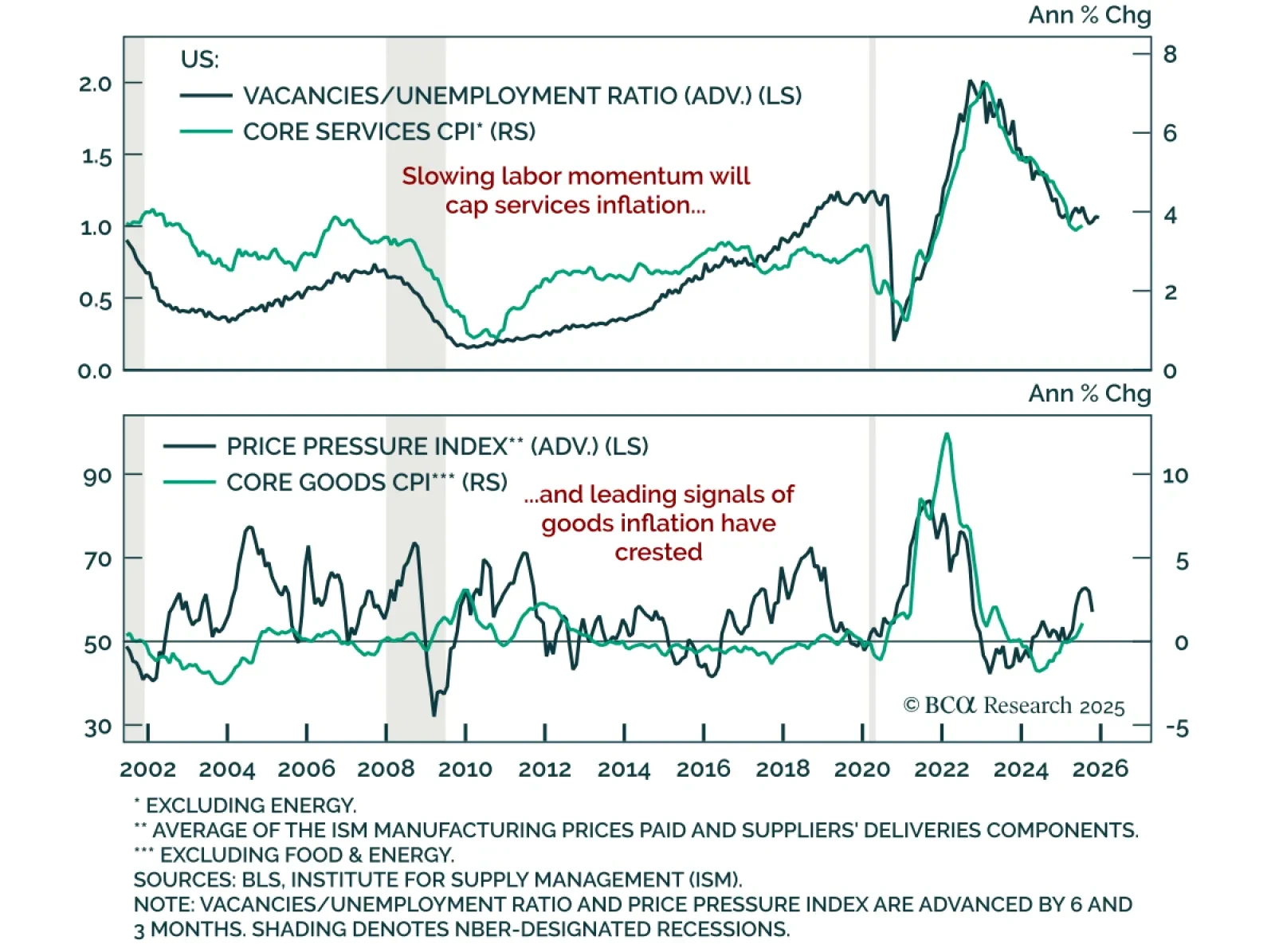

July US CPI met expectations as leading indicators point to disinflation, supporting our long duration stance and preference for 2s5s steepeners. Headline CPI rose 0.2% m/m (2.7% y/y), while core increased 0.3% m/m and…

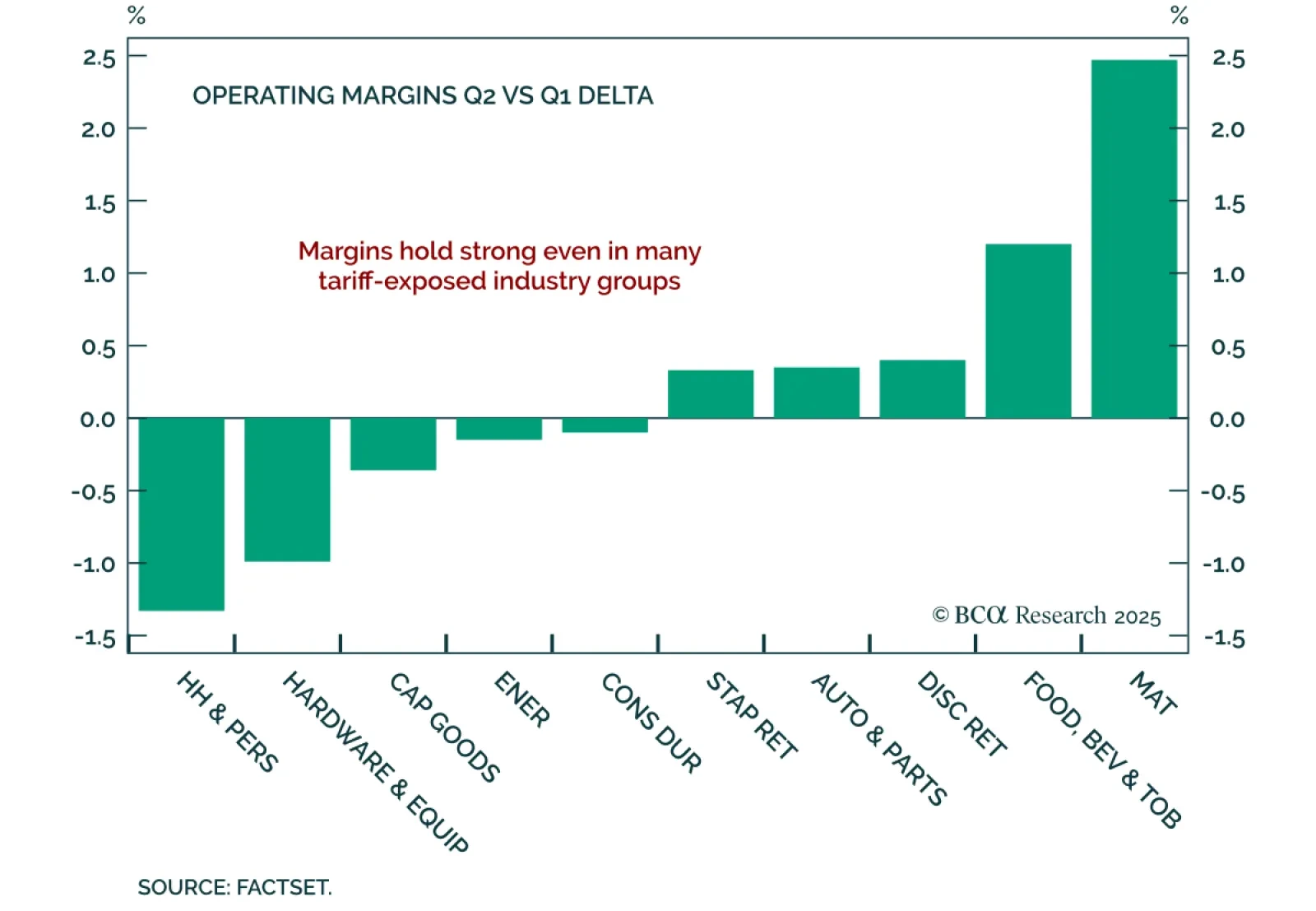

Our US Equity strategists view Q2 earnings as confirmation of corporate resilience, but caution that the full impact of tariffs is still ahead. Strong results show that companies have weathered tariff-related costs through…

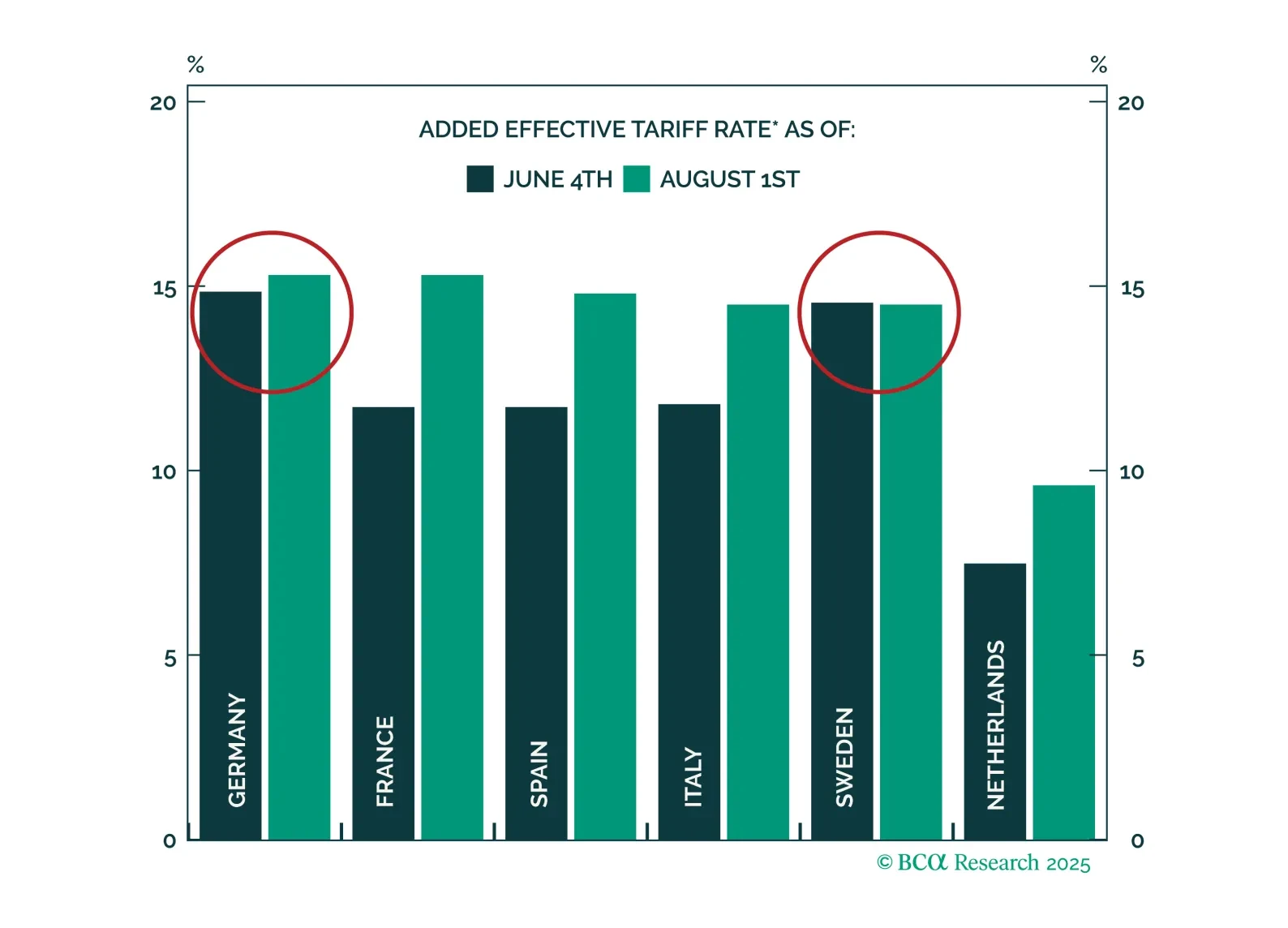

US tariffs will not derail the low-inflation economic recovery underway in the Euro Area. Investors should overweight European equities, focusing on parts of the market more insulated from tariffs.

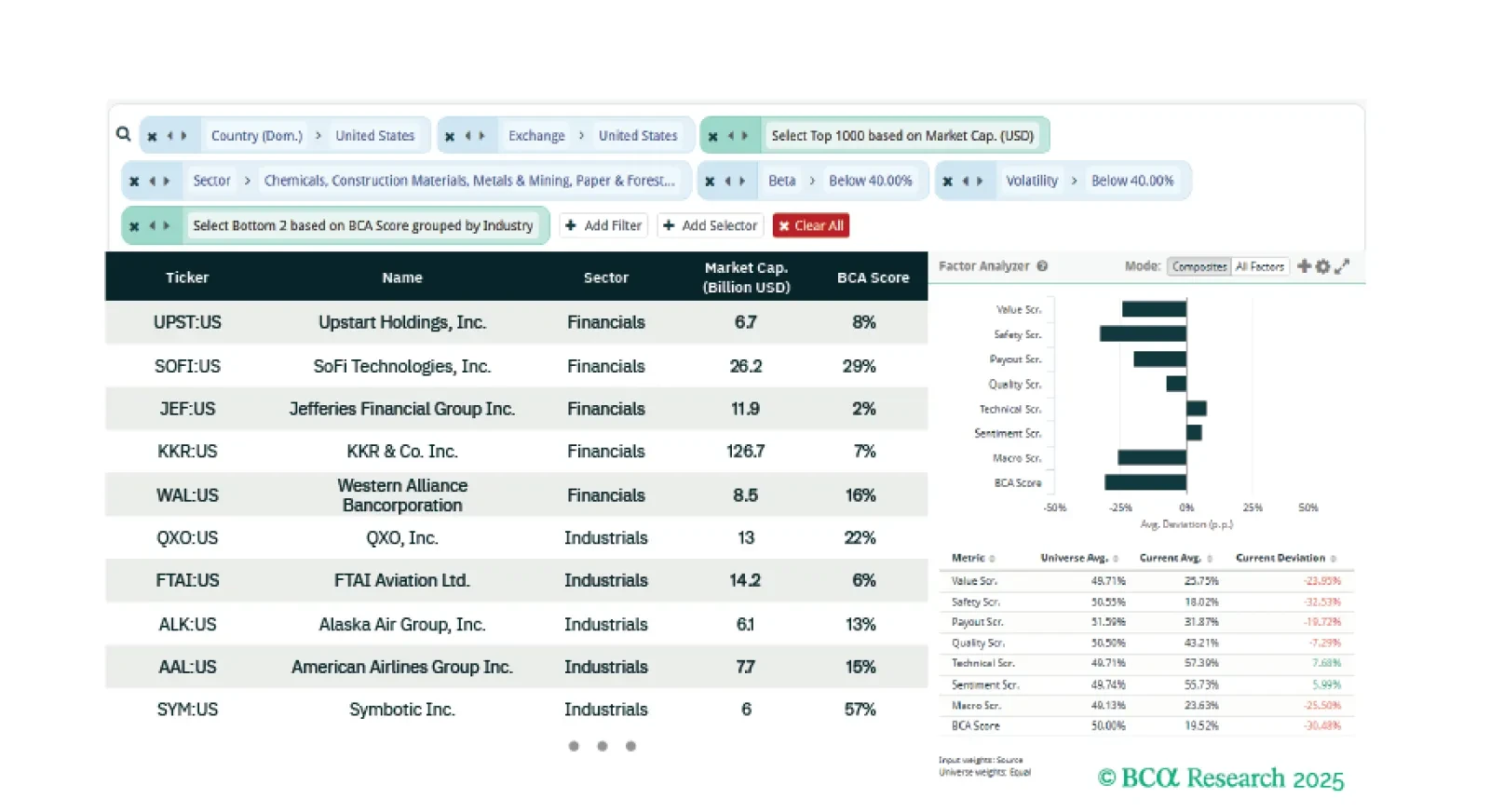

This week we develop two ideas with three screeners. The first identifies deep cyclical sectors that continue to outperform post Liberation Day in the US. We provide two screens to identify equity opportunities for this. Our…

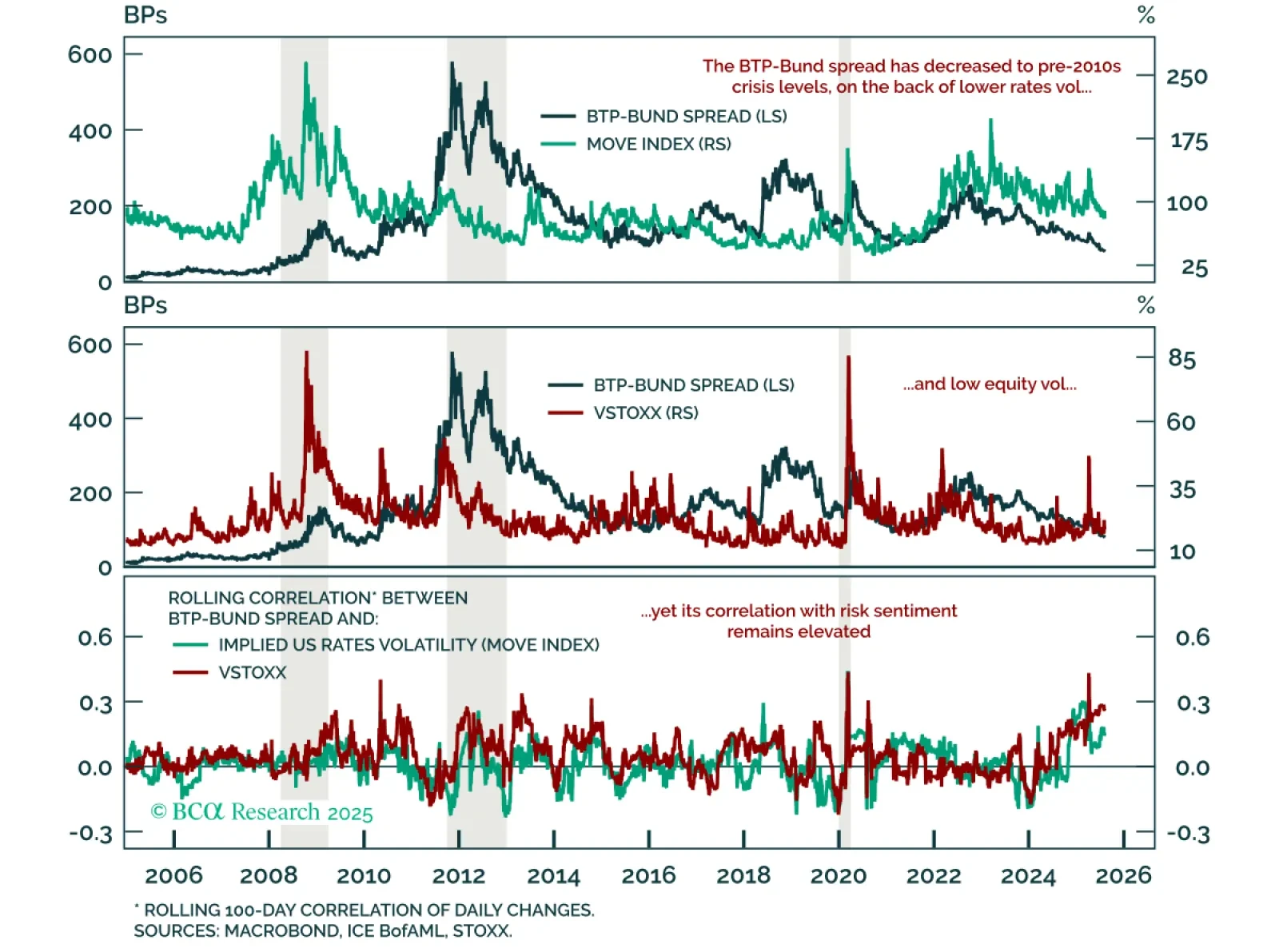

The BTP-Bund spread has tightened to pre-2010s levels, but with global growth risks we favor Gilts over Bunds and prefer BTPs over credit. While the EURO STOXX 50 remains rangebound since the Liberation Day recovery, European…

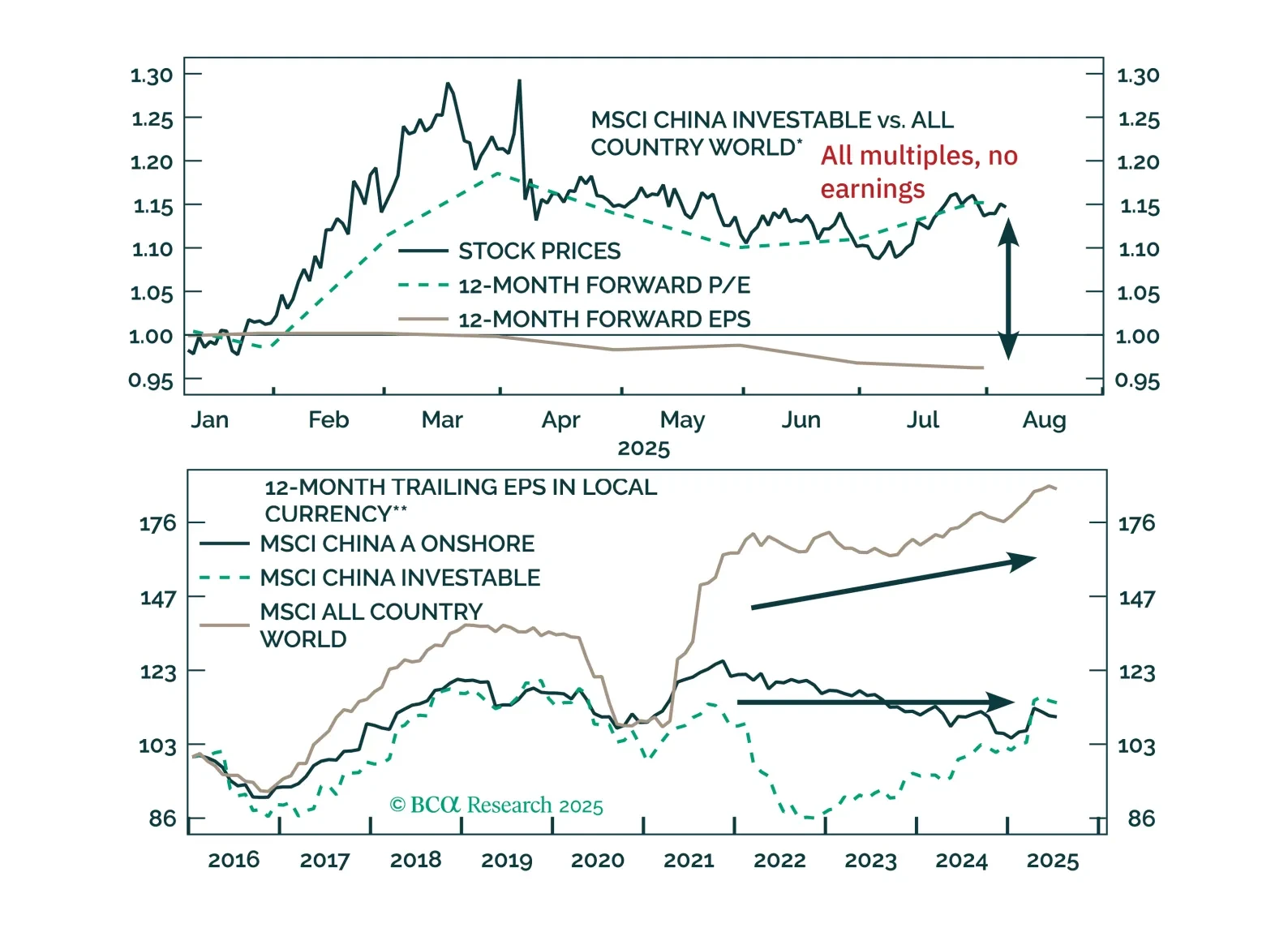

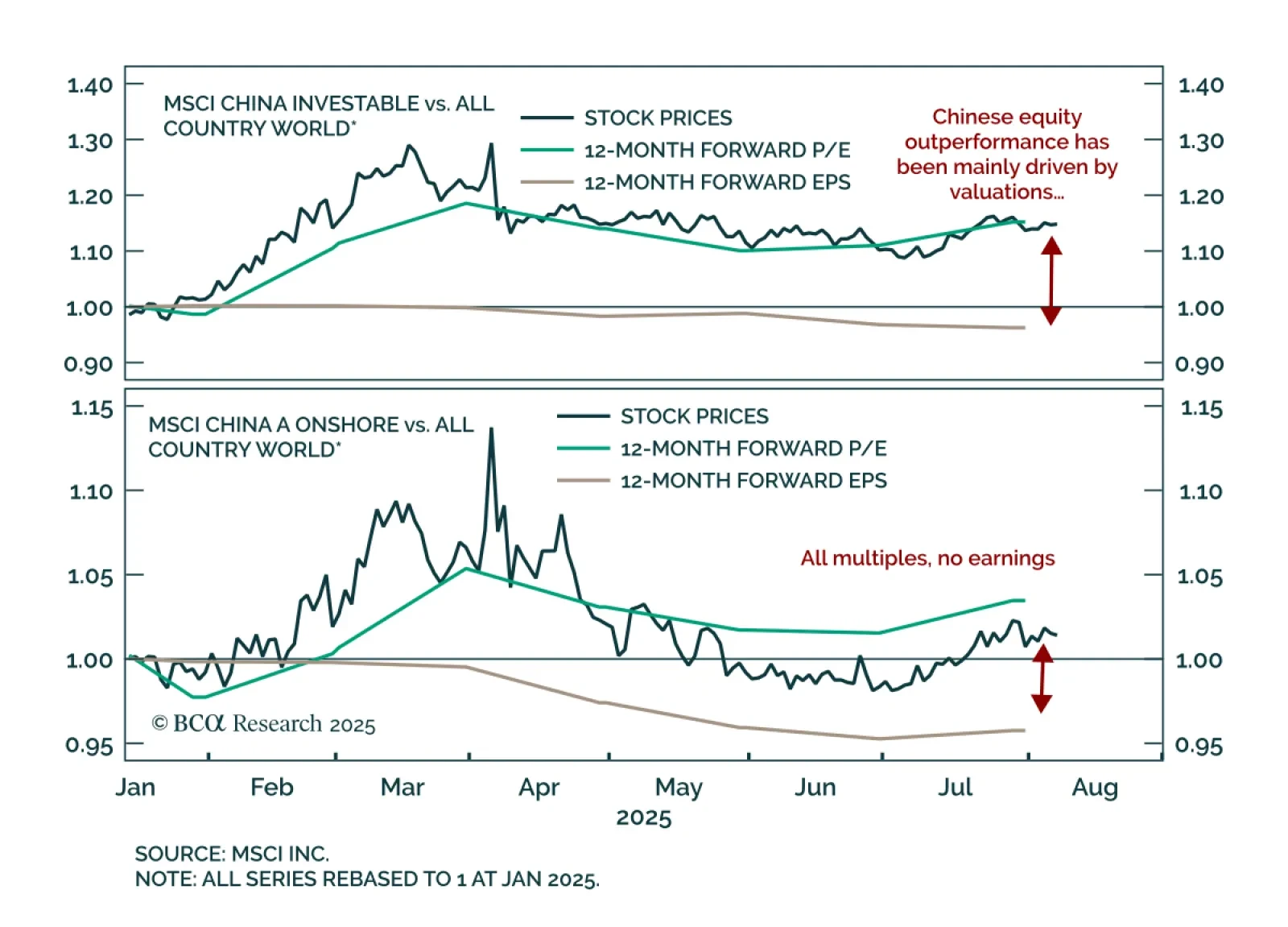

Our China Investment strategists maintain a defensive stance on Chinese equities, favoring A-shares over offshore markets. The earnings outlook remains weak, and the full impact of US tariffs has yet to be felt. Chinese equities have…

Our Emerging Markets strategists recommend downgrading Korean equities from overweight to neutral and staying long 10-year Korean bonds, currency unhedged. A deflationary shock from shrinking exports will ripple through the Korean…

Expectations for US inflation at 3.3 percent are inconsistent with expectations for the Fed to slash rates, so one of these expectations is likely wrong. We describe how to play this mispricing. Plus, a new position is to go…

Chinese stock prices have significantly decoupled from the country’s business cycle, with the full impact of US tariffs yet to be realized. The valuation-driven equity gains without a cyclical economic recovery will be vulnerable to…

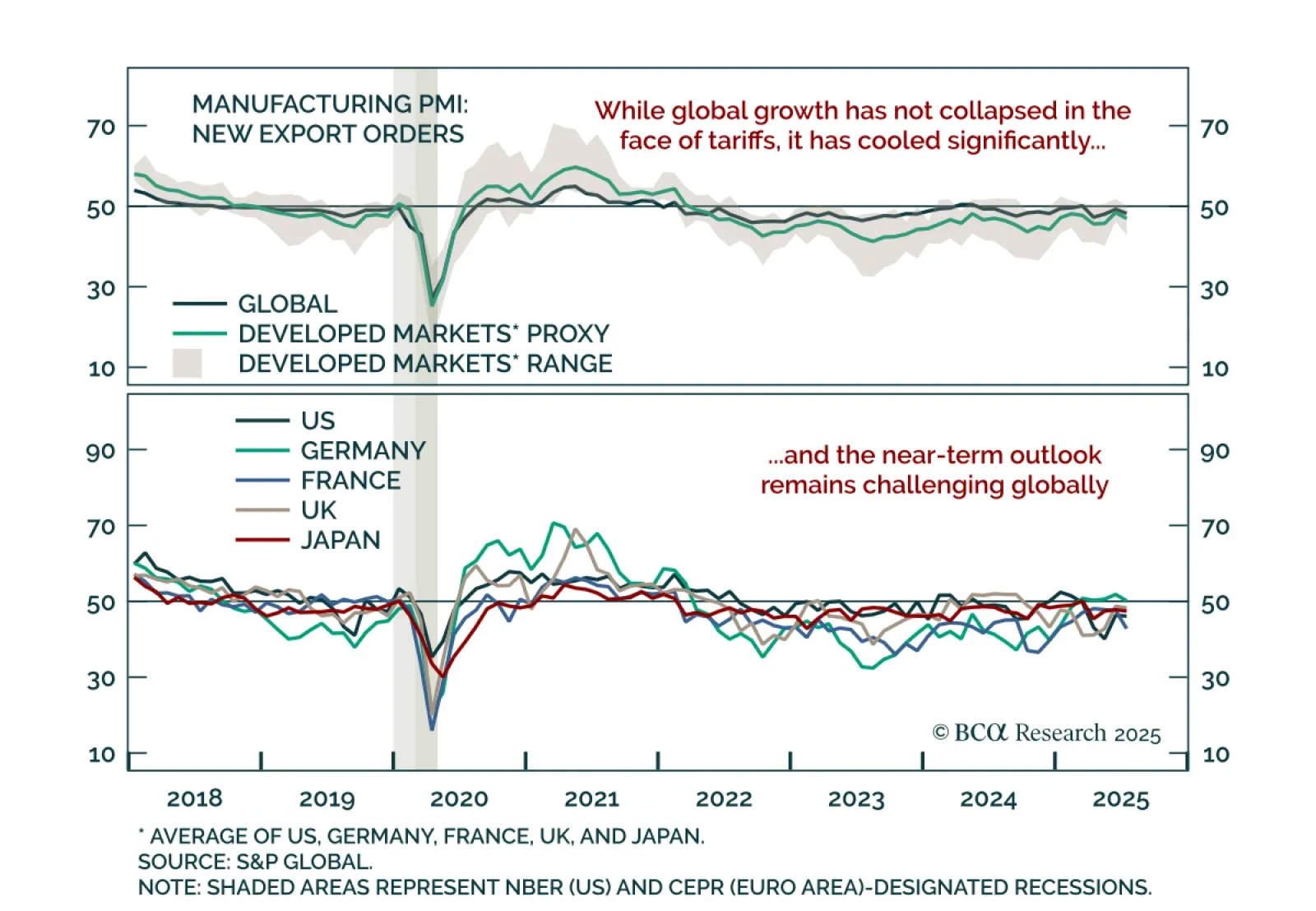

In response to trade uncertainty, global growth is cooling but not collapsing, supporting a cautious near-term view on risk assets. Trade disruption earlier this year raised fears of a global recession, but the data so far point…