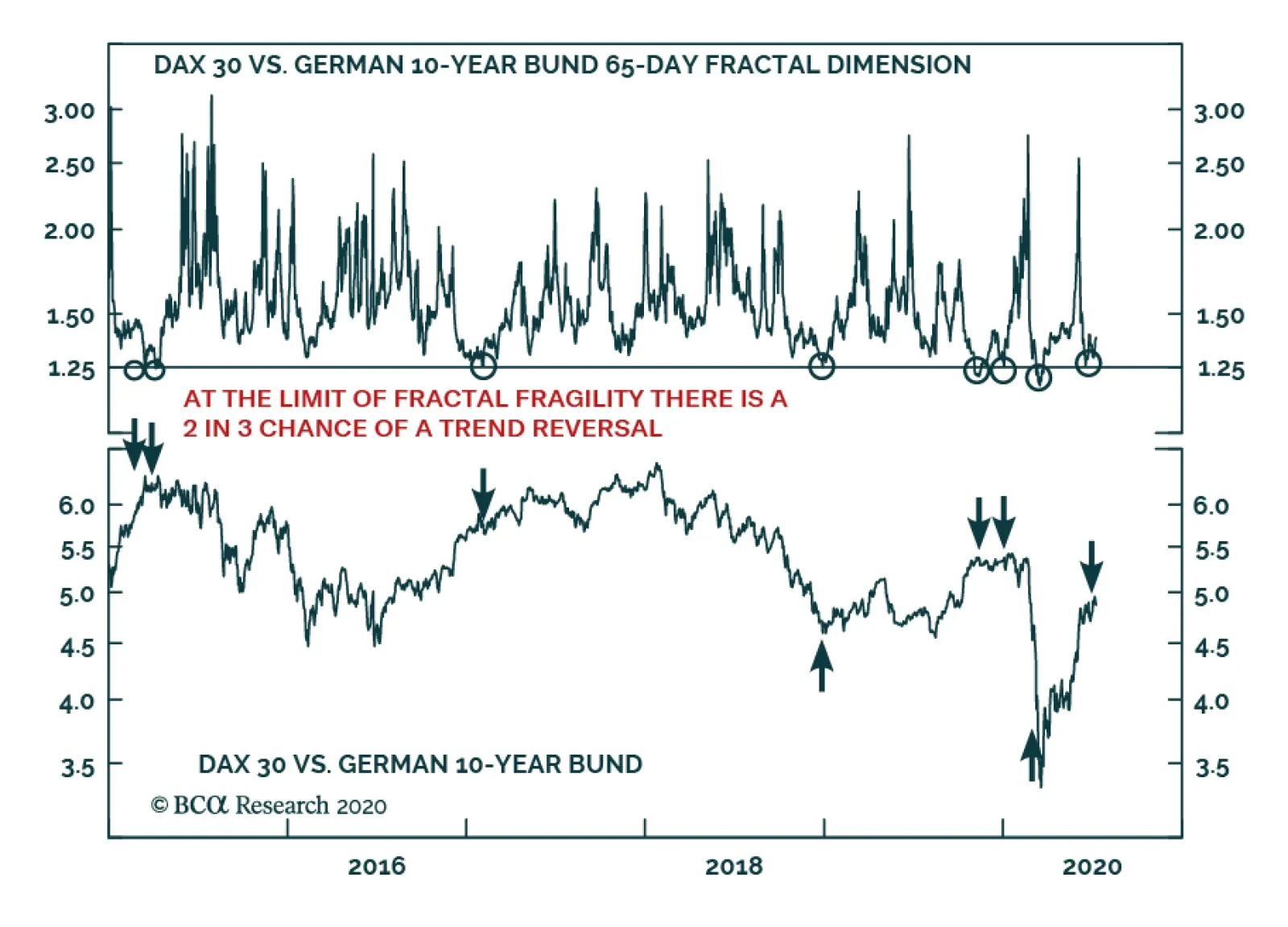

BCA Research's European Investment Strategy service's fractal trading model has given them a sell signal on the stock-to-bond ratio. Since 2015, a collapsed 65-day fractal structure of the German stock-to-bond ratio…

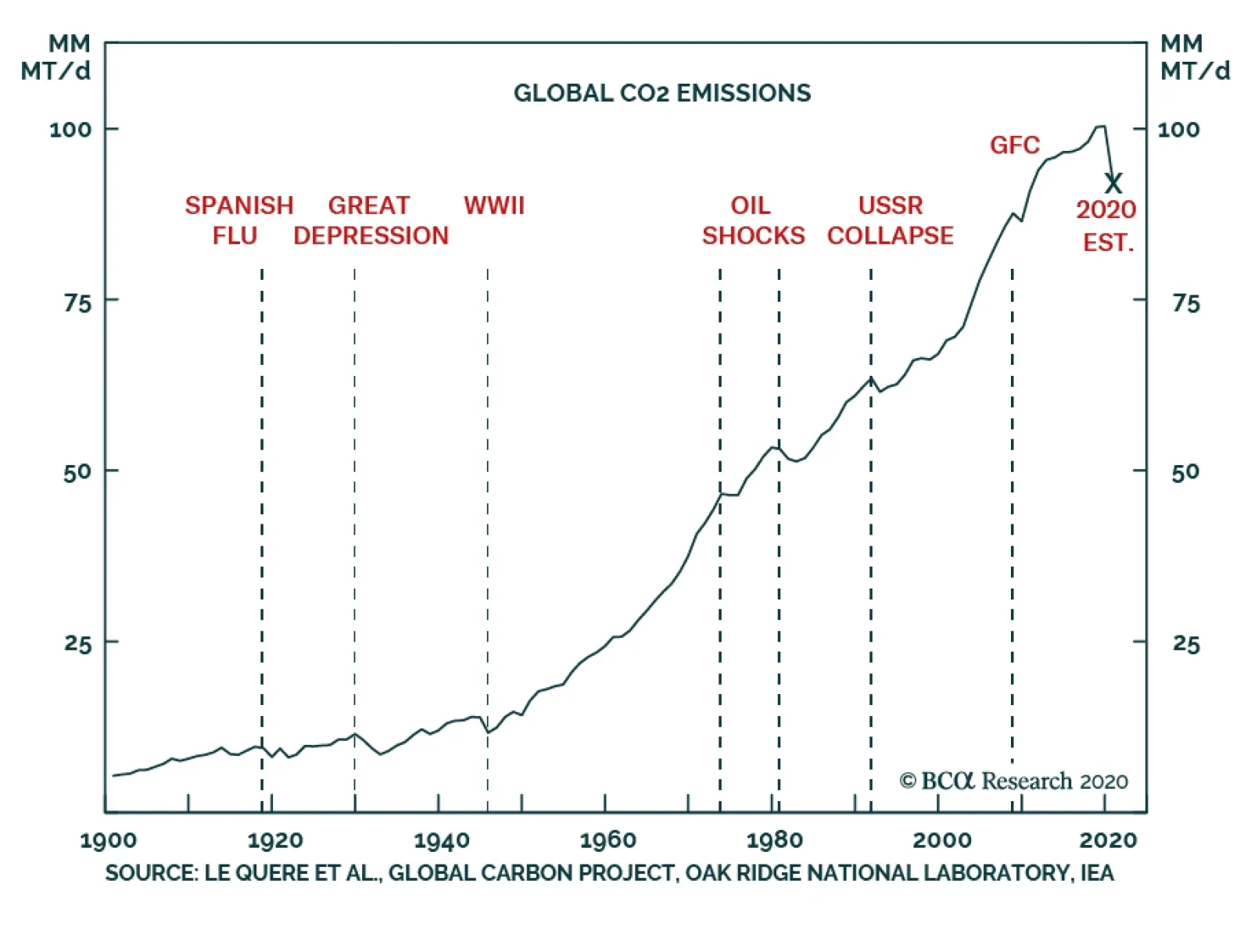

BCA Research's Commodity & Energy Strategy service has initiated coverage of the EU Emission Trading System’s (ETS) CO2 allowances. They expect this policy-driven cap-and-trade market to become central to the market…

Please note that I will be hosting a webcast on Friday July 17 and that the webcast will replace next week’s report. Highlights Go tactically short stocks versus bonds. But express it as short DAX versus the US 10-year T-bond…

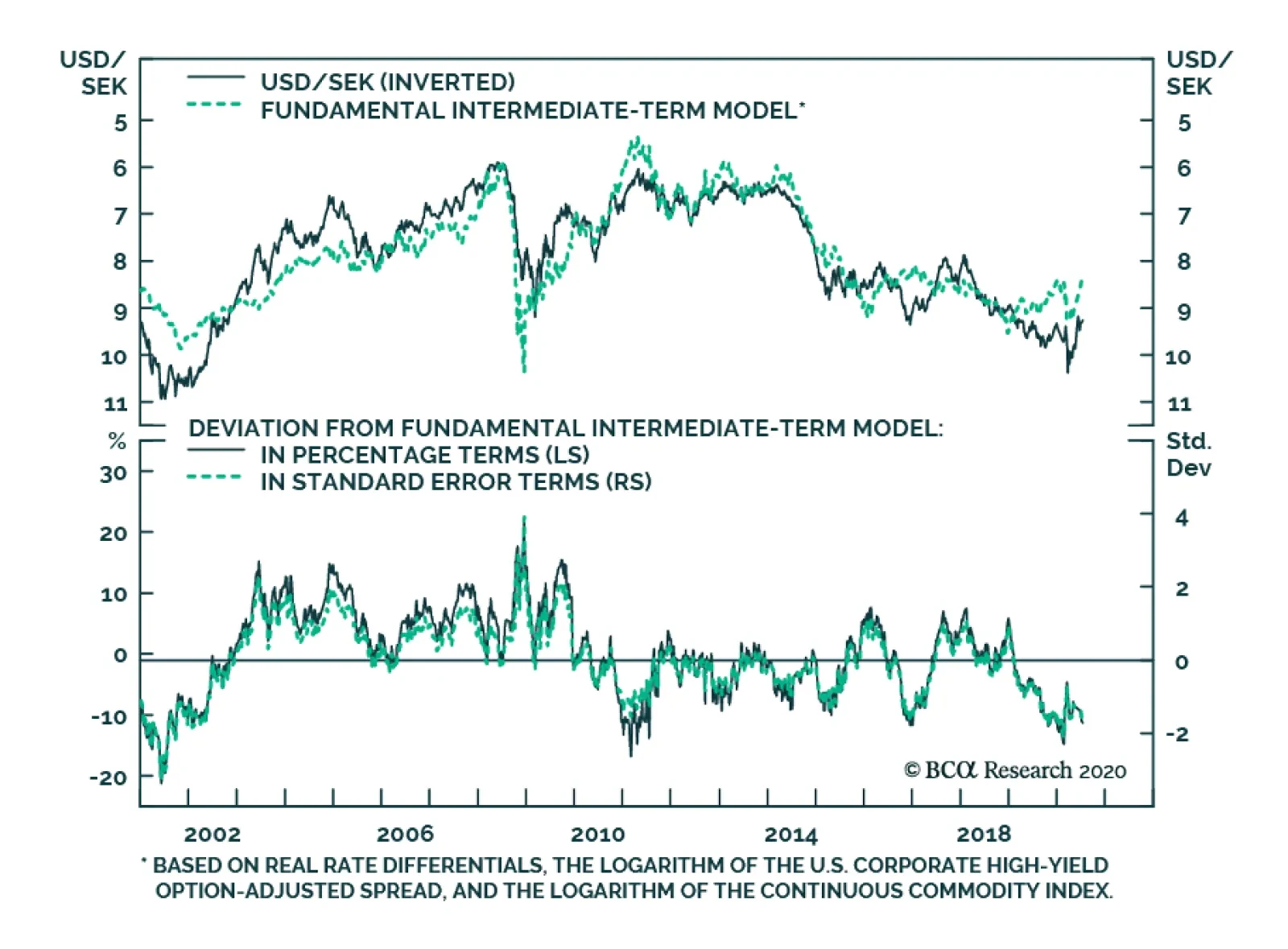

BCA Research's Foreign Exchange Strategy service's intermediate-term model shows that the Swedish krona is now quite cheap. As such, it is one of their favorite longs. Meanwhile, since the Fed extended its USD swap lines…

Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

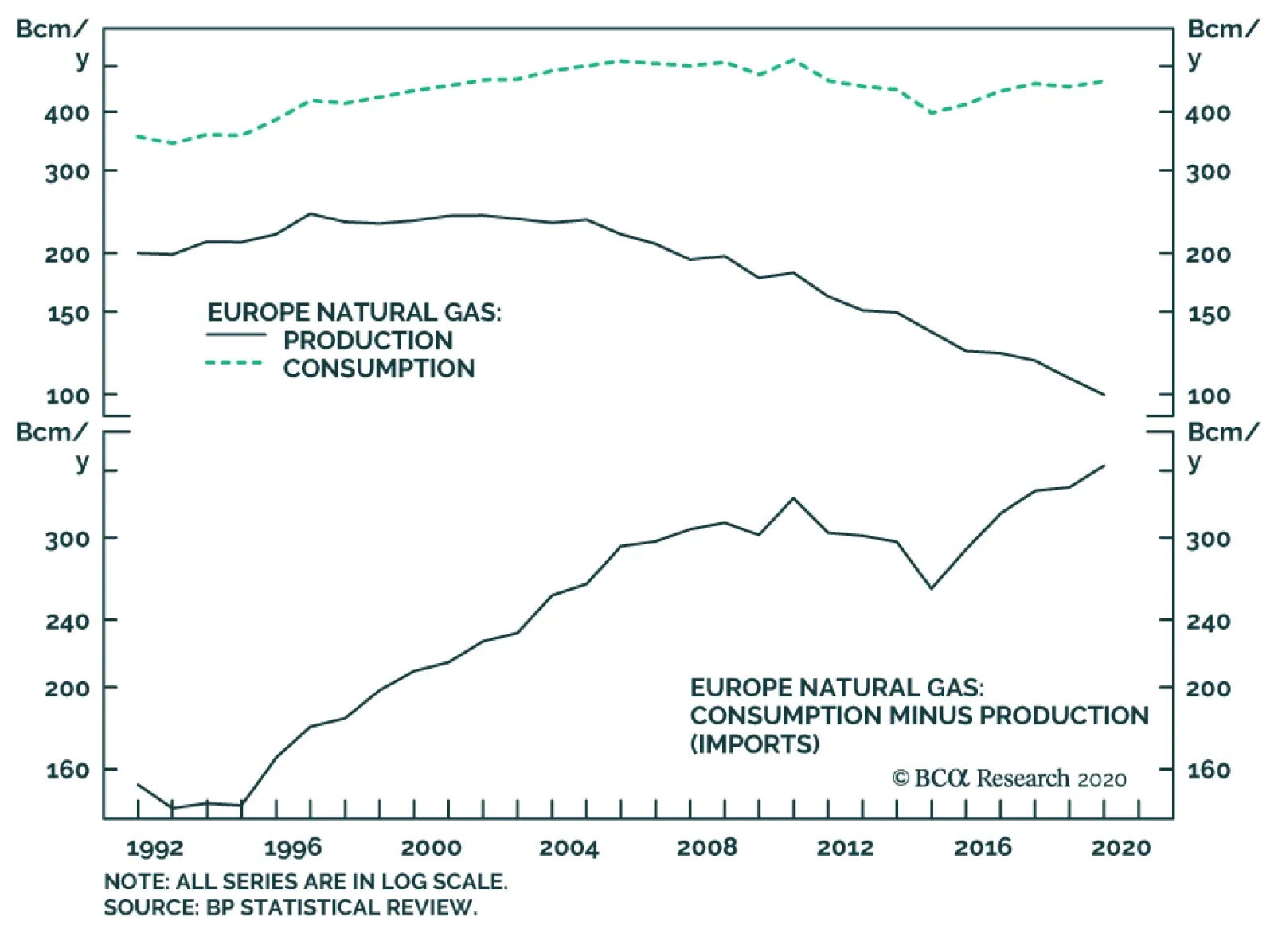

The combination of falling domestic production, steady consumption growth, and the ongoing structural shift to cleaner sources of energy will require greater imports of natural gas by European consumers. Critically, Europe…

Highlights The cost of housing is the one item that has held up US inflation vis a vis European inflation in recent years. But as the cost of housing flips from being a strong tailwind to a strong headwind, US inflation is about to…

Highlights Recommended Allocation The coronavirus pandemic is not over. Enormous fiscal and monetary stimulus will soften the blow to the global economy, but there remain significant risks to growth over the next 12 months…