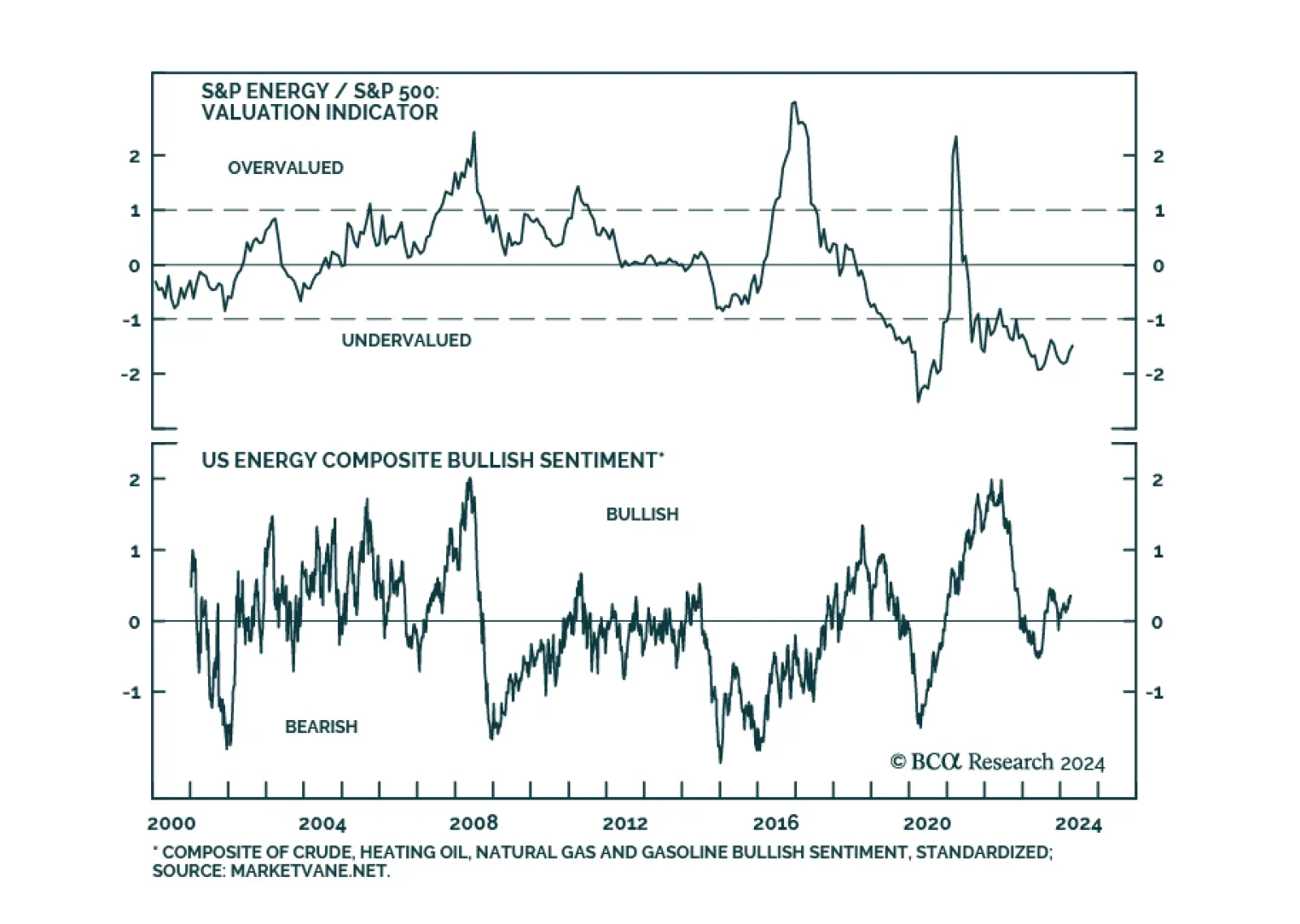

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

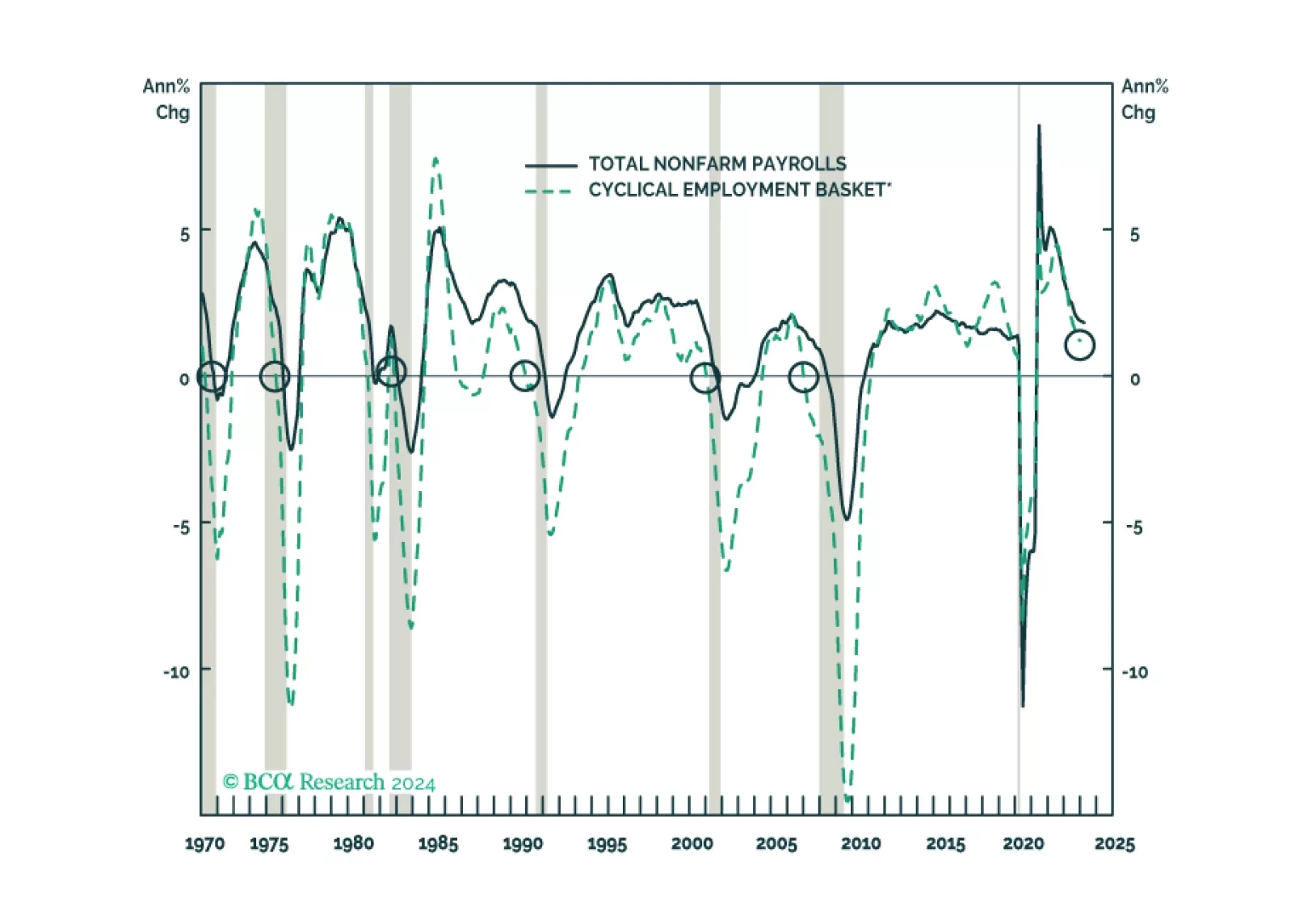

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

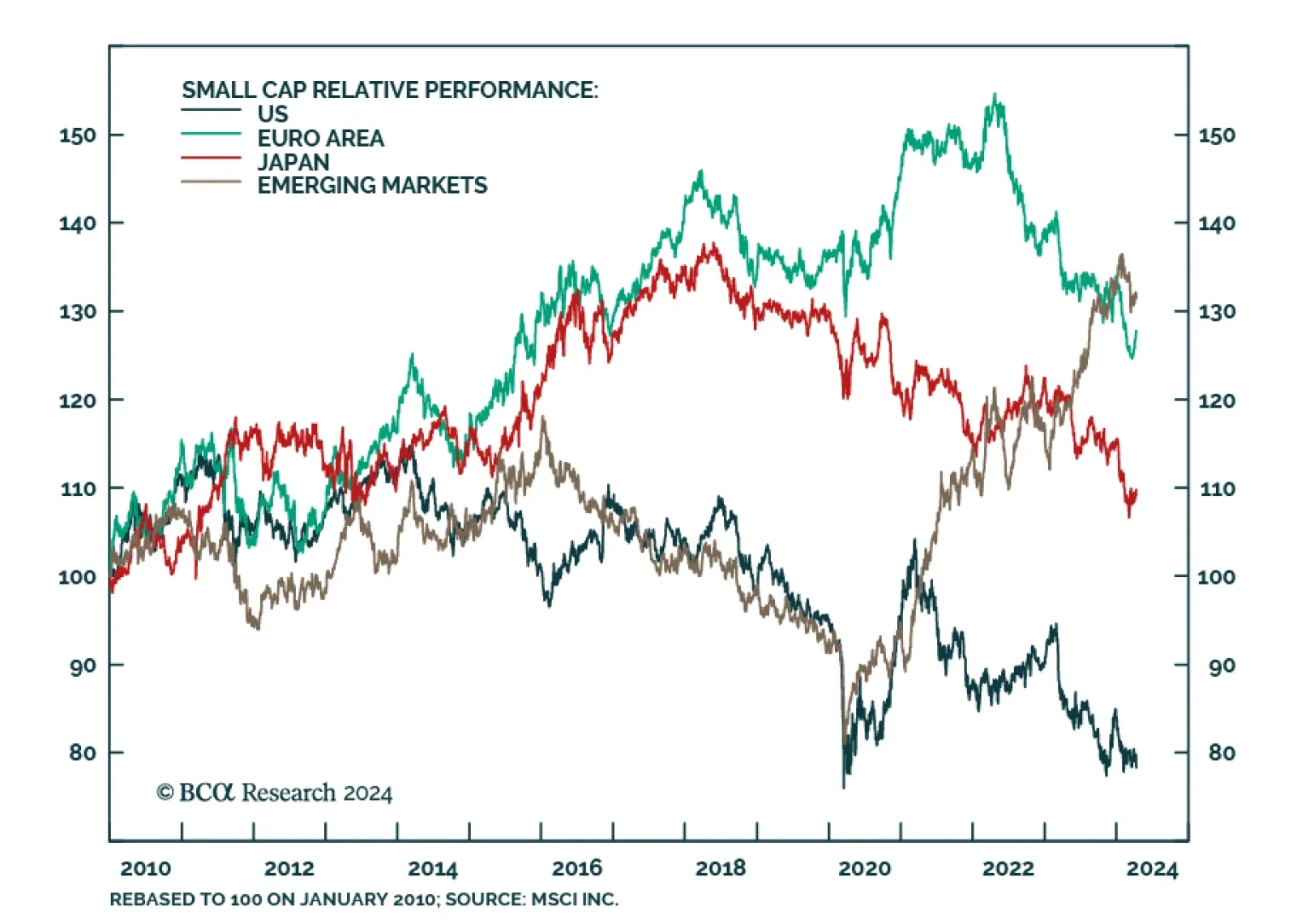

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

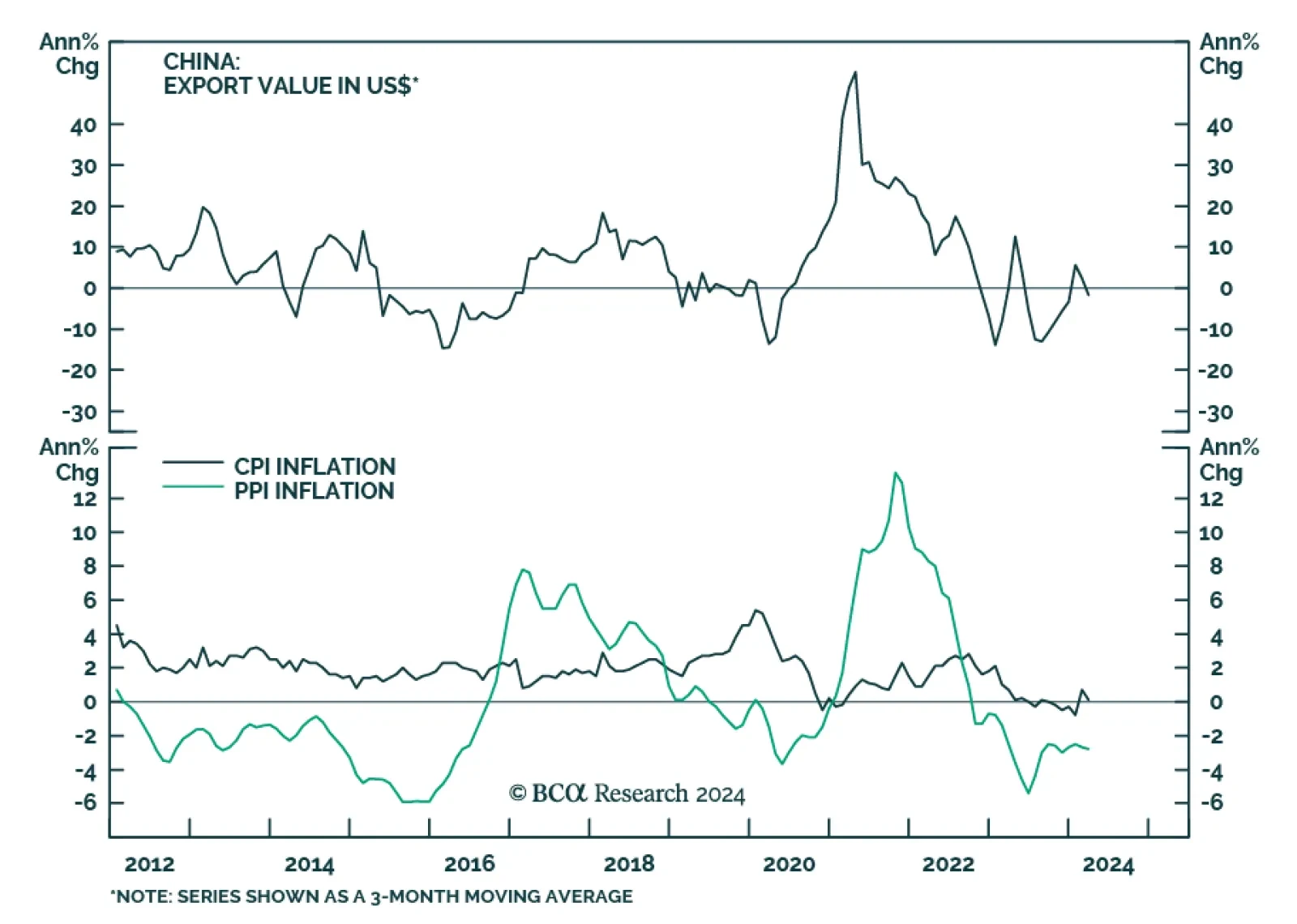

Chinese trade and credit data delivered a negative surprise for March. On the trade front, the 7.5% y/y drop in exports came in below expectations of a 1.9% y/y decline following four consecutive months of growth. While the jump…

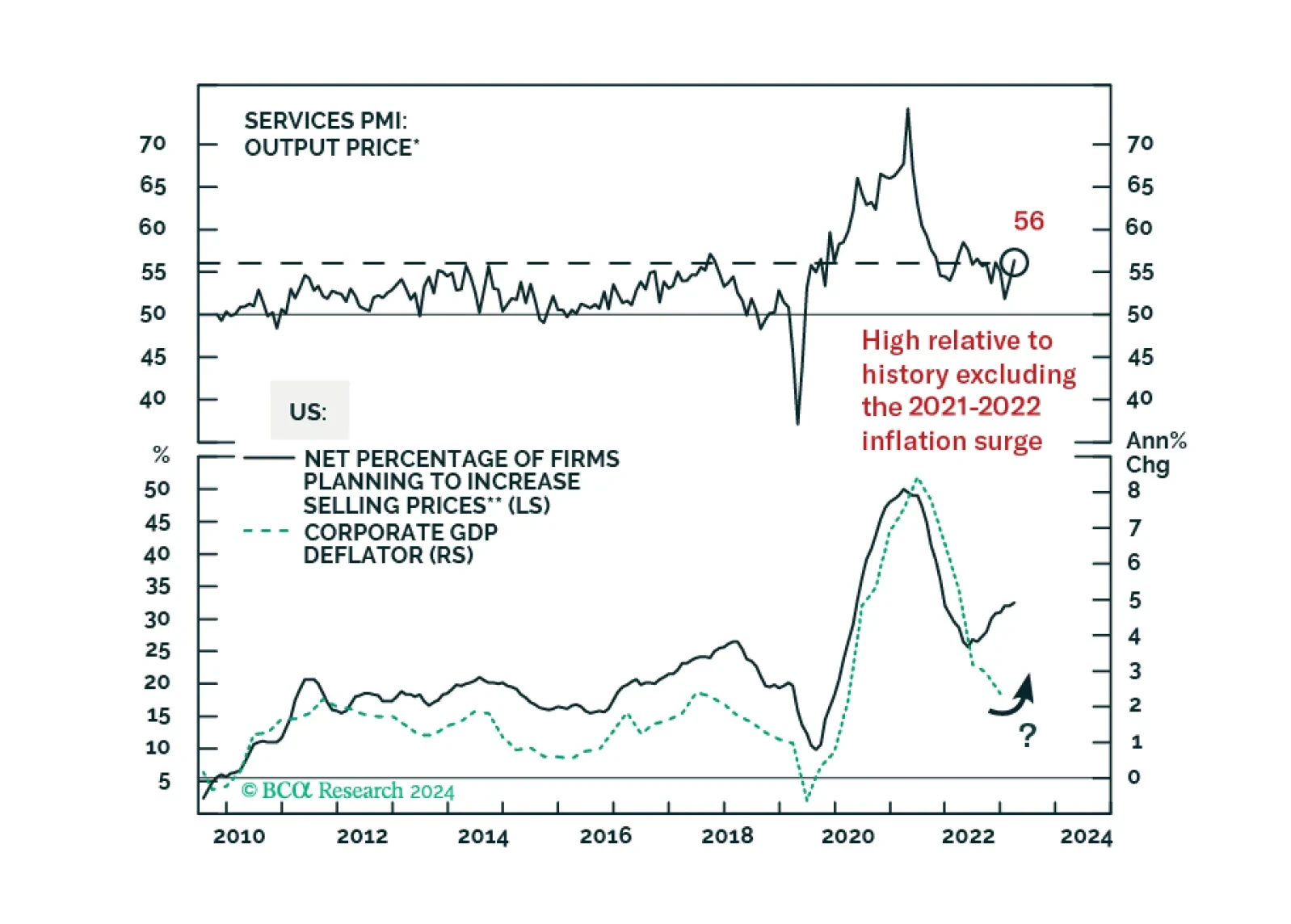

According to BCA Research’s US Equity Strategy service, rising inflation benefits Utilities, Energy, and Materials, and is a headwind for the Consumer Discretionary sector. After a protracted bout of underperformance,…

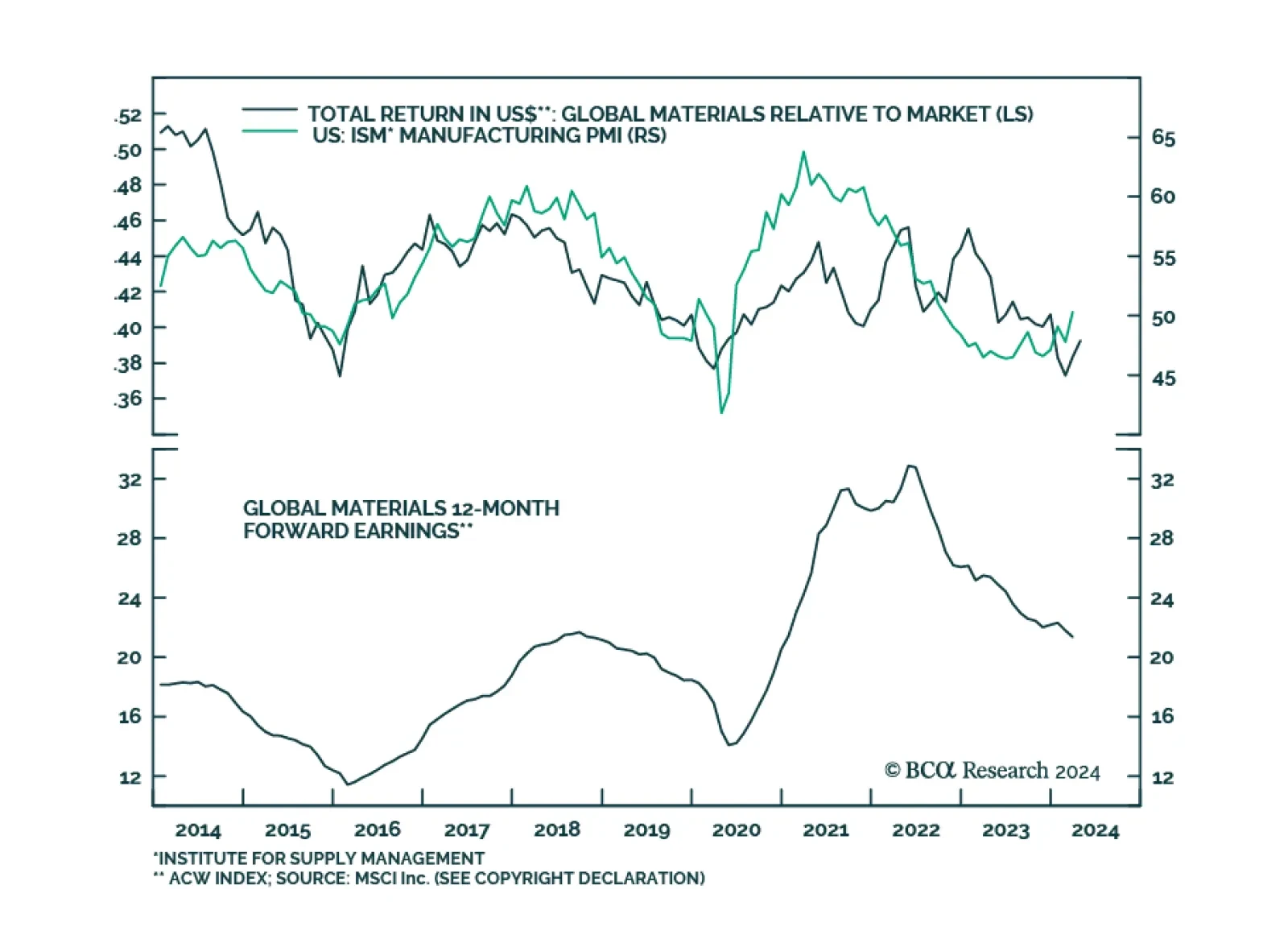

Global material stocks have underperformed over the past 12 months, returning only 11.3% vs 21.4% for the overall market. But could they be a buy now? There are several arguments to argue that they will: The ISM has…

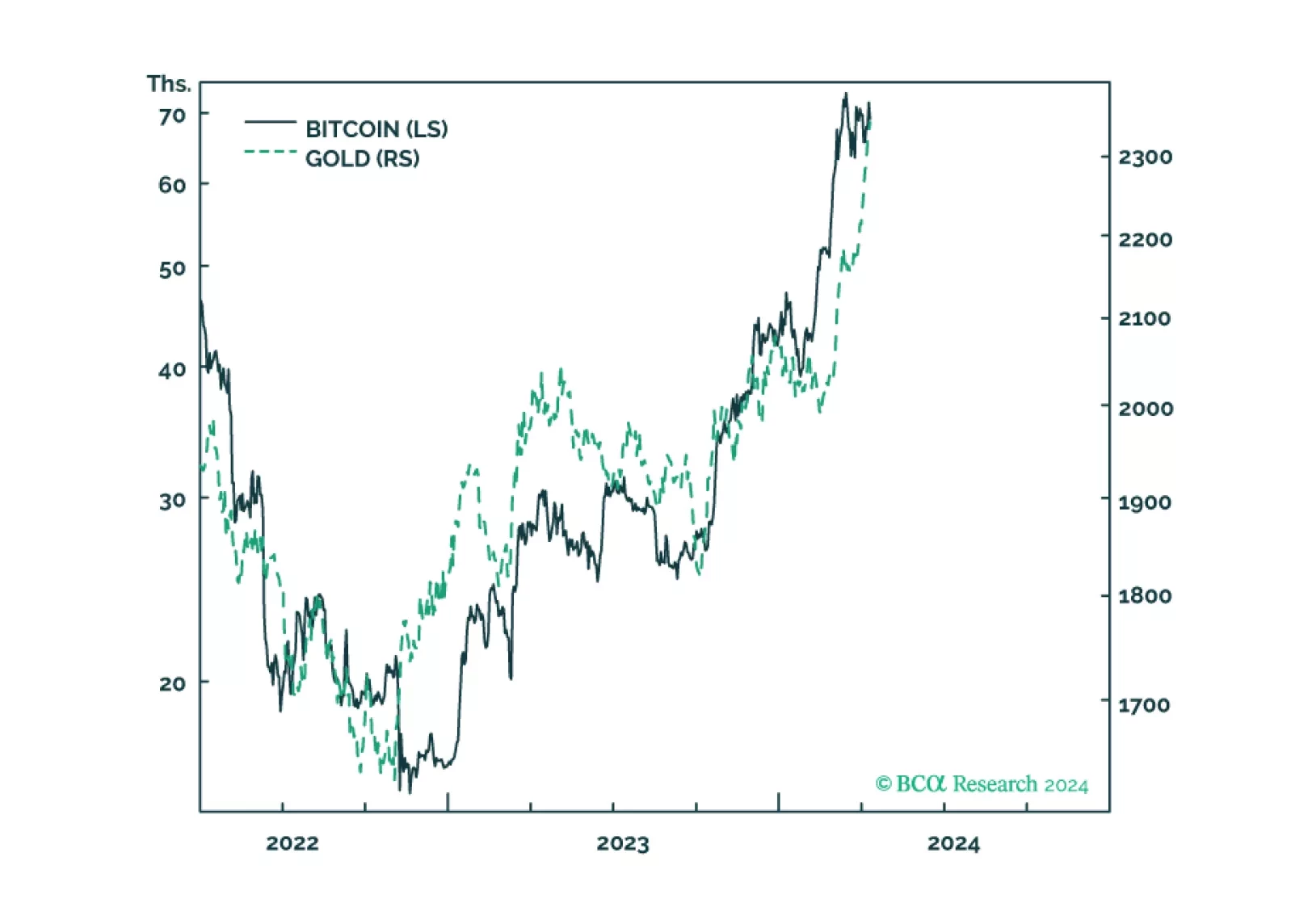

Gold and bitcoin are conceptually joined at the hip because the value of both comes from their ‘non-confiscatability’ by inflation, by bank failure, and in the case of bitcoin, by state expropriation. The sharp recent rallies in both…

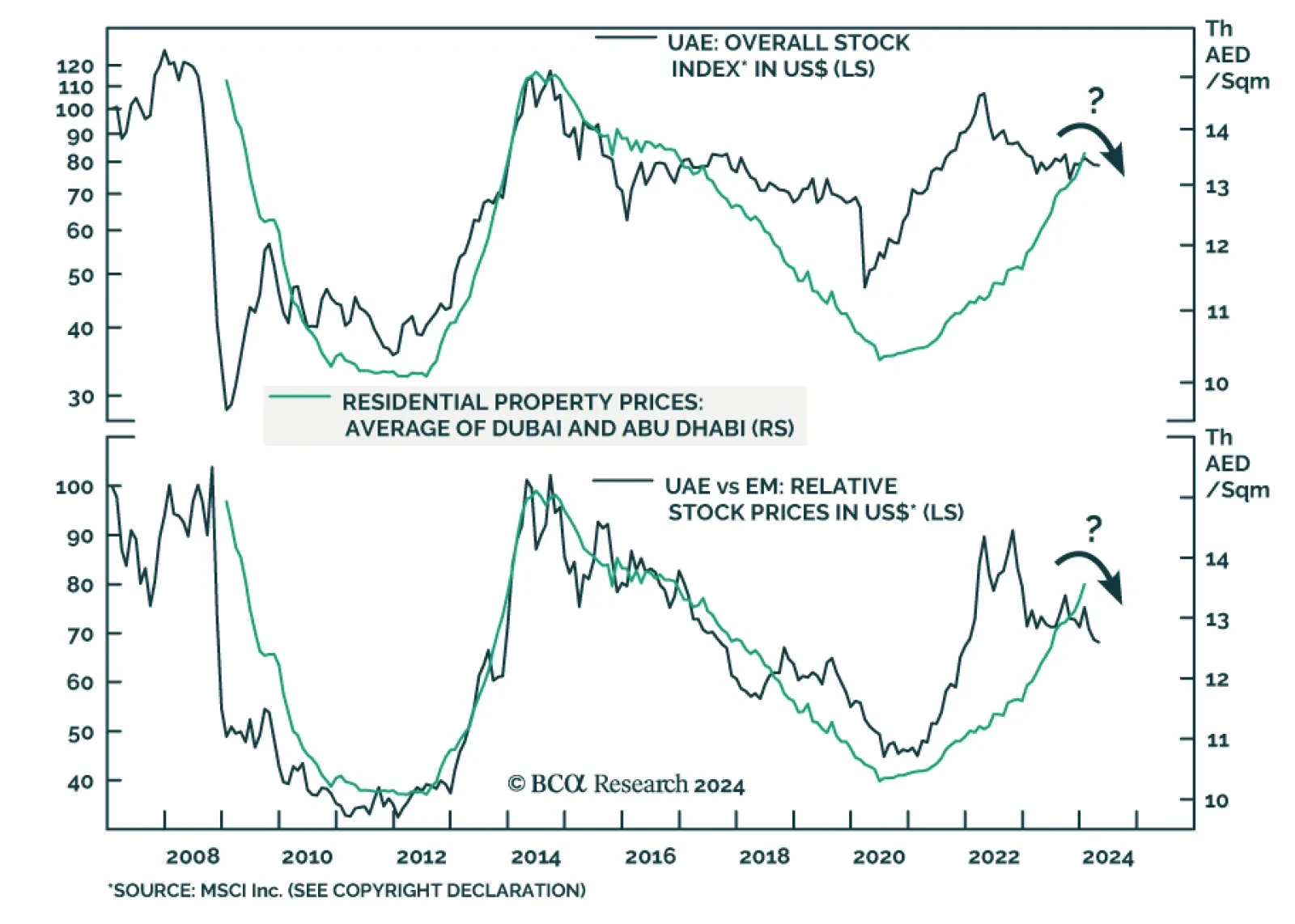

According to BCA Research’s Emerging Markets Strategy service, peaking property prices will remove the sole tailwind behind the Emirati Stock Market. Over the past couple of years, the Emirati stock market has been…