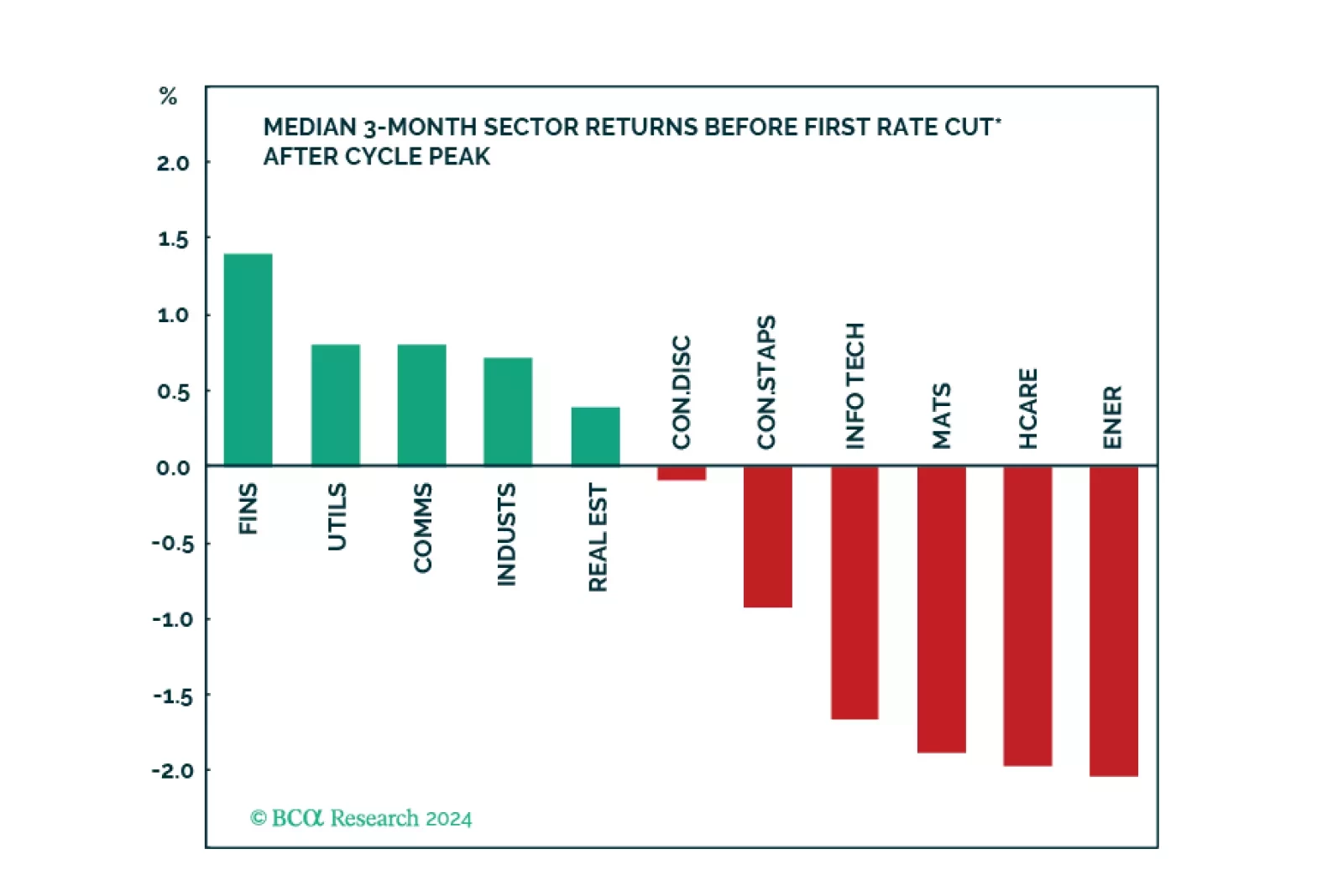

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

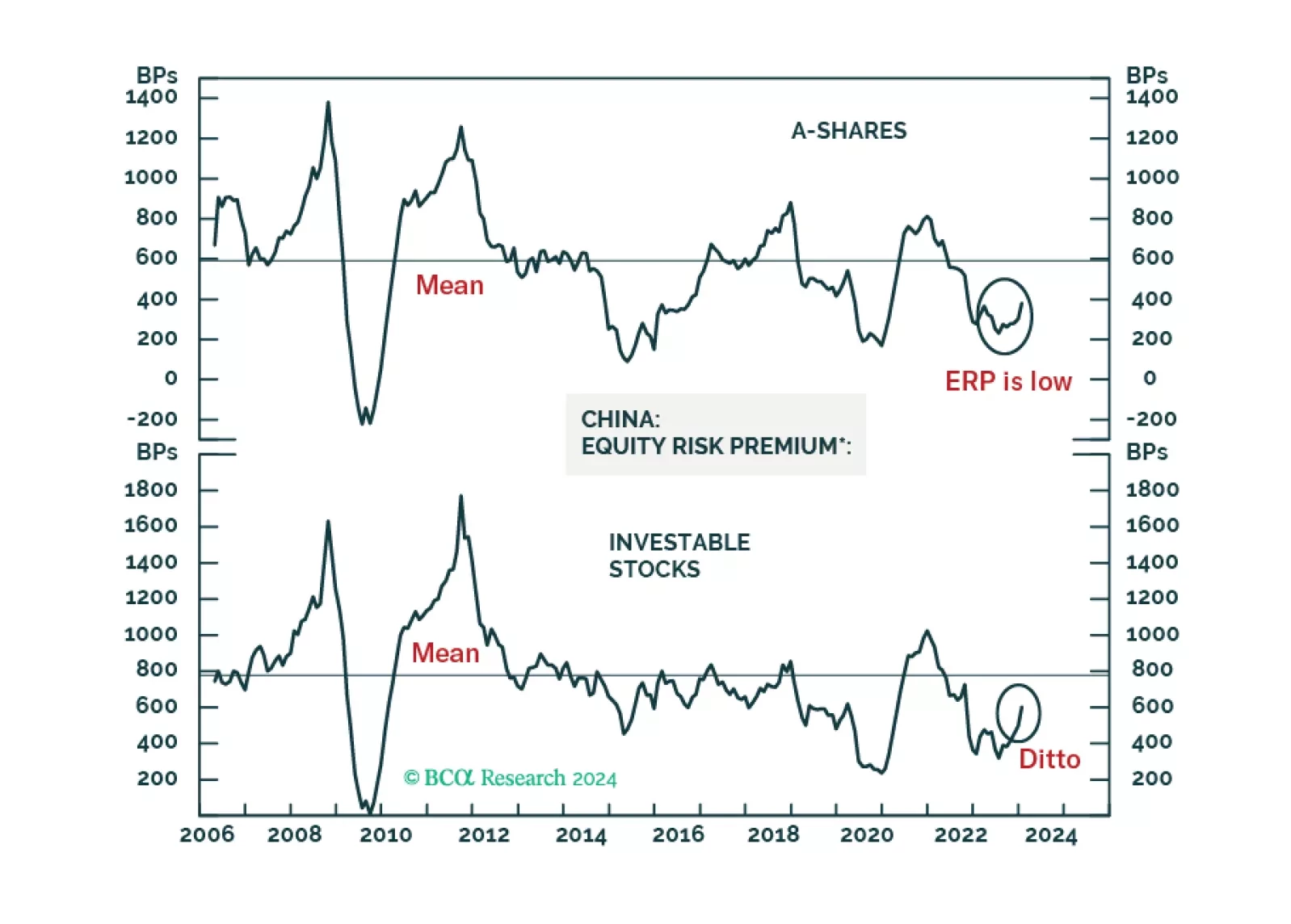

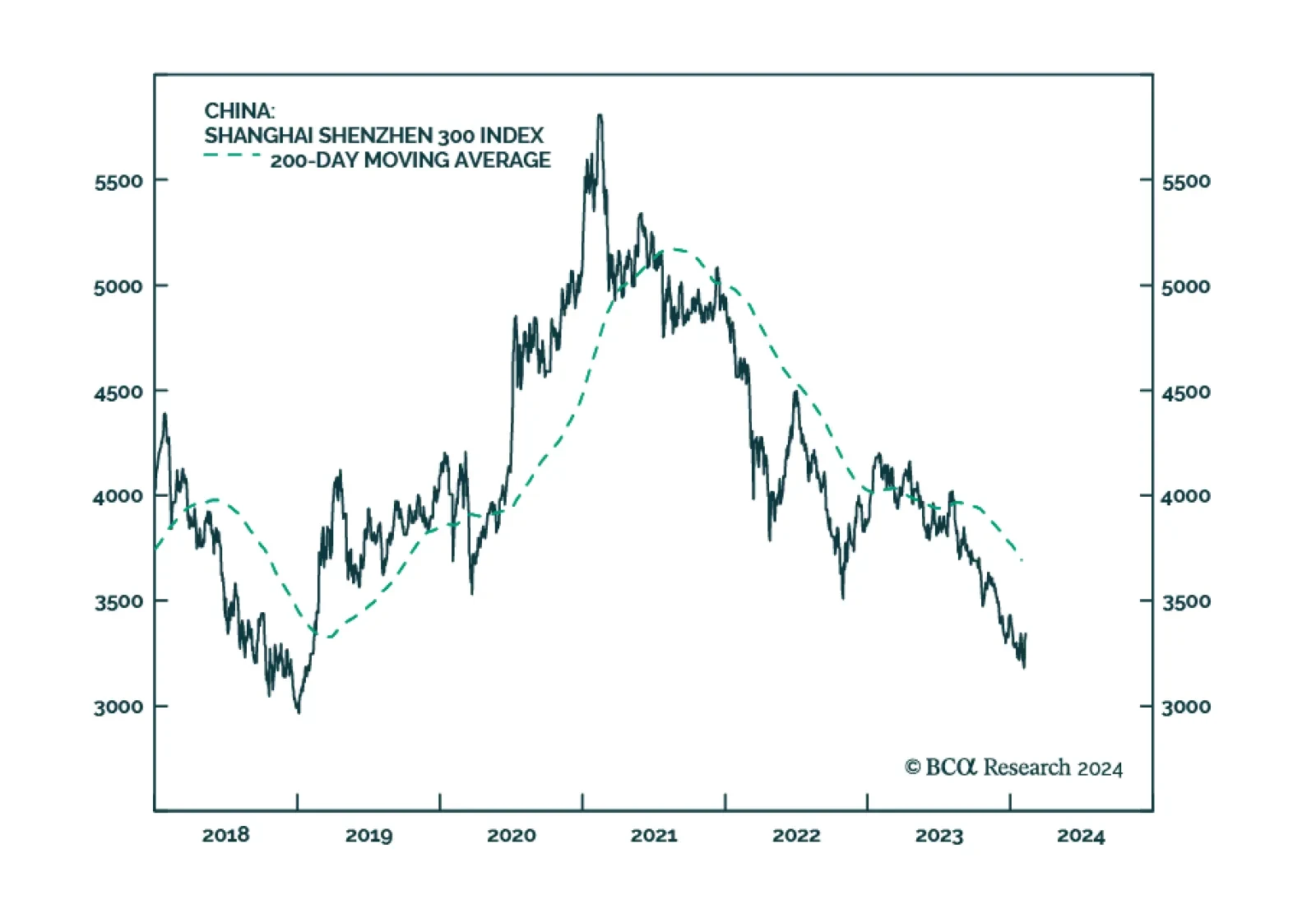

Chinese A-shares will probably begin forming a volatile bottom. The basis is that authorities will likely throw the kitchen sink at the onshore market in an attempt to stabilize share prices. The same is not true for offshore listed…

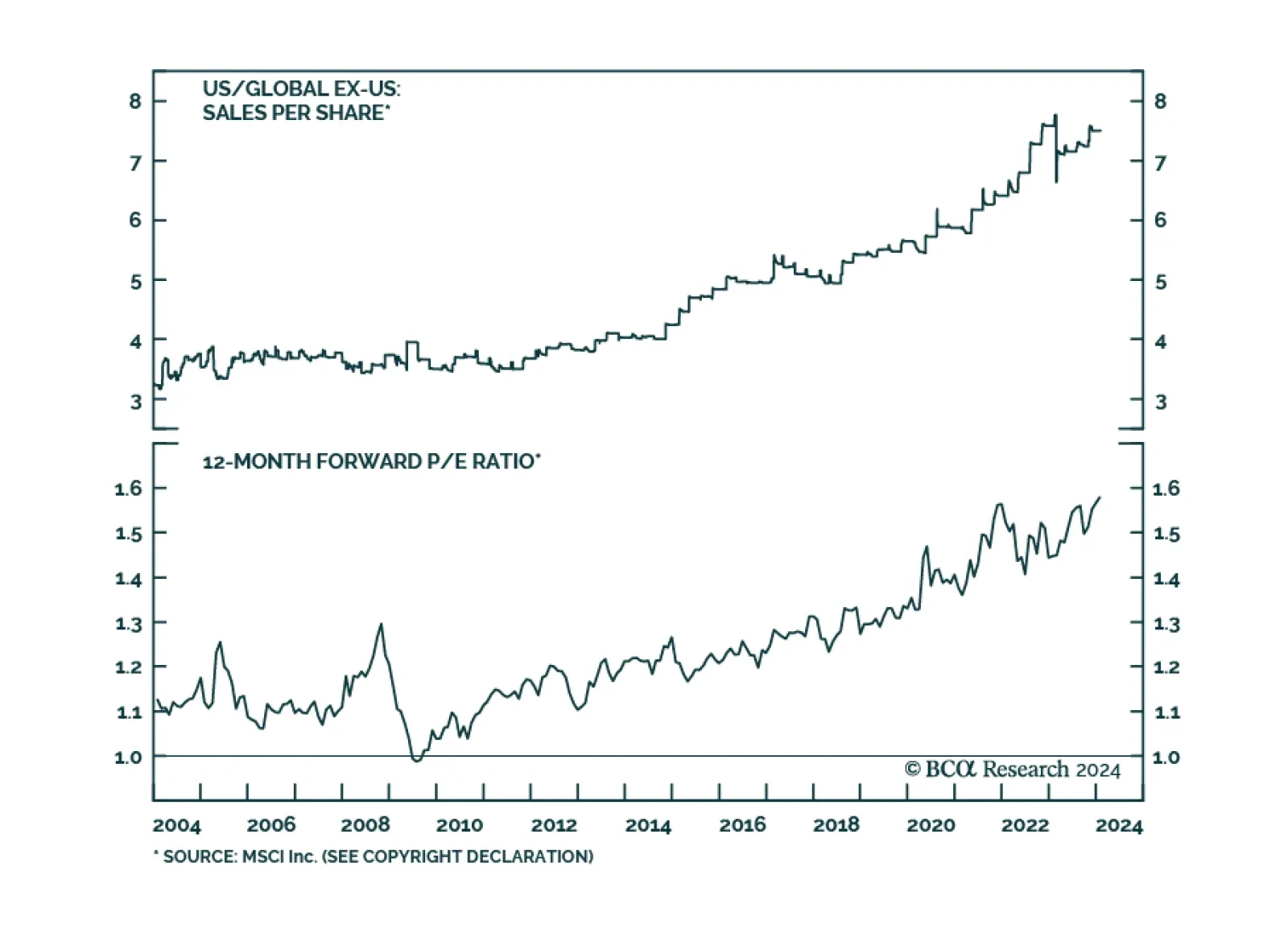

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

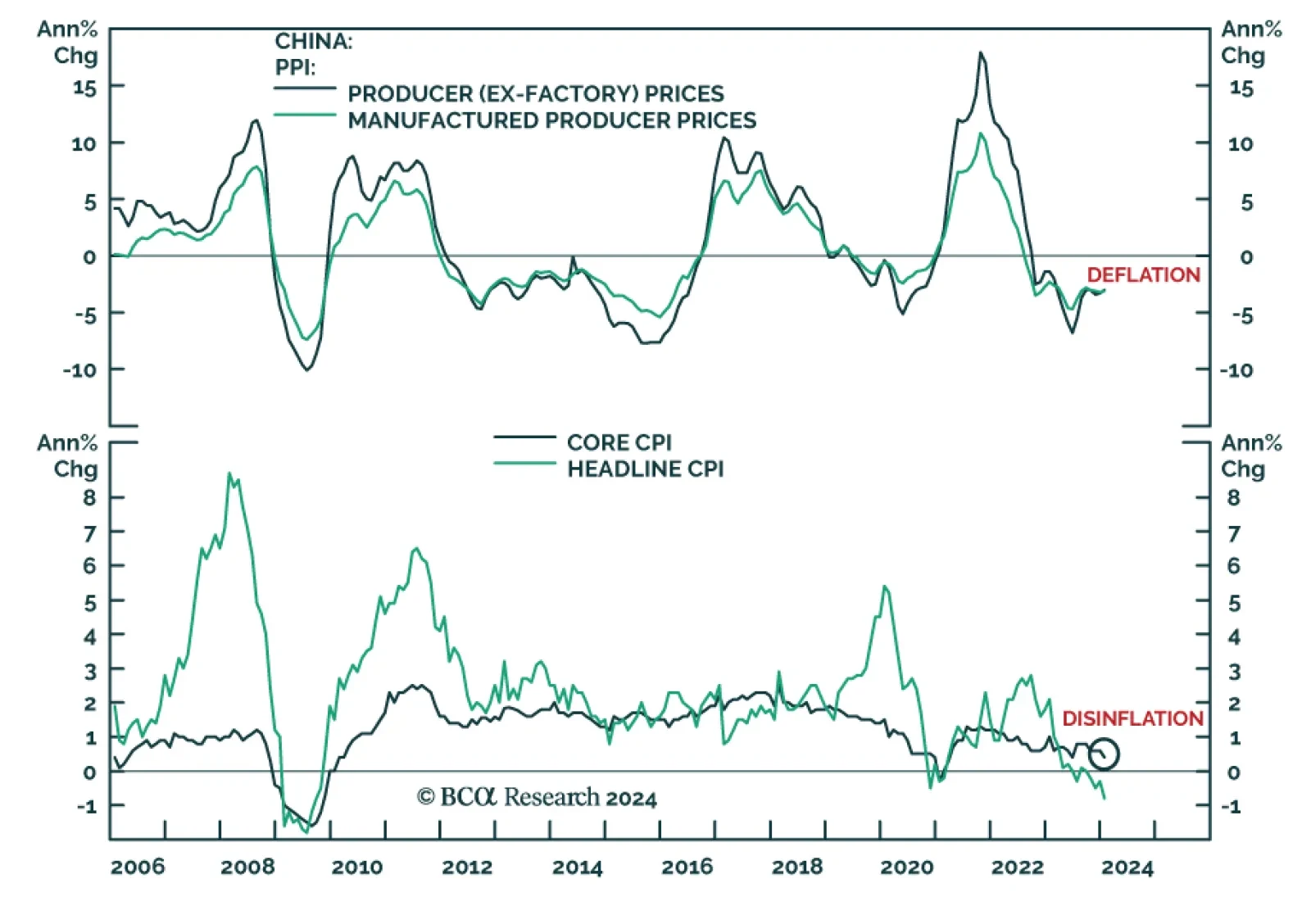

Thursday’s Chinese CPI and PPI release for January indicates that deflationary pressures continue to dominate the domestic economy. On the consumer side, prices registering the fastest pace of annual decline in 15 years.…

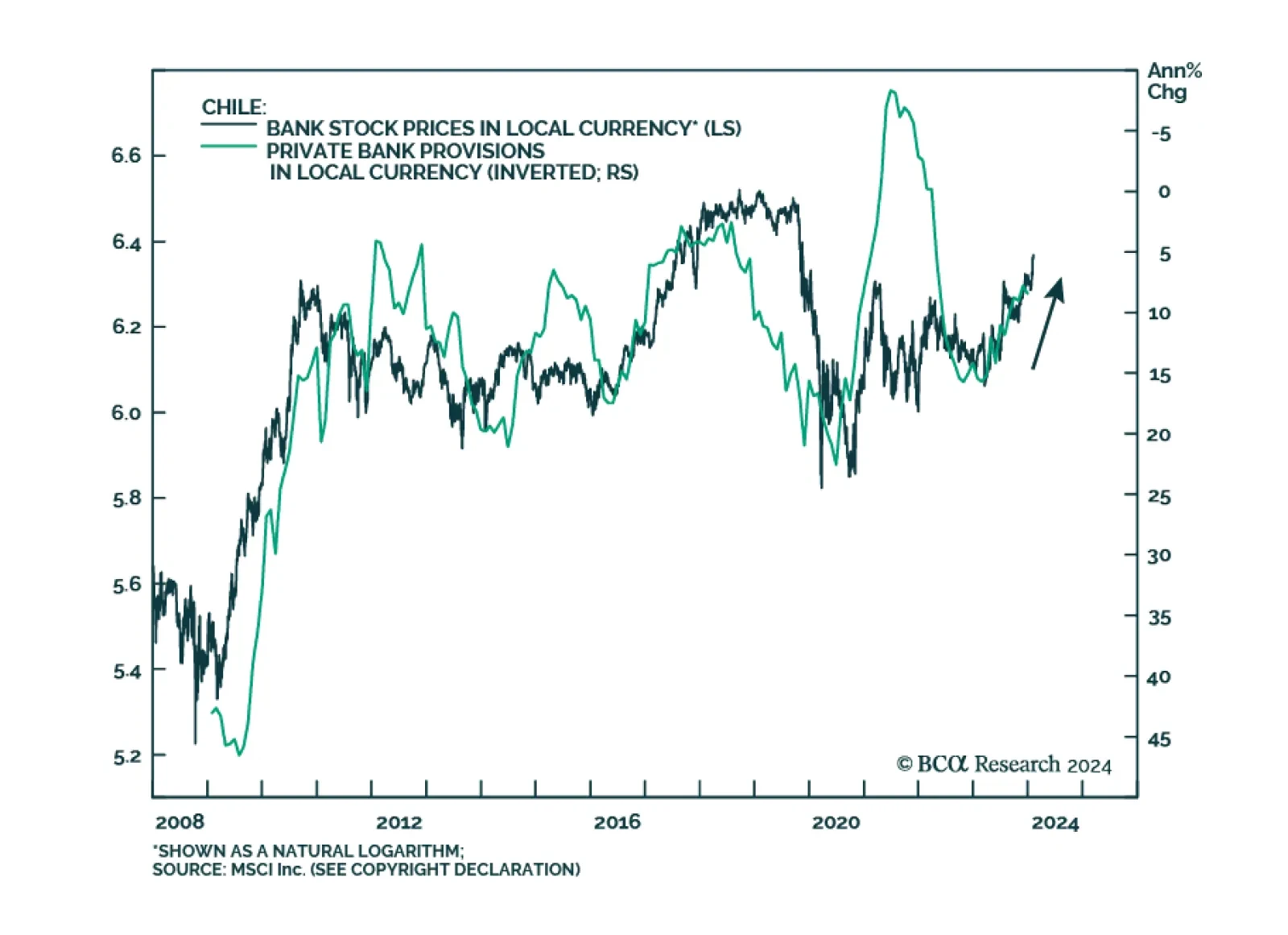

According to BCA Research’s Emerging Markets Strategy service, Chilean bank stocks offer great value and are poised to outperform the EM equity benchmark. Chilean bank share prices are well-positioned to outperform due…

Chinese domestic stocks have fared quite poorly over the past year. Since late-January 2023, the Shanghai Shenzhen 300 index fell roughly 24% to last week’s low, driven by ongoing weakness in China’s economy and a…

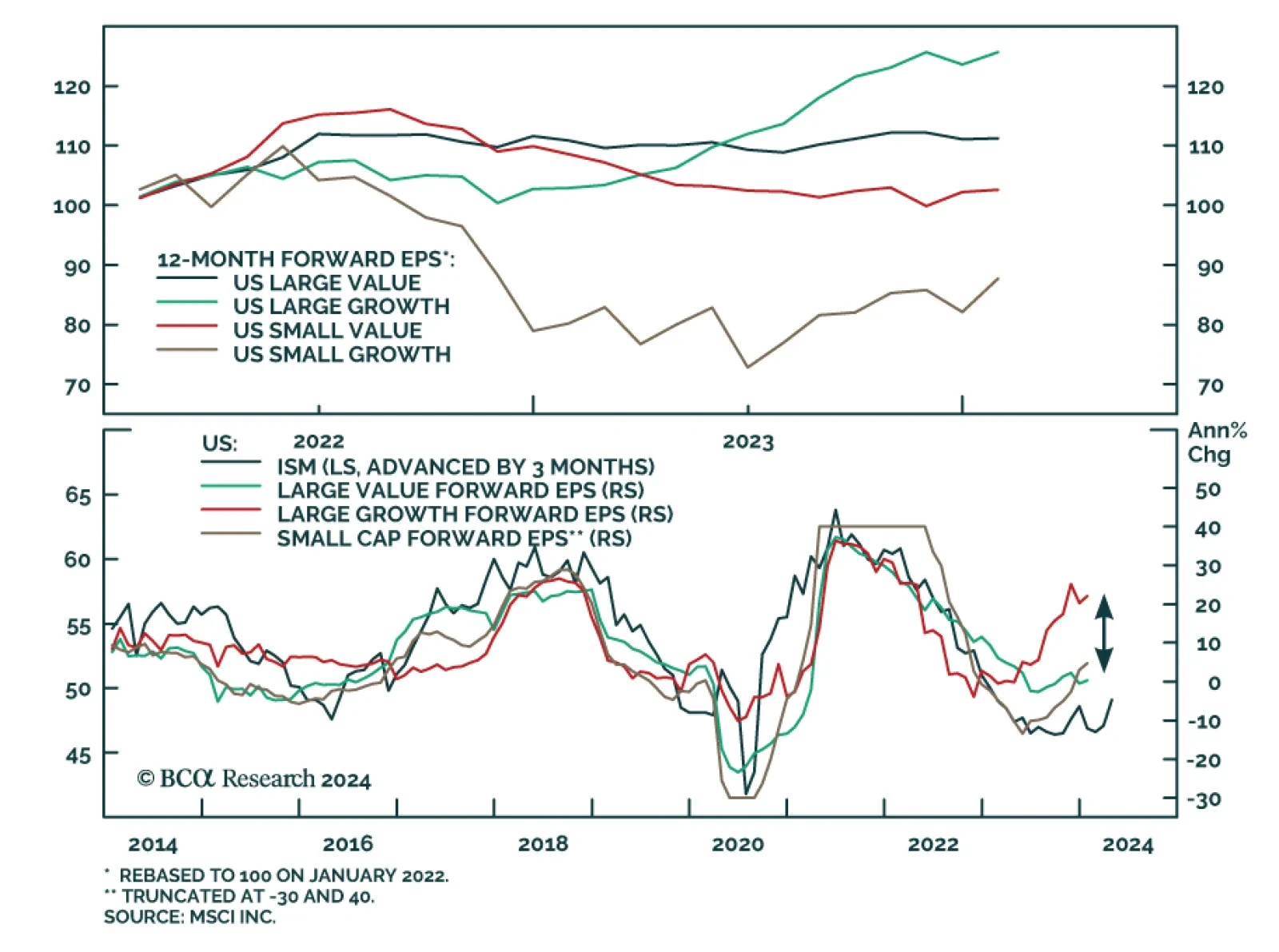

US equities remain on a winning streak. After a sluggish start to the year, US stocks resumed their rally in late-January. Importantly, the rally has recently broadened out, with nine of the 11 S&P 500 sectors rising so far…

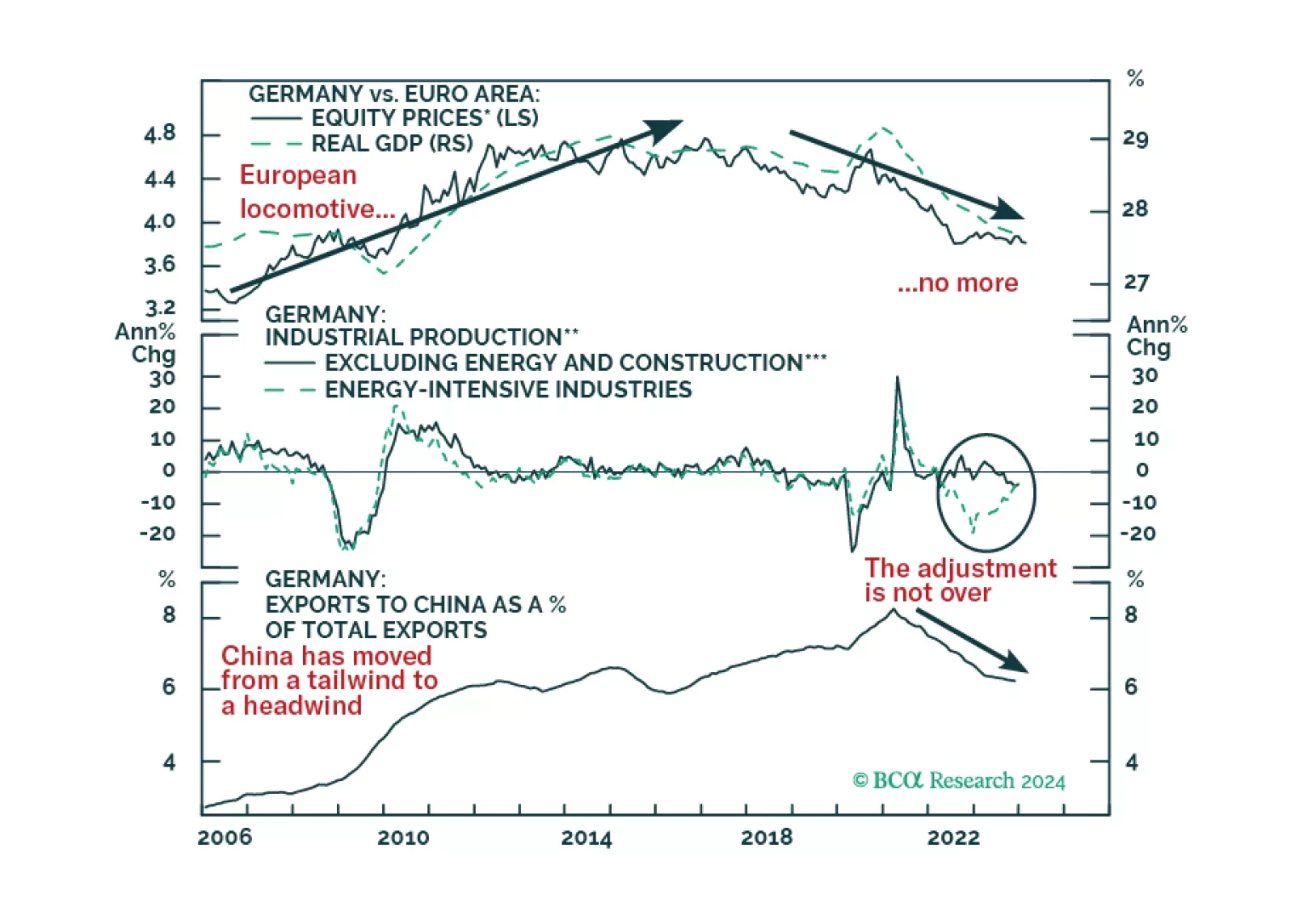

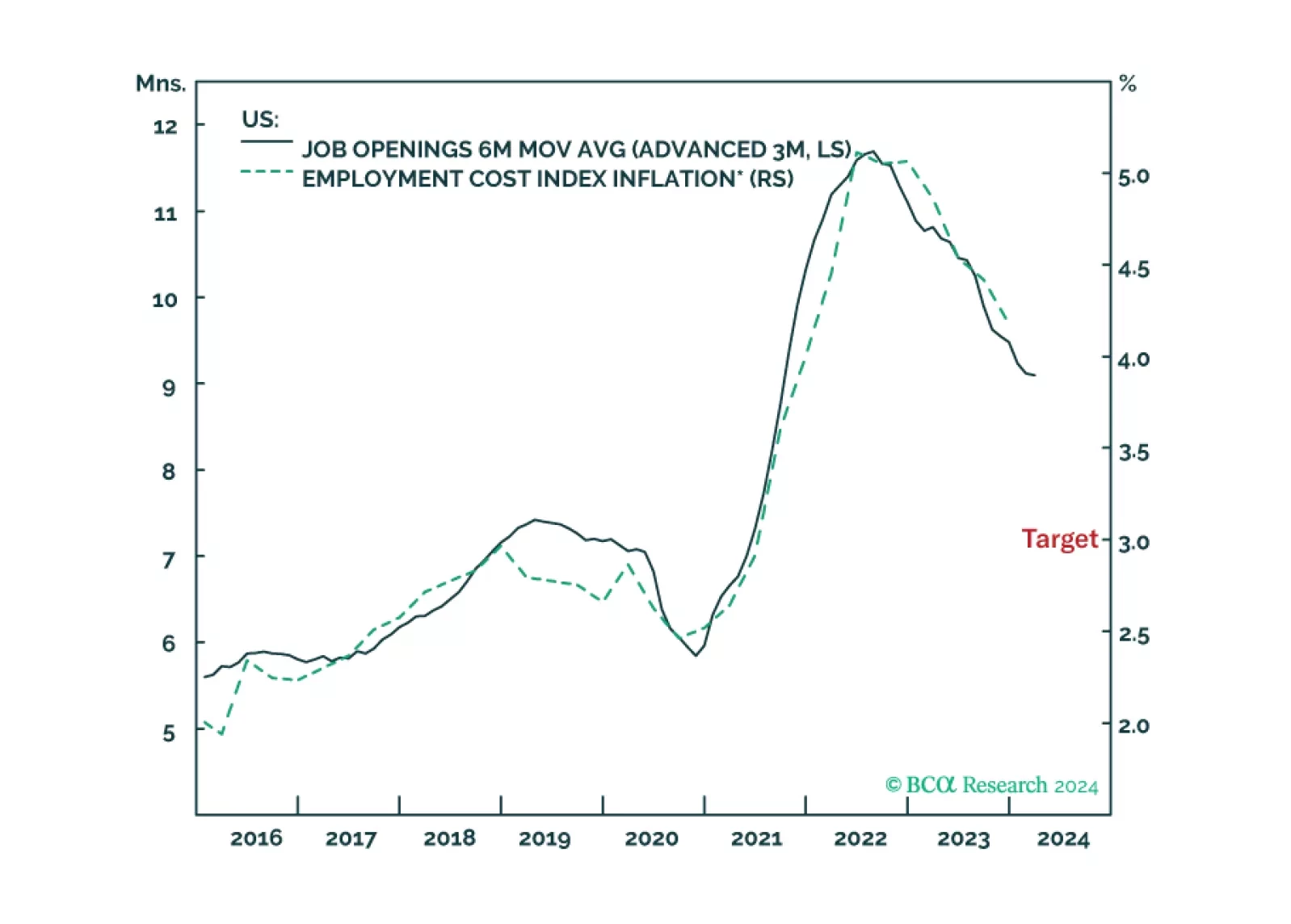

The disinflation to date has been benign because it has come almost entirely from improving supply. But the supply-side tailwind has exhausted, so the last mile of the journey to 2 percent inflation will be the hardest, especially in…

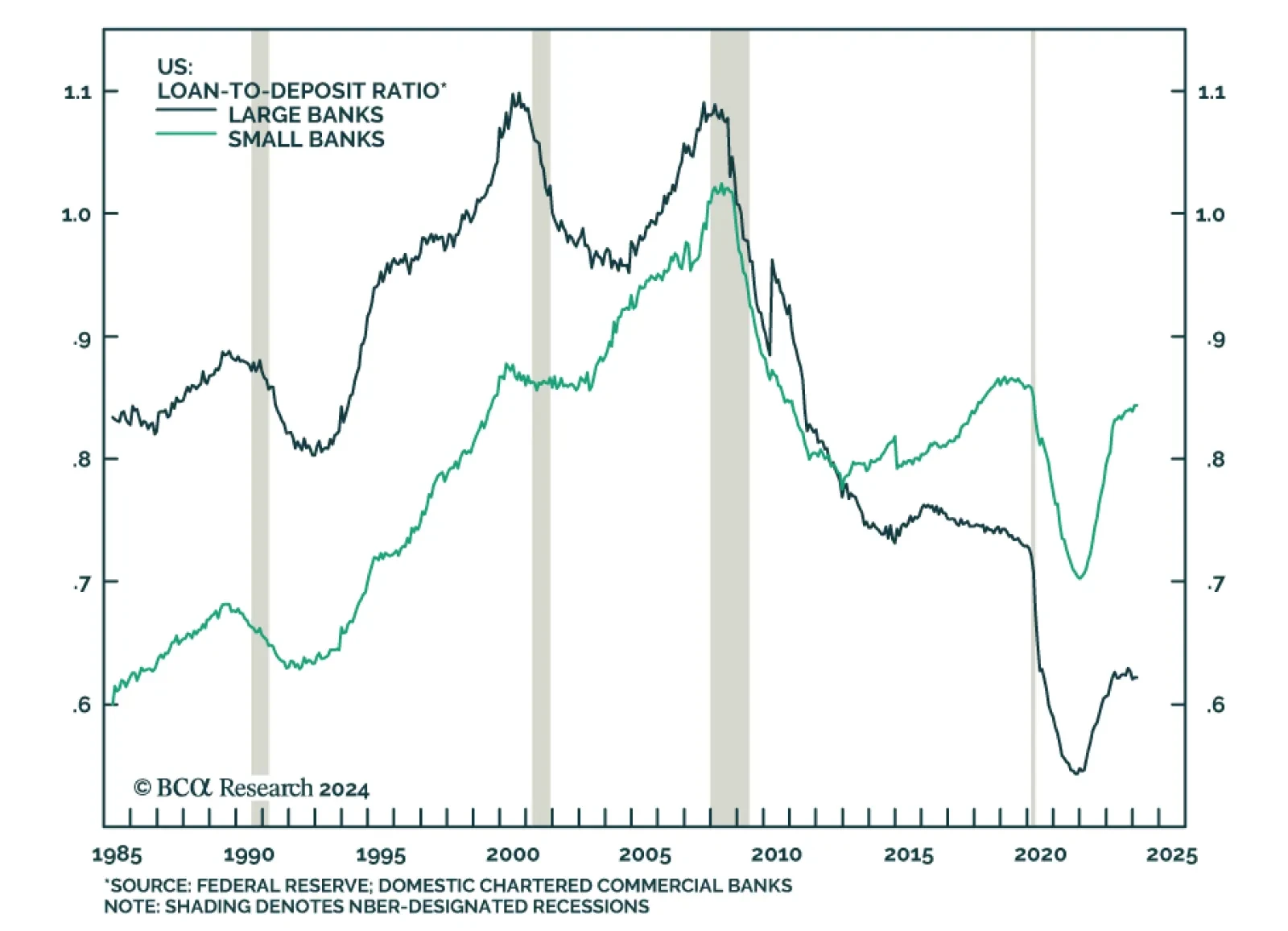

Banks were thrust back in the spotlight’s unflattering glare last week when mid-cap regional New York Community Bank shocked analysts and shareholders with an enormous credit loss. According to BCA Research’s US…