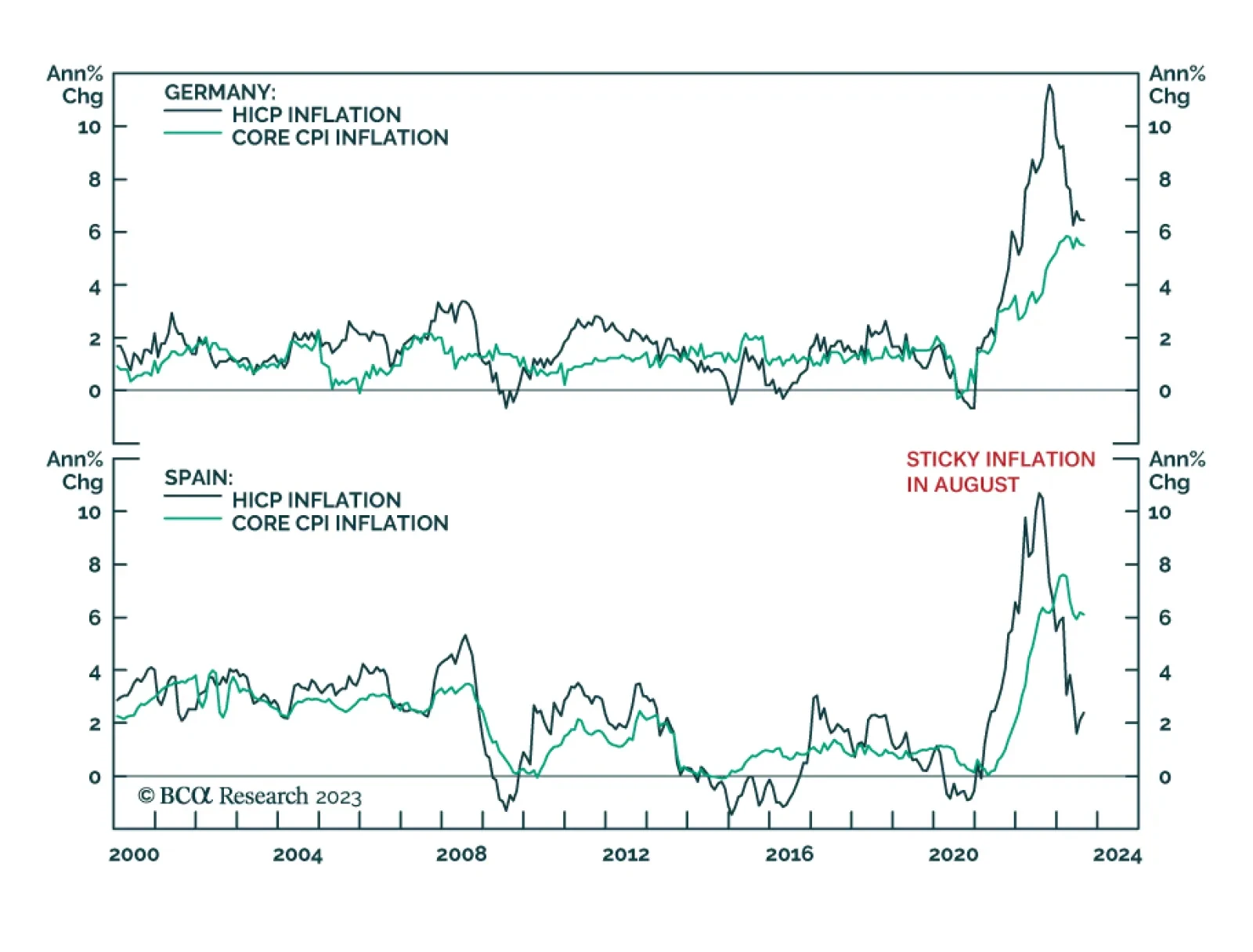

Euro Area inflation data surprised to the upside on Wednesday. According to preliminary data, although Germany’s harmonized headline CPI inflation rate fell from 6.5% y/y to 6.4% y/y in August, it nevertheless came in…

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

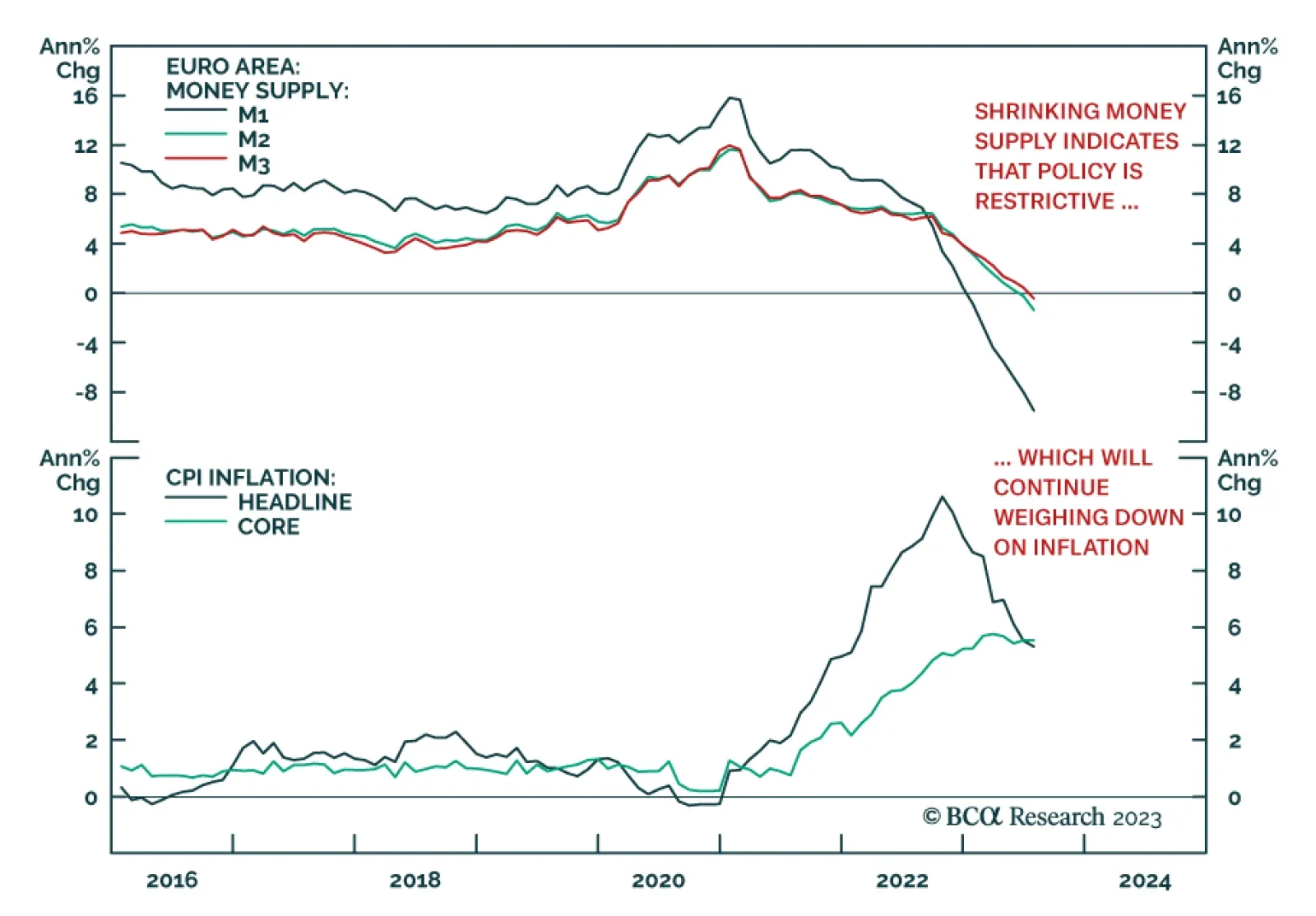

The Eurozone's economy remains soft. Yesterday we highlighted that M3 money supply fell by 0.4% y/y in July, a rate unseen since 2010. This decline was driven by a slowdown in private sector bank lending, which confirms broad…

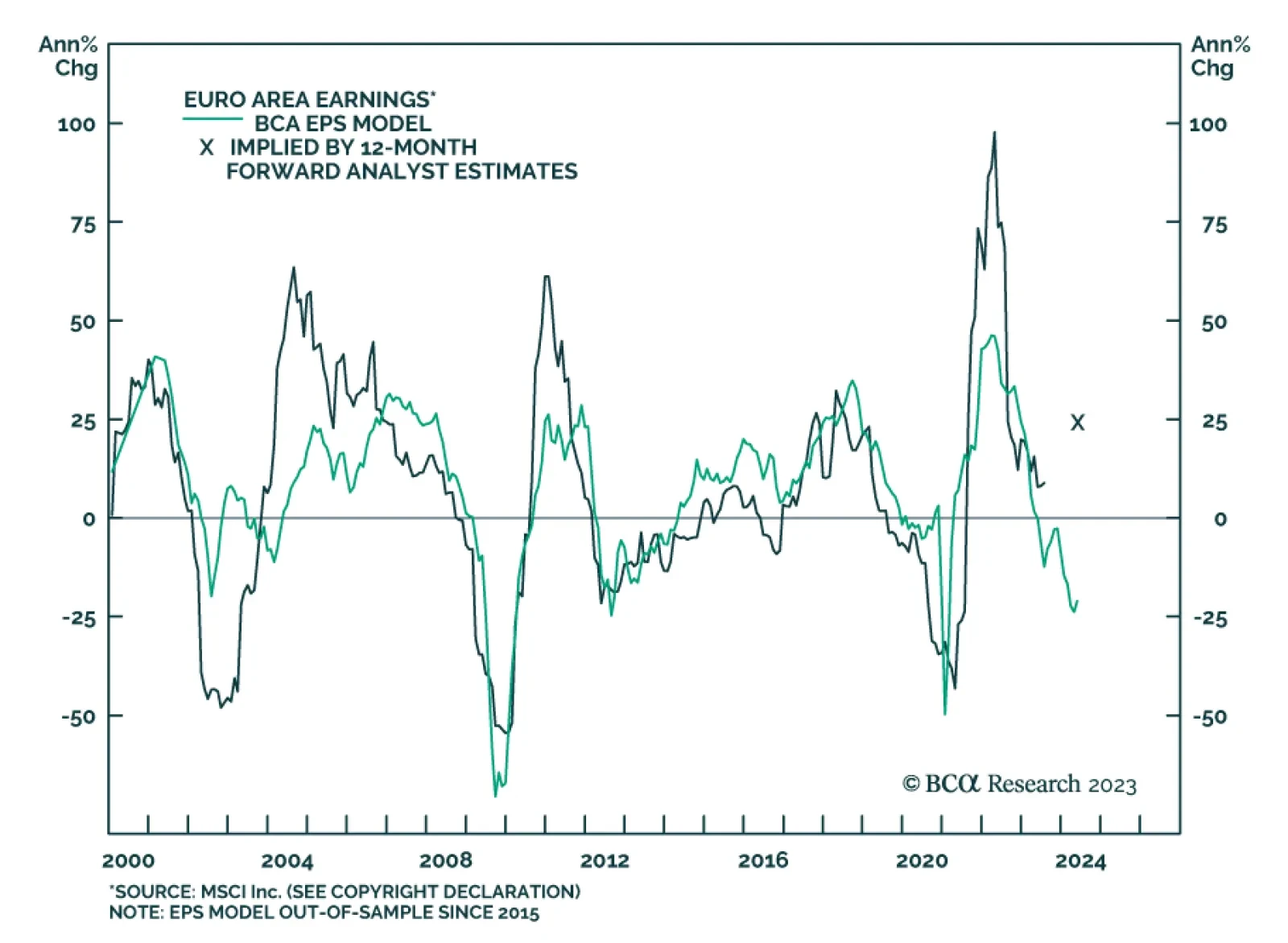

According to BCA Research’s European Investment Strategy service, the profit outlook for Eurozone earnings continues to deteriorate. The team’s earnings model for Eurozone equities continues to point to a deepening…

Eurozone money supply data reflect the impact of the ECB’s aggressive tightening campaign on the region’s economy. Data released on Monday showed the July M3 measure of broad money (the sum of M2, repurchase…

The profit outlook for the Eurozone continues to deteriorate. Find out what the drivers behind this deterioration are.

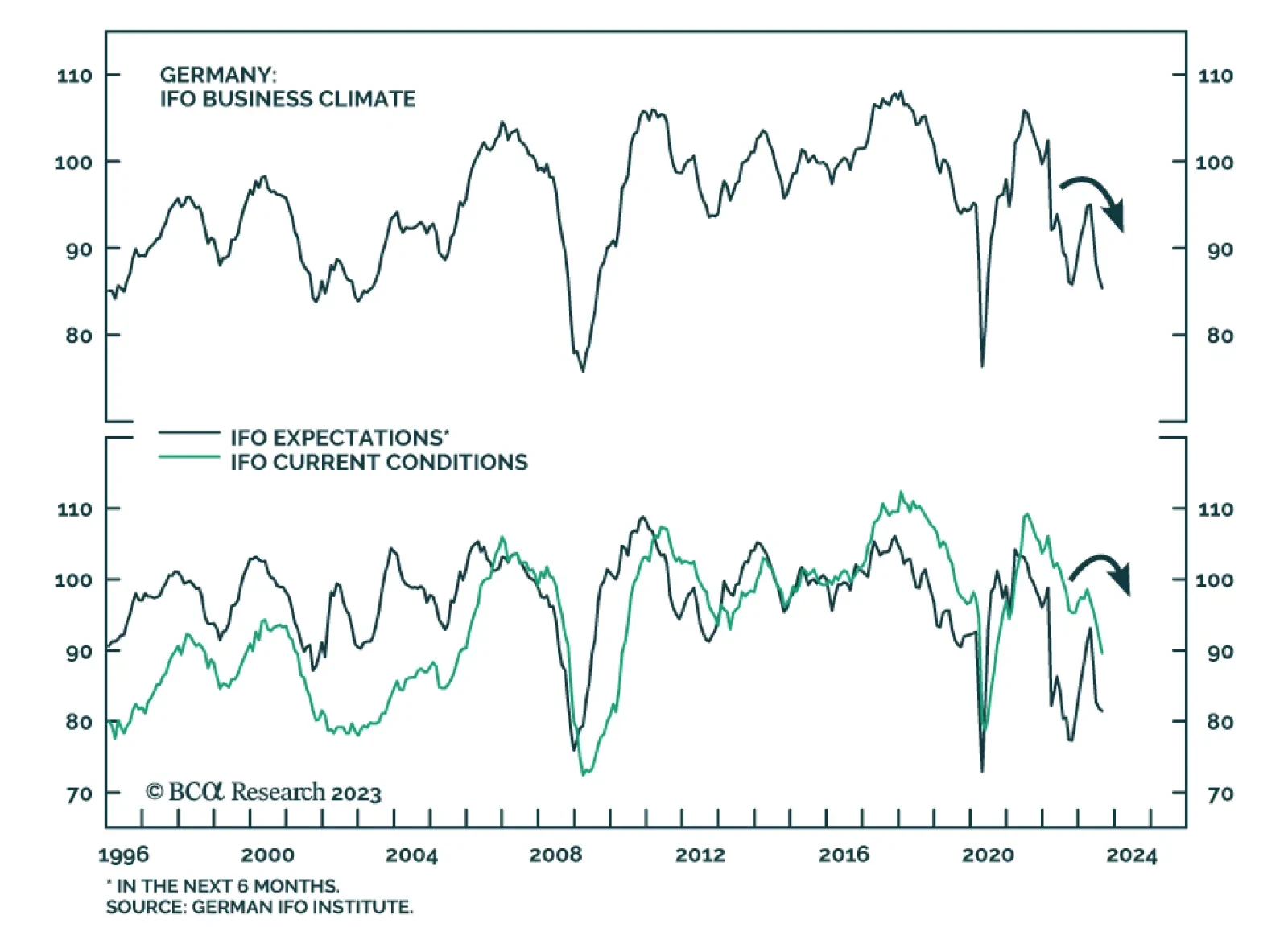

Germany’s IFO survey sent a downbeat message on Friday. The headline Business Climate Index fell by 1.7 points to 85.7, below expectations of 86.8 and near the 85.2 level at which it bottomed in October. A 2.4-point…

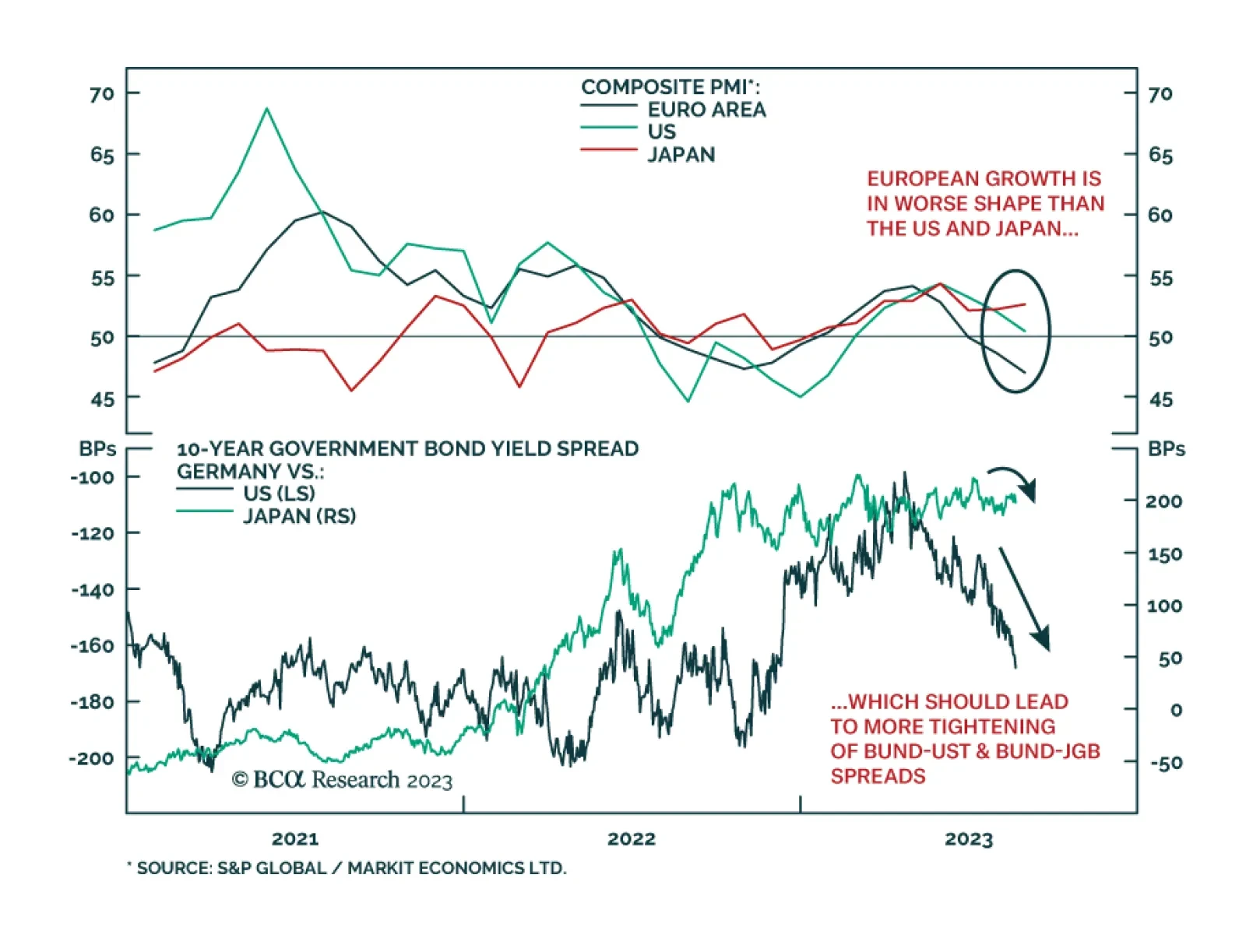

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…

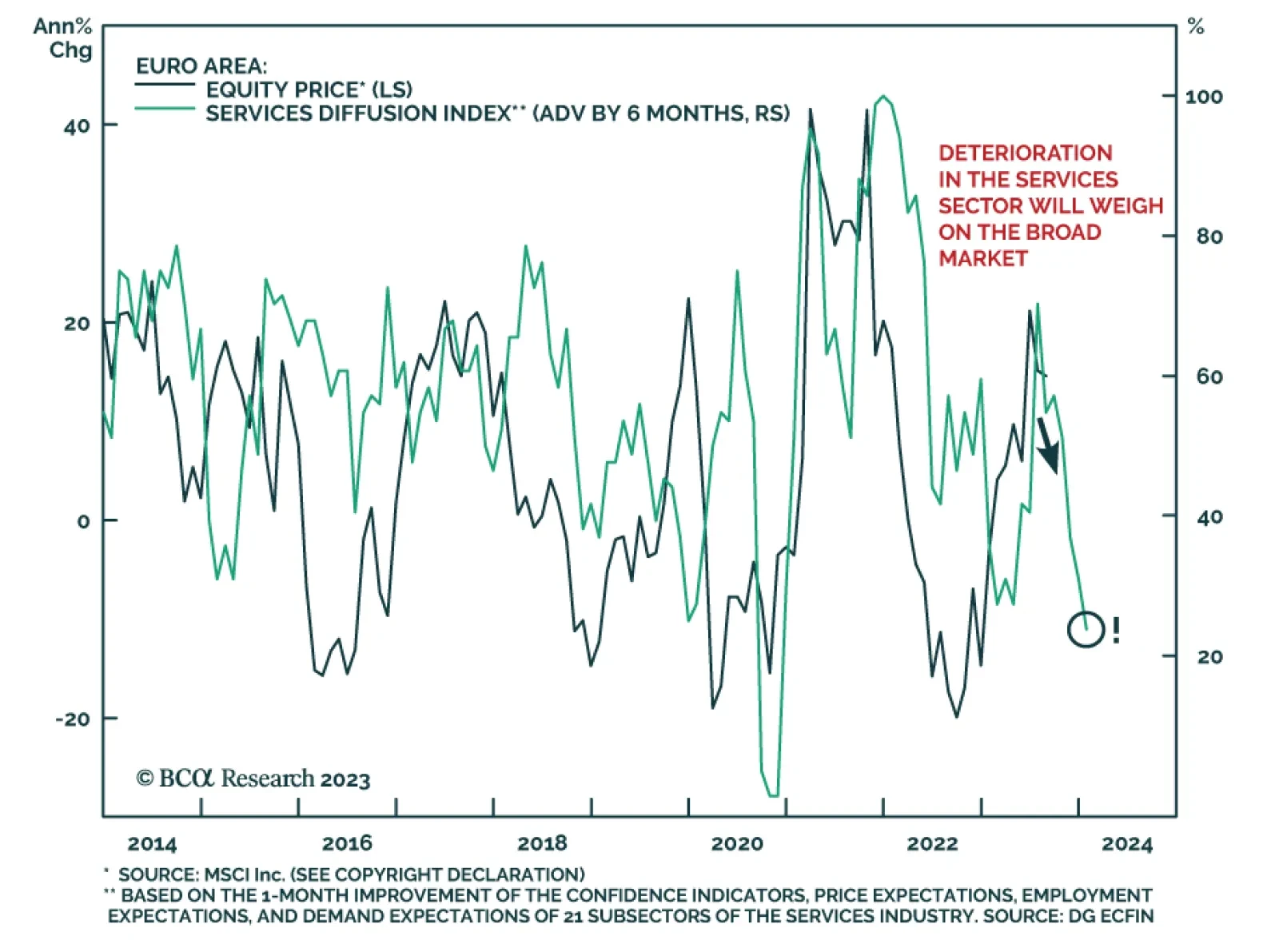

The flash August S&P Global PMI data released on Wednesday painted a picture of softer global growth, while also hinting that Europe is on the cusp of recession. The composite PMI for the euro area fell by 1.6 versus the…