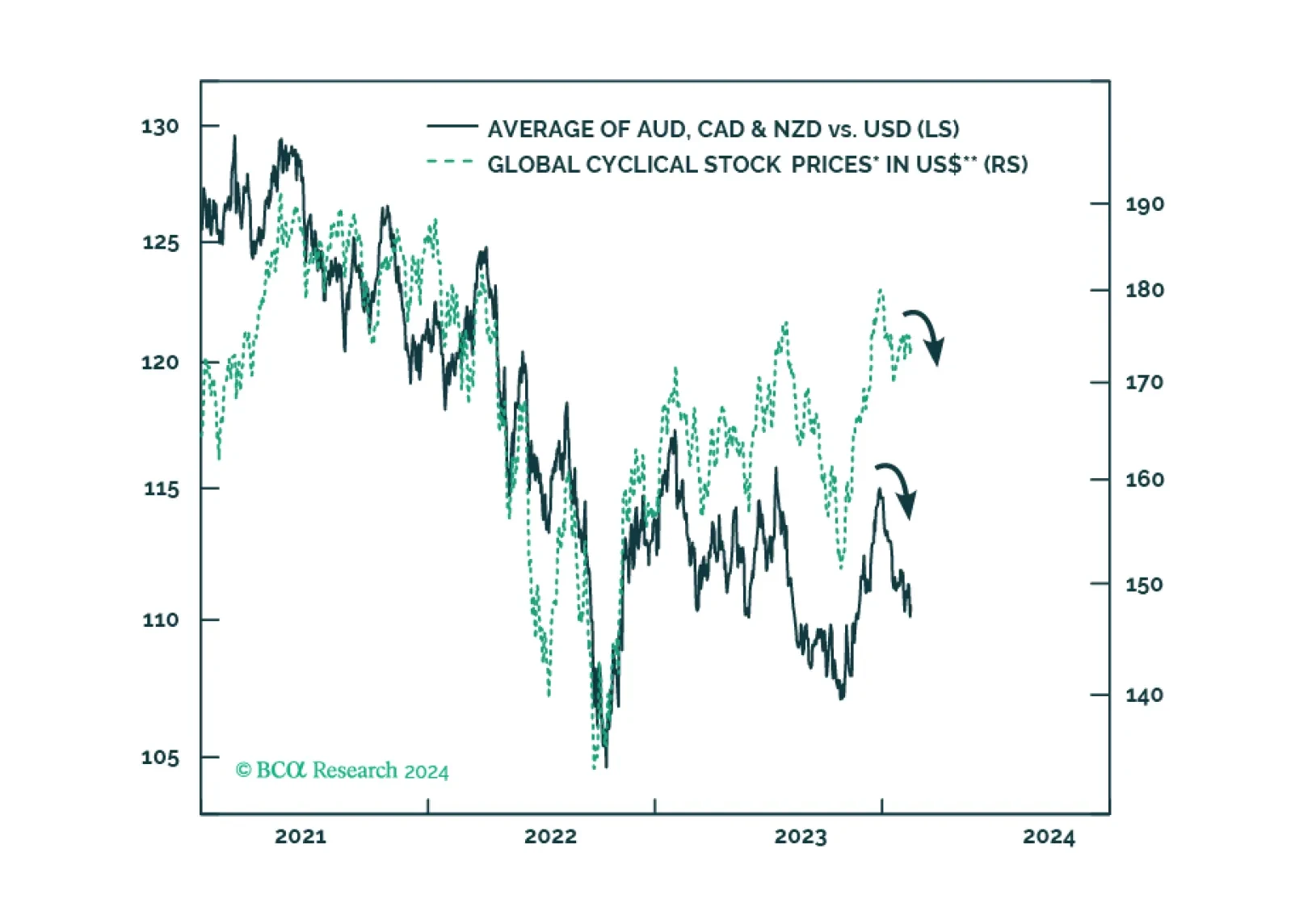

Over the next six months, the deterioration in non-US growth will occur earlier and be more pronounced than in the US. This expectation reinforces our confidence to bet on the strength of the US dollar. As usual, the flip side of the…

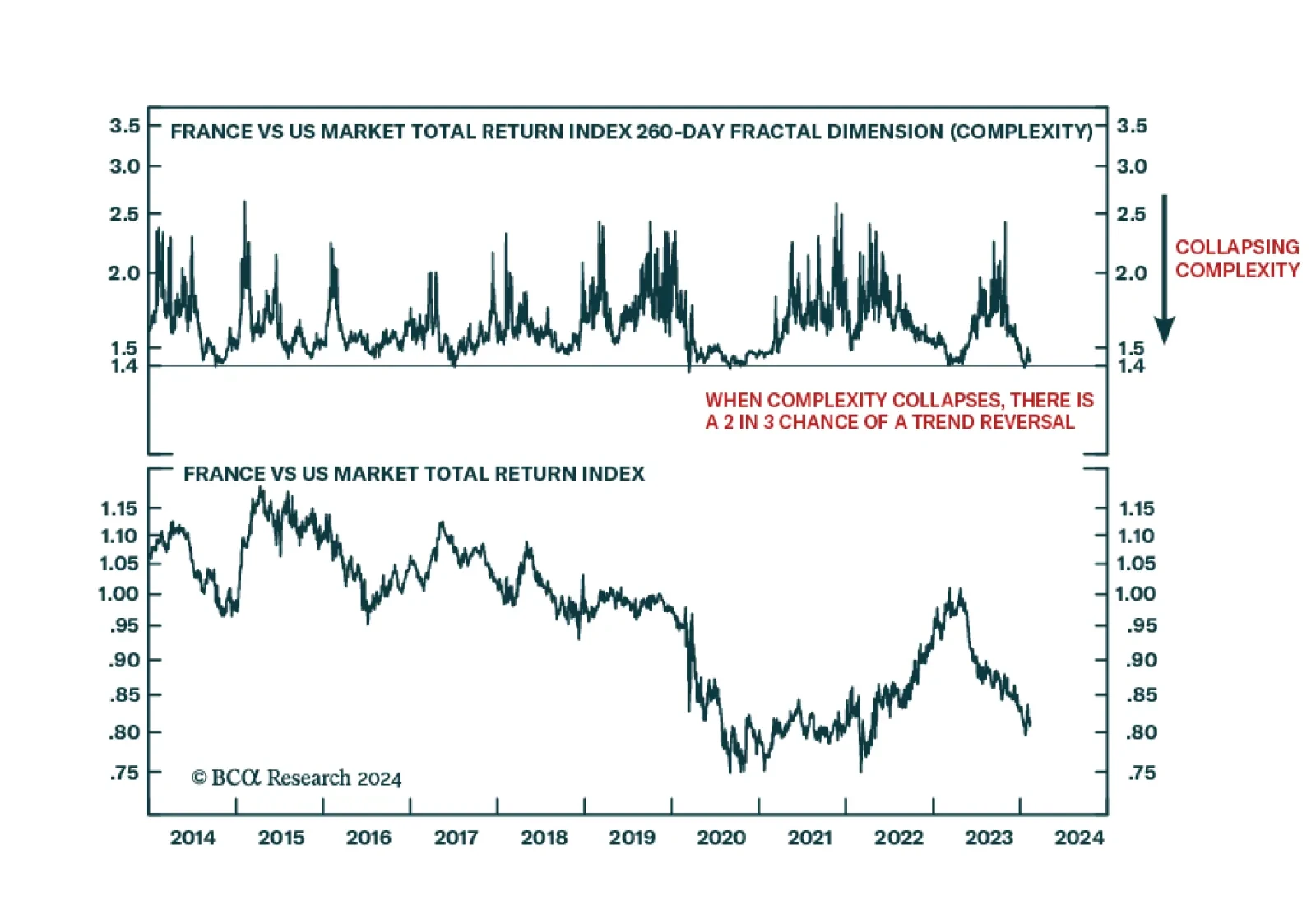

According to BCA Research’s Counterpoint service, European stocks will be the big winners of the 2020s. Every decade has a big loser and a big winner. Which stock market will be the winner through the remaining two-…

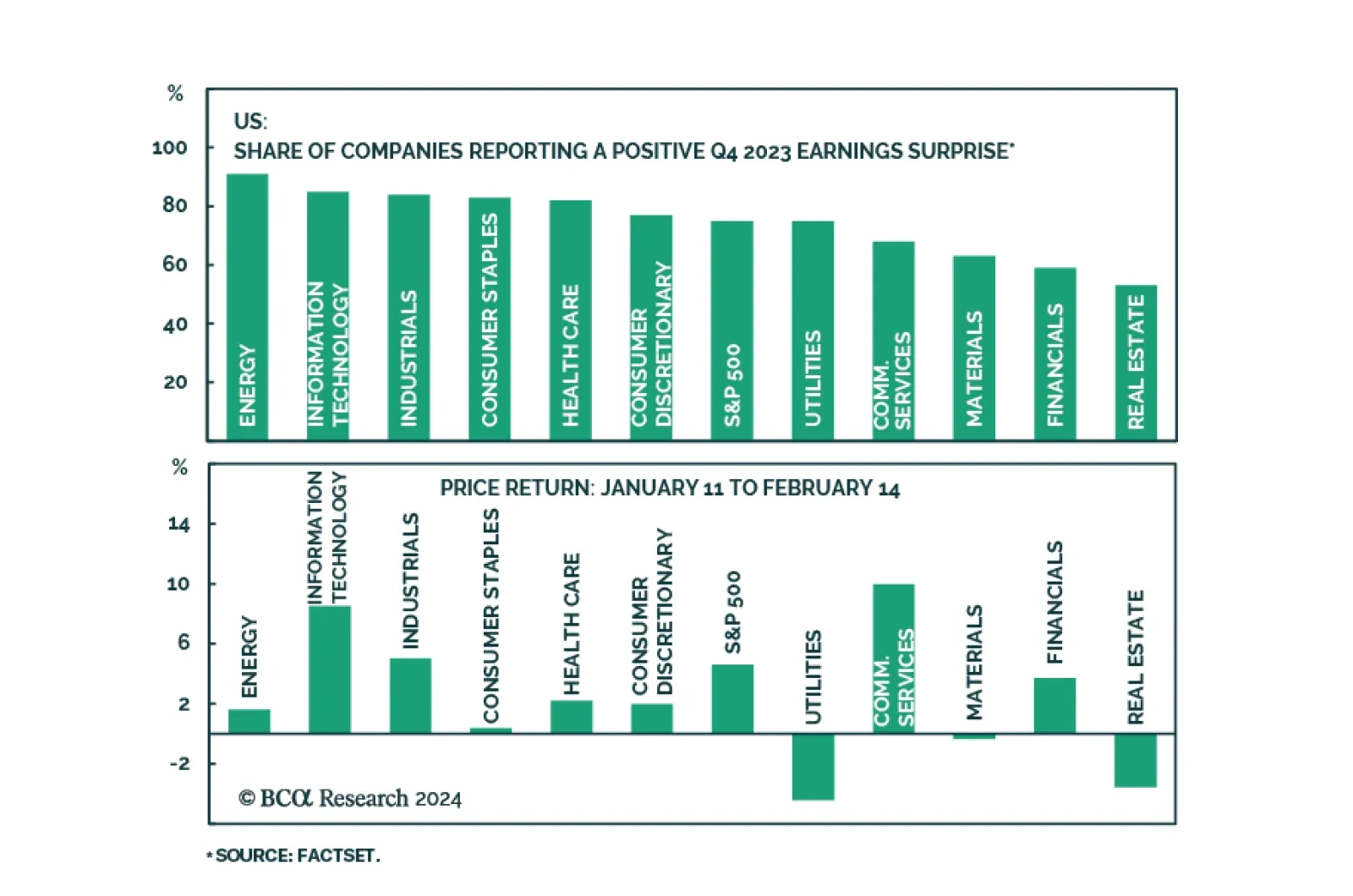

We are now more than midway through the Q4 2023 earnings season. Roughly two-thirds of the companies in the S&P 500 have released their earnings reports. It’s therefore worthwhile to stand back and observe some of the…

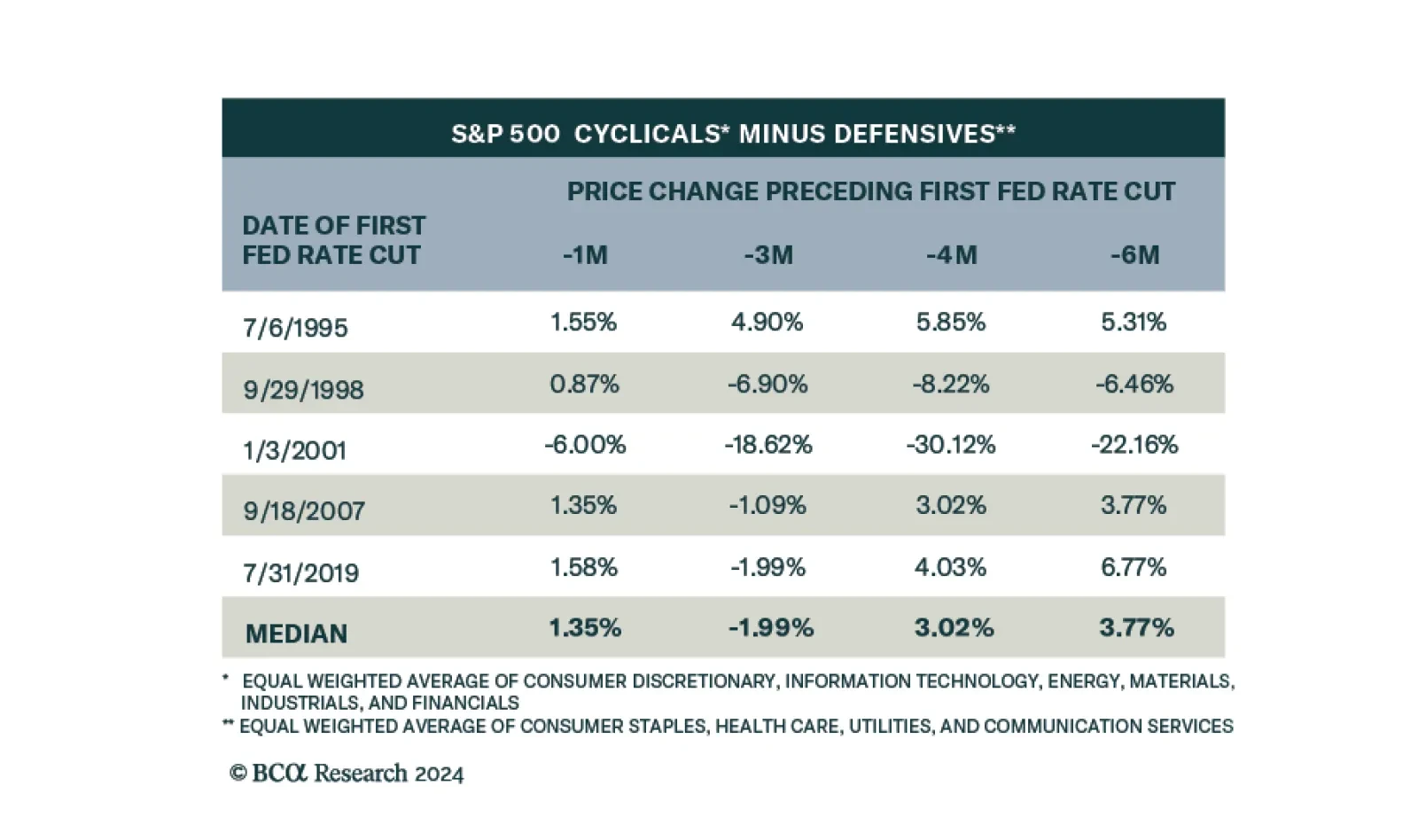

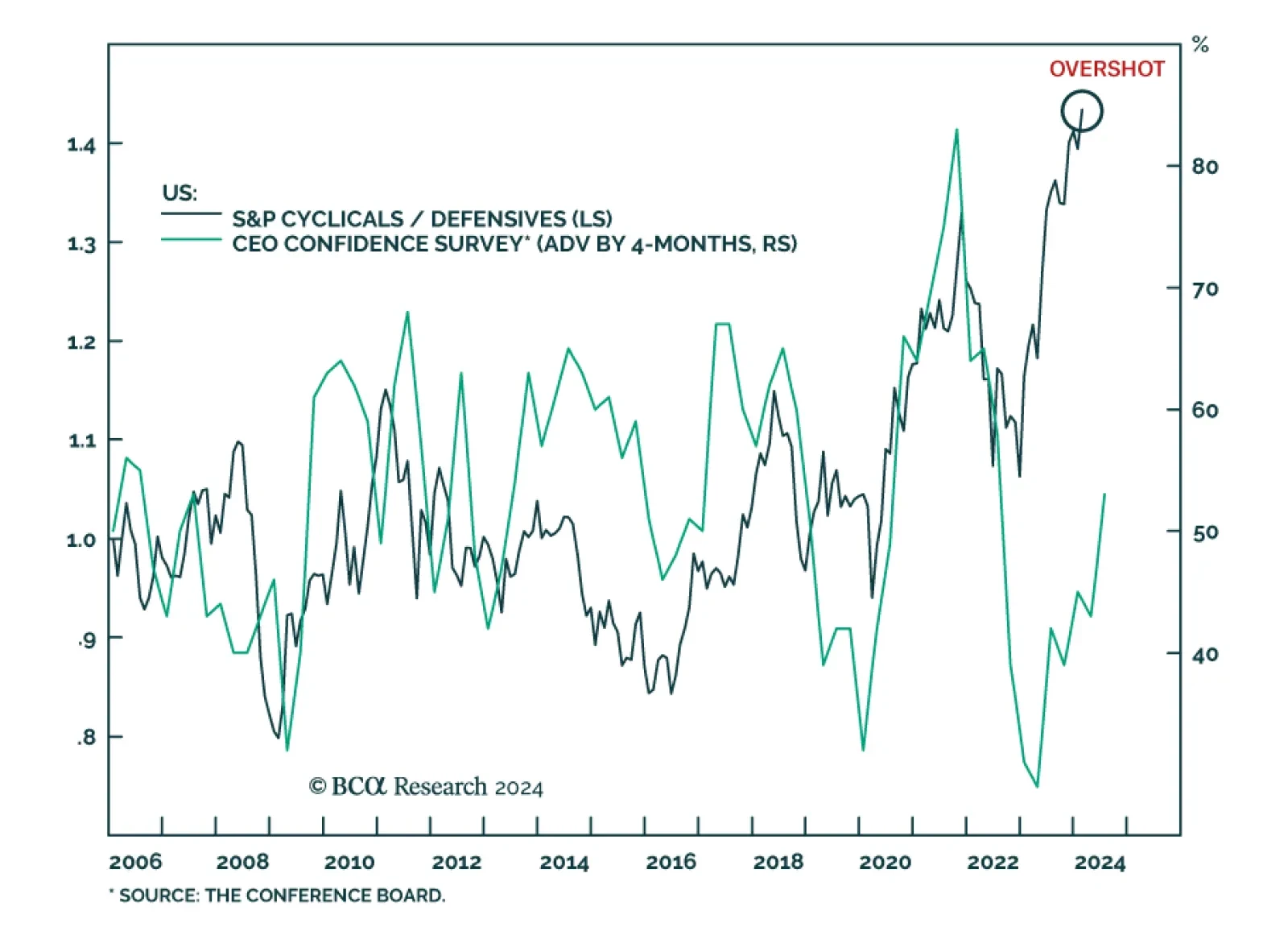

In a recent Insight we looked at the performance of equities following the start of monetary easing cycles. Specifically, we looked at the historical performance of US cyclical sectors versus defensive sectors at various points…

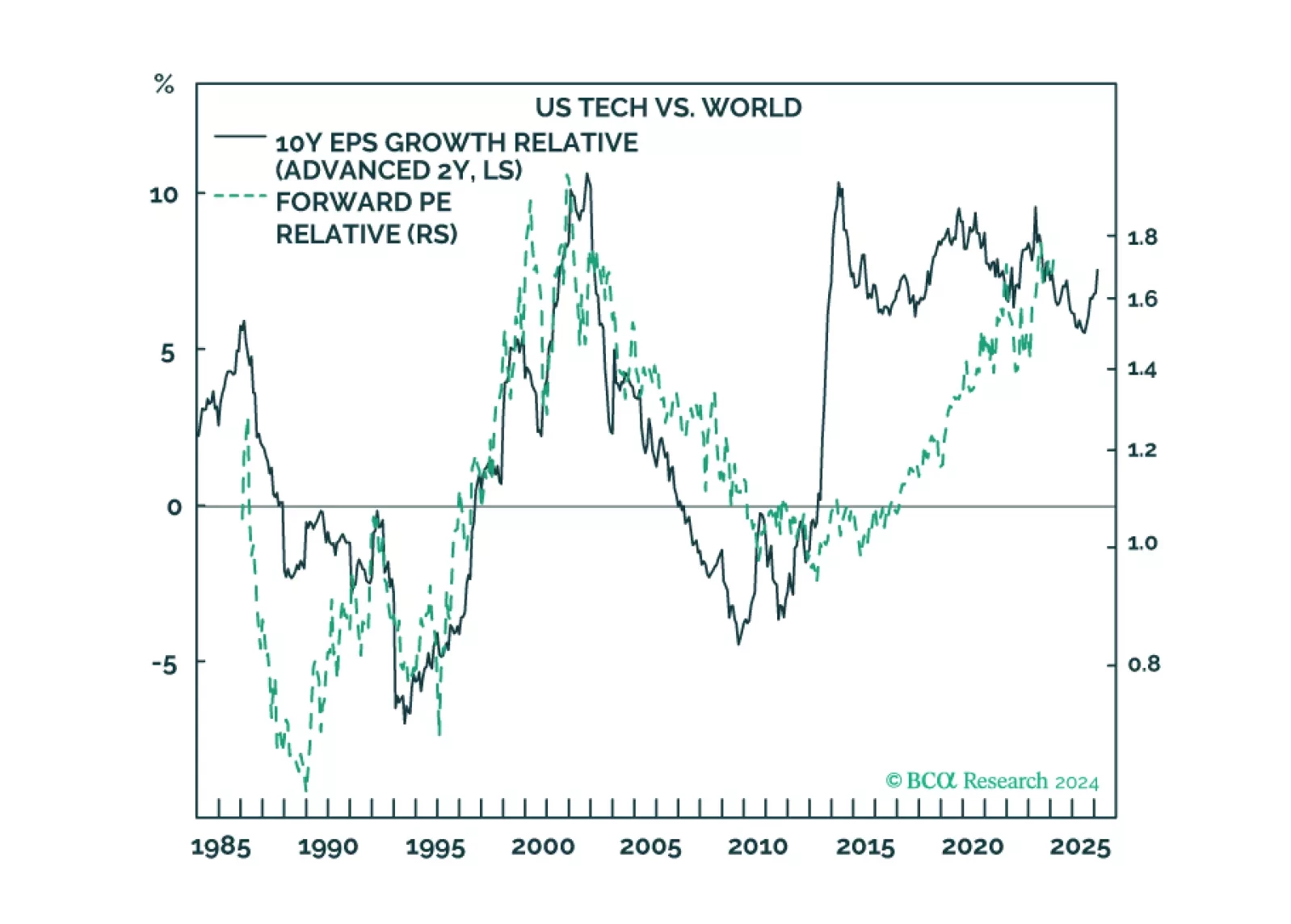

Our Valentine’s Day report is about two love stories: the infatuation with US tech and China’s infatuation with housing. We describe how these love stories will end, and why Europe could be the winner.

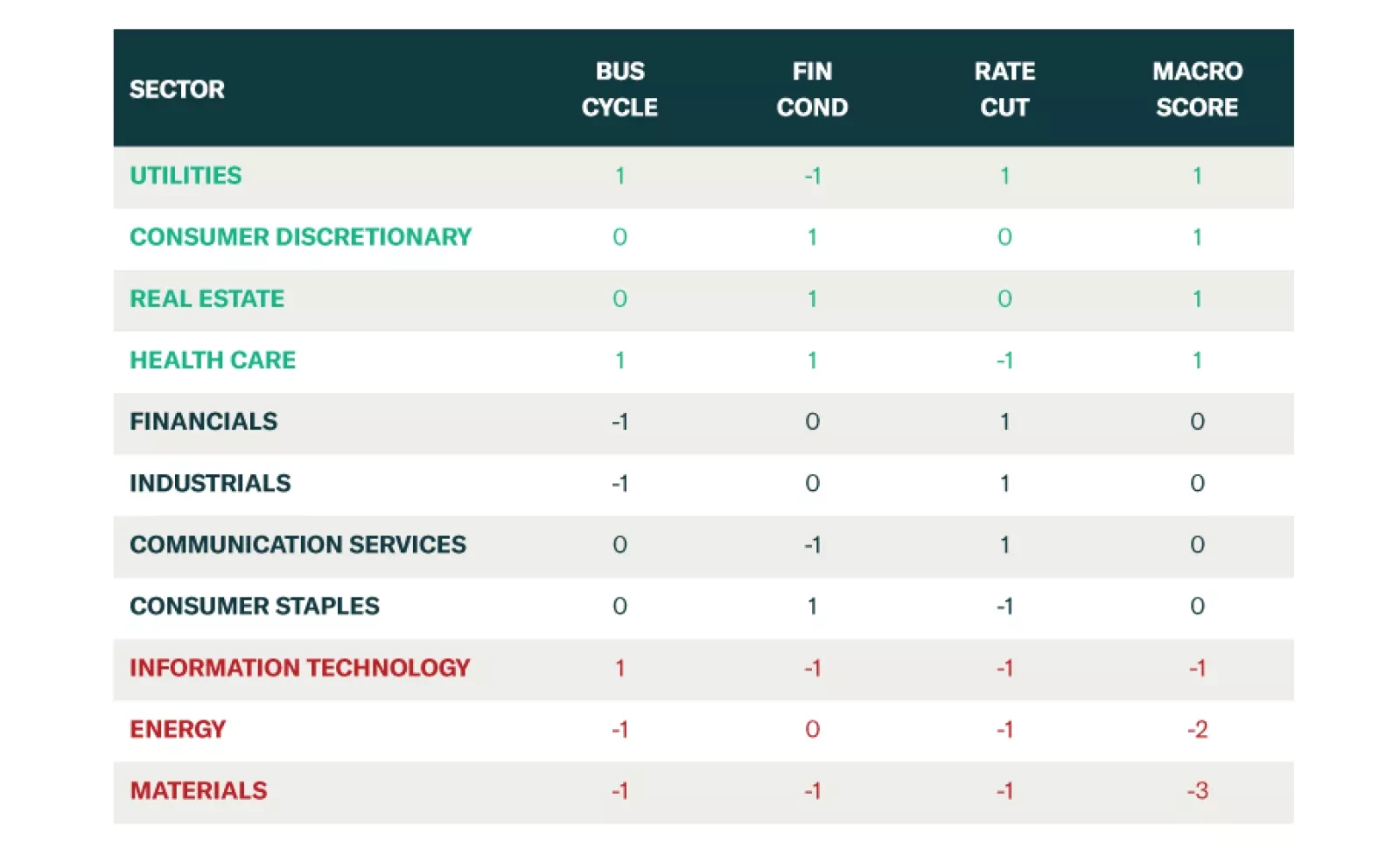

BCA Research’s US Equity Strategy service created a sector selection scorecard based on performance of sectors under various macroeconomic regimes. The current macroeconomic backdrop is characterized by the following…

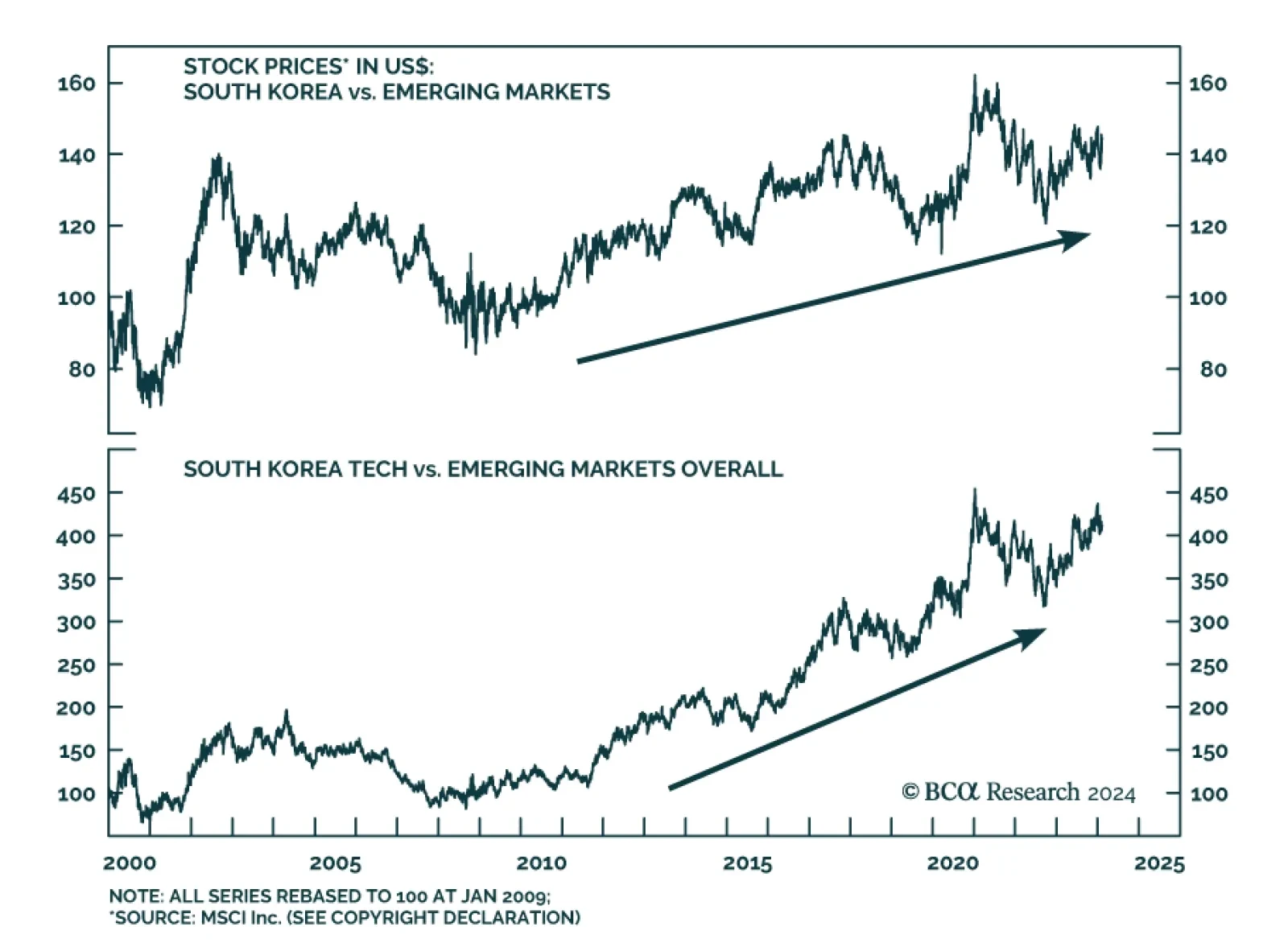

According to BCA Research’s Emerging Markets Strategy service, barring a pullback in global share prices, Korean tech stock prices will likely have more upside this year. The memory chip market will improve in 2024,…

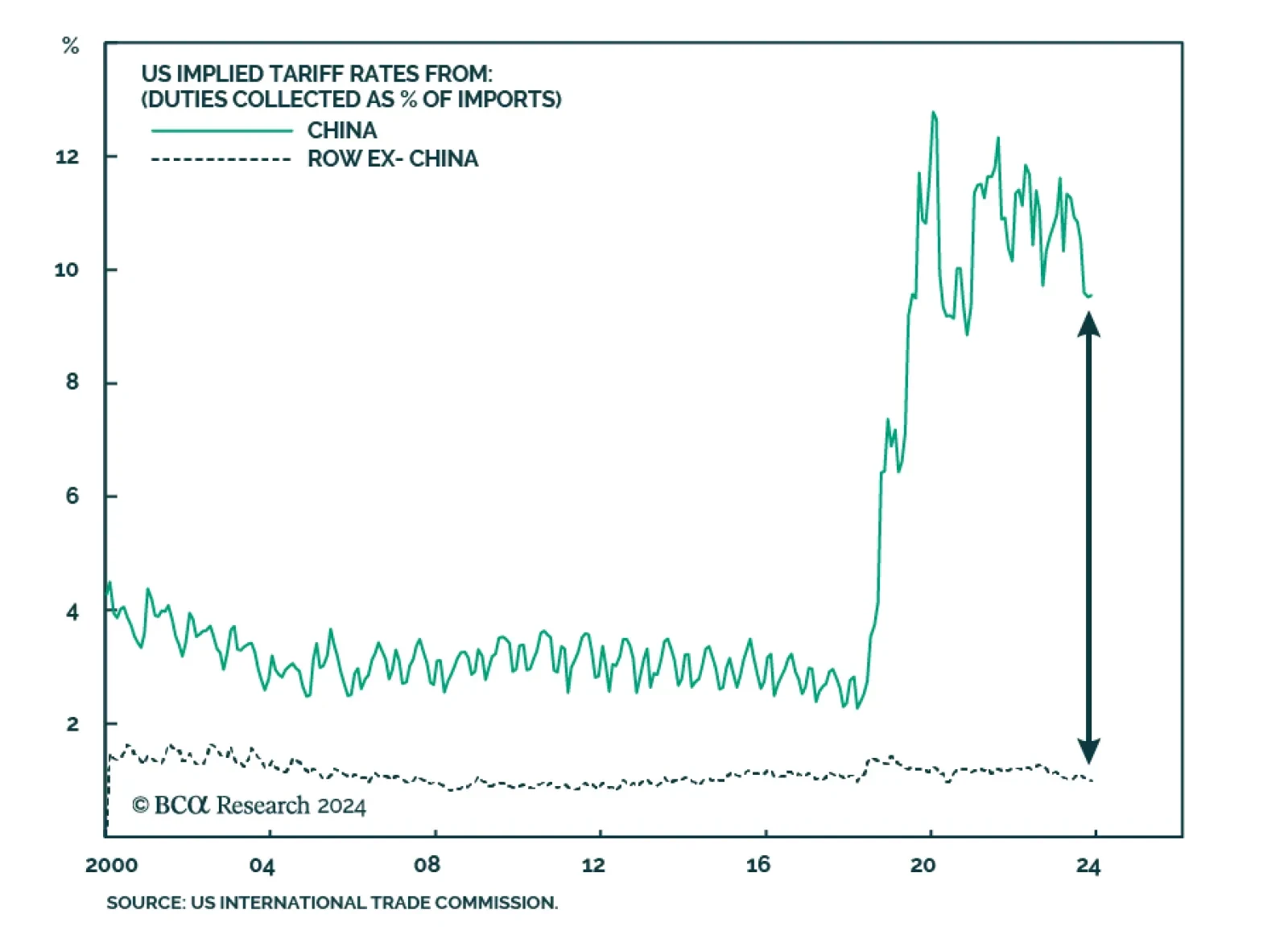

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…

Results of the US Conference Board’s latest quarterly survey show an improvement in sentiment among business leaders. The CEO Confidence measure rose above 50 for the first time in two years – indicating that…

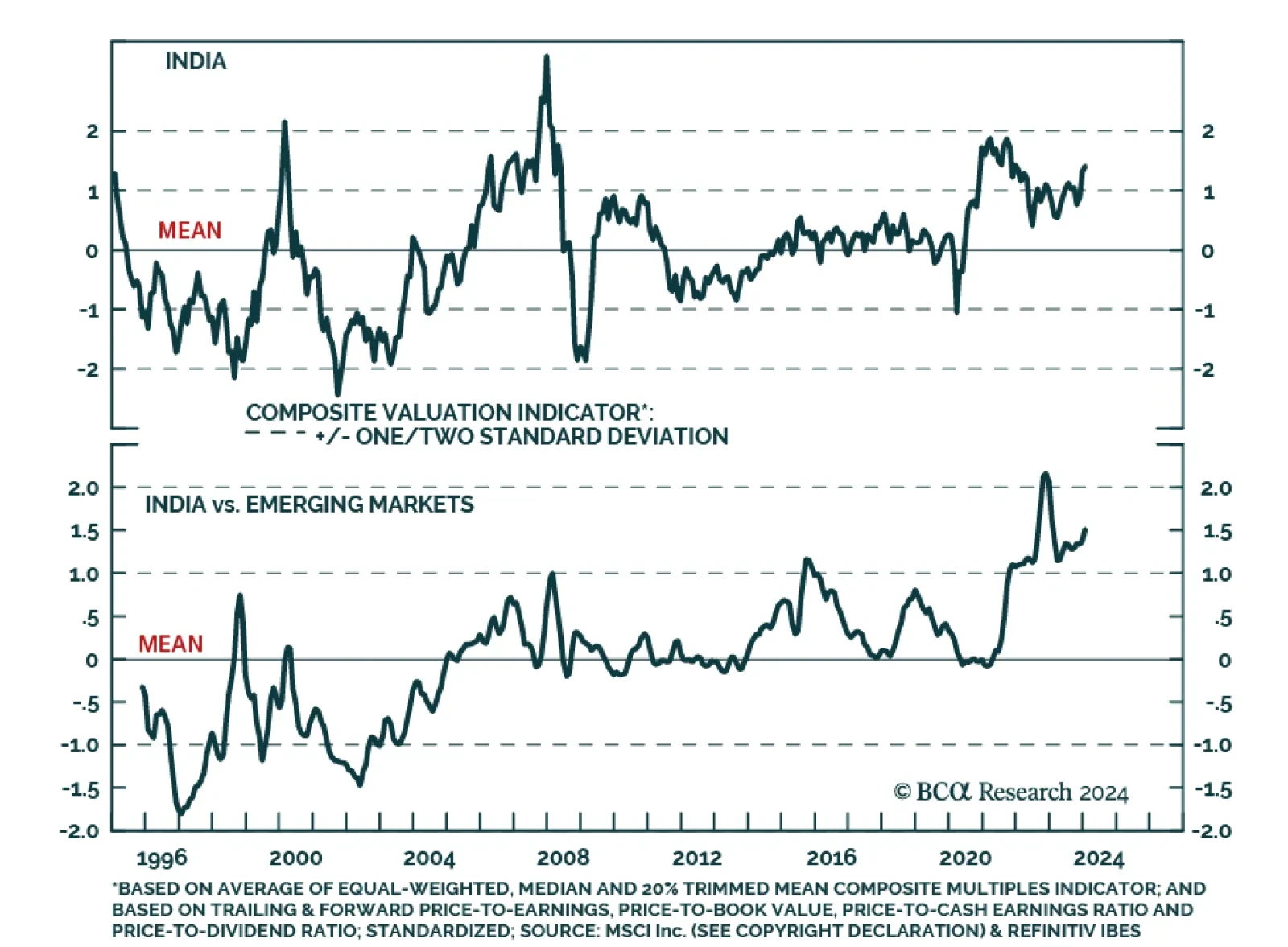

Indian economic data releases delivered a positive signal on Monday. CPI inflation slowed from 5.7% y/y to 5.1% y/y in January – within the Reserve Bank of India’s (RBI) 2-6% target range. Meanwhile, industrial…