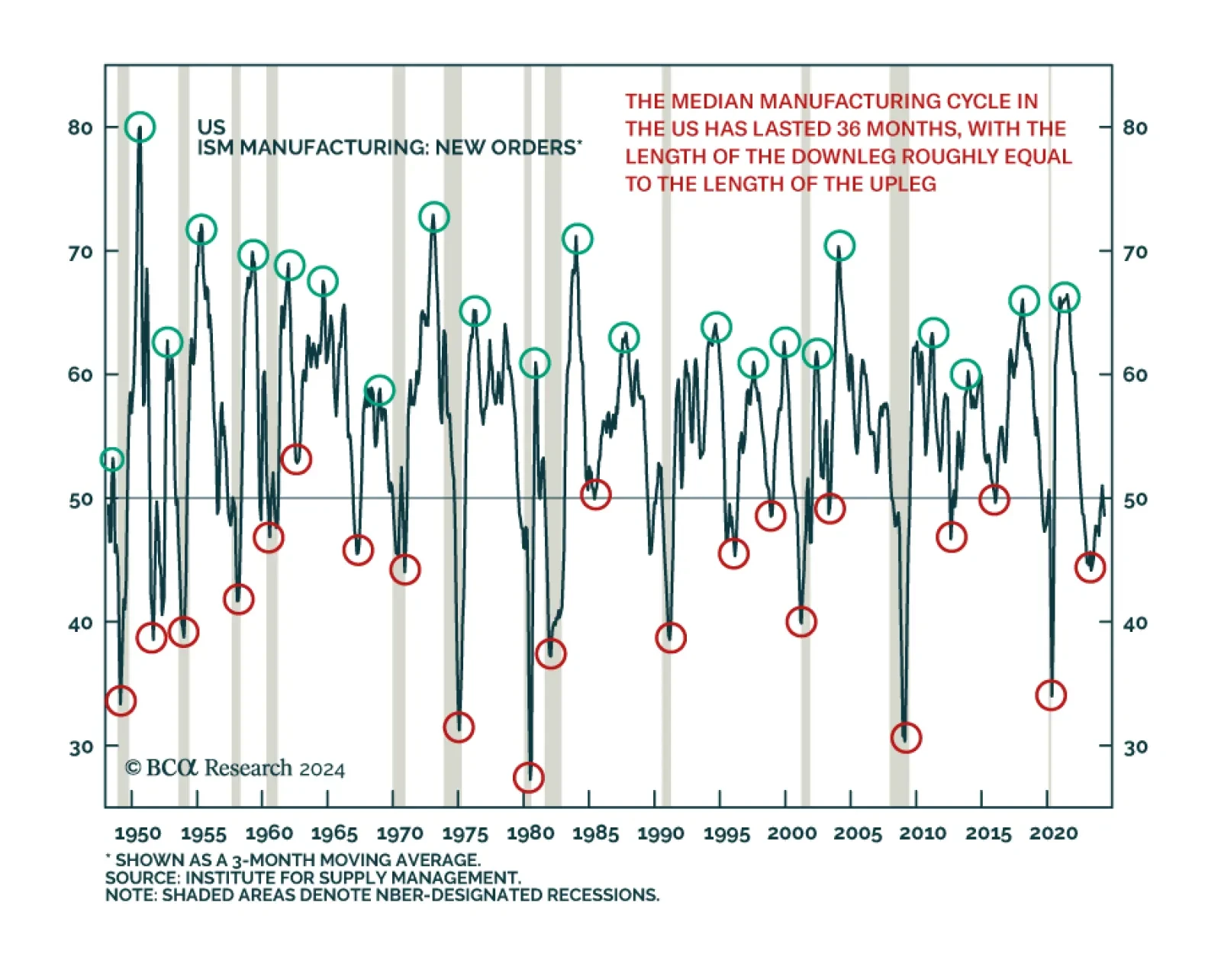

Our colleagues at Global Investment Strategy have shown that postwar US (and global) manufacturing cycles have tended to last 3 years, divided equally between an 18-month up leg and an 18-month down leg. This framework has been a…

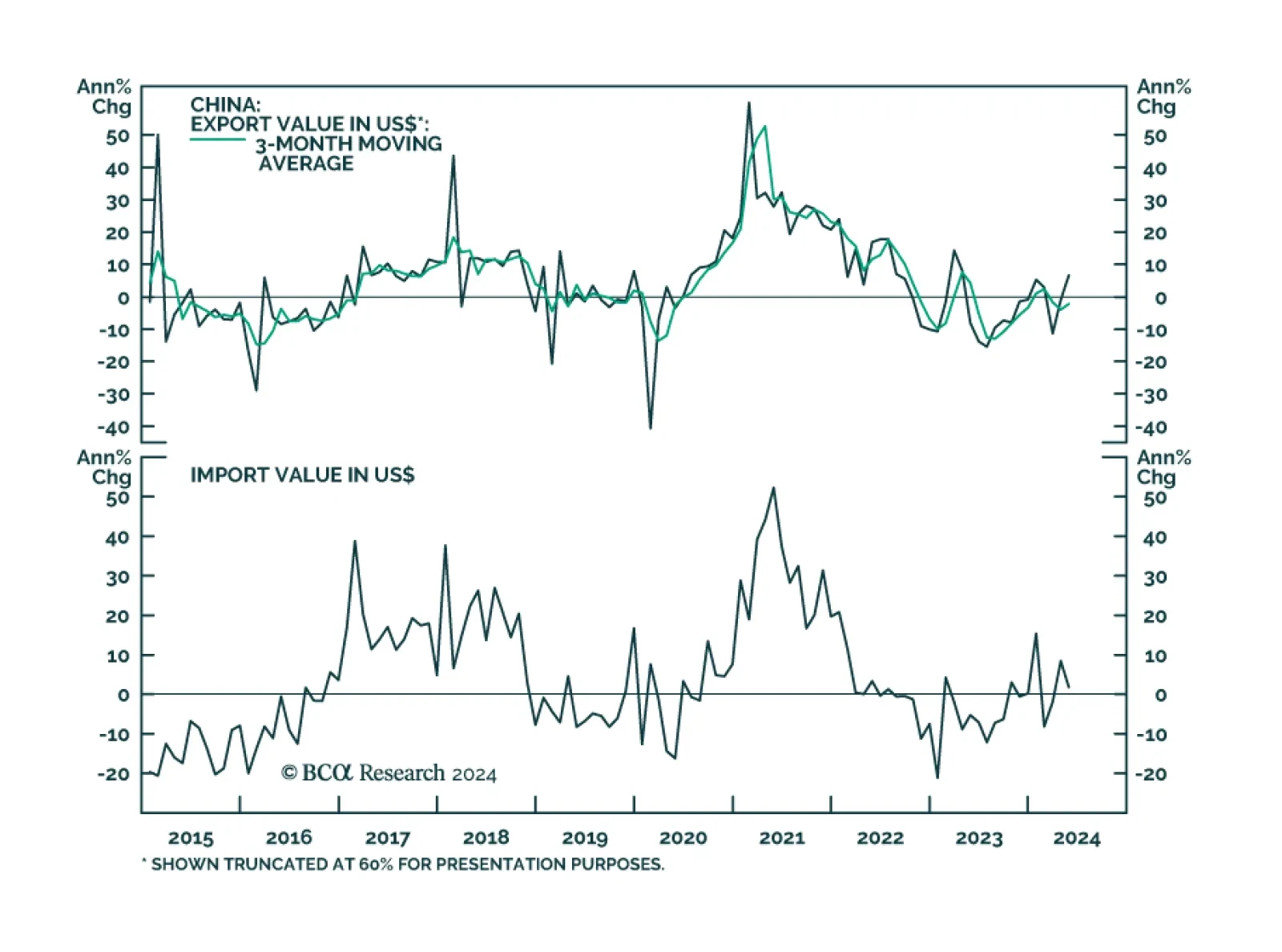

China’s exports in USD terms surged 7.6% y/y in May, from 1.5% in April, surpassing expectations of a 5.7% gain. However, base effects largely overstate the strength of Chinese exports given that they contracted by 8% y/…

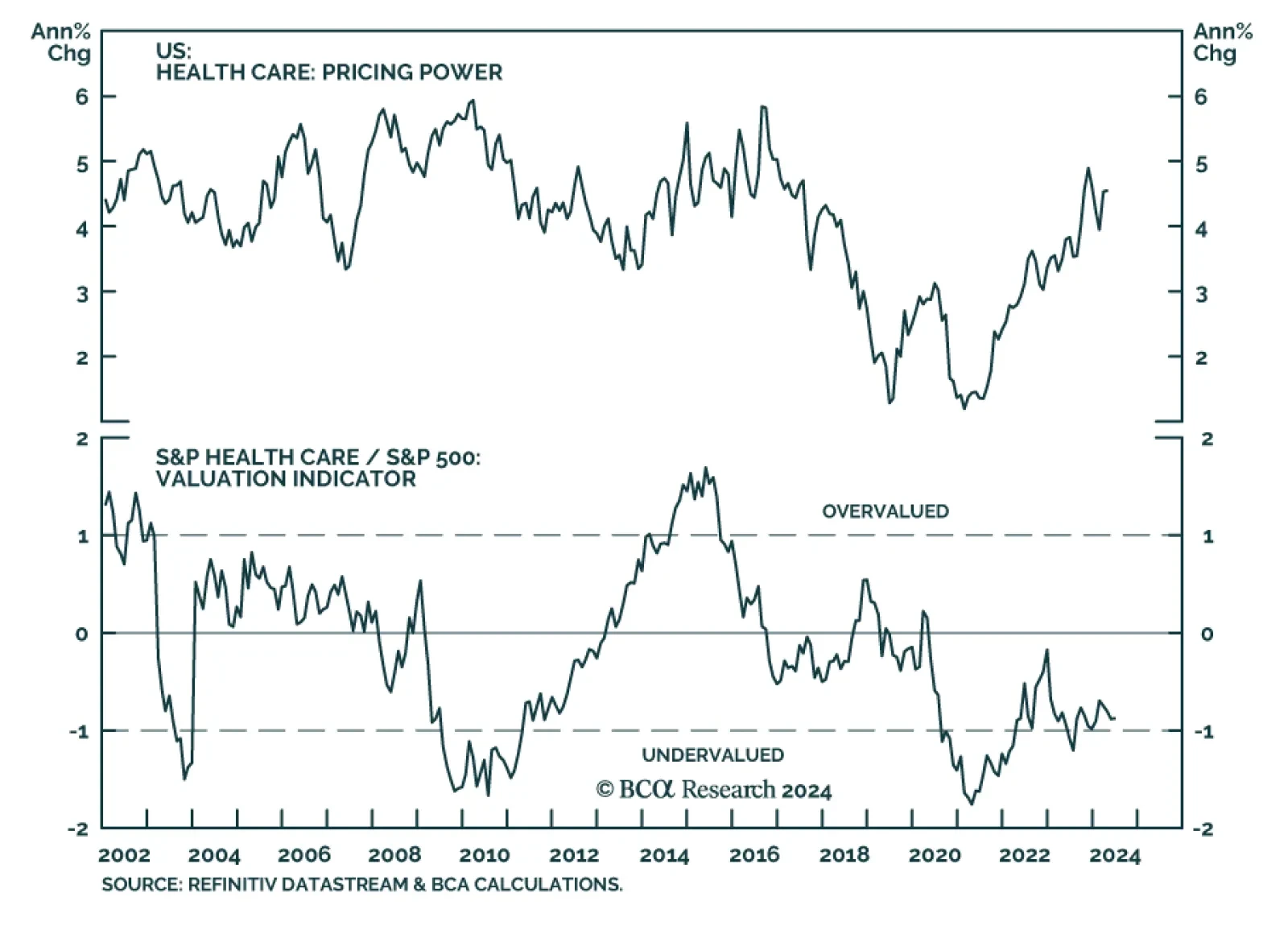

Healthcare has underperformed the S&P 500 by 23% since early 2023. Profit margins have been squeezed since the pandemic revenue windfall dried up and because long-term contracts prevented companies from raising prices in line…

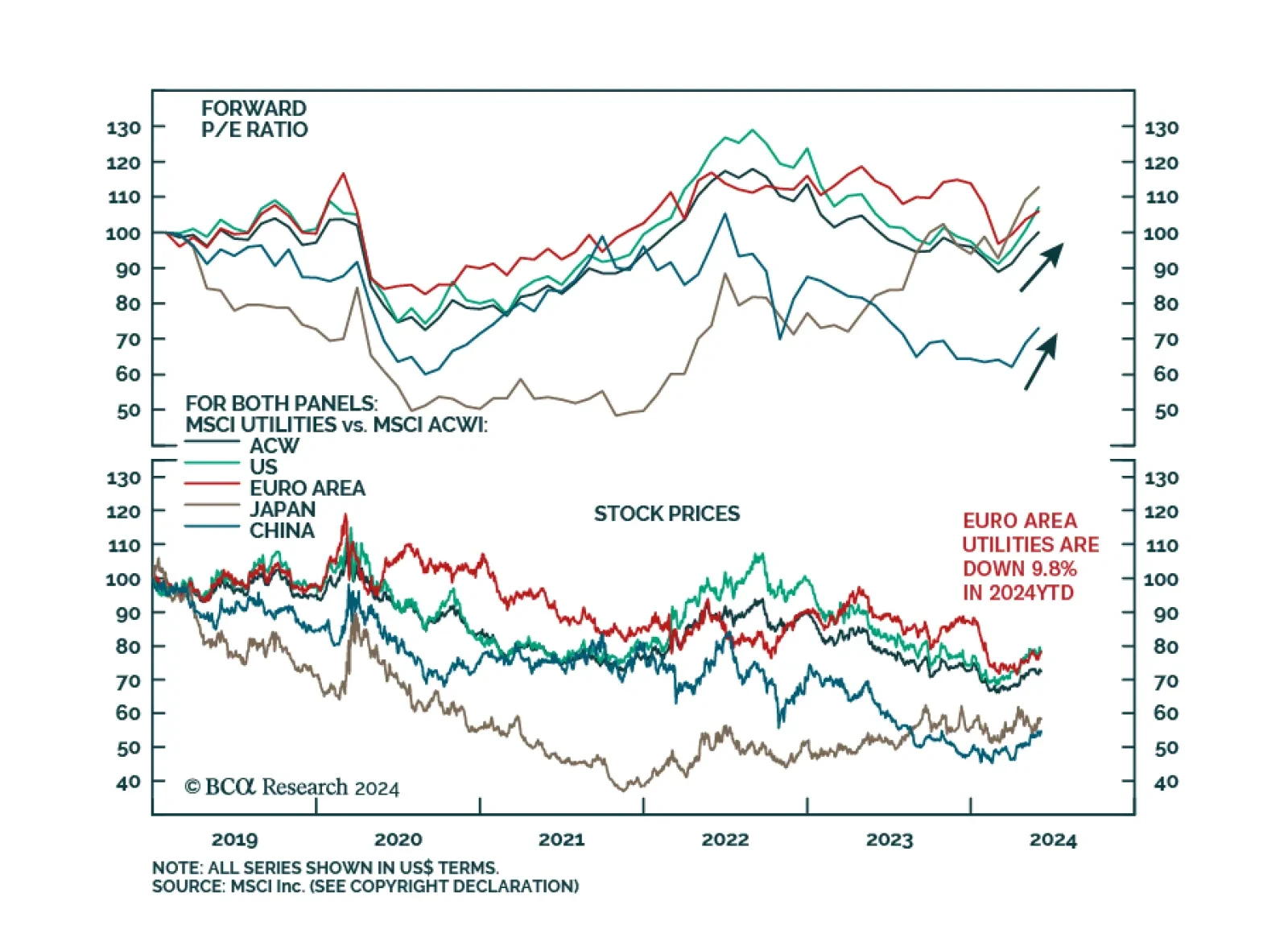

Utilities have had a stellar run since February with the MSCI ACW Utilities index outperforming the MSCI ACW by nearly nine percentage points. Despite being a defensive sector, Utilities’ performance this year has been…

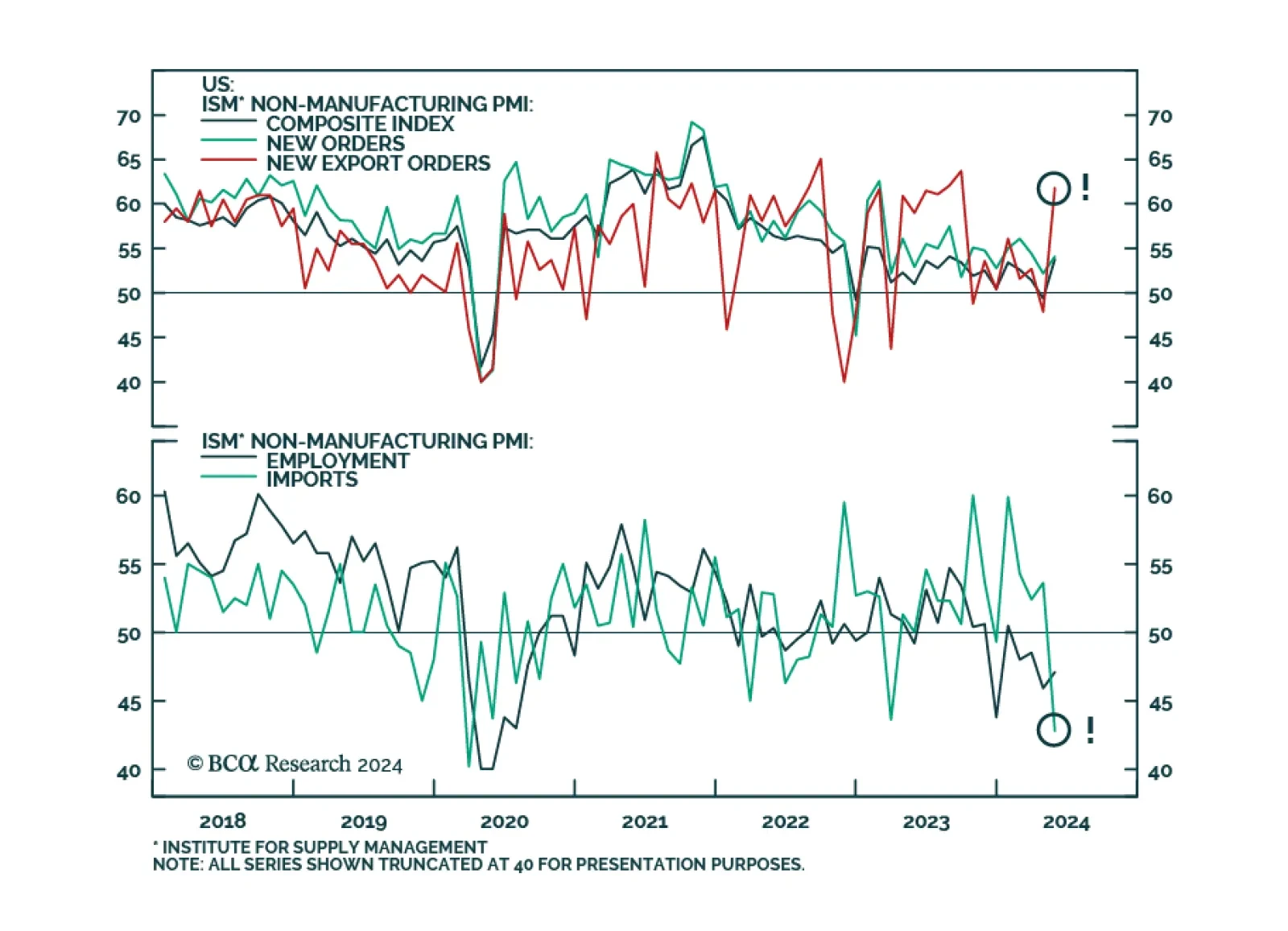

The ISM Services PMI largely surpassed expectations in May. The headline index grew by 4.4 ppt to 53.8, returning to expansion following April’s one-month contraction. Double-digit jumps in new export orders (13.9 ppt) and…

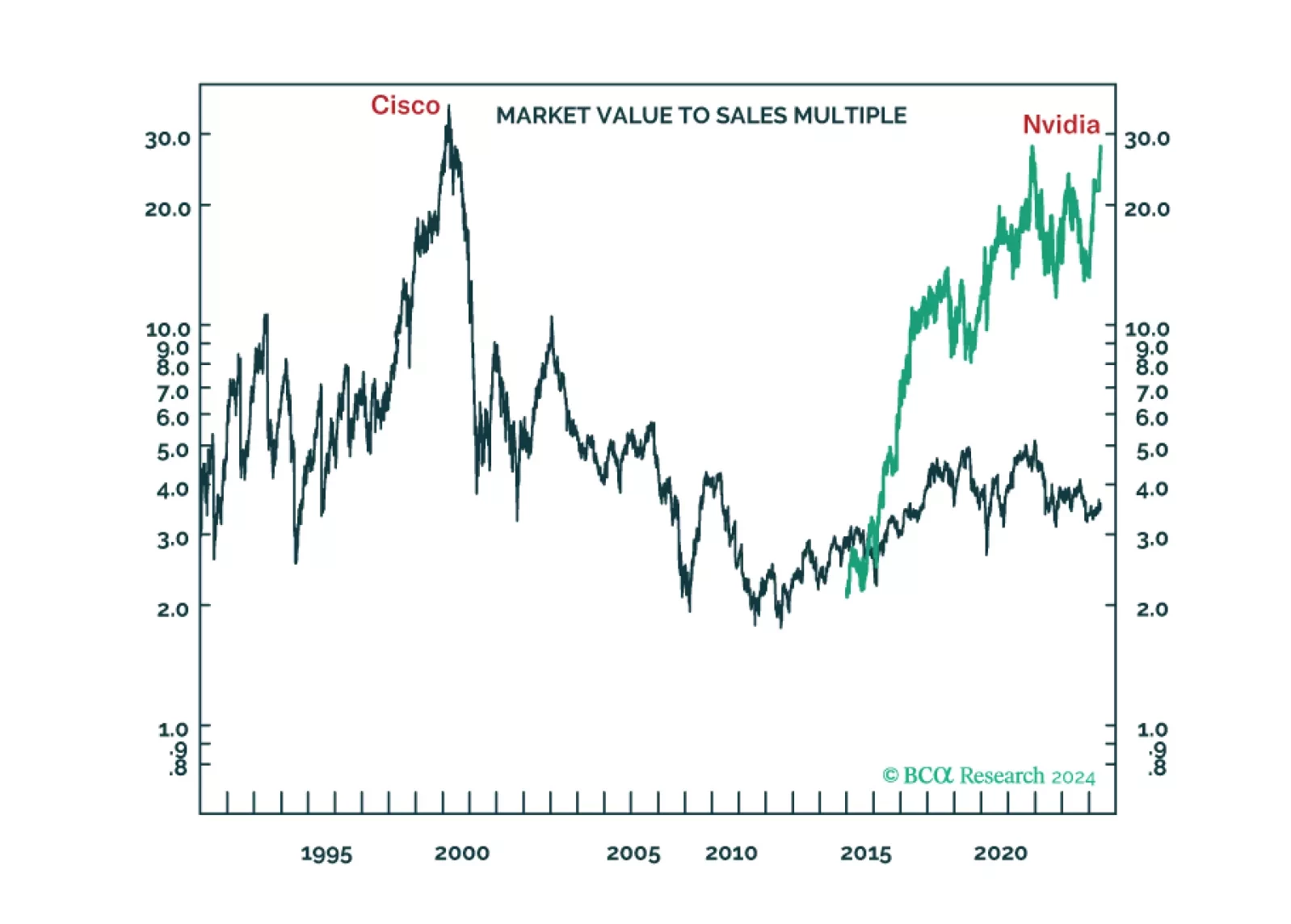

The long-term winners from the generative-AI gold rush are unlikely to be the ‘picks and shovels’ stock Nvidia or the overvalued US superstars of Web 2.0. We discuss the structural investment implications. Plus: time to go tactically…

According to BCA Research’s Global Asset Allocation service, the economy has been in the “Overheating” phase of the cycle for a while, with signs of slowing growth but also stubbornly high inflation. The most…

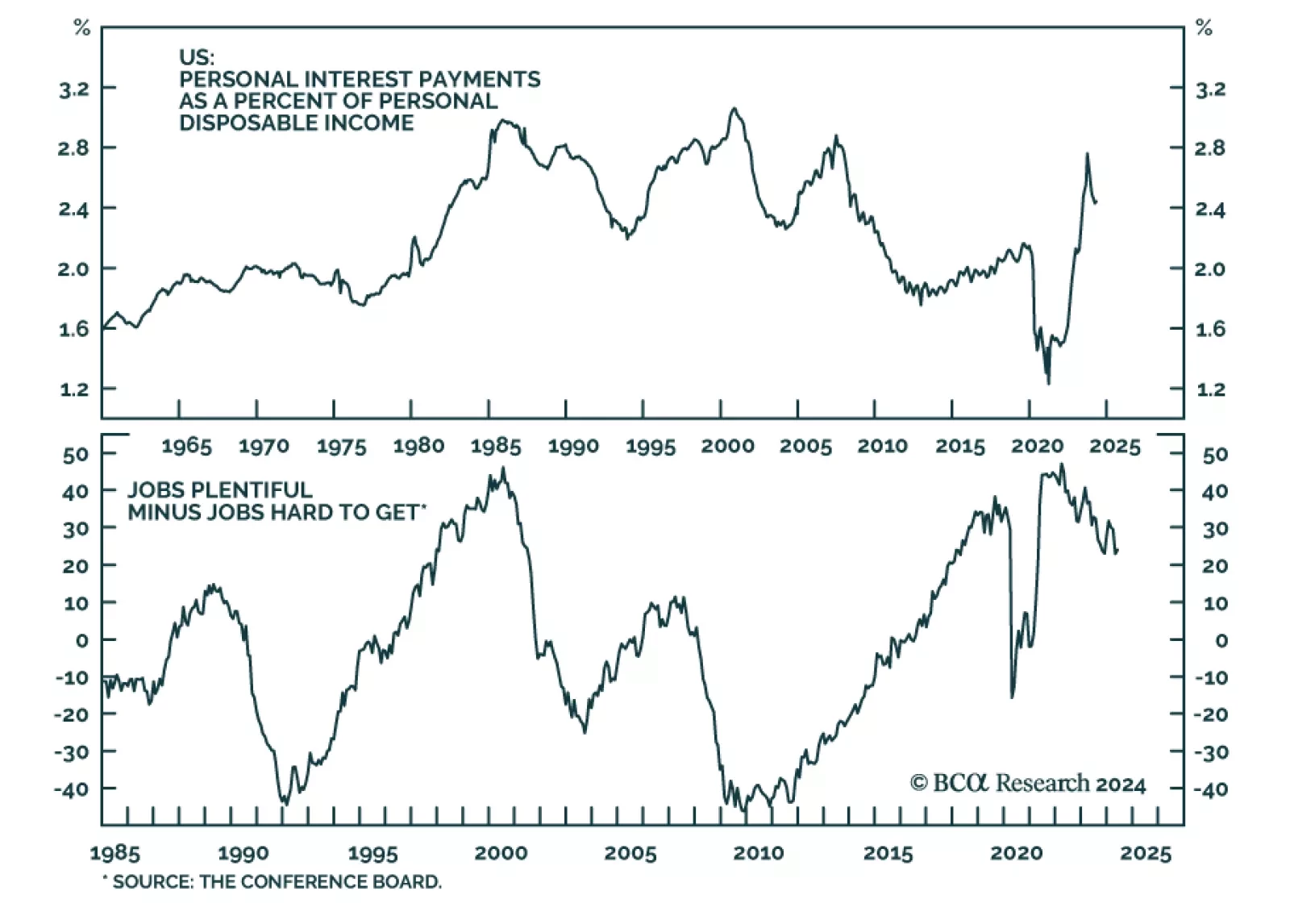

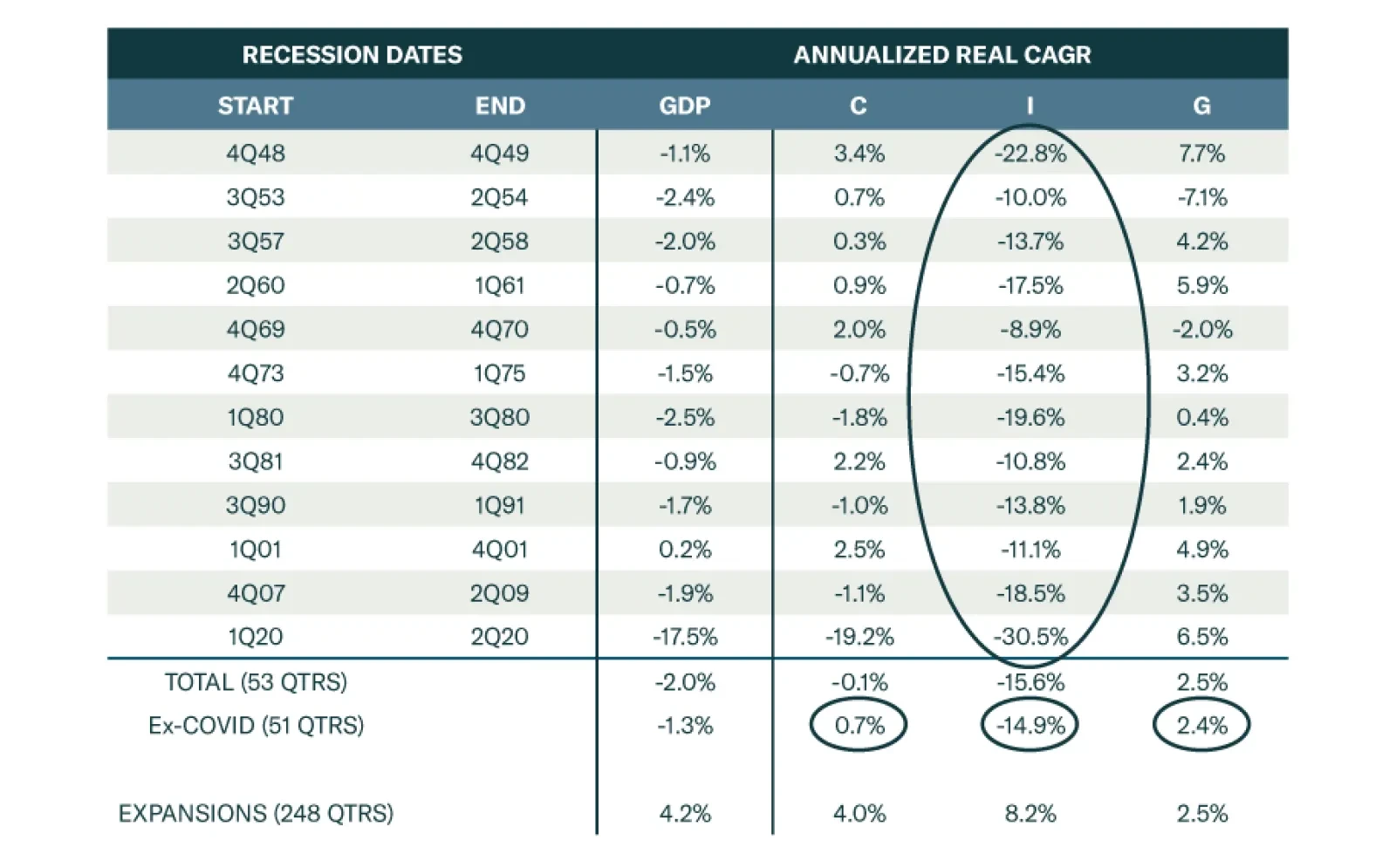

Consumption accounts for two-thirds of the US economy, and our recession view relies heavily on the deteriorating outlook for US consumers. That said, dissecting US GDP into its components reveals that consumption tends to…

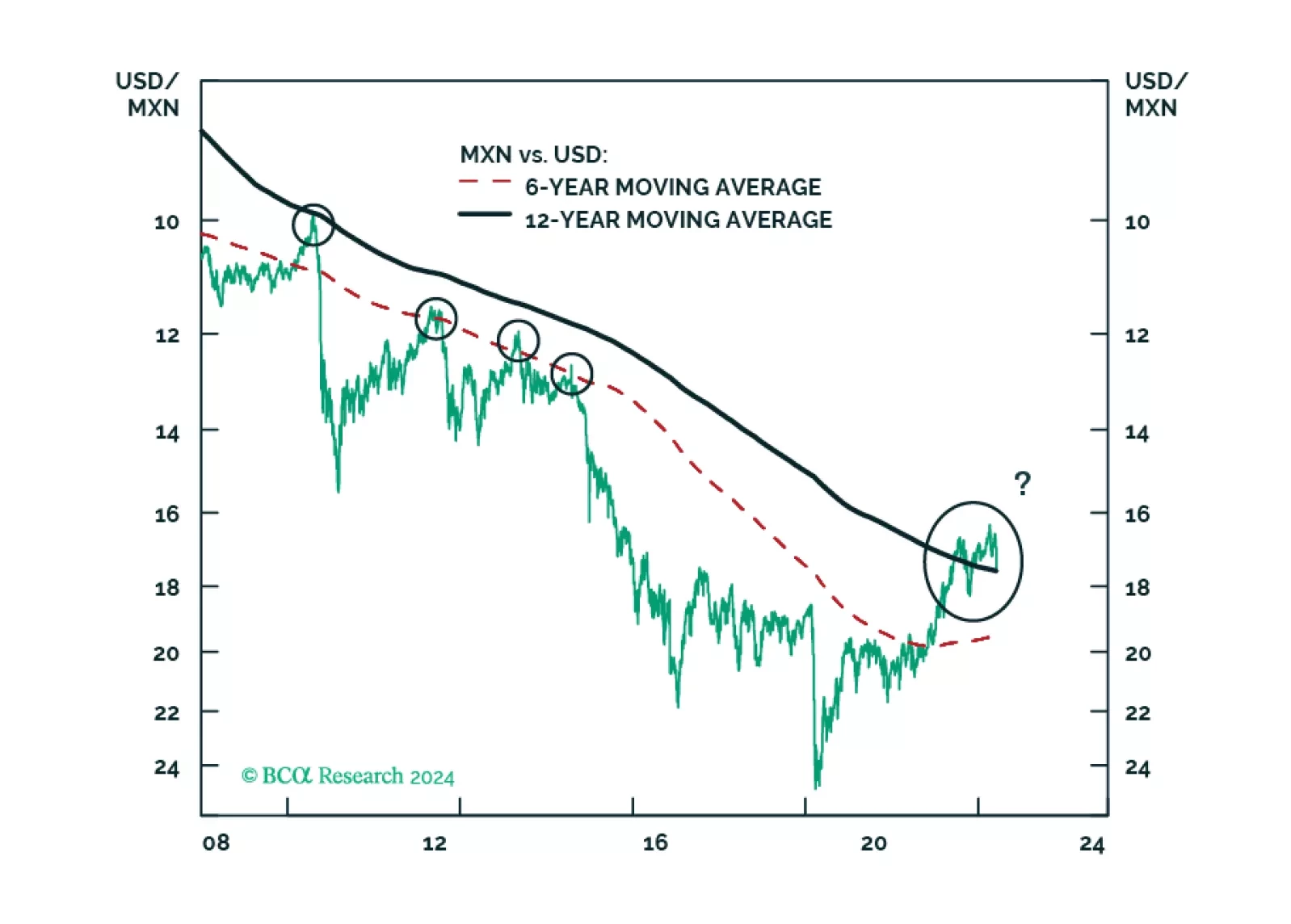

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…