The ECB left policy unchanged in September, reiterating a data-dependent stance and signaling no urgency to ease. Markets barely reacted, consistent with a fully discounted decision. The Governing Council appears confident in a soft…

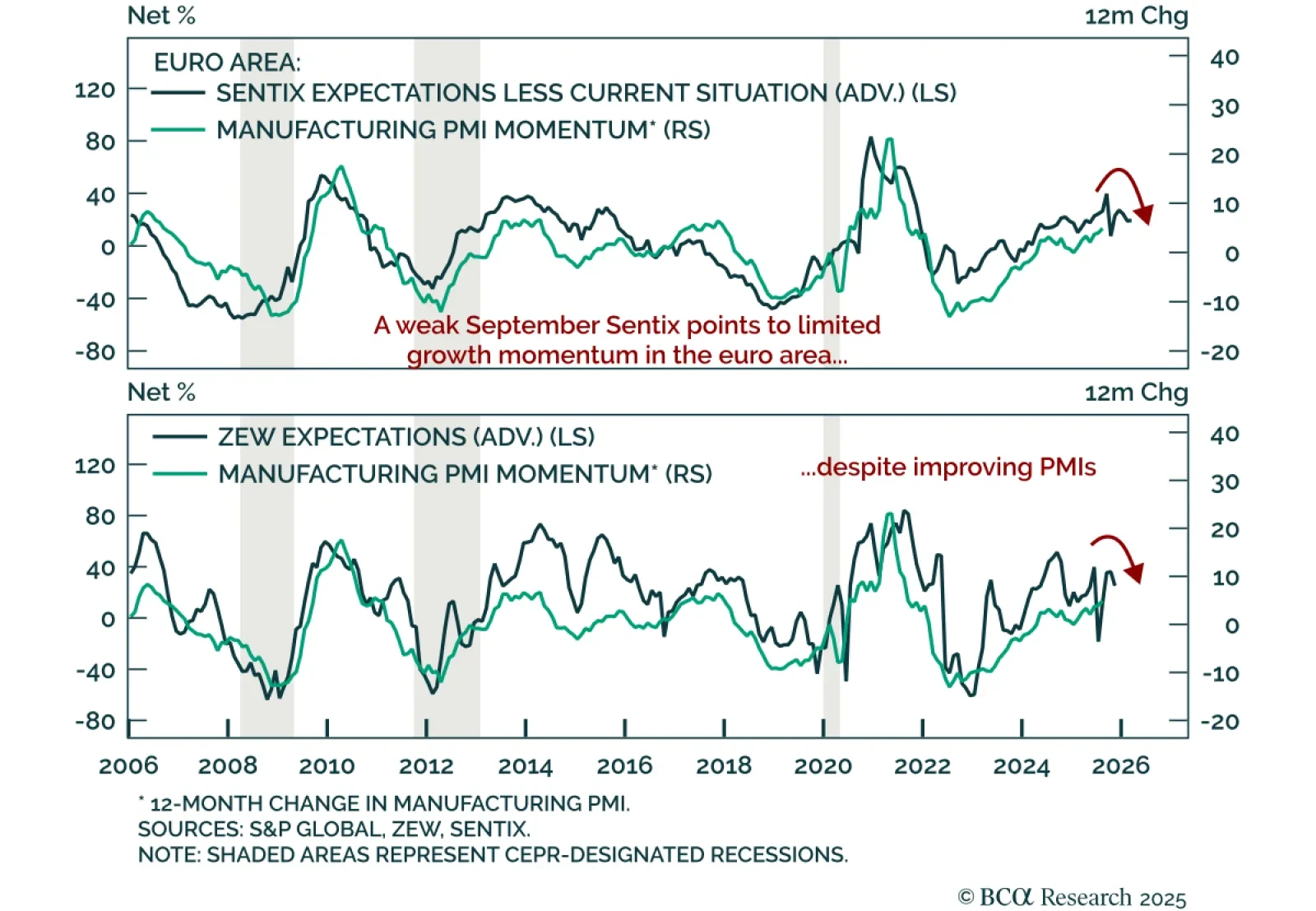

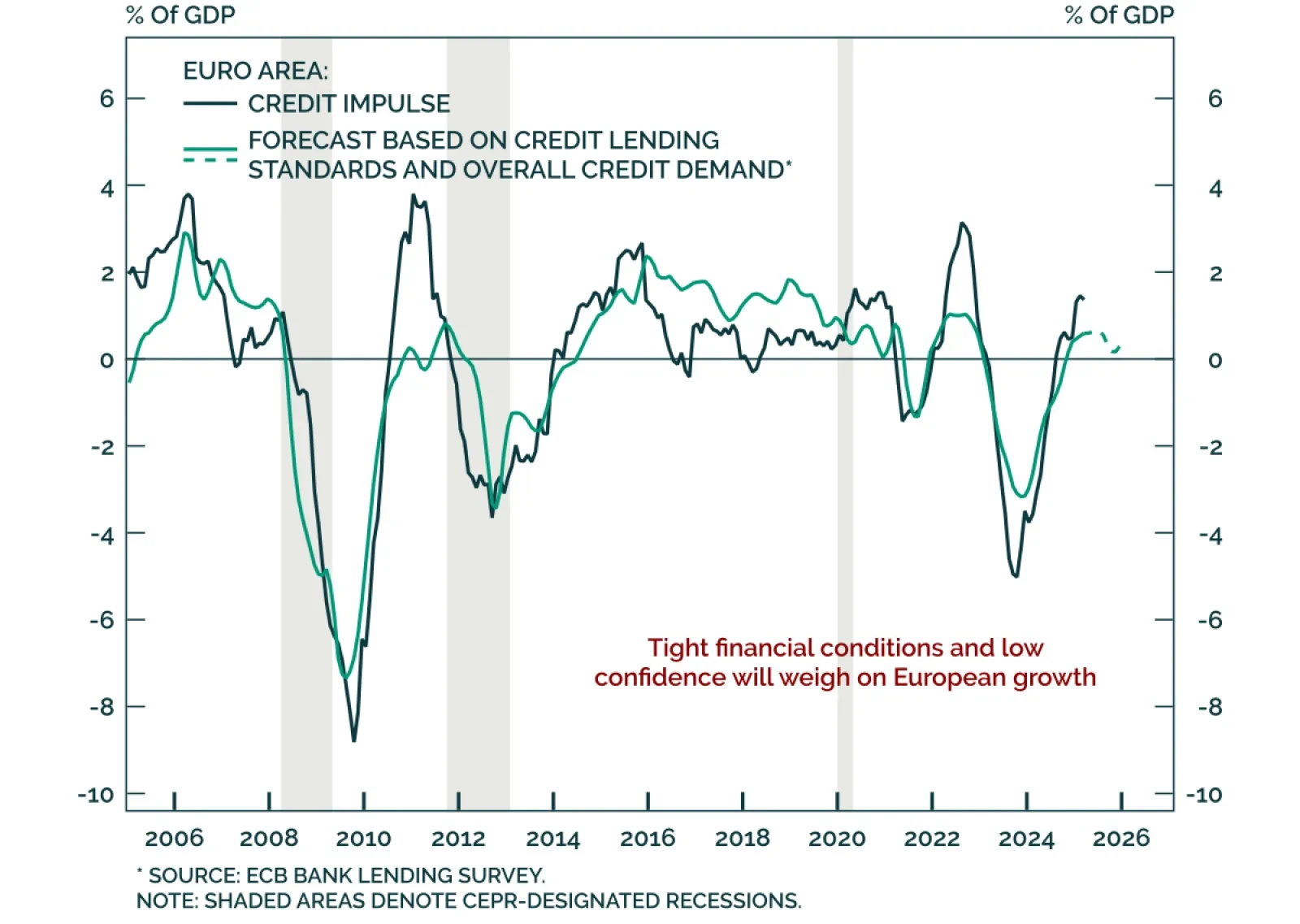

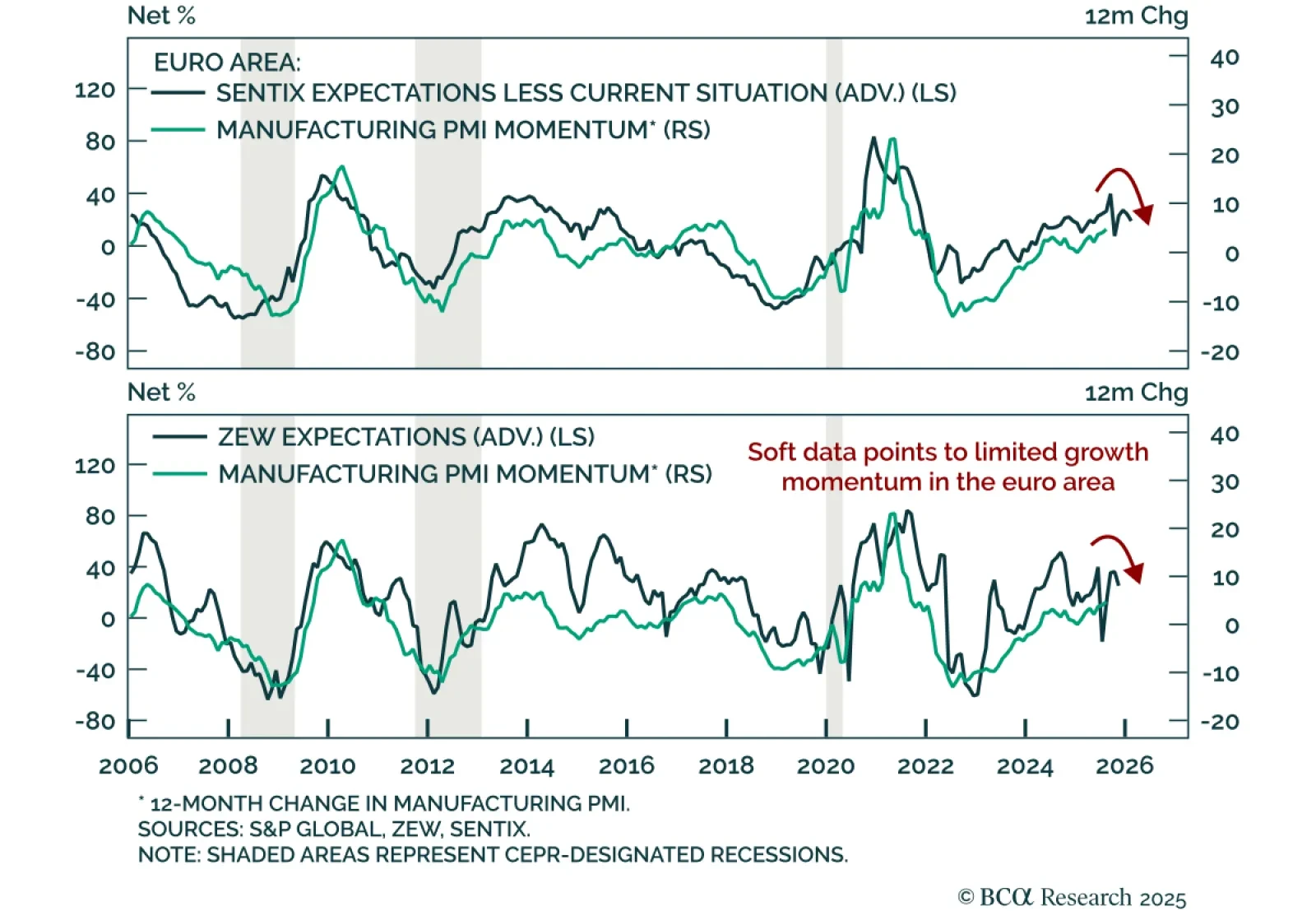

European sentiment continues to weaken, reinforcing the tactical case for US outperformance over Europe. The September Sentix Investor Confidence index fell to -9.2 from -3.7, defying expectations for an increase and signaling that…

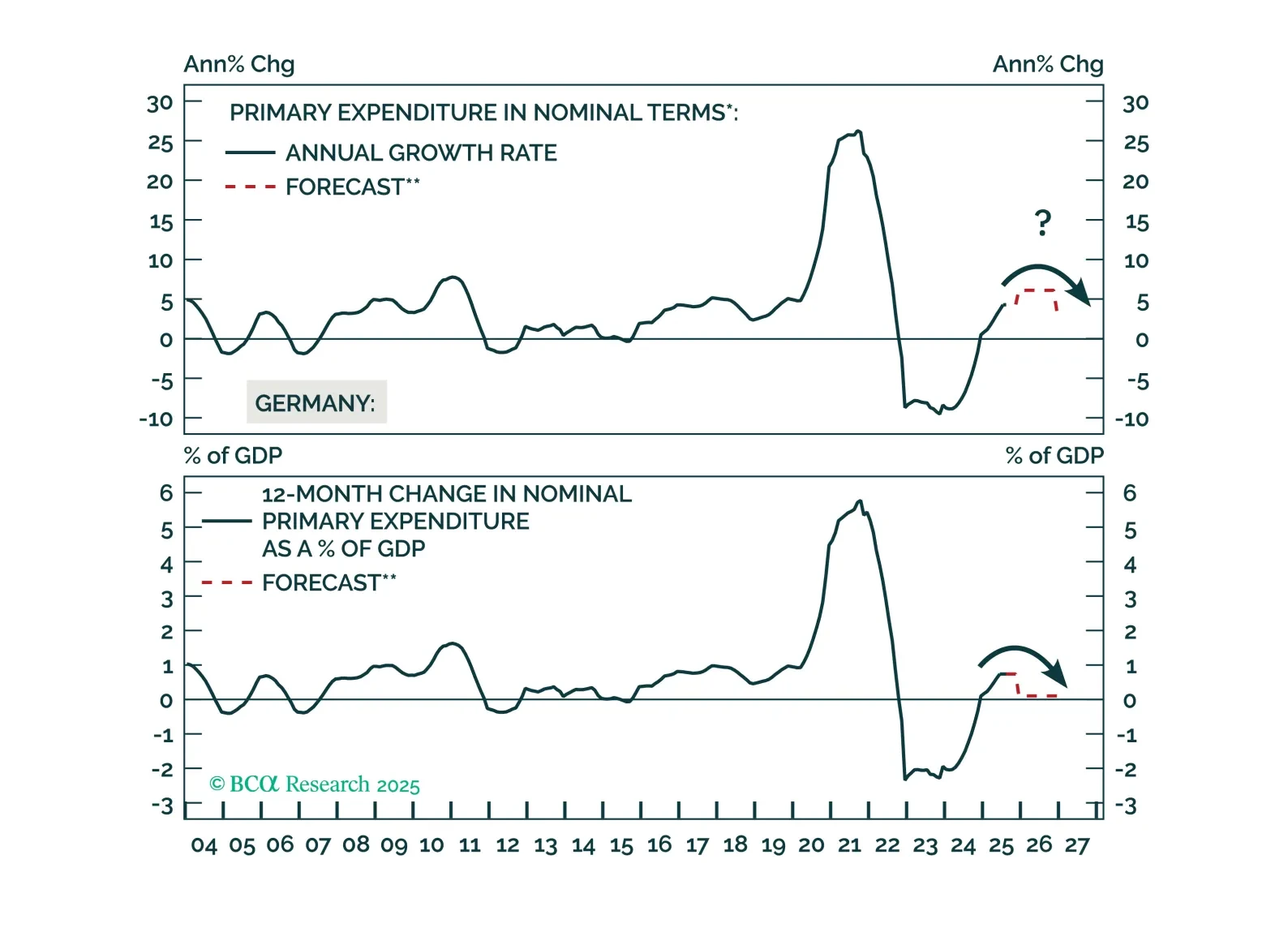

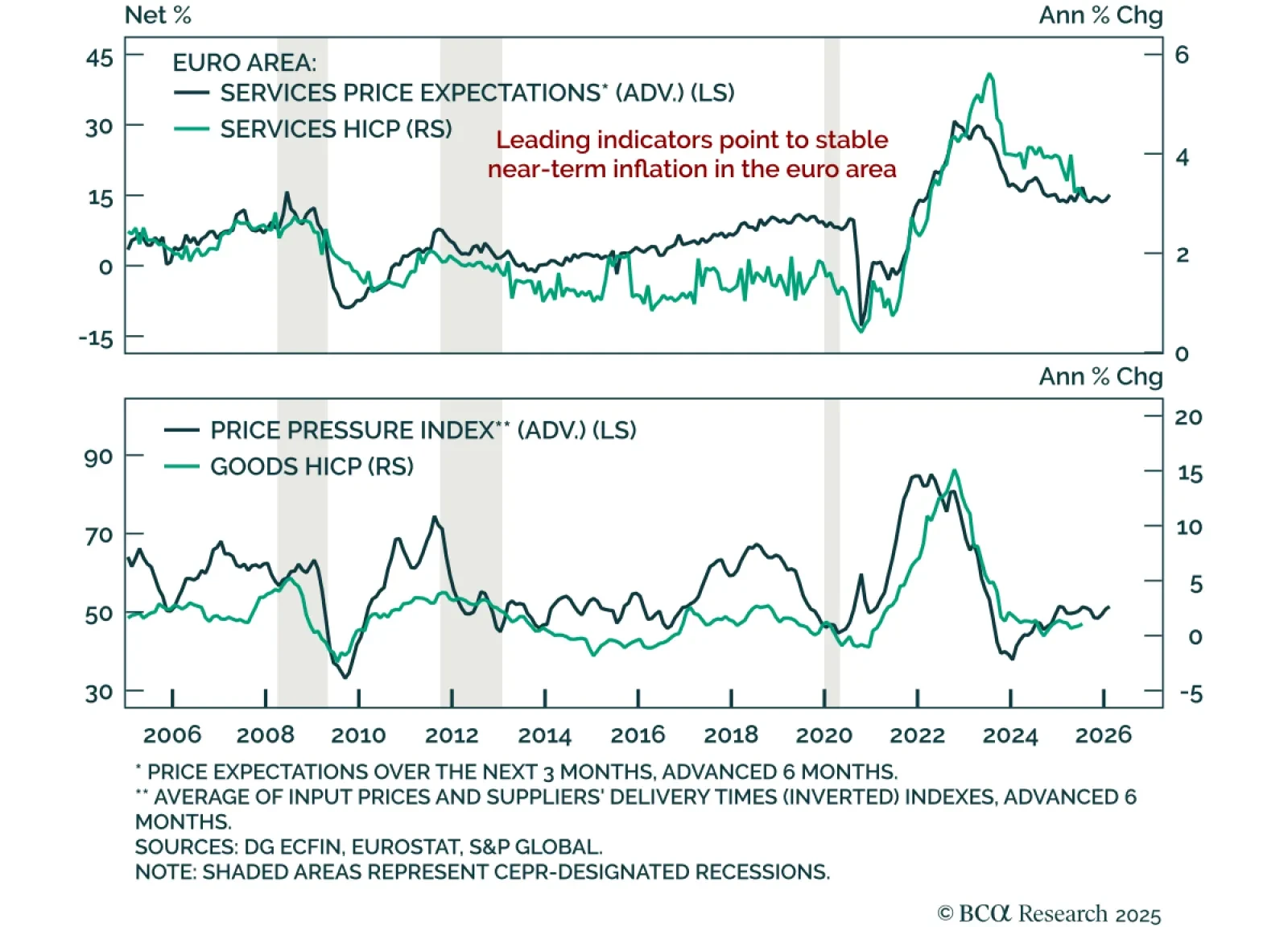

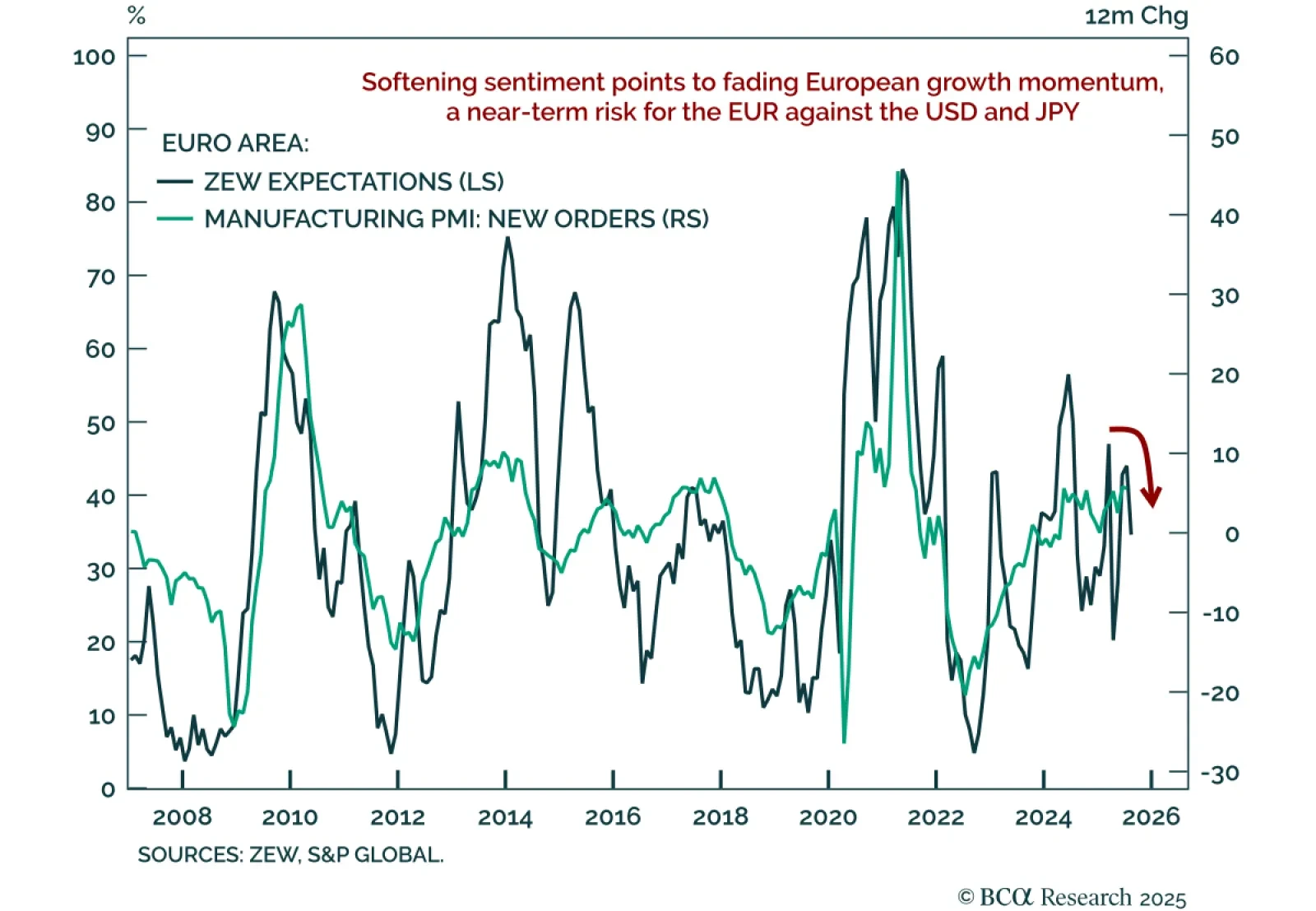

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

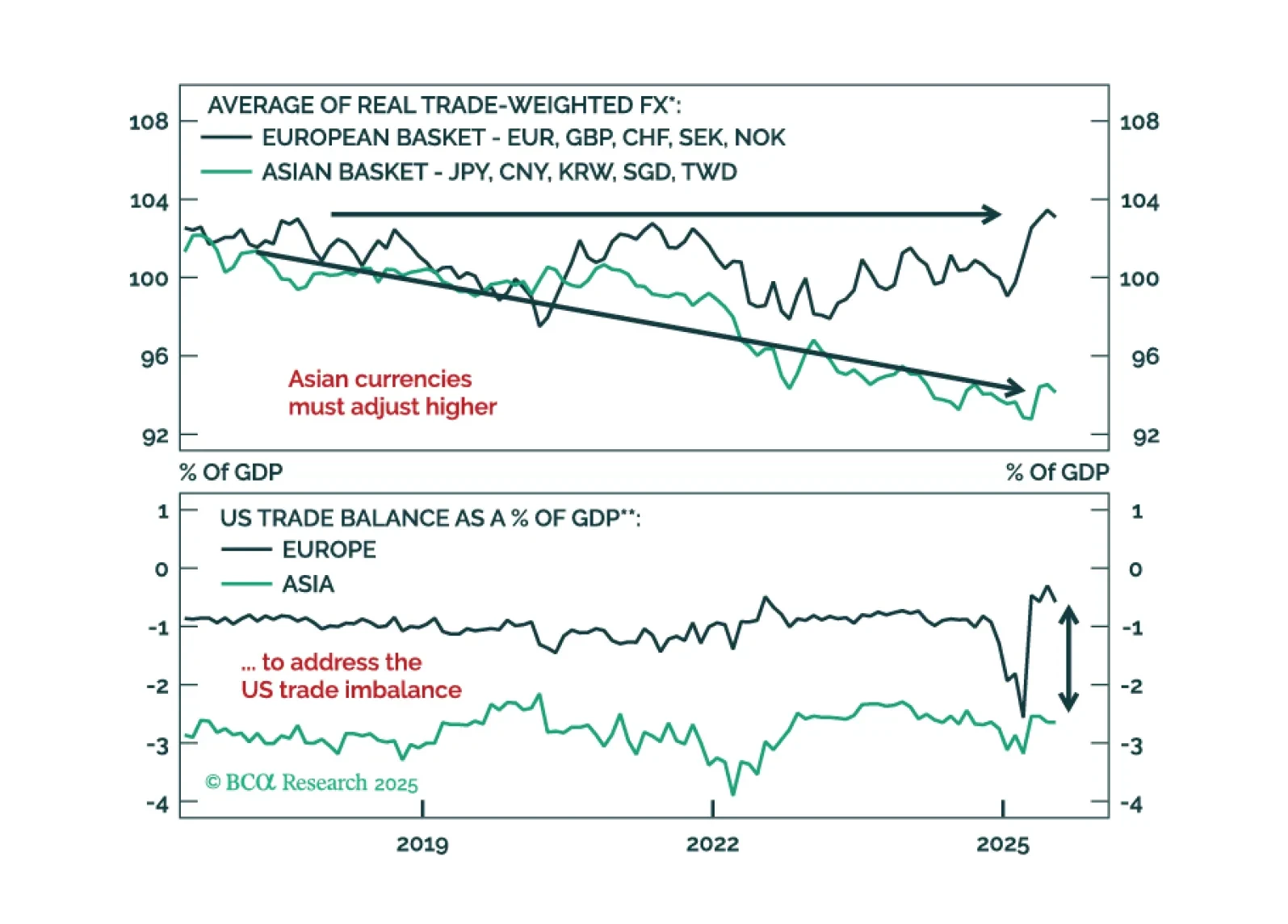

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

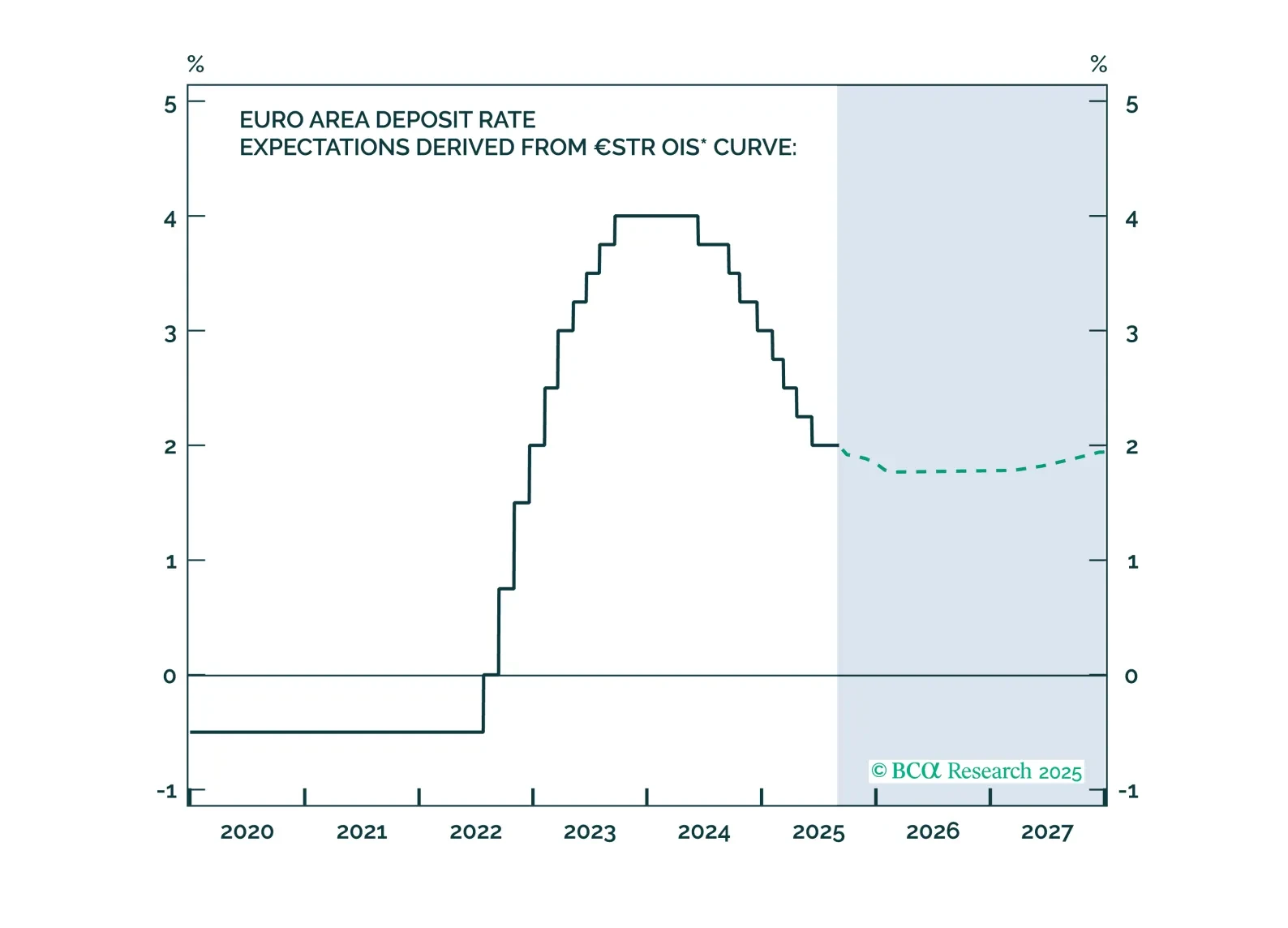

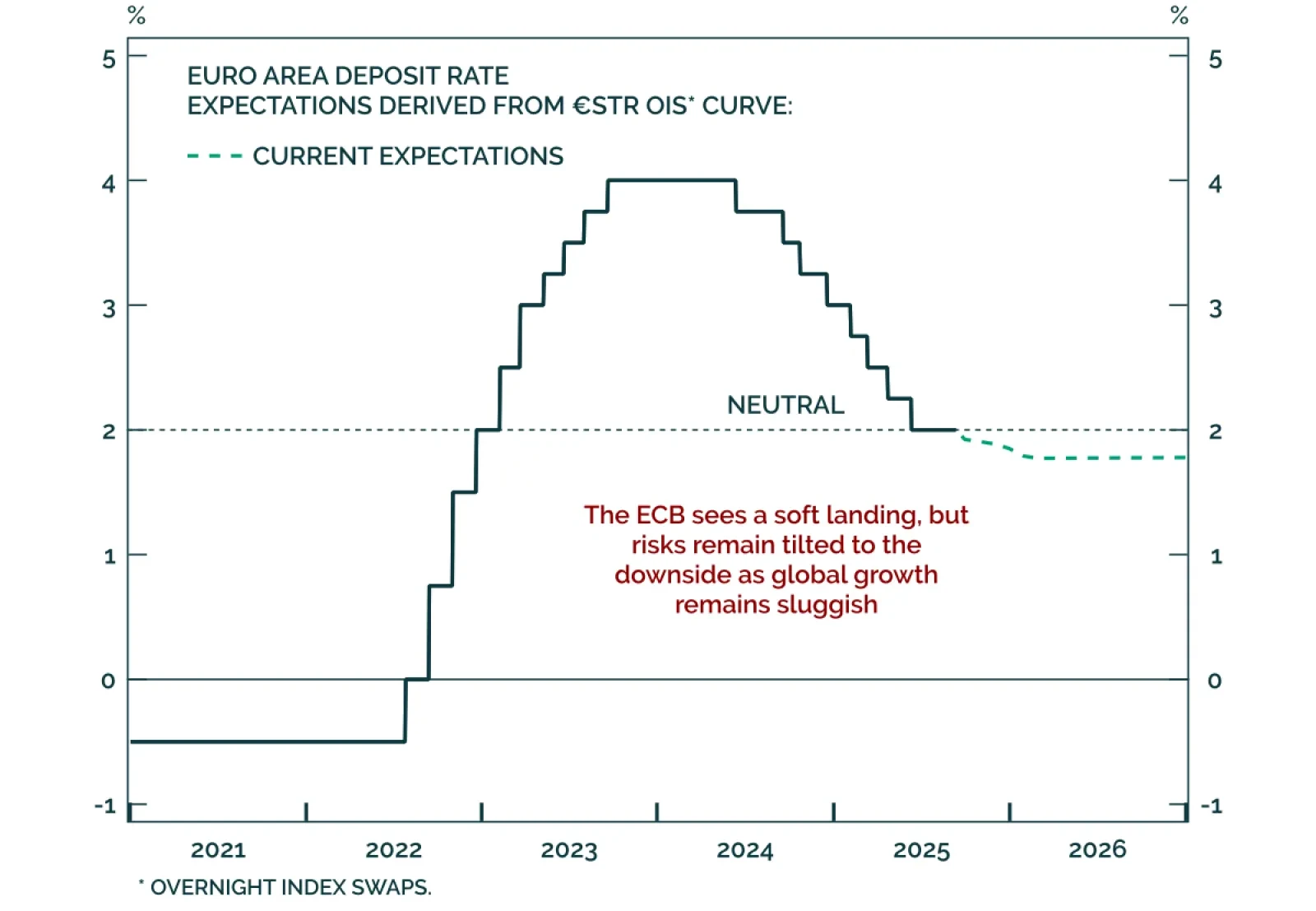

The European Central Bank has achieved a soft landing. Inflation is back to target, with well-anchored inflation expectations. The unemployment rate is historically low, and real economic growth is stable, albeit weak. Given that…

Euro area August flash HICP was slightly hotter than expected, reinforcing the case for the ECB to stay put in September. Headline inflation rose to 2.1% y/y from 2.0%, with the monthly print surprising at 0.2% m/m. Core inflation…

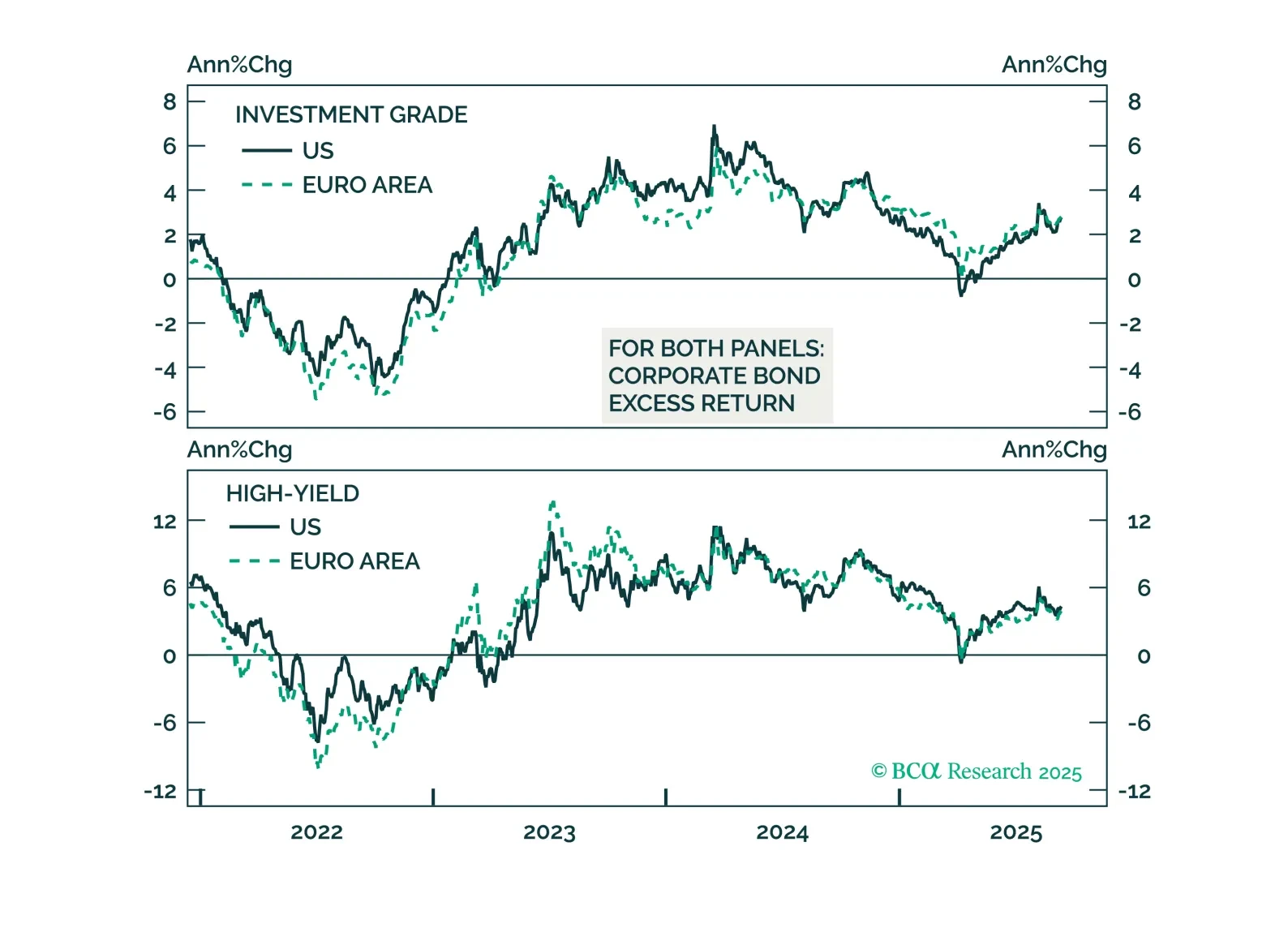

Weak Euro Area sentiment data and tight financial conditions support the case for a tactical US outperformance over Europe. July monetary data came in slightly below expectations, with M3 growth only edging up to 3.4% y/y from 3…

Although Euro area PMIs beat expectations in August, the growth outlook remains weak. The composite index rose to 51.1, driven by manufacturing returning to expansion at 50.5 from 49.8. Meanwhile the services PMI slipped 0.3…

European sentiment has moderated, pointing to near-term downside risk for a technically-stretched Euro. The August Eurozone ZEW Expectations index fell to 25.1 from 36.1, with Germany’s reading missing estimates, dropping sharply to…