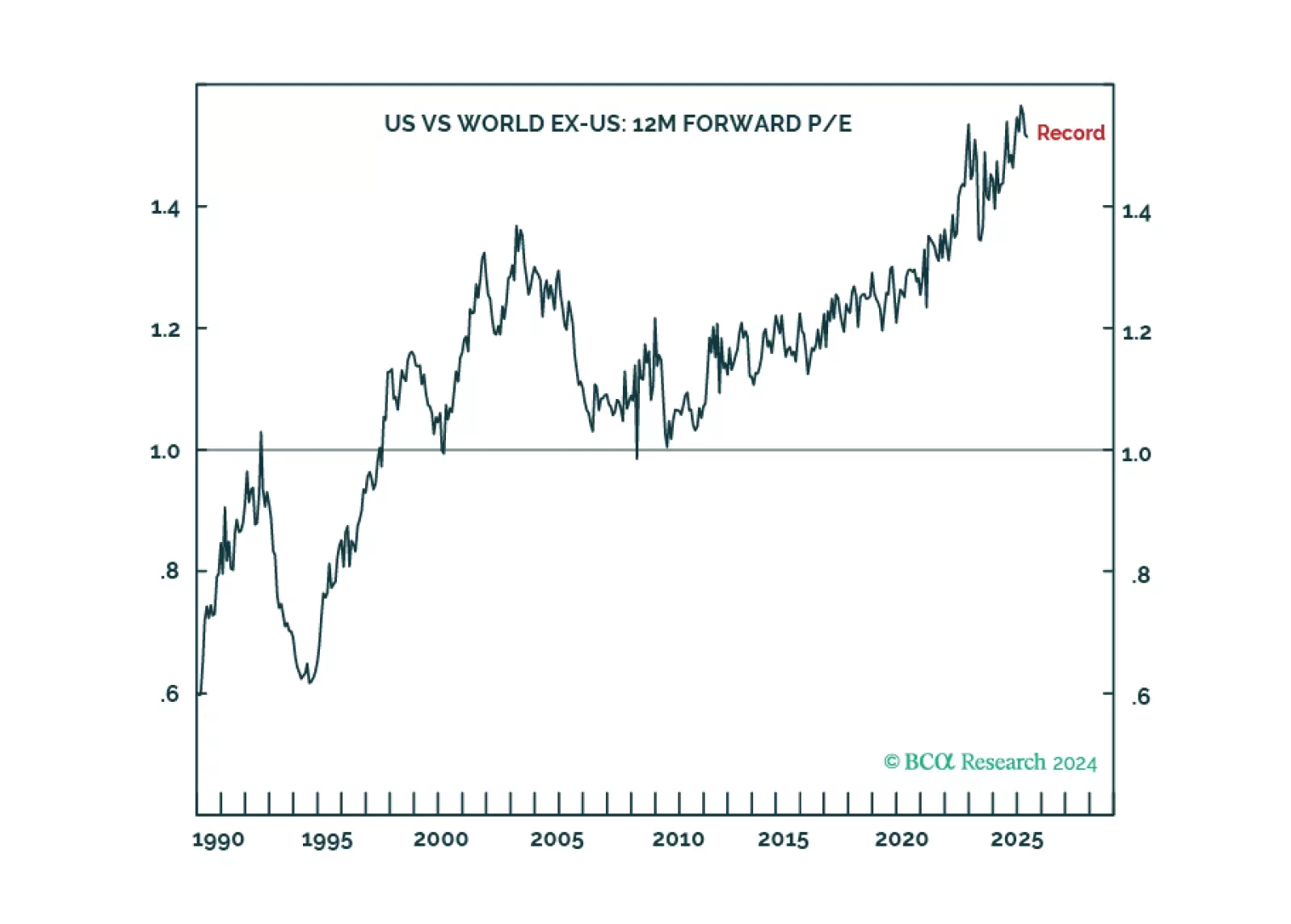

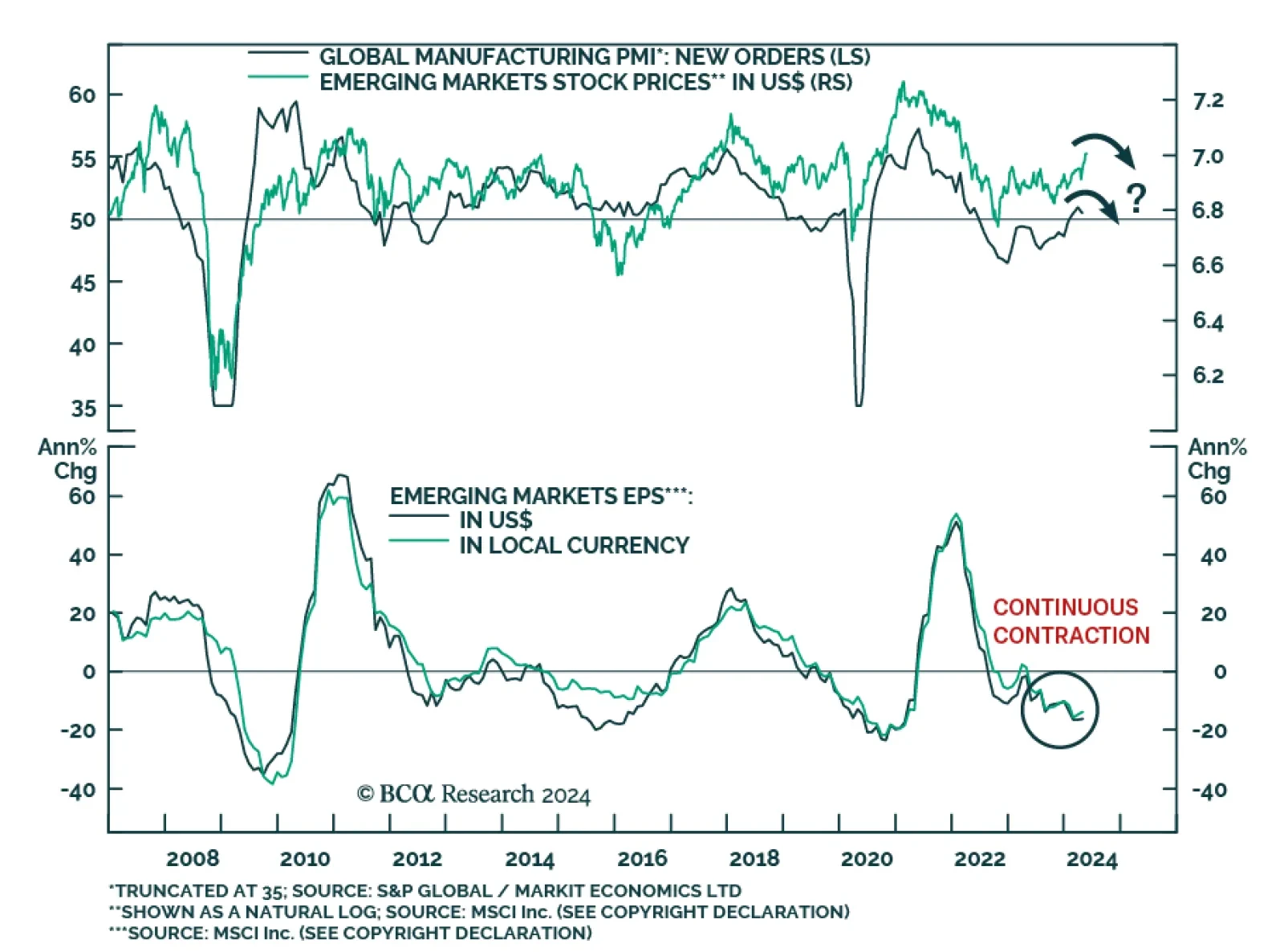

Emerging market stocks have outperformed their global counterparts by 4 percentage points in USD terms since February according to MSCI indices. They have gotten a boost from the bounce in the global manufacturing cycle. The MSCI…

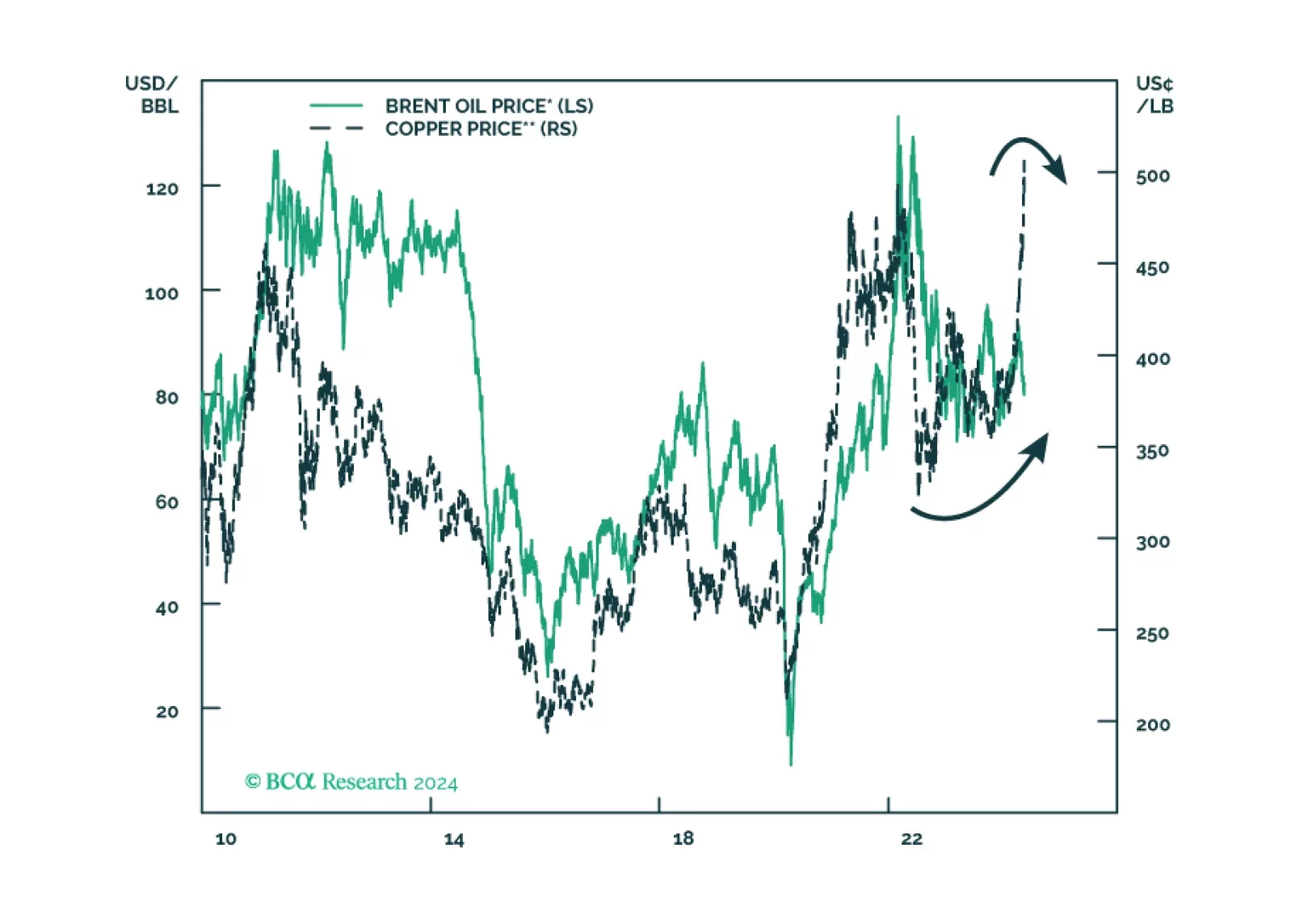

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

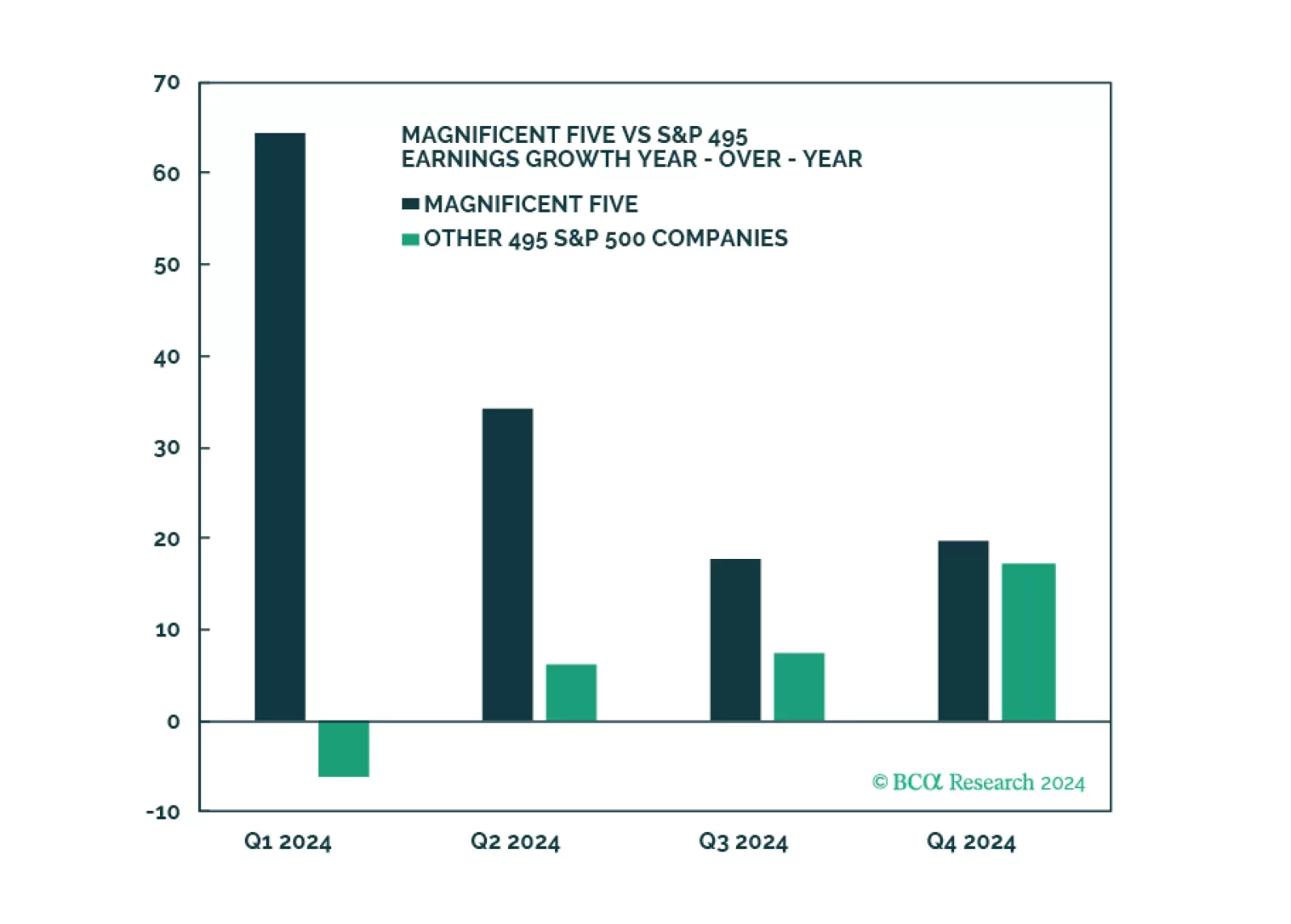

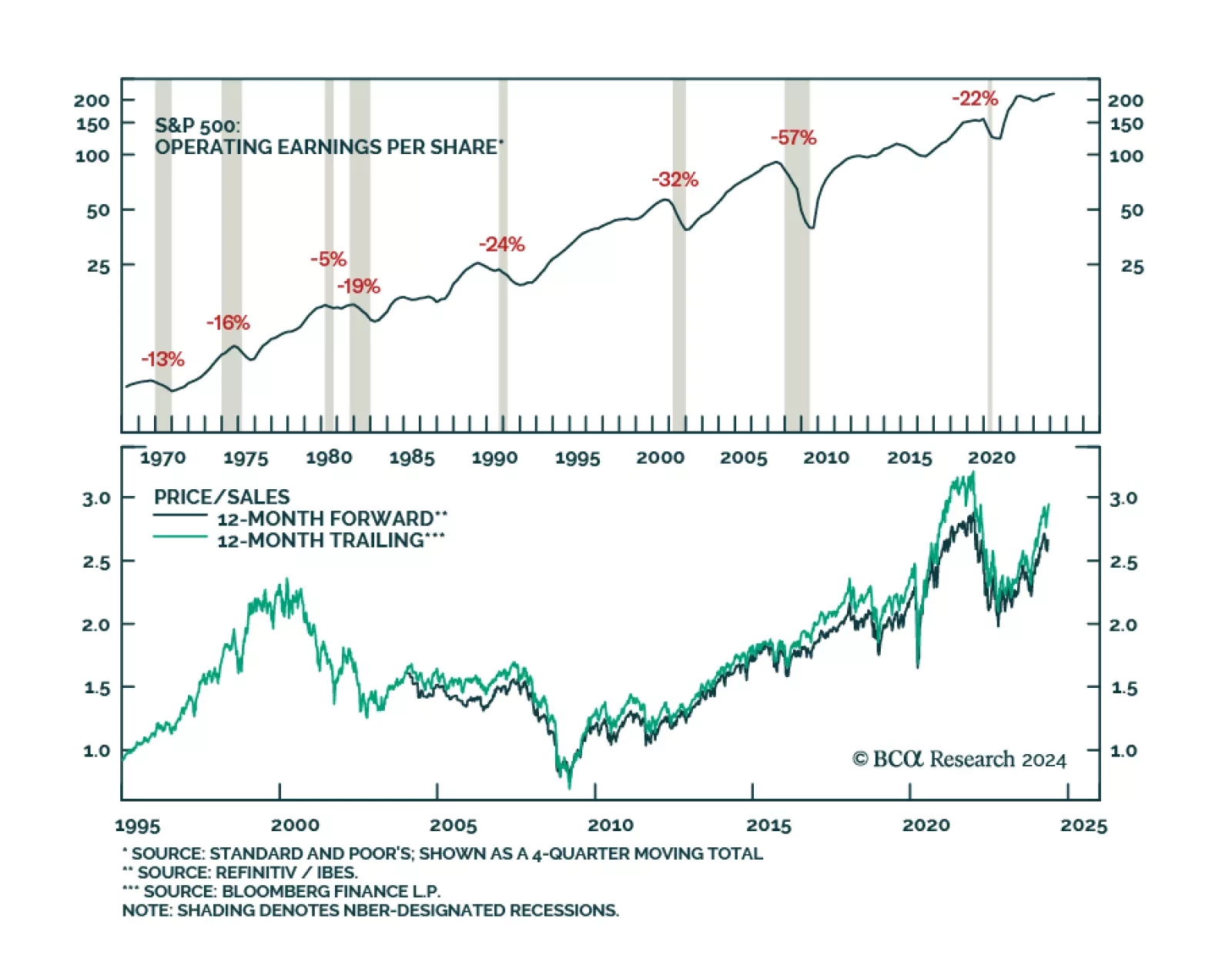

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

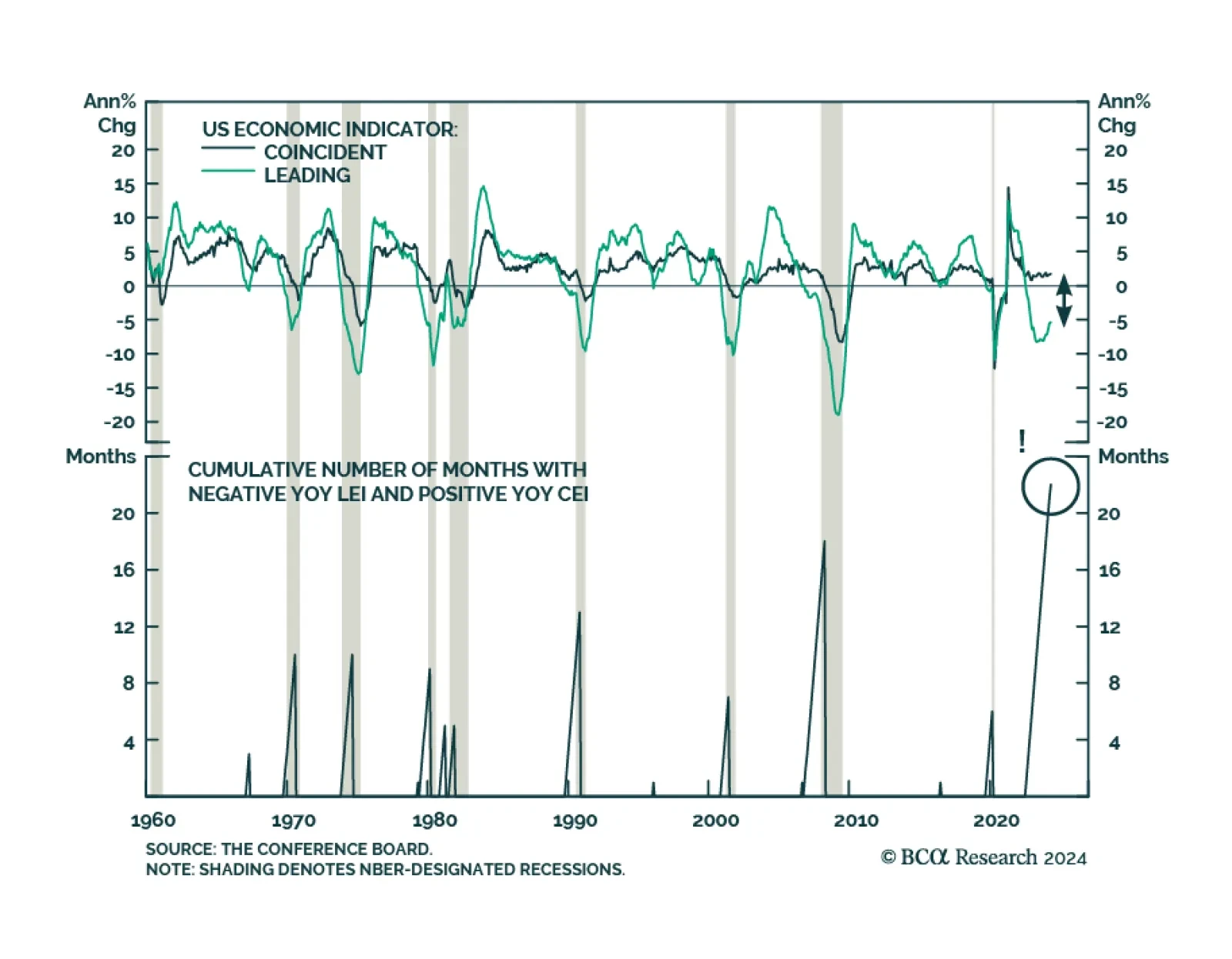

An adverse shock is not a recession prerequisite. The empirical record shows that the US economy regularly evolves its way into a contraction with little fanfare. If current cooling trends continue, we project a recession will…

The Conference Board US Leading Economic Index (LEI) declined by a larger-than-expected 0.6% m/m in April from 0.3% m/m. Deteriorating consumer sentiment and manufacturing new orders led the overall decline. Contractions in…

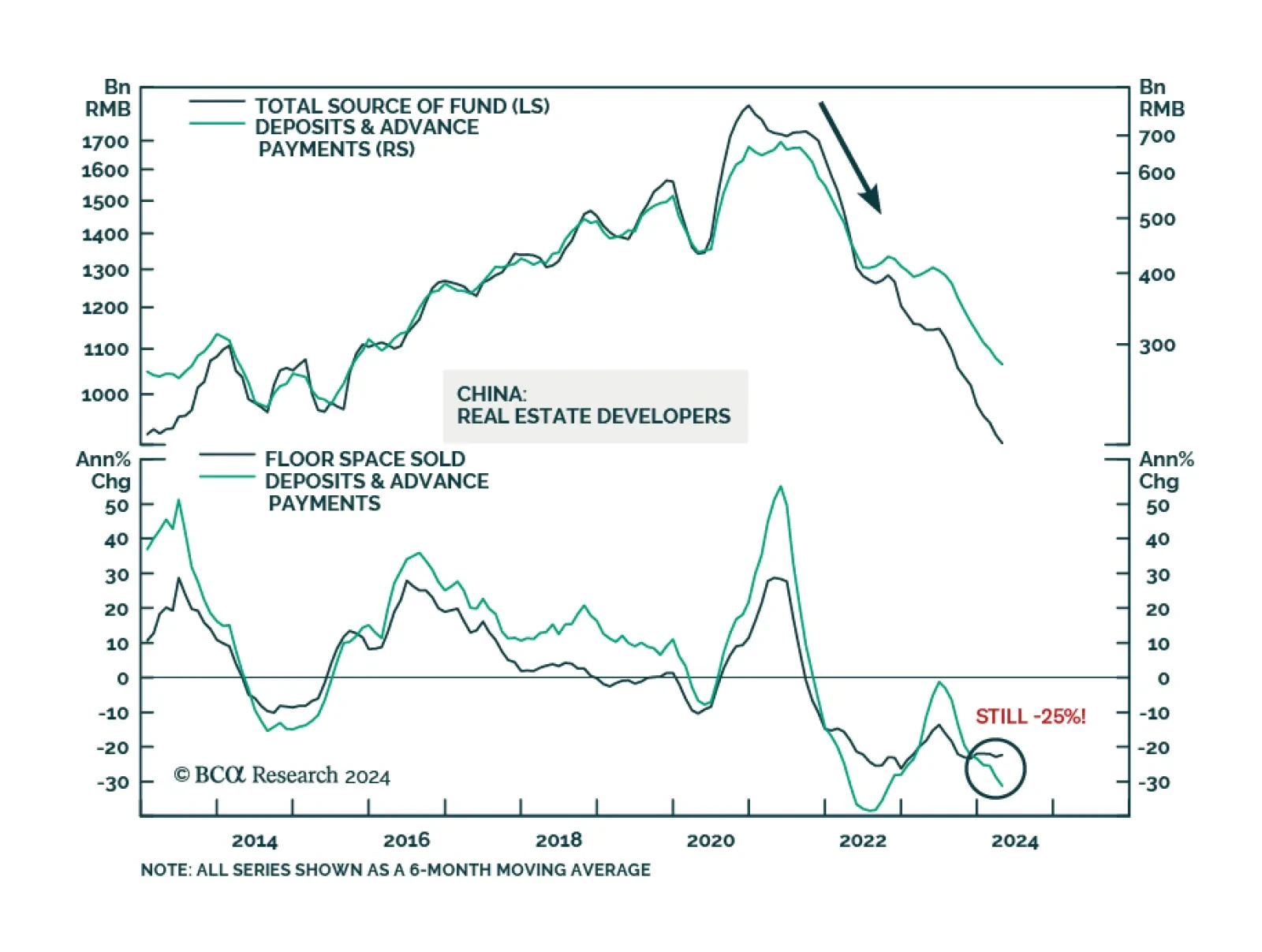

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

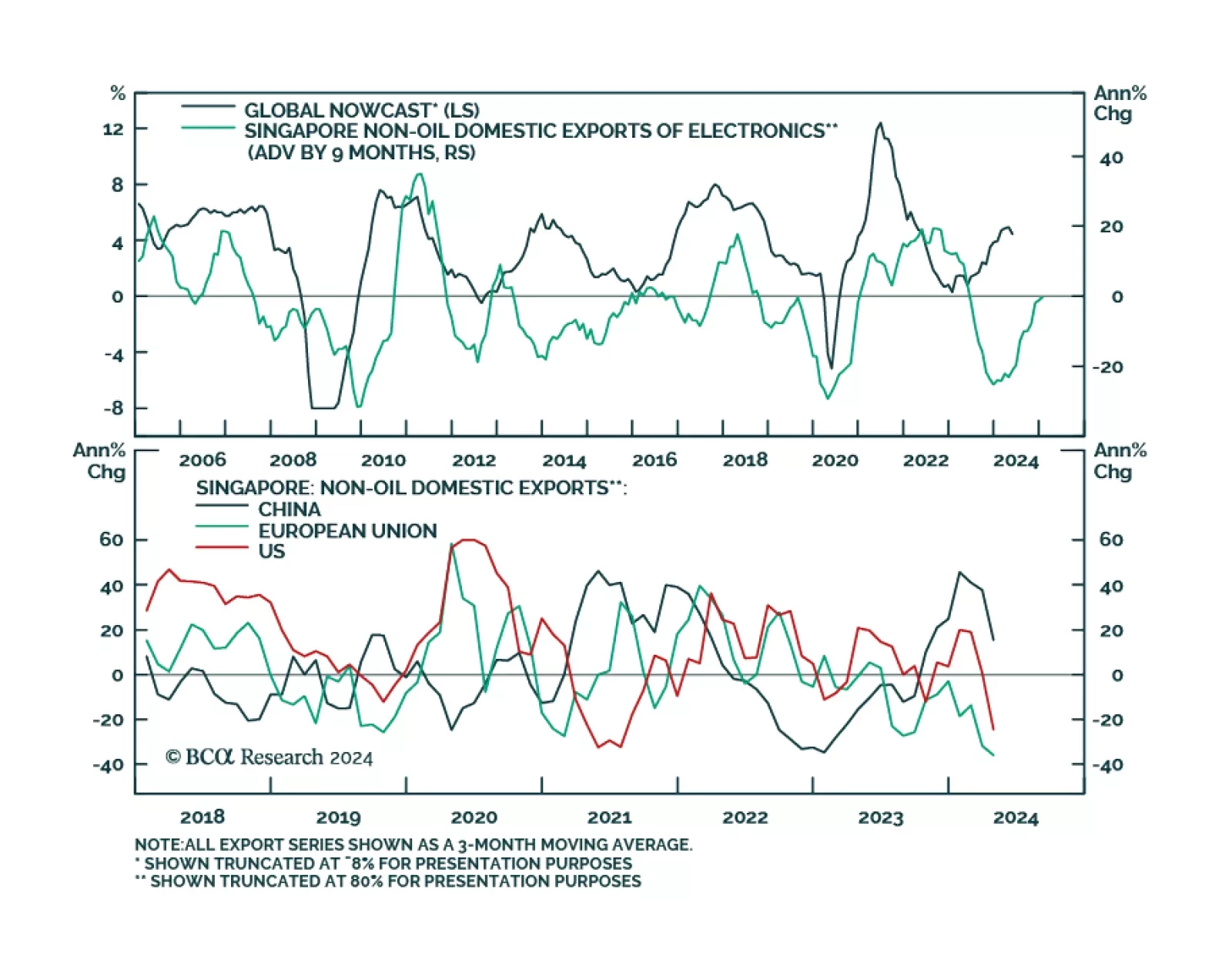

Export dynamics from small open economies are bellwethers for global trade and recent export data out of Taiwan and South Korea suggested robust global growth momentum in March. In April, Singapore’s electronics exports…

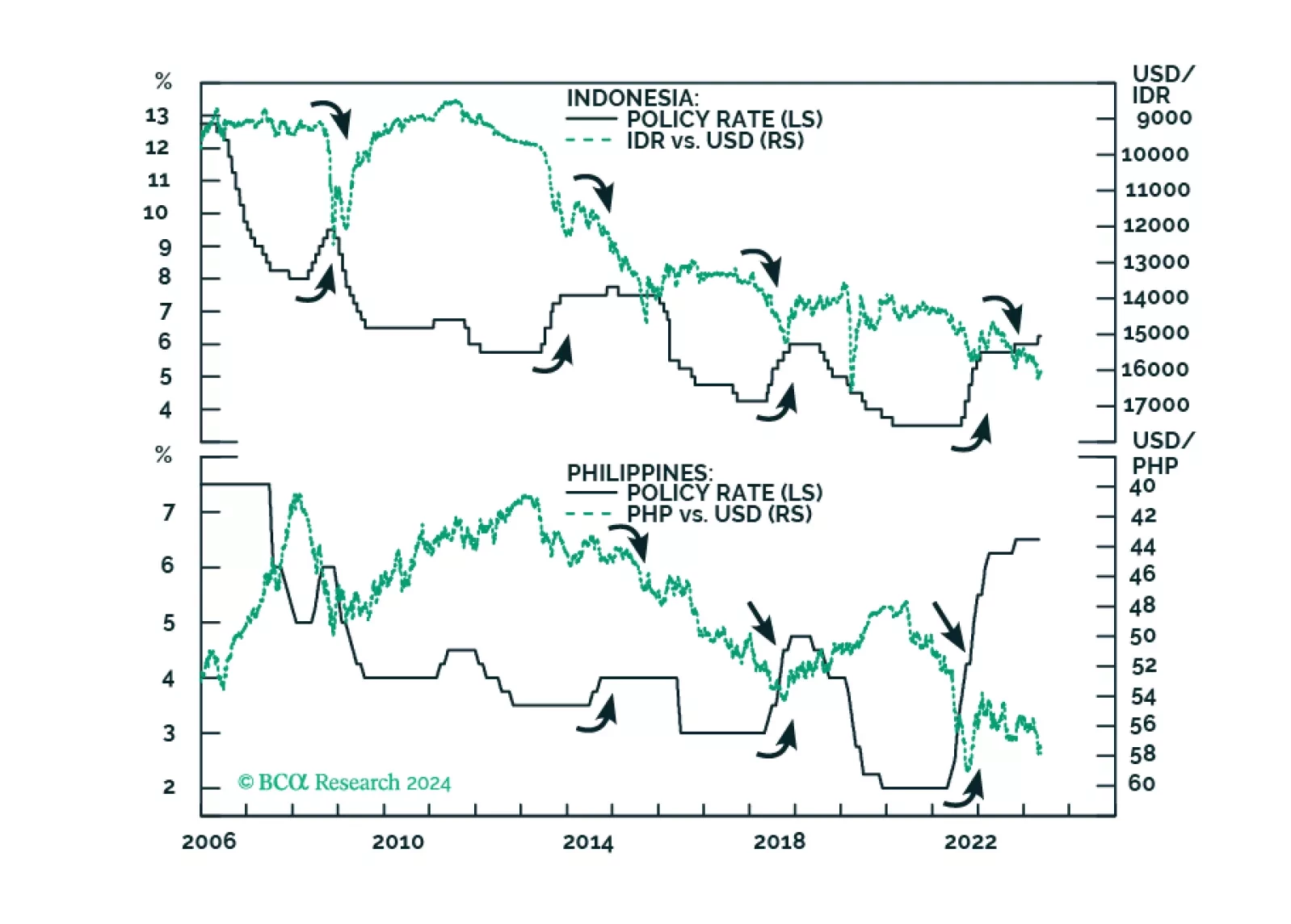

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

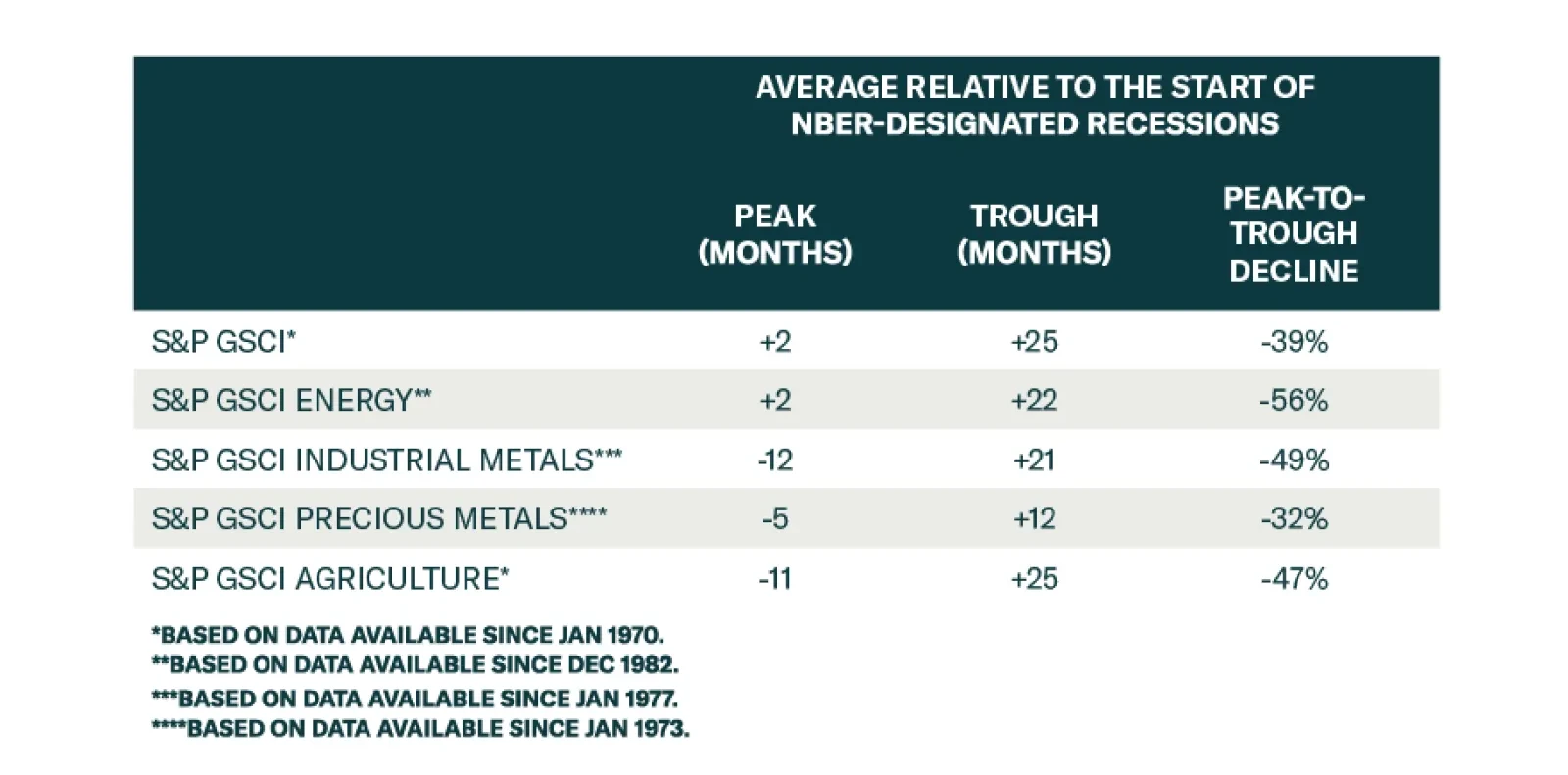

According to BCA Research’s Commodity & Energy Strategy service, among the commodity groups, industrial metals provide the most reliable leading signal that the US economy is heading toward recession. Industrial metals…