There is a general consensus among BCA Research strategists that a US recession is highly likely over the next two years. While last month our Global Investment strategists reduced the probability that a recession will…

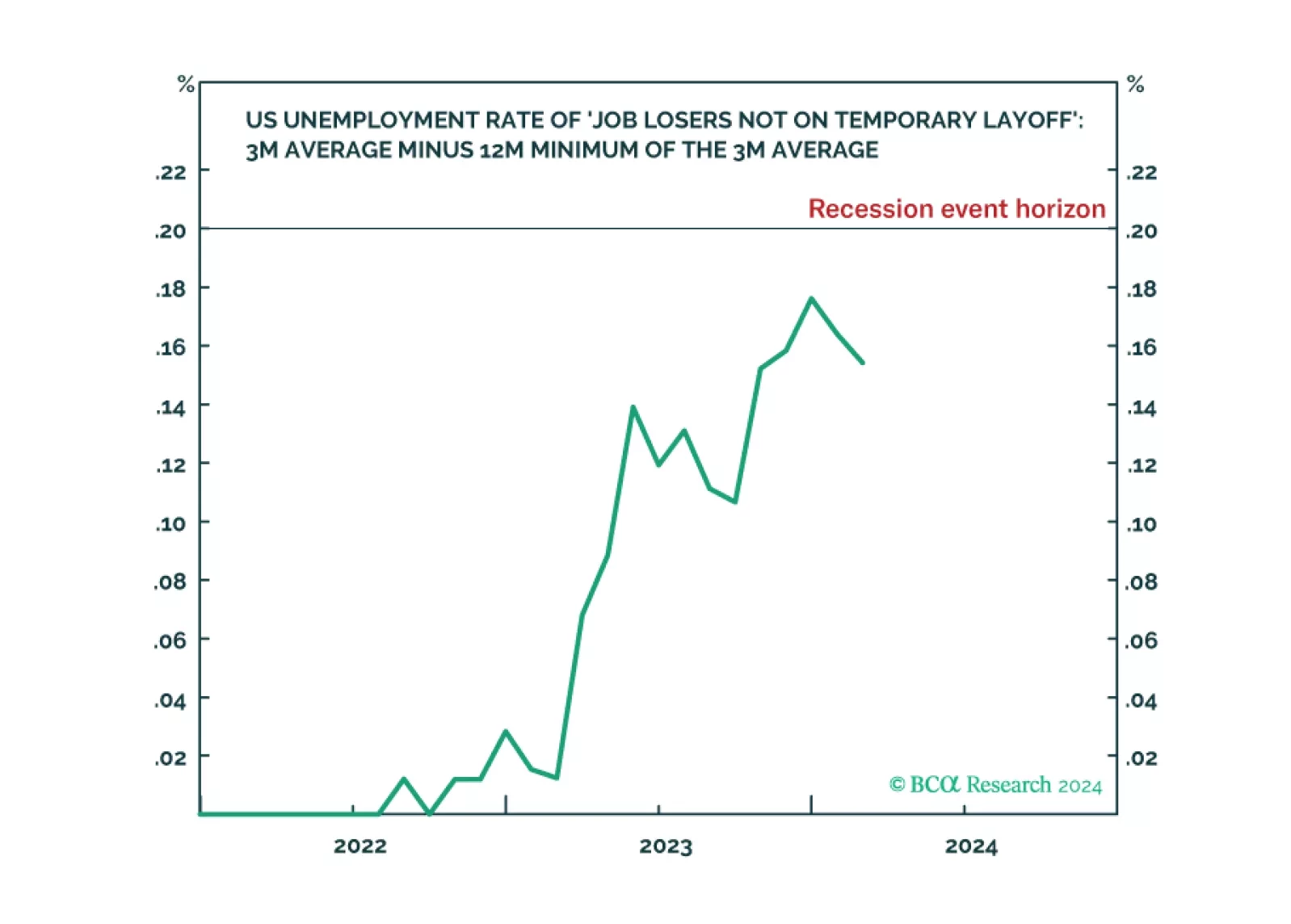

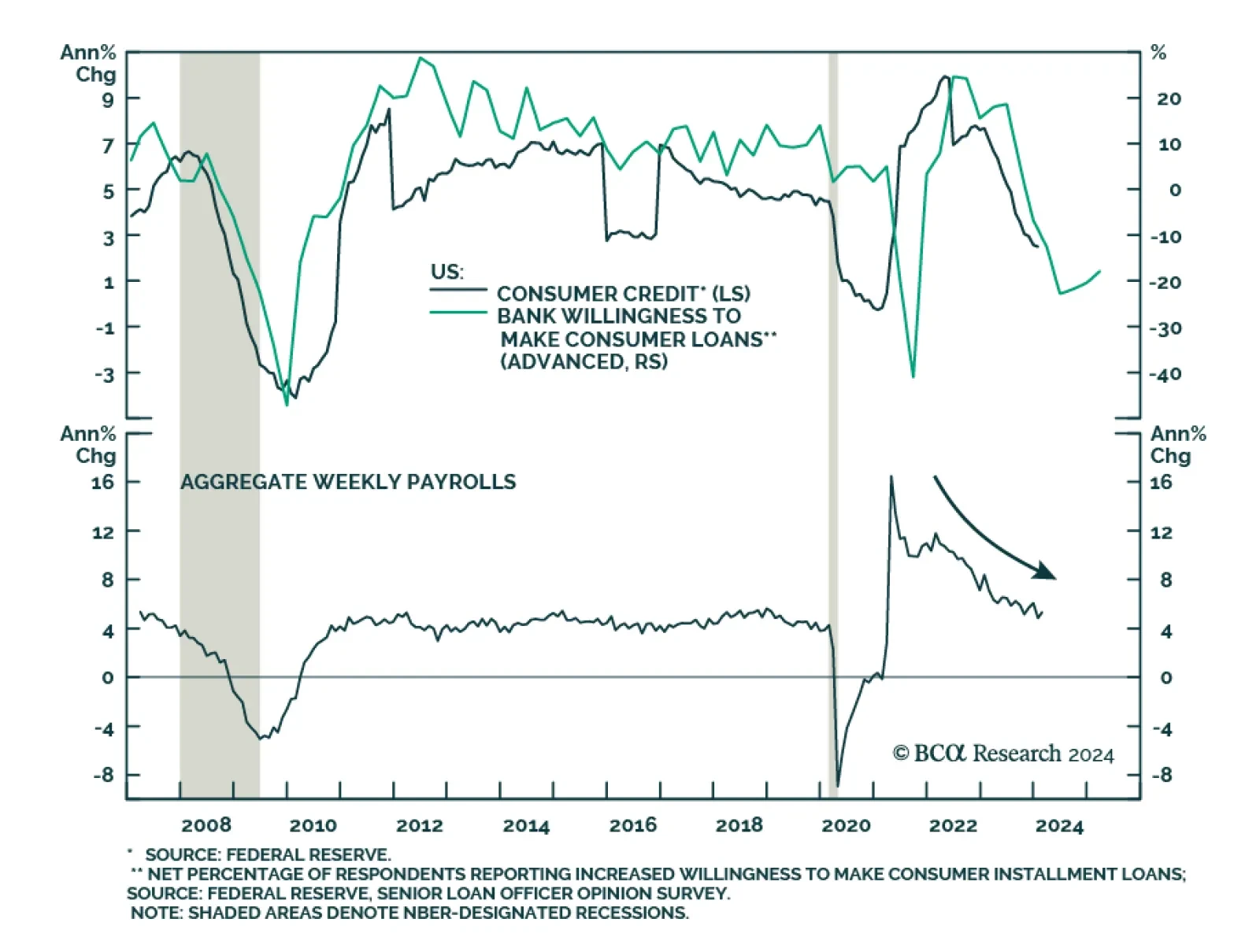

The Joshi rule real-time US recession indicator remains at an elevated 0.154 versus its recession event horizon of 0.200, indicating weakening US labour demand. With the last mile of US disinflation requiring labour demand to ‘catch…

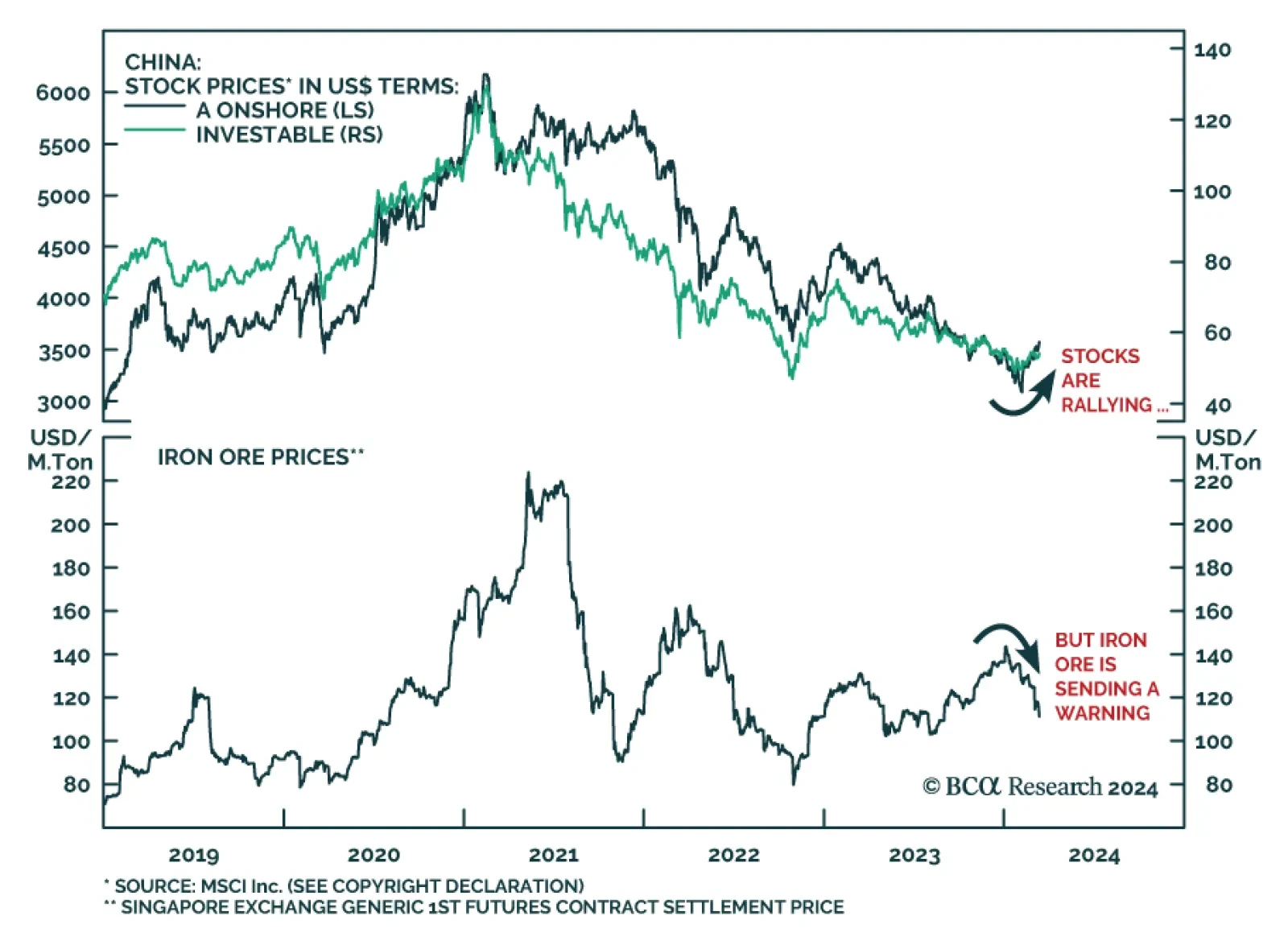

Chinese stocks are experiencing their longest rally since the country’s exit from Covid restrictions over a year ago. The MSCI Onshore and Investable indices (in USD terms) have gained 15.8% and 9.1% respectively since…

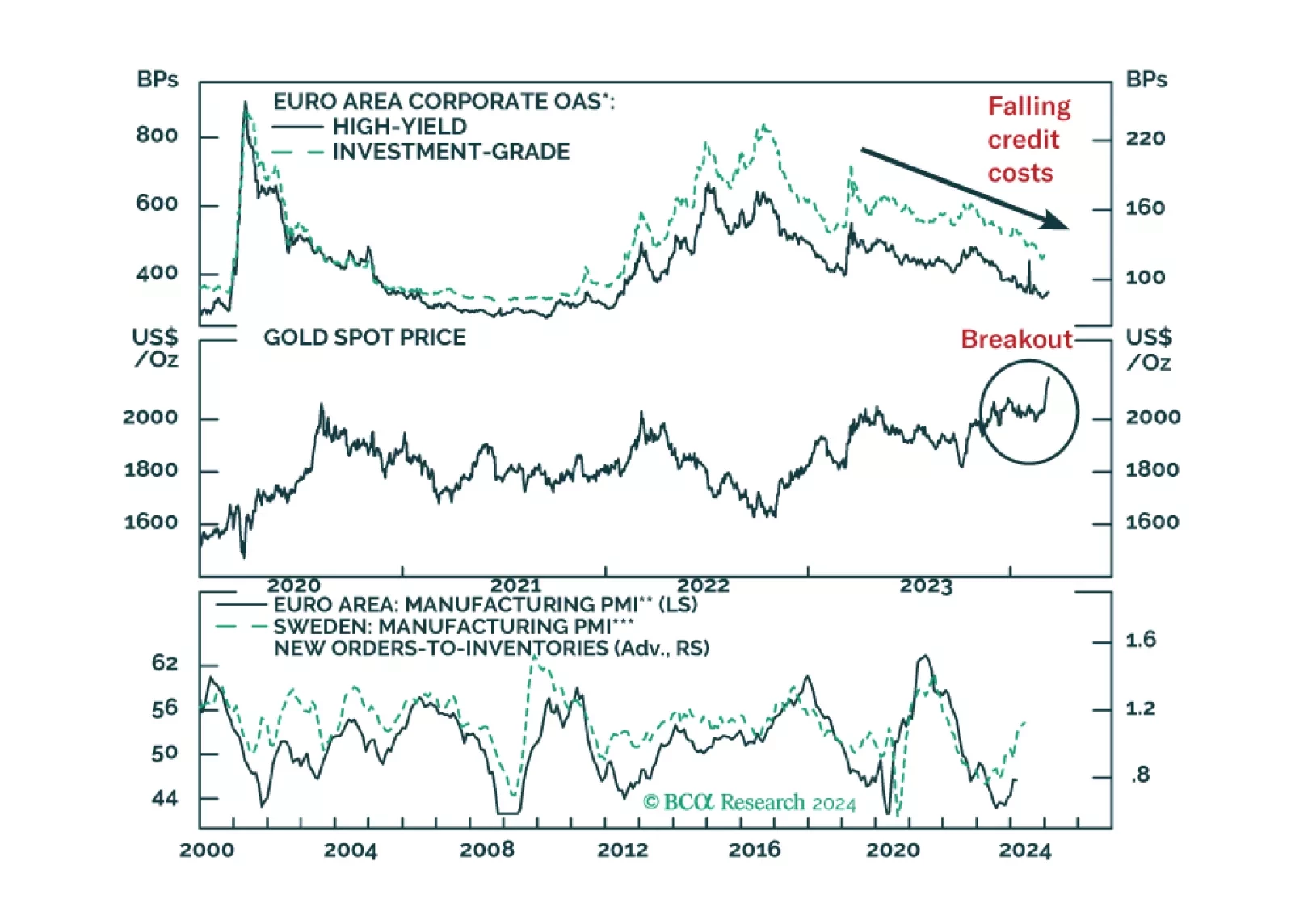

We are pushing back the anticipated start date for a Eurozone recession and assessing how it affects our equity stance.

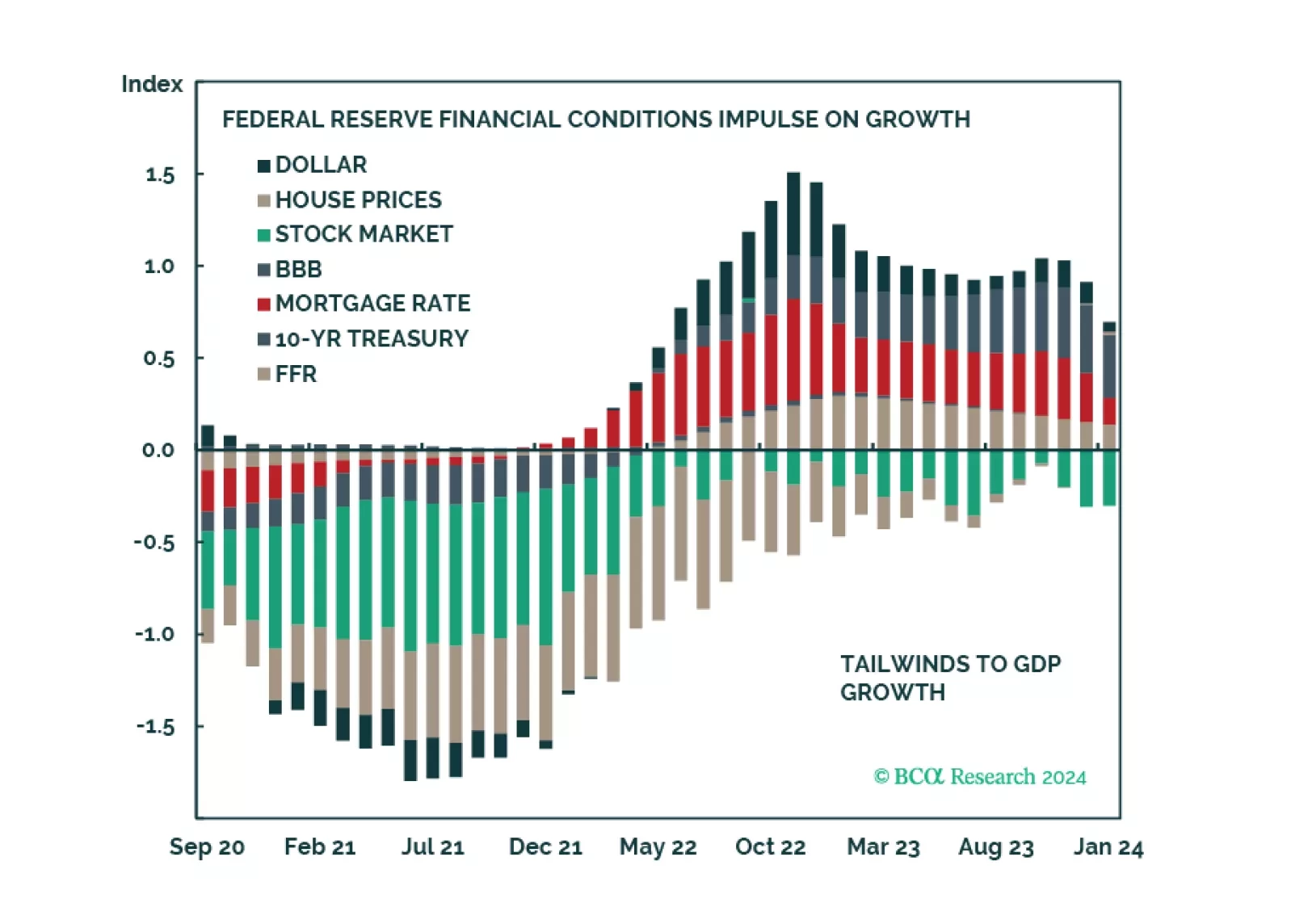

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

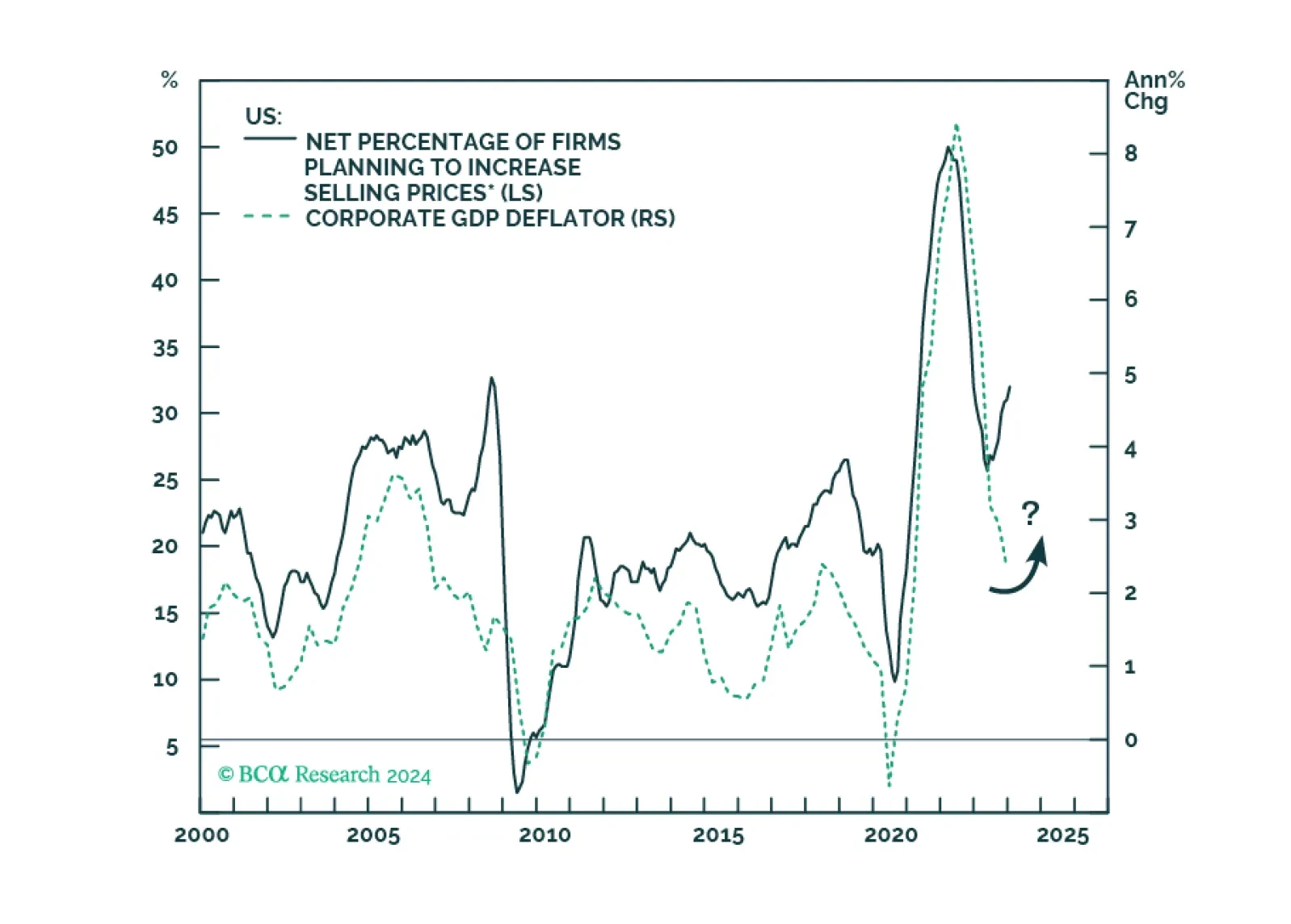

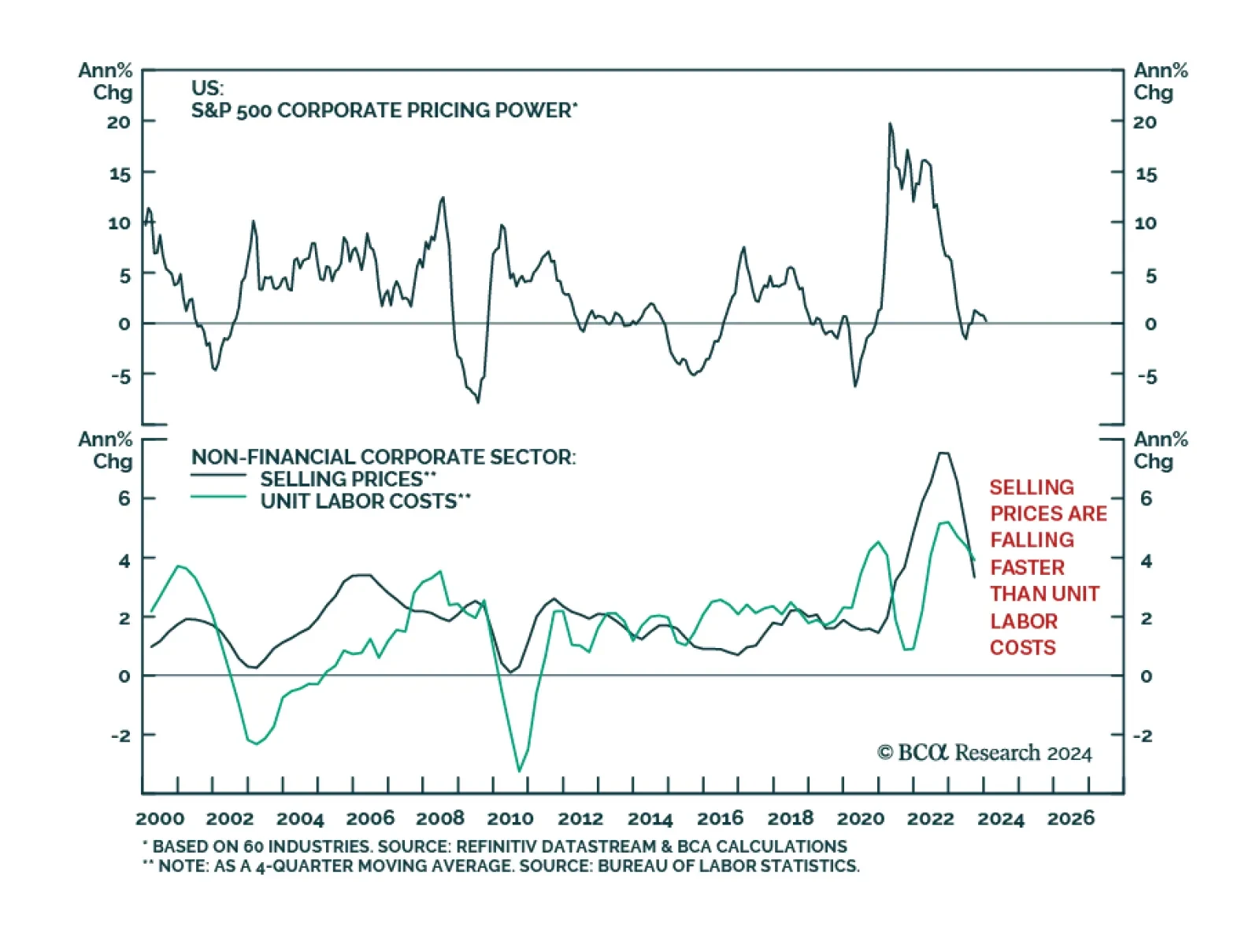

According to Factset, analysts are forecasting S&P 500 earnings and revenues to grow by 11.0% y/y and 5.0% y/y respectively in 2024 (an acceleration from 0.9% and 2.8% in 2023). Information technology and communications…

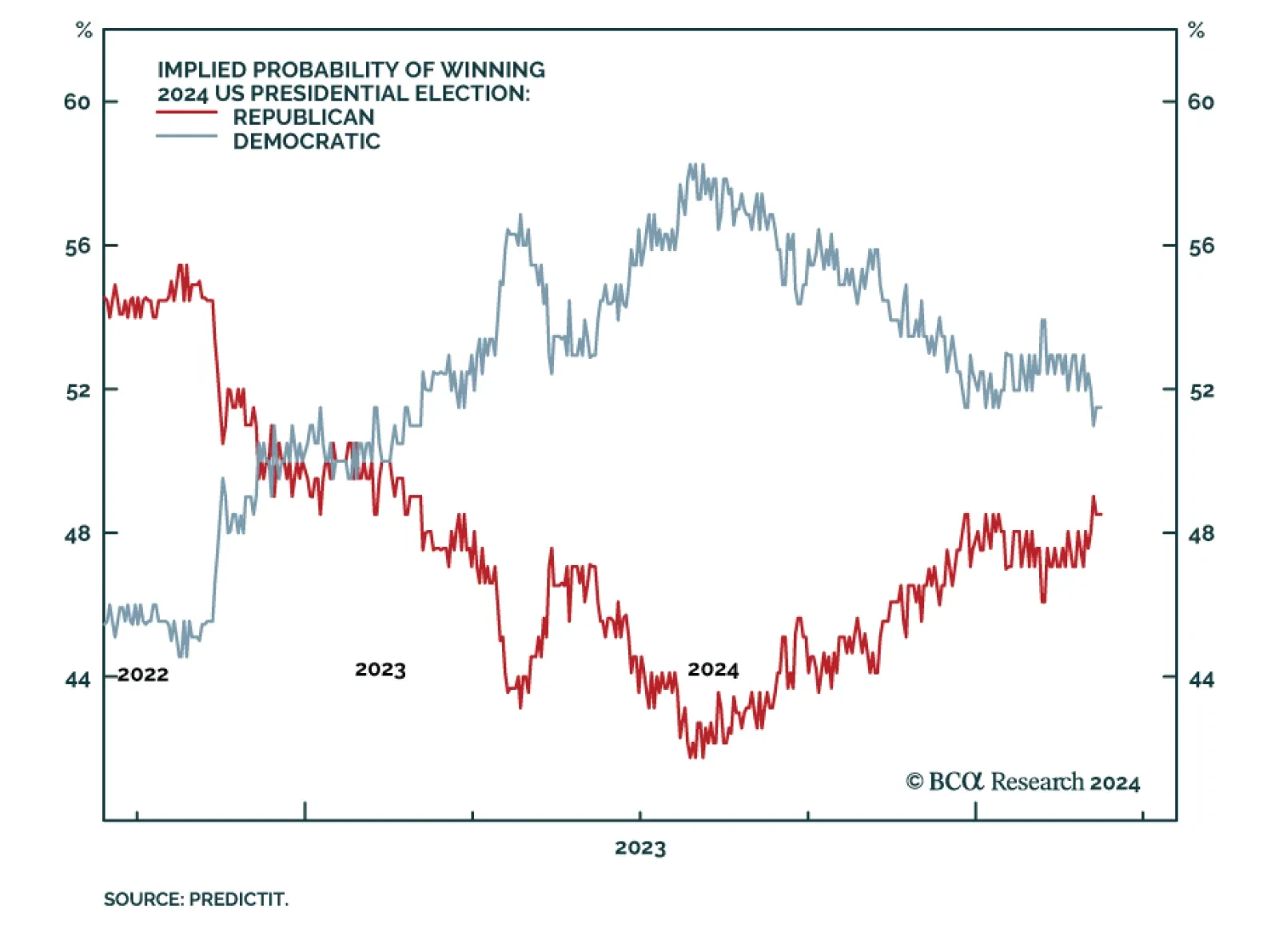

According to BCA Research’s US Political Strategy service, the Democrats are still favored for reelection due to the resilient economy, but President Biden’s victories on Super Tuesday had not positively affected his…

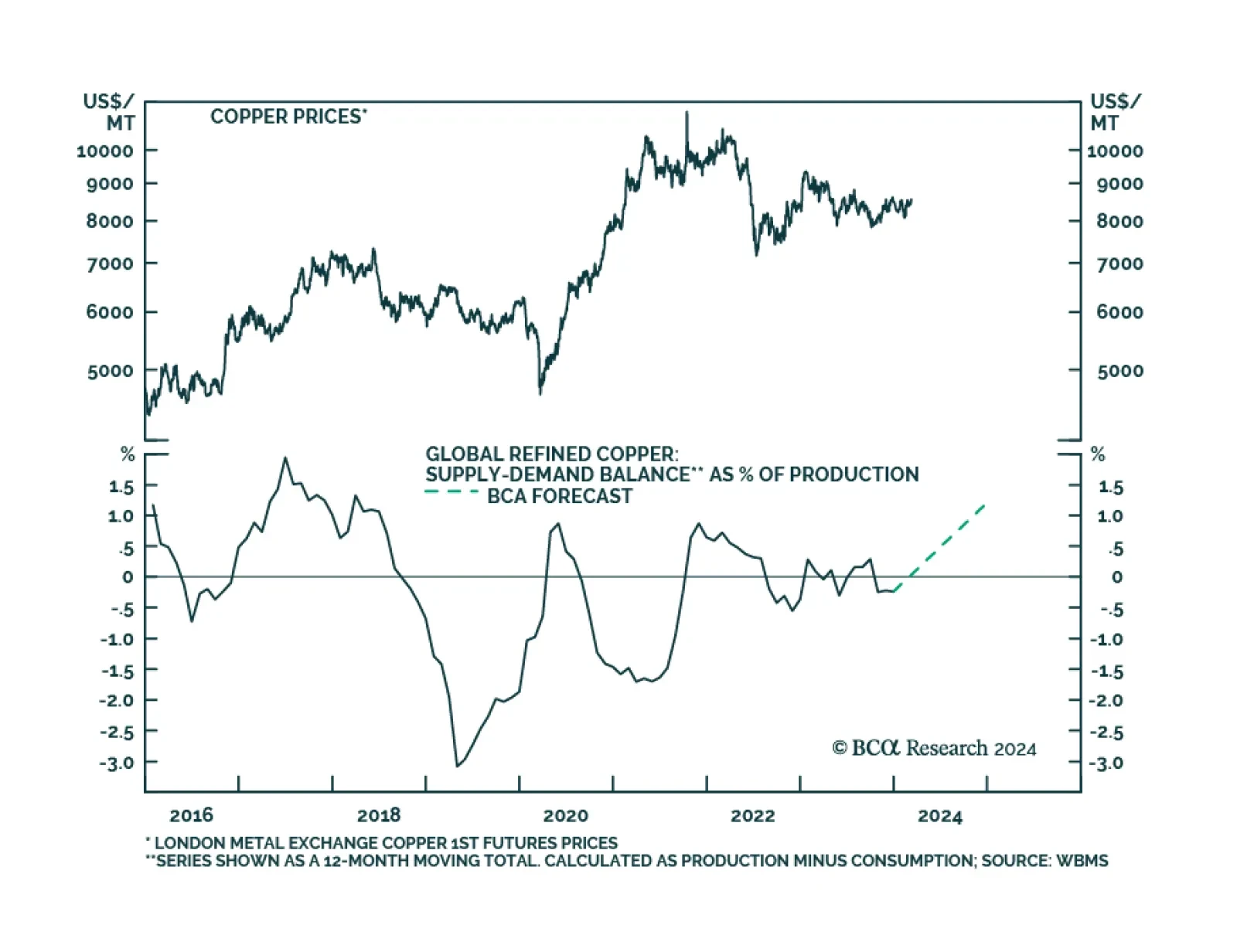

2023 was a year of mystery for the copper market. On the one hand, China’s copper intake boomed last year despite the travails of the mainland economy and shrinking property construction. On the other hand, global copper…

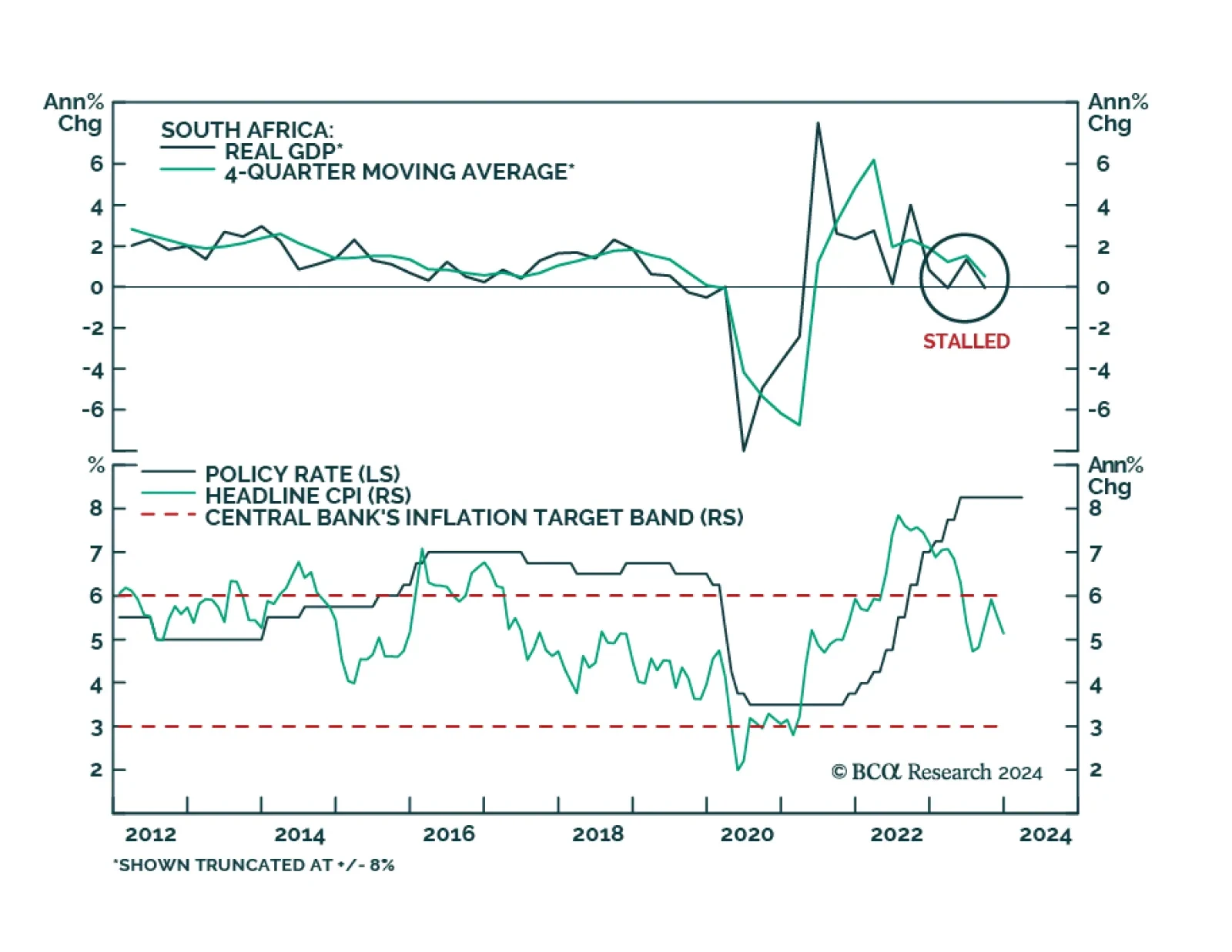

Our Emerging Markets Strategy team posits that the South African economy is heading into a recession later this year. The South African government refrained from announcing any stimulus measures in its recent budget proposals.…

Presently, our four high-conviction themes are: (1) the US dollar will rally as US growth continues to outpace the rest of the world; (2) US equities will continue to outperform EM and European stocks until a major sell-off occurs; (…