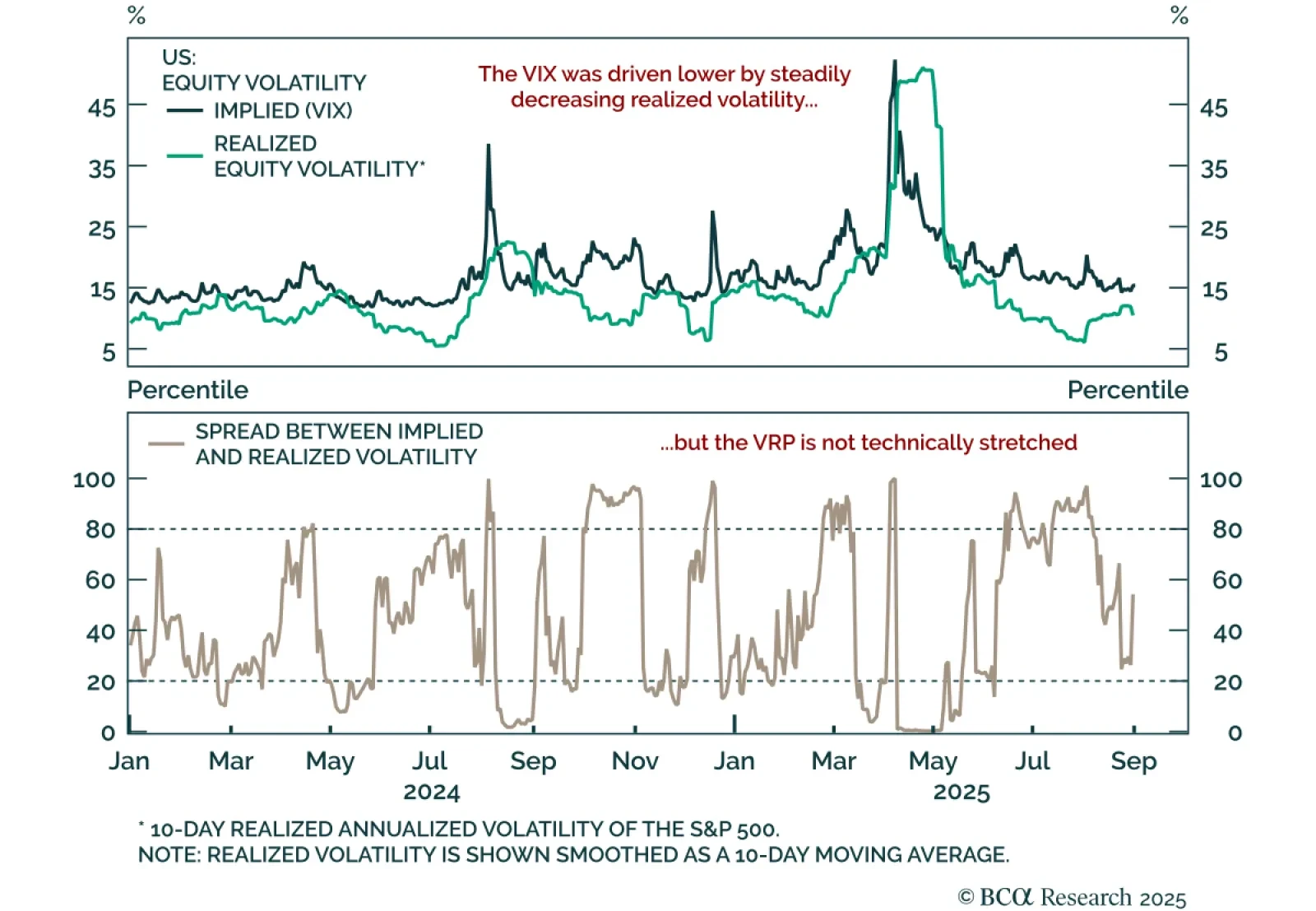

A smooth S&P 500 rally has crushed volatility, but stretched signals argue for buying protection. The index has climbed back to all-time highs with almost no drawdown, producing a steady decline in realized volatility. This…

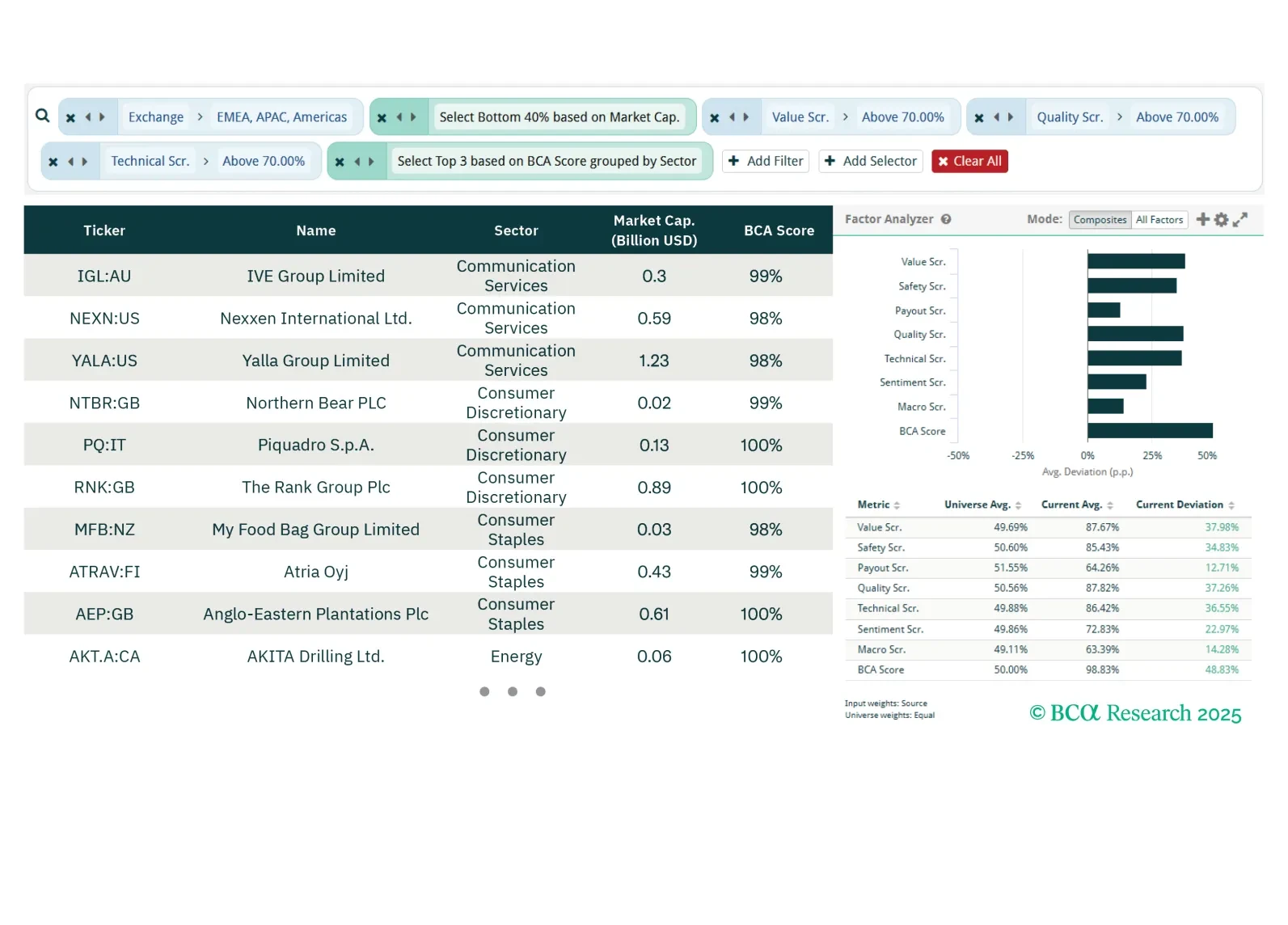

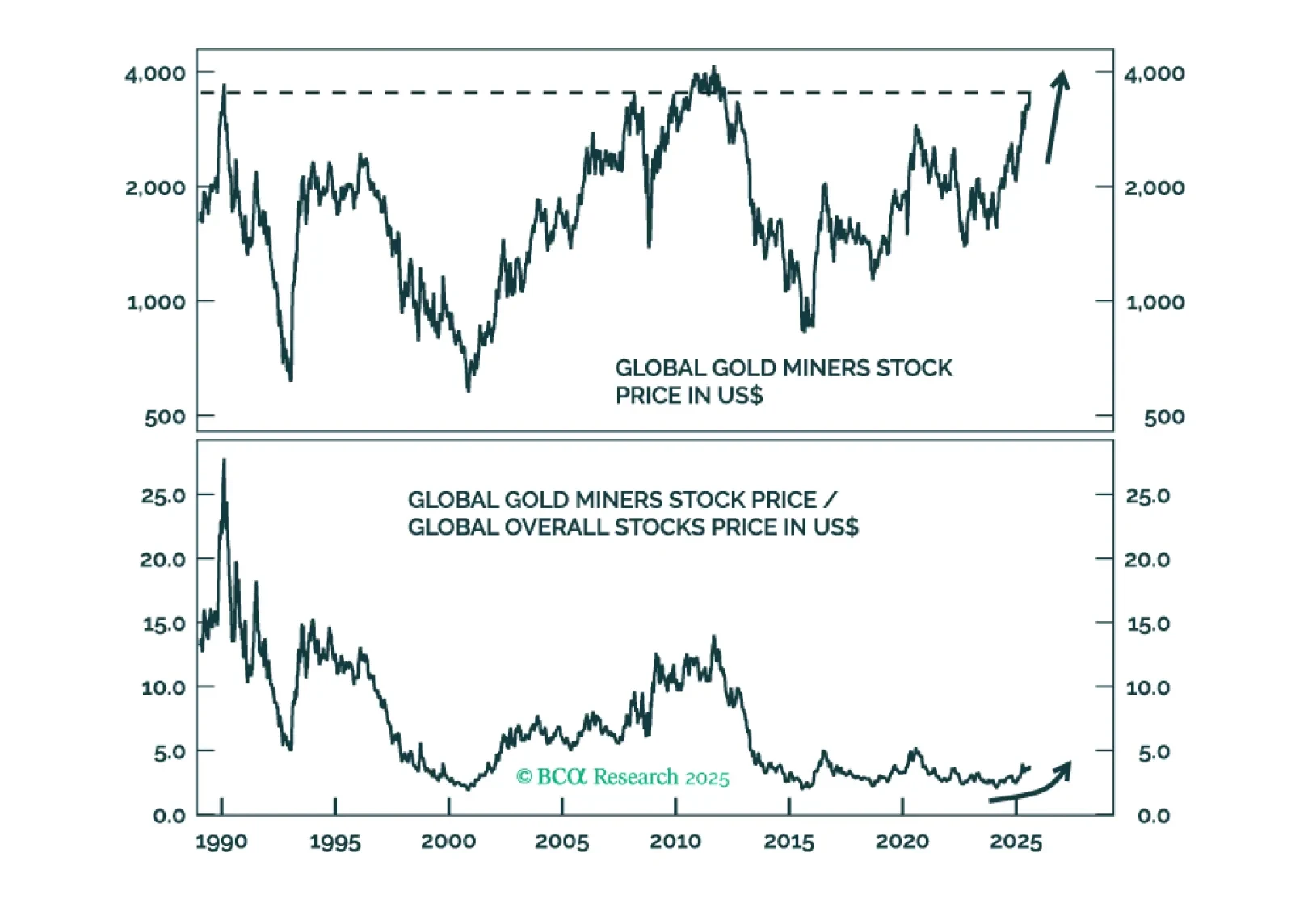

This week our three screeners highlight plays in global small-cap value stocks, gold miners, and stocks exposed to an exciting structural investment theme: Space.

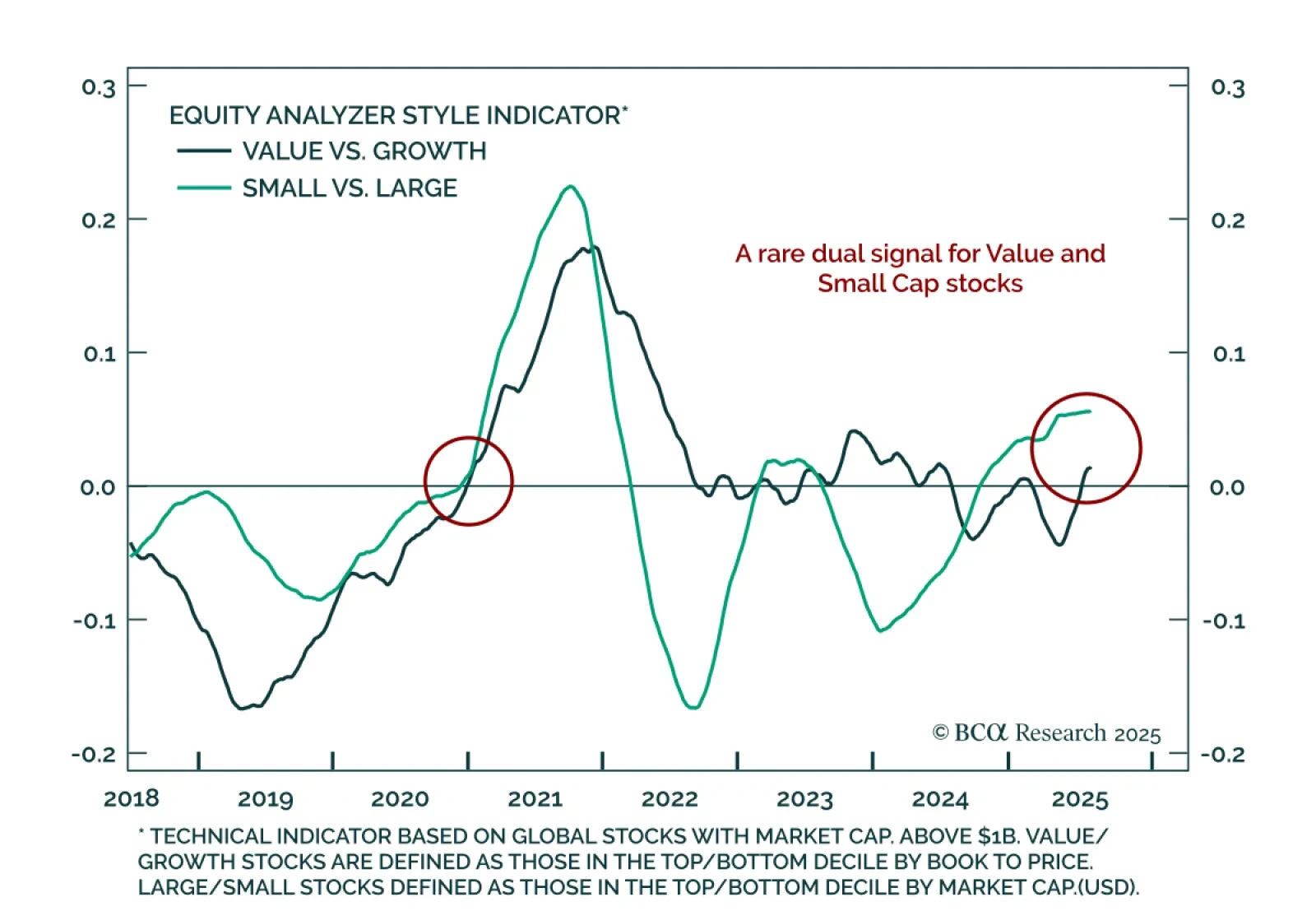

Momentum is building behind small-cap and value stocks, signaling a rare dual tailwind for cyclical styles. Our Chart Of The Week comes from Guy Russell, strategist for Equity Analyzer.While market attention remains focused on the…

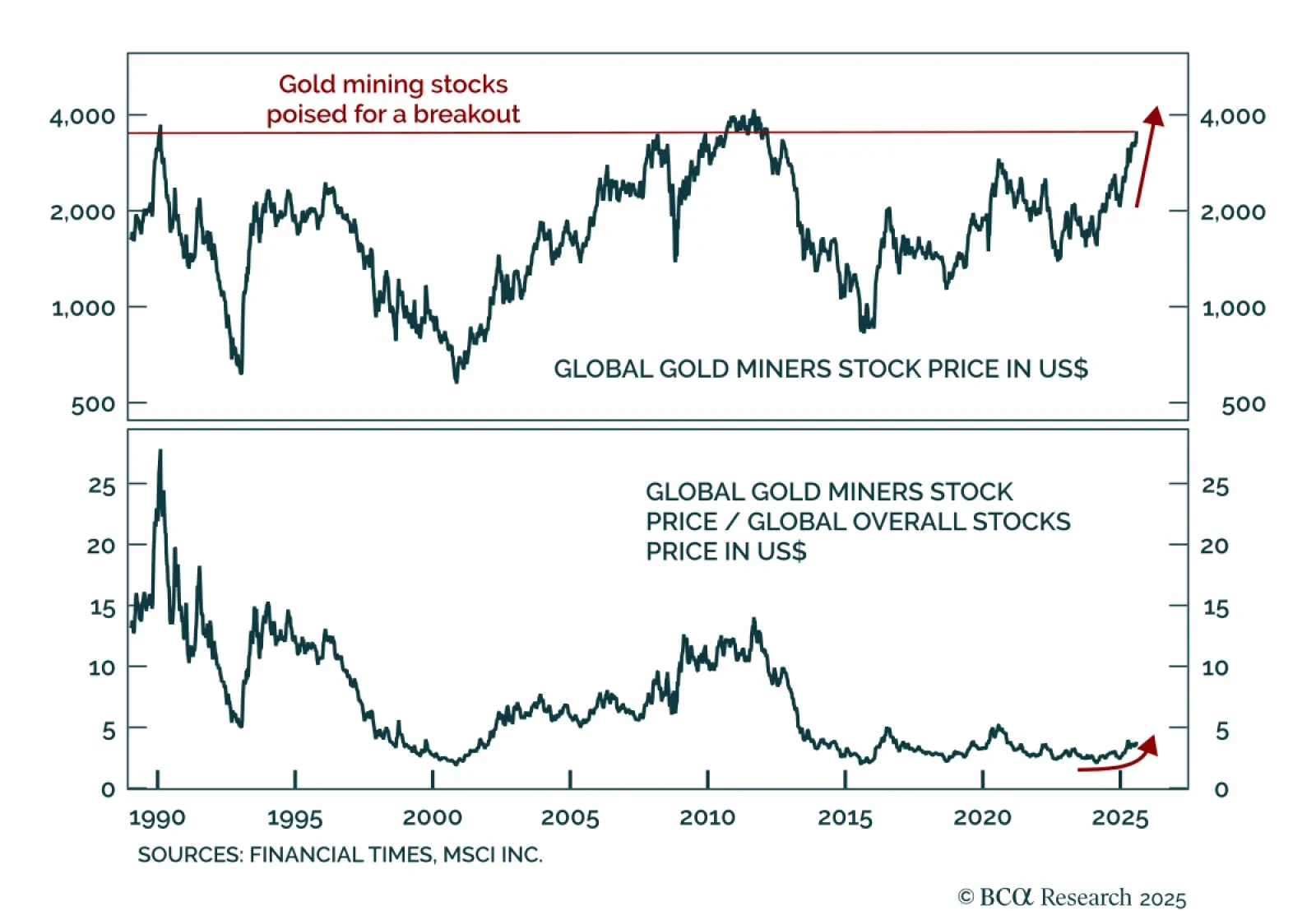

Our Commodity strategists expect gold’s consolidation to resolve in a bullish breakout; buy gold and gold mining stocks in both absolute and relative terms. The metal’s resilience despite unfavorable cyclical drivers points to a…

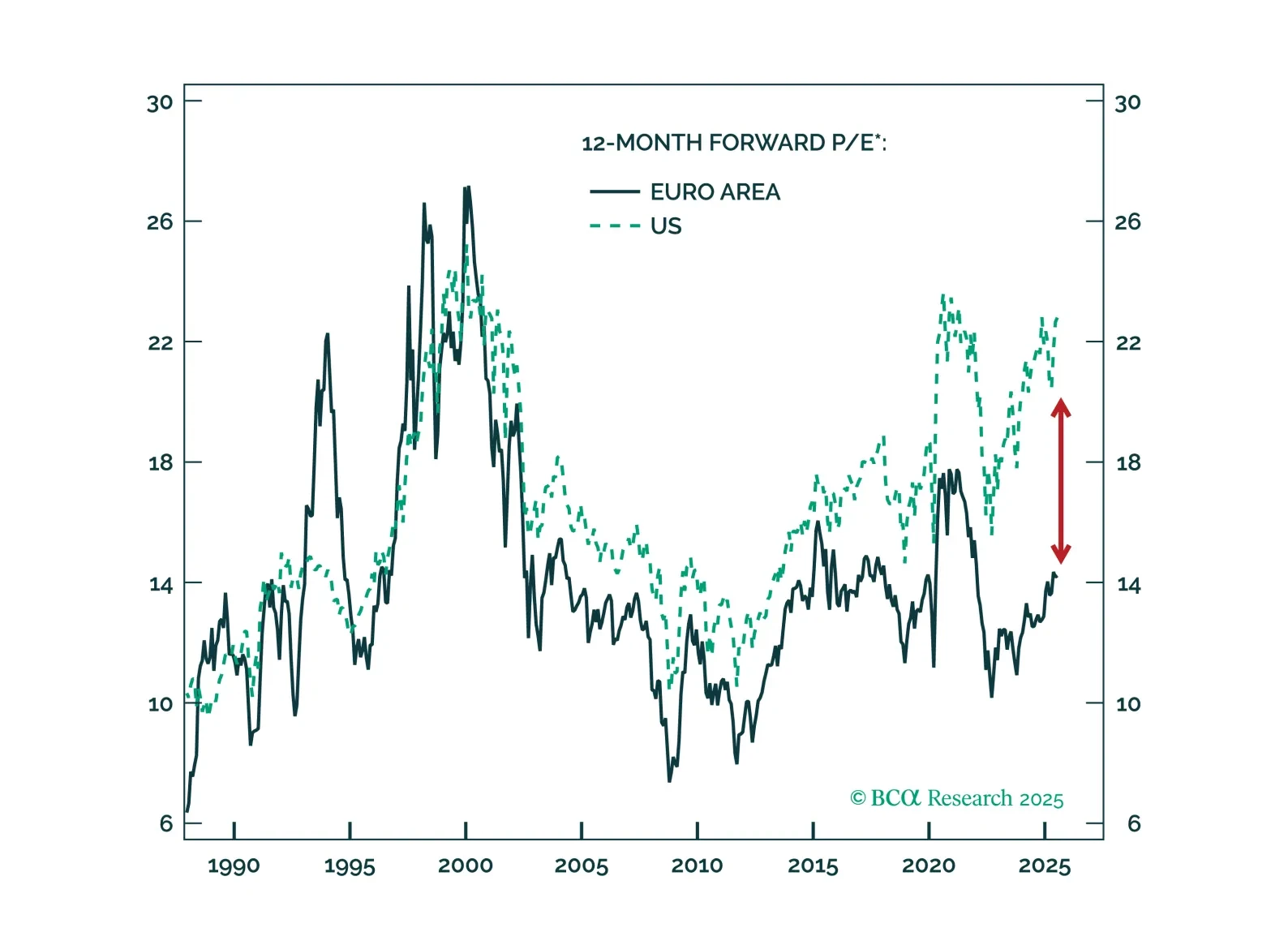

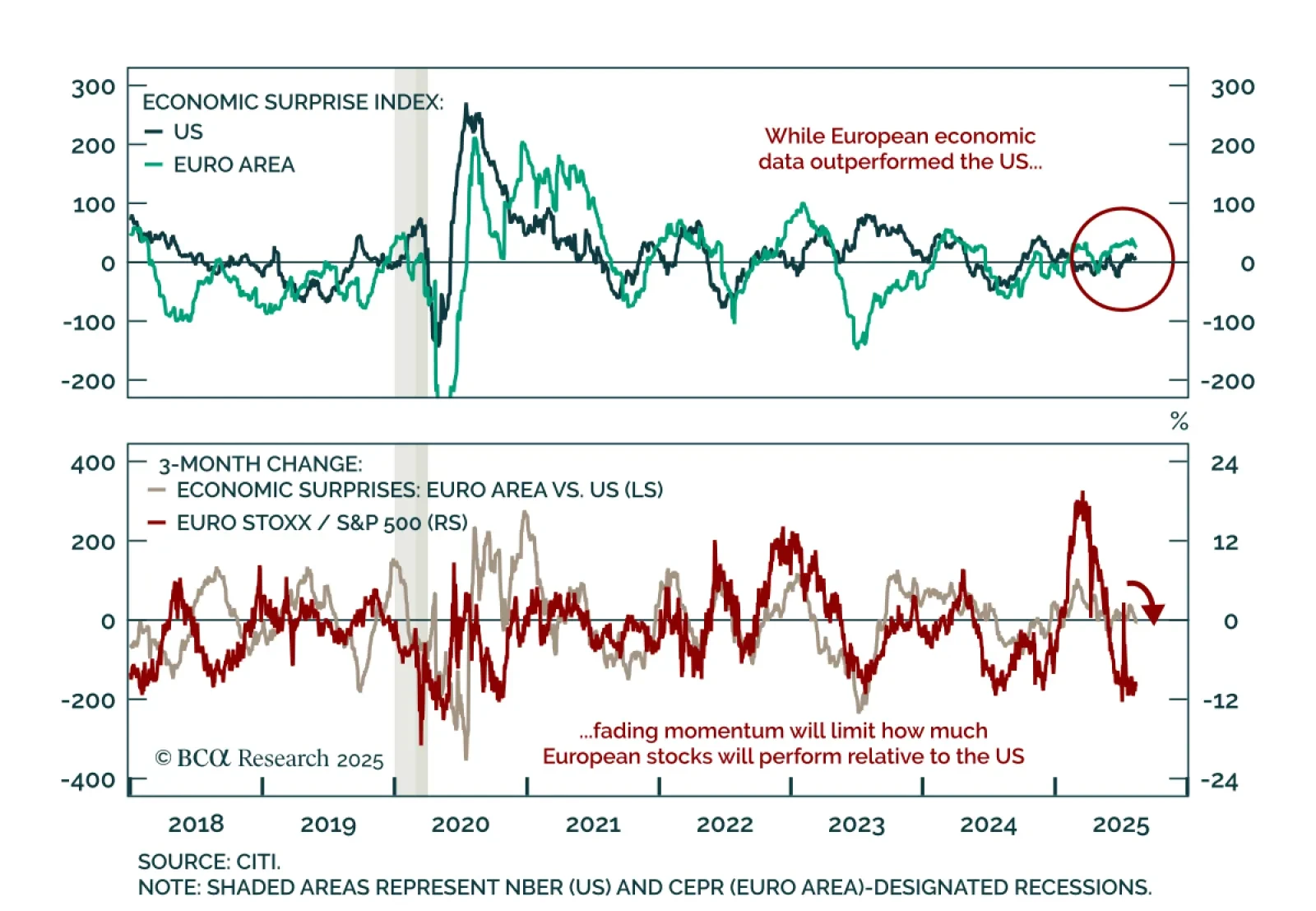

Dollar softness has had little growth impact, and European equities should keep lagging. A key 2025 trend has been USD depreciation, but the associated easing in financial conditions has offered minimal support to US growth,…

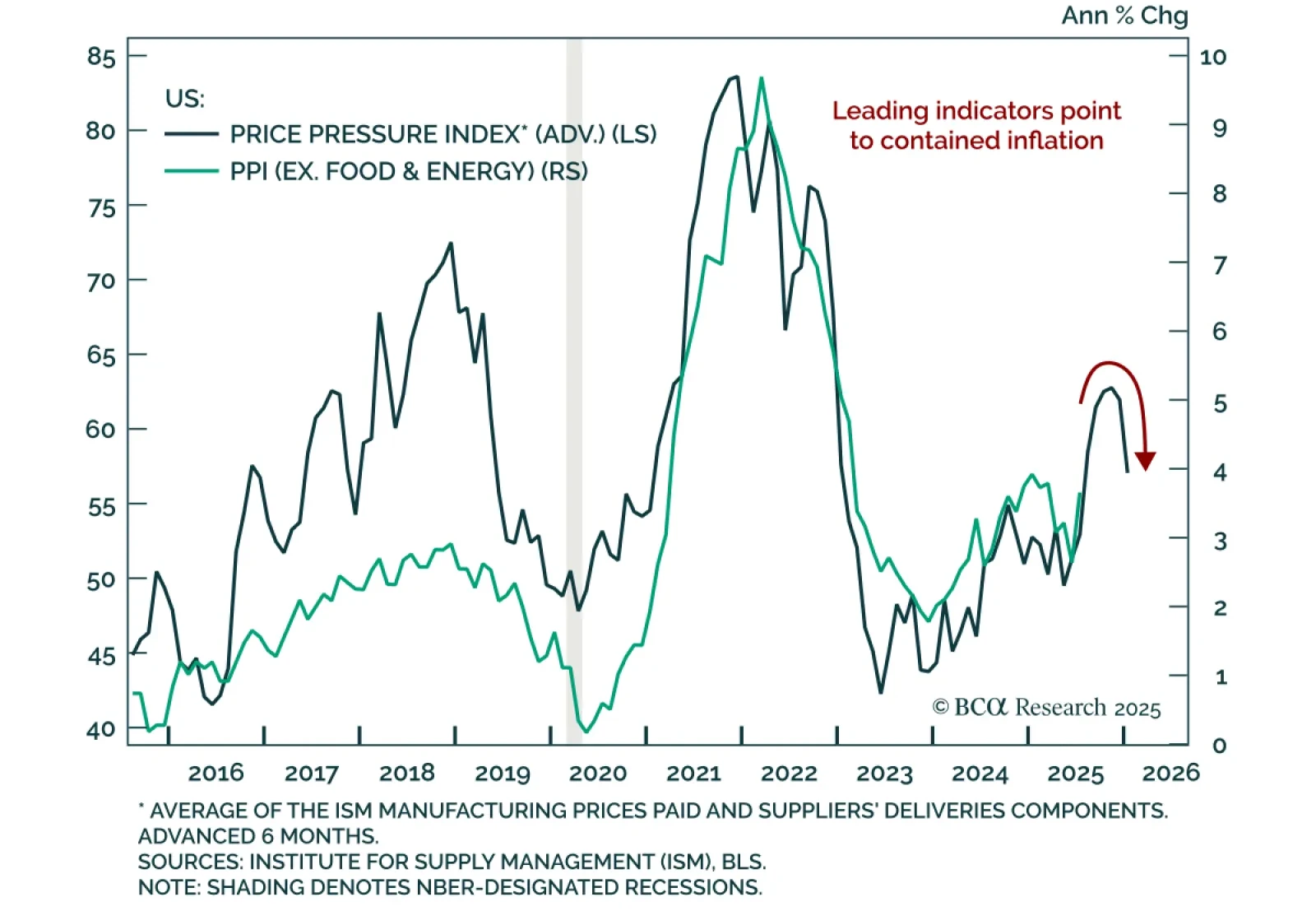

July PPI surprised sharply to the upside, but inflation pressures are likely to remain limited. Headline PPI rose 0.9% m/m (3.3% y/y) in July from 0.0% m/m (2.3% y/y) in June, while core PPI gained 0.6% m/m (2.8% y/y). PPI components…

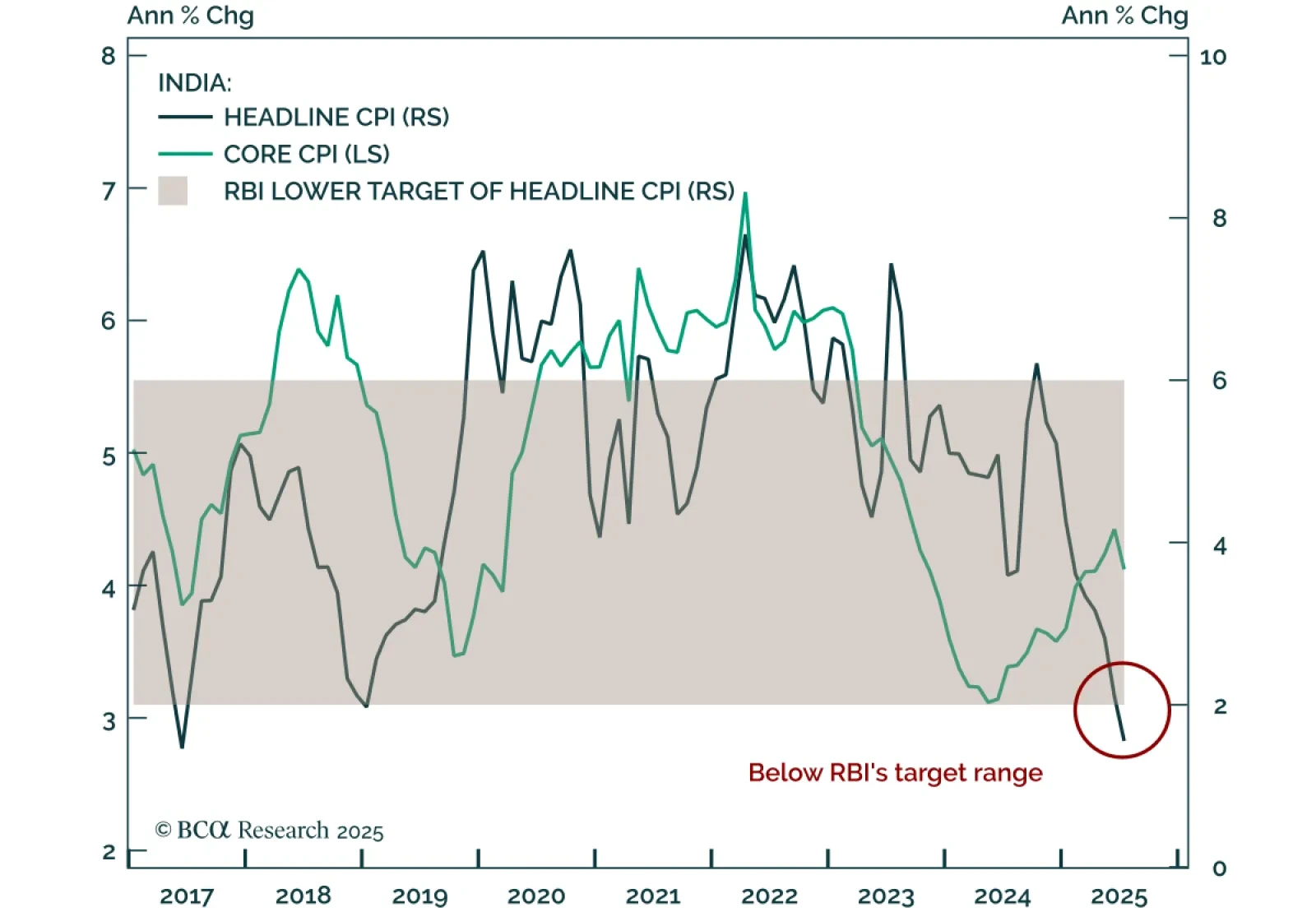

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

US equities are set for tactical outperformance versus Europe, but dips or underperformance in European assets remain entry points for long-term investors. European stocks have stalled below prior highs, while the S&P 500 has…