Slowing growth would be bad for equities, but so would stronger growth since it would mean more rate hikes.

In Section I, we note that the global growth outlook has modestly deteriorated over the past month, despite an improving 12-month outlook for Chinese domestic demand in response to the imminent end of the nation’s “dynamic zero-COVID…

This week, we look at the latest data releases in the G10, along with implications for all the major currencies.

In this, our final report of a tumultuous year, we summarize our policy outlook for the “Big 4” central banks – the Fed, the ECB, the Bank of England (BoE) and the BoJ – and the associated bond market implications for 2023.

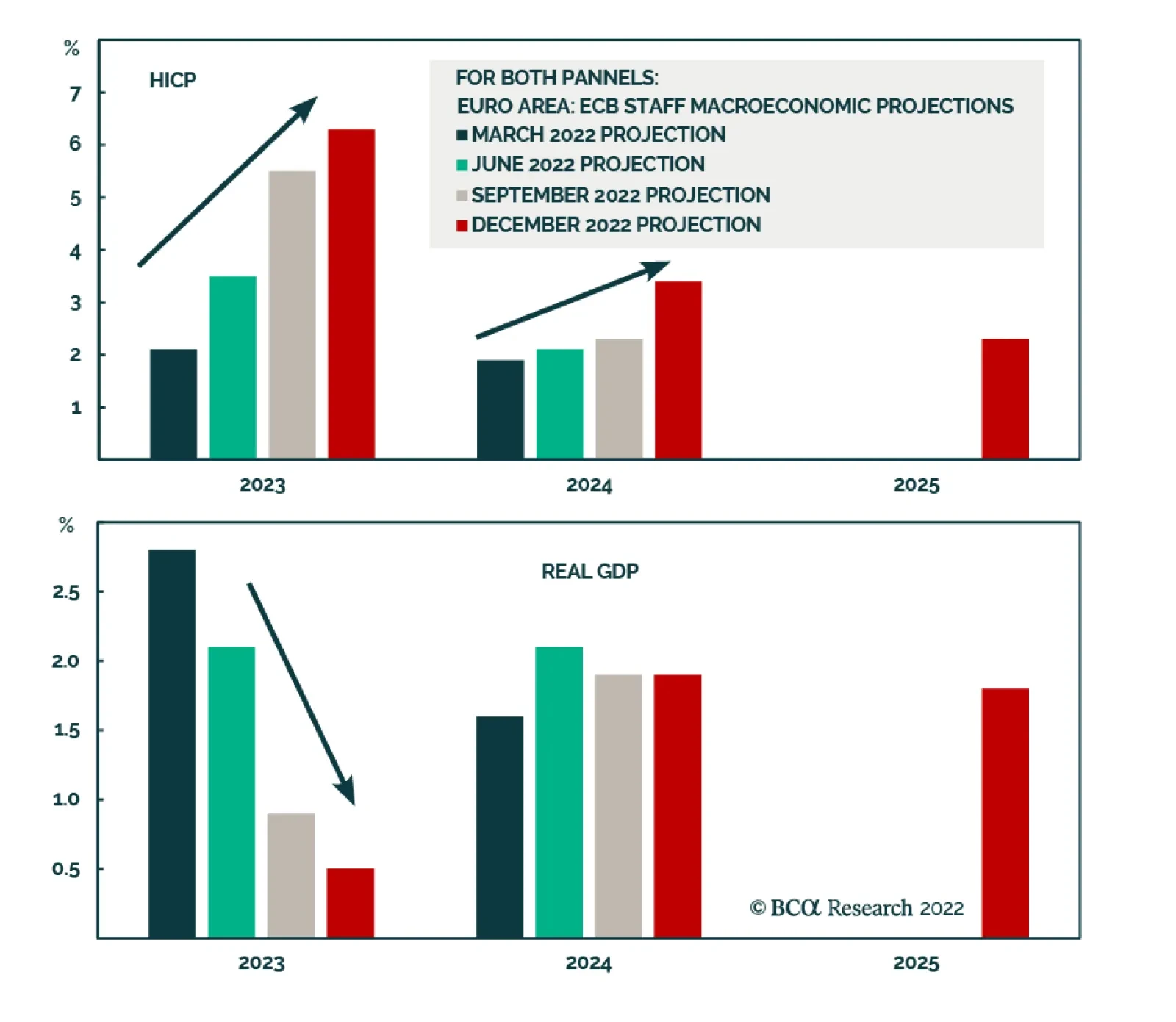

As expected, the ECB hiked interest rates by 50bps at its final meeting in 2022. In addition, it announced the start of quantitative tightening. Starting in March 2023, the APP portfolio will decline at a monthly rate of EUR 15…

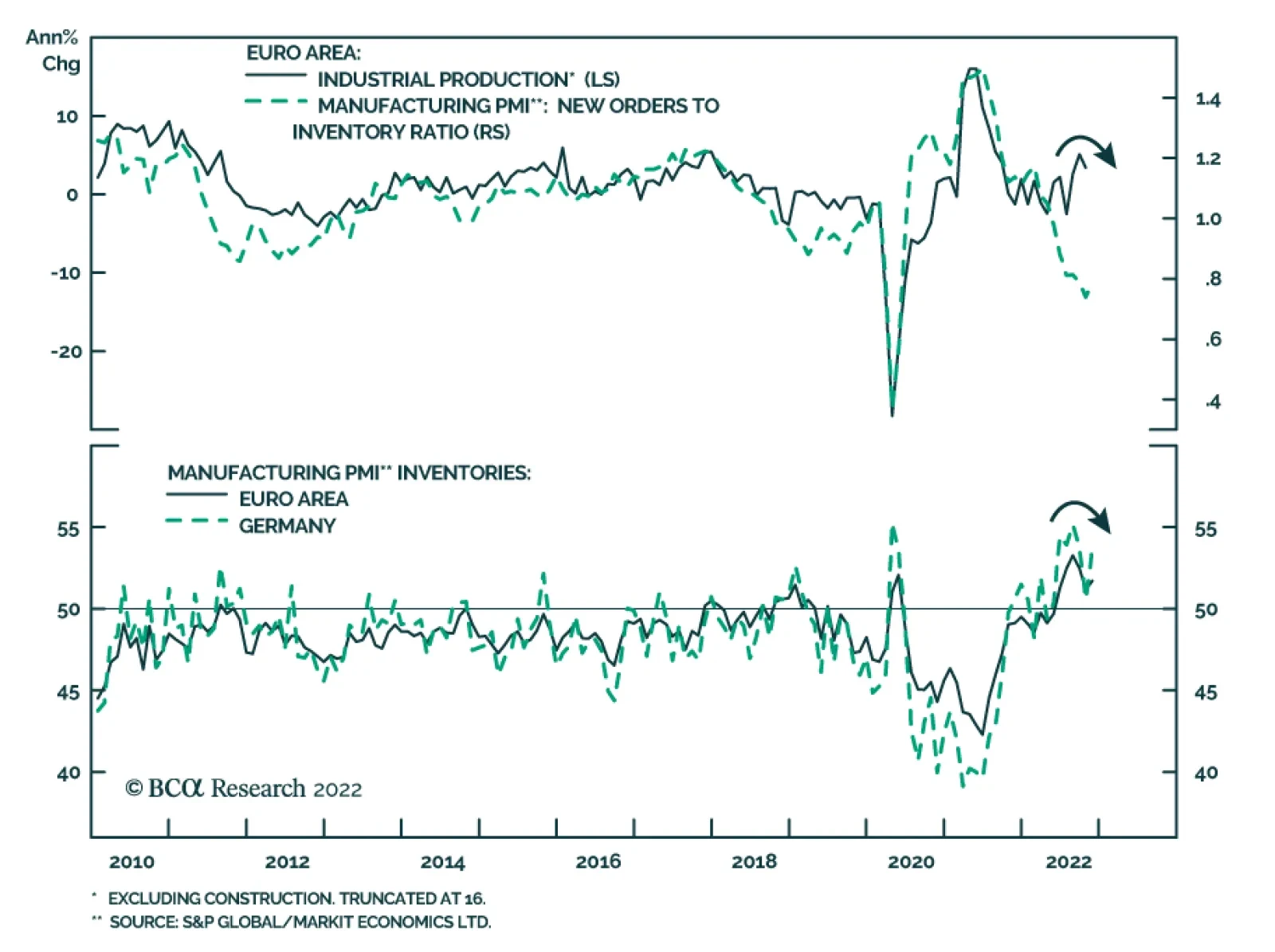

Eurozone industrial production declined by a larger-than-expected 2.0% m/m in October, following a 0.8% m/m expansion. Meanwhile, output growth slowed from 5.1% to 3.4% on a year-on-year basis. The energy sector (-3.9% m/m),…

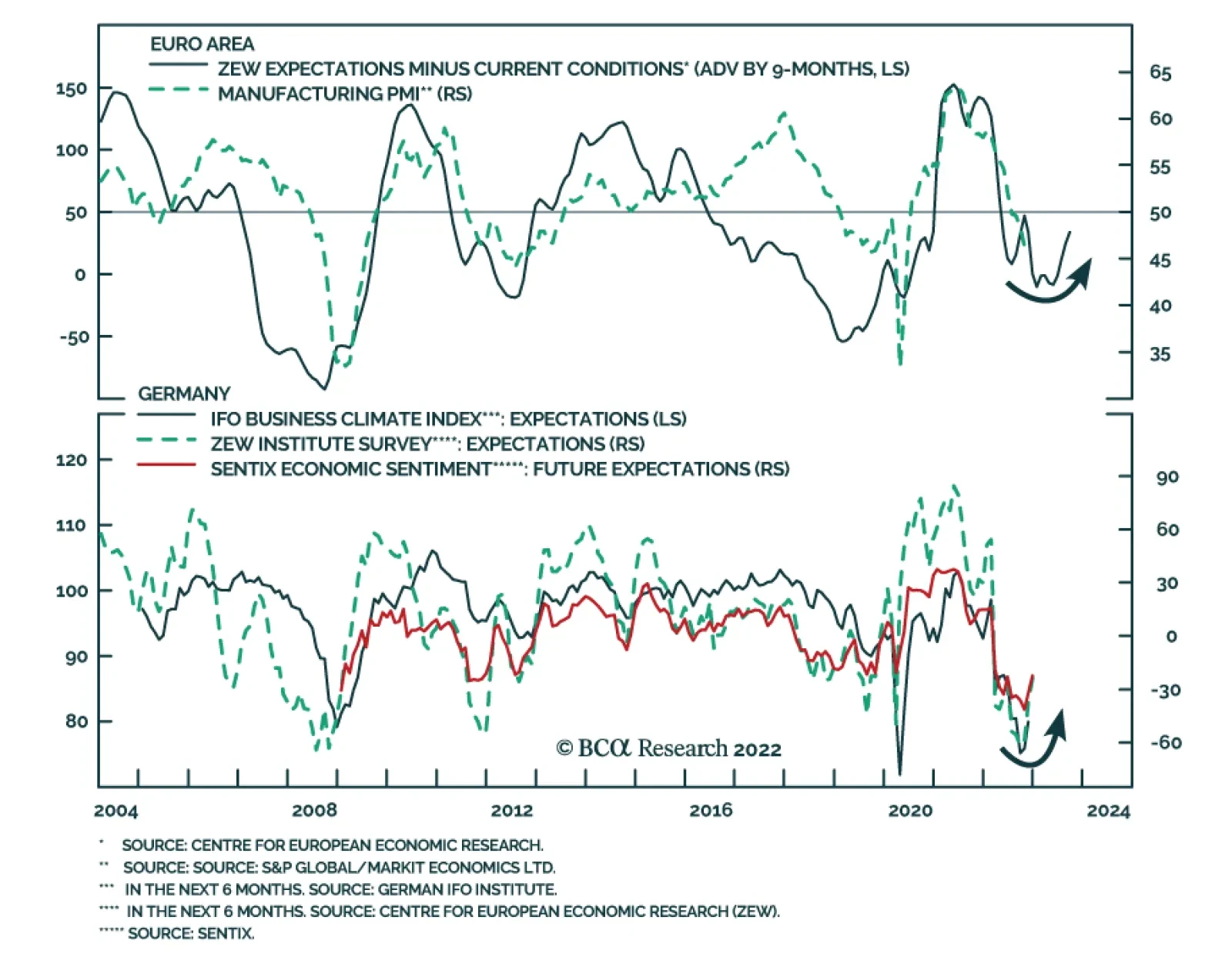

The ZEW survey of investor sentiment sent an upbeat signal about economic conditions in both Germany and the Eurozone in December. The headline index for Germany rebounded by 13.4 points to -23.3 while the Eurozone measure jumped…

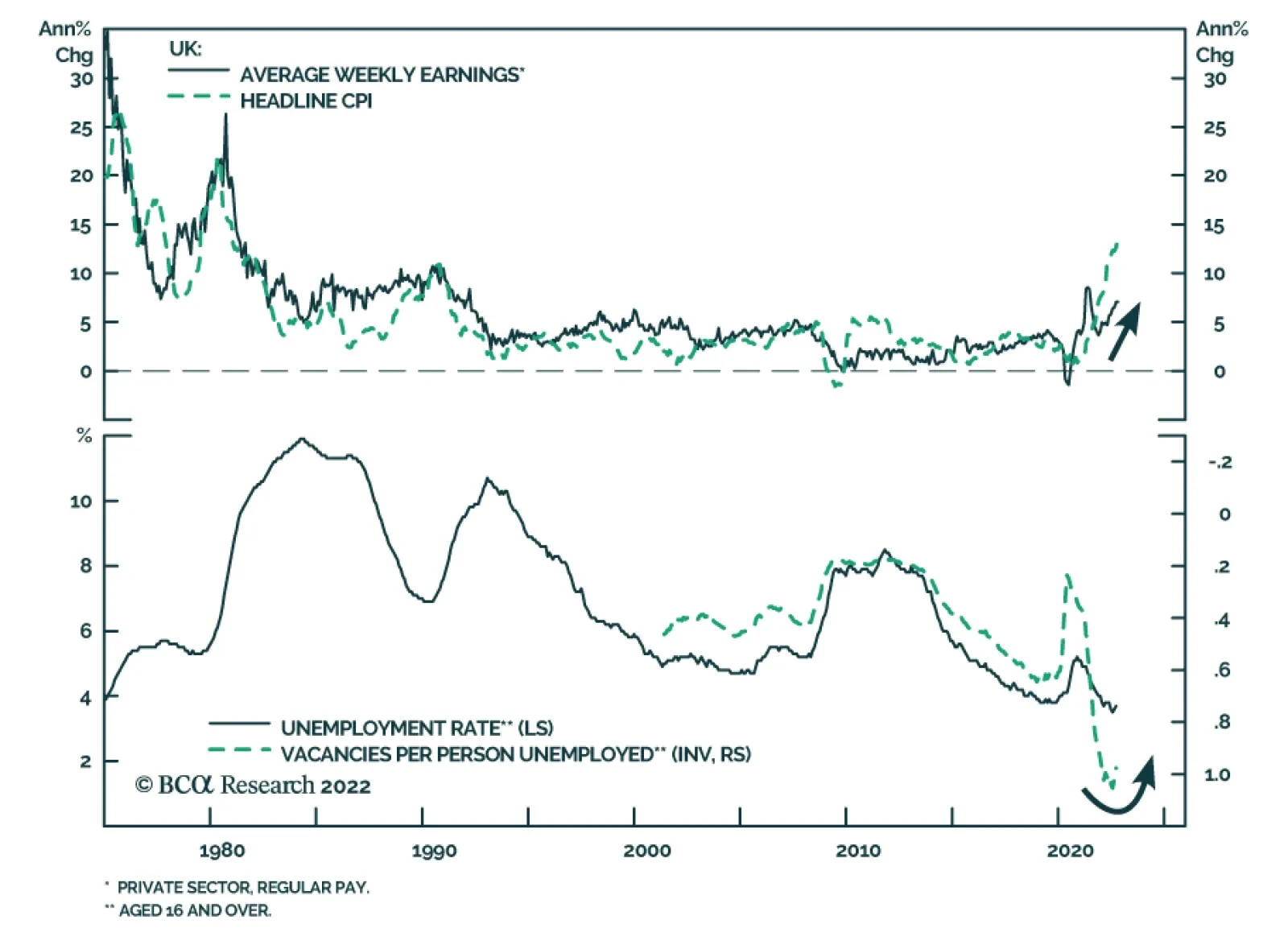

Conflicting forces are dominating the UK labor market. Data released on Tuesday revealed that the unemployment rate ticked up from 3.6% to 3.7% in the three months to October (the second consecutive increase), providing some…

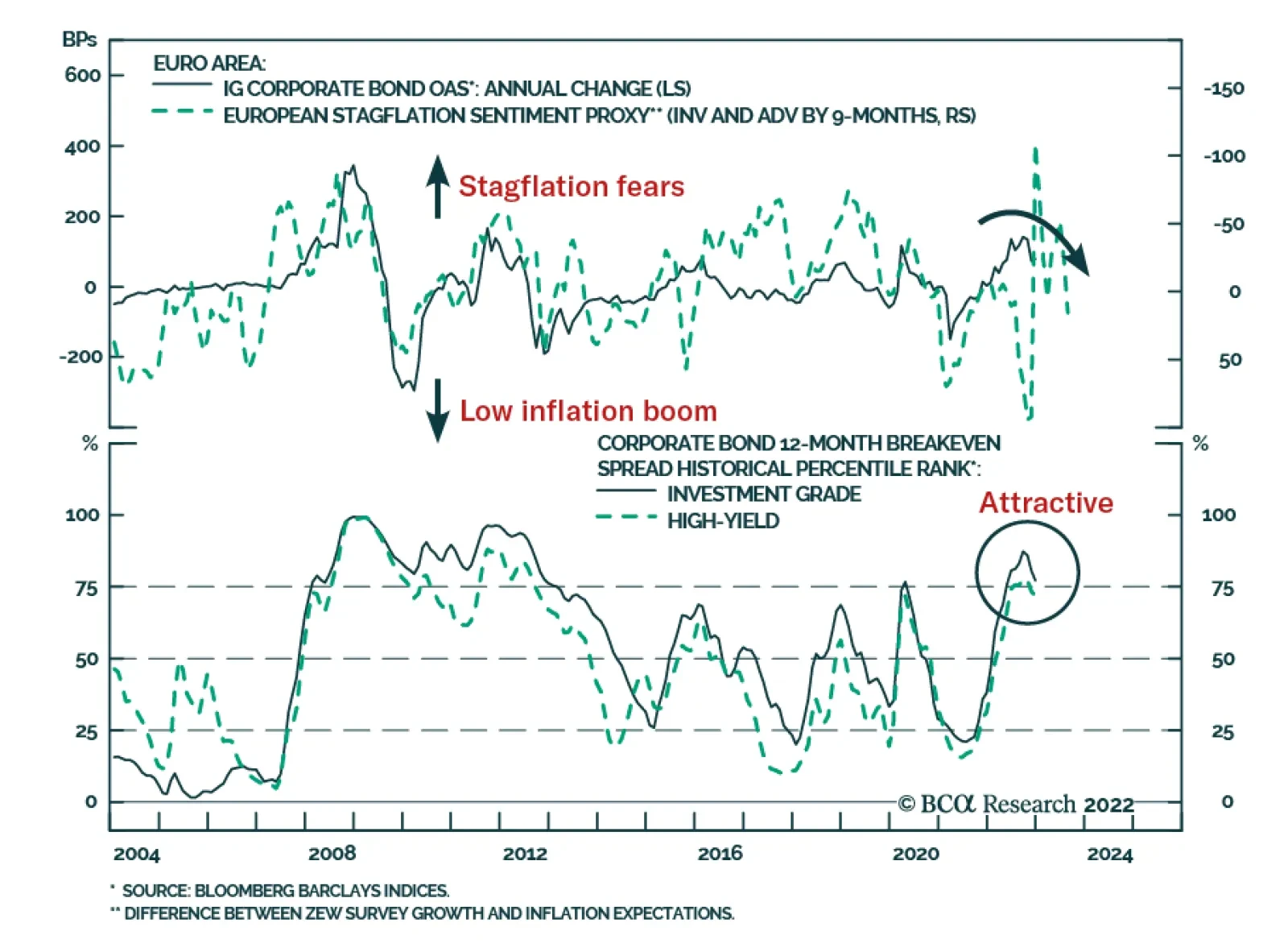

Heading into 2023, BCA Research’s European Investment Strategy service recommends fixed-income investors overweight Euro Area IG relative to both government bonds and US credit, while adopting a more cautious stance toward…