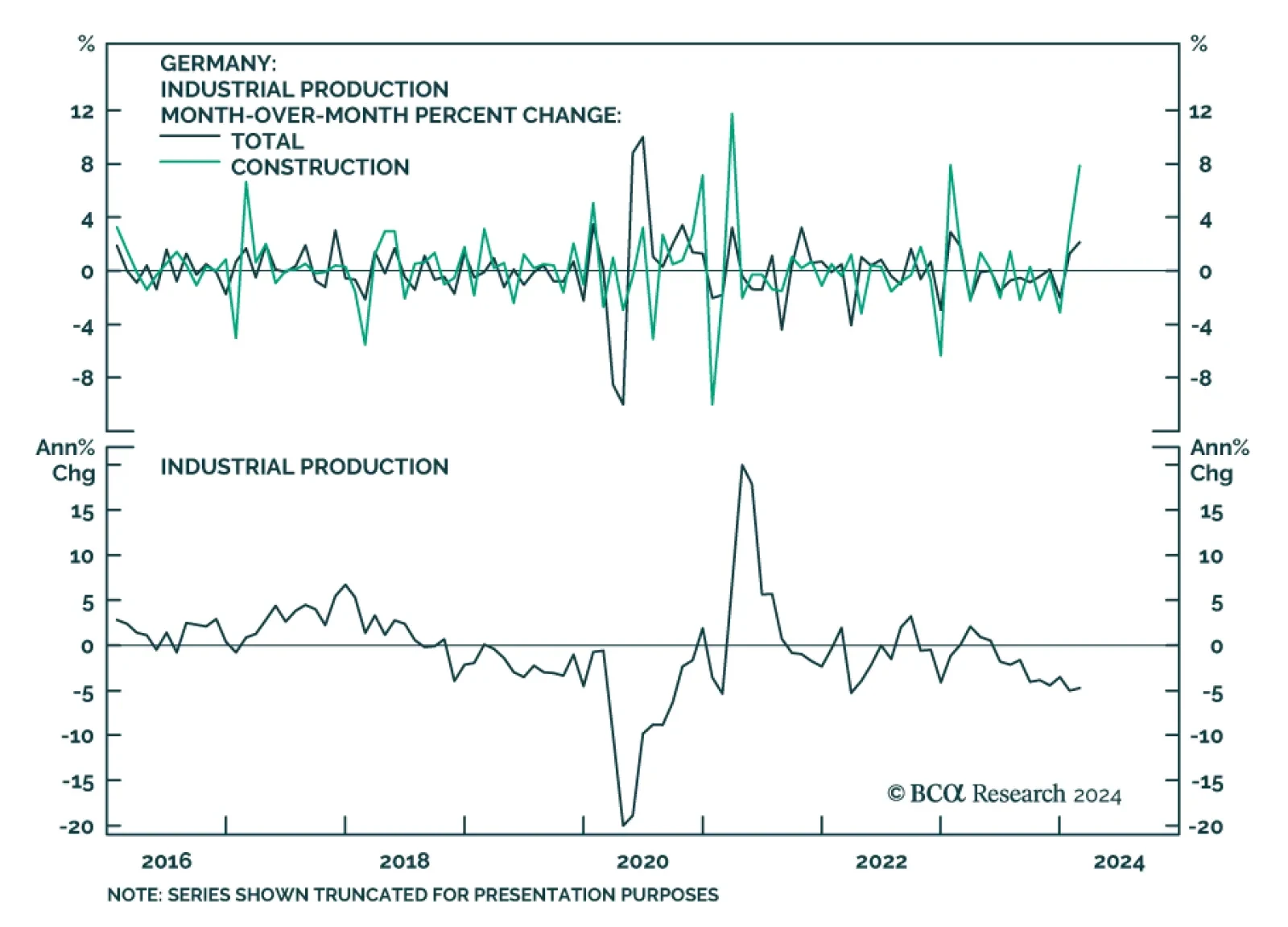

German industrial production growth accelerated from an upwardly revised 1.3% m/m to 2.1% m/m in February, registering the fastest pace in 13 months and largely beating expectations of a slowdown. A 7.9% m/m increase in the…

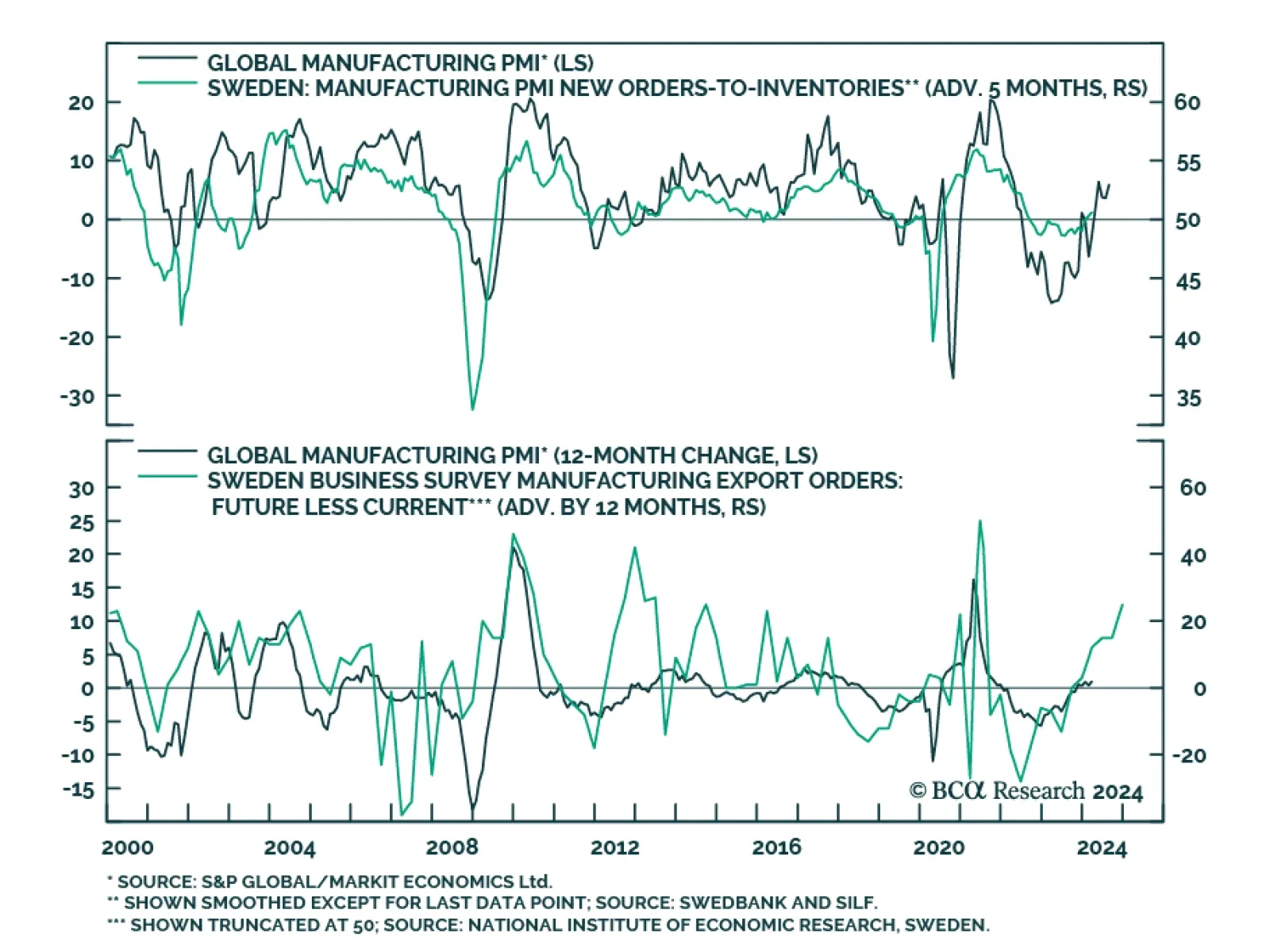

As a small open economy, Sweden’s economic performance is a good barometer of global growth developments. Swedish PMIs for March were overall positive. The Manufacturing PMI rose to the 50 boom-bust line following 19…

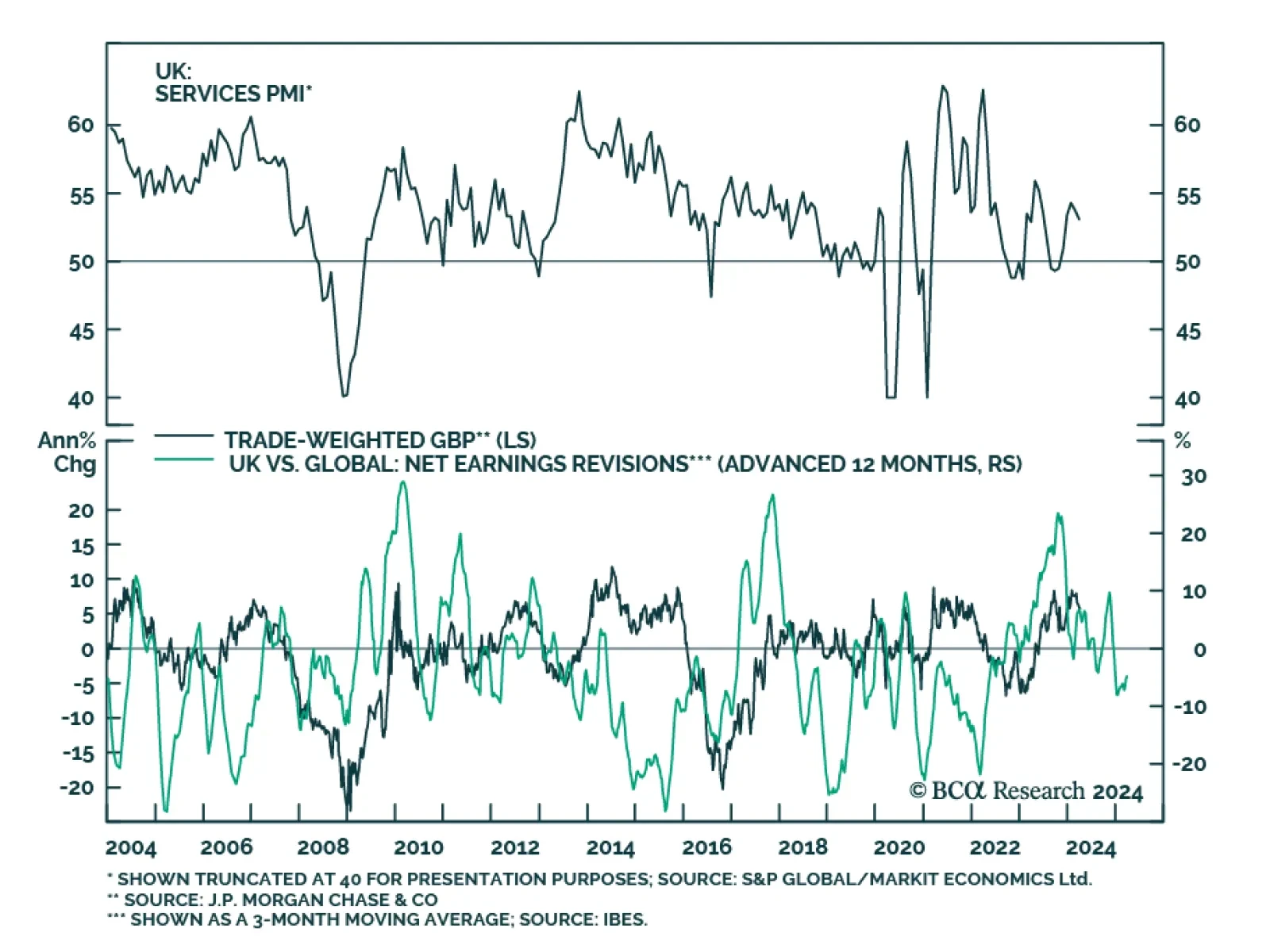

The final UK S&P Global Services and Composite PMIs for March were both revised down slightly from their flash estimates. While the report indicates that activity is still expanding, there has been a clear loss in momentum…

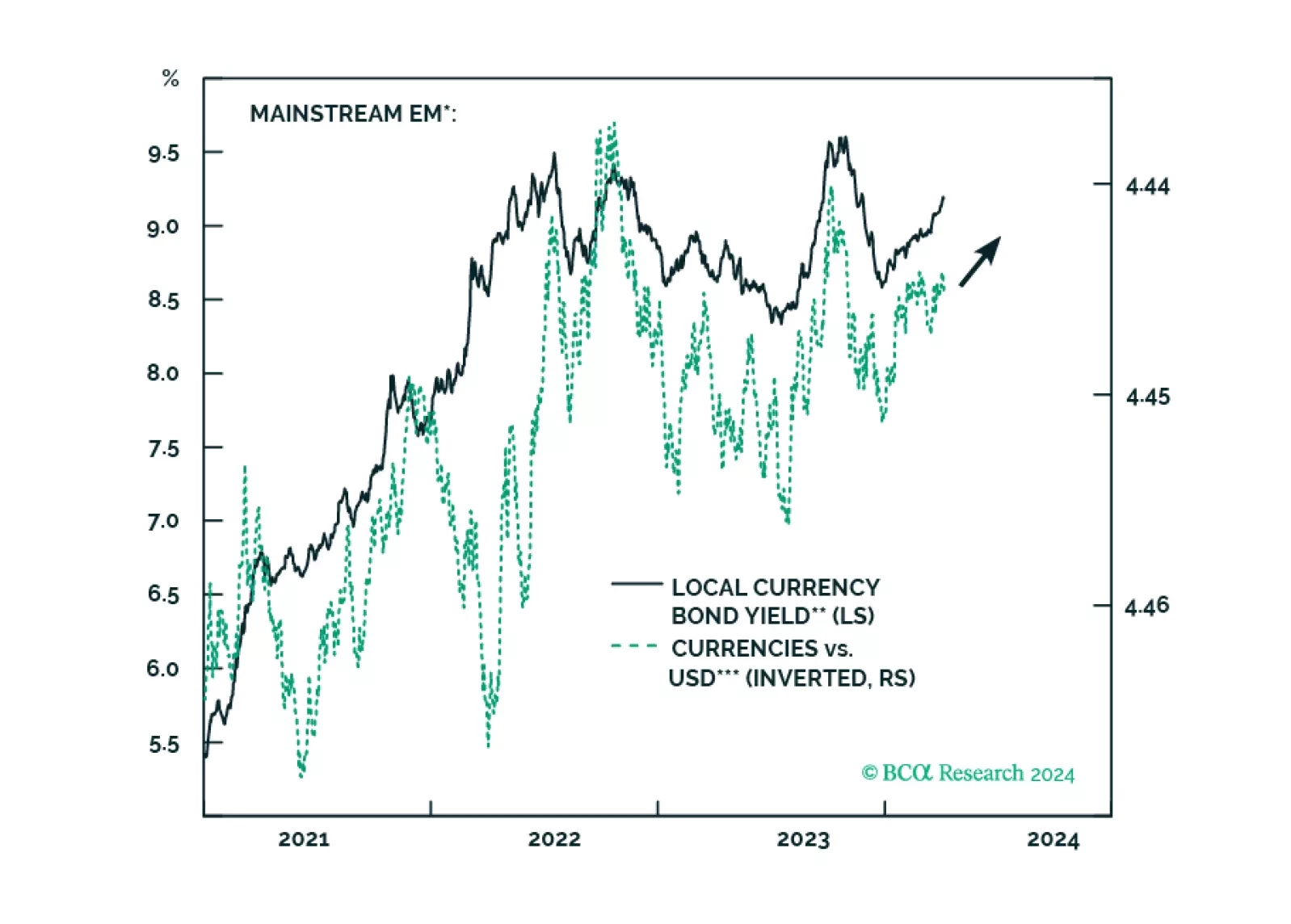

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

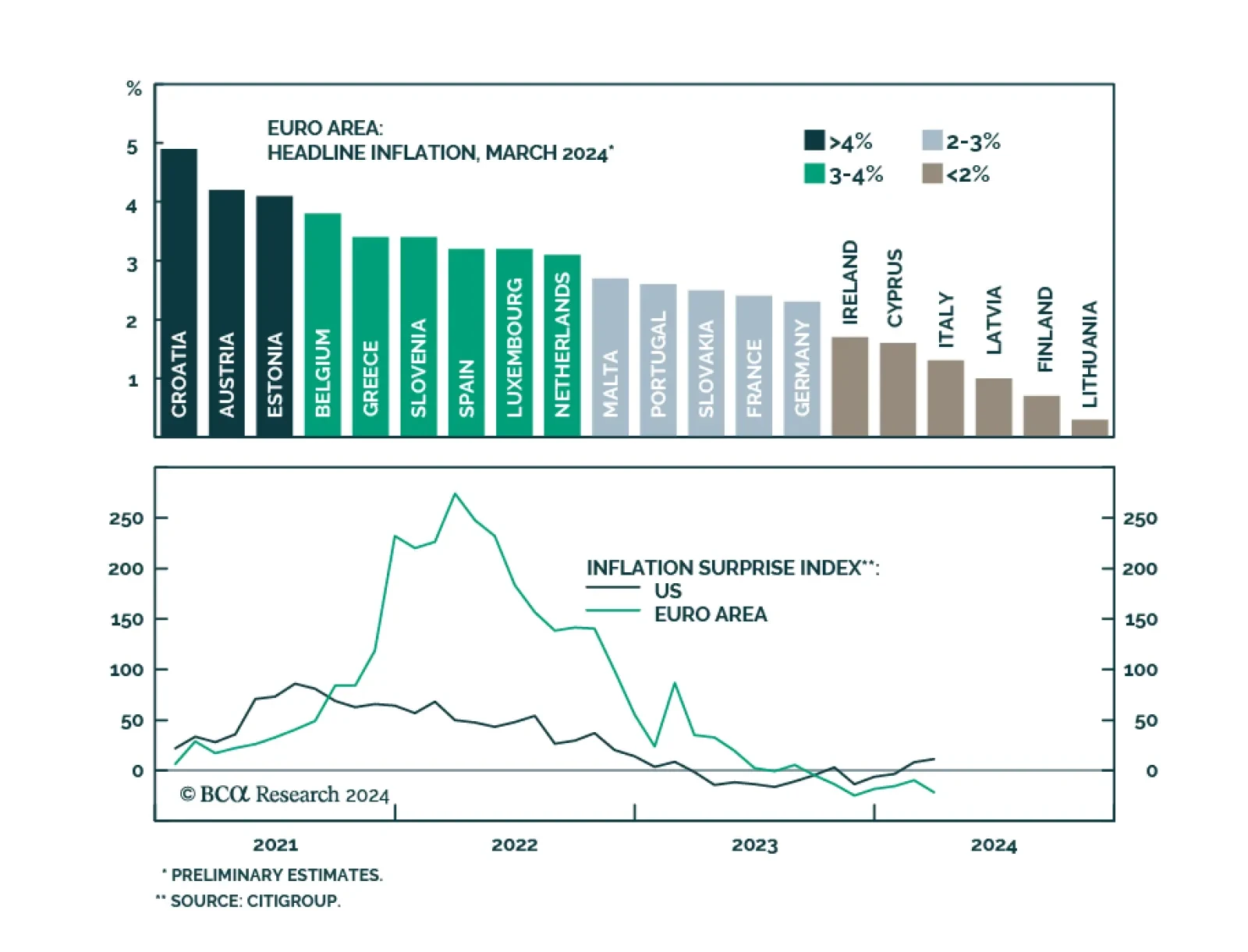

Flash estimates for Euro Area inflation in March surprised to the downside. Headline inflation slowed from 2.6% to 2.4% versus expectations of 2.5% and core inflation eased from 3.1% to 2.9% versus expectations of 3%. While the…

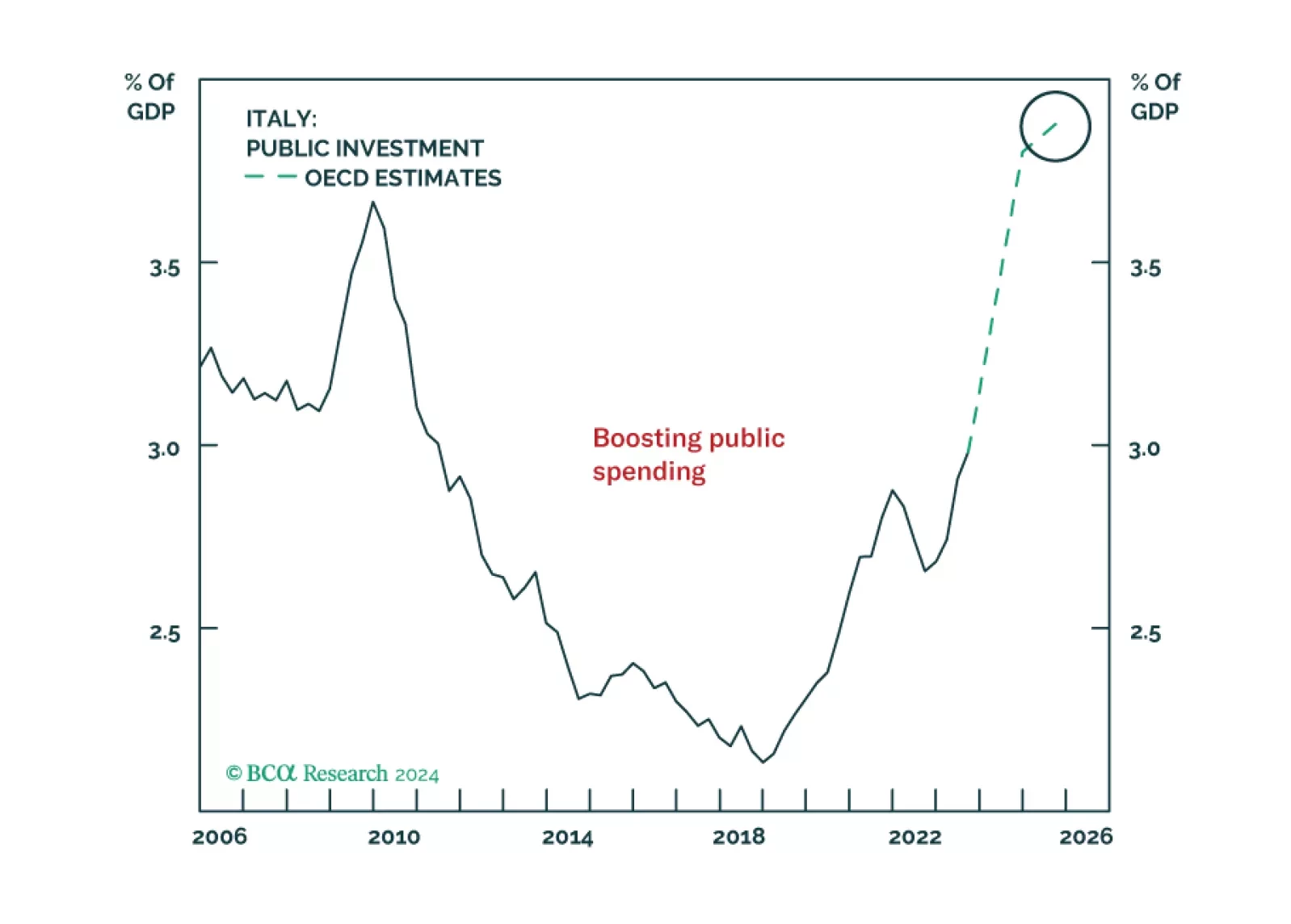

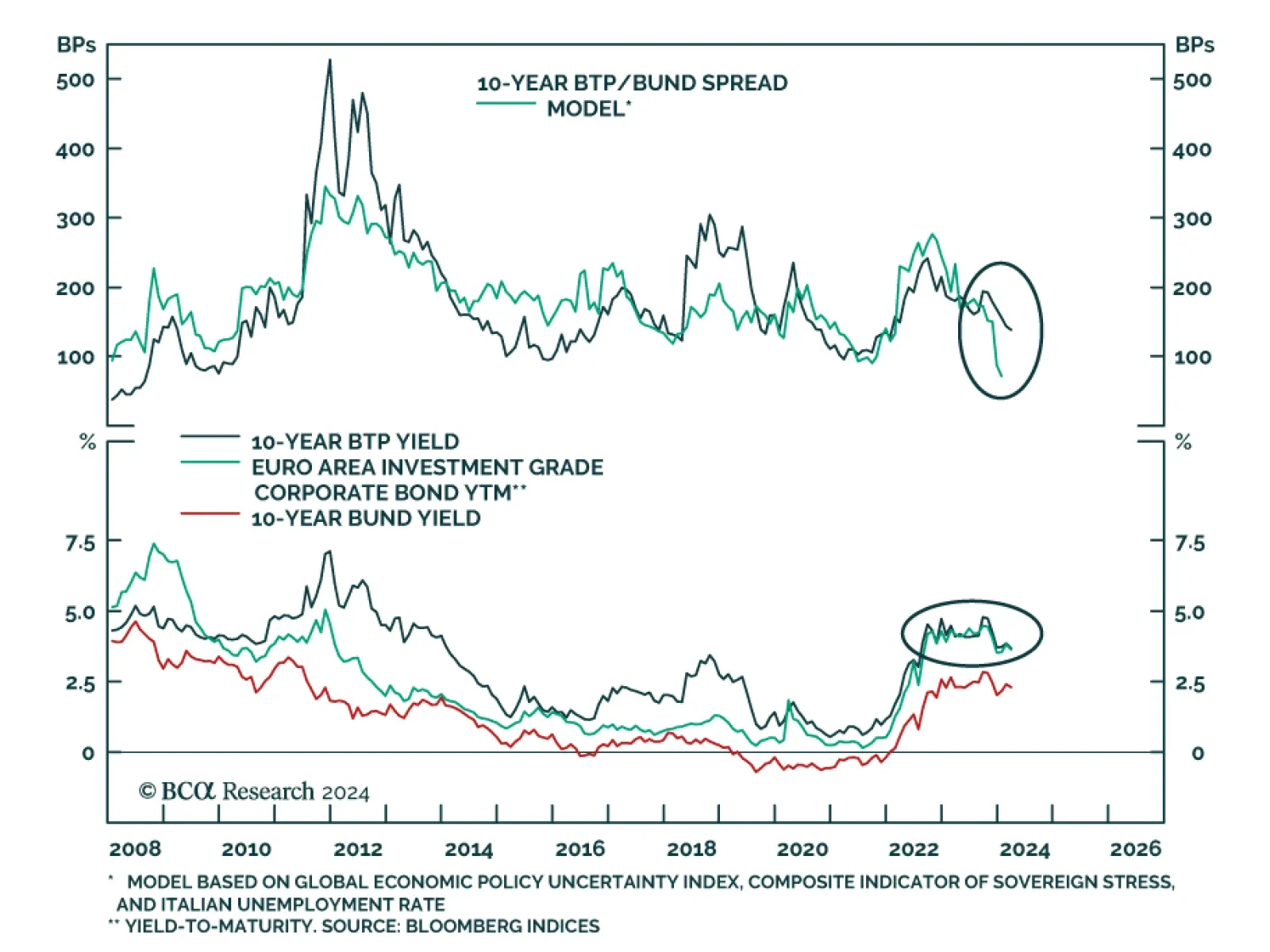

According to BCA Research’s European Investment Strategy service, investors should favor Italian BTPs over Euro Area IG until there is a better entry point to add exposure to BTP-bund spreads. The team’s latest…

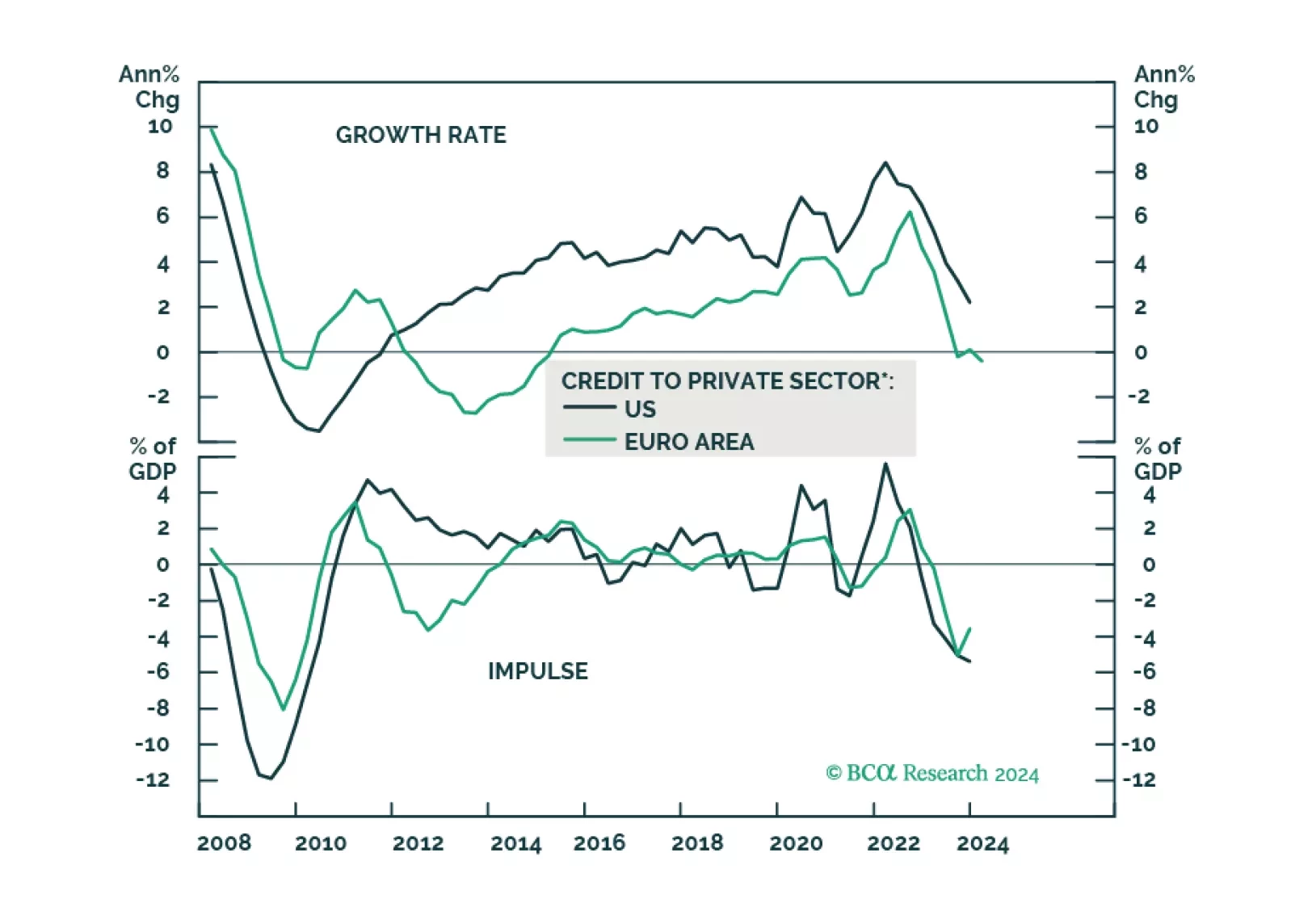

The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

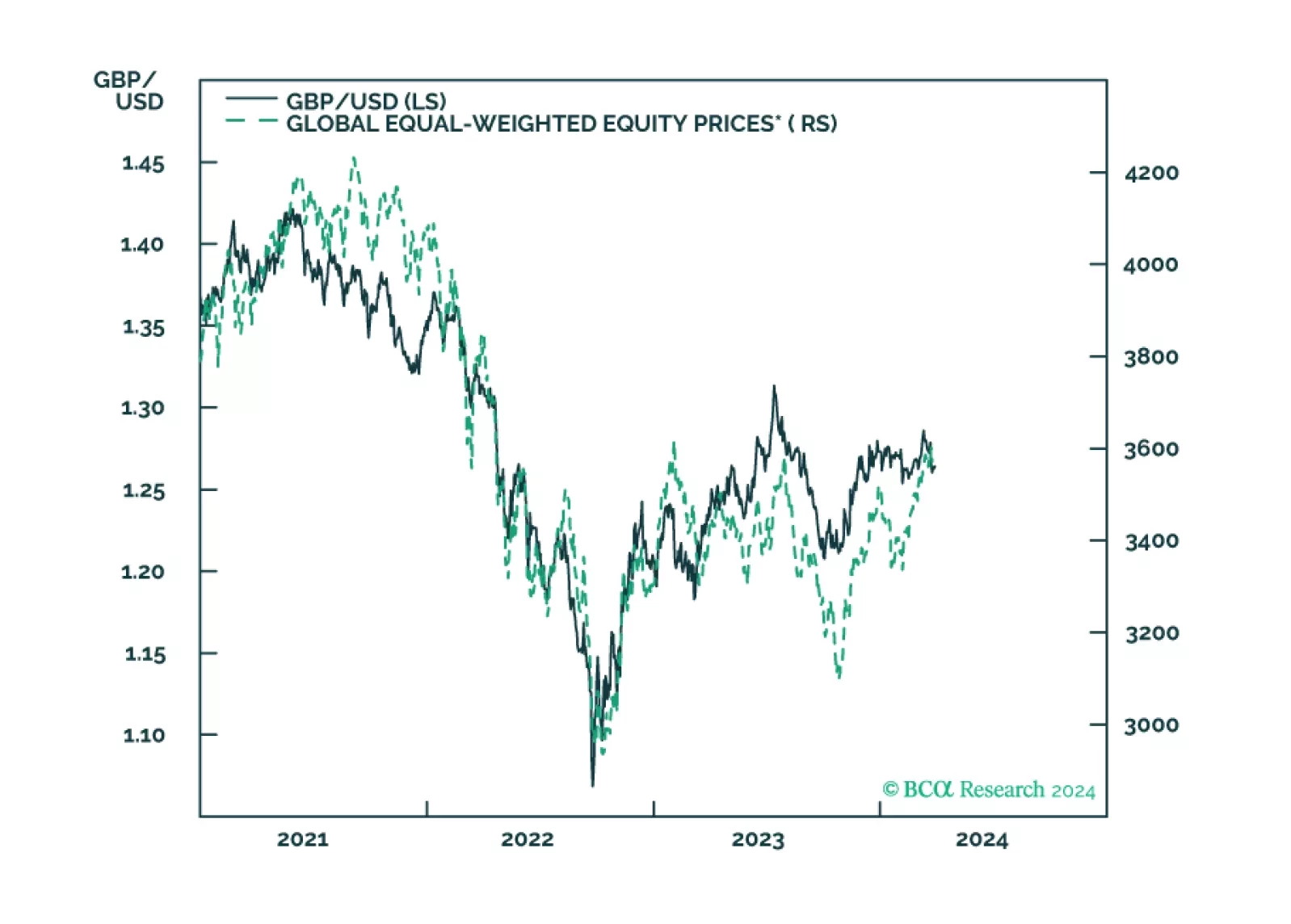

In this Insight, we discuss our rationale for a short sterling position.

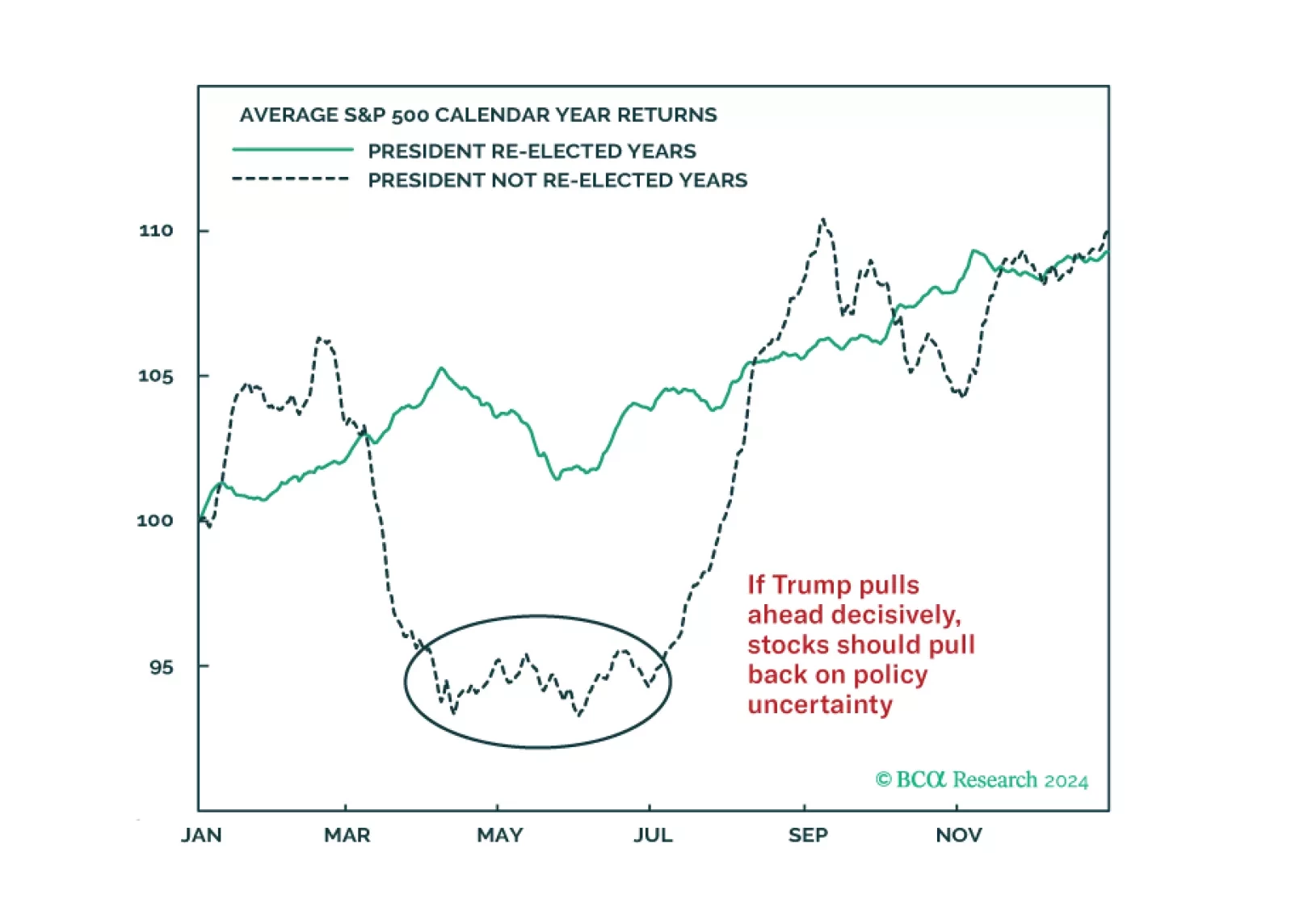

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…