Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

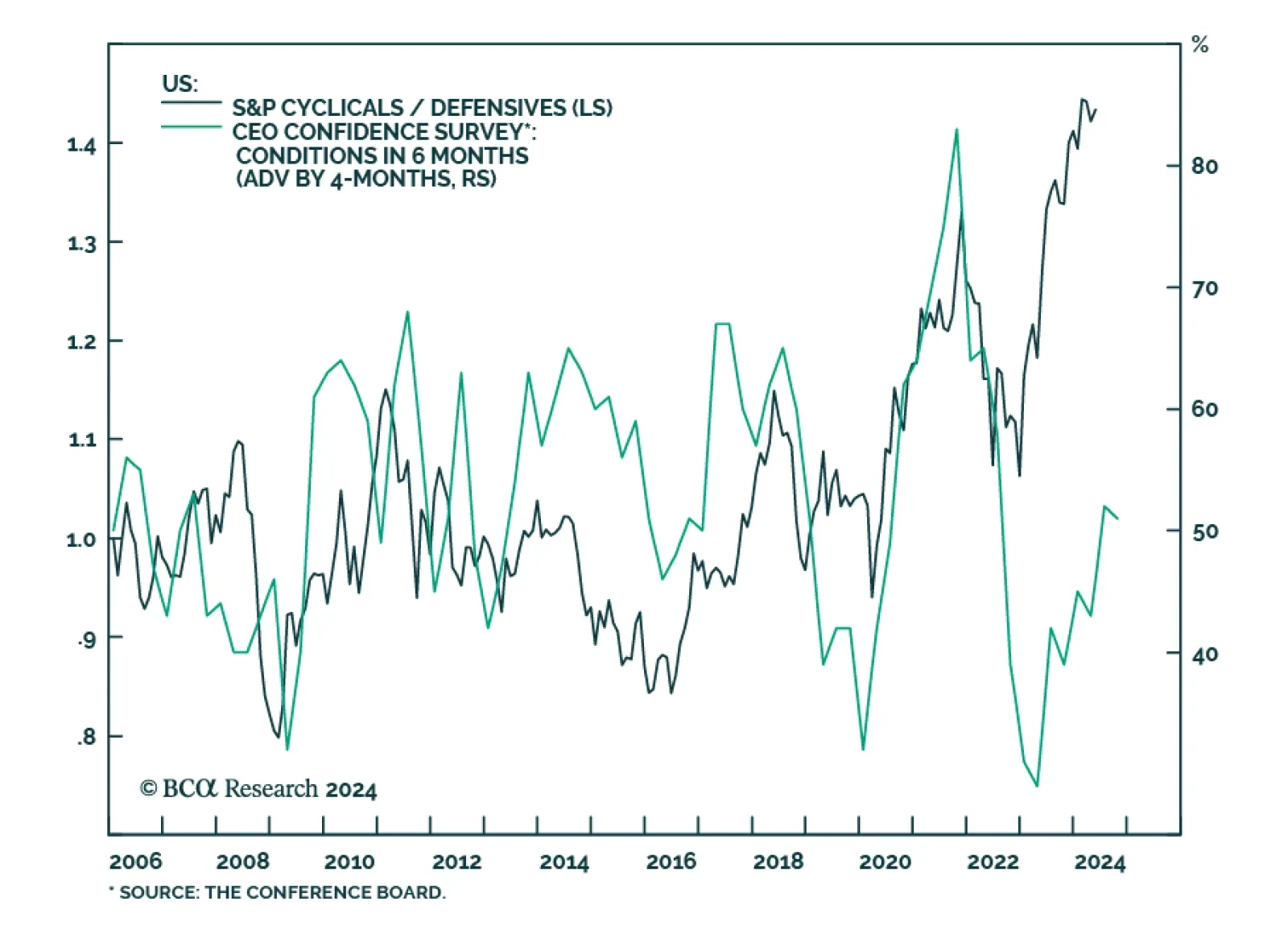

The Conference Board measure of CEO Confidence improved slightly in Q2, from 53 to 54. A reading above 50 indicates that optimistic perceptions of business conditions outweigh pessimistic assessments. The Q2 survey result marks a…

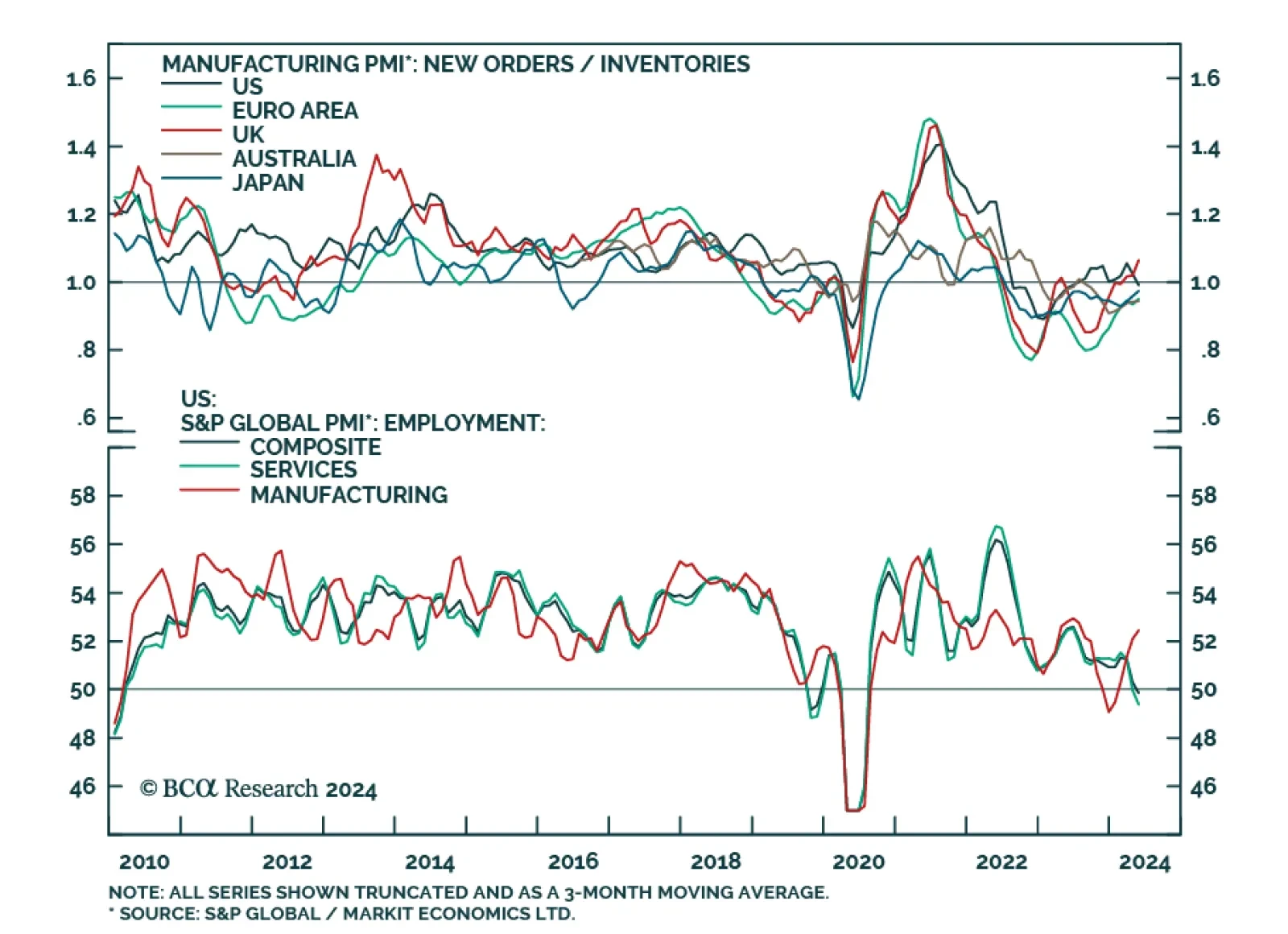

Preliminary estimates suggest that manufacturing activity generally improved across DM economies in May. Manufacturing PMIs for the US, the Eurozone, Japan and the UK all improved from their April levels. Notably,…

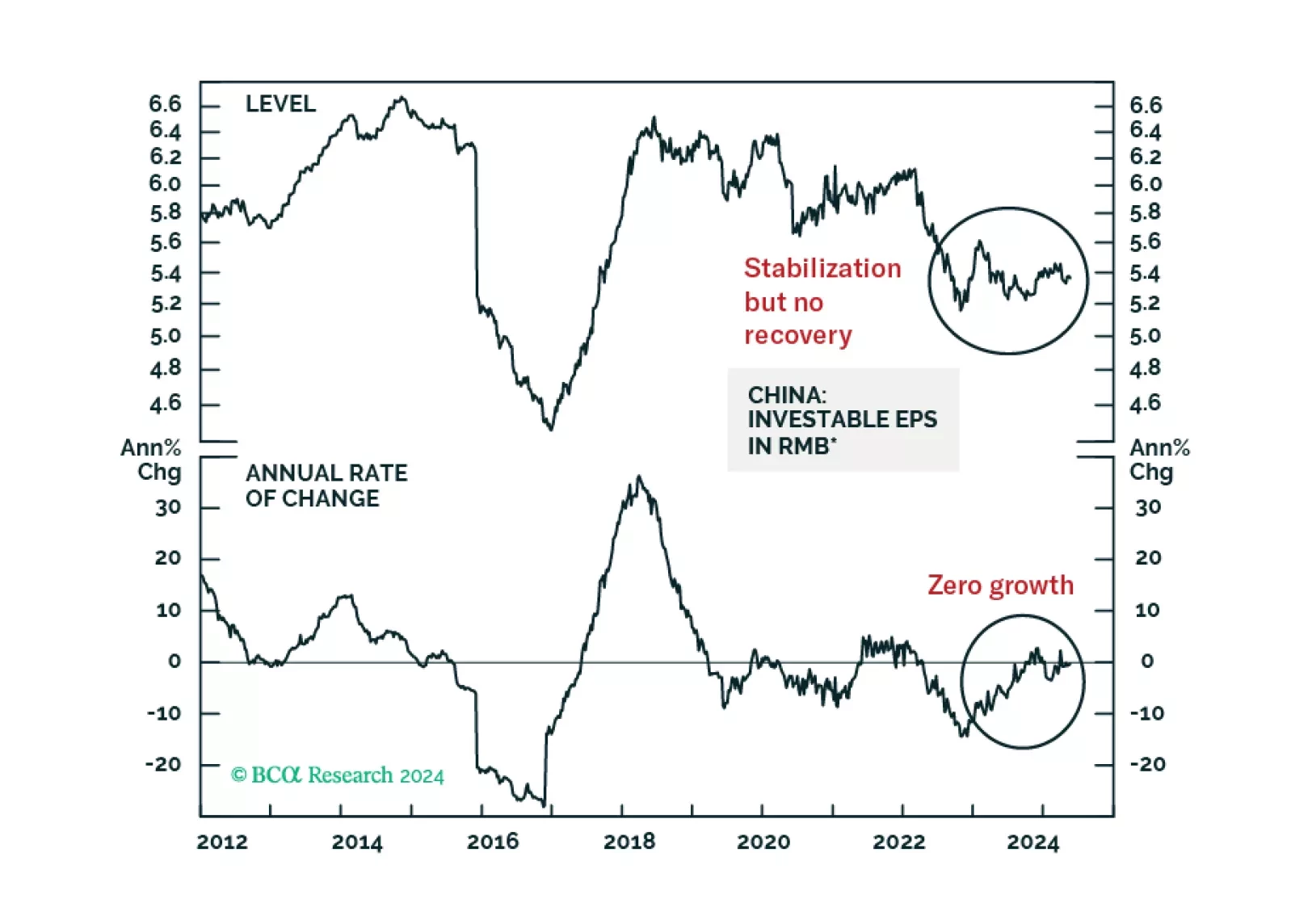

The RMB 500 billion program is small, as it is equivalent to only 4% of property developers' total funding from the past 12 months. This will preclude a recovery in property construction this year. Corporate profits will determine…

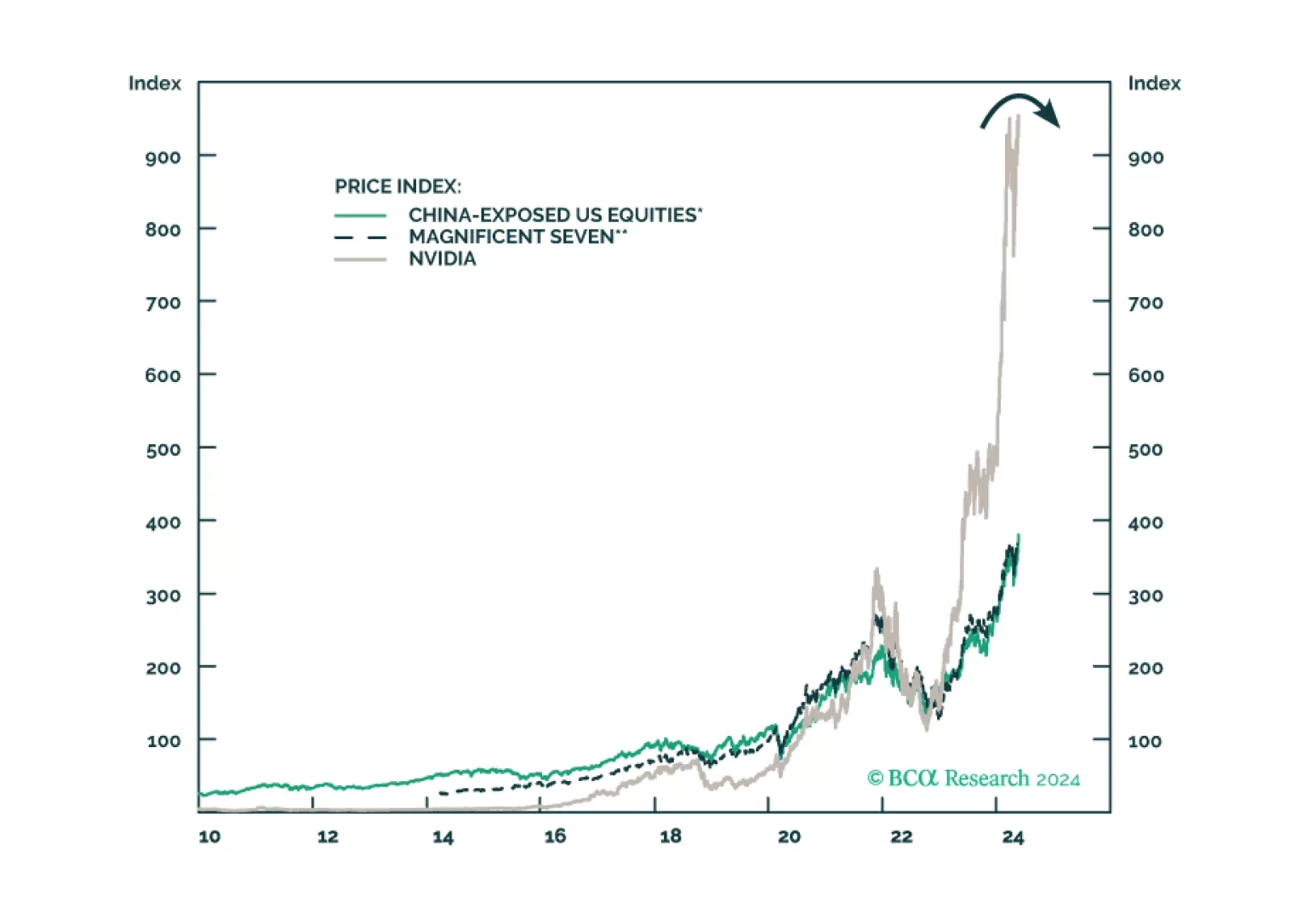

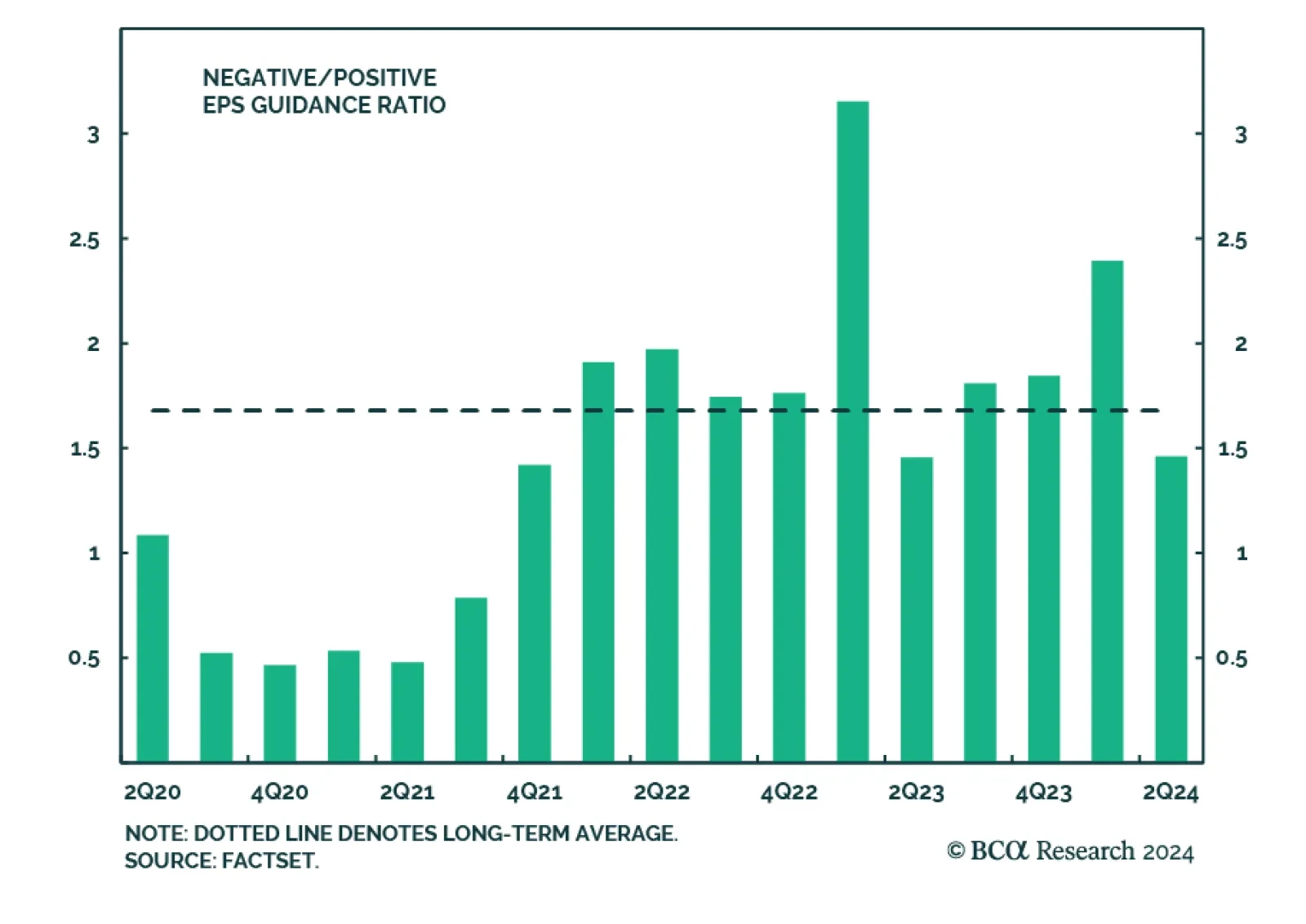

The Q1 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Three-quarters (two-thirds) of companies have topped earnings (sales) expectations in Q1, according to…

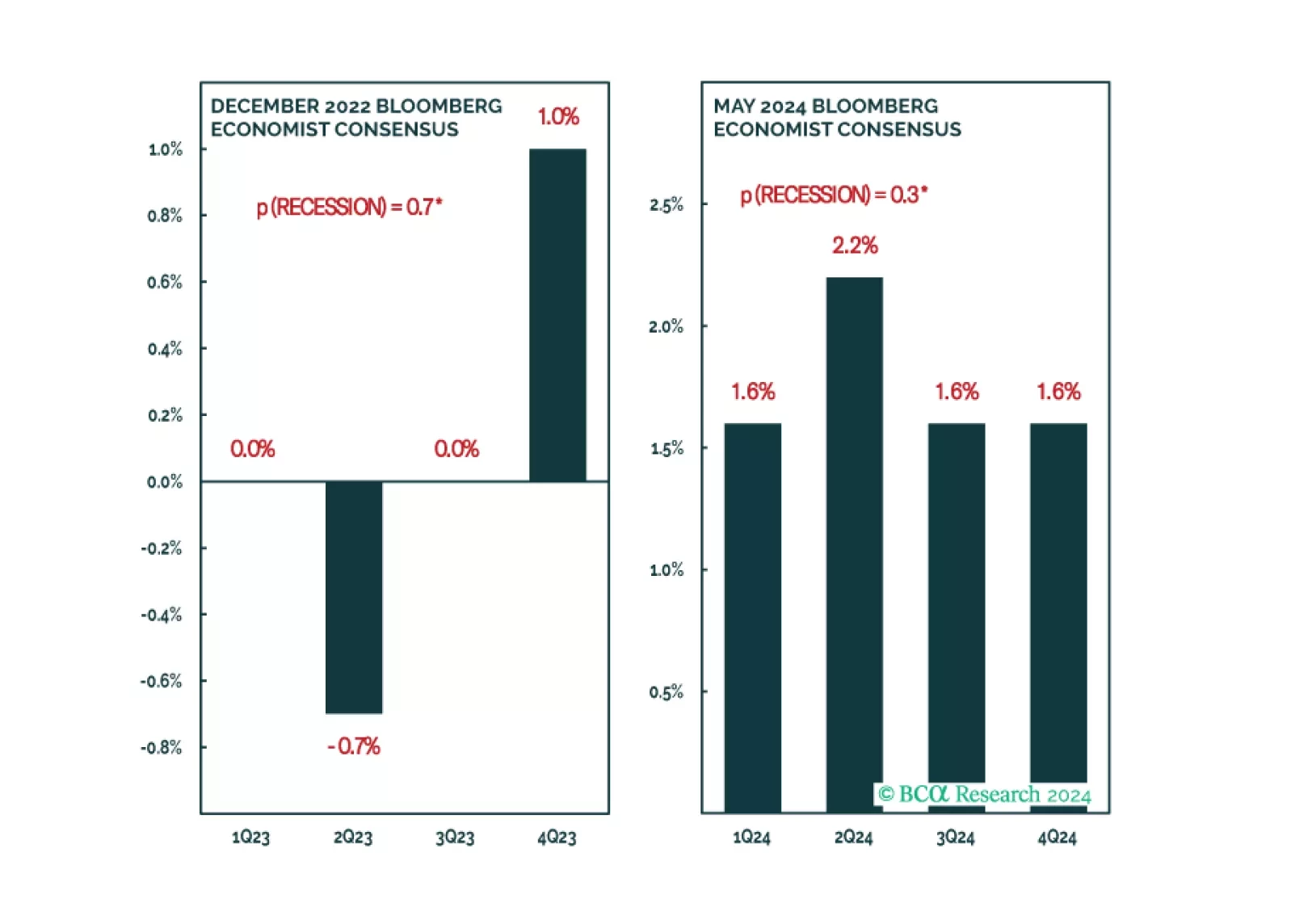

We do not subscribe to the Goldilocks scenario in which price pressures continue to ease while economic growth remains robust. We expect that softening labor demand will eventually hinder consumption as wage and payrolls growth…

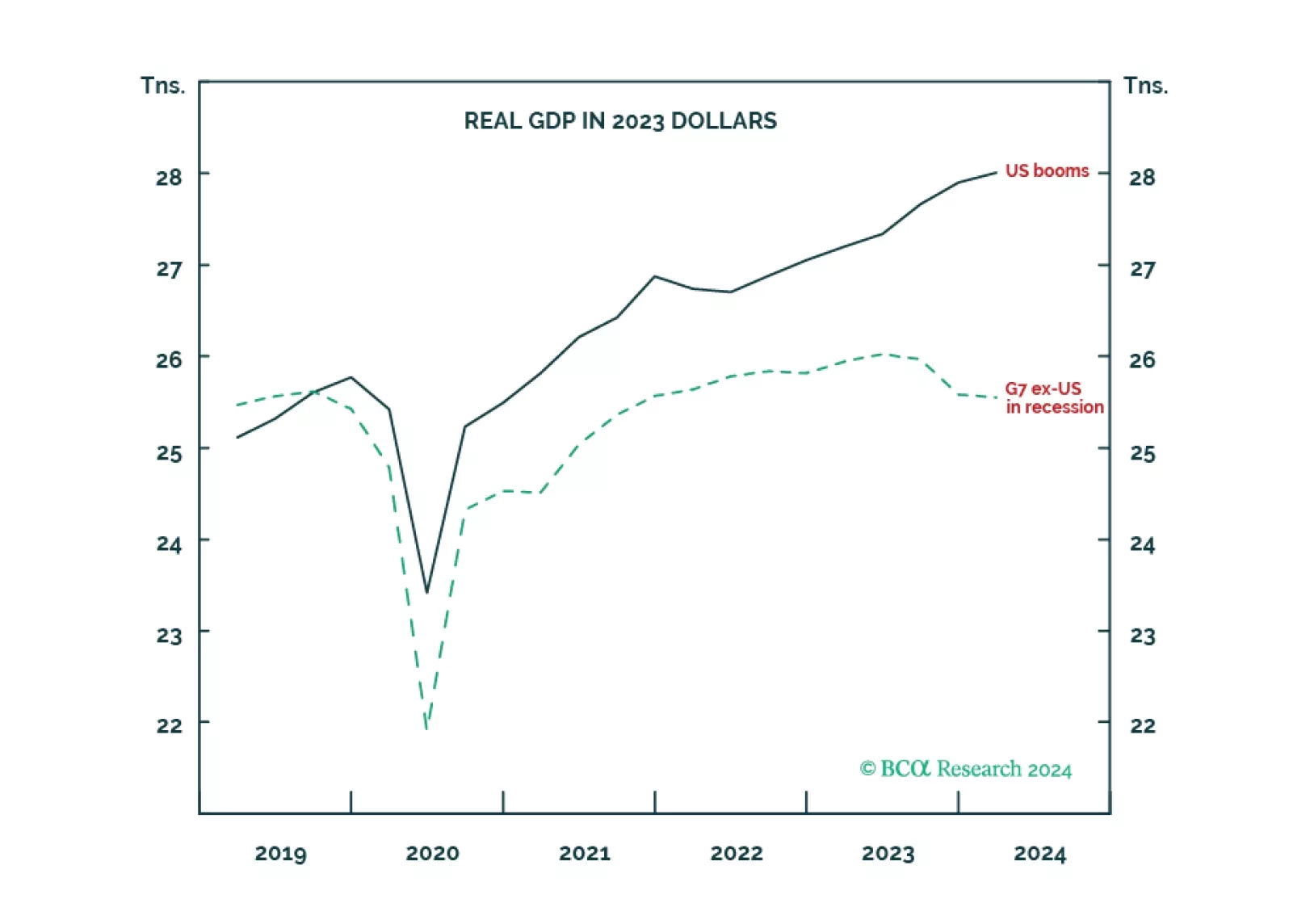

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

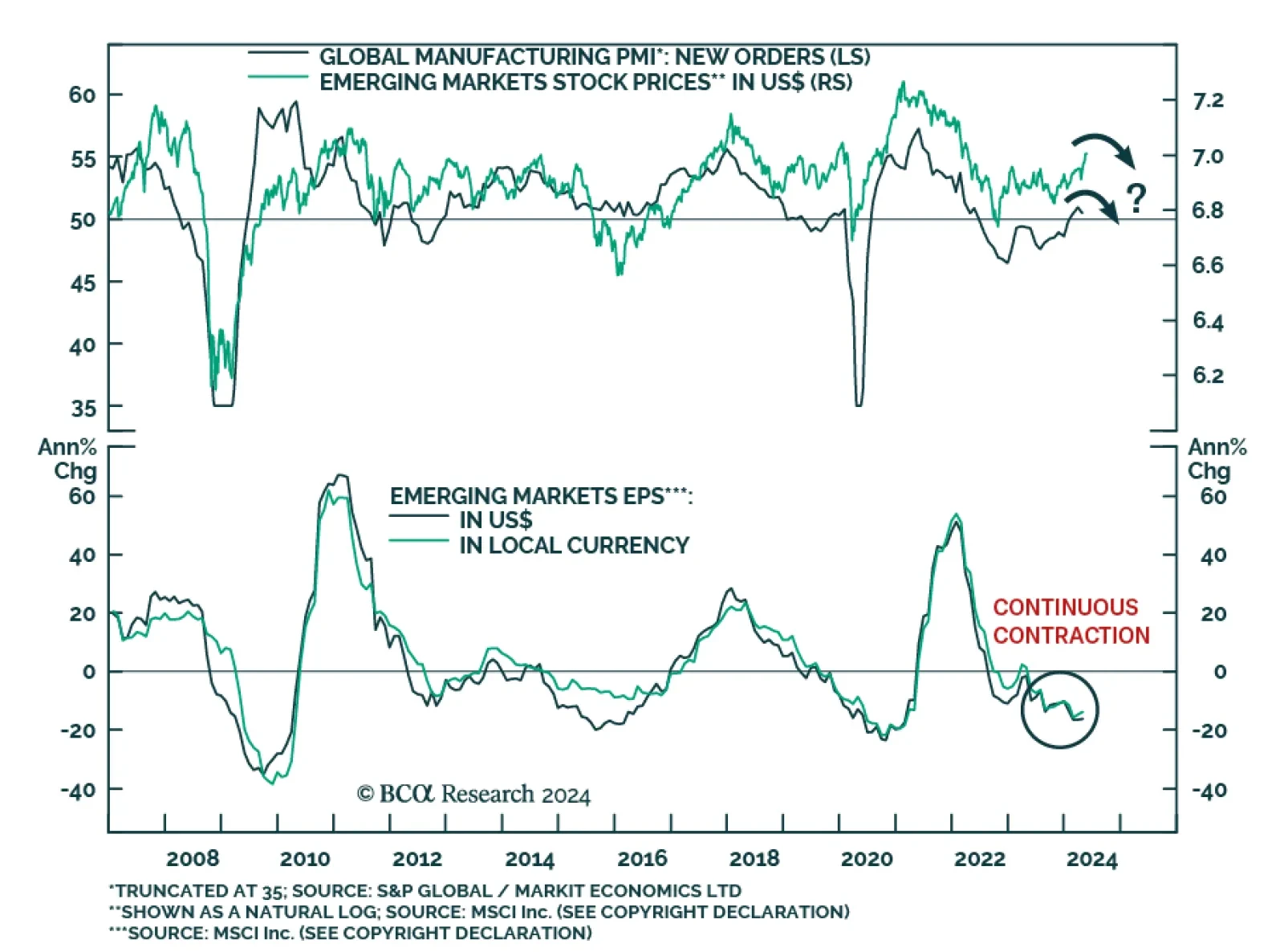

Emerging market stocks have outperformed their global counterparts by 4 percentage points in USD terms since February according to MSCI indices. They have gotten a boost from the bounce in the global manufacturing cycle. The MSCI…