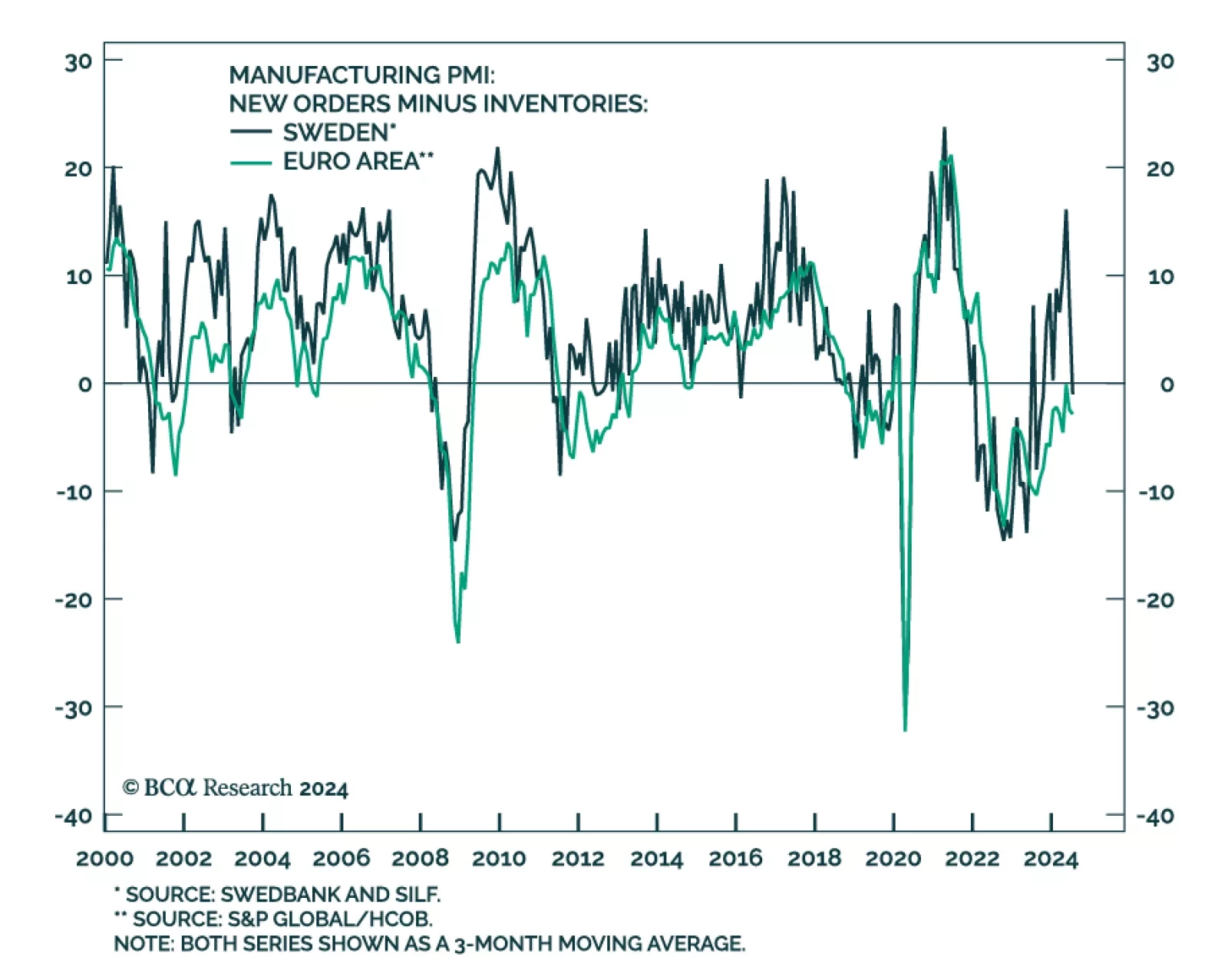

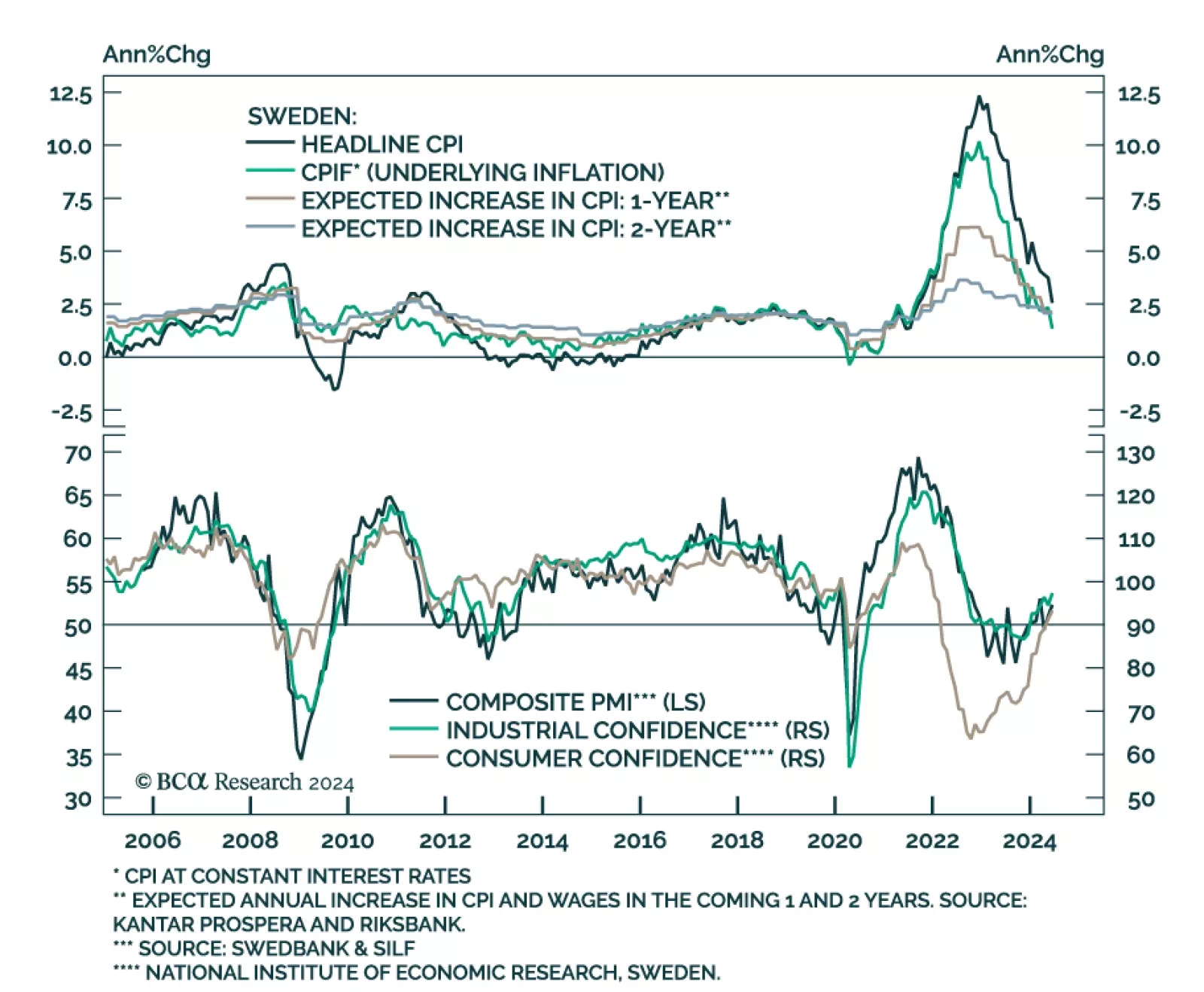

Sweden’s manufacturing PMI started contracting in July, plummeting from 53 to 49.2, falling far short of expectations that growth would broaden. Weakness was broad-based. Notably, new orders and new export orders plunged…

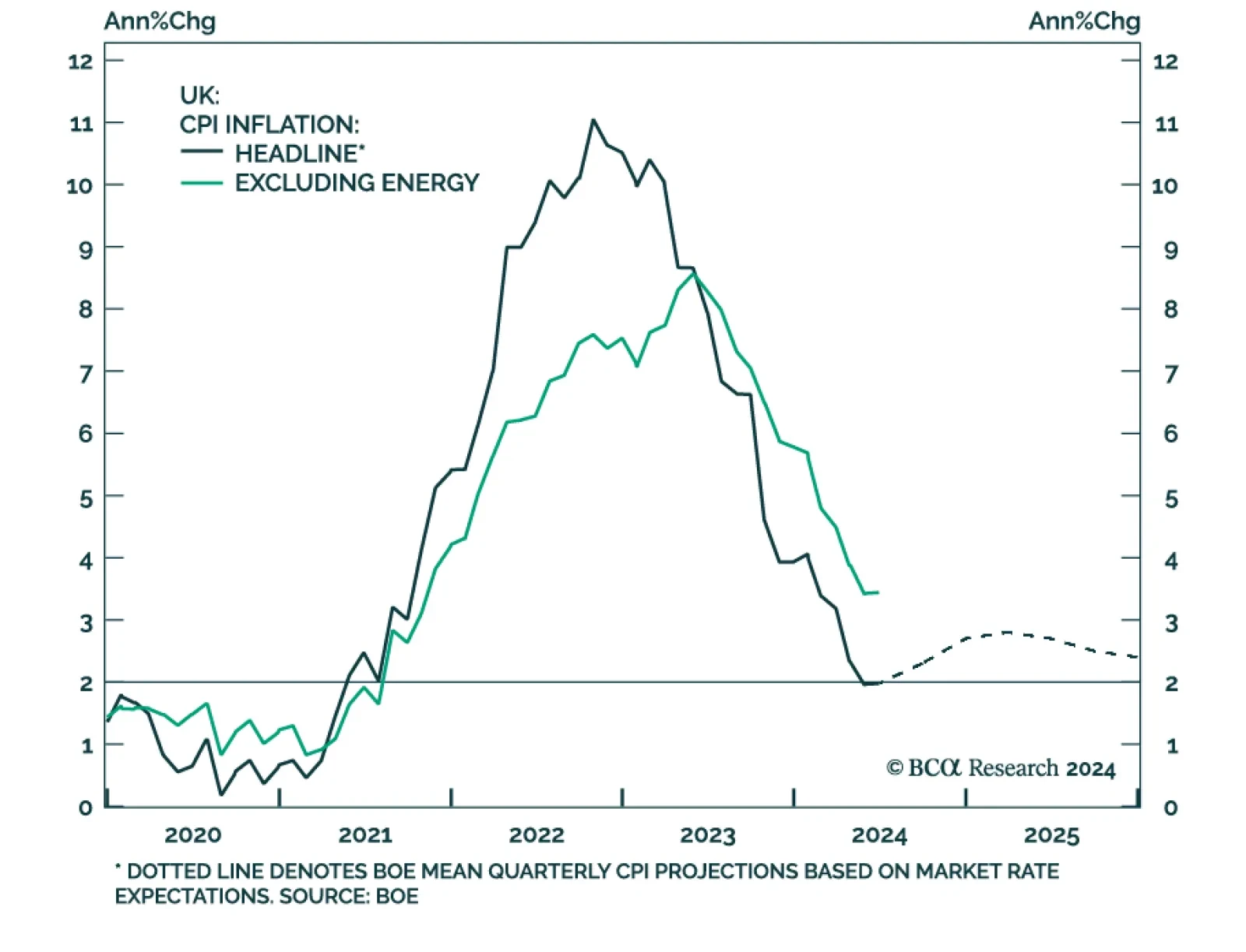

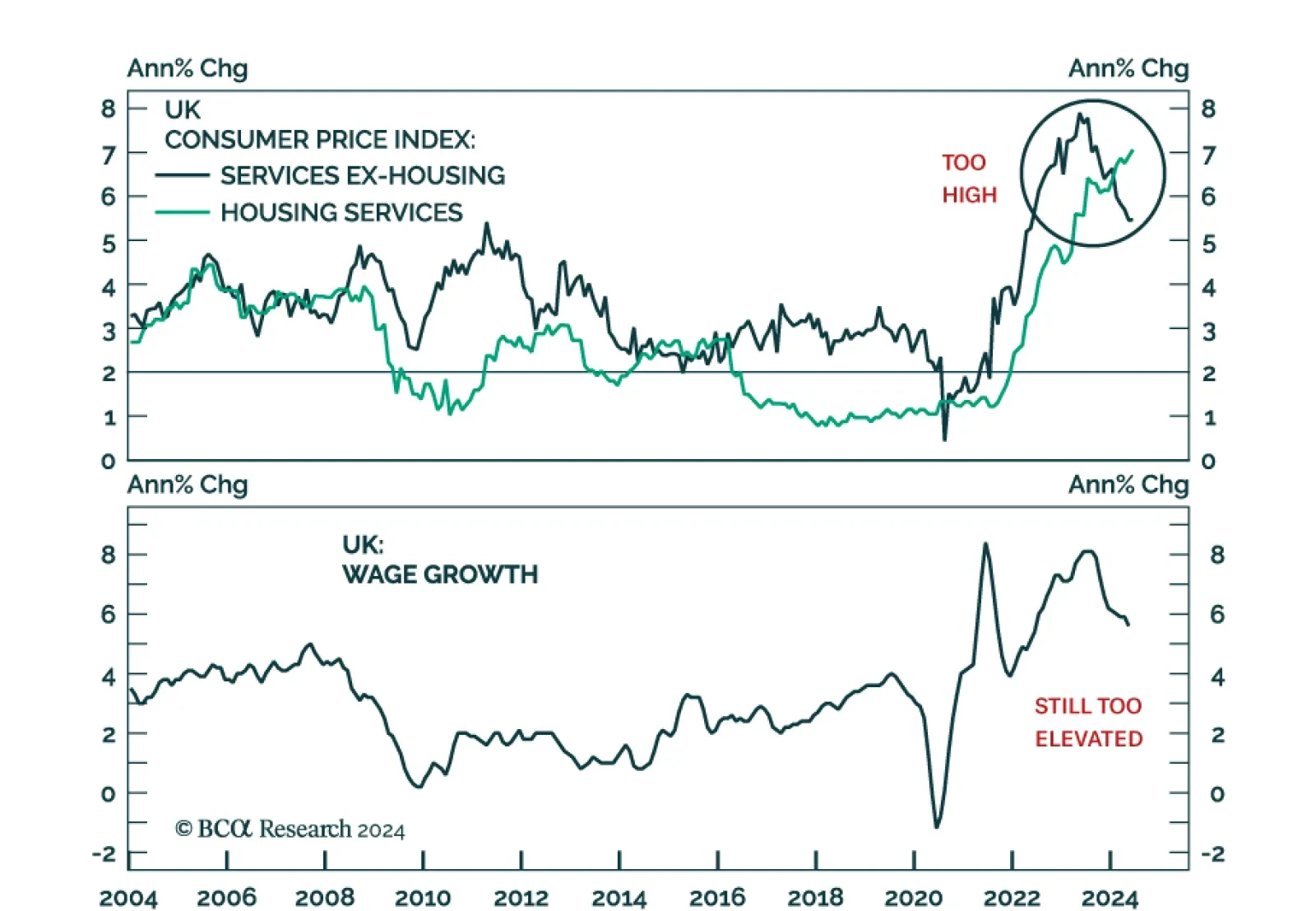

The Bank of England (BoE) lowered its policy rate by 25 basis points to 5% at its meeting on Thursday. While the move was expected, the governing board was split, voting 5 – 4 in favor of reducing the key interest rate.…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

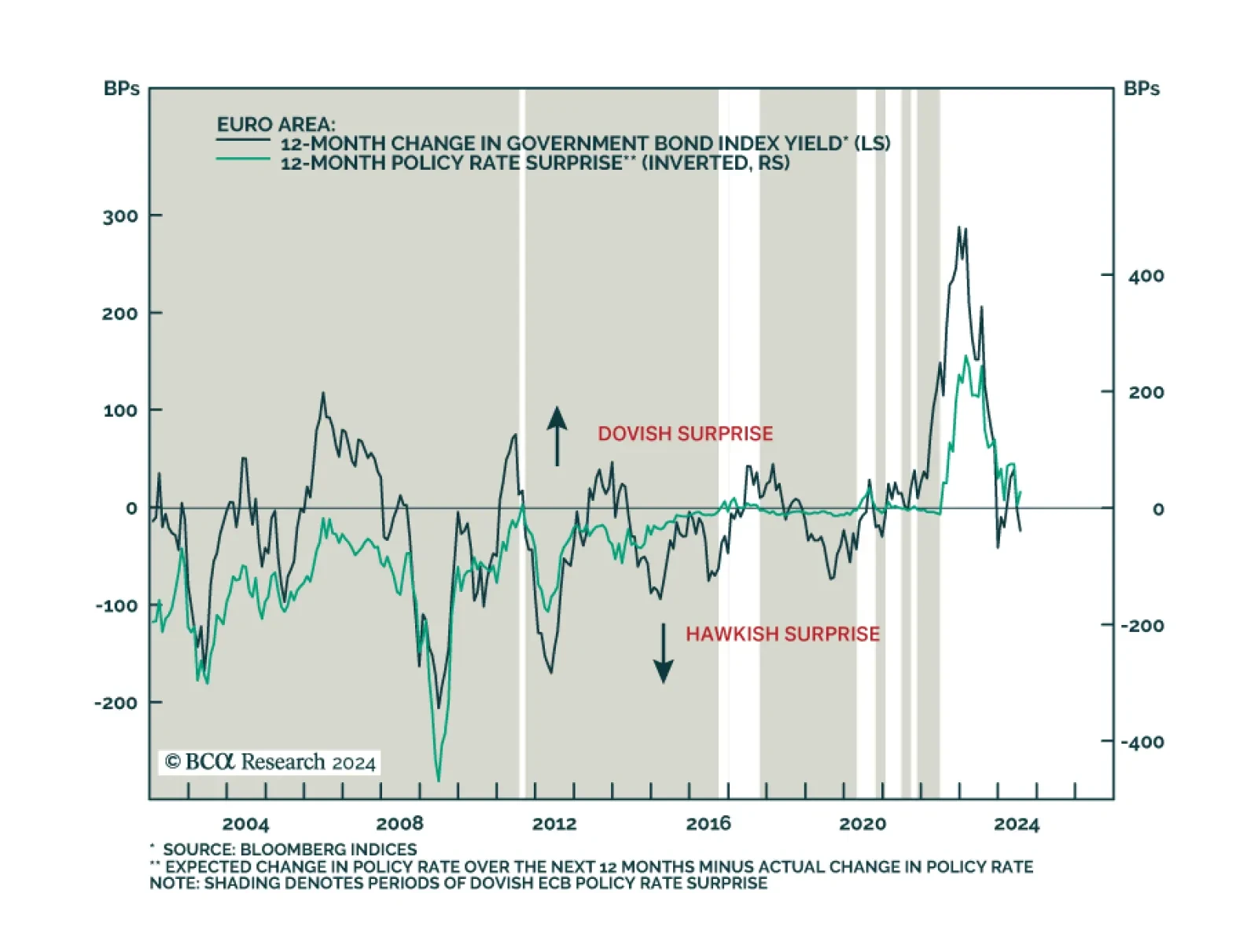

Eurozone headline CPI inflation unexpectedly accelerated in July, from 2.5% y/y to 2.6%. Core CPI remained stable at 2.9% despite expectations it would ease. EU Harmonized CPI accelerated in the regions’ three largest…

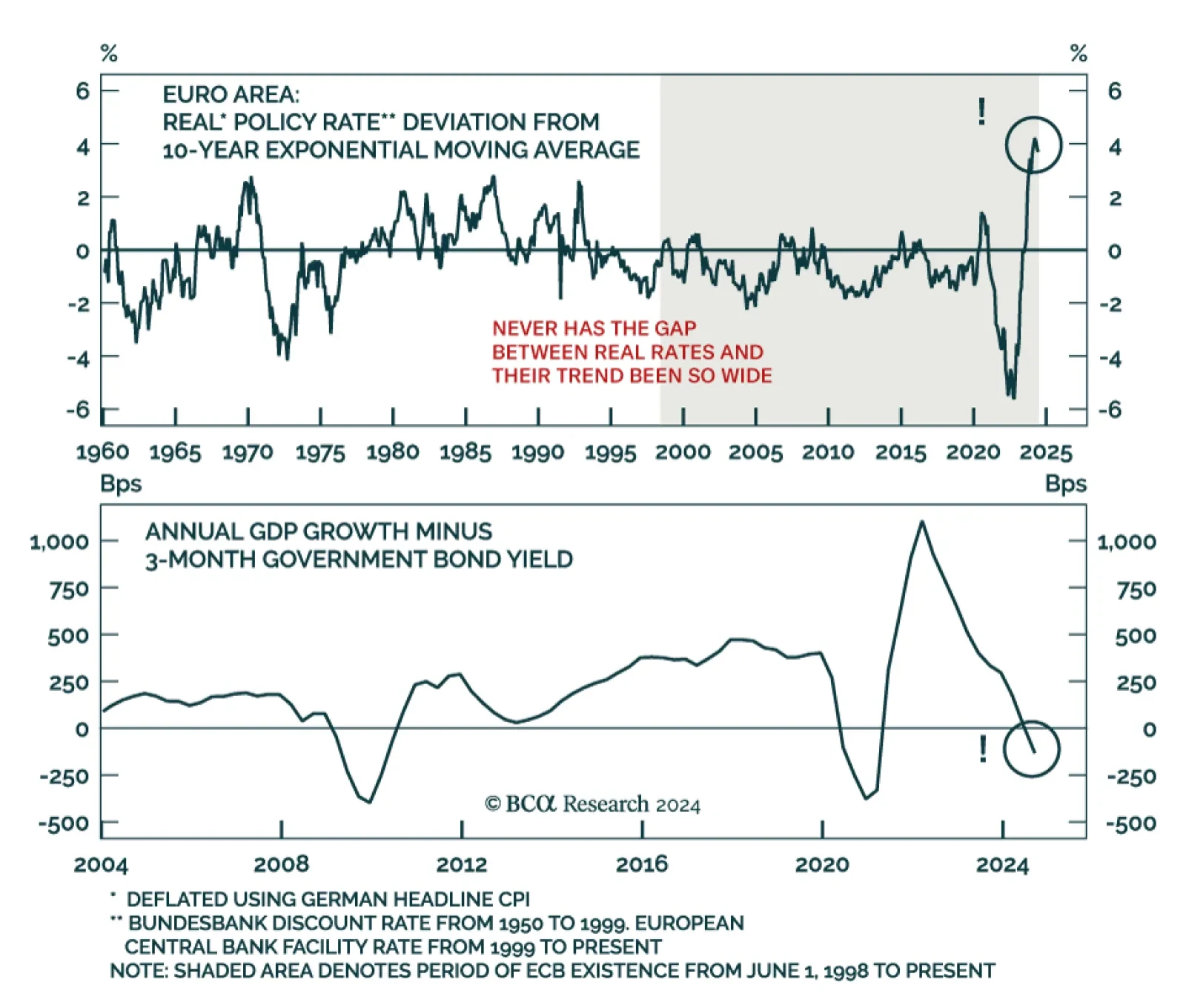

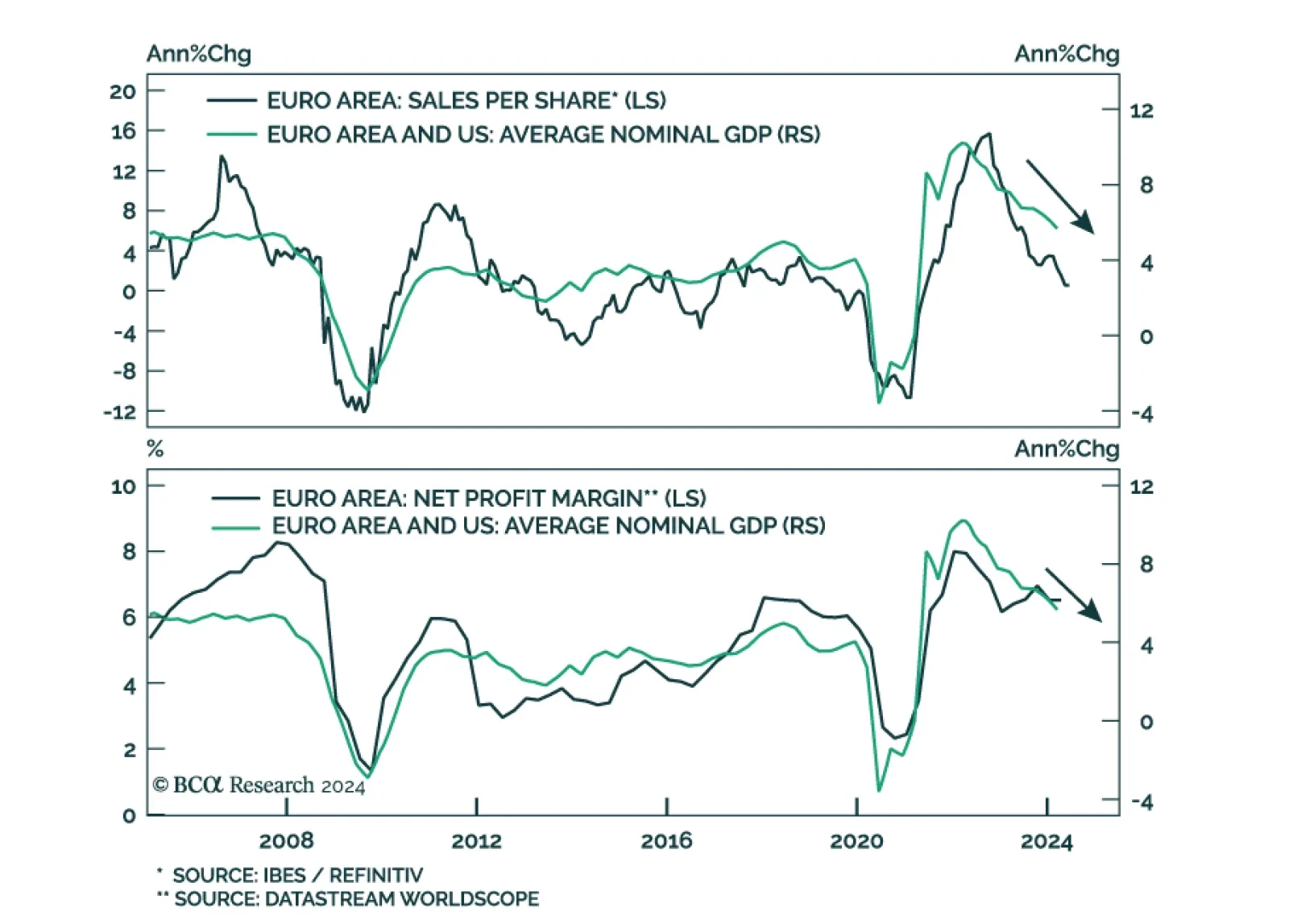

According to BCA Research’s European Investment Strategy service, a foreign shock is likely to tip the Eurozone economy into a recession because important vulnerabilities have emerged domestically. Policy is restrictive…

Preliminary estimates suggests that the Swedish economy unexpectedly contracted in Q2. The seasonally adjusted GDP Indicator declined by 0.8% q/q, following a 0.7% Q1 rise in actual GDP growth. Flash estimates lack details and…

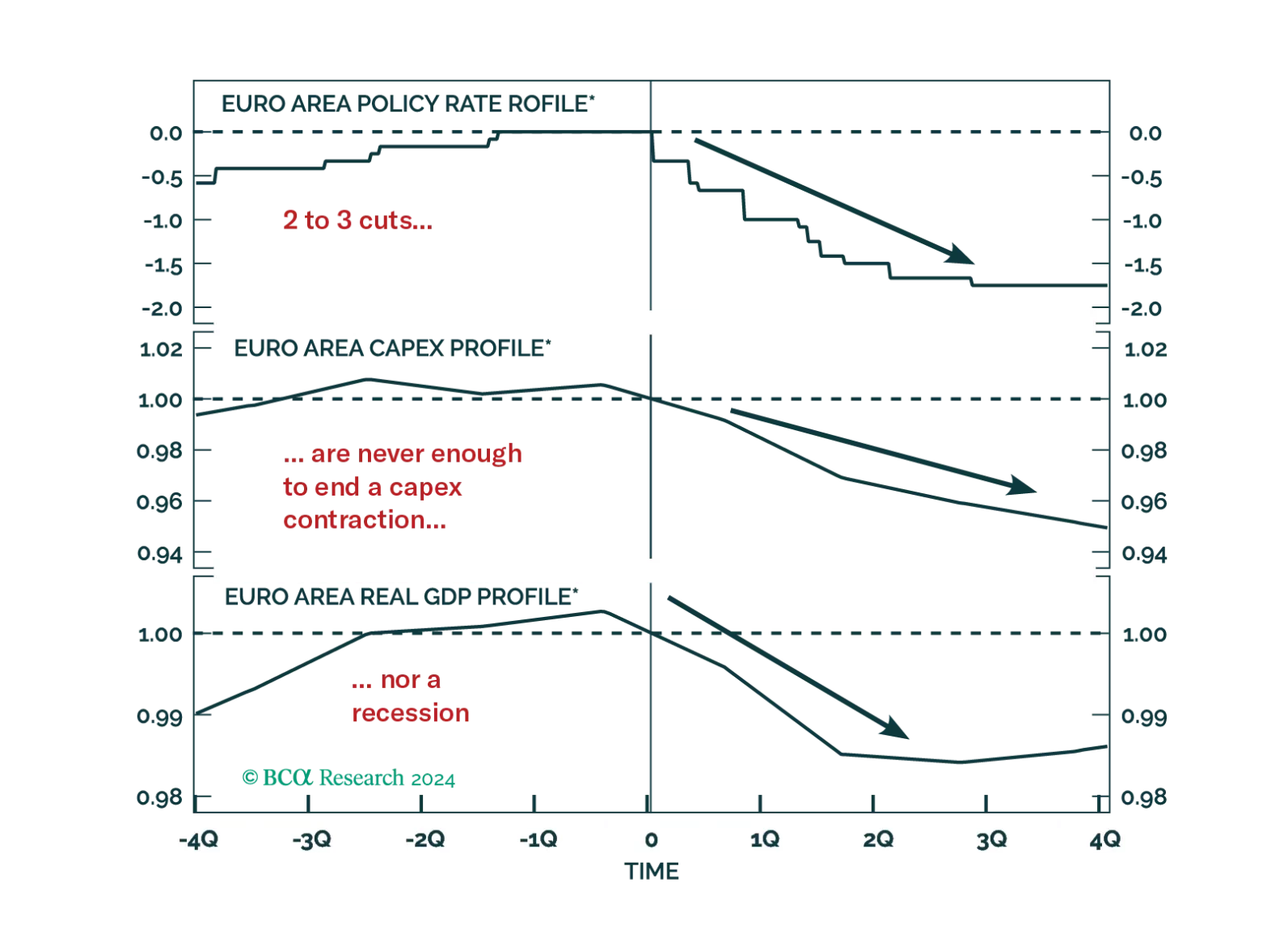

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

We assign high odds that the US will tip into a recession by year-end or early 2025. Given it has been the largest driver of global demand in this cycle, a US recession will morph into a global downturn. The procyclical…

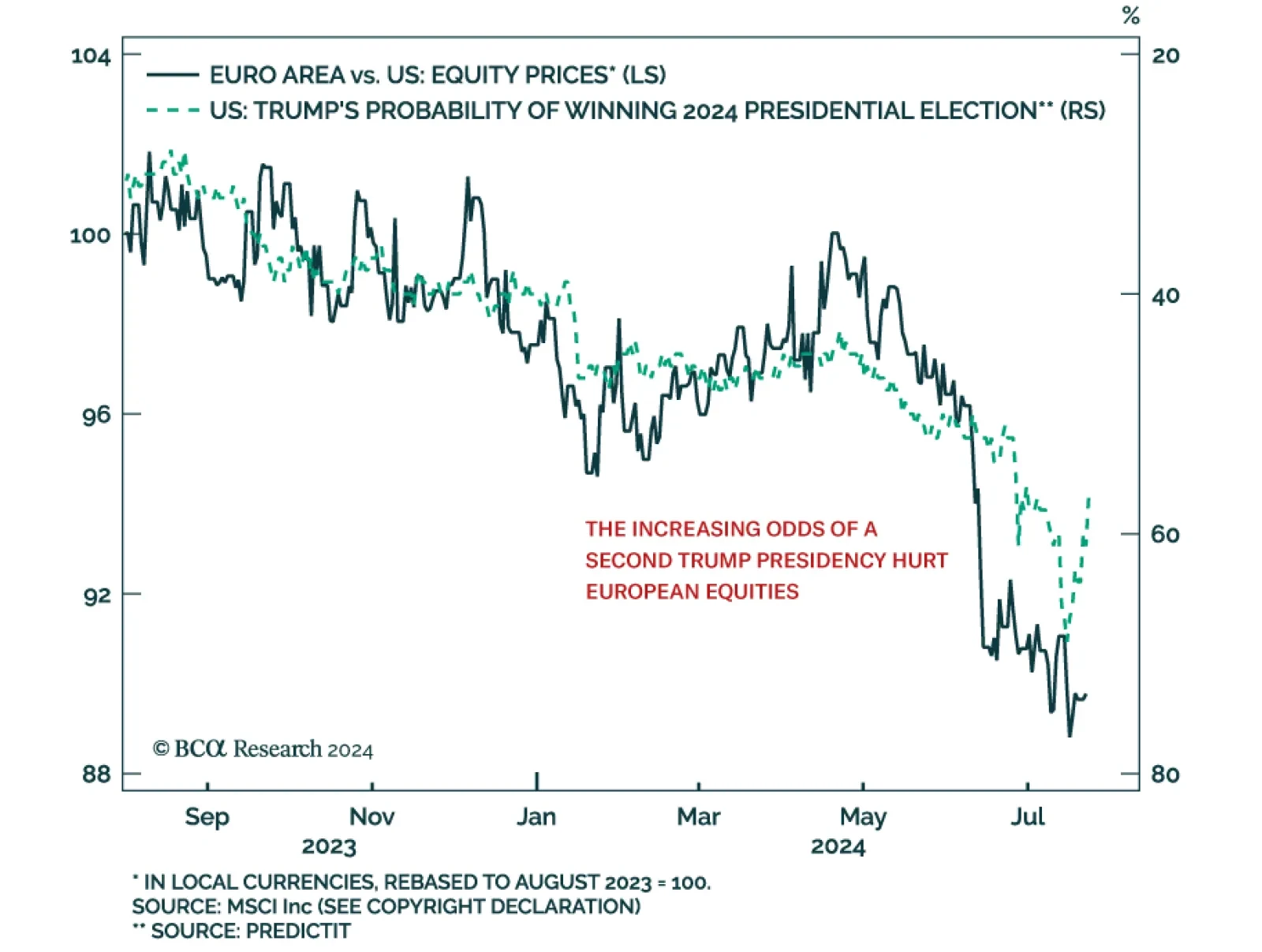

According to BCA Research’s European Investment Strategy service, the impact on global trade from another round of tariffs under a potential Trump administration is an emerging risk to Europe. The underperformance of…

UK’s CPI growth stands right on the Bank of England’s (BoE) 2% target. However, services inflation remains sticky, growing at a constant 5.7% y/y in June. Moreover, the deceleration in wage growth remains insufficient…