Investors typically associate high-flying tech stocks with high sensitivity to interest rates. The rationale is simple: Given that most of their cashflows are further into the future, their value will be more sensitive to changes…

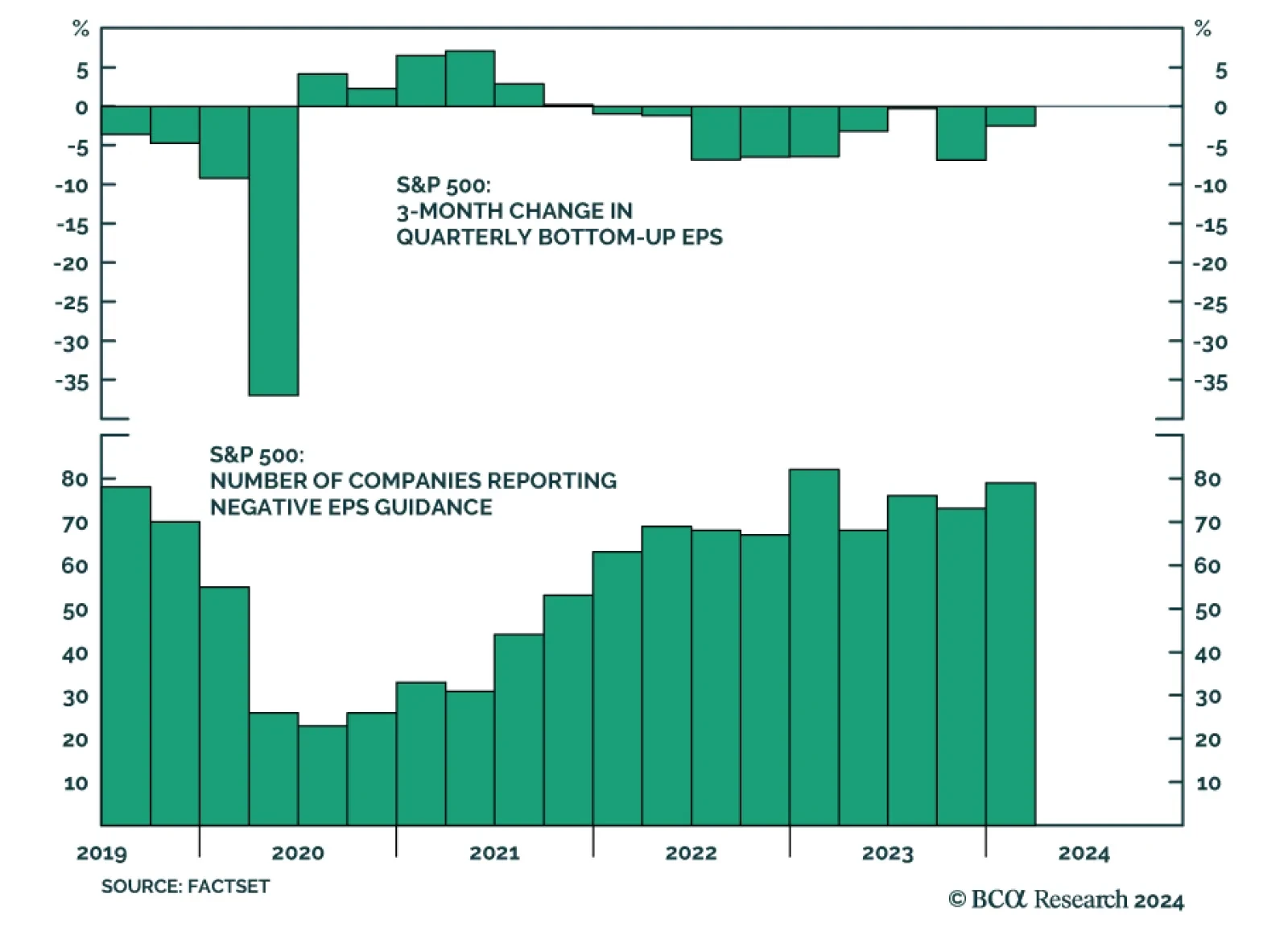

Some of the biggest US banks will kick off the reporting season in earnest this Friday, leading increased market focus on Q1 2024 earnings. According to Factset, analysts expect S&P 500 year-over-year earnings growth to…

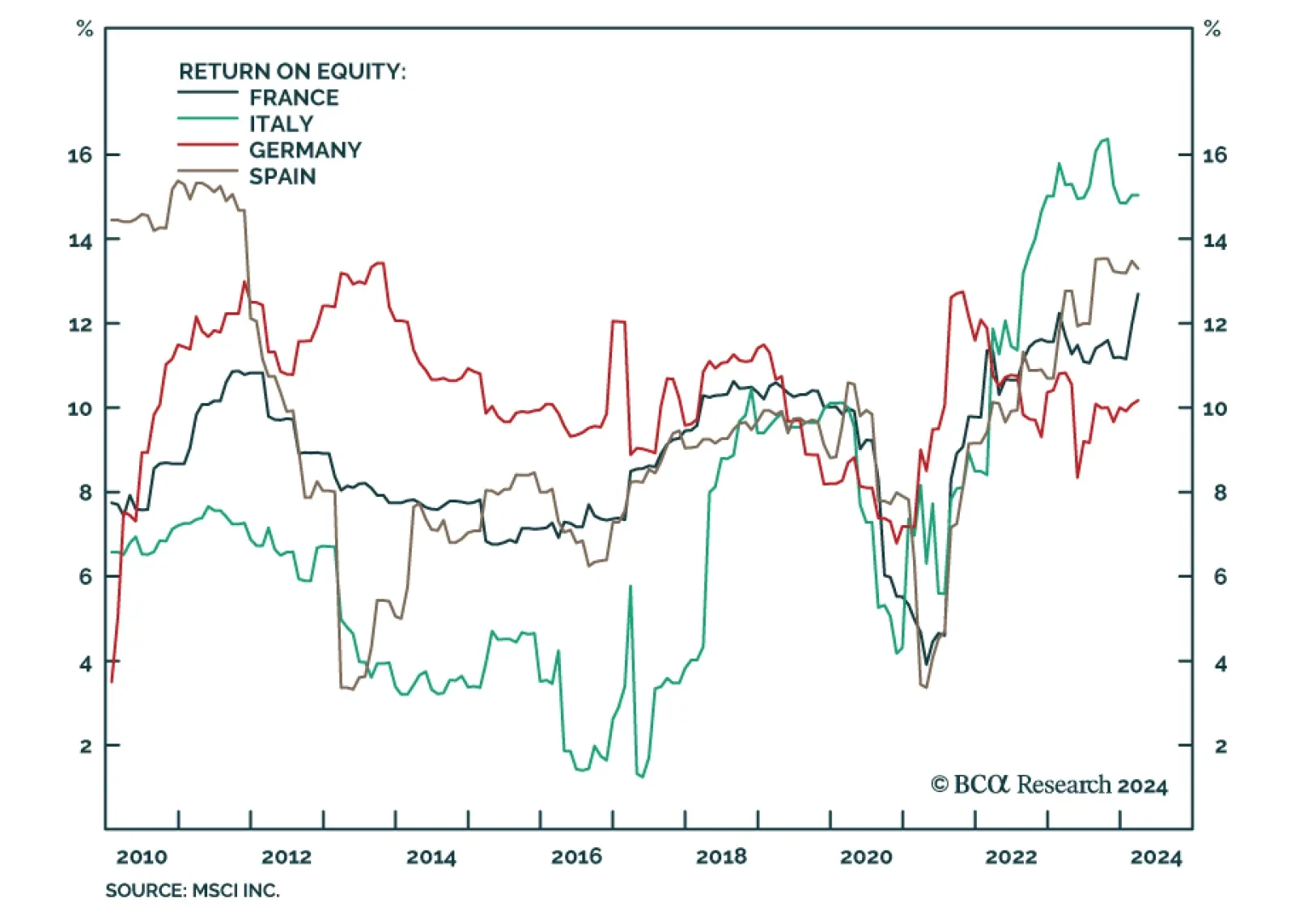

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

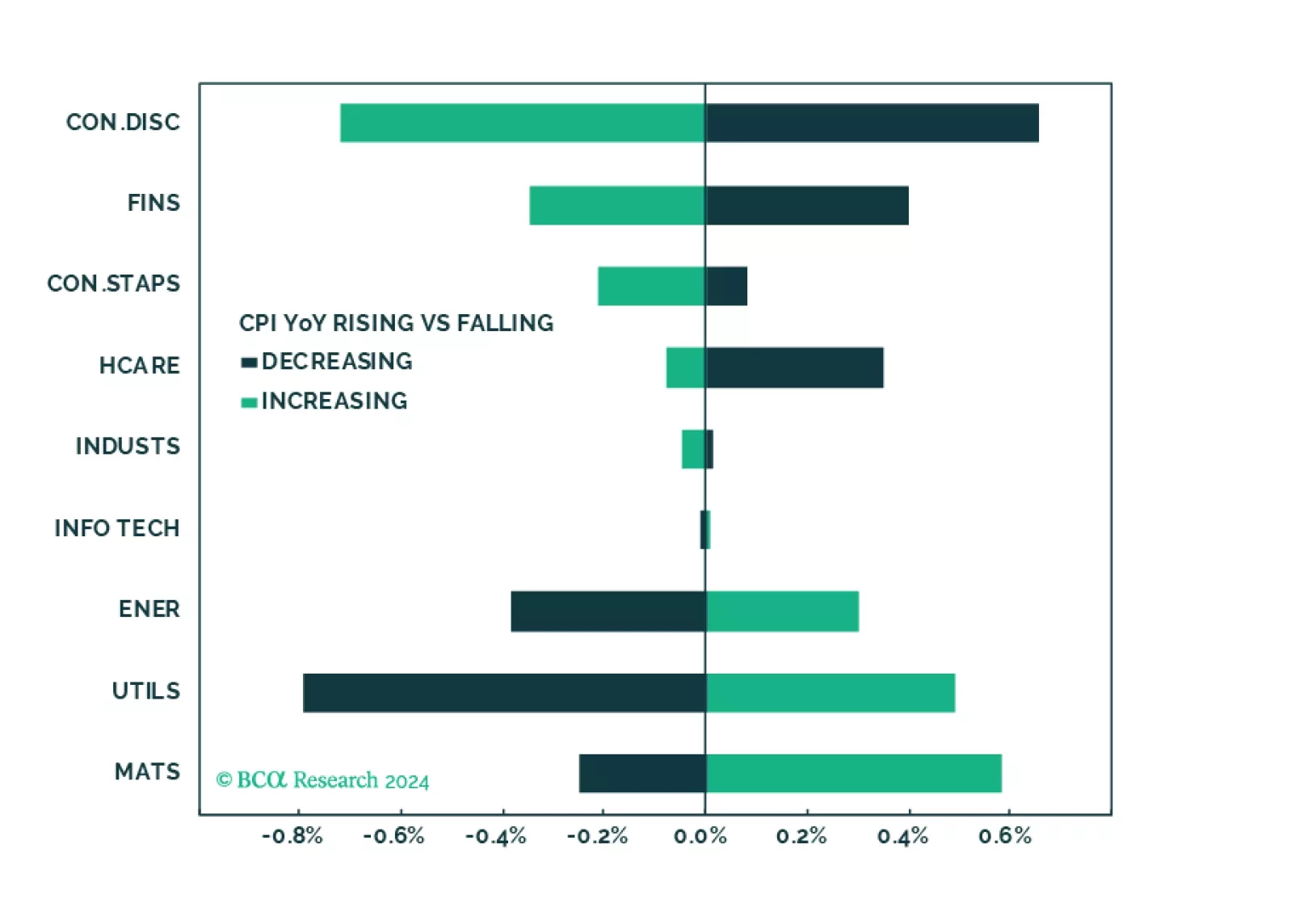

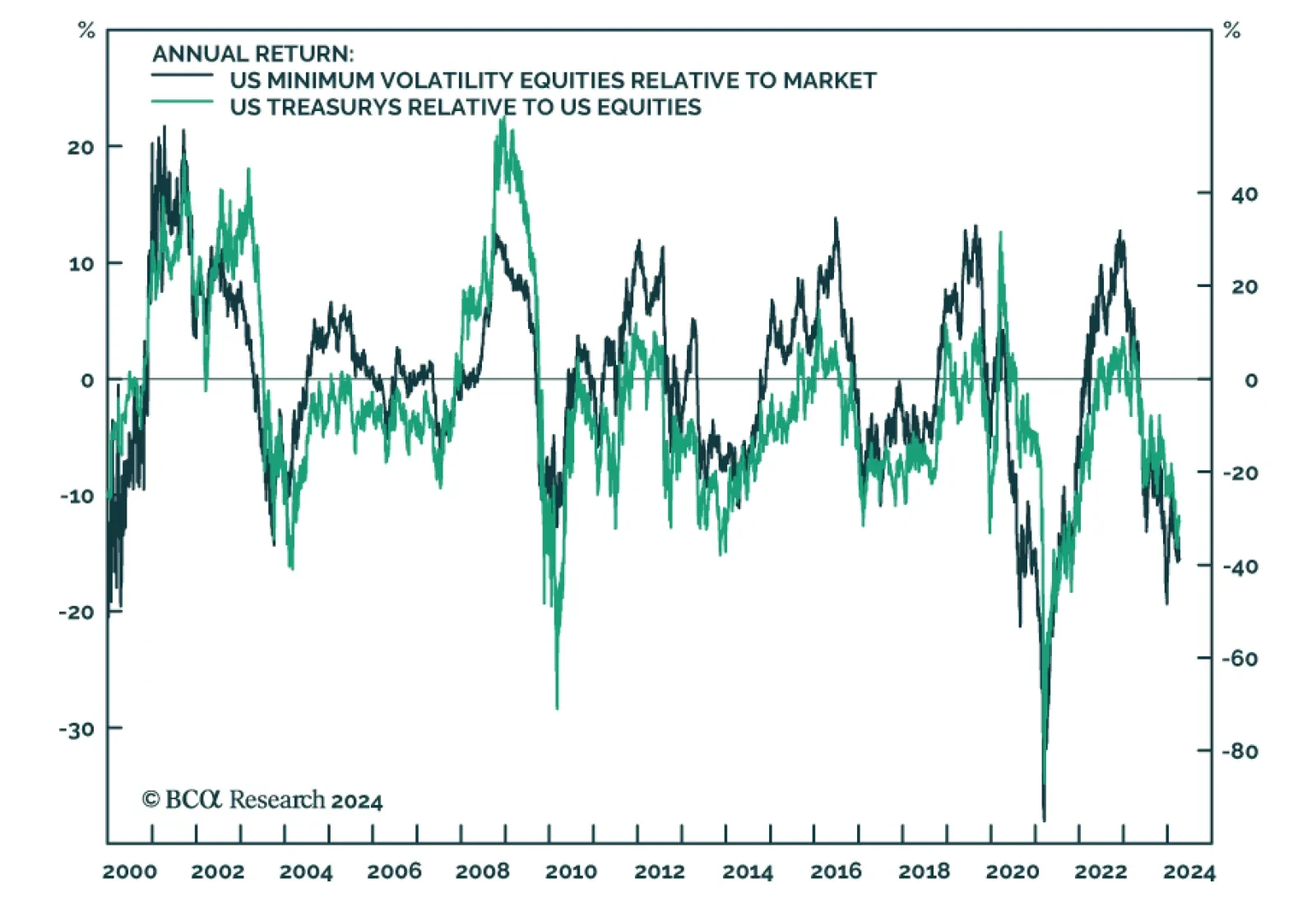

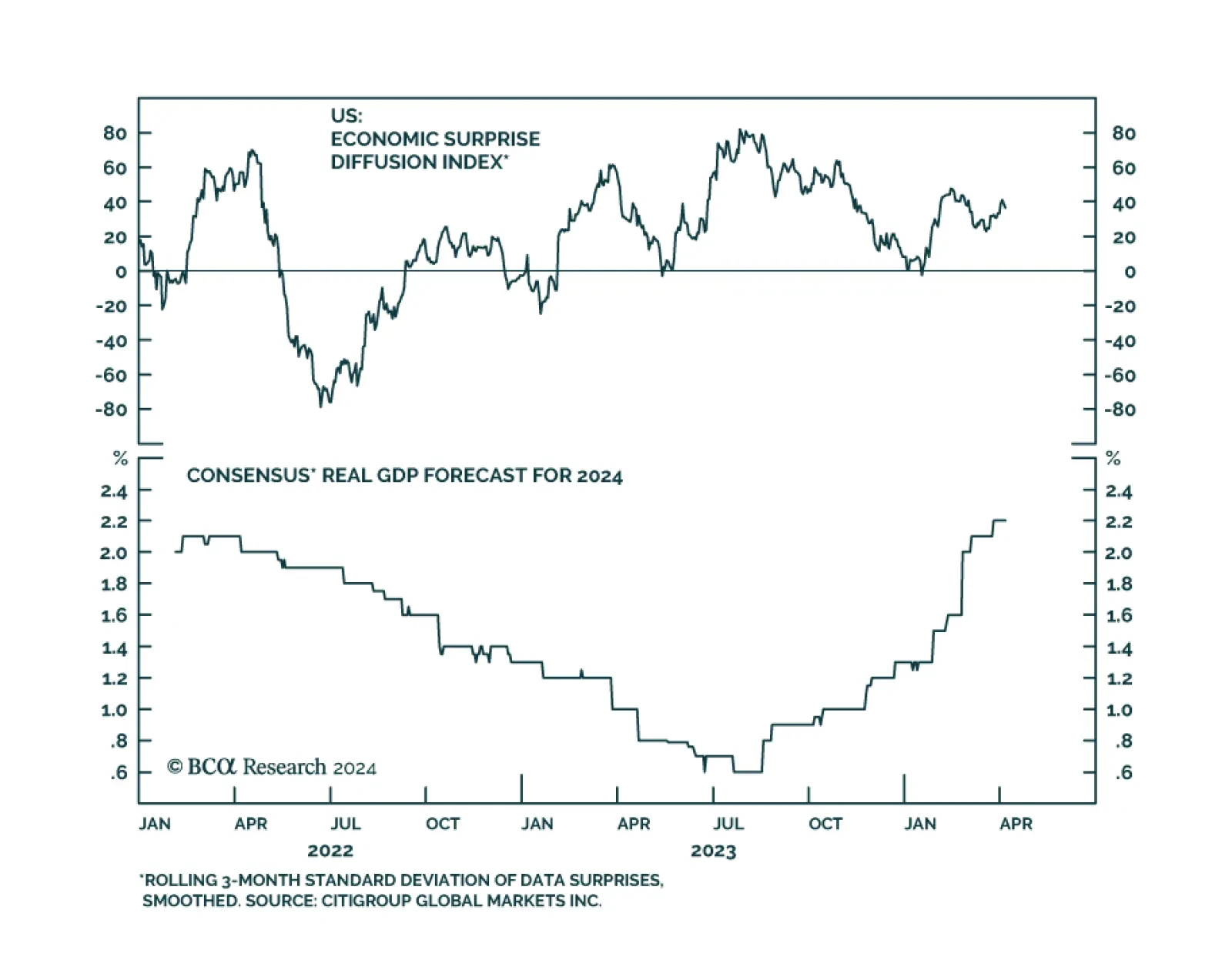

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

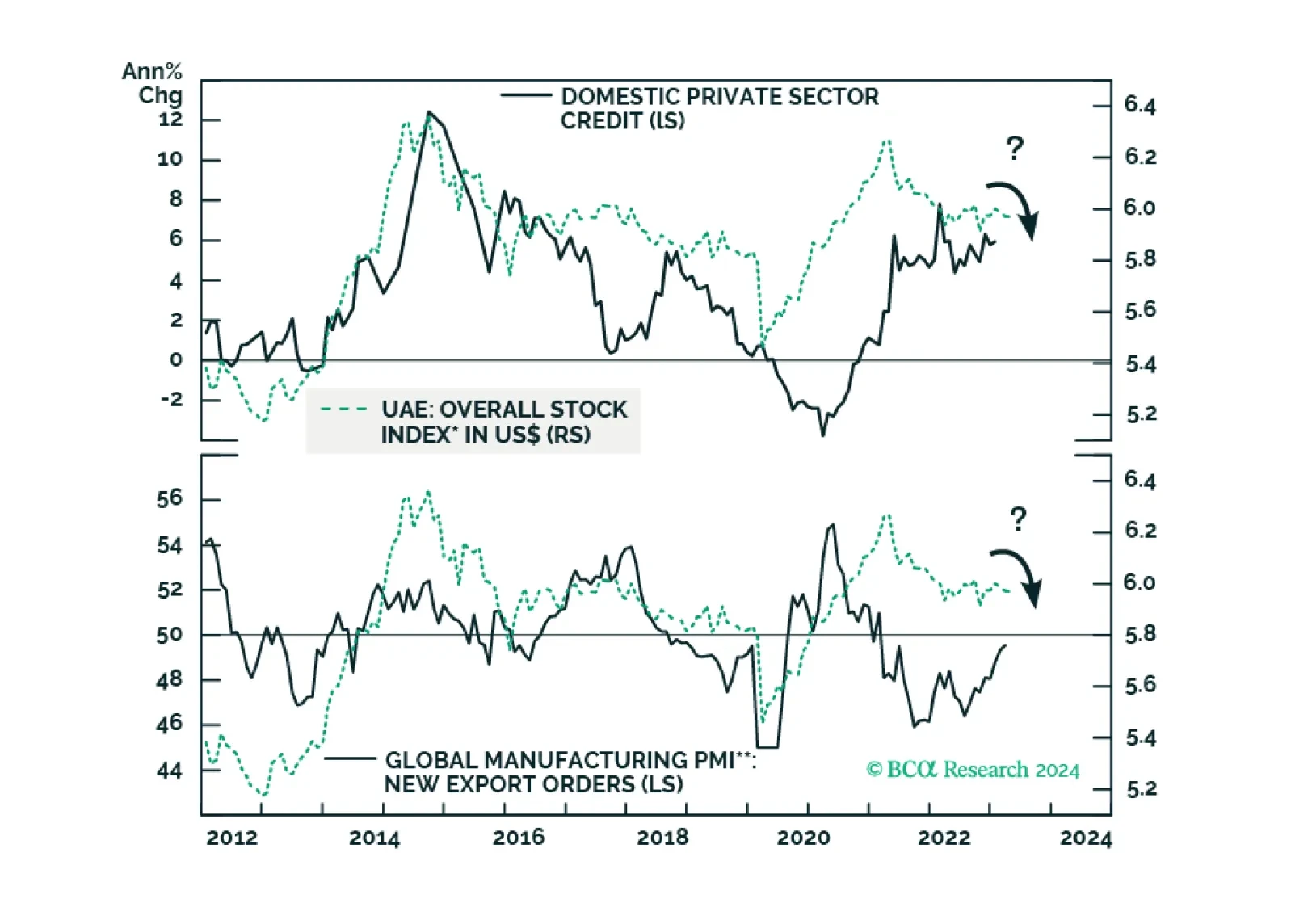

Subdued credit growth and weak global trade will remain headwinds for Emirati stocks. Surging property prices, which have led to a boom in real estate stocks, will also peak soon. Stay neutral on this bourse. Sovereign credit…

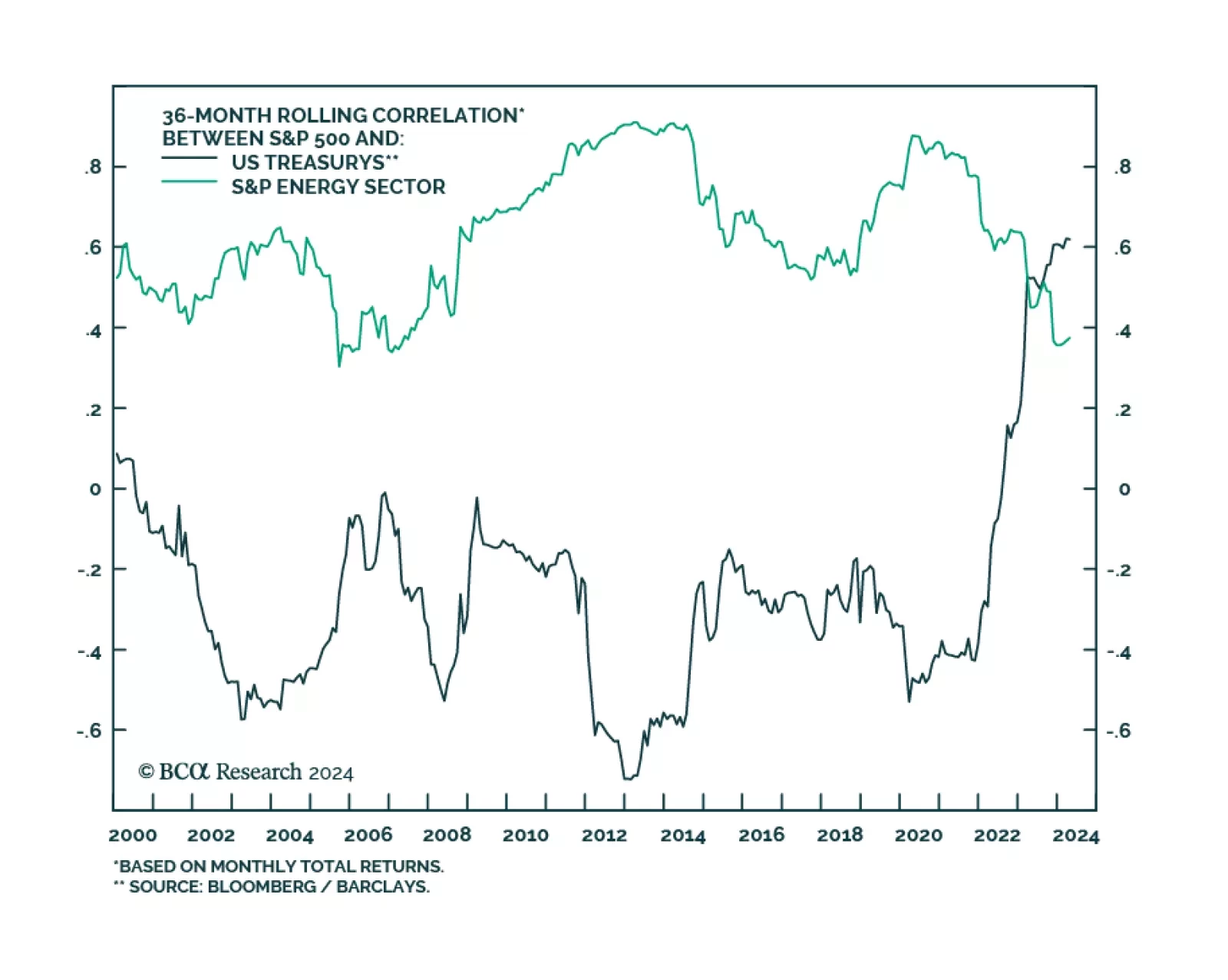

Traditionally, equity managers have thought of oil equities as cyclical. This is because, in the past, oil equities had a strong positive correlation to the overall market. But US oil equities have increasingly become more…

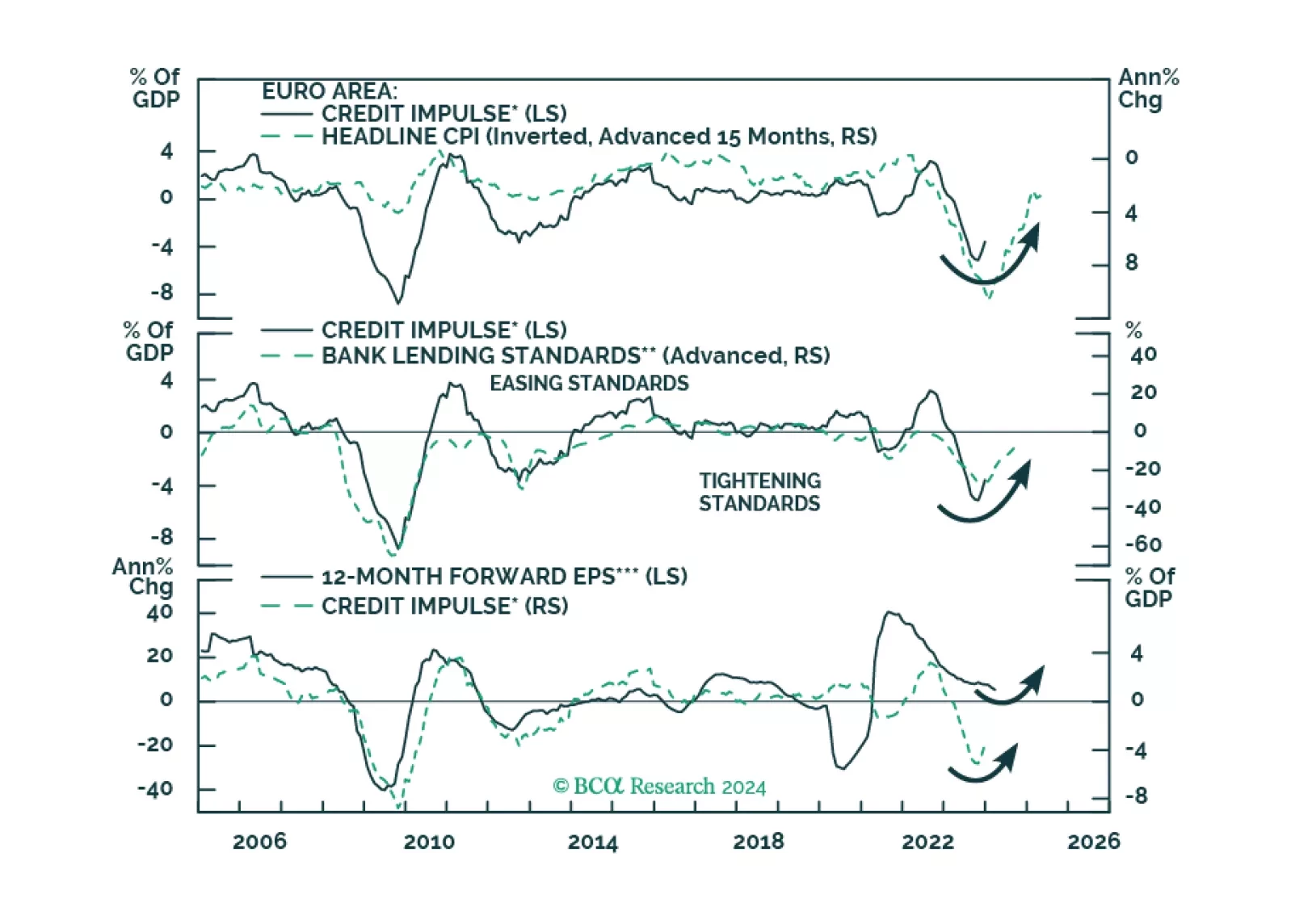

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?

The past week brought a slew of positive US economic data, all suggesting that conditions remain robust and a recession is not imminent. The ISM Manufacturing PMI crossed into expansion for the first time since September 2022,…

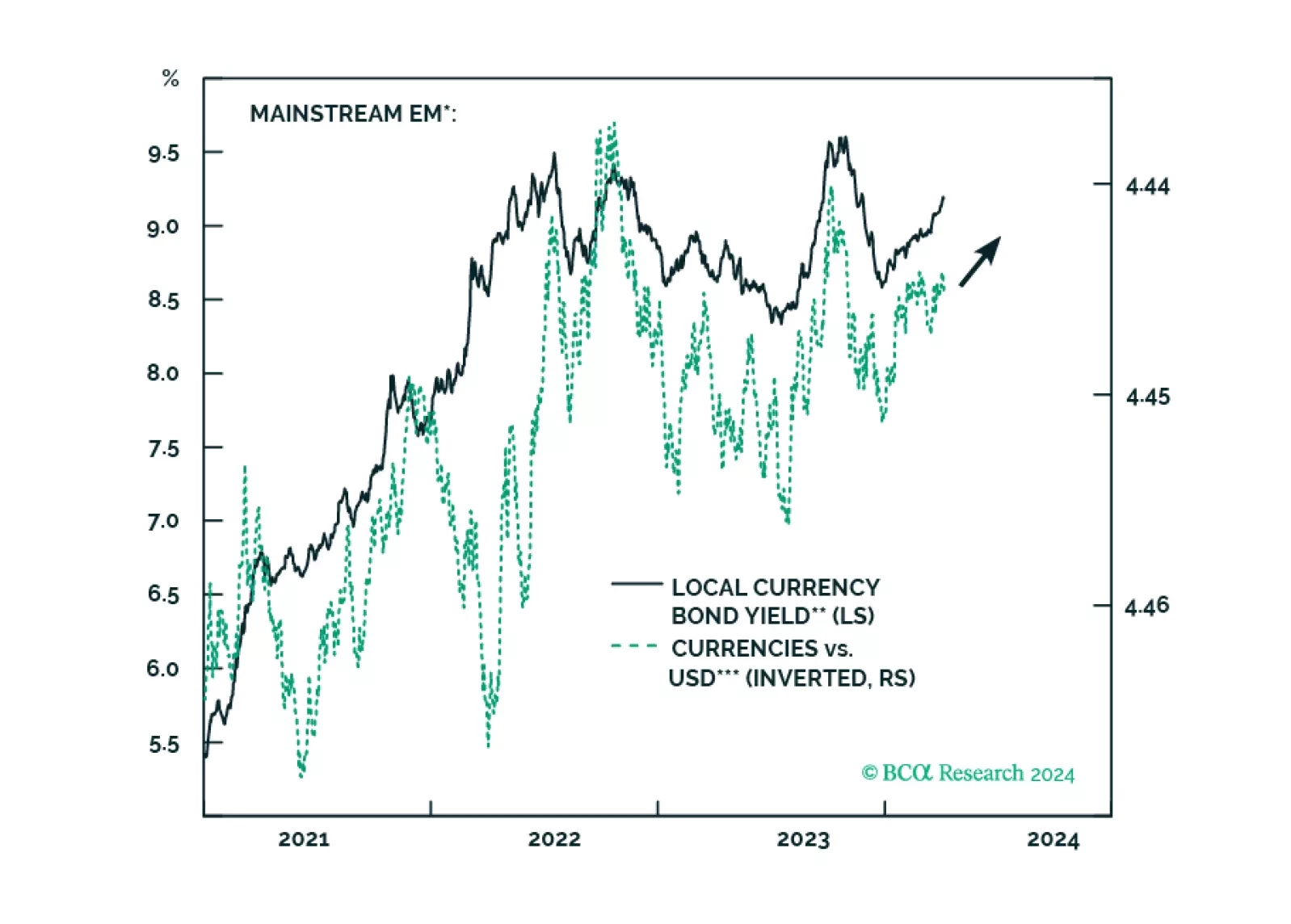

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

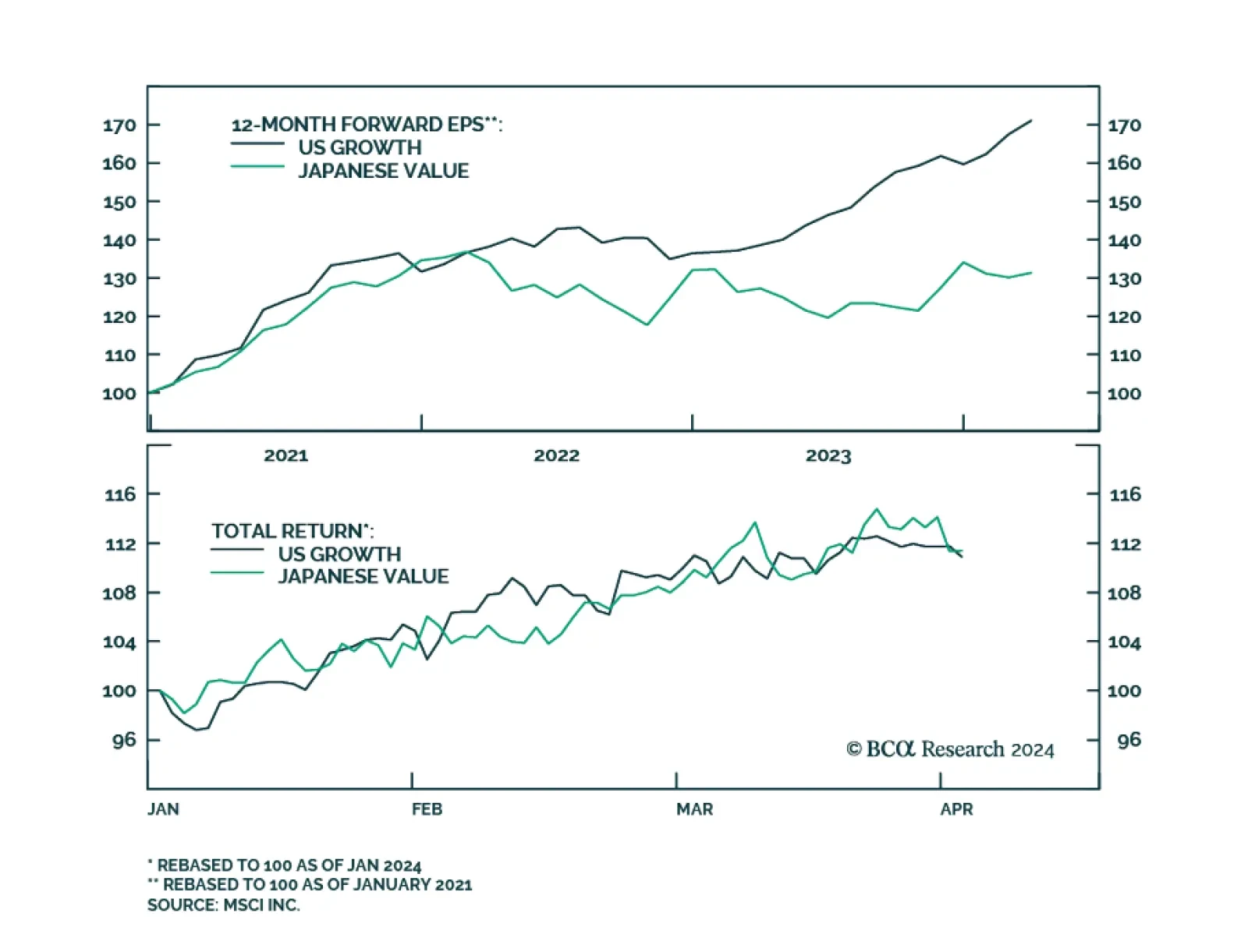

The extraordinary performance of AI companies has pushed US growth stocks to new highs. So far, the MSCI US Growth Index has returned almost 11% since the start of the year, outperforming global stocks by over 3%. No growth index…