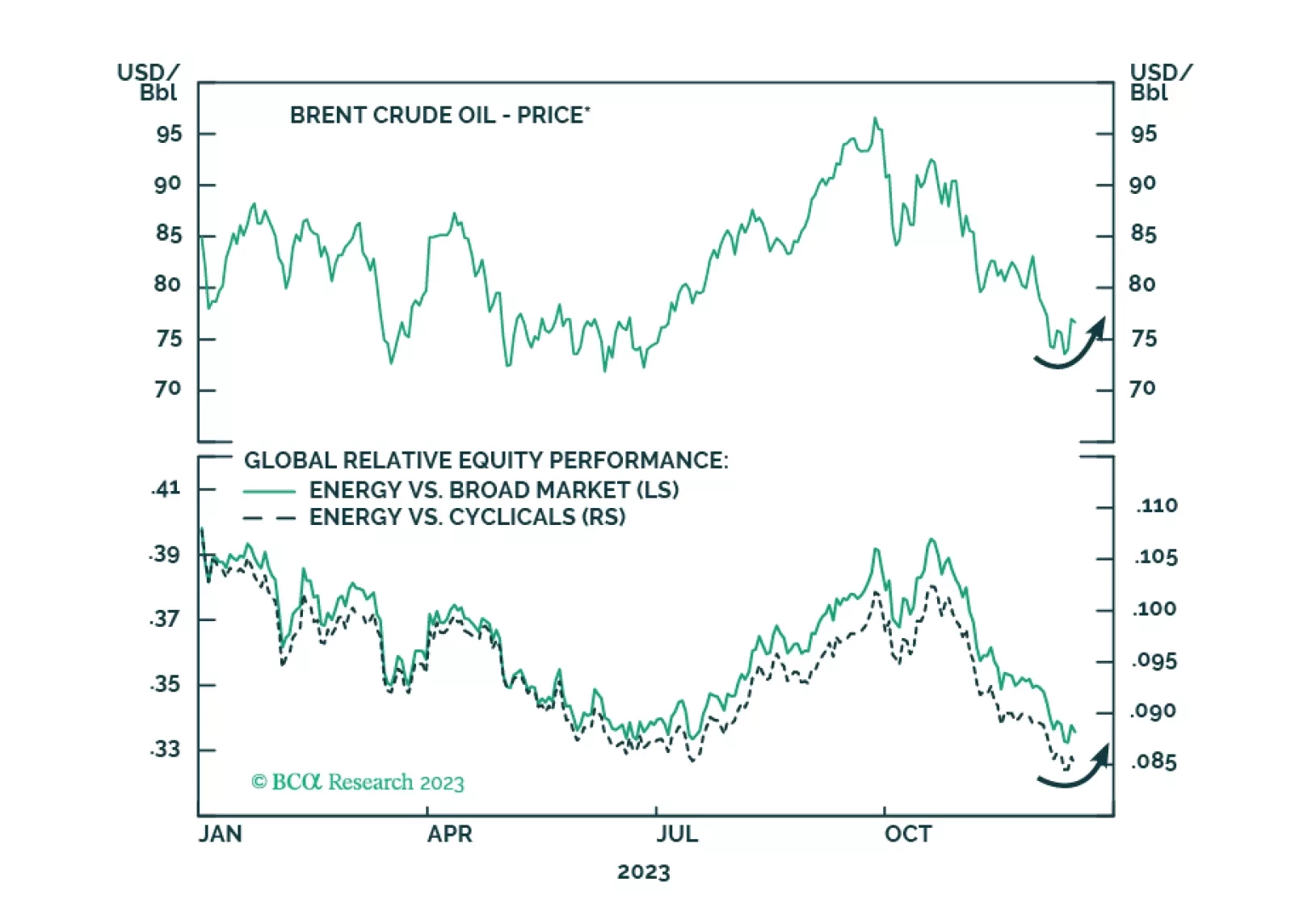

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…

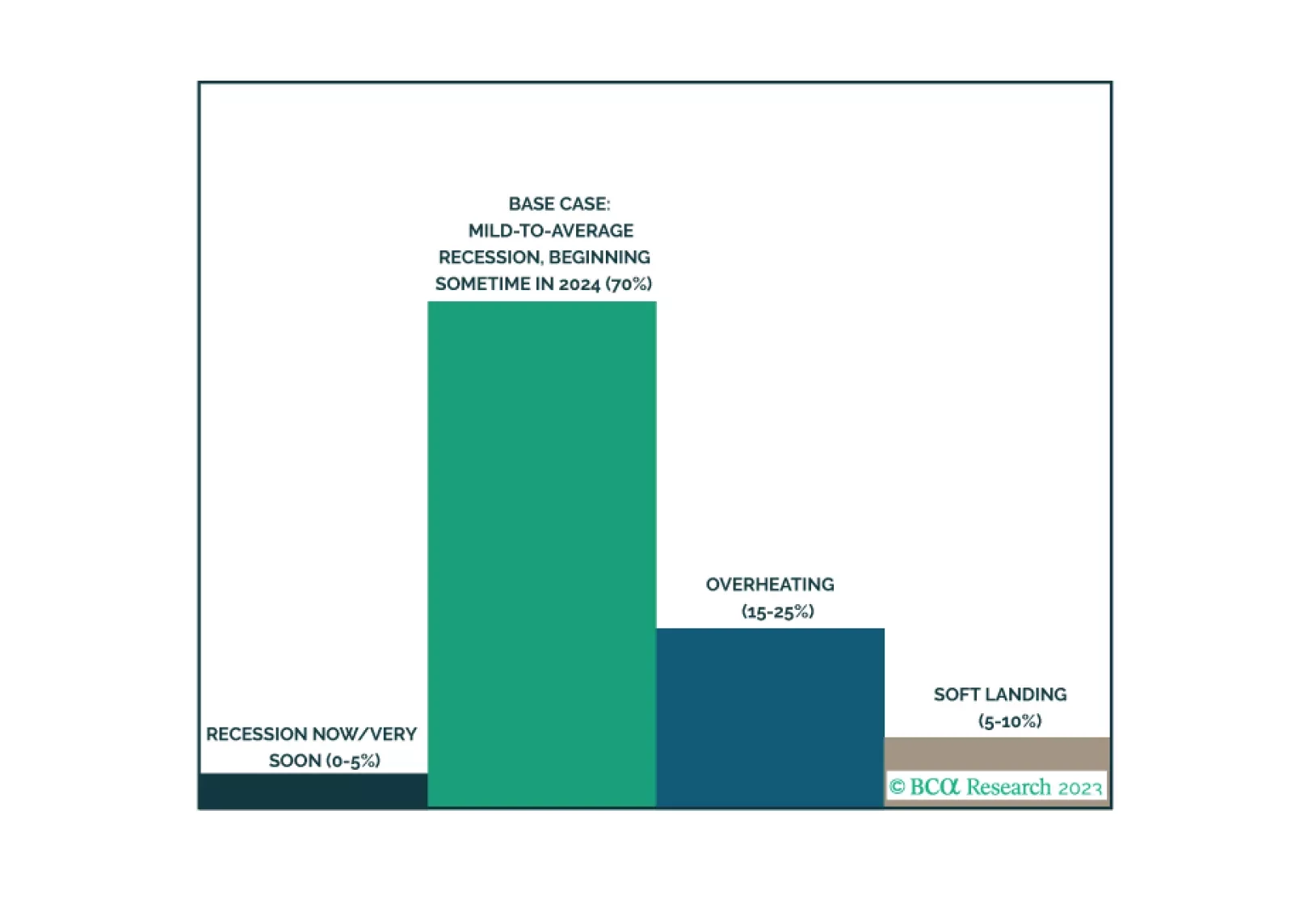

Our last publication of 2023 is an illustrated guide to our view that the economy will enter a recession around midyear. We expect equities will underperform Treasuries and cash over much of 2024, but we are waiting to turn…

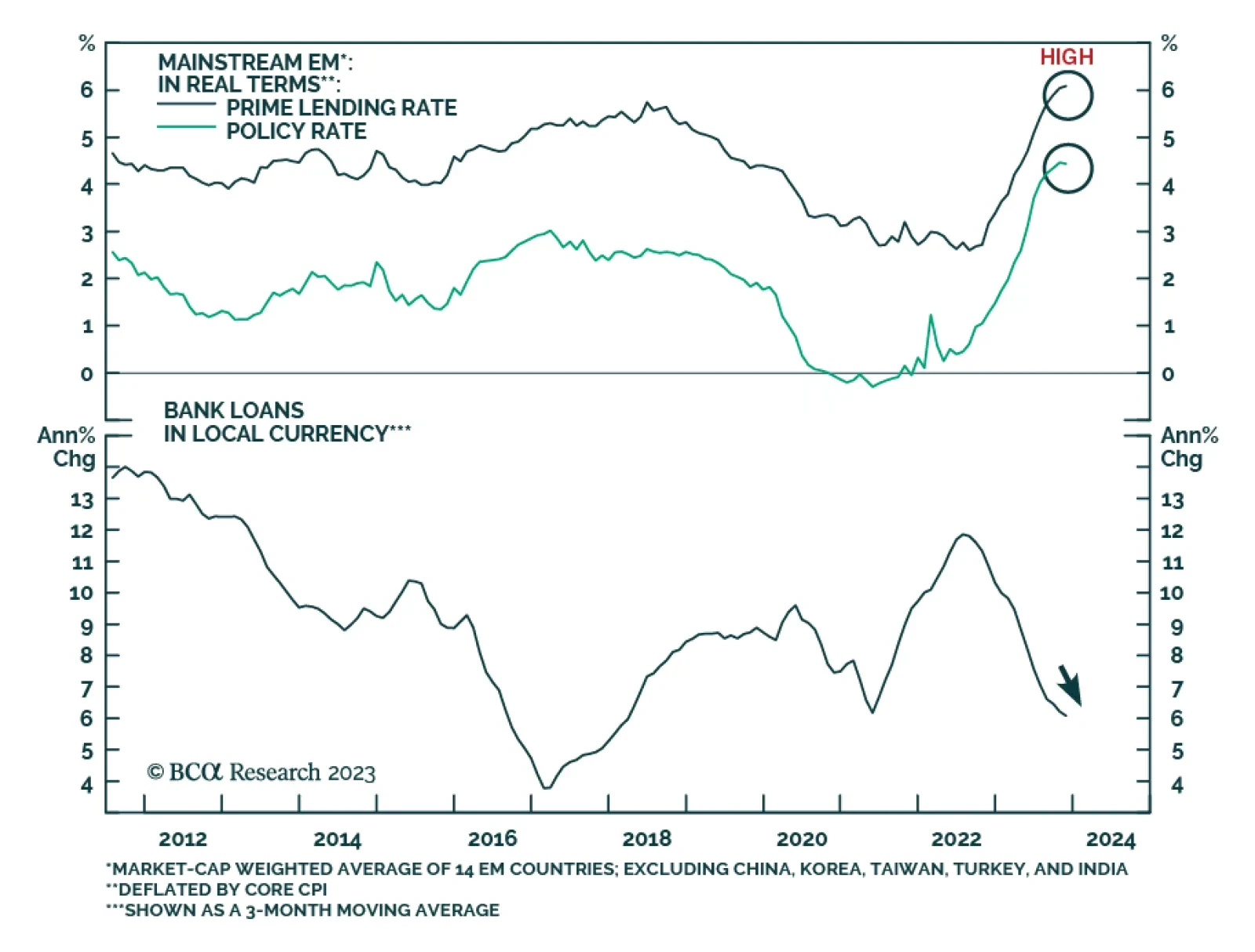

According to BCA Research’s Emerging Markets Strategy service, domestic demand and corporate profits will disappoint across mainstream Emerging Market economies (excluding China, India, Korea, and Taiwan) in H1 2024.…

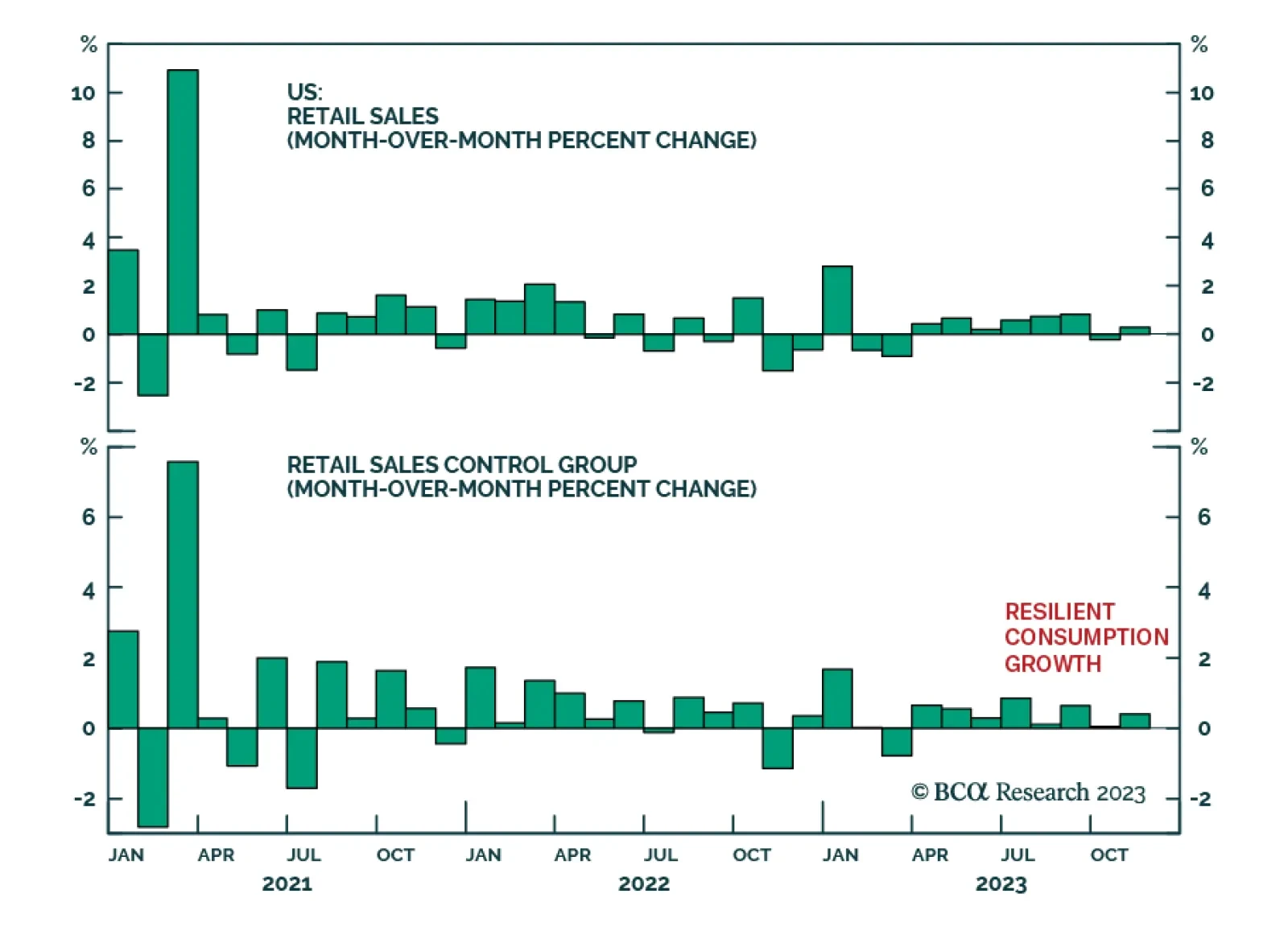

The November US retail sales release for November delivered a positive signal about consumer spending. Overall retail sales unexpectedly increased by 0.3% m/m, surprising expectations of a 0.1% m/m decline. The details of the…

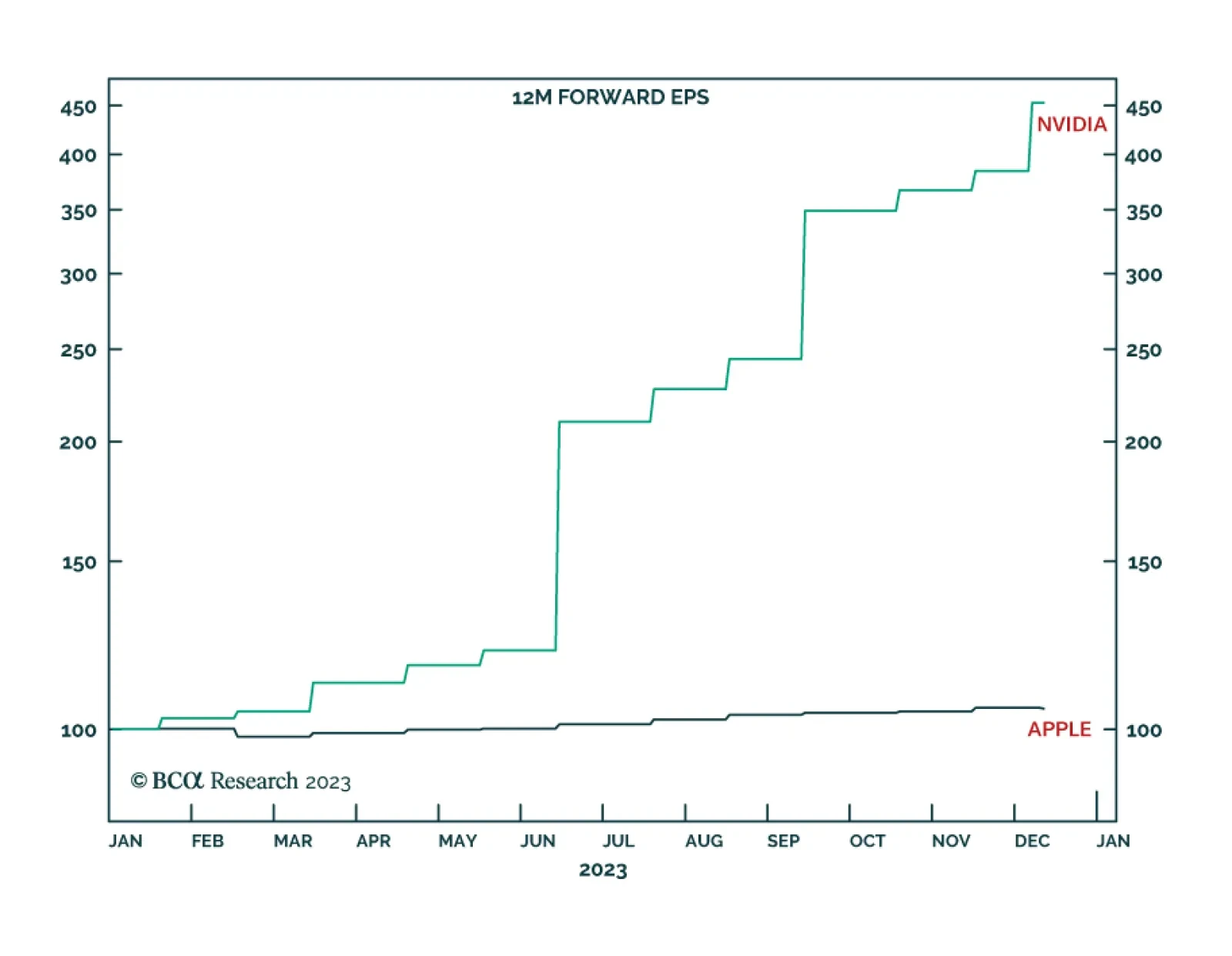

According to BCA Research’s Counterpoint service, the AI gold rush will struggle to find any gold. In a gold rush, very few people get rich finding gold. But the guys selling the picks and shovels make a fortune! In the…

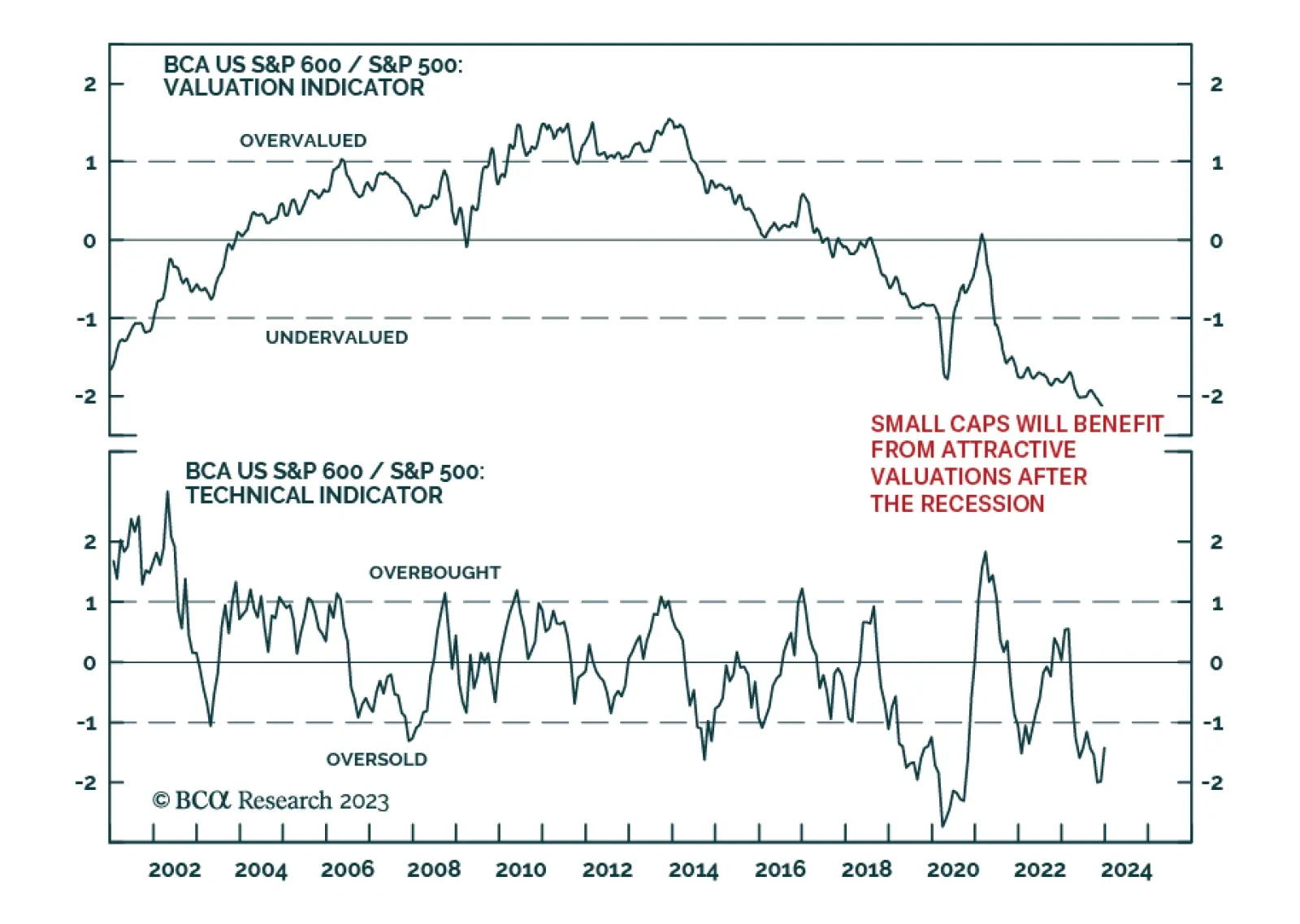

US small-cap stocks have benefitted from the recent improvement in risk sentiment. The S&P 600 is up 10% over the past month – exceeding the S&P 500’s gains by 5.4 percentage points after having underperformed…