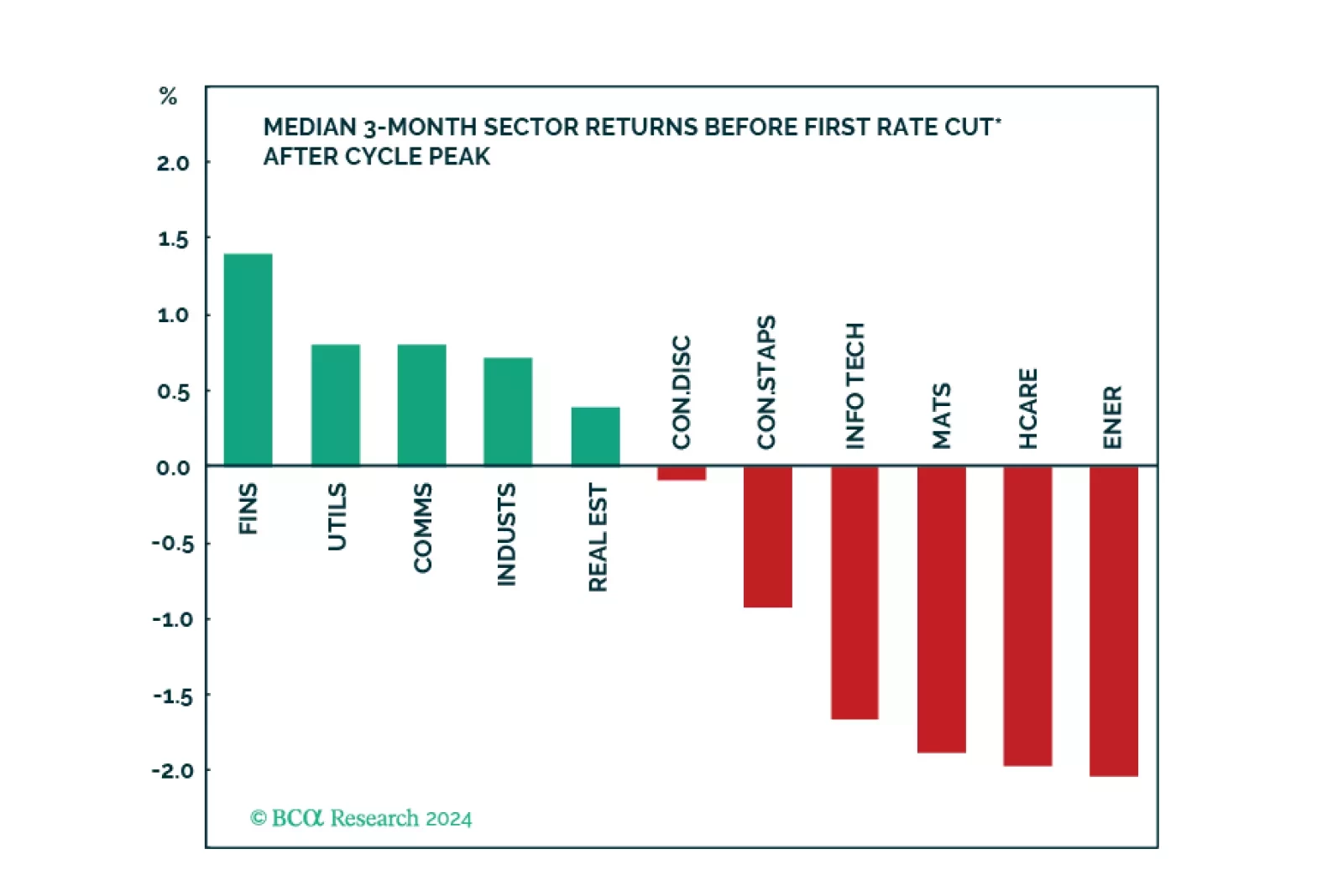

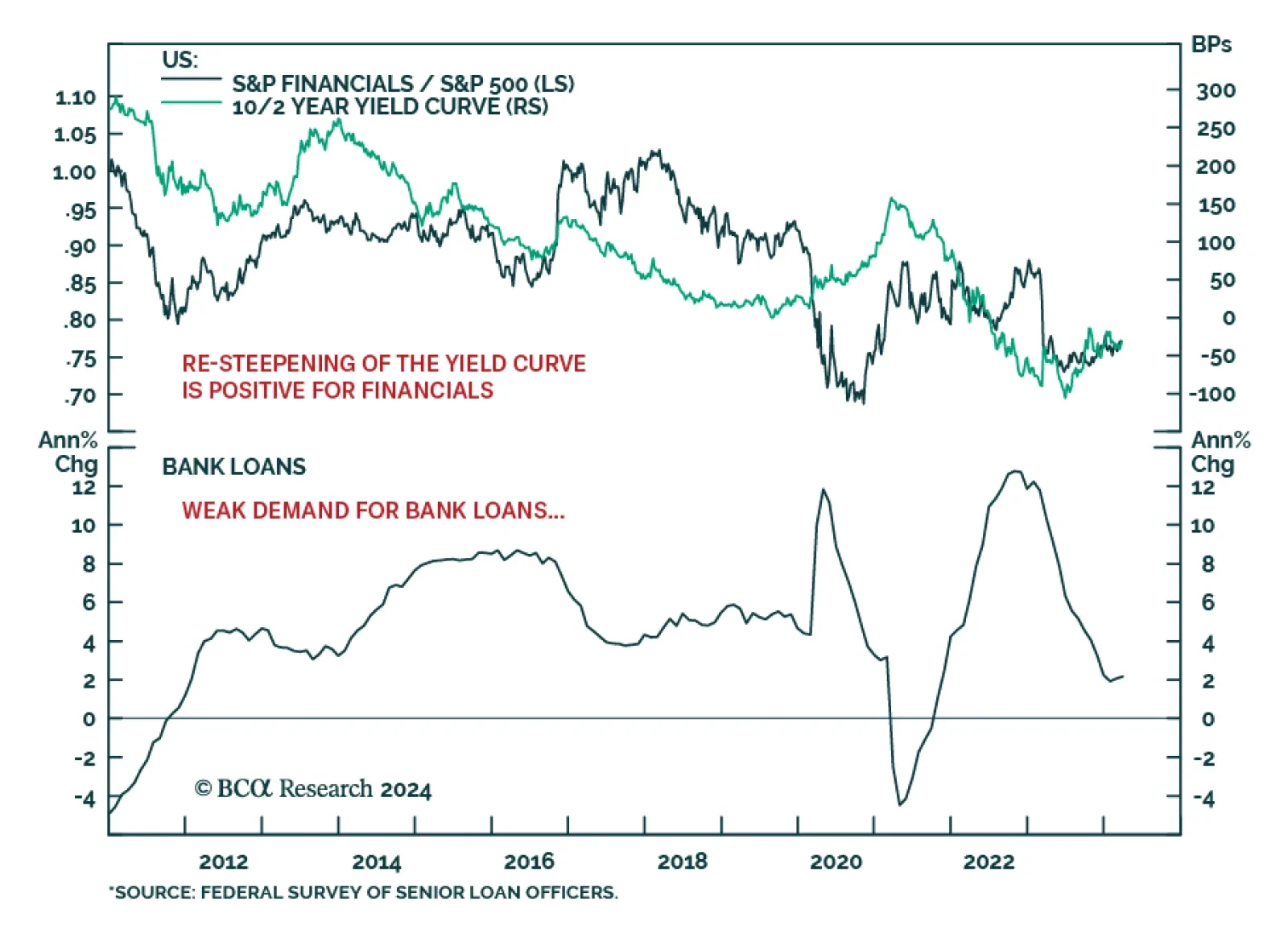

The steepening of the yield-curve powered the outperformance of the S&P 500 Financials relative to the overall market since the spring of 2023 banking crisis. This sector returned 30.1% over this period, against 27.3% for the…

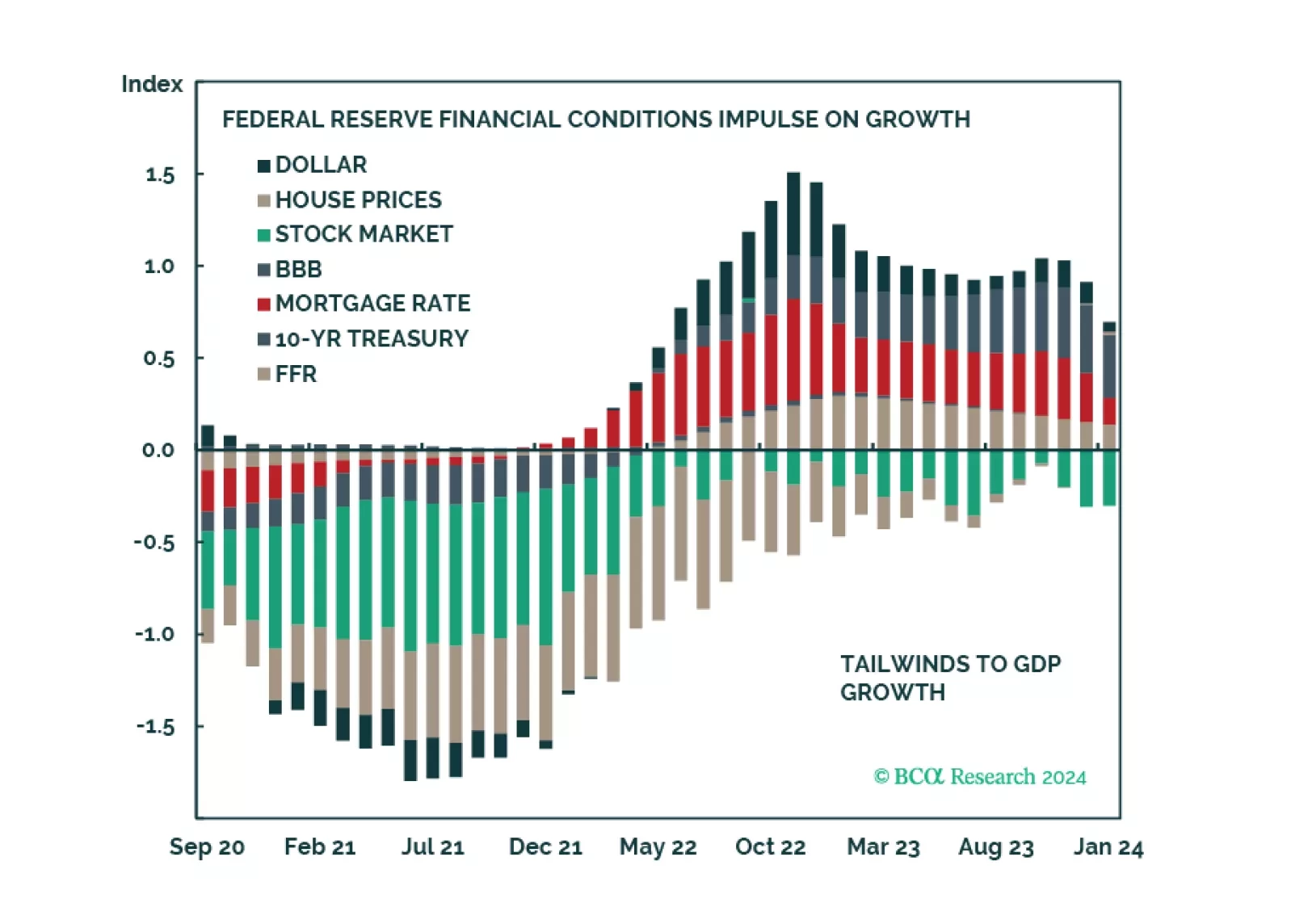

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

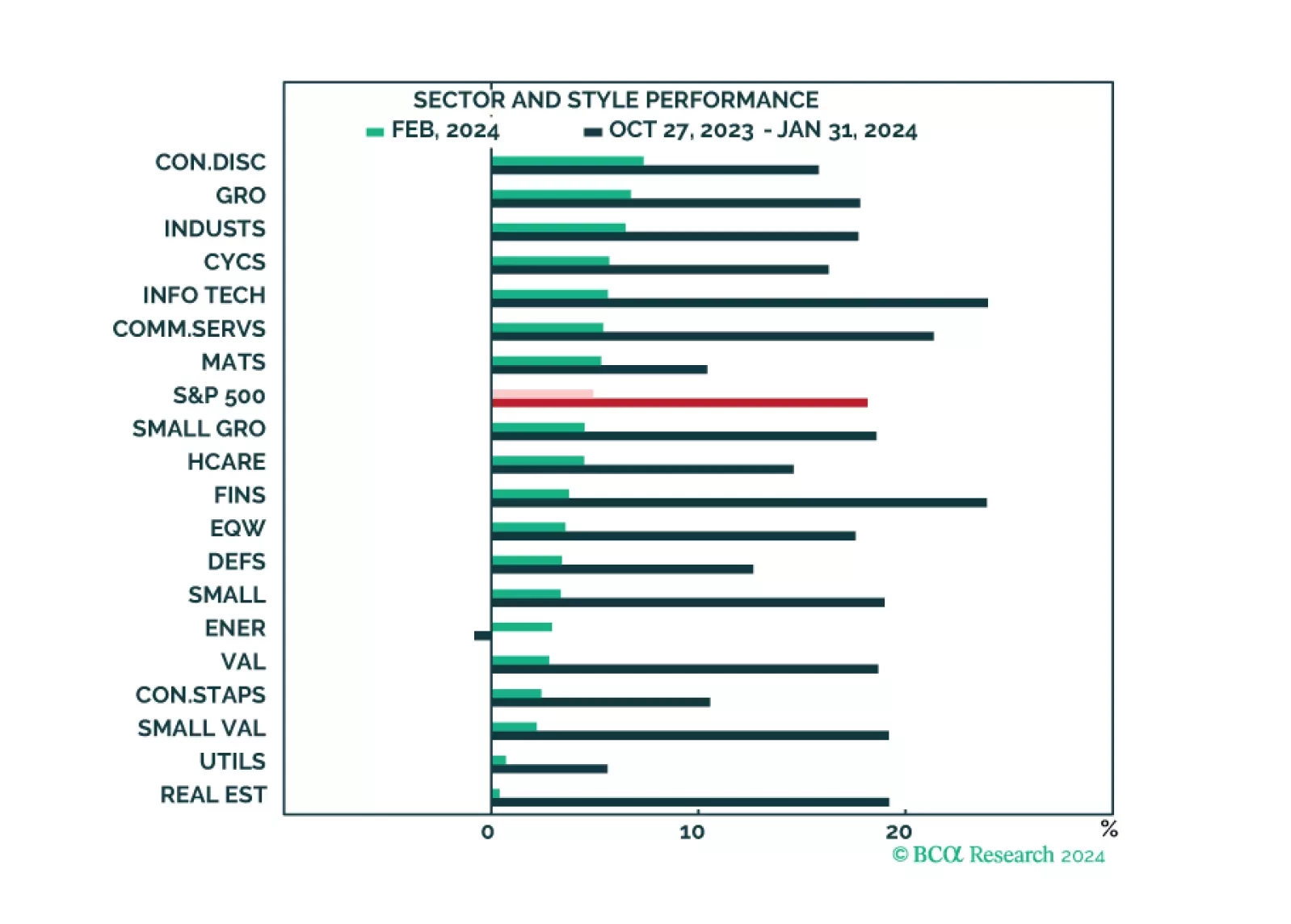

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

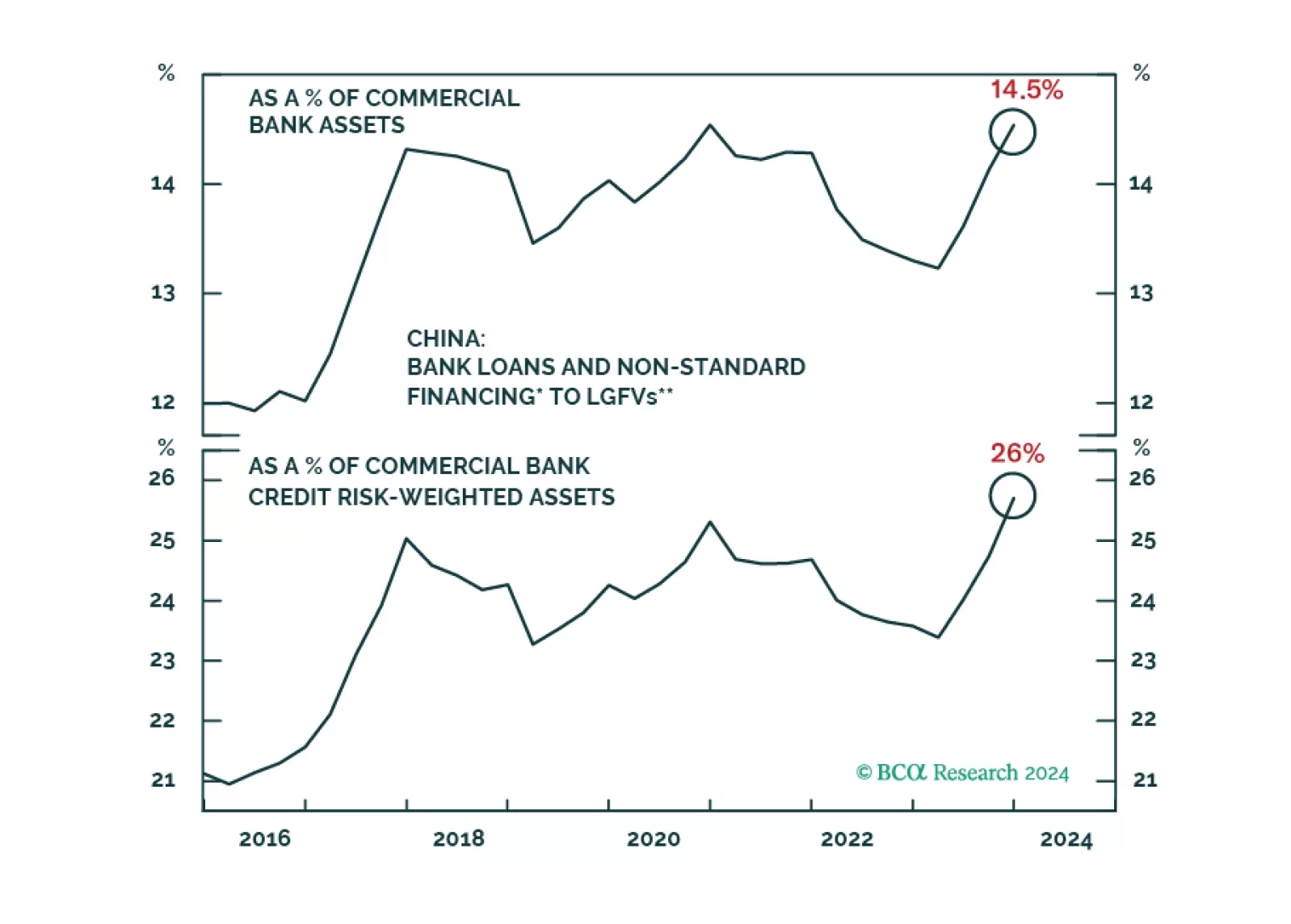

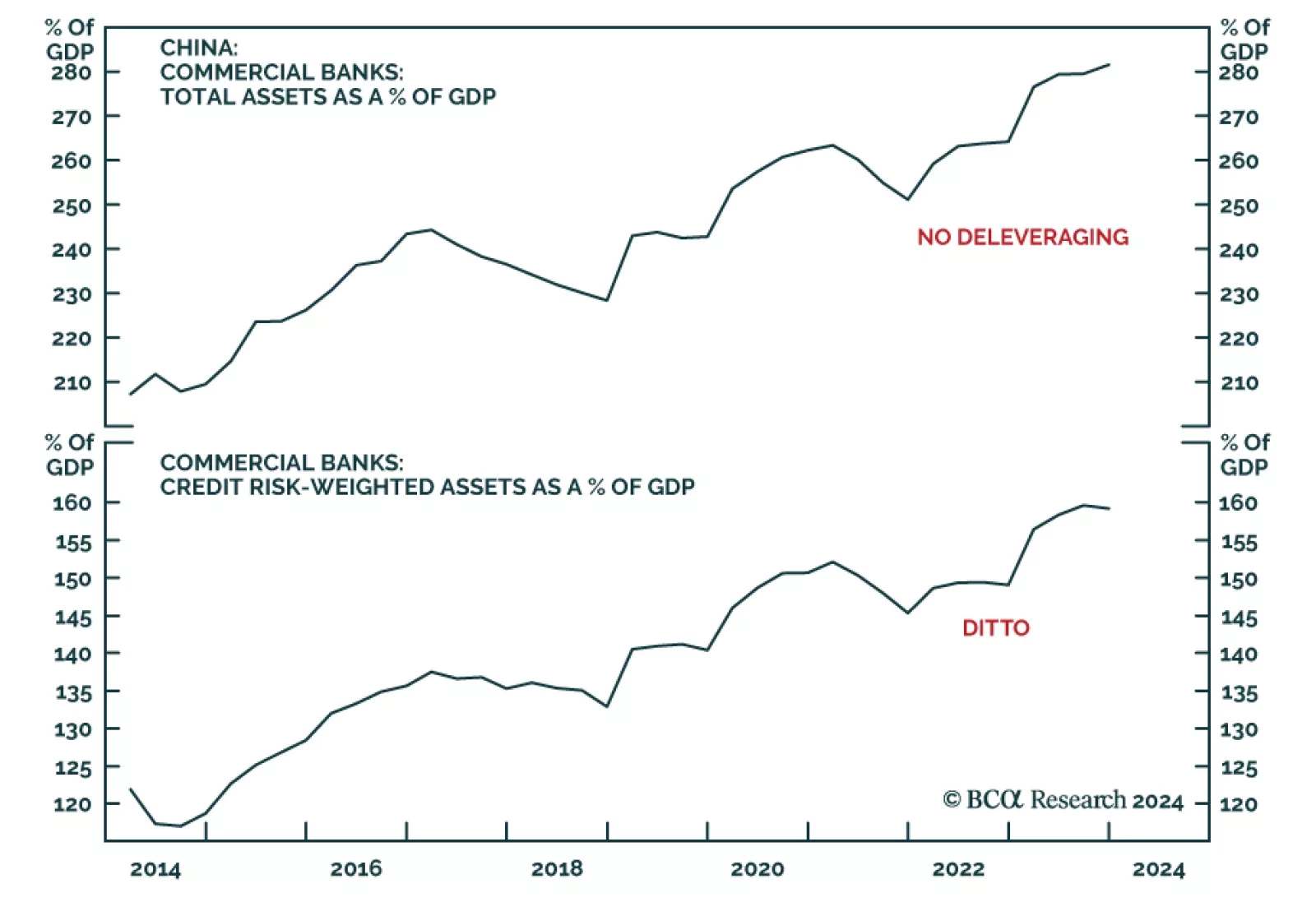

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

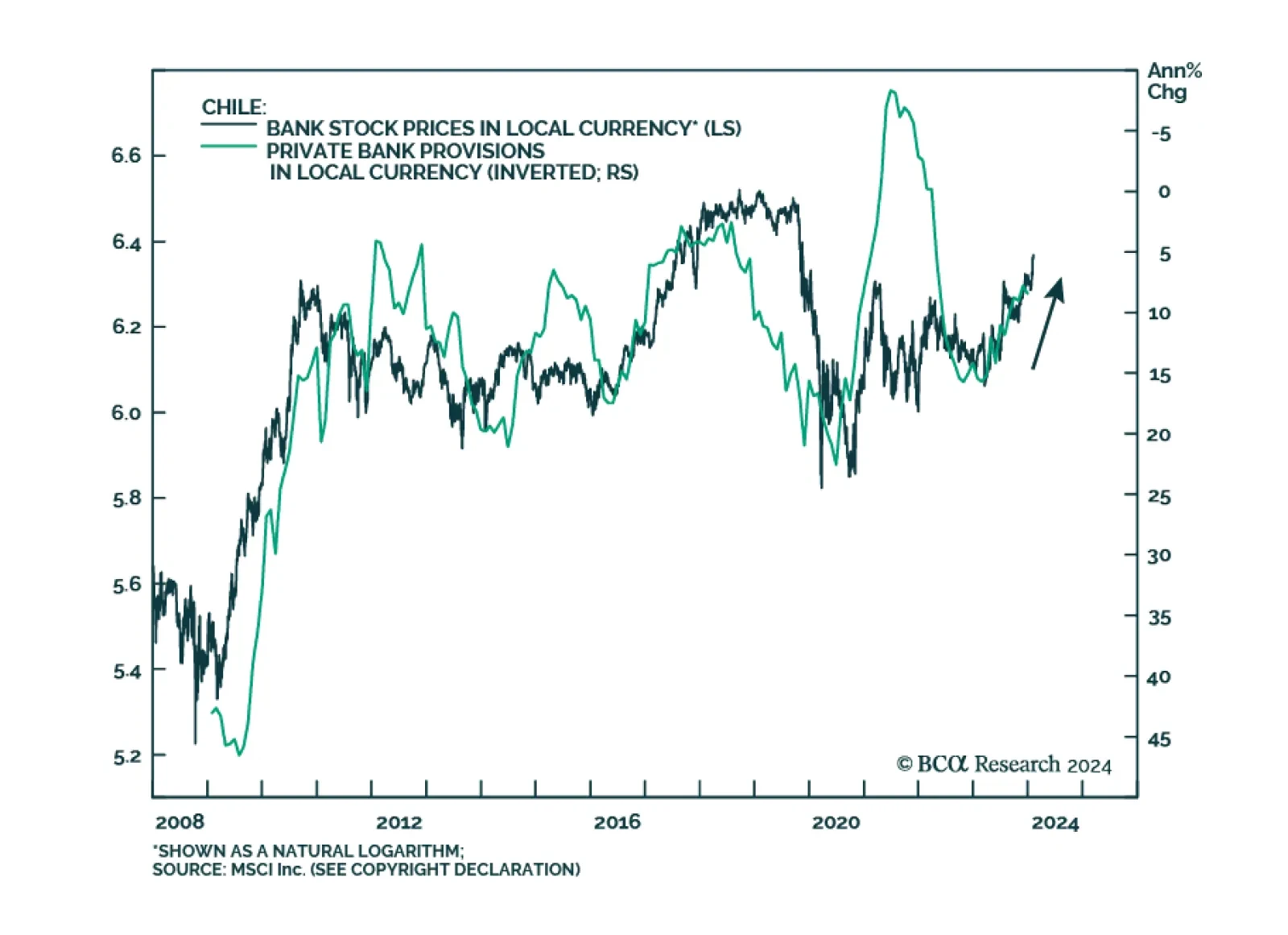

According to BCA Research’s Emerging Markets Strategy service, Chilean bank stocks offer great value and are poised to outperform the EM equity benchmark. Chilean bank share prices are well-positioned to outperform due…

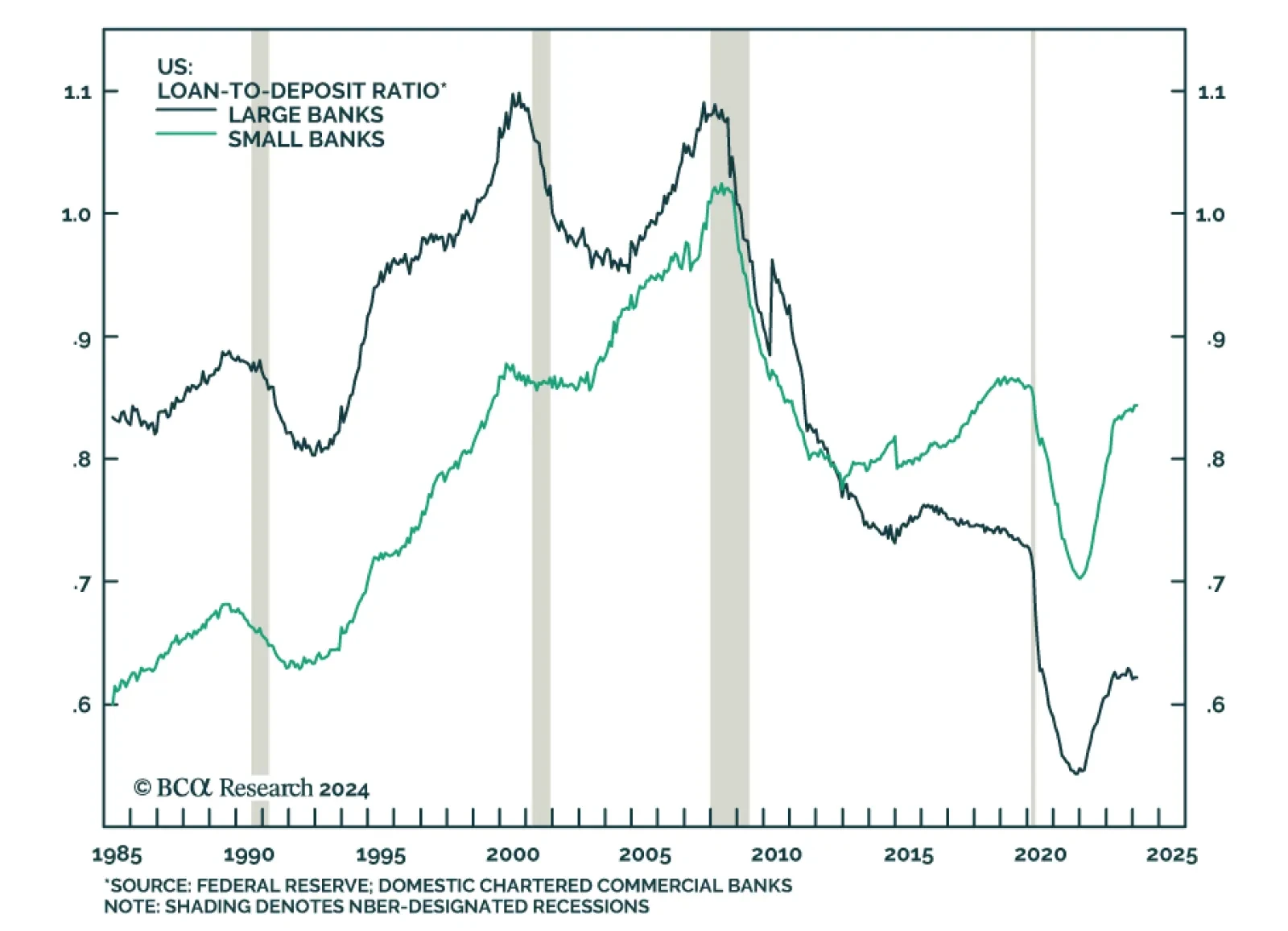

Banks were thrust back in the spotlight’s unflattering glare last week when mid-cap regional New York Community Bank shocked analysts and shareholders with an enormous credit loss. According to BCA Research’s US…