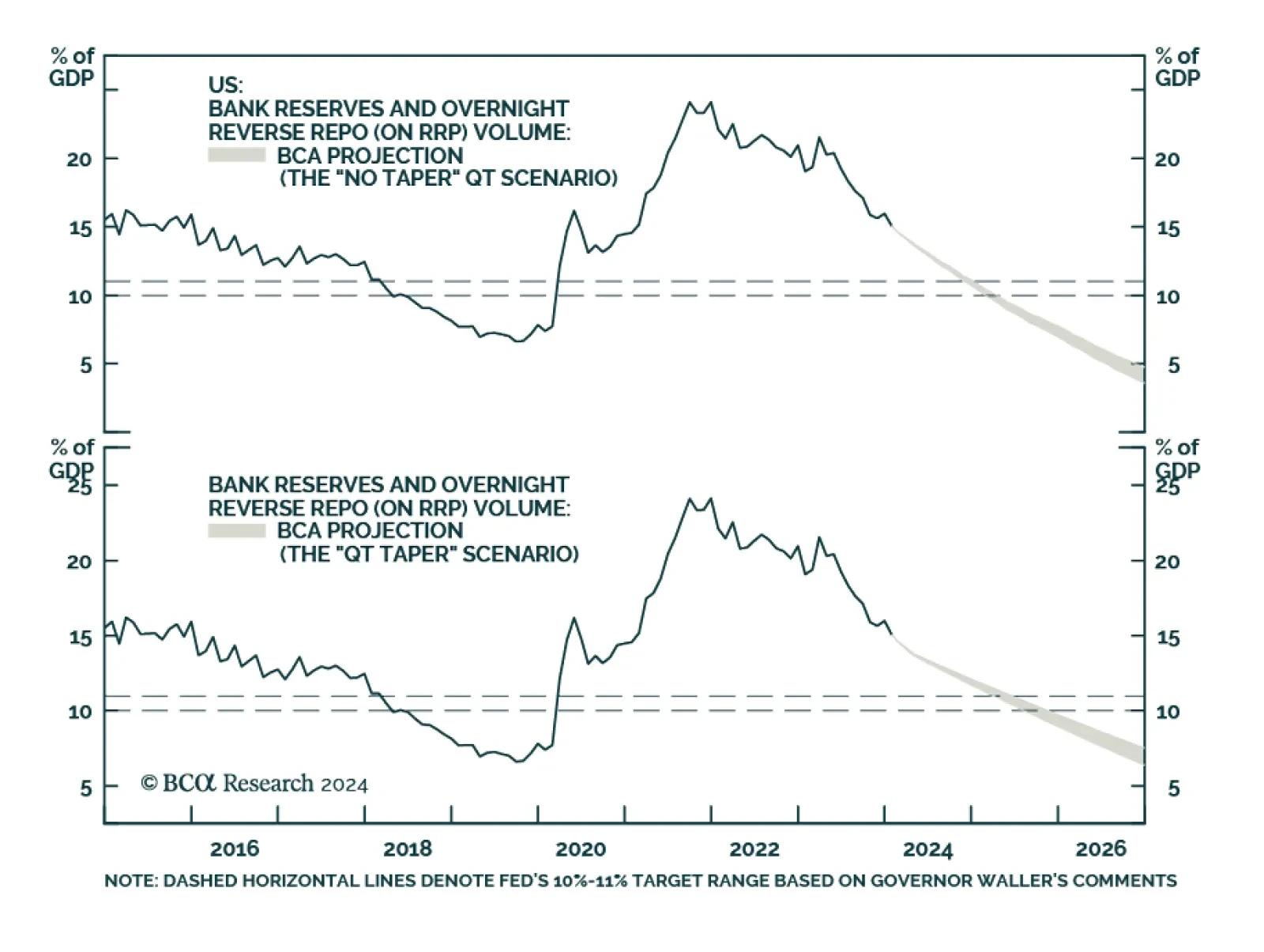

BCA Research’s US Bond Strategy service expects the Fed to slow the pace of QT starting at the May FOMC meeting, the same time that it starts cutting rates. QT will likely end altogether later in 2024 if the economy enters…

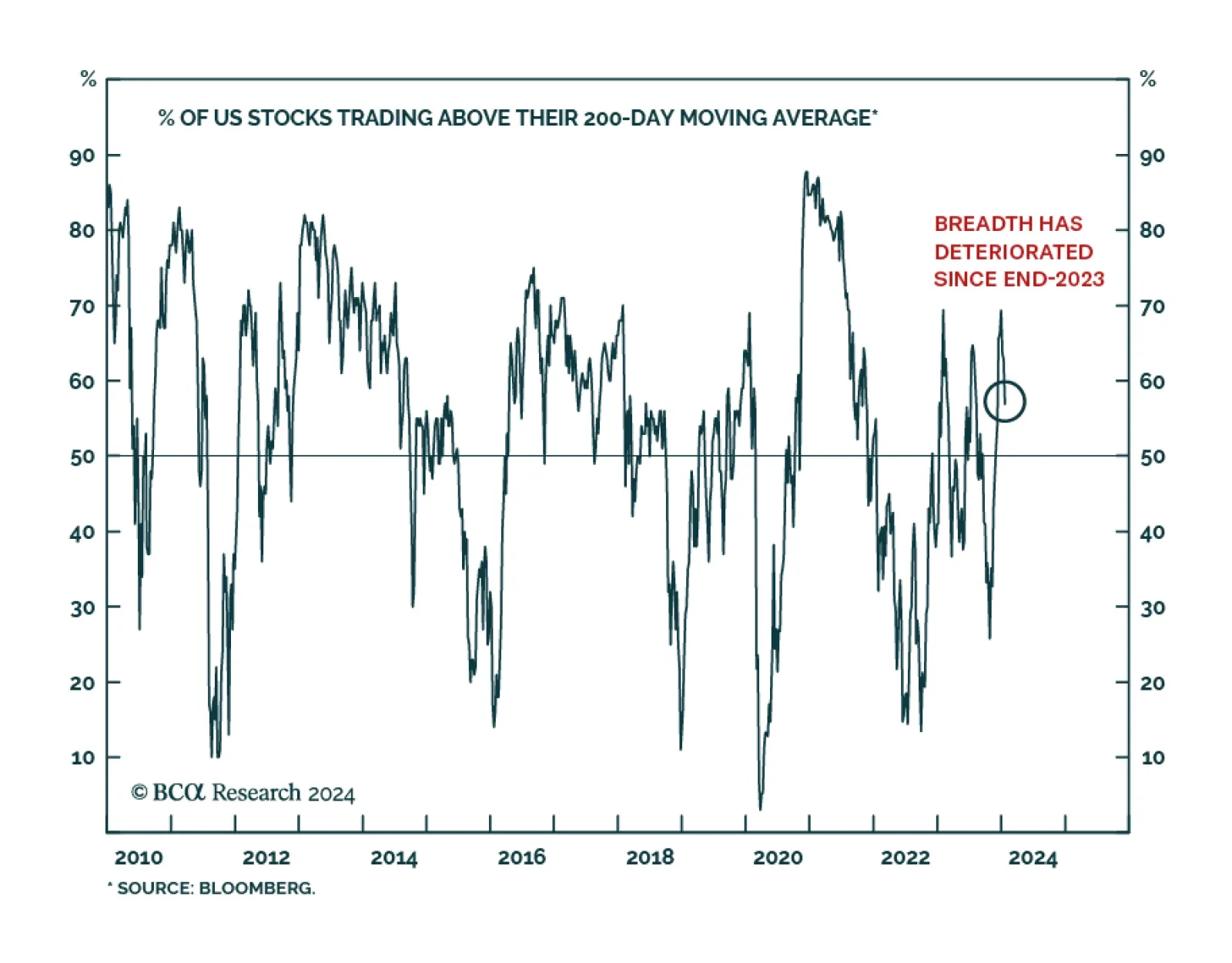

After having traded sideways for the past month, US equities ended the week on a high note with the S&P 500 closing at fresh record high on Friday. Last year’s winners are once again driving the rally. Information…

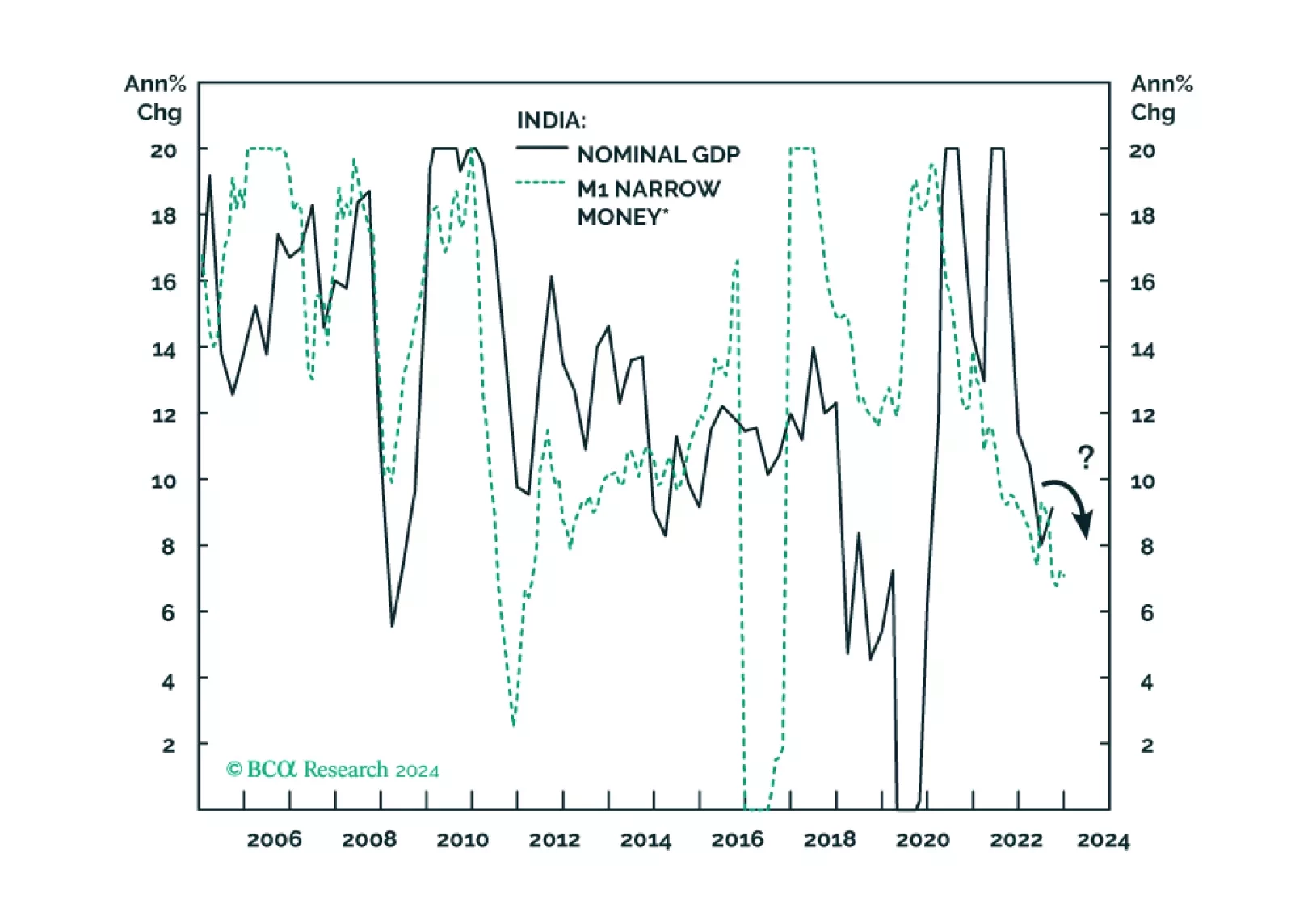

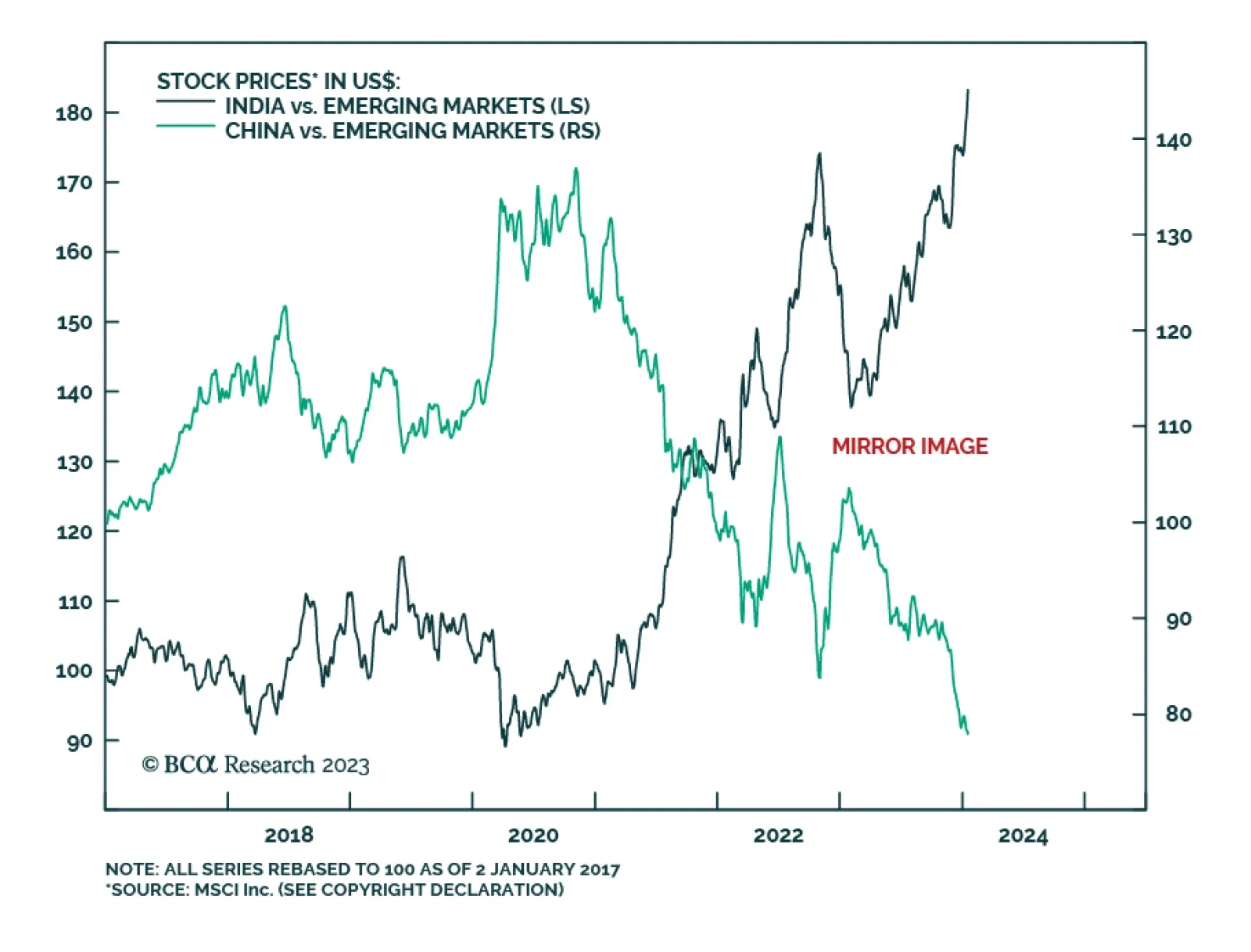

According to BCA Research’s Emerging Markets Strategy service, Indian stocks, which benefitted immensely from foreign portfolio inflows and are now very expensive, remain vulnerable to any global risk-off sentiment. The…

Decelerating nominal sales, a peaking credit cycle, and very high valuations - Indian stocks will not escape the carnage when risk assets globally begin to sell off.

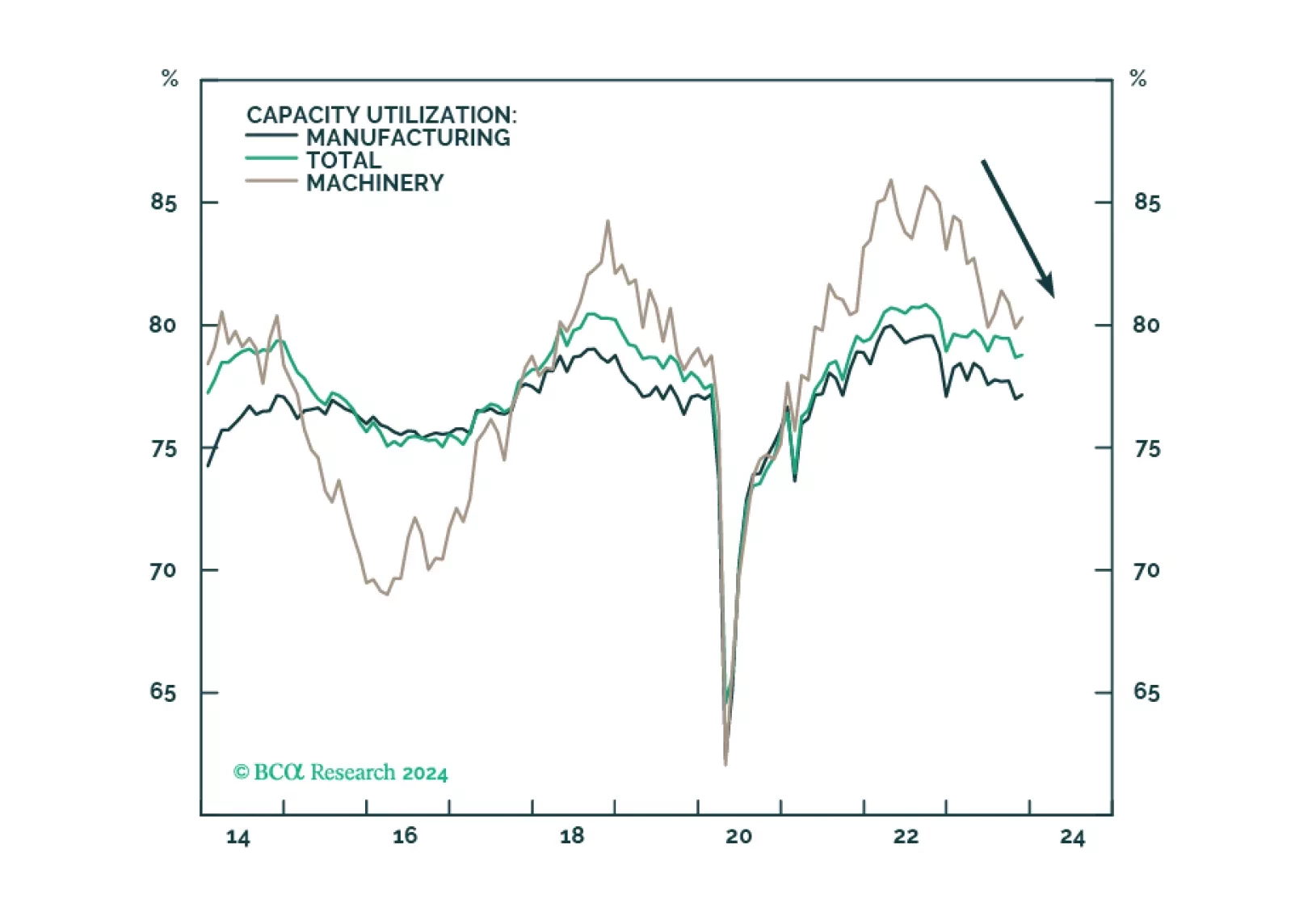

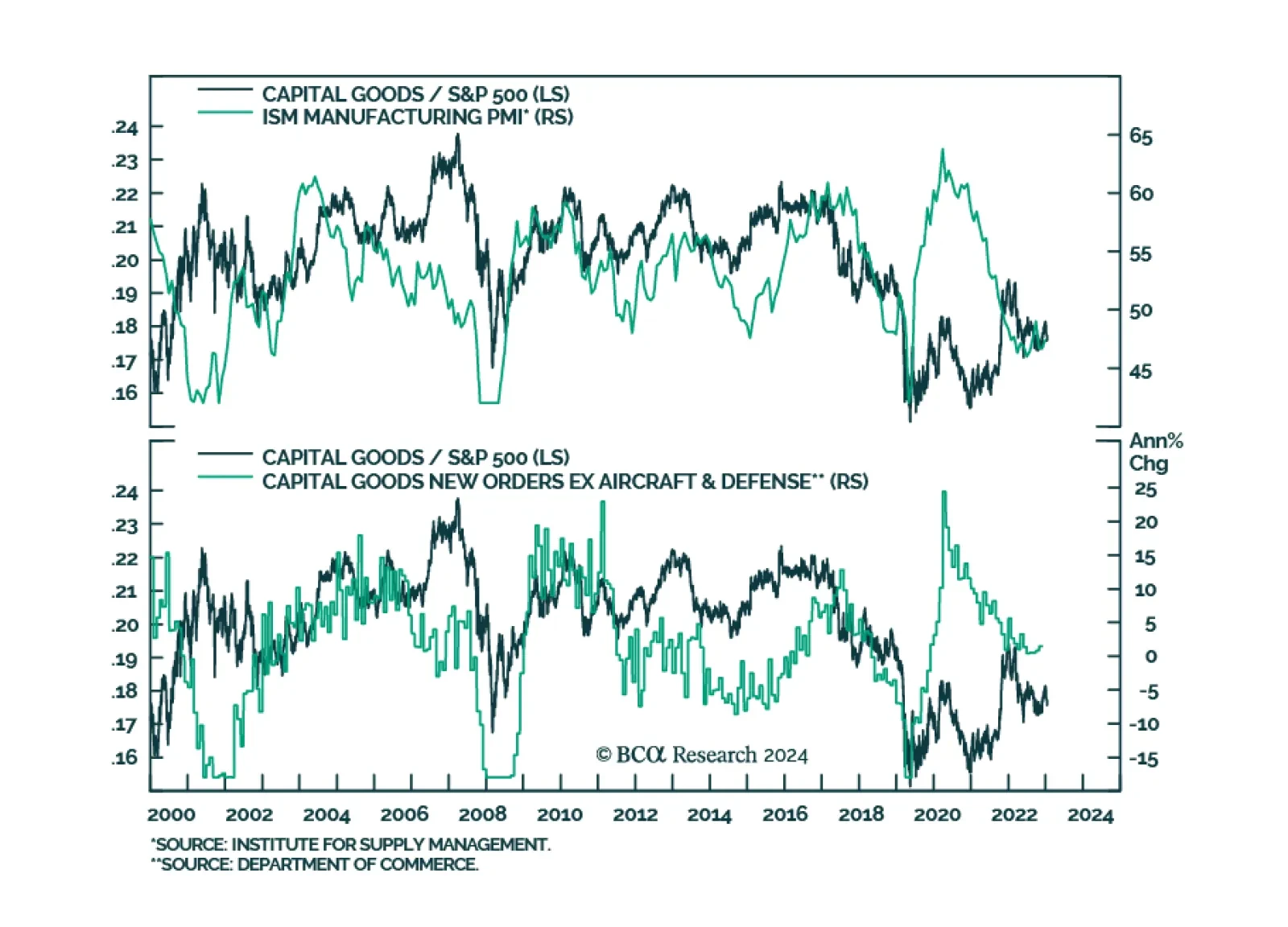

The performance of the Industrials sector tends to lag the business cycle, as companies invest in capex on the heels of economic expansion. But demand is not entirely cyclical, as the need to replace obsolete or aging equipment…

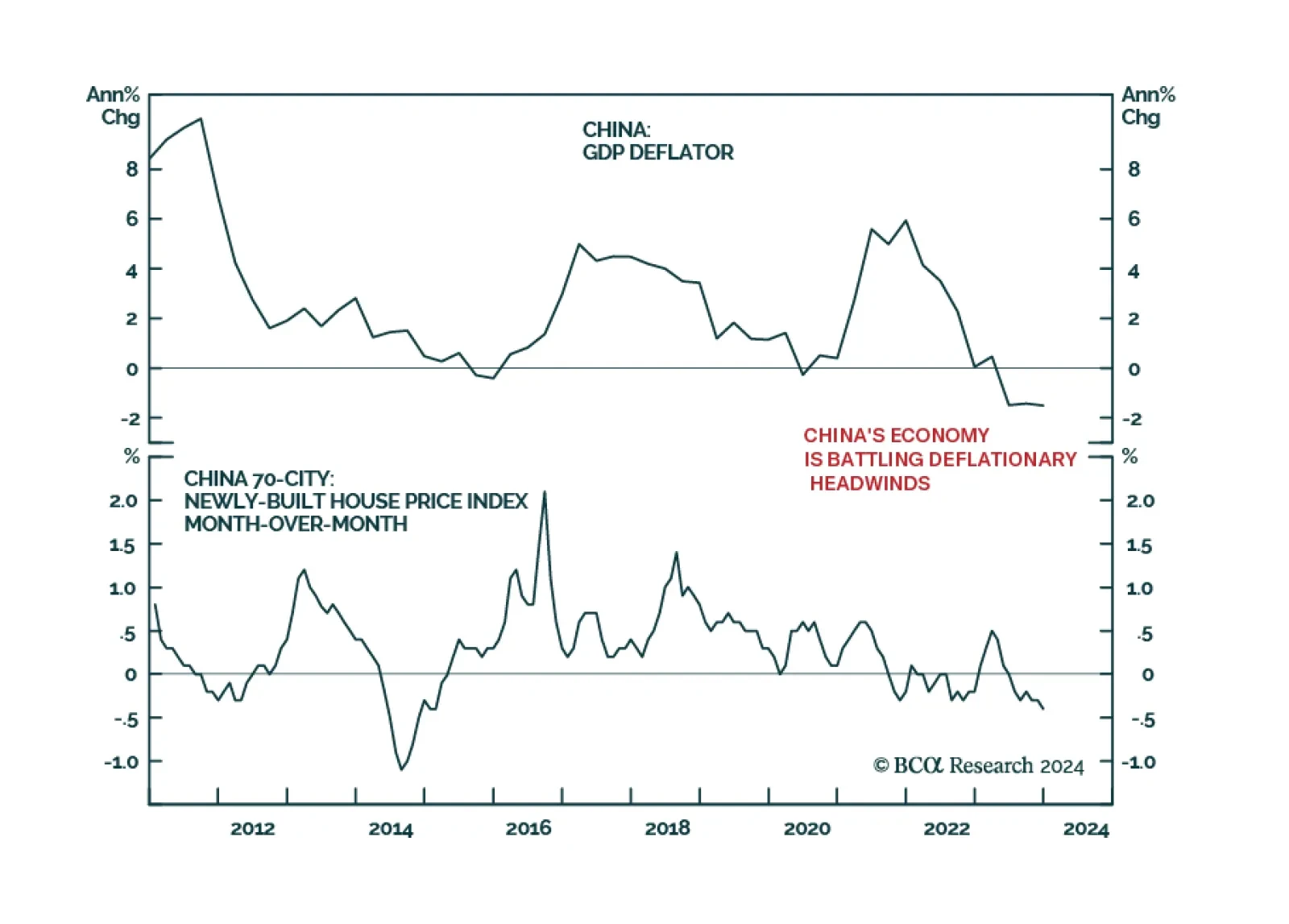

Chinese data continues to send a pessimistic signal for domestic risk assets and China plays. Although at 5.2% in Q4, GDP growth stands above the official target, it underwhelmed anticipations of 5.3%. Moreover, other data…

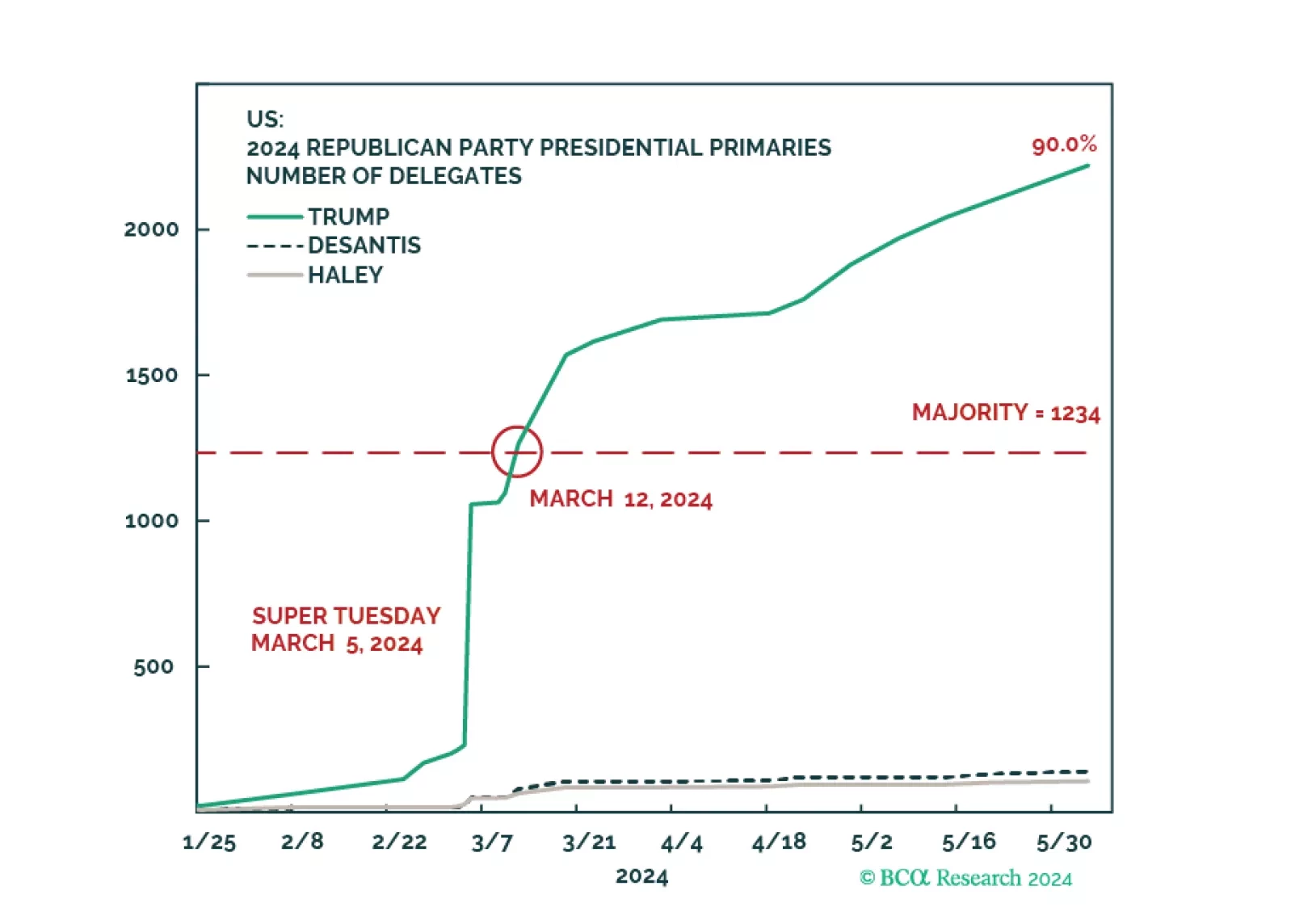

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

According to BCA Research’s European Investment Strategy service, investors should not chase European equities higher from current levels. The soft-landing narrative has captured the minds of investors. The expectations…