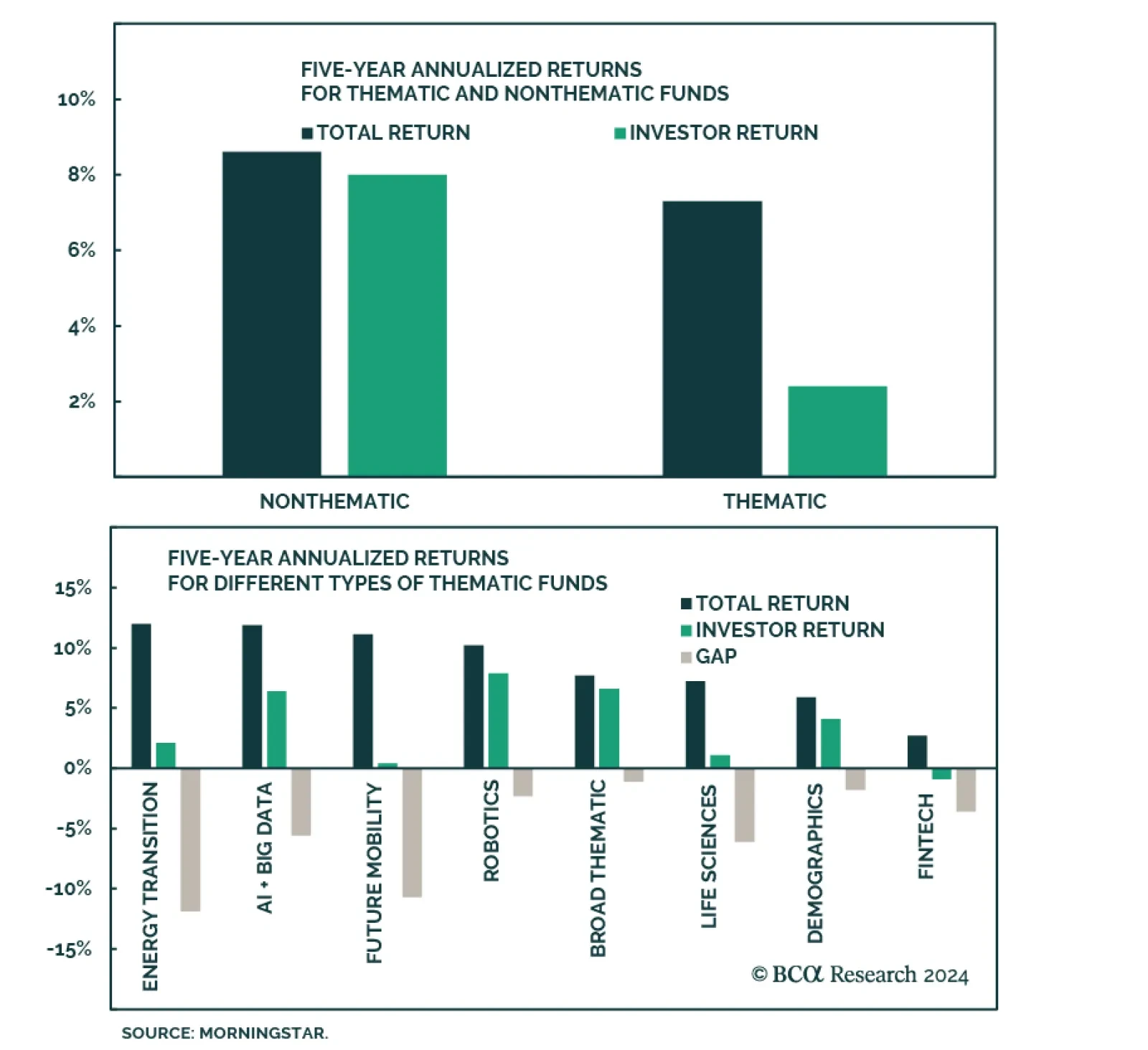

Thematic investing has become increasingly important for investors over the past few years. And yet, in spite of the popularity of thematic strategies, the vast majority of investors underperform when buying into such…

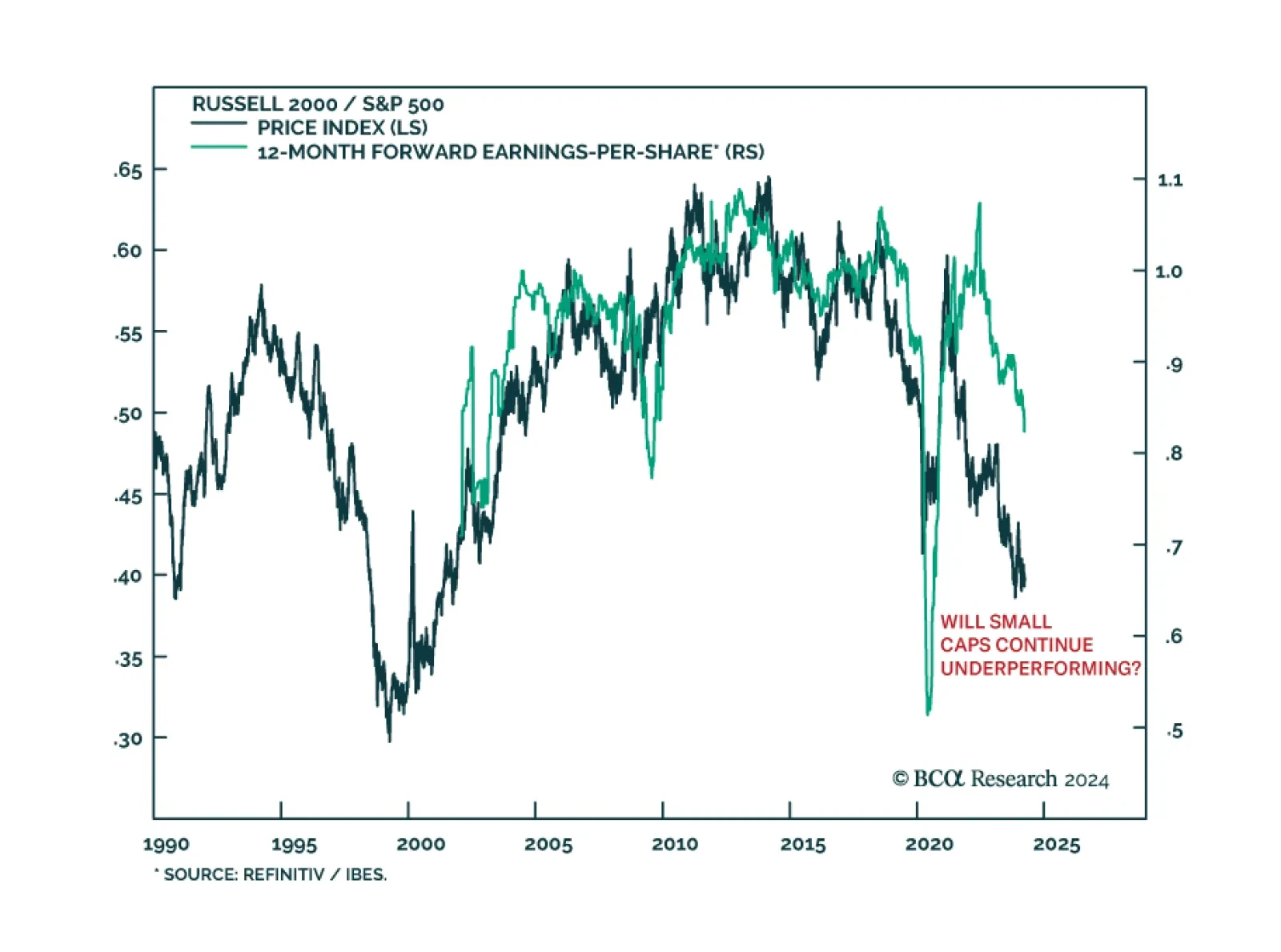

In an Insight we published yesterday, we highlighted that the S&P 500 rally has recently stopped narrowing with the gap between the market cap-weighted and equal-weighted indices stabilizing over the past month. This has also…

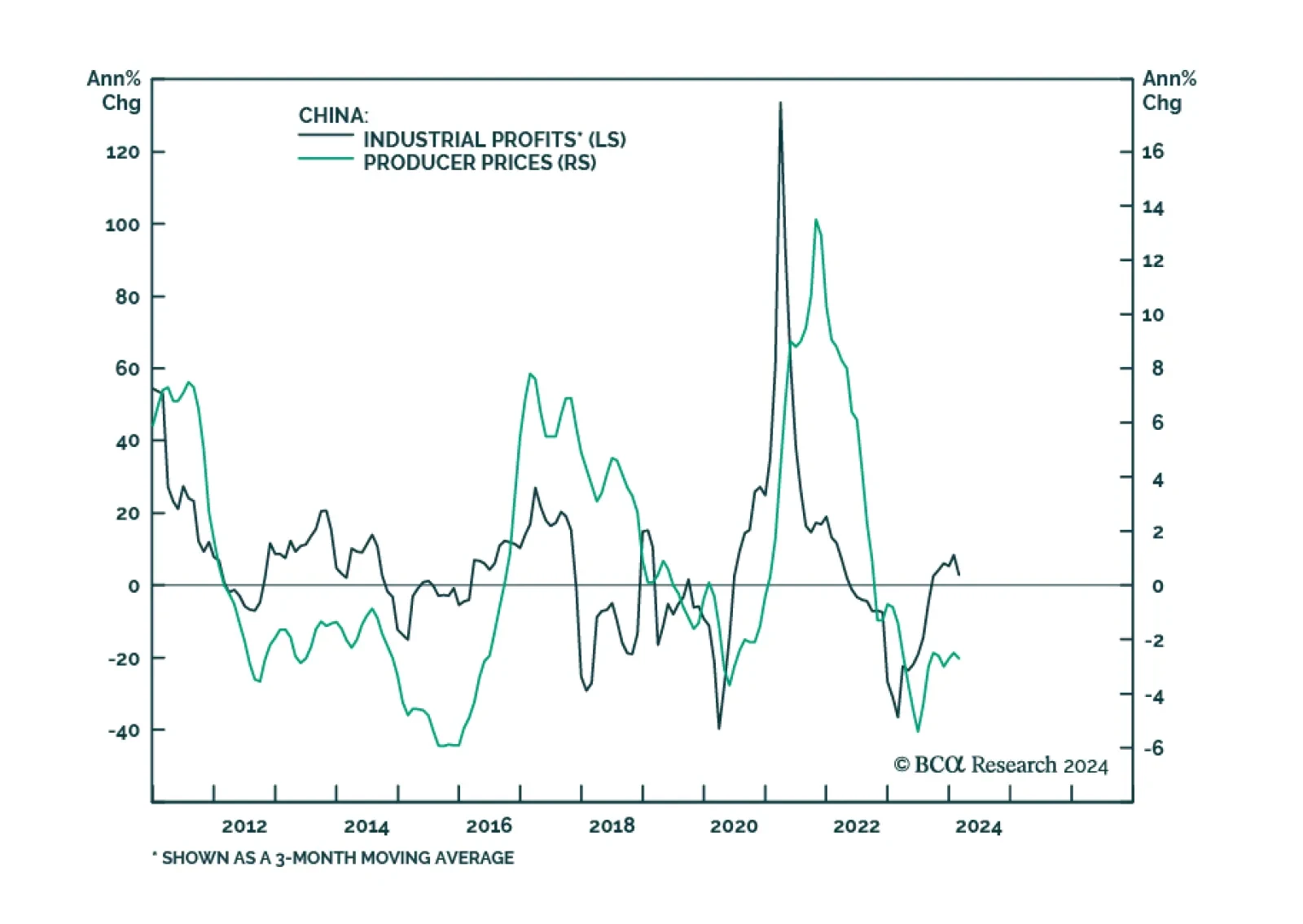

Chinese industrial profit growth surged to 10.2% y/y in the first two months of the year after having contracted by 2.3% in 2023. Does this rebound in profits suggest that investors should become more optimistic about the Chinese…

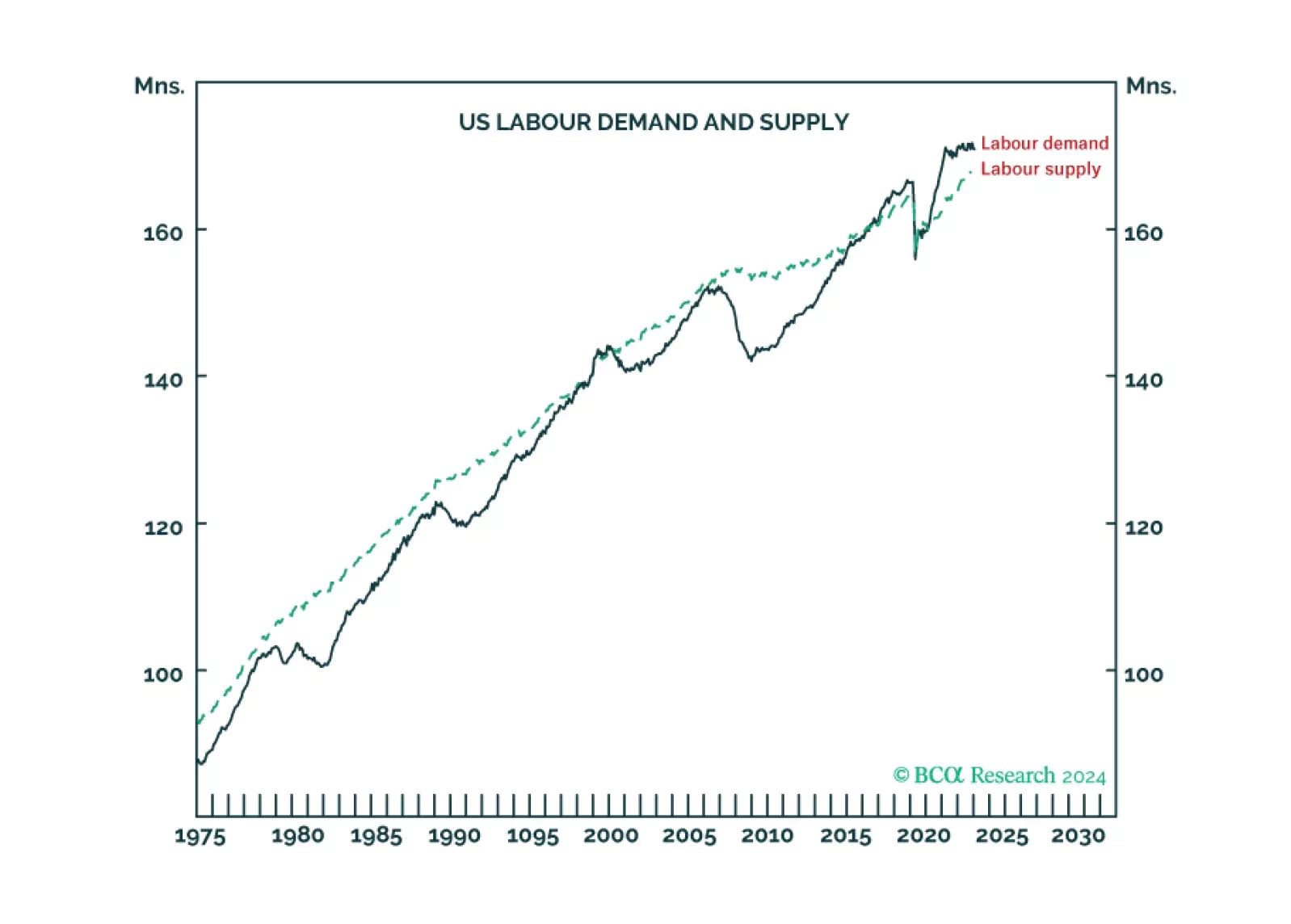

For the first time in at least fifty years, US labour supply is running well below labour demand, meaning the US economy is ‘inverted’. We discuss how and why the economy inverted, and what it means for recession, inflation, and…

The US equity rally has recently stopped narrowing with the gap between the market cap-weighted and equal-weighted indices for the S&P 500 stabilizing over the past month. Indeed, this has coincided with a shift in market…

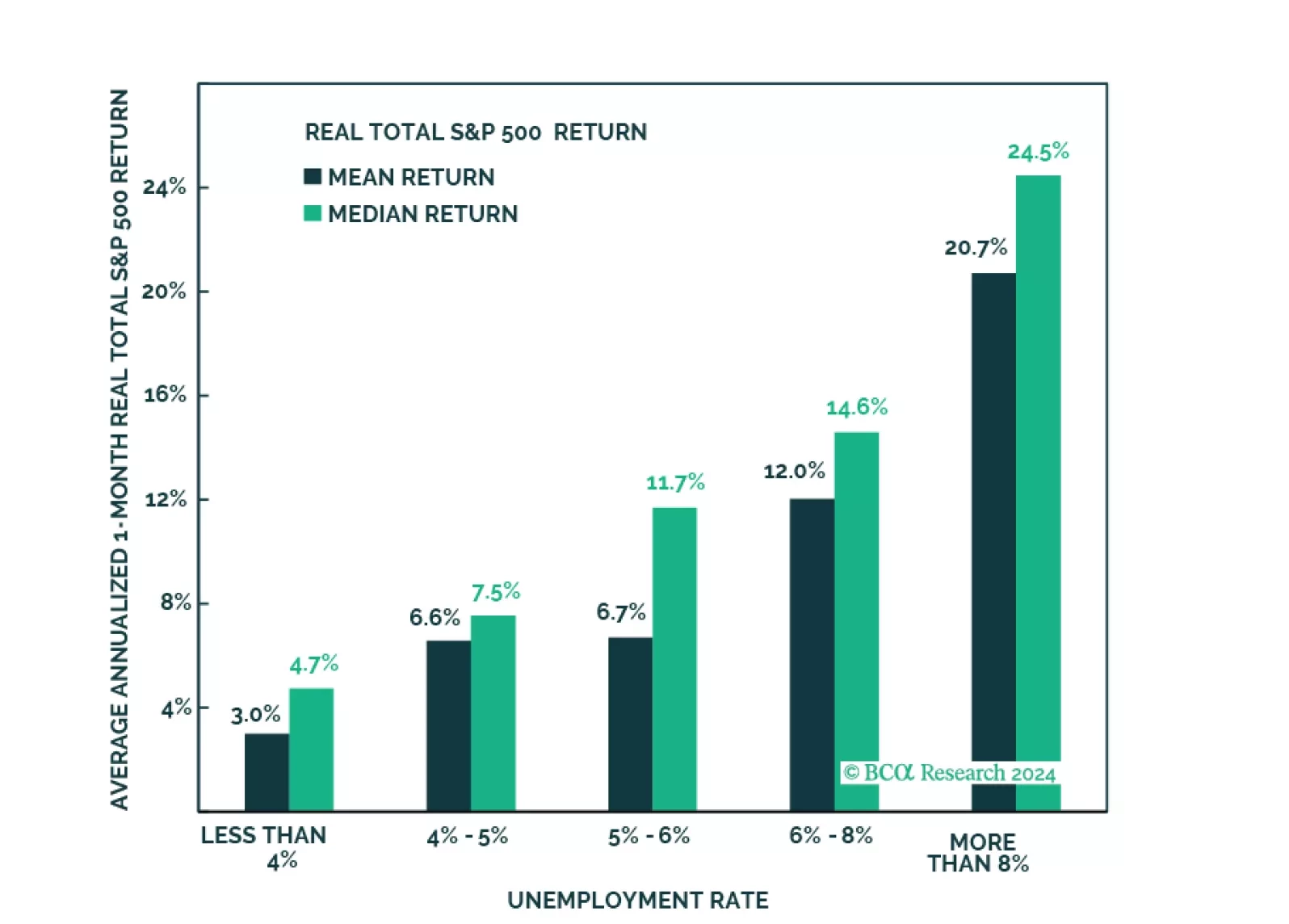

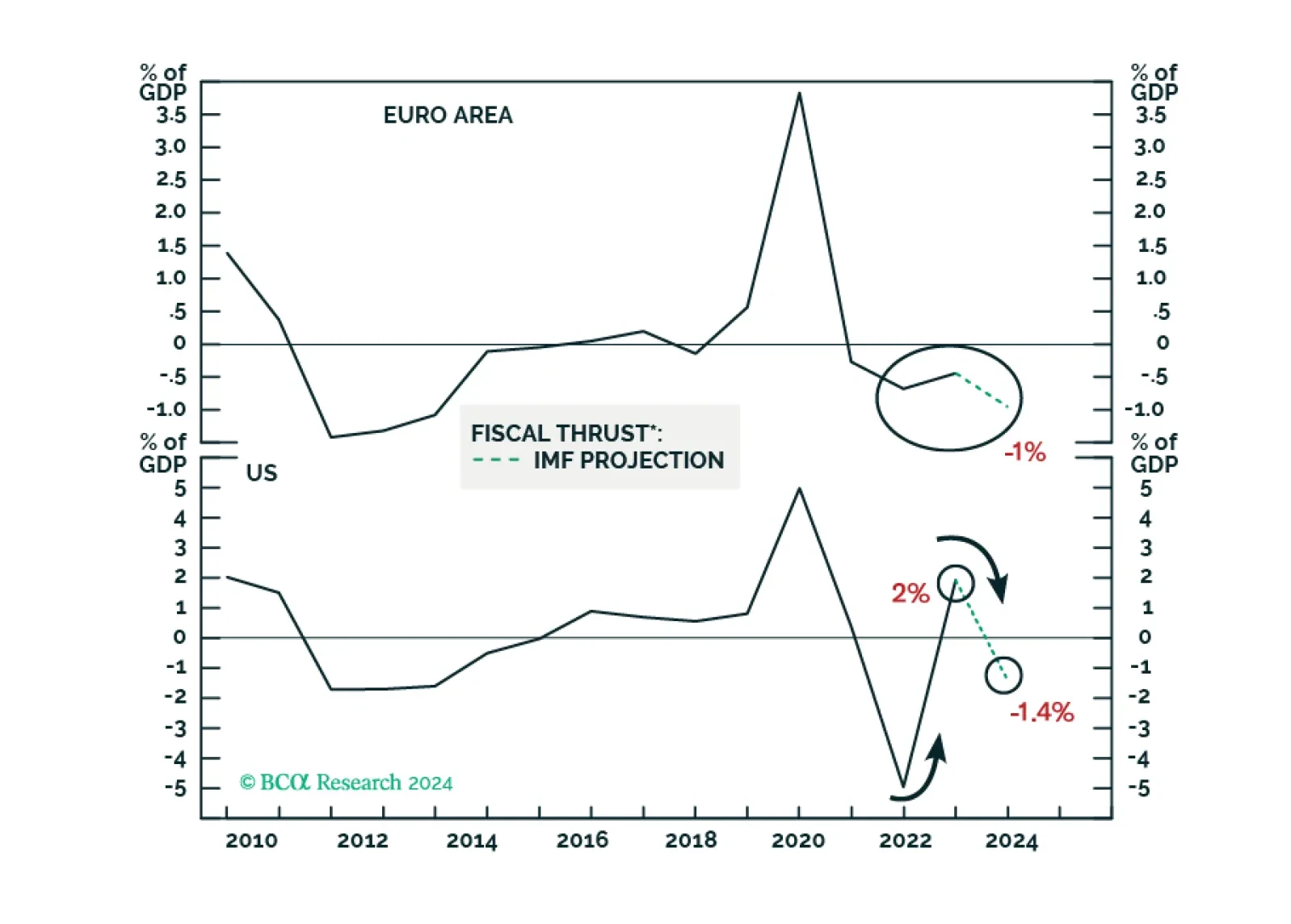

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

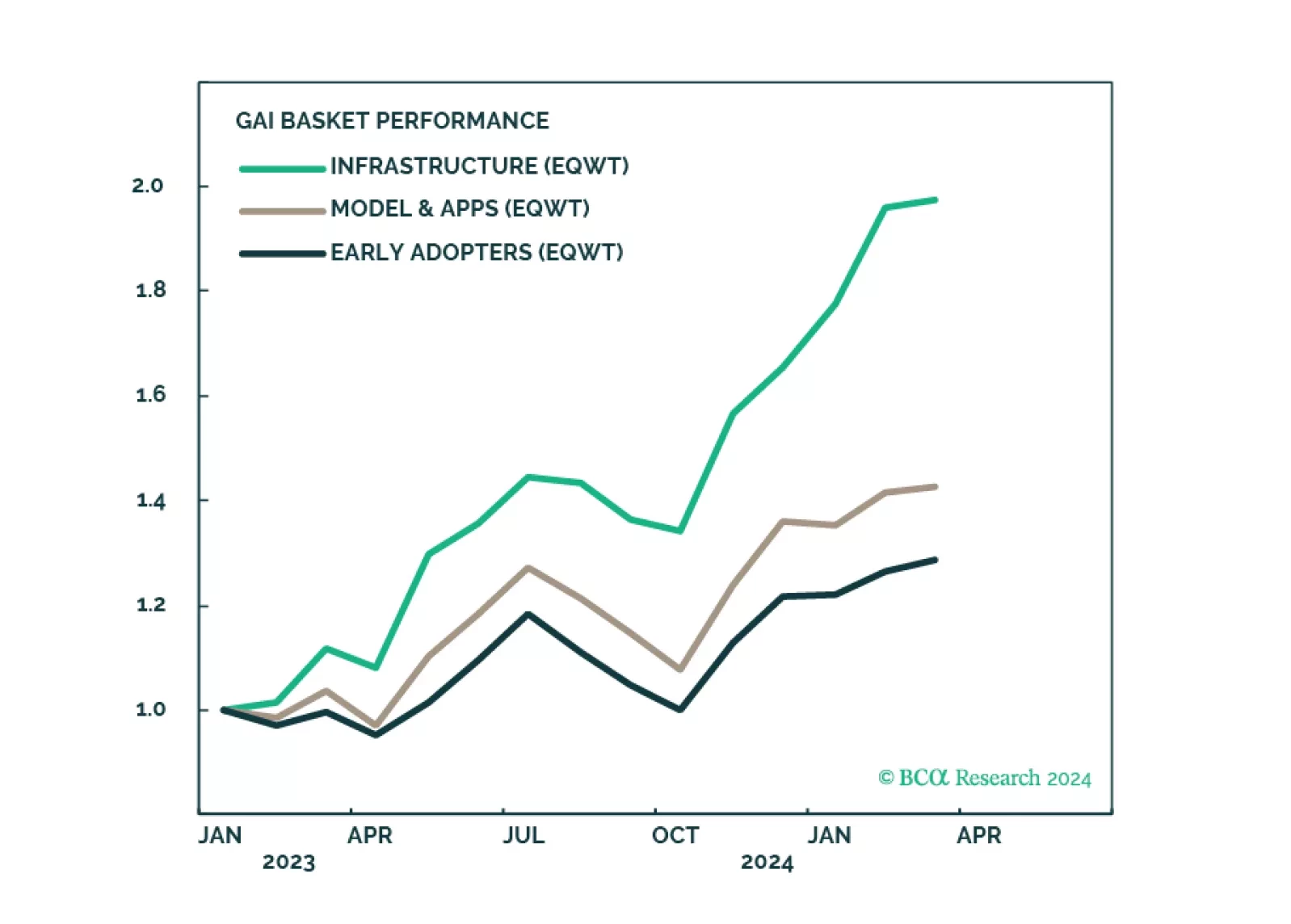

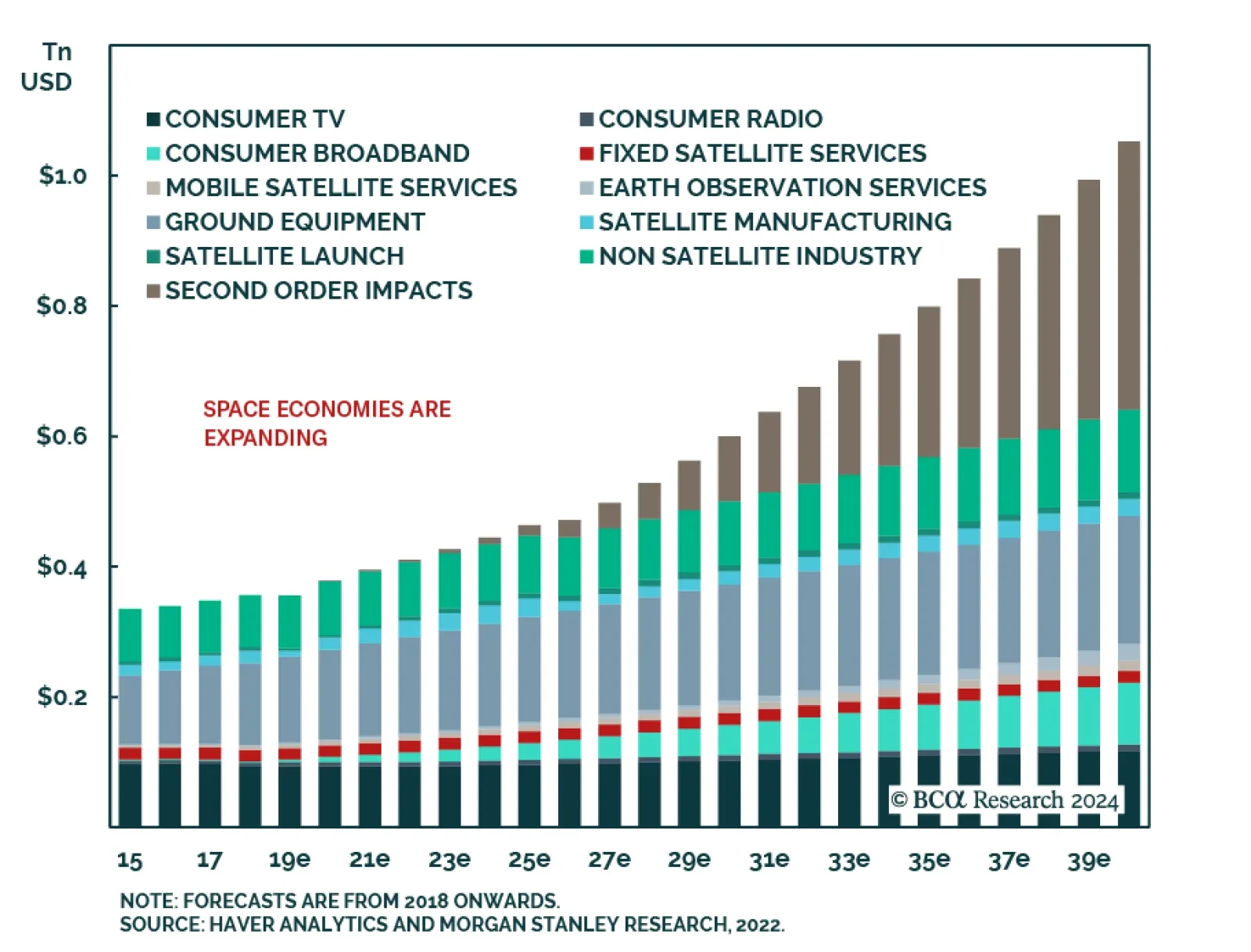

According to BCA Research’s Private Markets & Alternatives service, Artificial Intelligence is old news. Given such, it is not prime for Early-Stage Venture Capital (VC) investing. While everyone is distracted with…

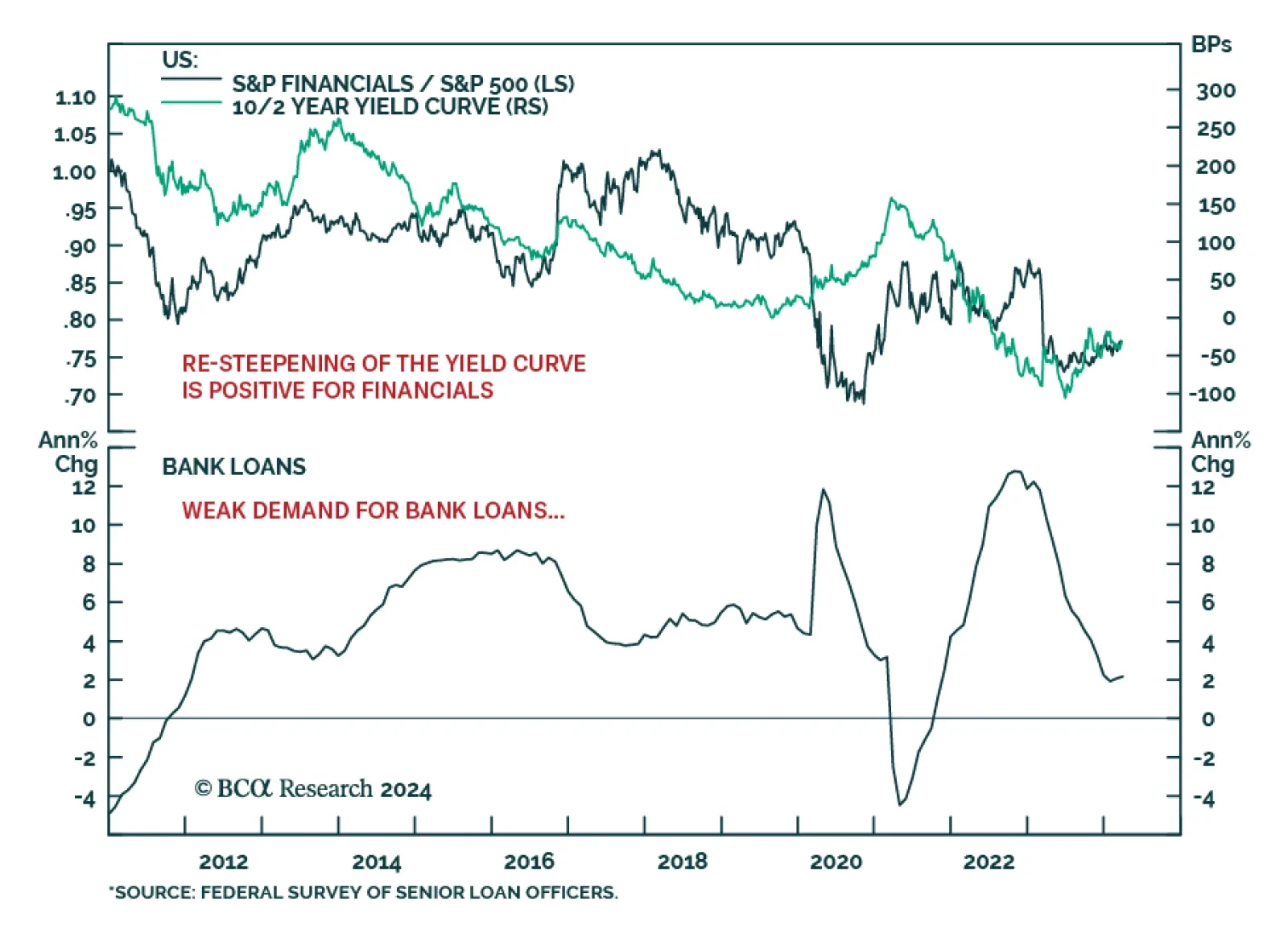

The steepening of the yield-curve powered the outperformance of the S&P 500 Financials relative to the overall market since the spring of 2023 banking crisis. This sector returned 30.1% over this period, against 27.3% for the…

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…