Foreign flows had put a solid bid under U.S. bonds and artificially suppressed yields and this is at the margin reversing. In addition, the market was hoping for a 50bps rate cut from the Fed in the September meeting further…

Highlights Portfolio Strategy Small cracks are forming in the labor market according to the ISM manufacturing, ISM services and NFIB surveys, and if the Fed goes ahead and cuts interest rates in half in the coming year as the bond…

Highlights The lingering global manufacturing recession and the substantial drop in U.S. bond yields have been behind the decoupling between both EM stocks and the S&P 500, and cyclical and defensive equities. Neither the most…

Underweight While insurers have enjoyed a knee jerk rally recently, relative share prices remain in a downtrend, and we recommend fading this run-up. House and auto sales have been in contraction for nearly a year, which…

Highlights Analysis on Brazil is available below. If banks in China are forced by regulators to properly recognize and provision for non-performing assets, large banks would become substantially undercapitalized while many small- and…

Highlights The onset of a down-oscillation in growth strongly suggests a rotation out of the growth-sensitive Industrials and Materials into the relatively defensive Healthcare sector. But if the sharpest move in bond yields has…

Highlights The Chinese economy slowed in May following two months of improvement, but the June PMI data suggests that the pace of decline is moderating. Still, the economy remains highly vulnerable in a full-tariff scenario. This…

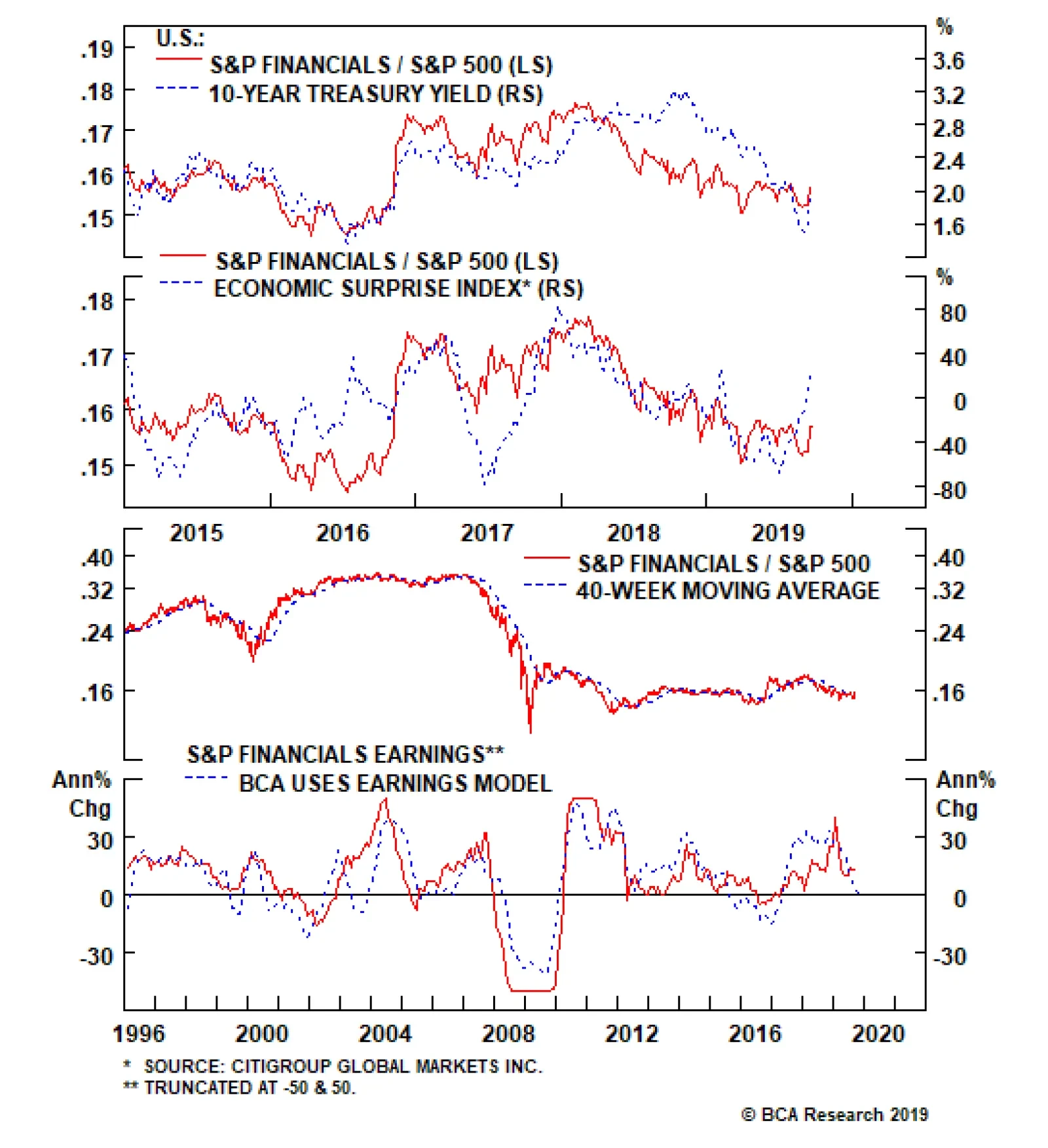

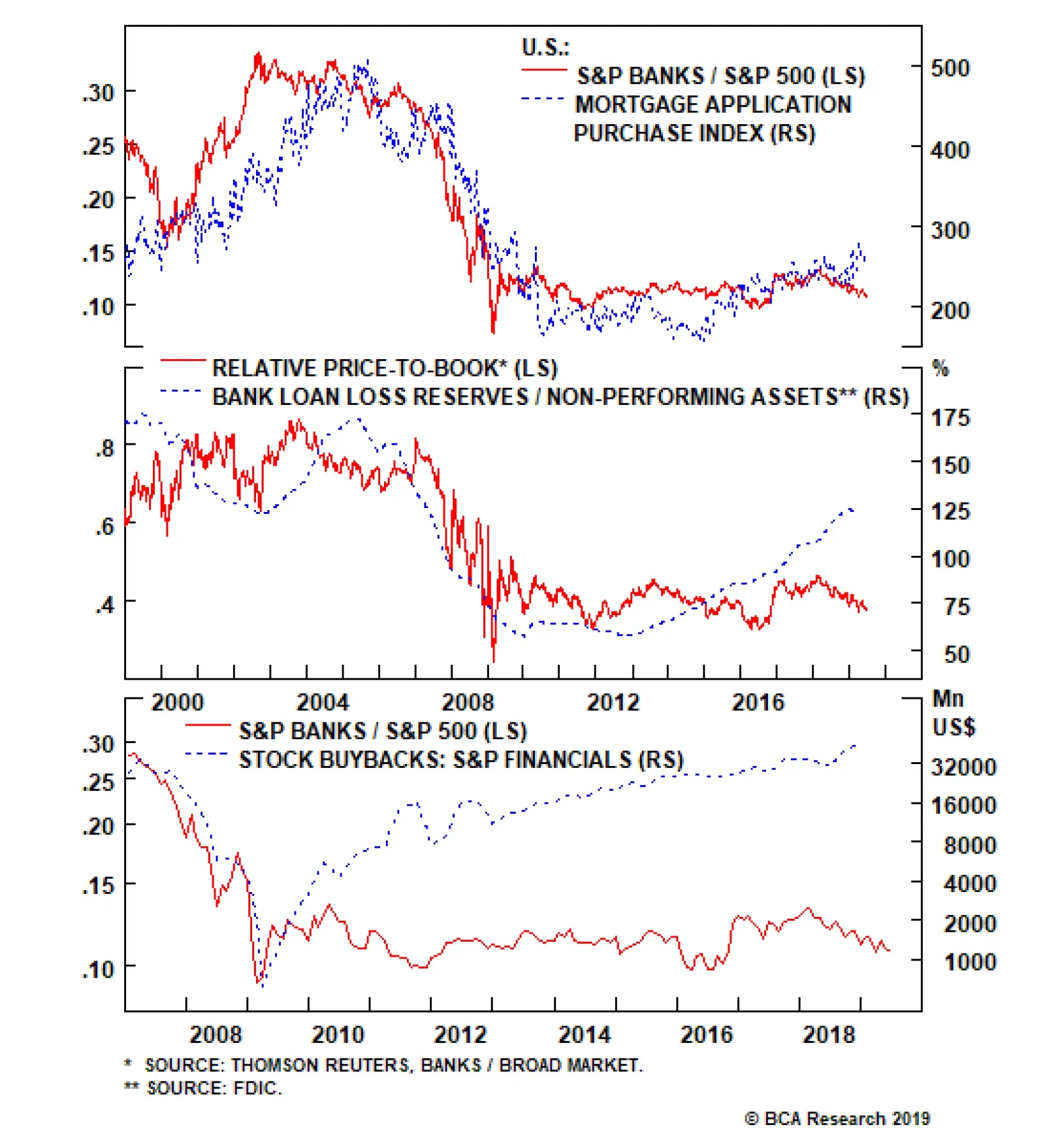

In the context of de-risking our portfolio, this past Monday we added the S&P banks index on our downgrade watch list. The Fed’s signal of a cut in the upcoming July meeting has steepened the yield curve. While the…

Our bank EPS growth model signals that bank EPS euphoria is misplaced. Nevertheless, four significant offsets prevent us from going for an outright downgrade. First, the 30-year fixed mortgage rate almost perfectly mimics the…