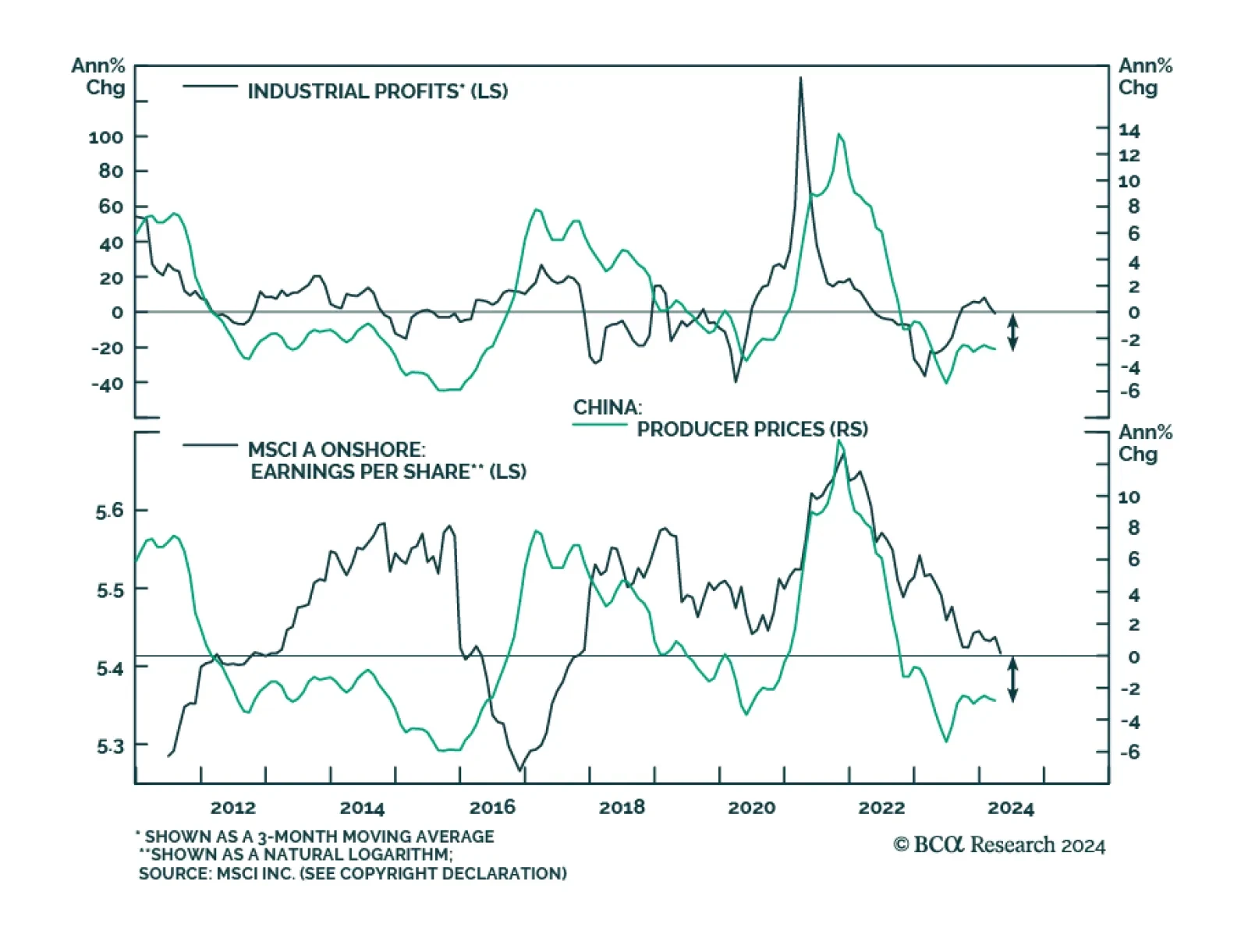

Chinese investable stocks have rallied on a combination of investors’ hopes for stimulus, revival in the global manufacturing cycle and cheap valuations. The MSCI China index and the Hang Seng have both gained close to 15%…

The broad market took a significant step backward in April, as market jitters gripped investors, stoking fears of higher for longer monetary policy. However, our roundtable investor poll has demonstrated that the majority remain…

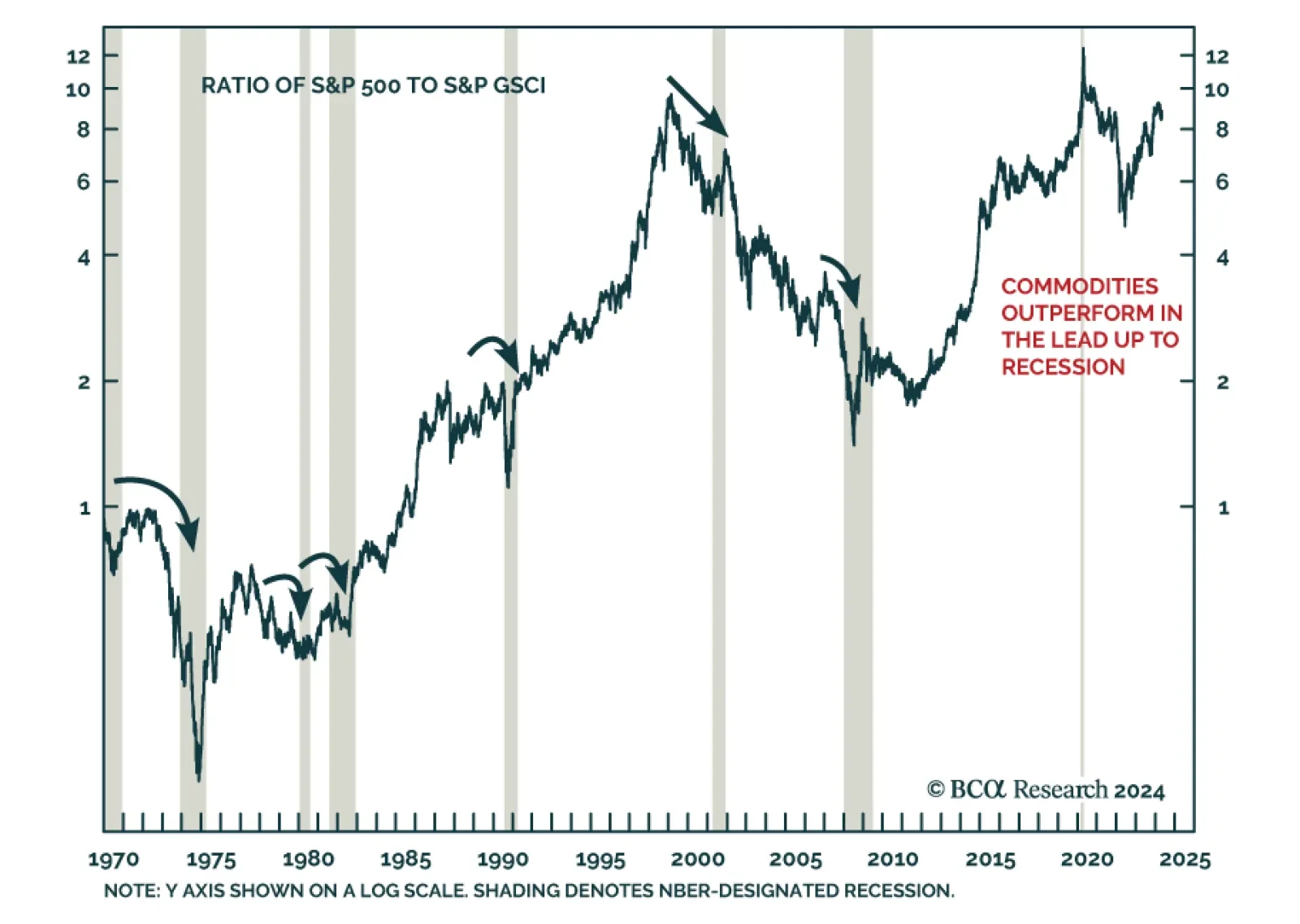

According to BCA Research’s Commodity & Energy Strategy service, commodity prices typically rally toward the end of the business cycle. In the past six recessions, the S&P 500 peaked before commodity prices.…

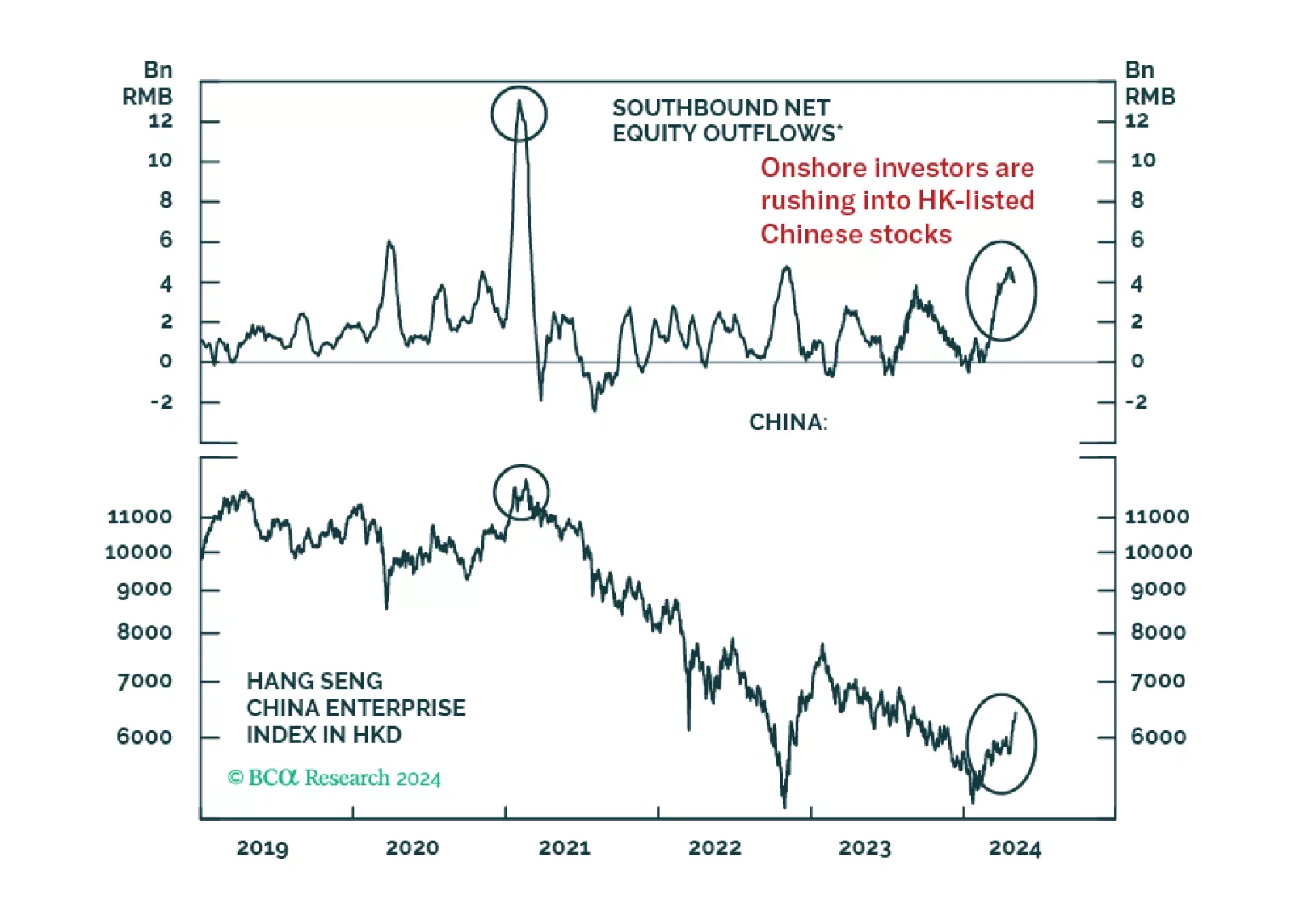

Mainland residents’ investments in gold, other metals, and Hong Kong-traded stocks are a form of capital outflow. Chinese authorities will counter any excessive capital flight with stricter administrative controls. Thus, markets…

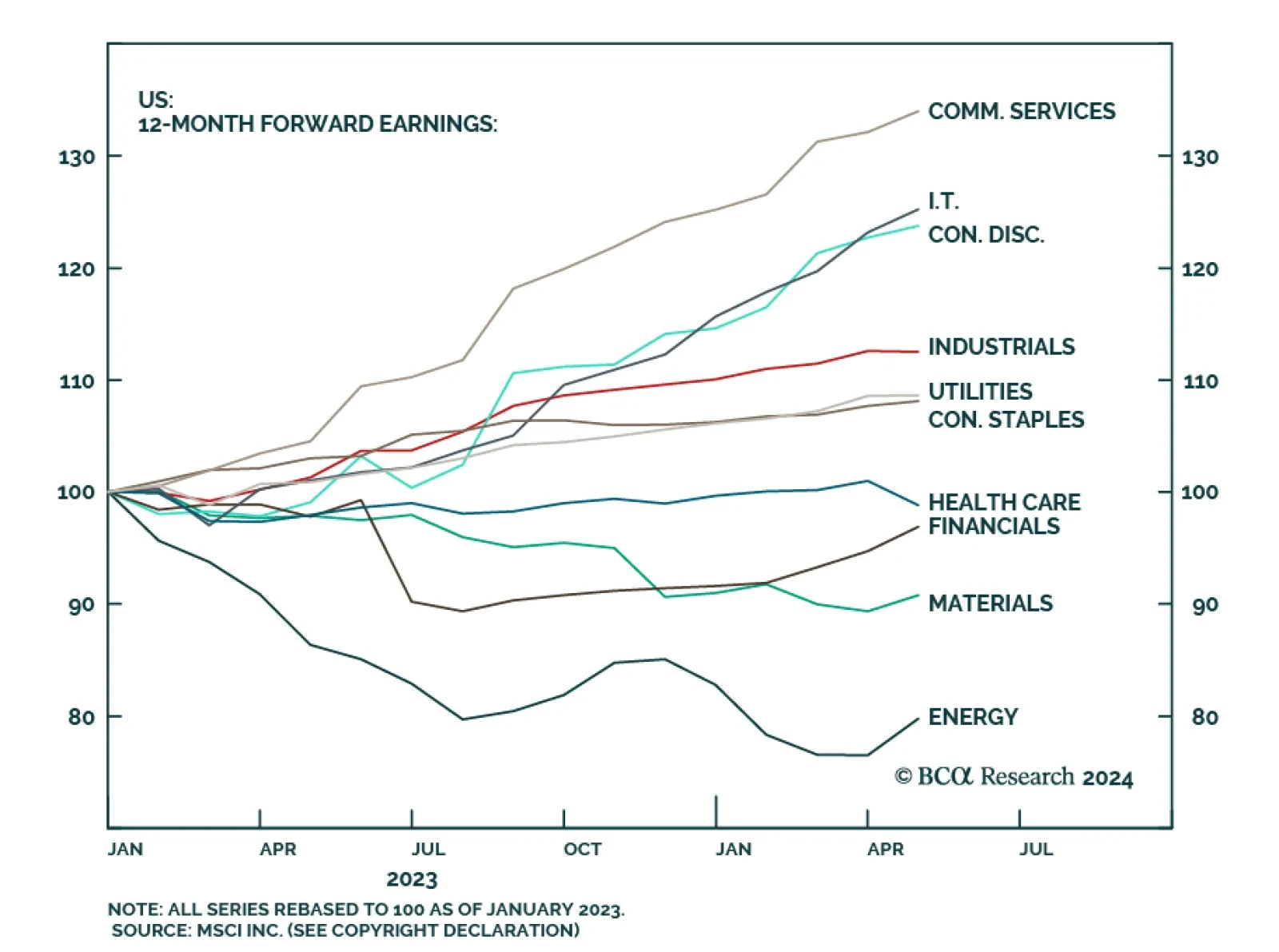

After underperforming in 2022, I.T., Consumer Discretionary and Communication Services – the three sectors encompassing America’s largest tech companies – have rallied by 61.3%, 41.4% and 73.7%, respectively,…

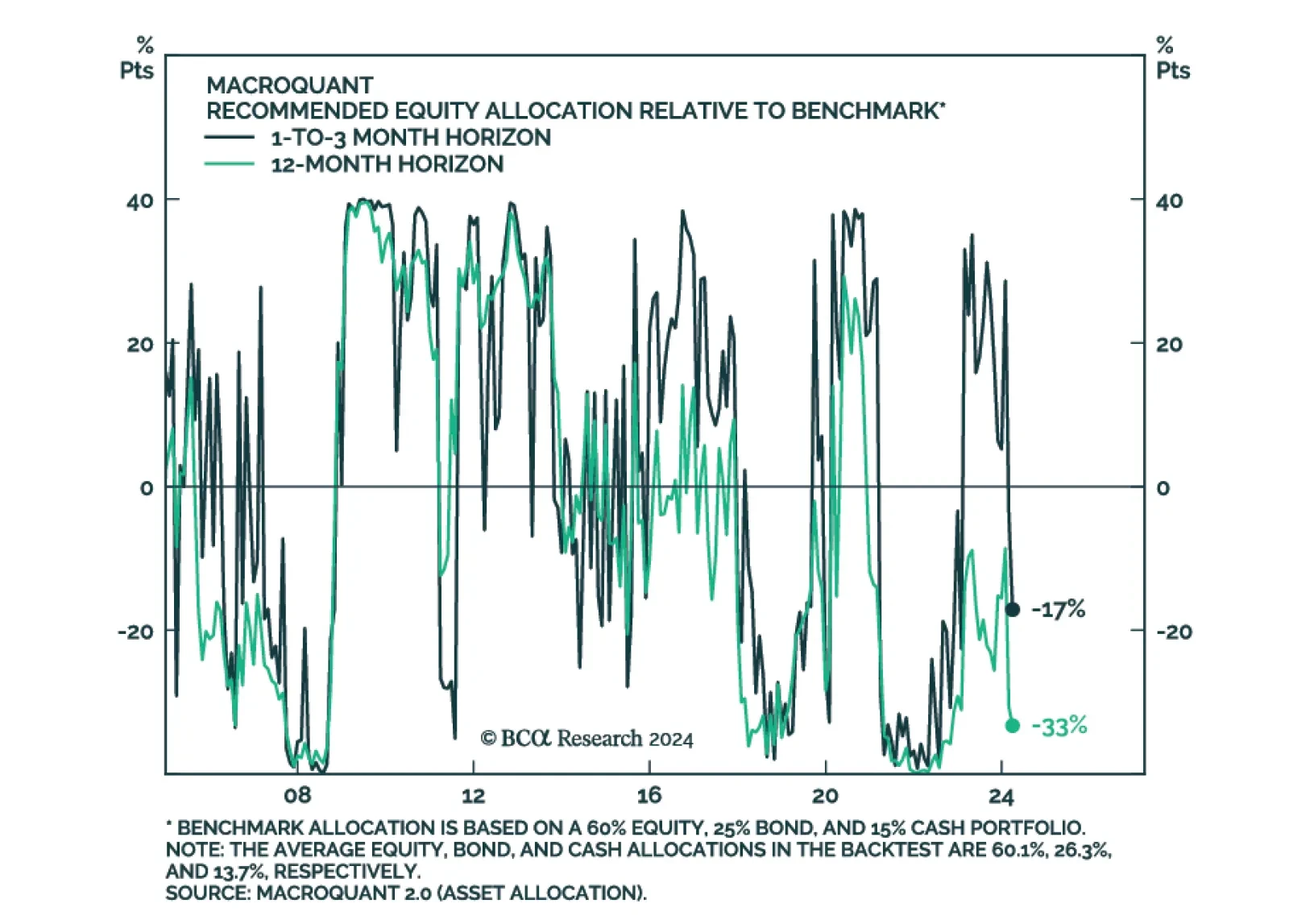

In its latest report, BCA Research’s Global Investment Strategy service provides an update on its MacroQuant model. The overall equity score declined in April, finishing the month at the 29th percentile, which is enough to…

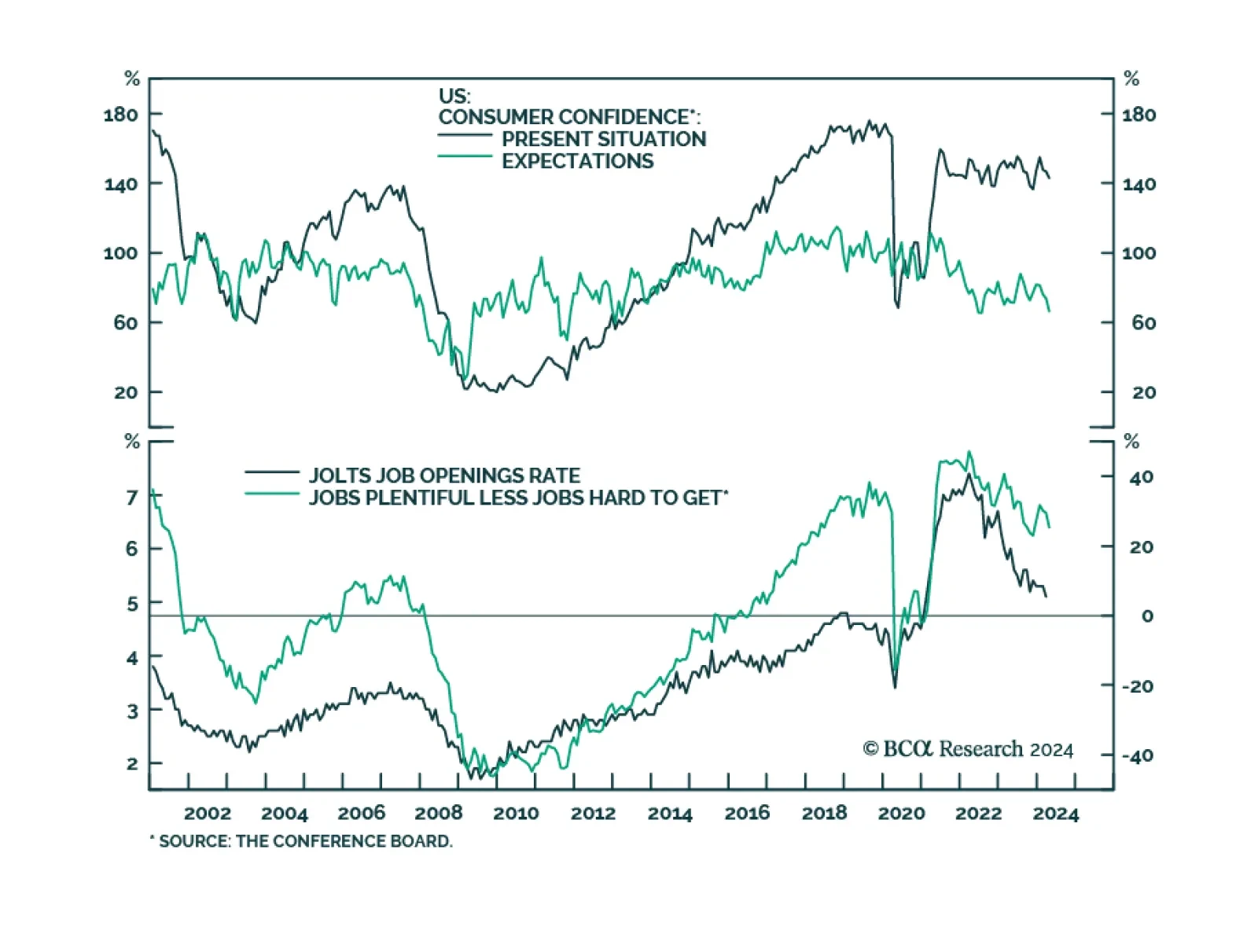

The Conference Board’s gauge of consumer confidence largely disappointed in April. 3.9- and 7.6-point decreases in the Present Situation and Expectations subcomponents, respectively, drove the overall index to a 22-month…

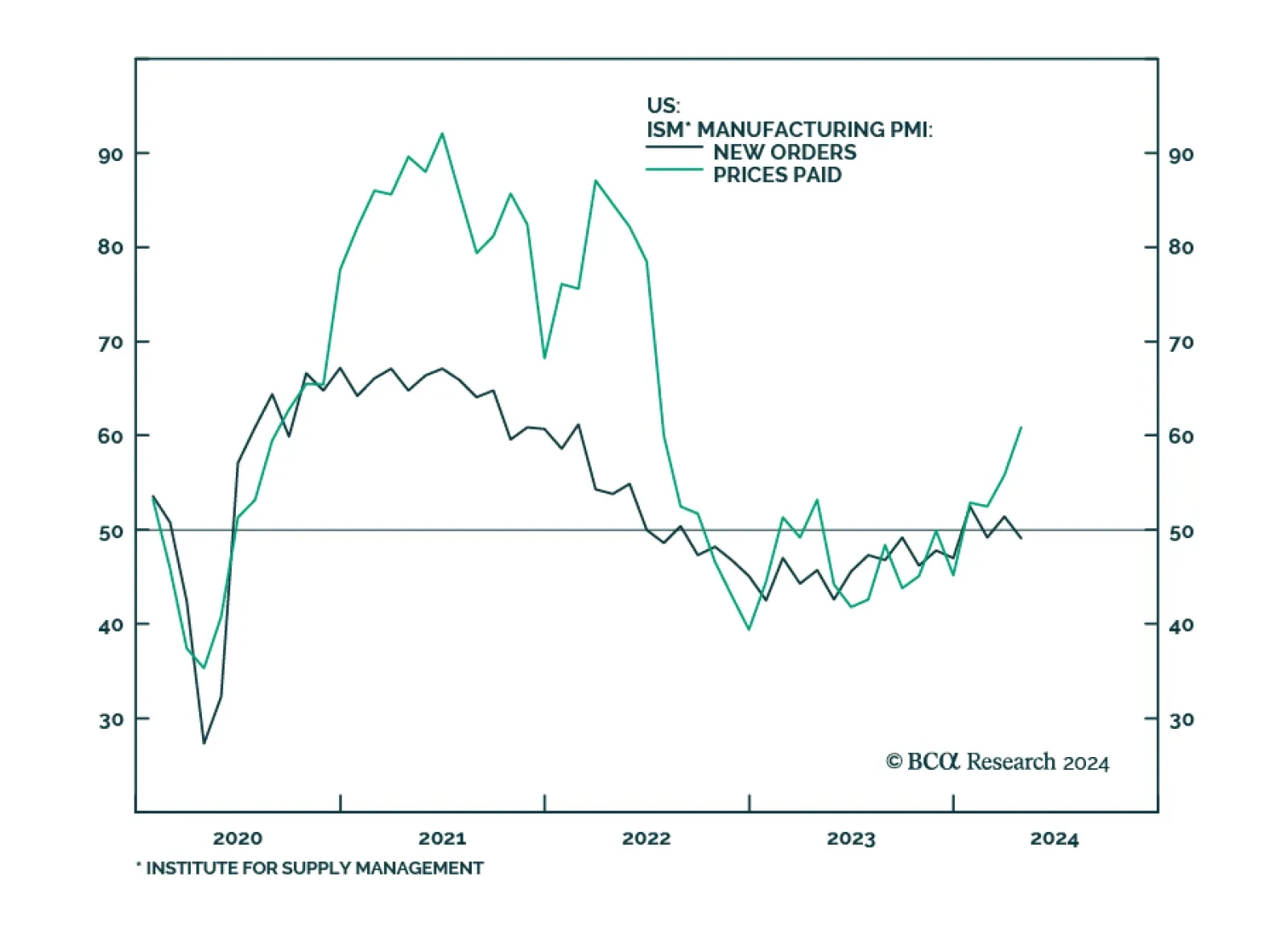

After briefly breaking a 16-month contraction streak, the ISM Manufacturing PMI dipped back below the 50.0 boom-bust line in April. It decreased from 50.3 to 49.2, disappointing expectations of 50.0. Notably, measures of…

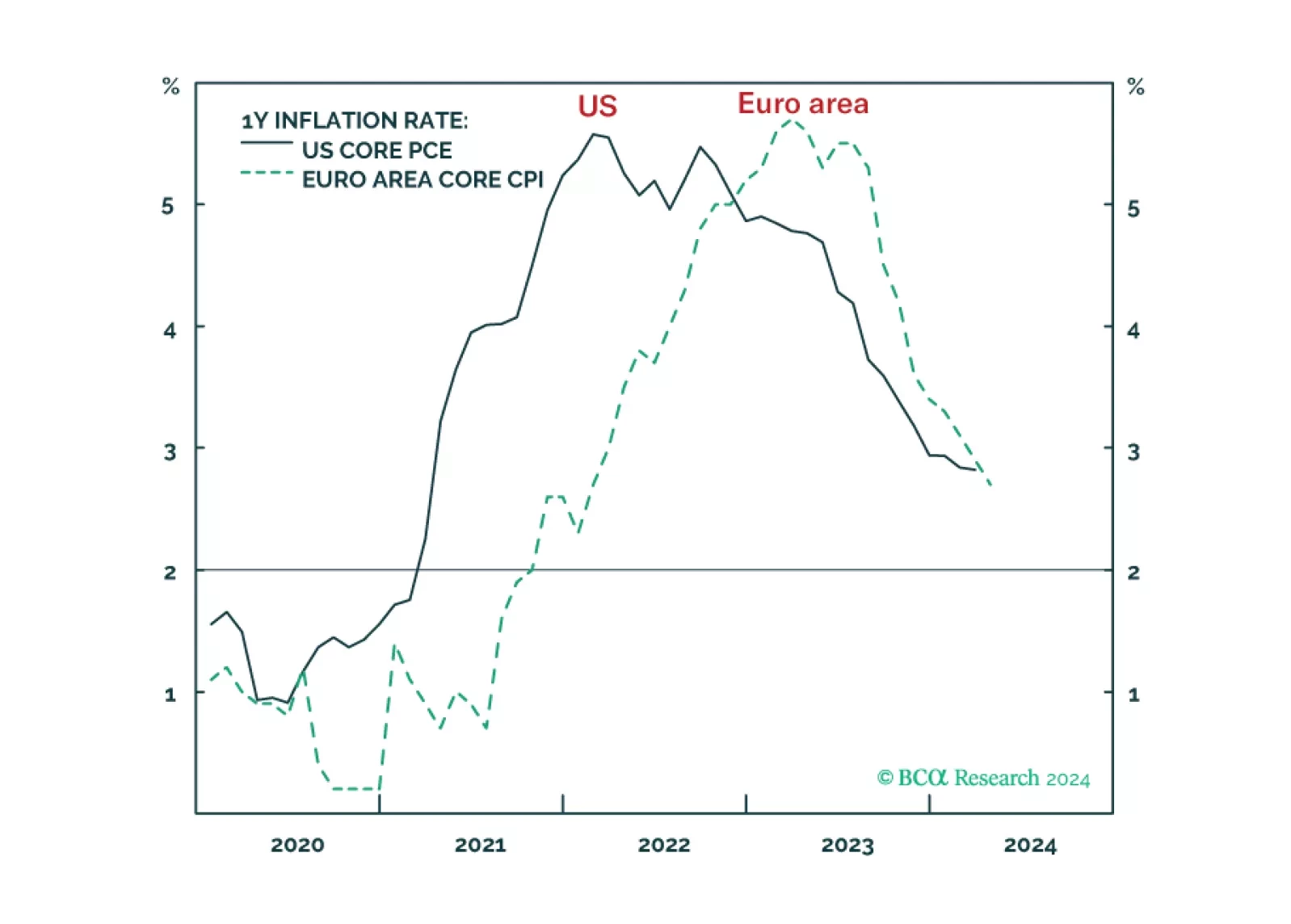

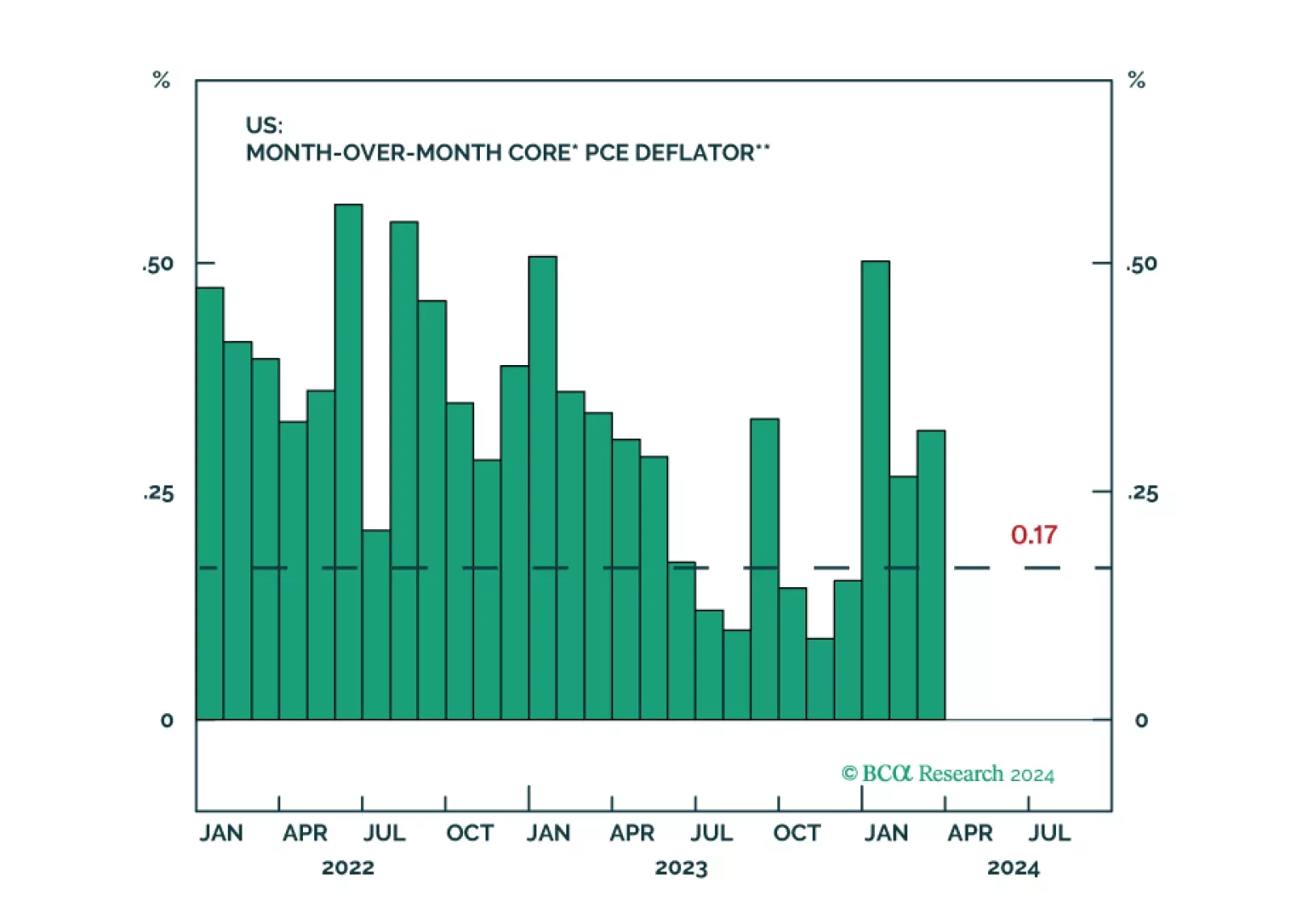

Wild hopes for US rate cuts got shattered, exactly as we predicted. But given the different incentives that the Fed and ECB now face, the relative pricing between the Fed and the ECB could widen further in the coming months. We…

Central banks are in a dilemma whether to prioritize supporting growth or bringing inflation back to target. This is unlikely to end well. Investors should be defensively positioned.