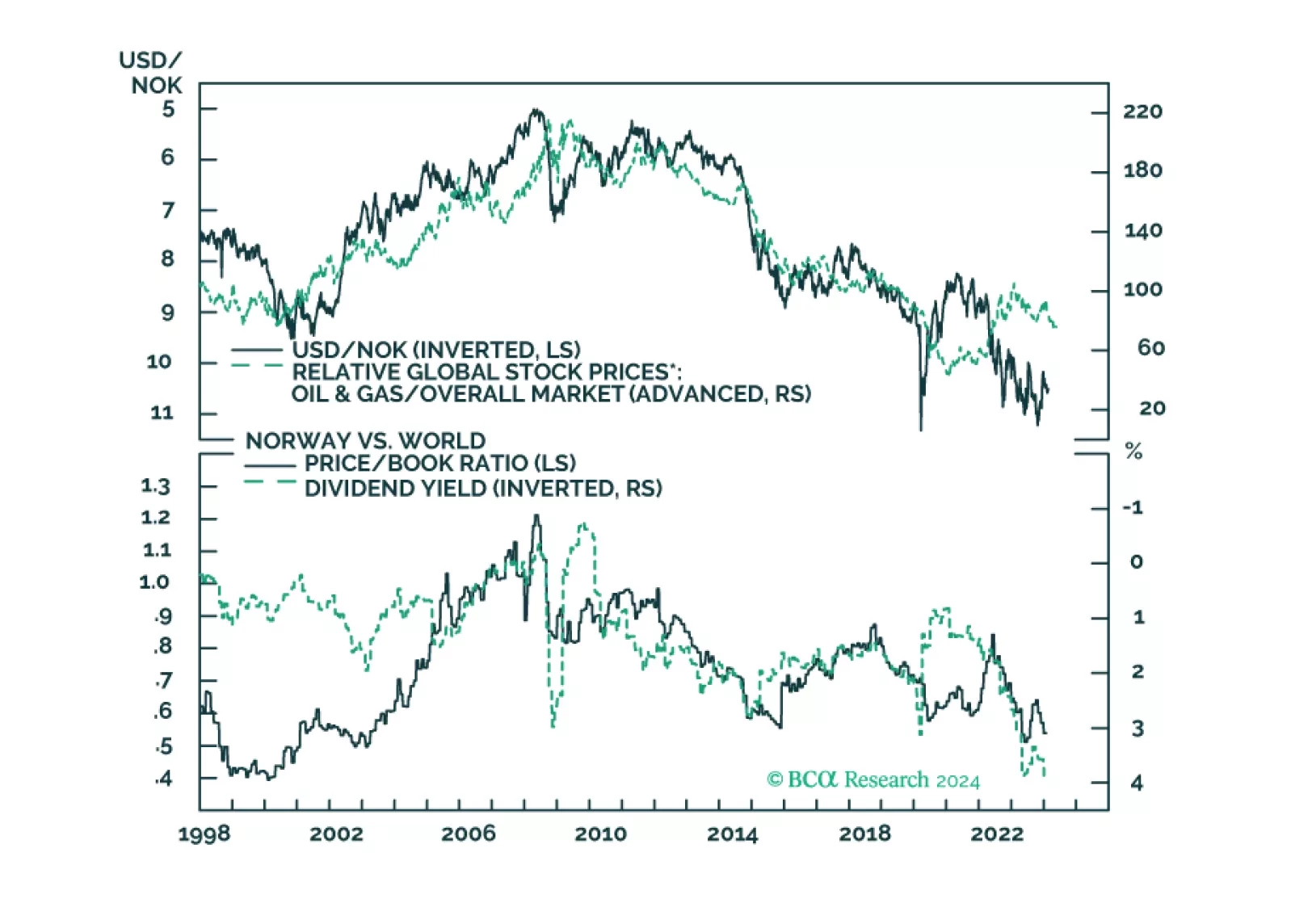

In this insight, we provide an update on the Norwegian krone, with attractive trade ideas over a long-term horizon. Shorter-term, our neutral-to-positive view on the dollar keeps us on the sidelines for USD/NOK.

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…

BCA Research’s Global Investment Strategy service’s US equity model, Stock Coach, has become more bullish on the near-term prospects for the S&P 500. The model’s short-term (1-to-3 month) equity score…

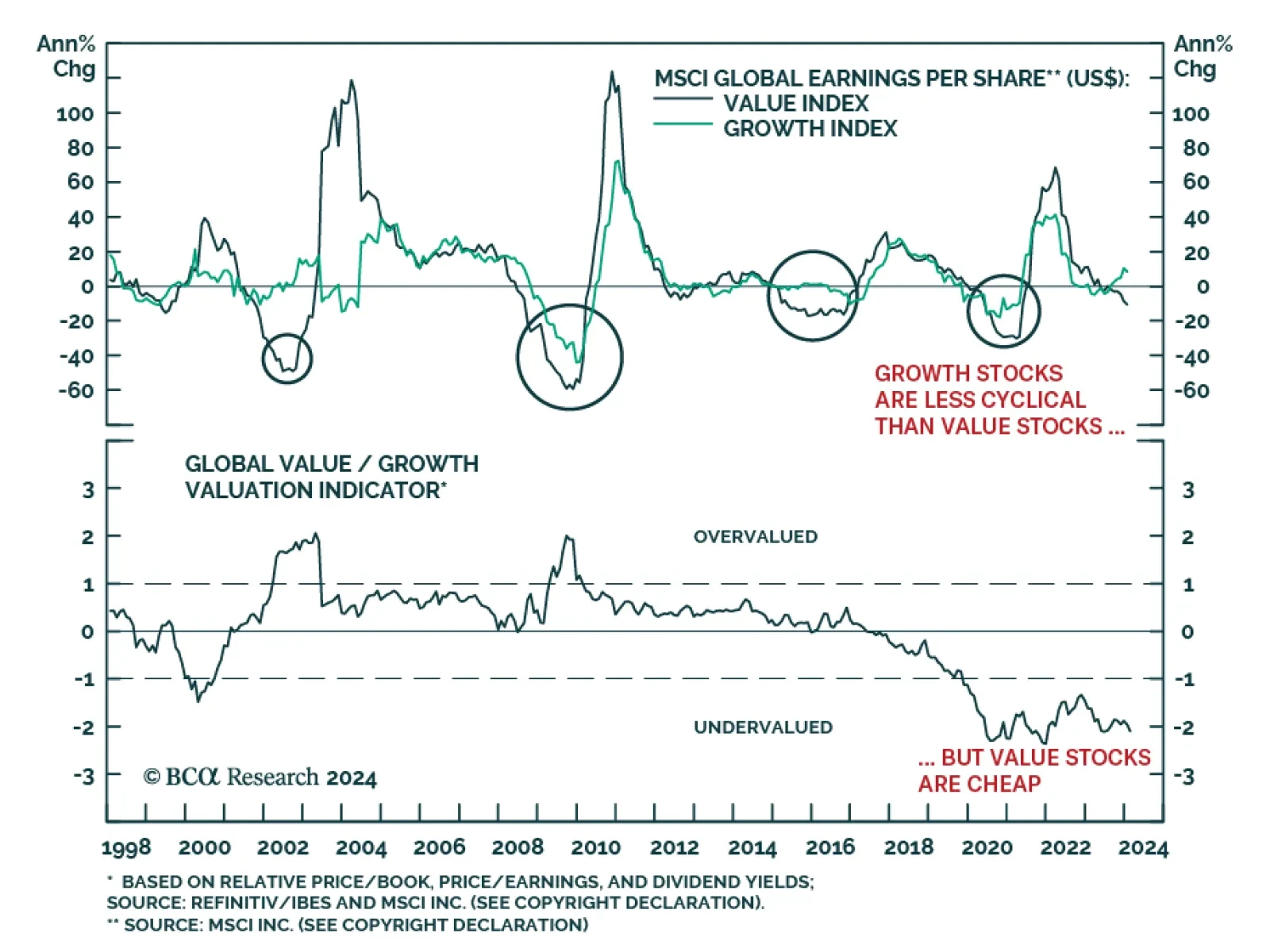

The MSCI ACW Growth index continues to strengthen vis-à-vis the Value index, outperforming the latter by 4.7 percentage points year-to-date, following 23.3 percentage points in 2023. Given that the IT, Consumer…

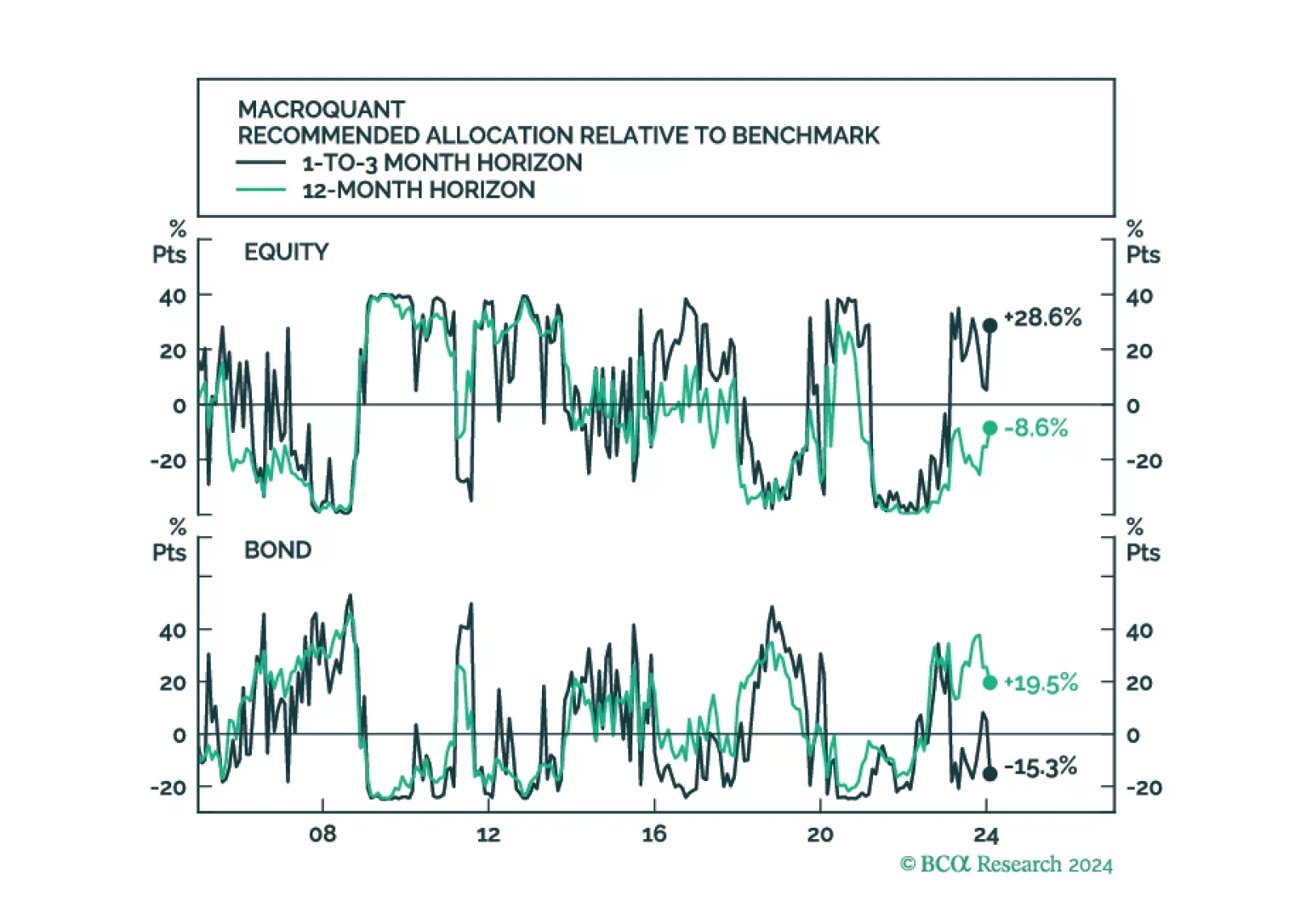

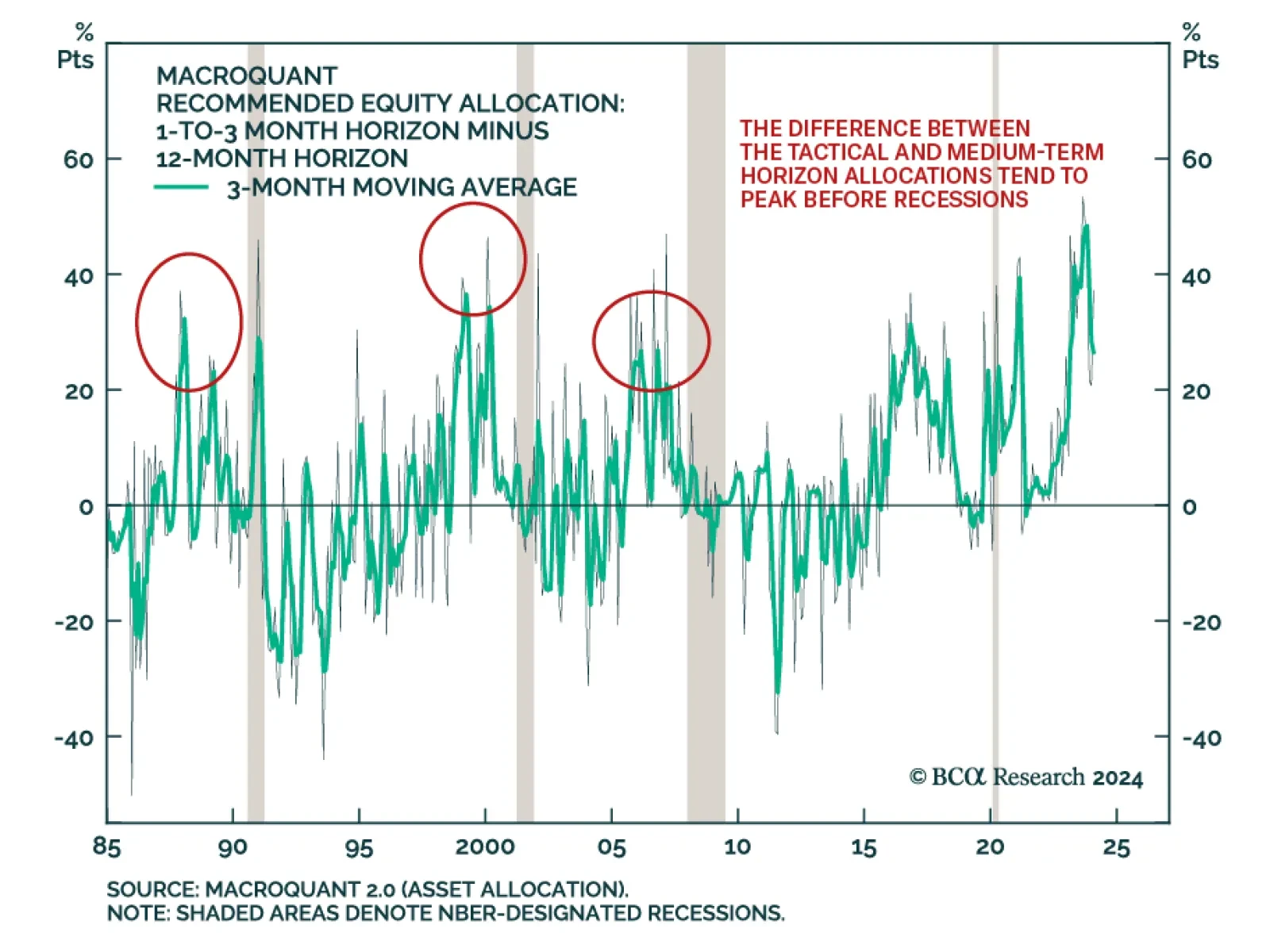

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…

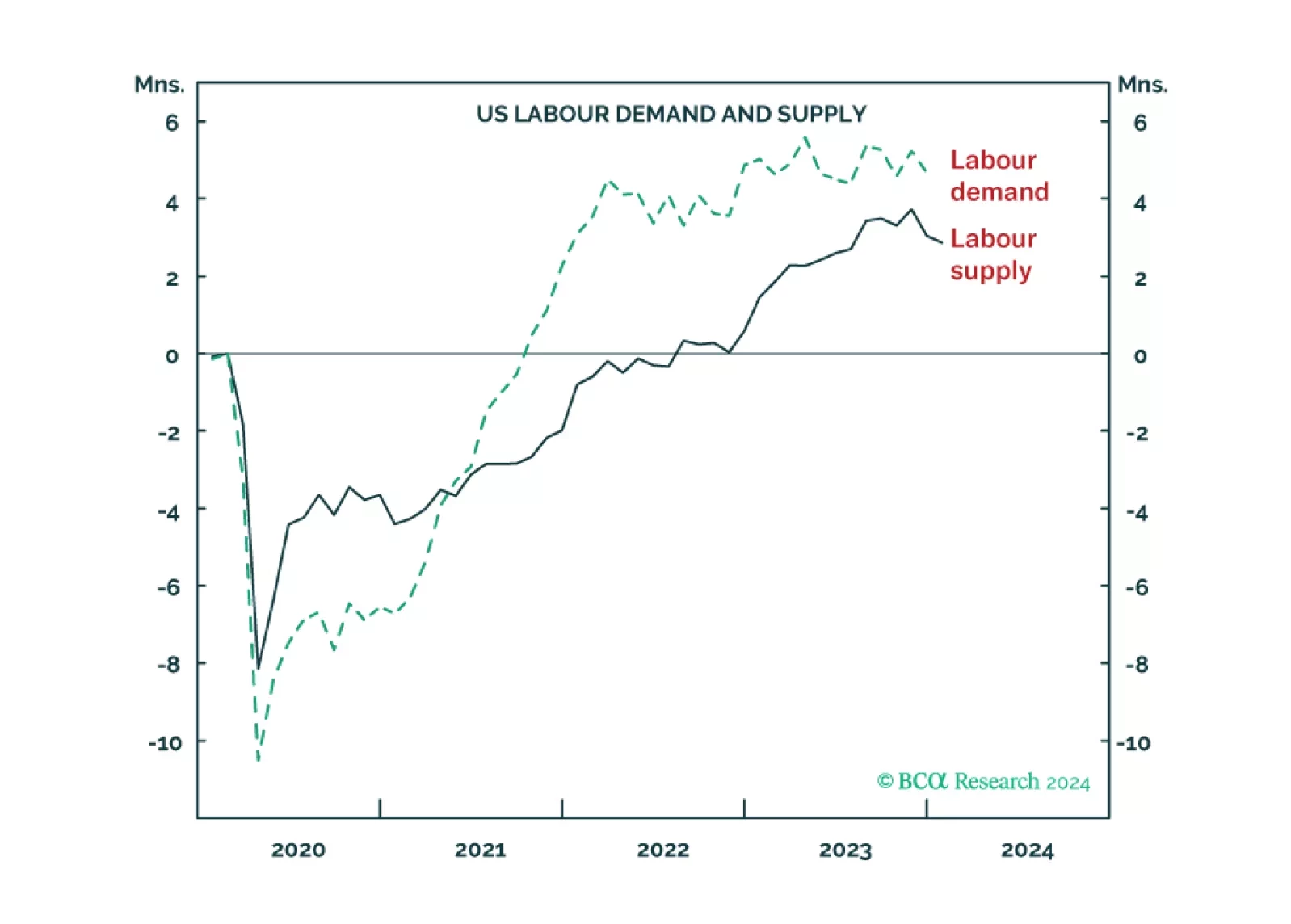

The US ‘immaculate disinflation’ has run its course, given that labour force participation is topping out. This leaves the Fed with a dilemma. Settle for price inflation stabilising at 3 percent, and cut rates early to avoid higher…

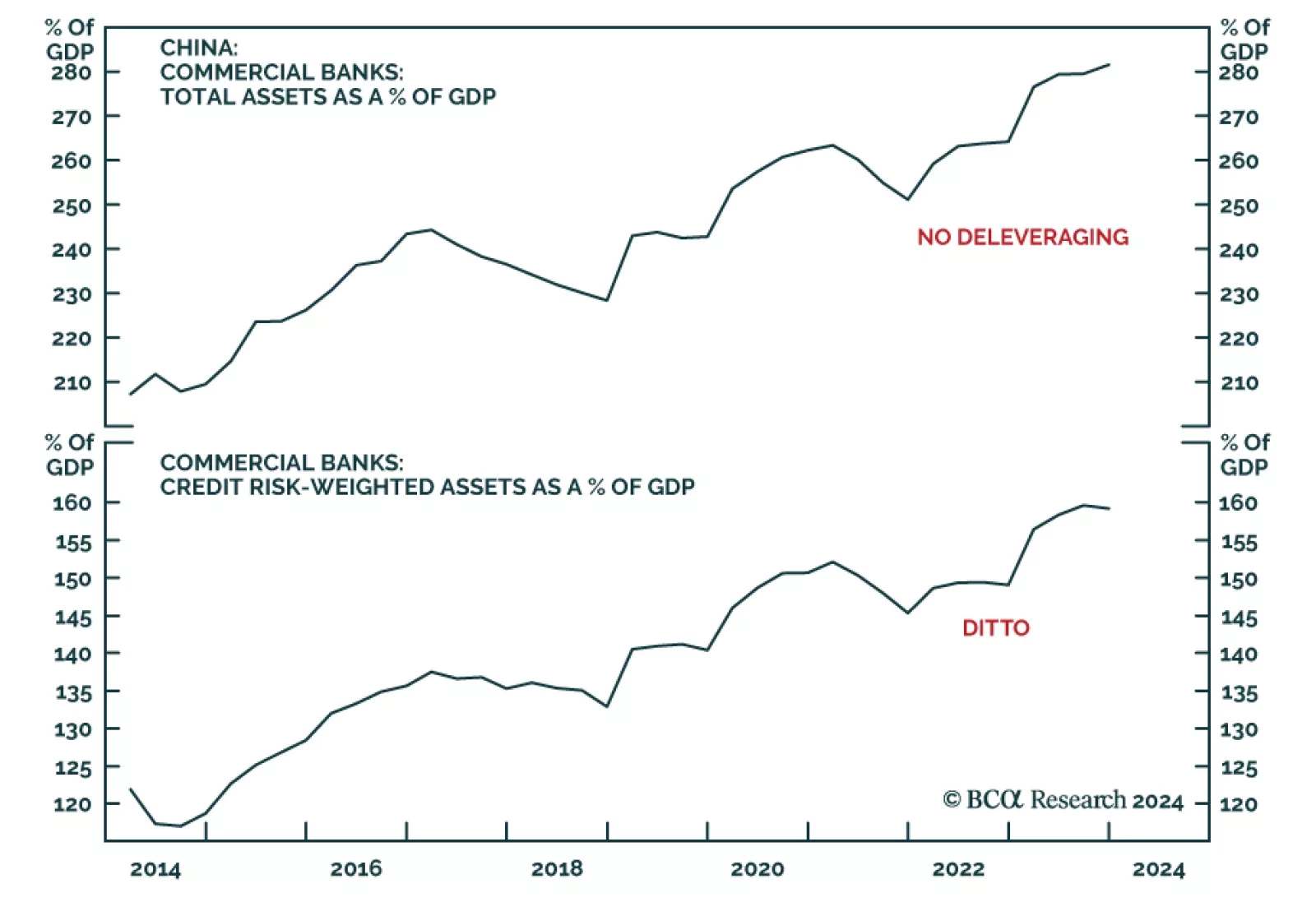

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…

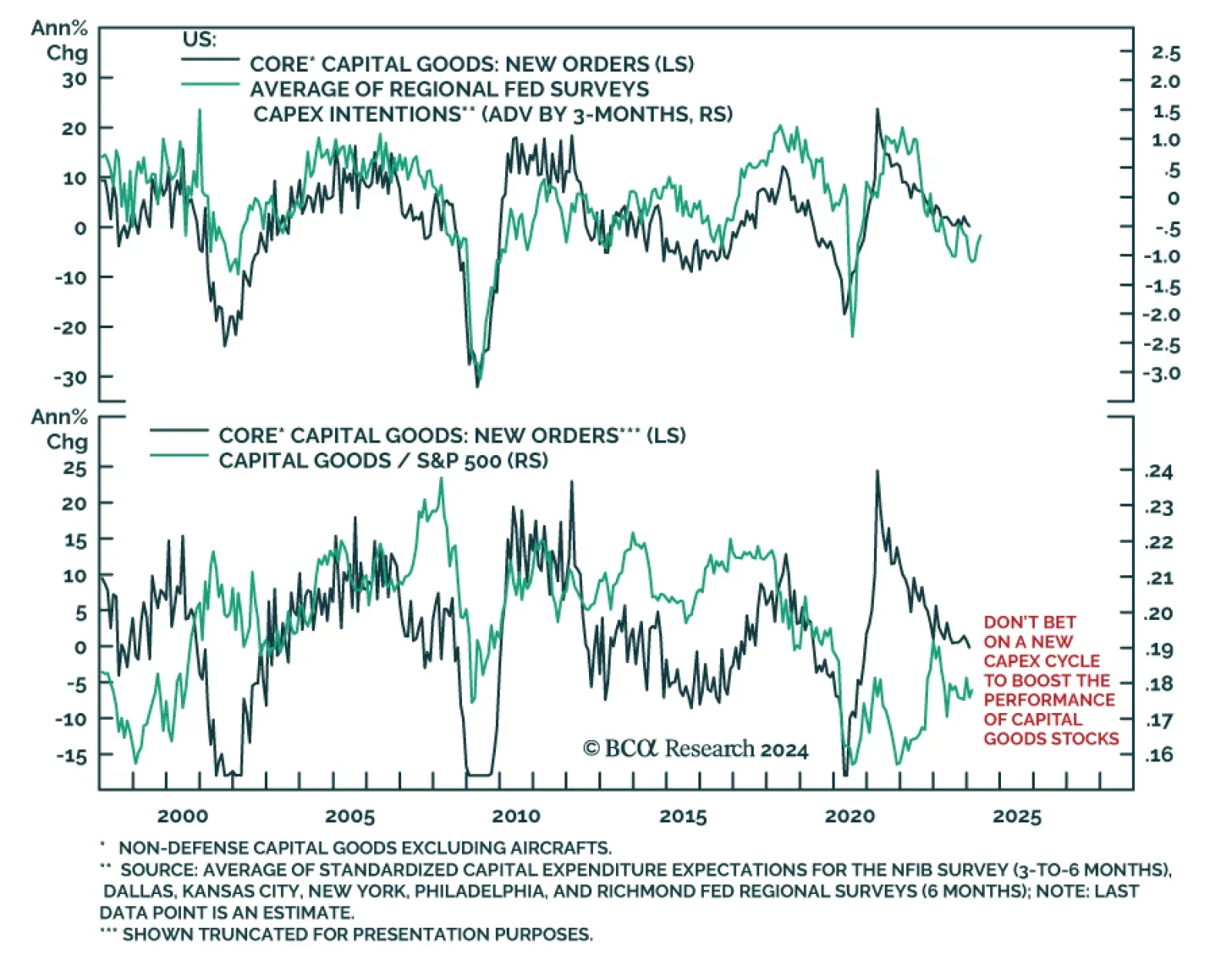

On the surface, the US durable goods report delivered a negative surprise on Tuesday. The 6.1% m/m drop in new orders in January fell below expectations and the December figure was revised down to 0.3% m/m from 0.0% m/m.…

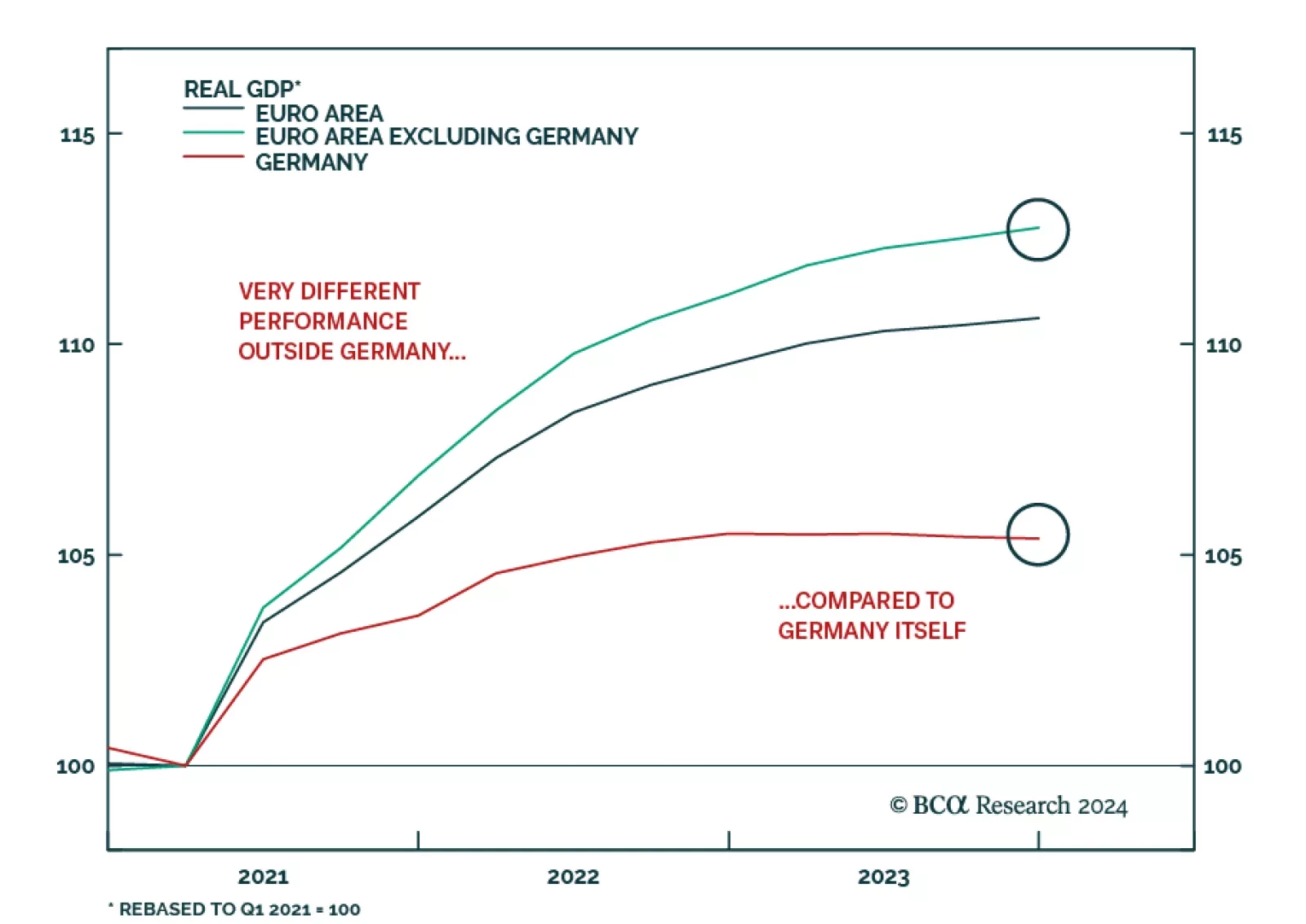

According to BCA Research’s European Investment Strategy service, Germany will likely drag the overall Euro Area into contraction, even if, individually, other countries manage to avoid a recession. This slightly better…