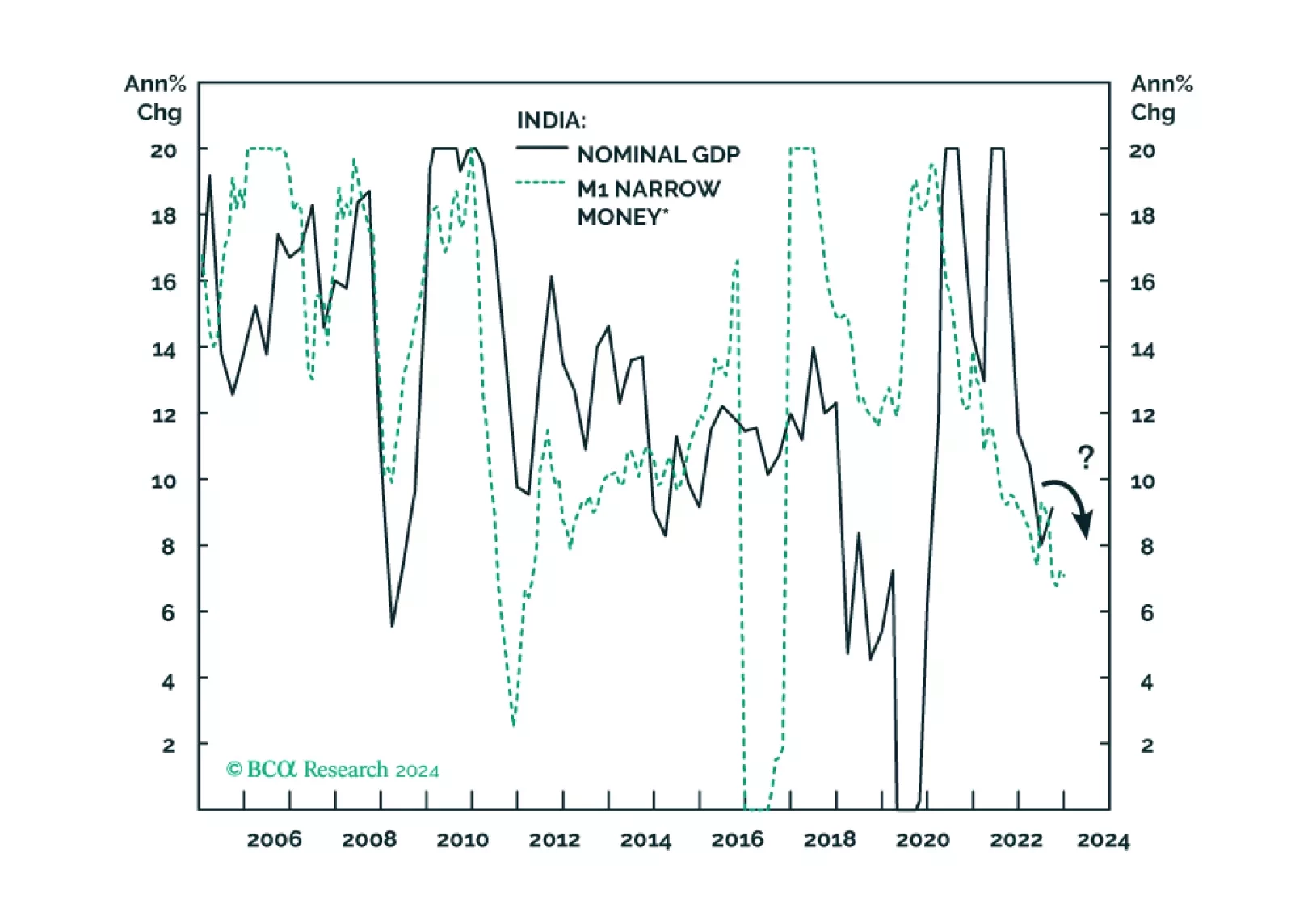

Decelerating nominal sales, a peaking credit cycle, and very high valuations - Indian stocks will not escape the carnage when risk assets globally begin to sell off.

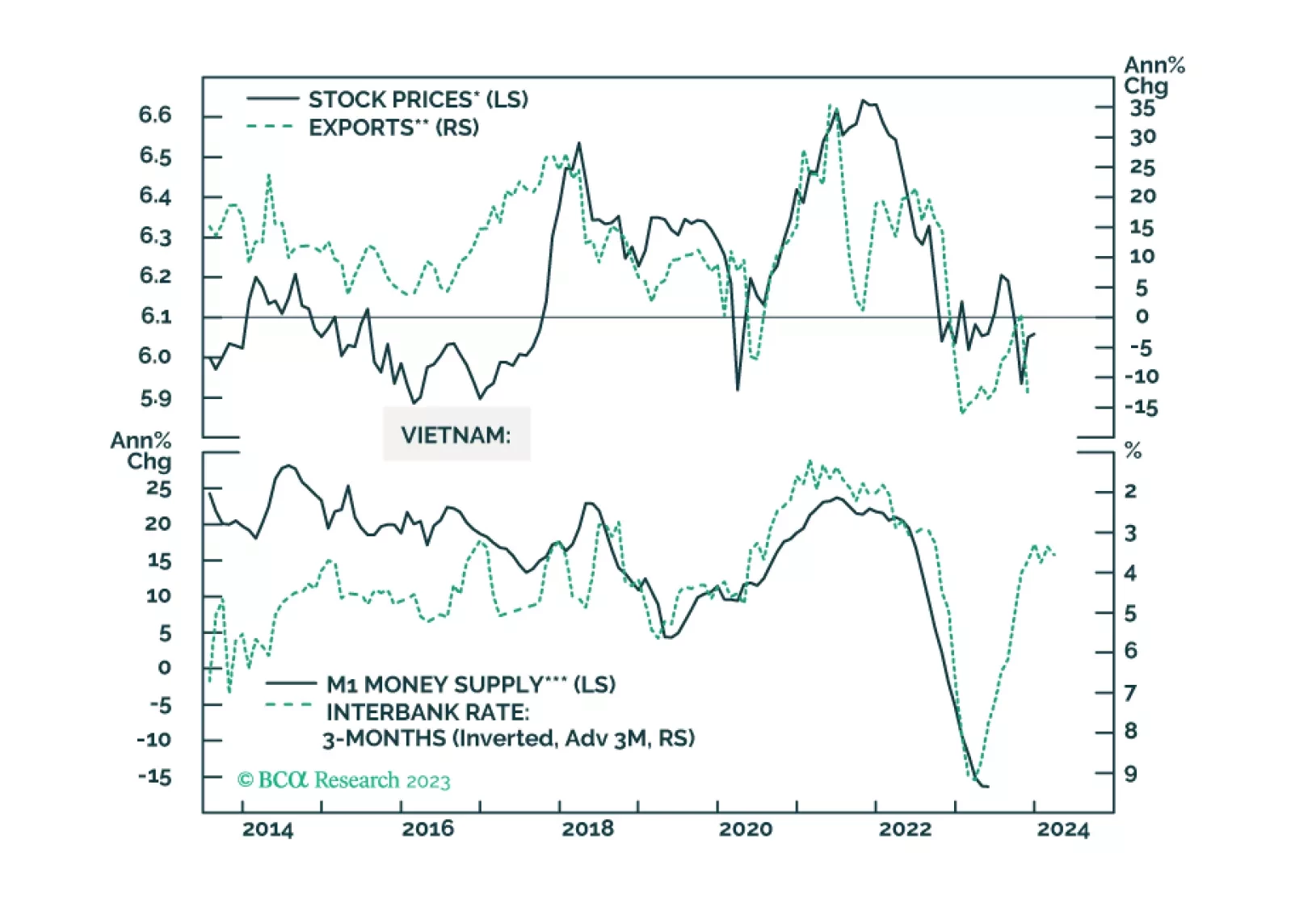

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

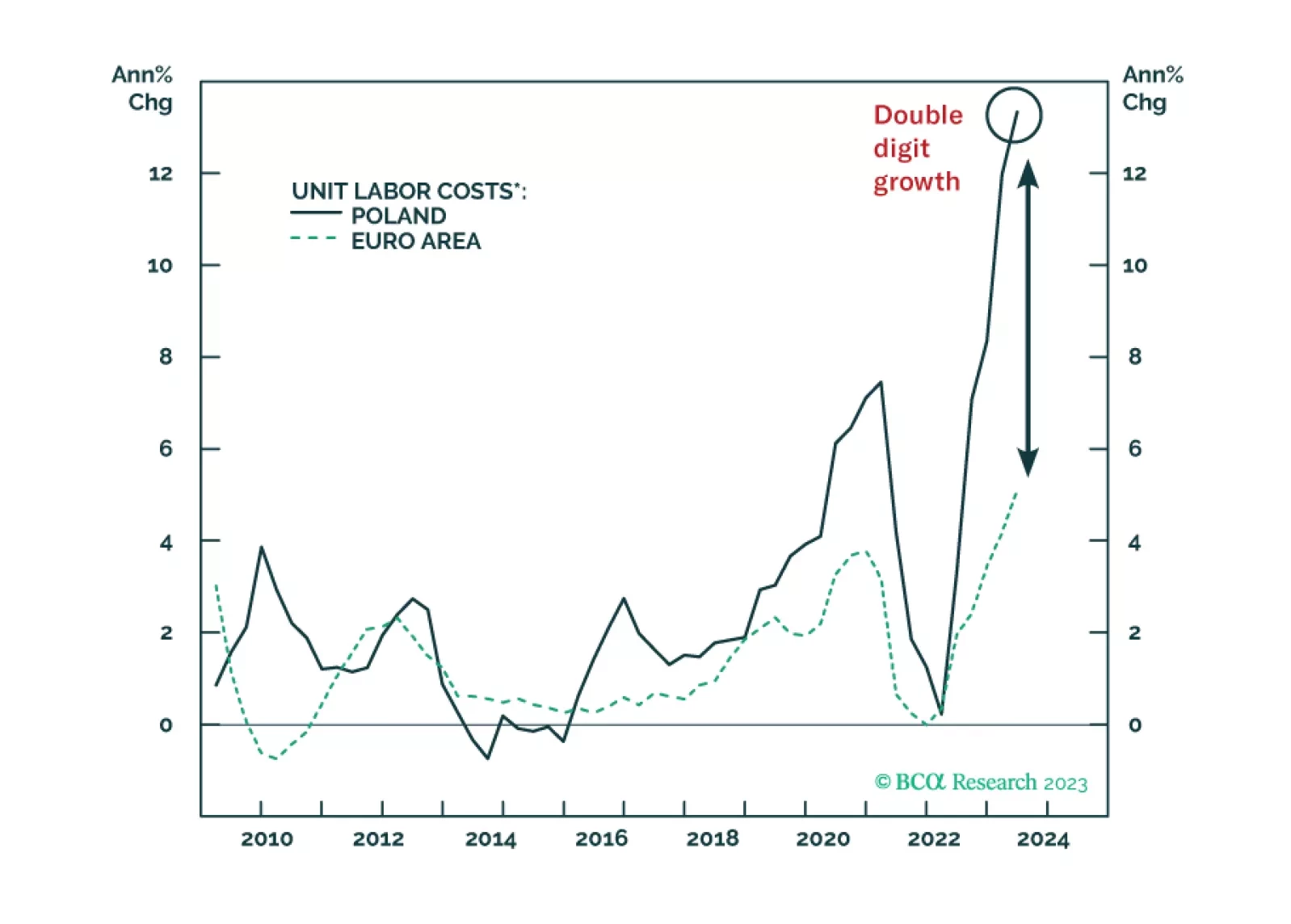

Poland’s inflation will stay elevated. And yet, its return to the European mainstream has improved its financial market outlook. Accordingly, we are recommending new trades on Polish equity, fixed income, and currency.

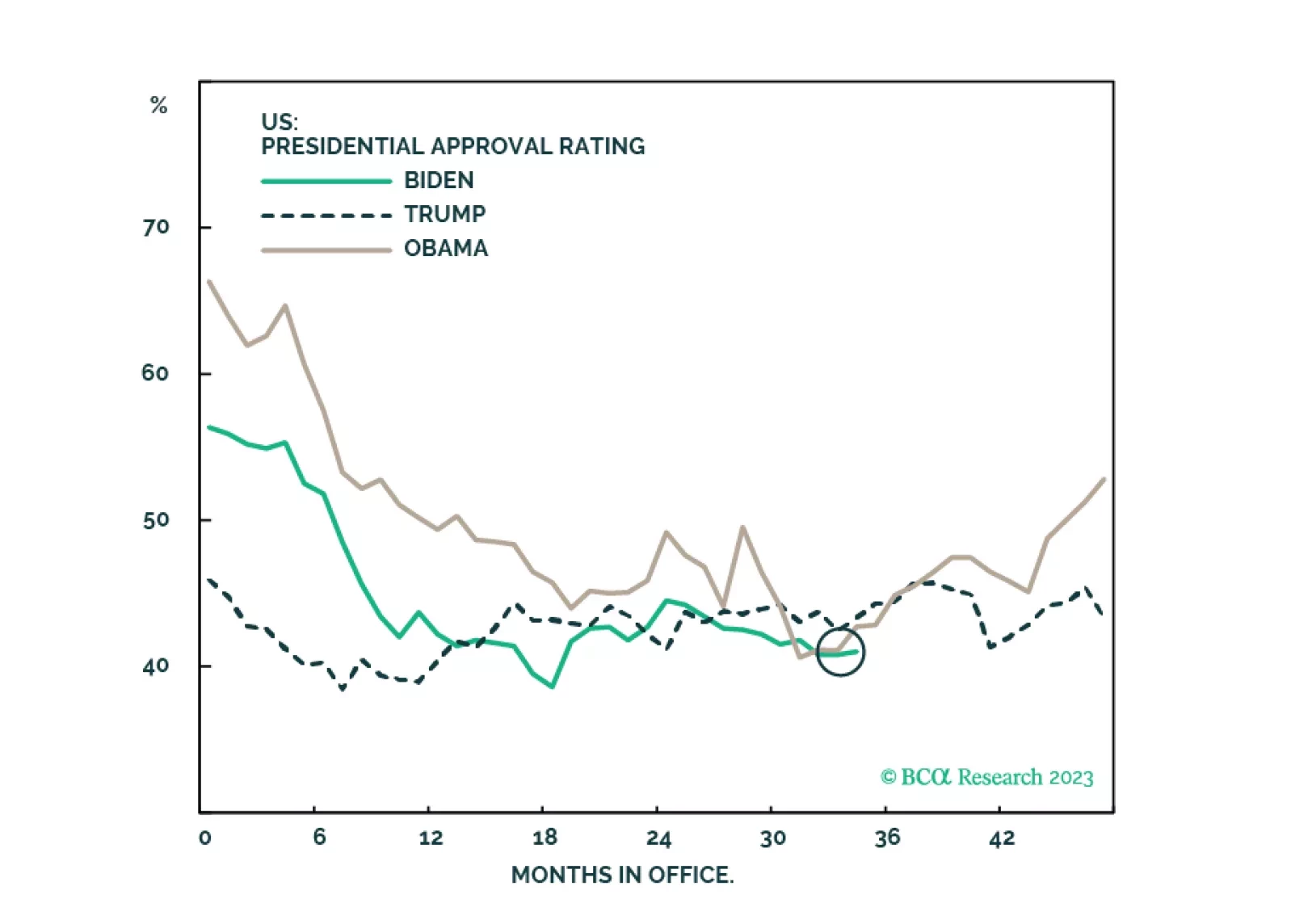

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…