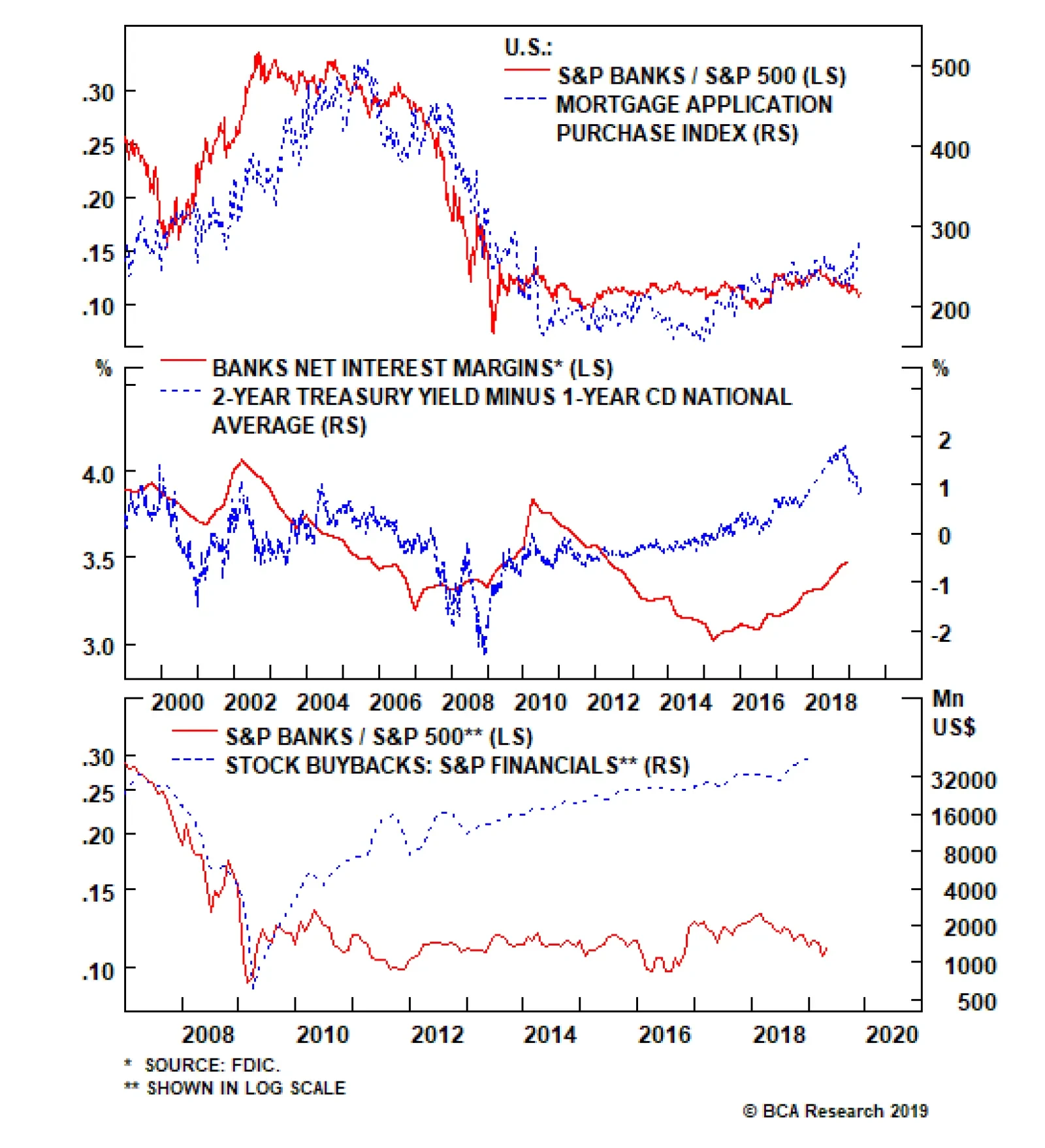

What partially explains the sector’s EPS resilience is net interest margins (NIMs) that just entered their fifth straight year of widening. While this may seem counterintuitive given the inverted/flattening yield curve,…

Highlights Portfolio Strategy Disney’s recent streaming pricing disclosure and a favorable macro backdrop for recreation PCE argue that more gains are in store for the S&P movies & entertainment index. The price of credit…

Highlights In China, “helicopter” money and the socialist put are positive for growth in the medium term but will prove harmful for the economy over the long run. In the socialist put scenario, a buy-and-hold strategy is…

Overweight This week and last have witnessed the cavalcade of U.S. banks reporting earnings. A headwind in this earnings season has been the transitory impacts of volatility, which was suppressed in Q1, on fixed income and equity…

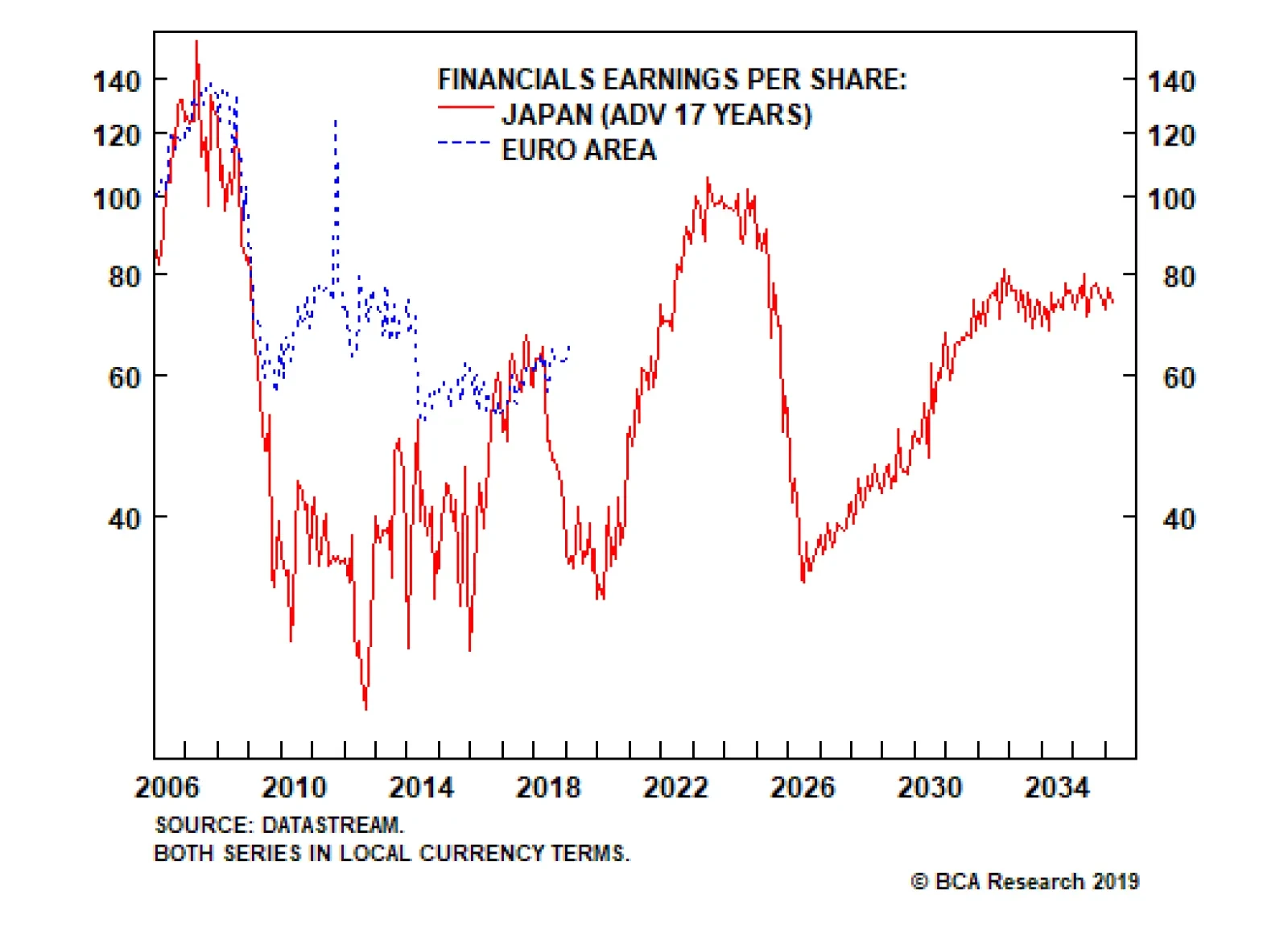

Japanese financial sector profits peaked in 1990 and stand at less than half that level today. Euro area financial sector profits peaked in 2007, and are tracking the Japanese experience with a 17-year lag. If euro area financial…

Highlights For the Eurostoxx50 to outperform the S&P500, the big euro area banks have to outperform the big U.S. tech stocks. Tactically overweight Eurostoxx50 versus S&P500 as well as other pro-cyclical positions such as…

Highlights Analysis on Indonesia is available below. EM financial markets have diverged from the global growth indicators they have historically correlated with. This raises doubts about the sustainability of this rally. In China,…

Highlights Stay tactically overweight to equities for the time being. Close the overweight to industrial commodities versus equities. The financials, basic resources, and industrials equity sectors can continue to outperform for a…