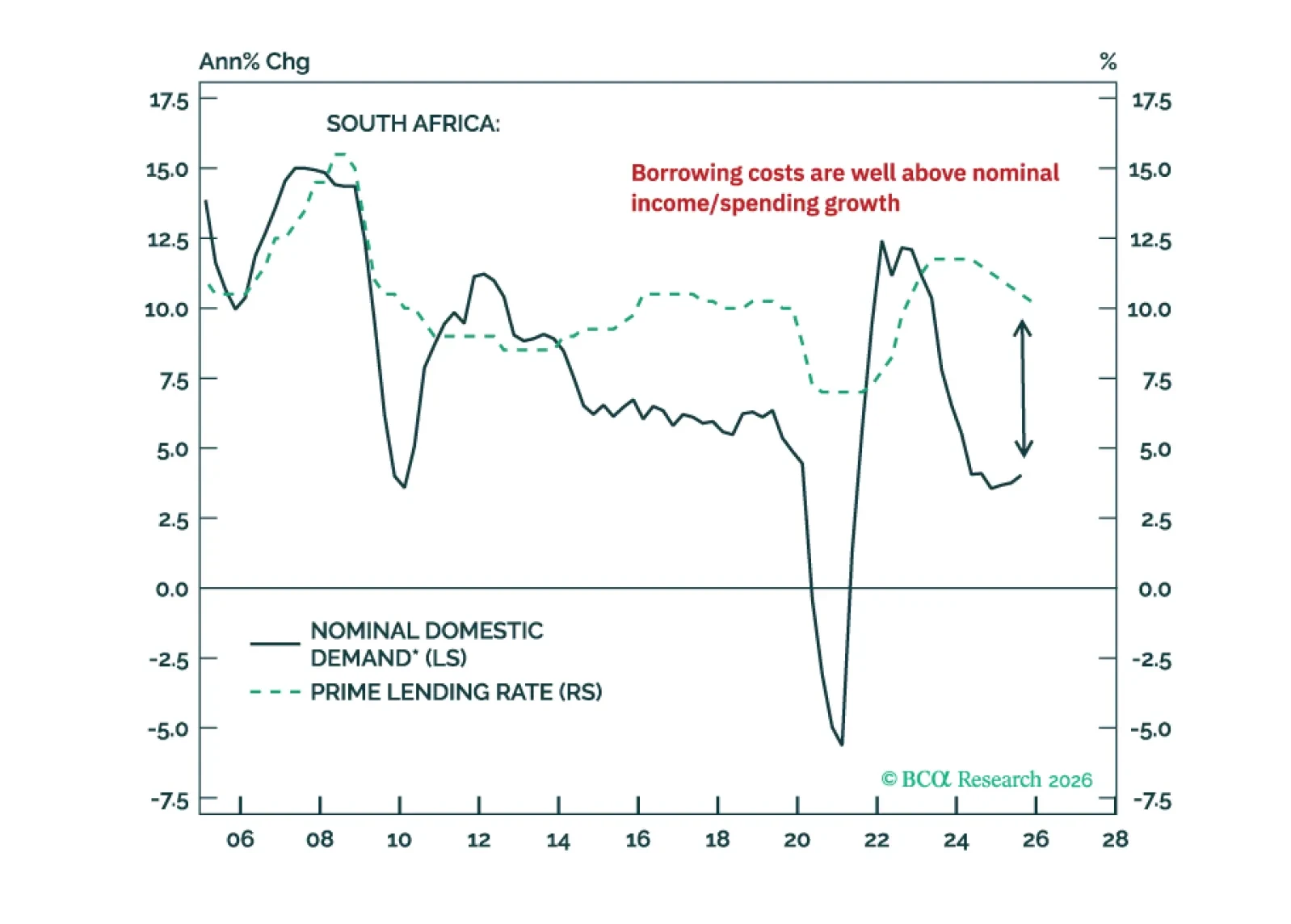

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

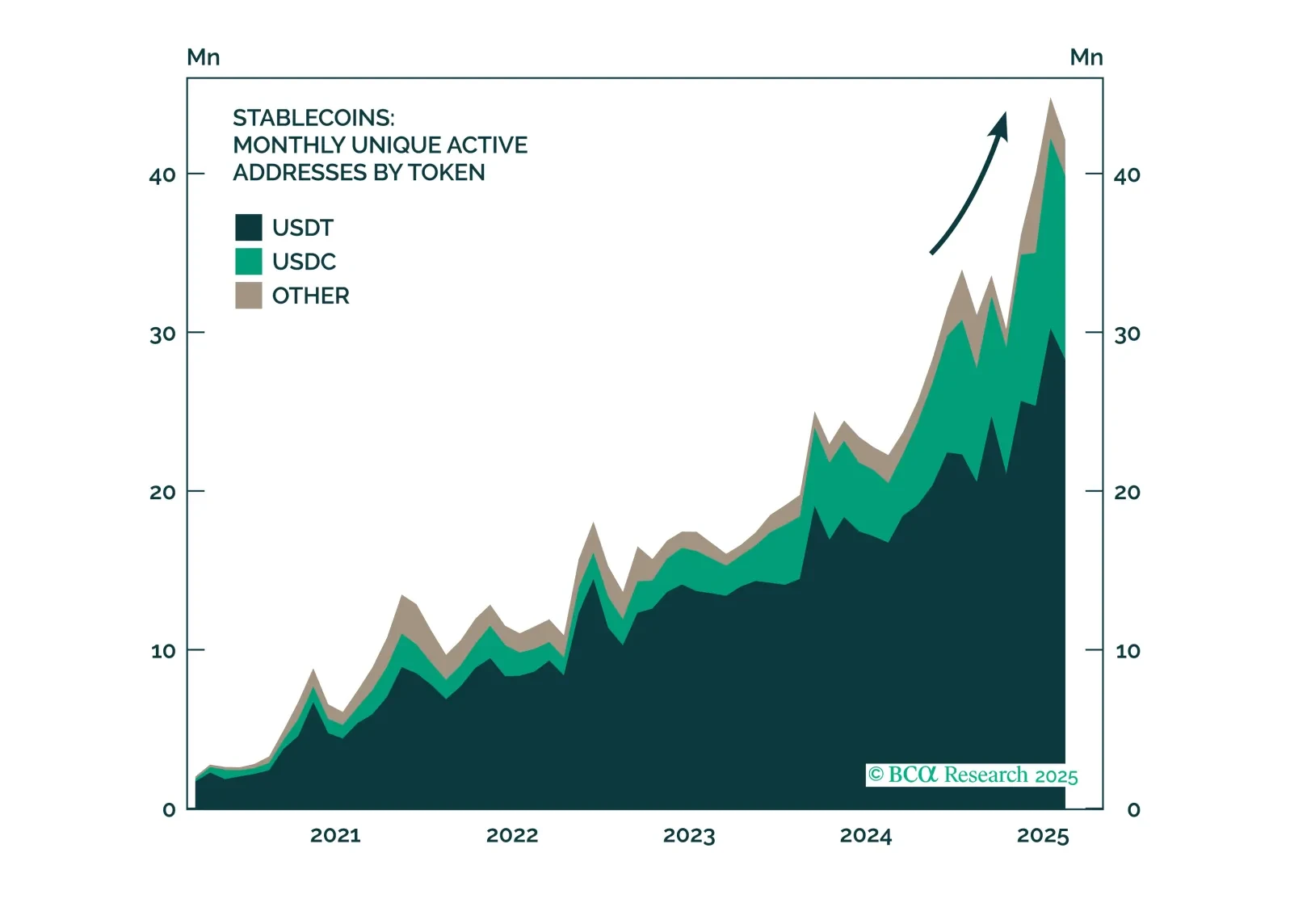

From Treasurys to tokenization, stablecoins are quietly becoming one of the most disruptive forces in global finance, with the power to compress yields, deepen dollar penetration, and shift the balance within crypto markets. Explore…

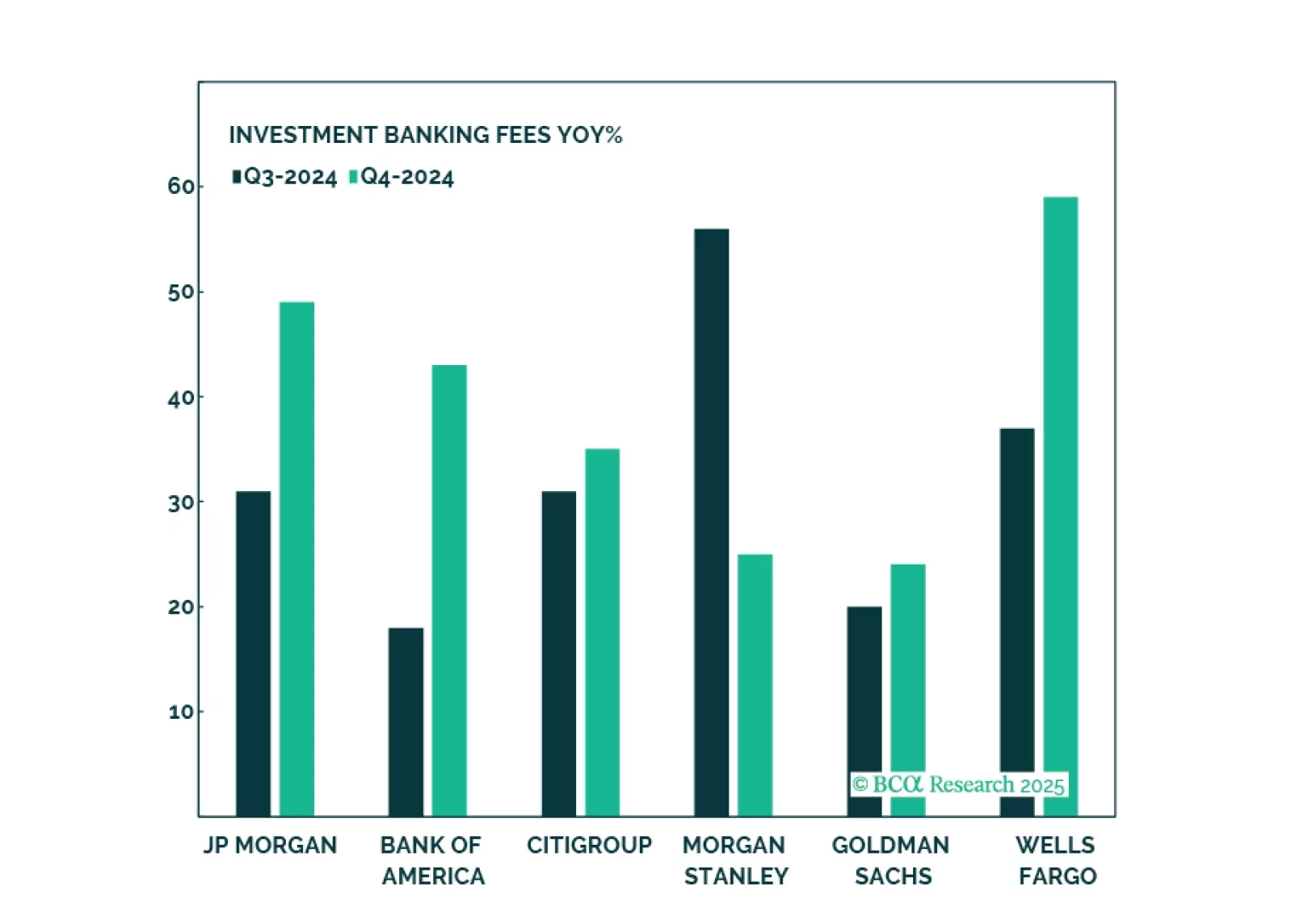

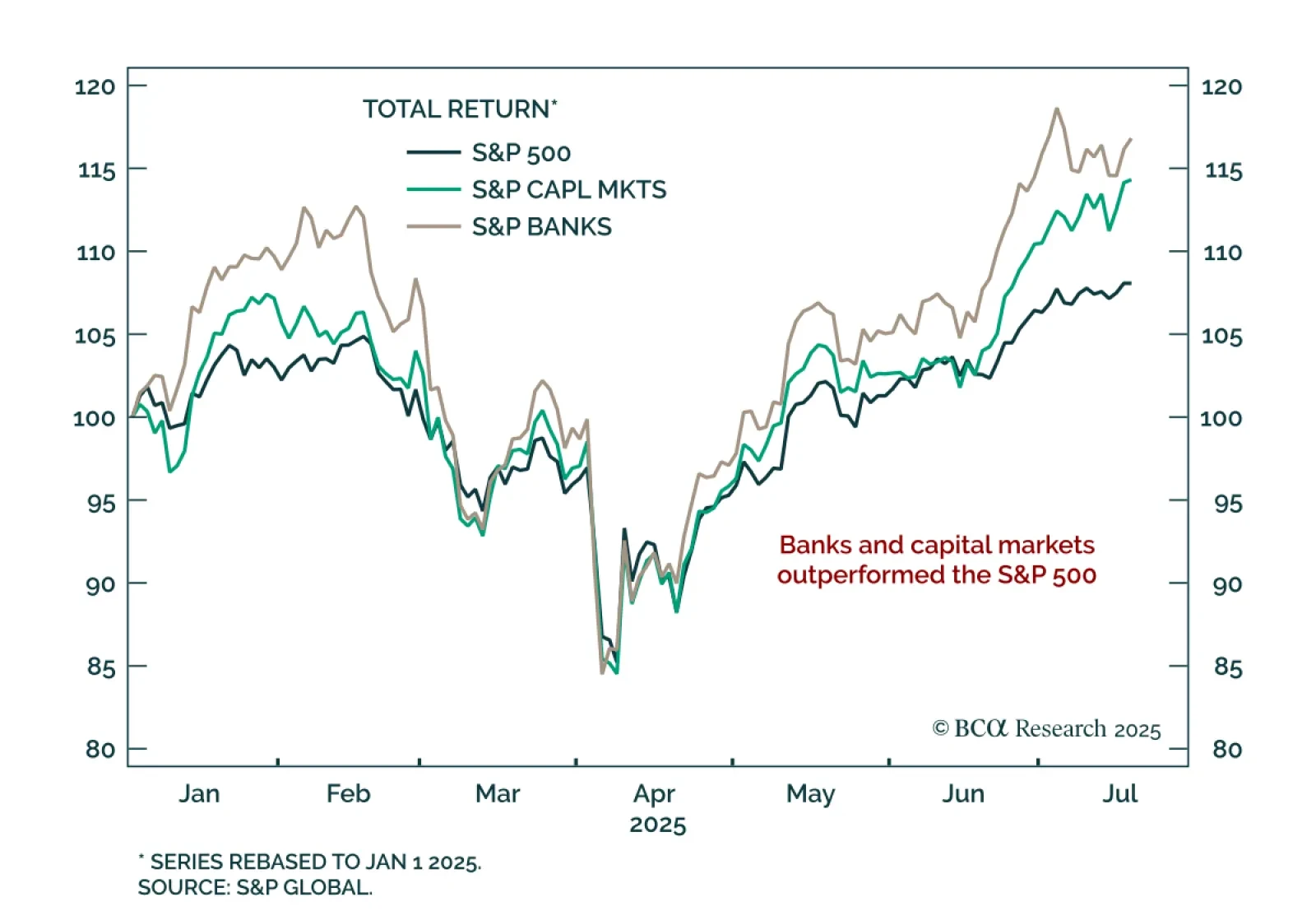

BCA’s US Equity strategists reiterate their overweight stance on Banks and Diversified Financials. Q2 results were solid, with resilient consumer strength and a rebound in capital markets activity. Net interest margins are…

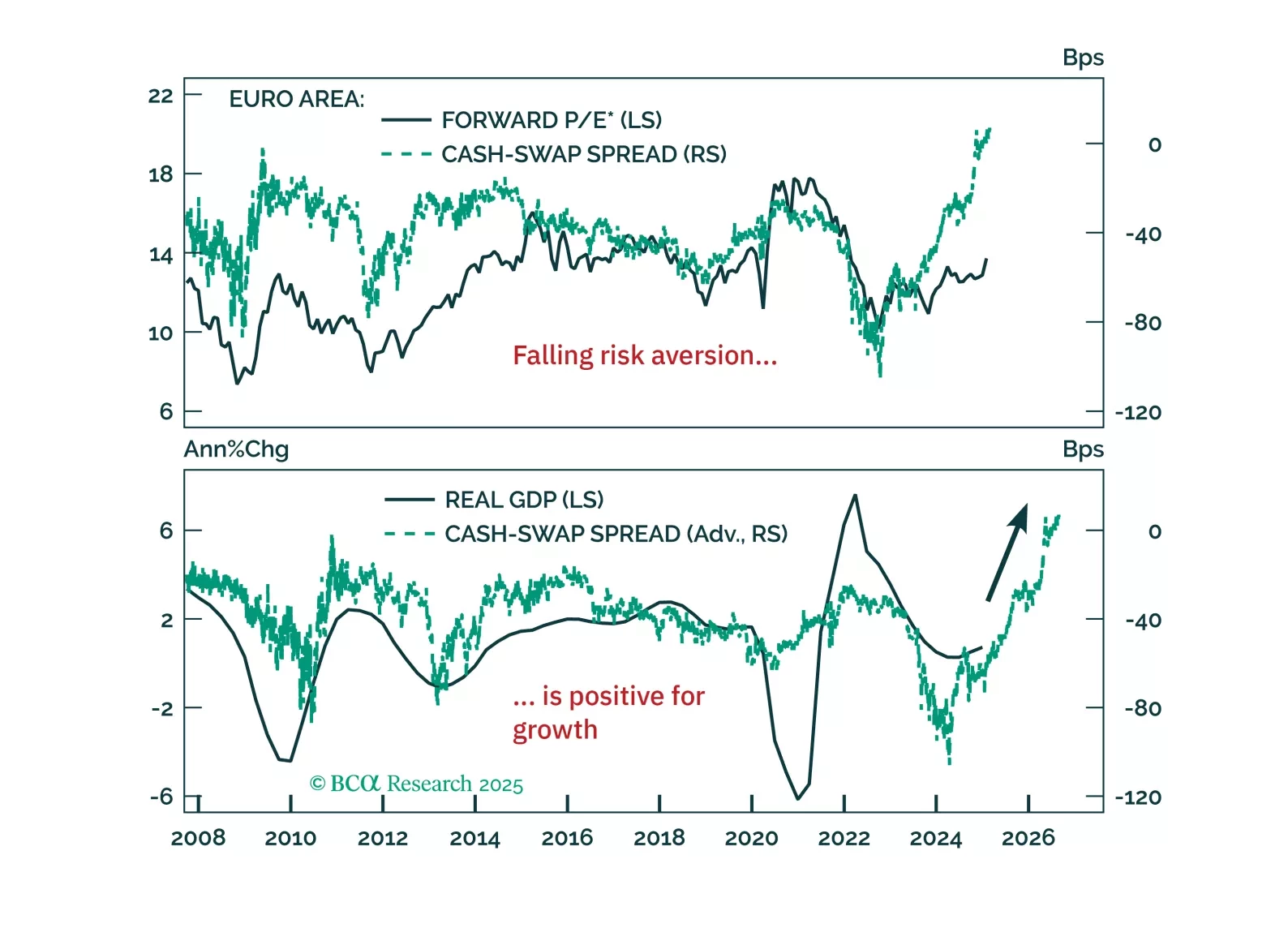

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

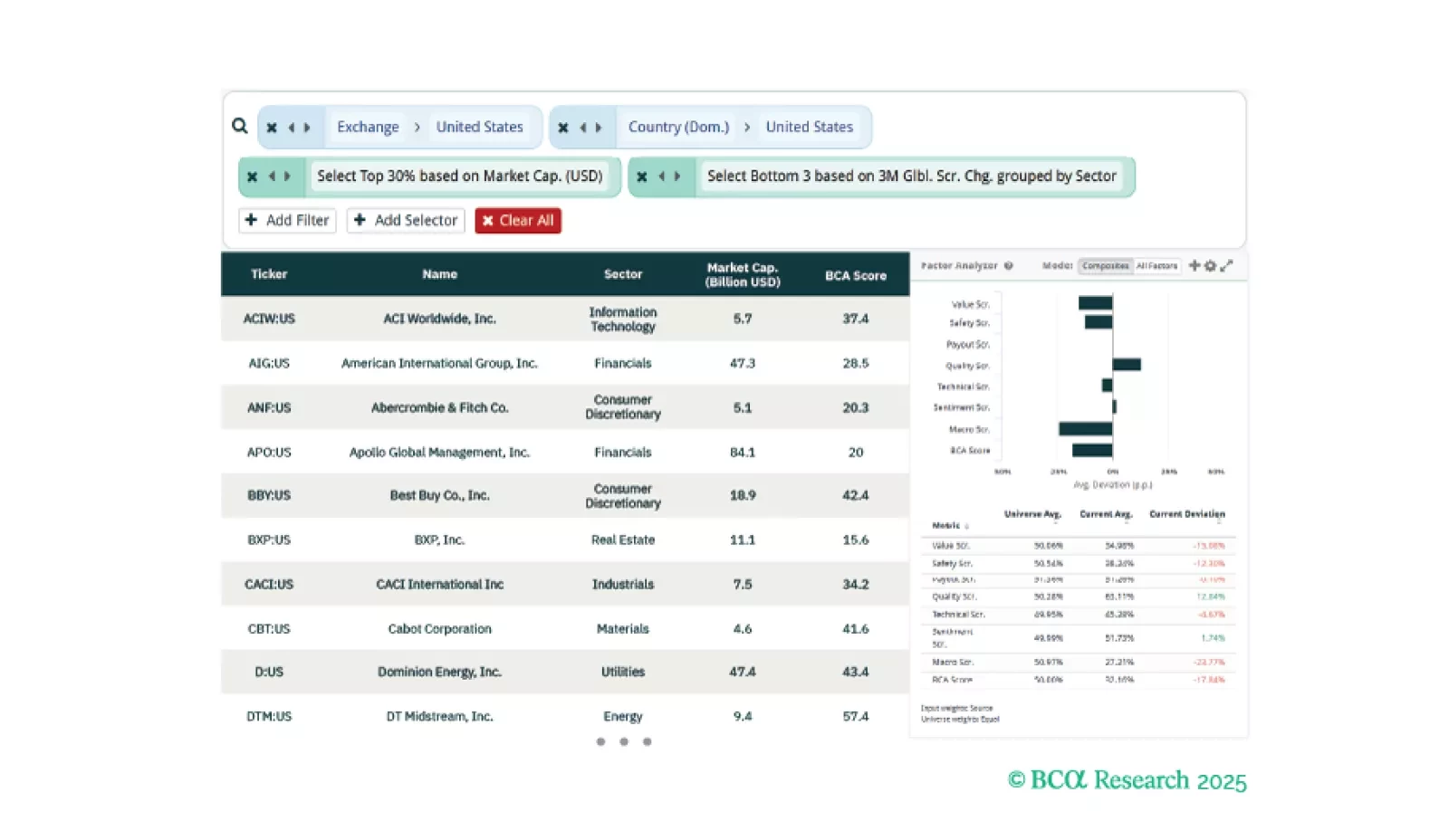

This week, our three screeners cover equity plays in European Banks, US Financials, And US Stocks that are “Grave Diggers”.

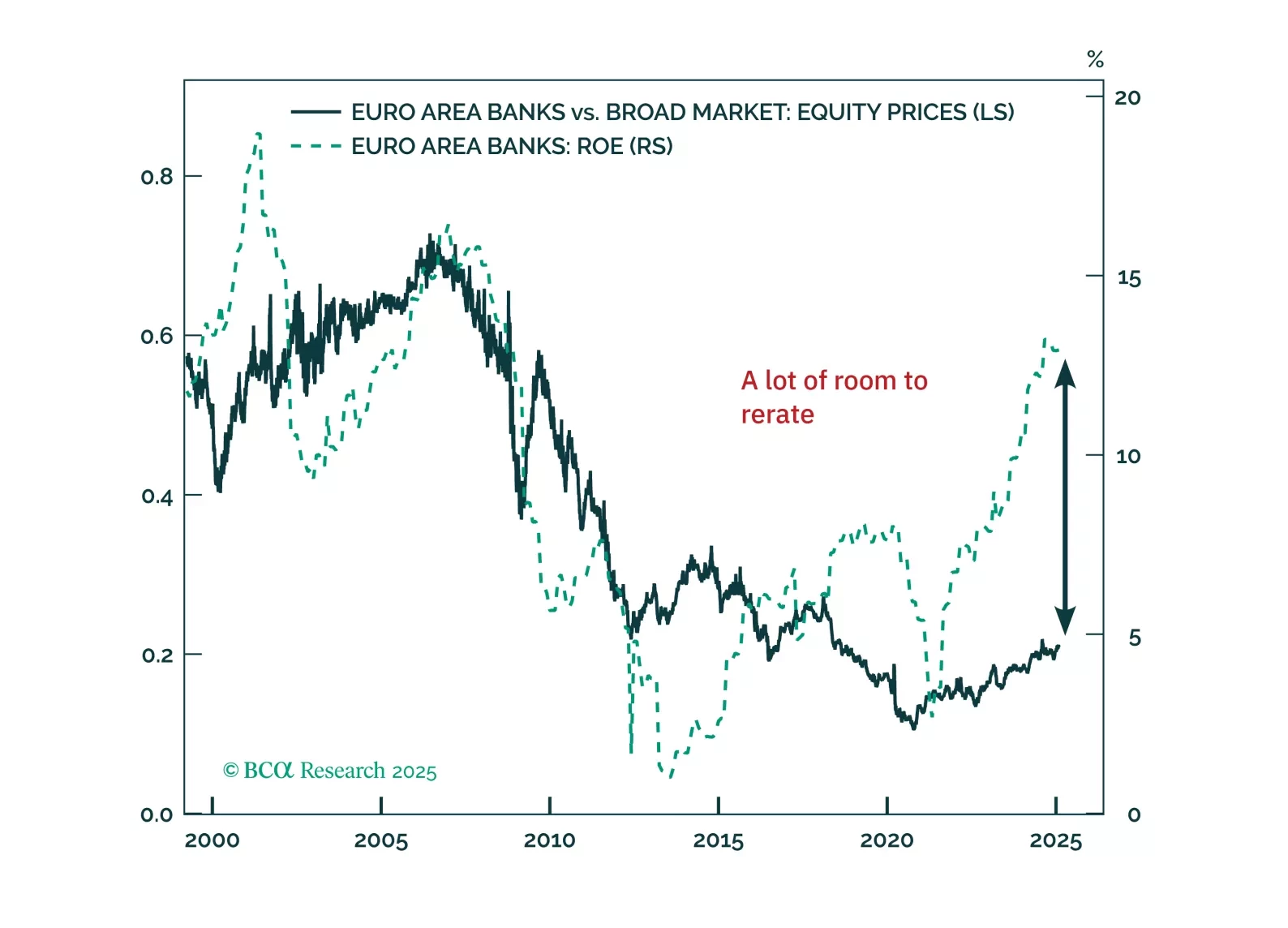

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

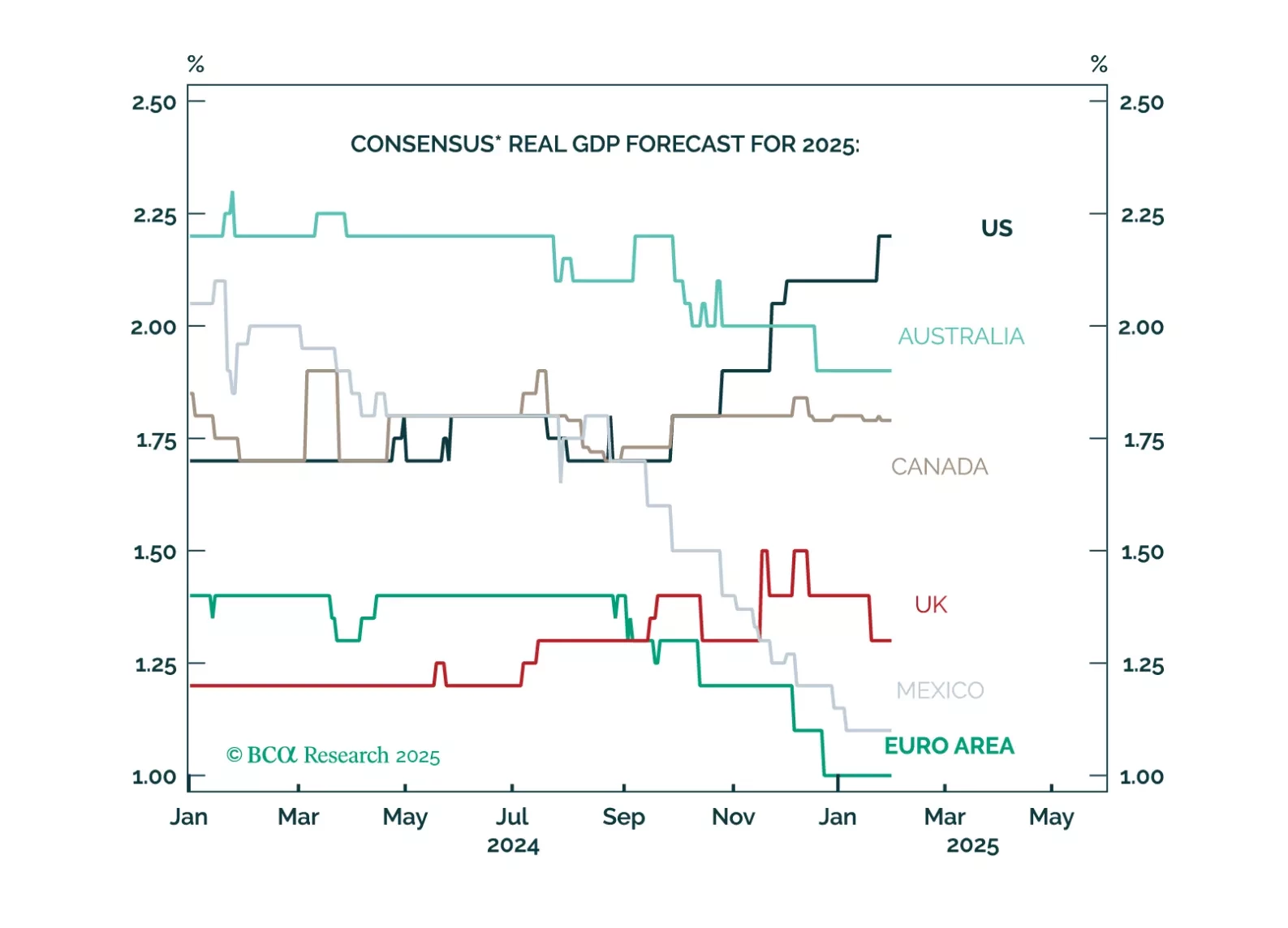

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

Banks have had an amazing run, and while such strong performance is unlikely to repeat, there is still oomph left in the trade thanks to a more favorable regulatory environment, stronger demand for loans, a steeper yield curve, and a…

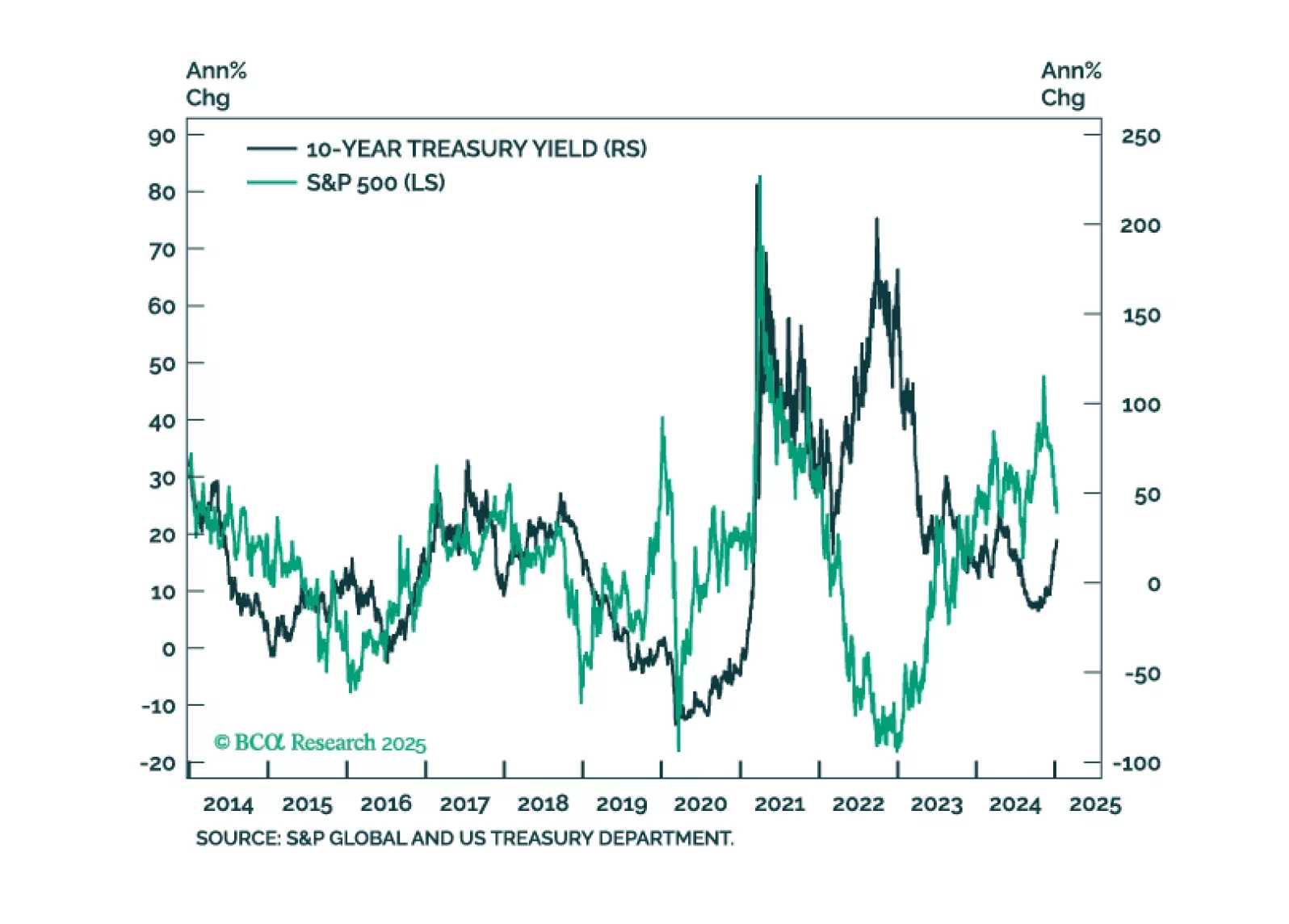

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…