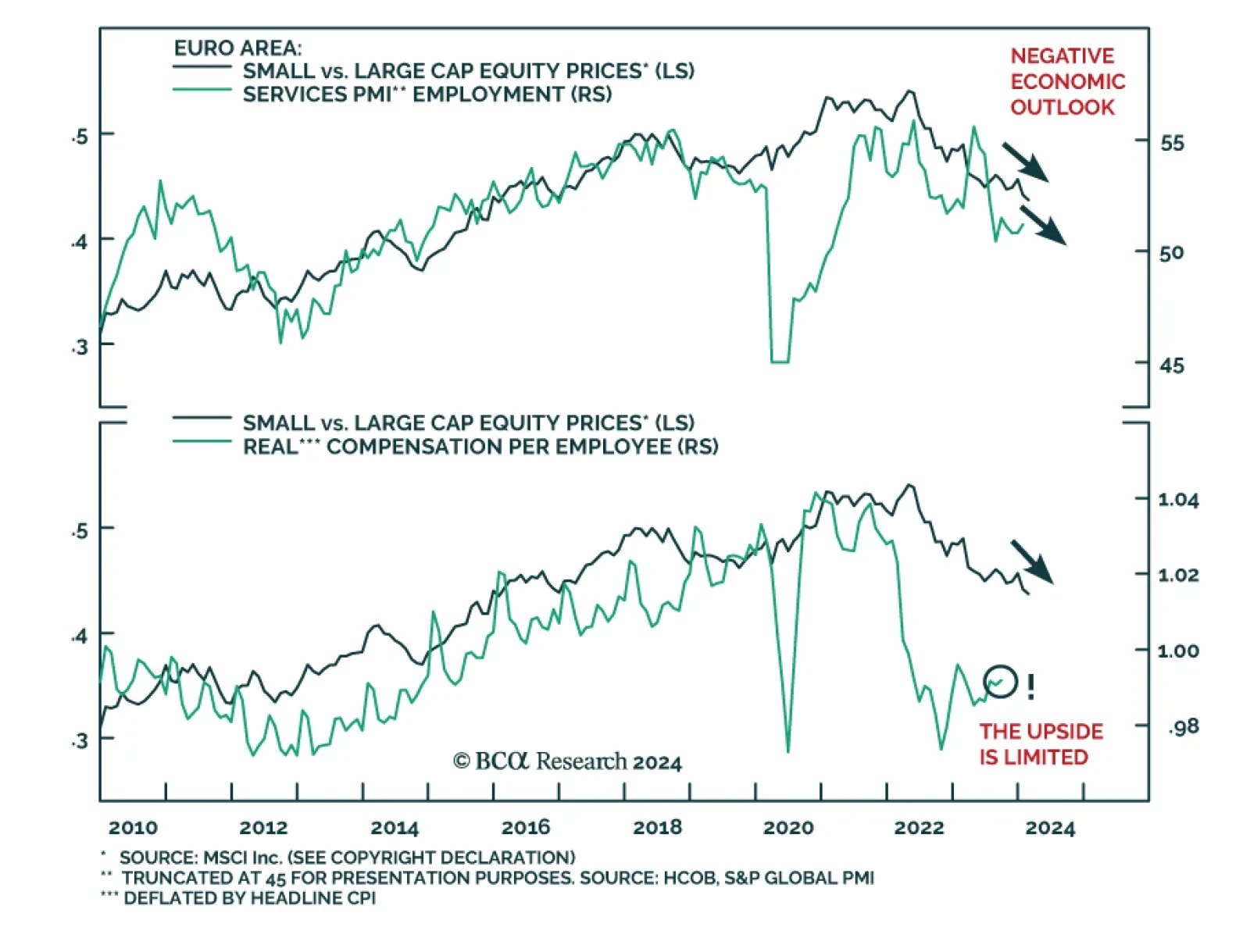

Euro area small-cap stocks are attractively valued compared to their large-cap counterparts. They have underperformed by 20% since April 2022, but small caps’ earnings have kept pace with those of large-cap firms. Hence,…

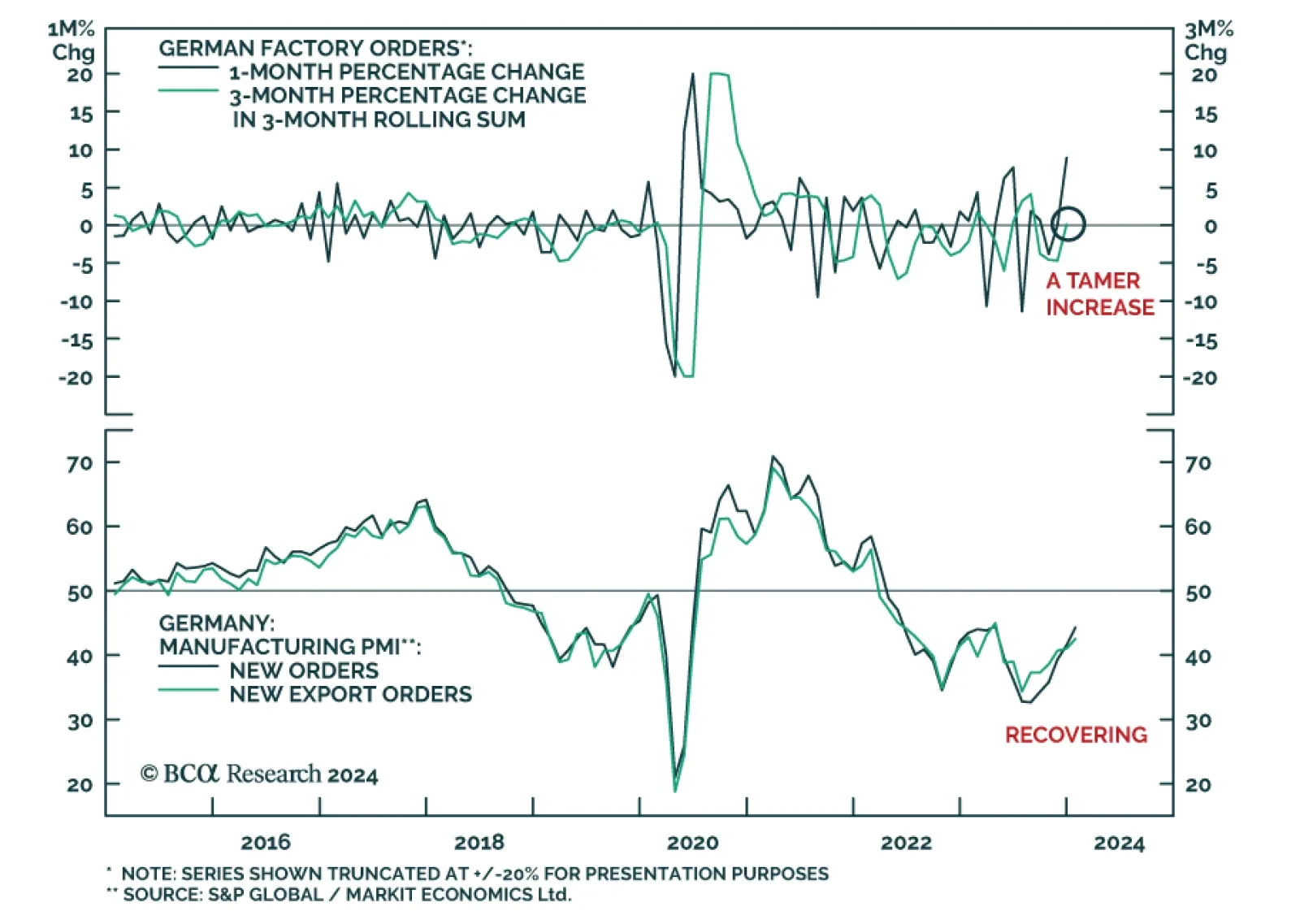

German factory orders delivered a positive surprise on Tuesday, unexpectedly increasing on both a monthly and annual basis. The 8.9% m/m increase in December came in well above consensus estimates of a 0.2% m/m decline. This…

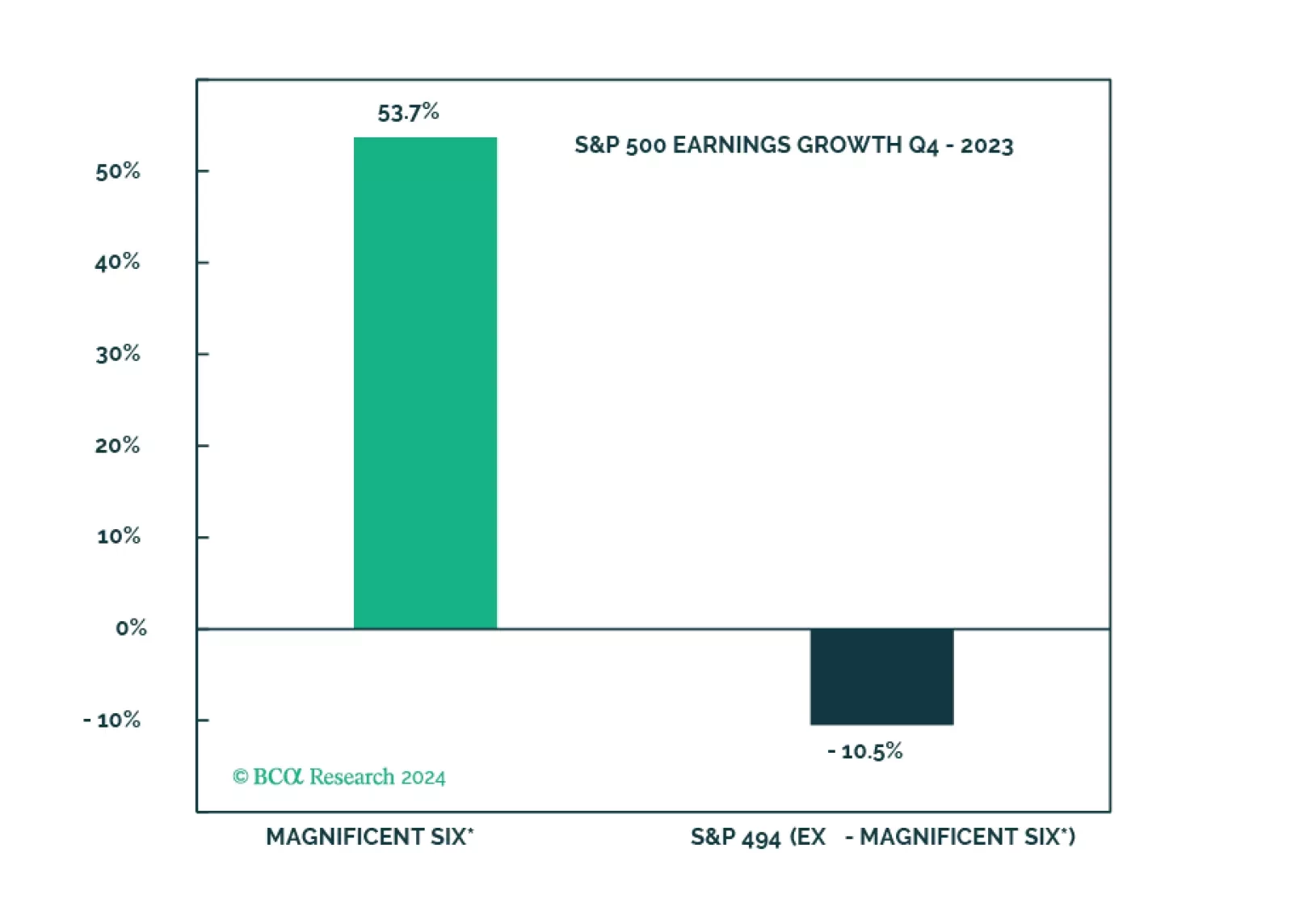

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

BCA Research’s Global Investment Strategy service’s MacroQuant 2.0 model continues to recommend that investors maintain a benchmark allocation to equities over a 1-to-3 month horizon. At the end of January,…

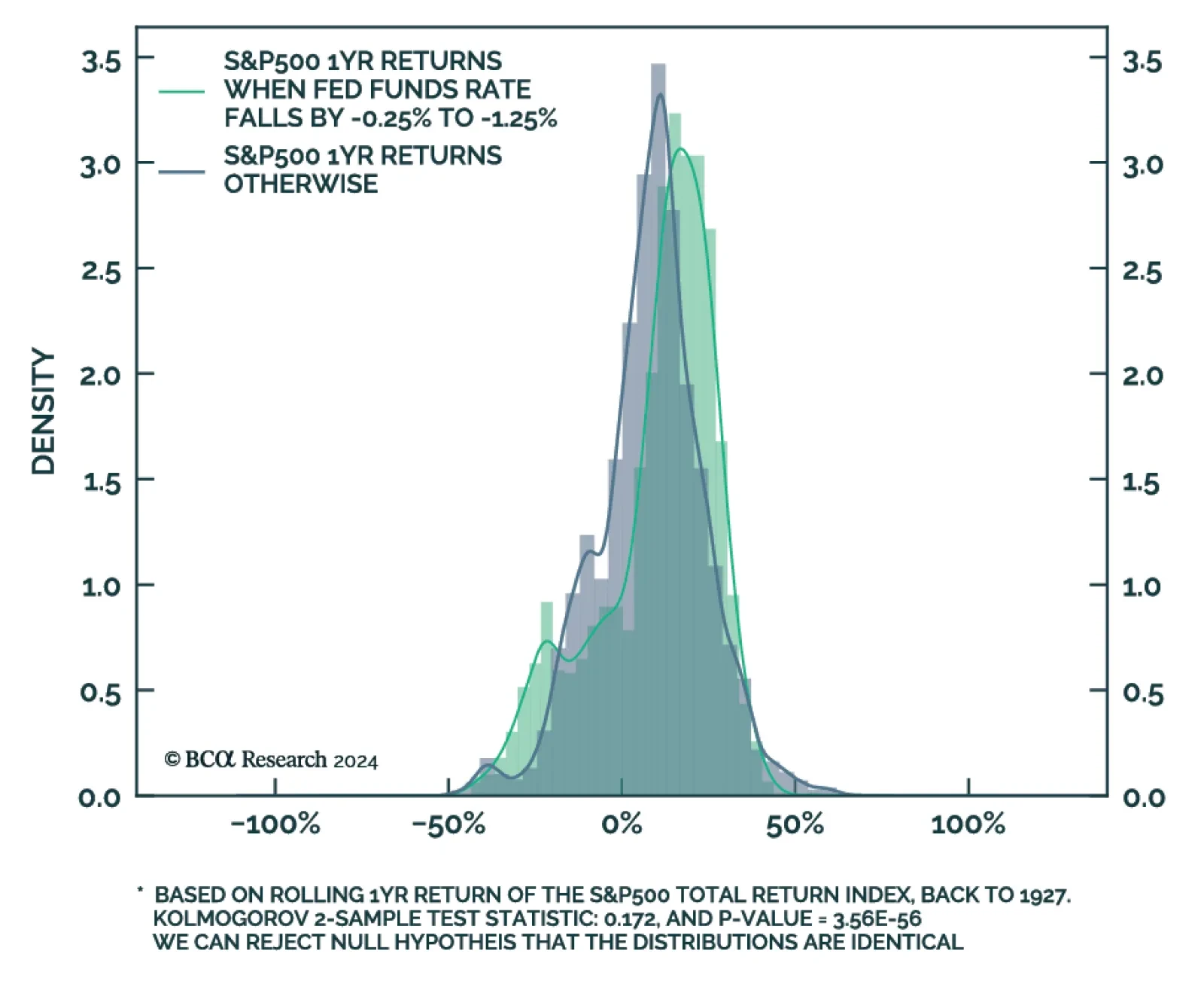

In this Insight our Equity Analyzer team explores how the S&P 500 behaves when the Fed Funds Target Rate drops by 25bps – 150bps within a single year. The current dot plot is signaling 75bps of cuts by the end of the…

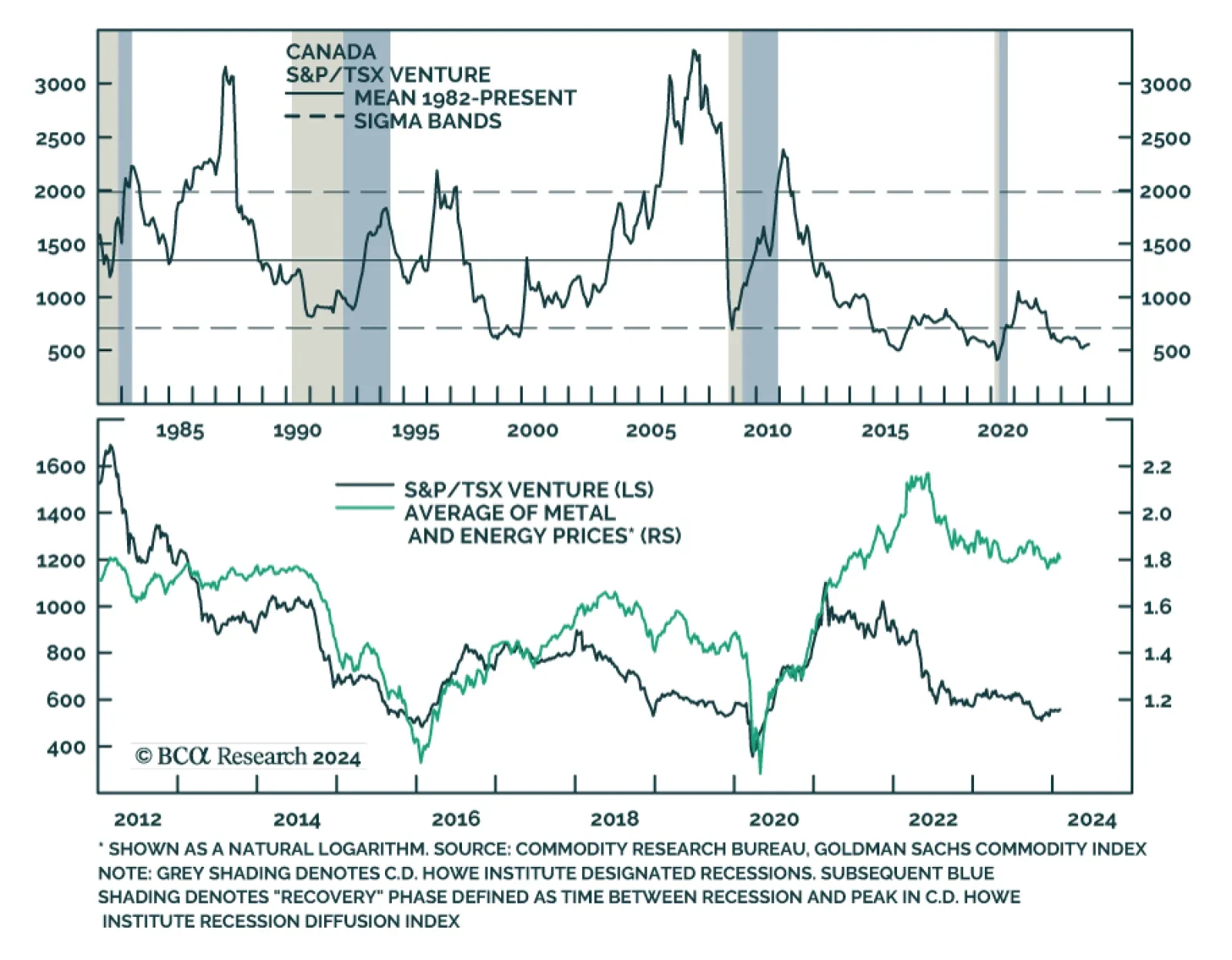

The S&P/TSX Venture Index is a micro-cap index of Canadian companies listed on the TSX Venture Stock Exchange. Nearly two thirds of the index is comprised of material and energy stocks, making the index exposed to…

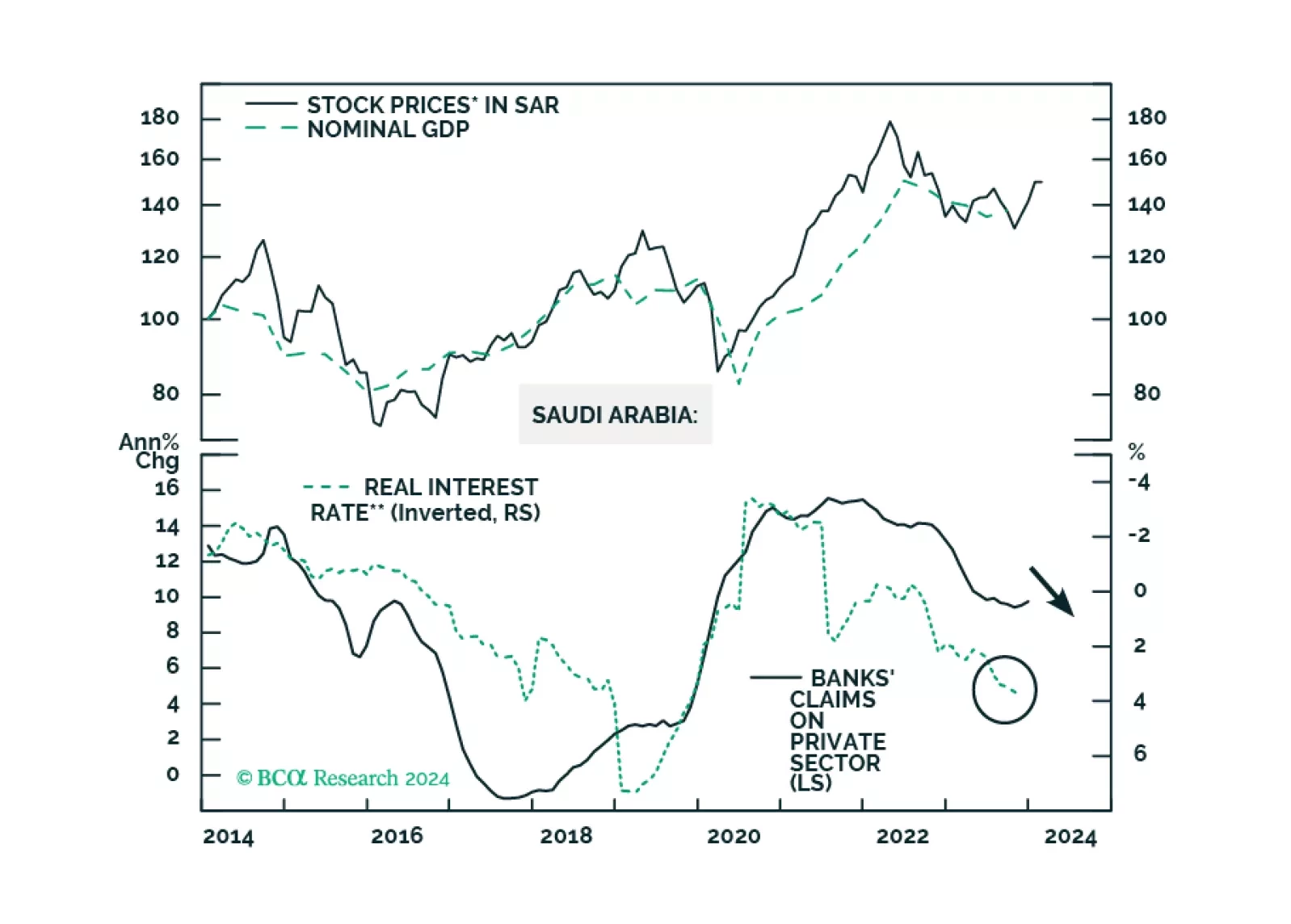

The Saudi economy is facing internal and external headwinds. The geopolitical conflict is also escalating in the Middle East. EM equity portfolios should stay neutral on Saudi stocks. EM sovereign credit portfolios should upgrade…

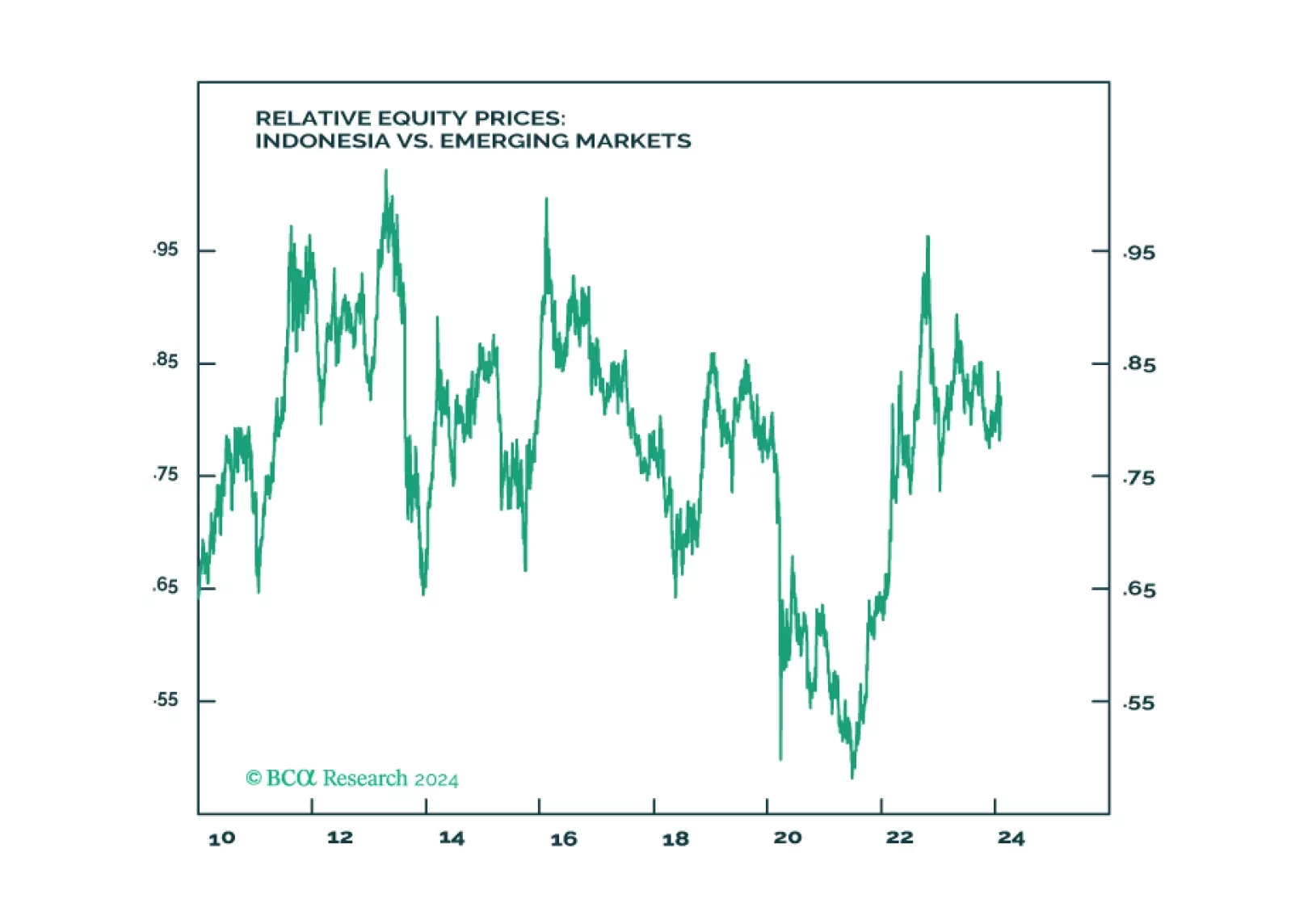

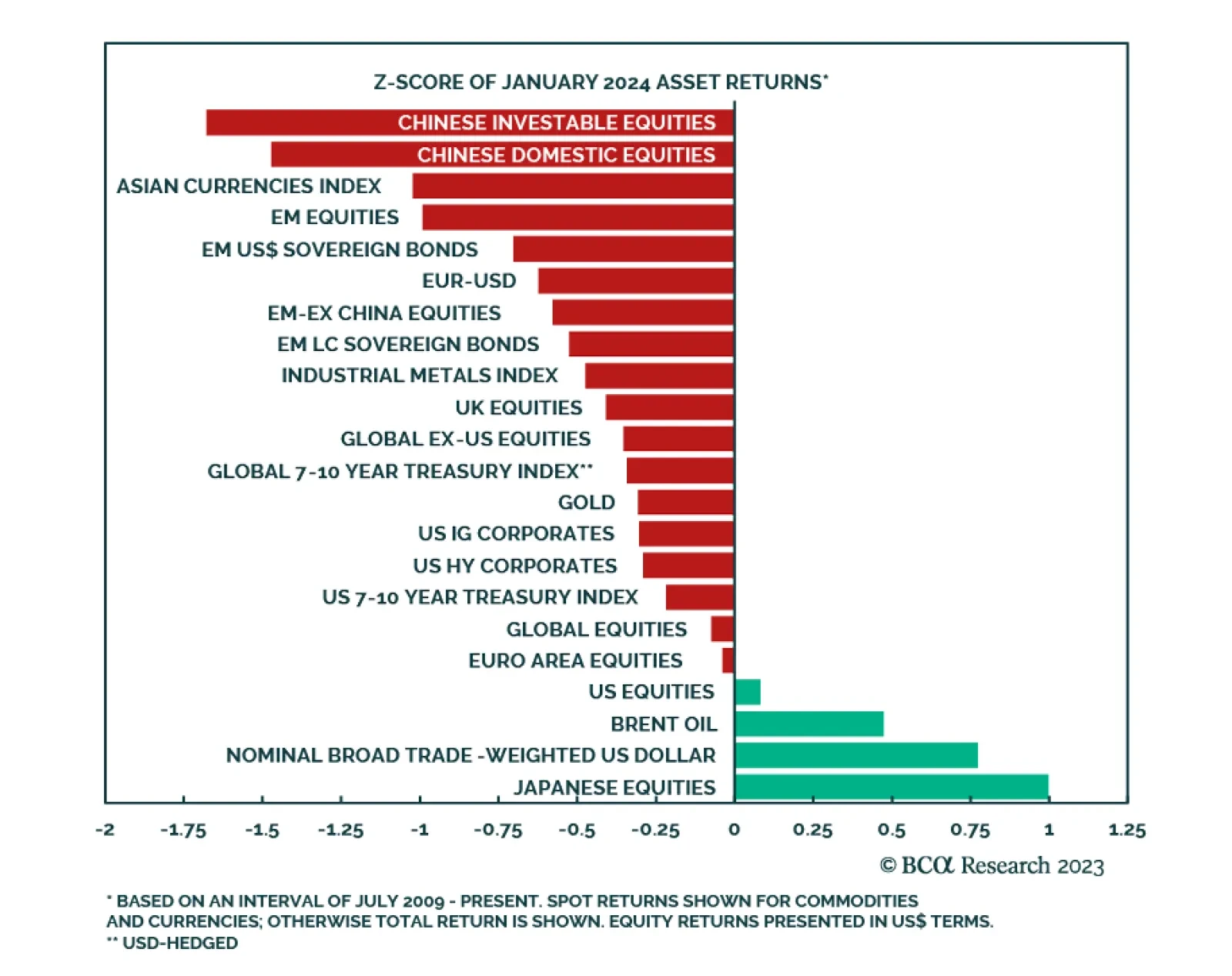

The late-2023 broad-based rally across major global financial assets fizzled at the start of this year, with most of the assets we track selling off in January. Chinese stocks continued to perform exceptionally poorly, with…