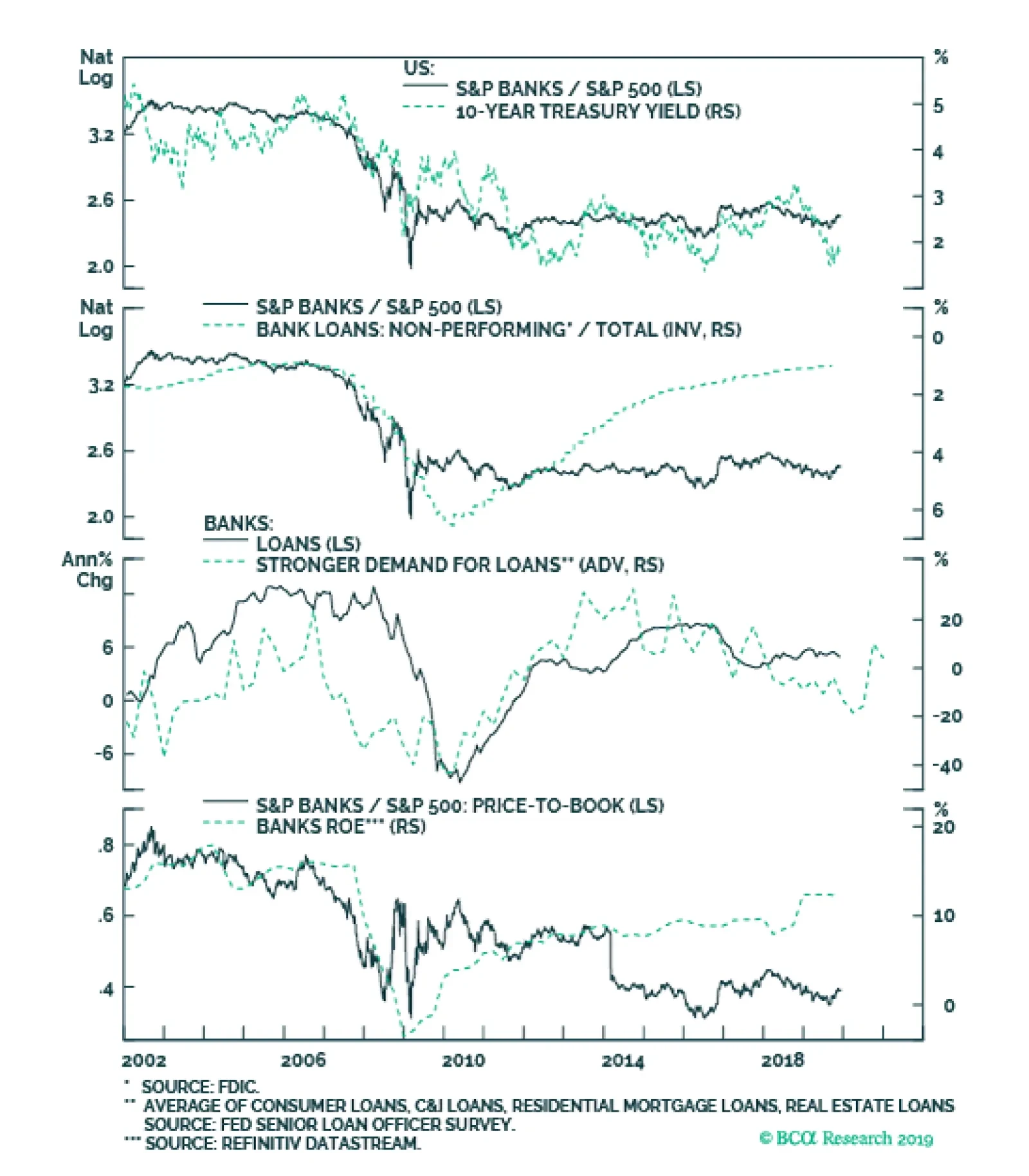

Overweight The expected price of credit, still pristine credit quality, and a looming reacceleration in credit growth all argue for including the S&P banks index in our high-conviction overweight list. Banks stocks…

The expected rise in yields, the looming reacceleration in credit growth, and the pristine state of banks’ balance sheets all argue for including the S&P banks index on our high-conviction overweight list. Banks…

Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

Feature Chart I-1Lebanese Bond Yields Have Surged To Precarious Levels In a May 2018 Special Report, we warned that a devaluation and government default were only a matter of time in Lebanon. The country's sovereign US…

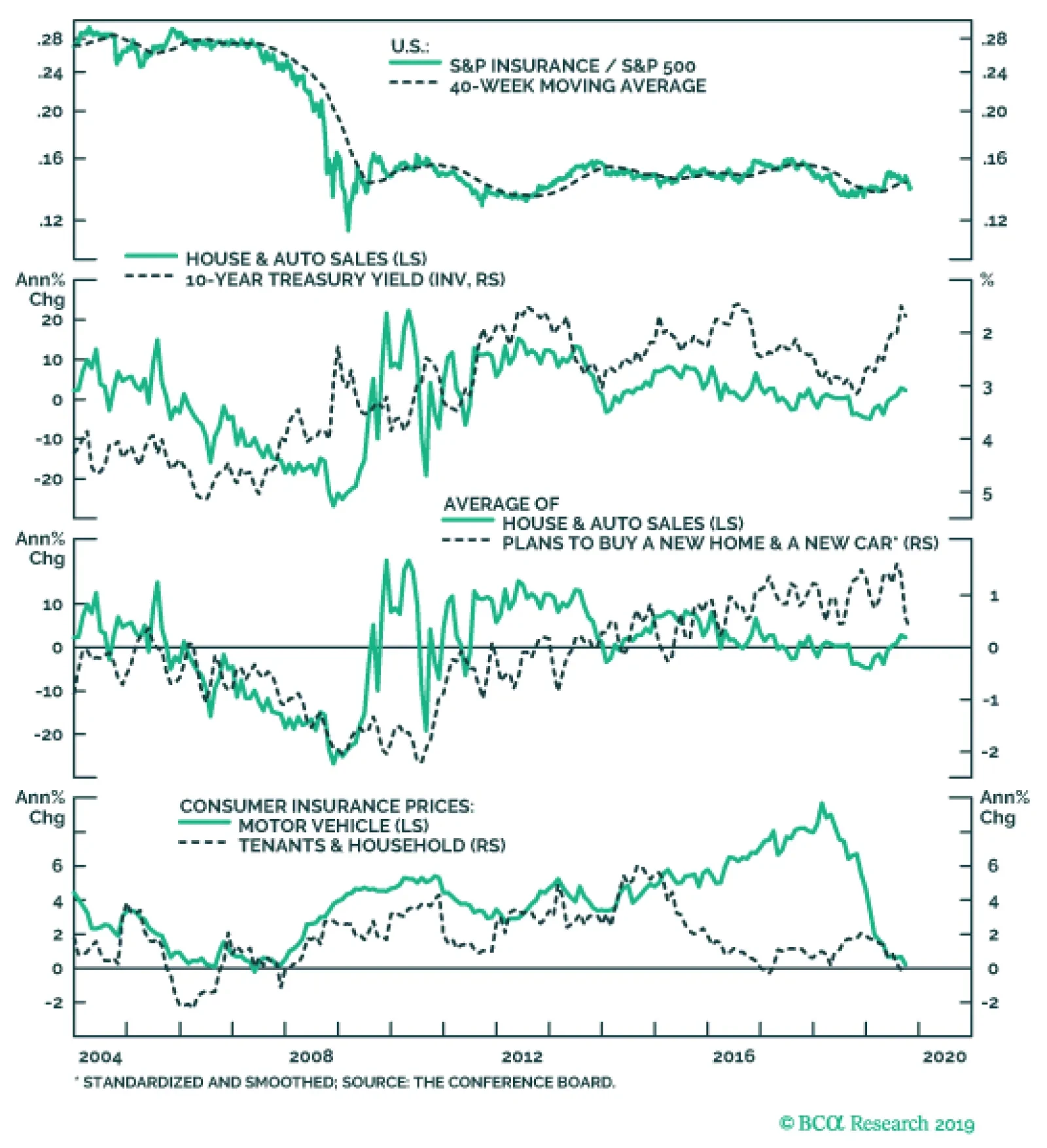

While we remain overweight S&P banks and the broad financials sector, we continue to recommend an underweight stance in the S&P insurance index. This early cyclical subgroup continues to underperform the broad equity…

Underweight While we remain overweight the S&P banks and the broad financials sector, we continue to recommend an underweight stance in the S&P insurance index. This early cyclical subgroup continues to…

Highlights The banks got the current earnings season off to a good start, … : Lending growth may be running in place, and net interest margins are under pressure, but positive operating leverage helped the banks beat…

Highlights The interim “phase 1” trade agreement reached last week represents a significant step forward towards reaching a détente in the China-U.S. trade war. Regardless of what happens next in the Brexit…