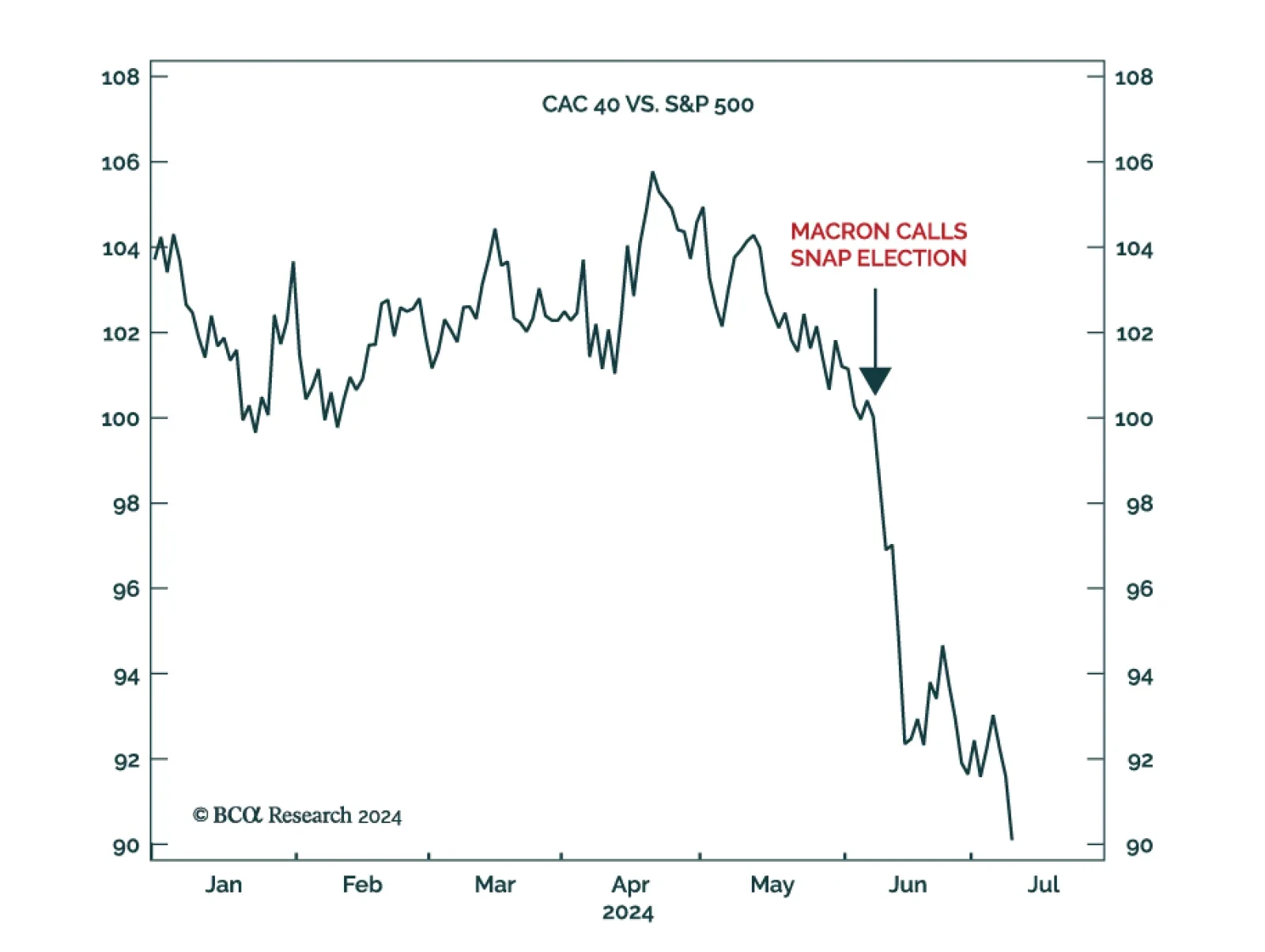

According to BCA Research’s Counterpoint service, the sharp underperformance of the French stock market over political uncertainty is irrational, given the CAC 40’s limited exposure to French domestic economics and…

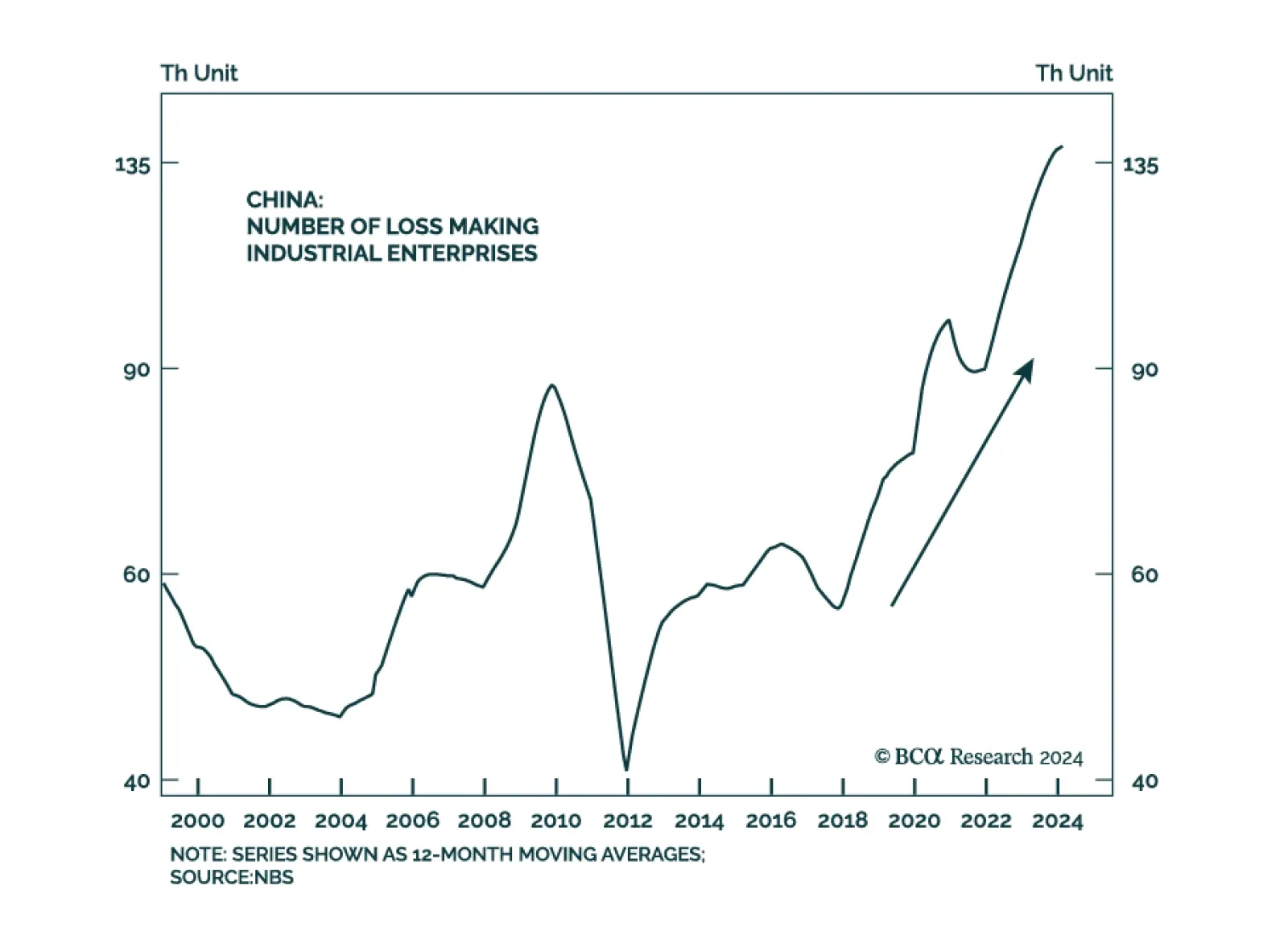

As highlighted in Wednesday’s edition of BCA Live & Unfiltered, the Chinese economy and its financial markets face several daunting challenges. Its demographic outlook is unfavorable, with a low birthrate stifling…

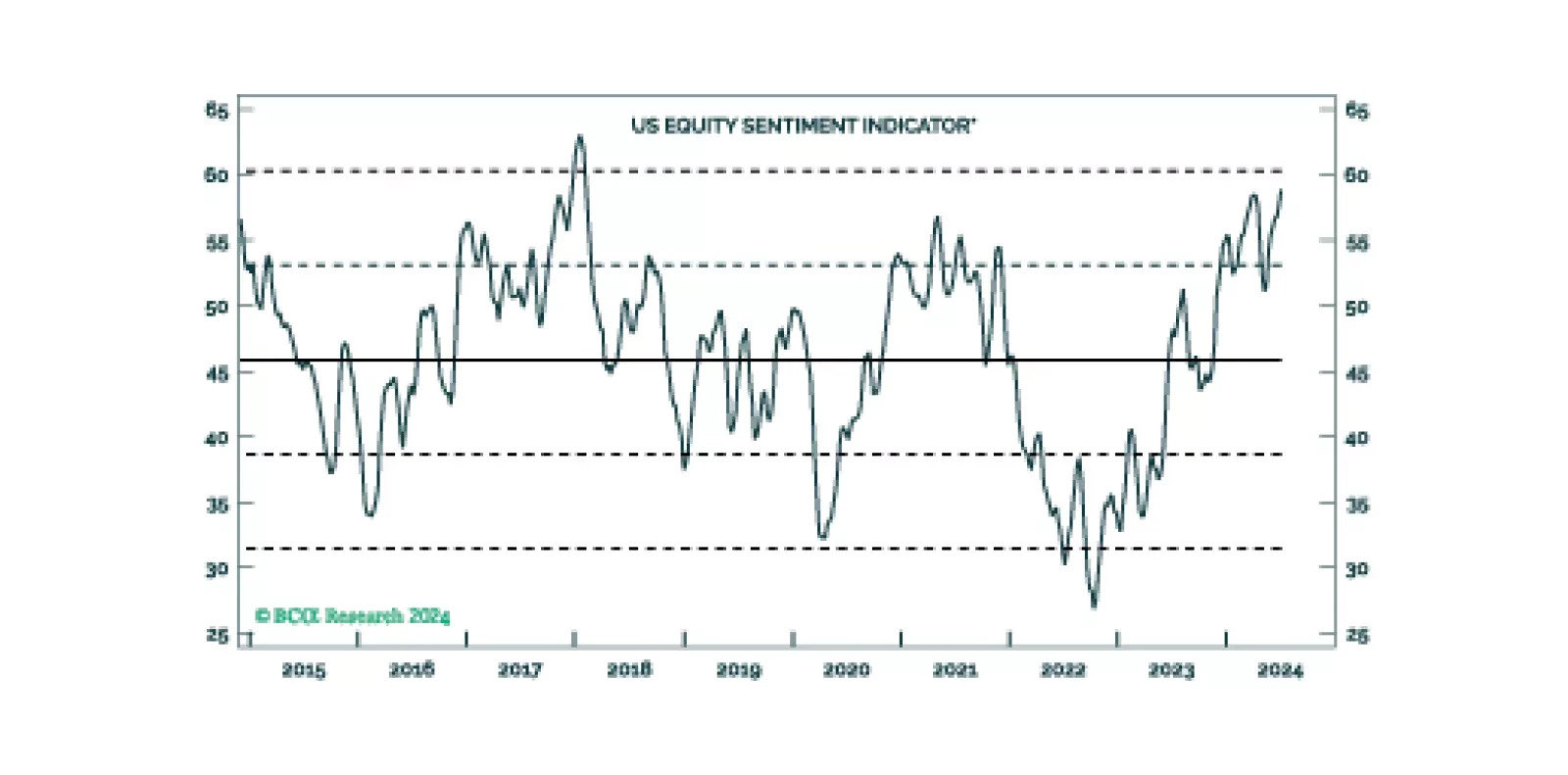

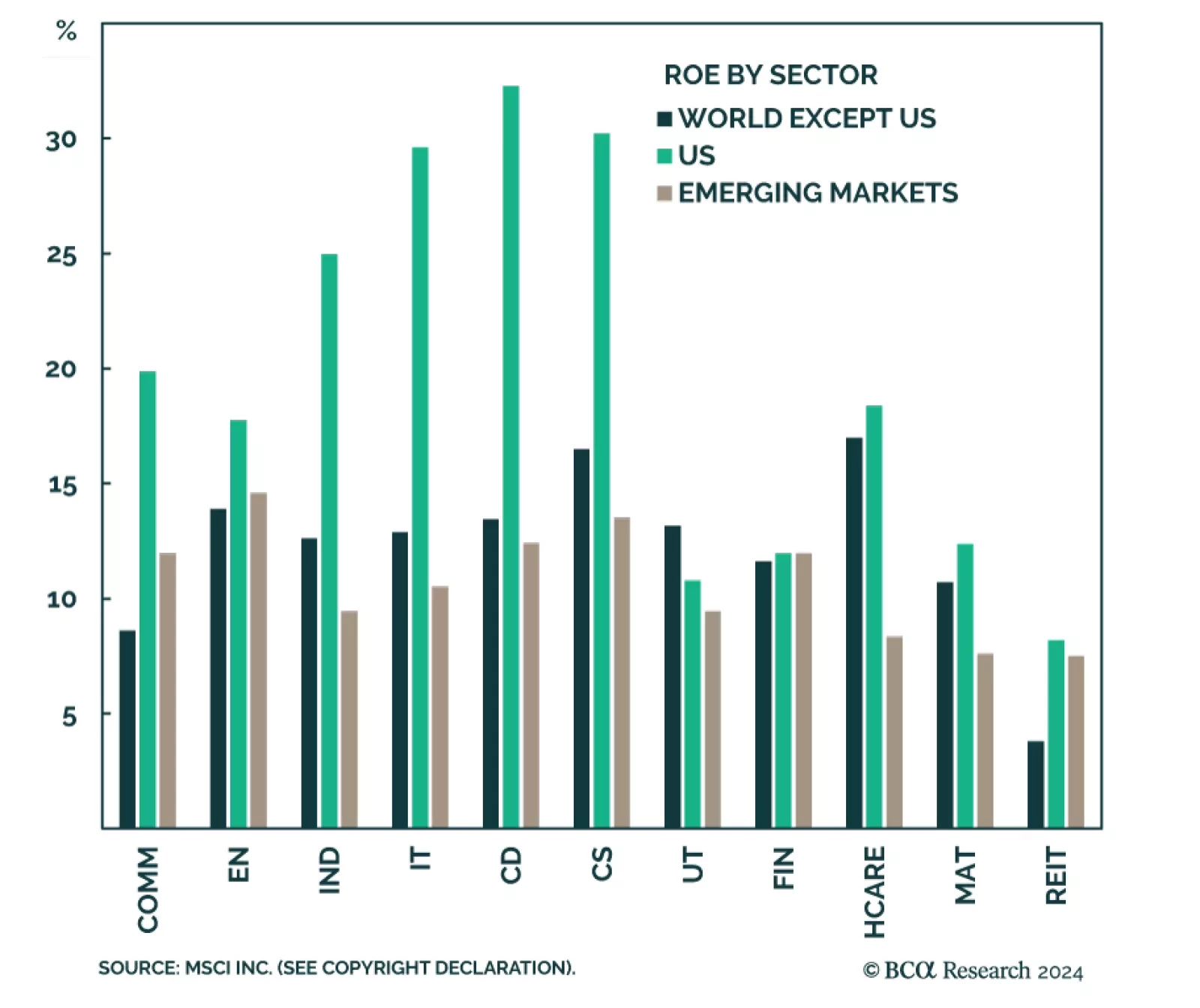

According to BCA Research’s US Equity Strategy service, post-GFC US equity outperformance can be attributed to a perfect storm of advantageous policies and a human capital edge. The topic of American exceptionalism is…

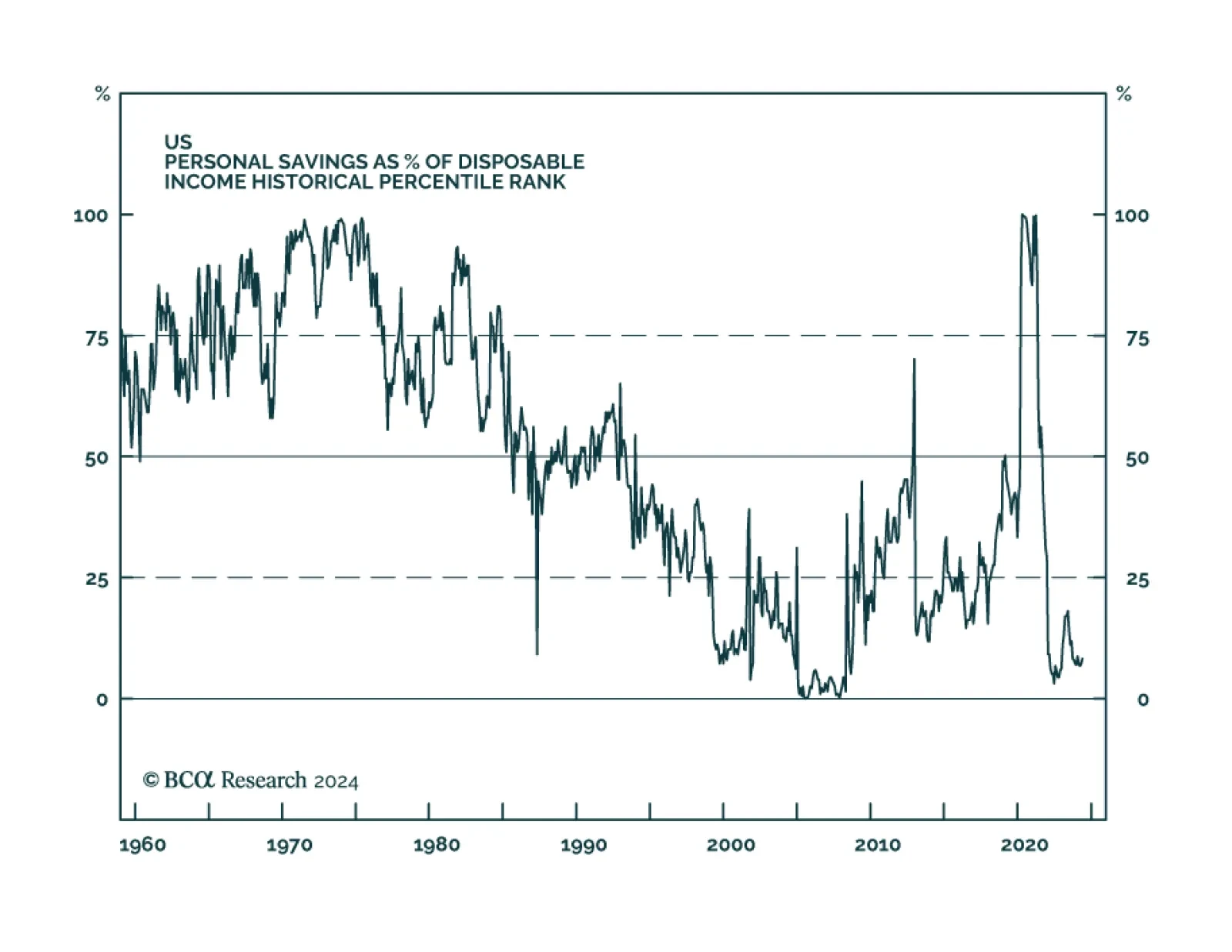

Our US Investment Strategy colleagues have kept a close eye on excess savings and their disposition since the CARES Act funds began to flow in the spring of 2020. Their conviction that the consensus failed to recognize the…

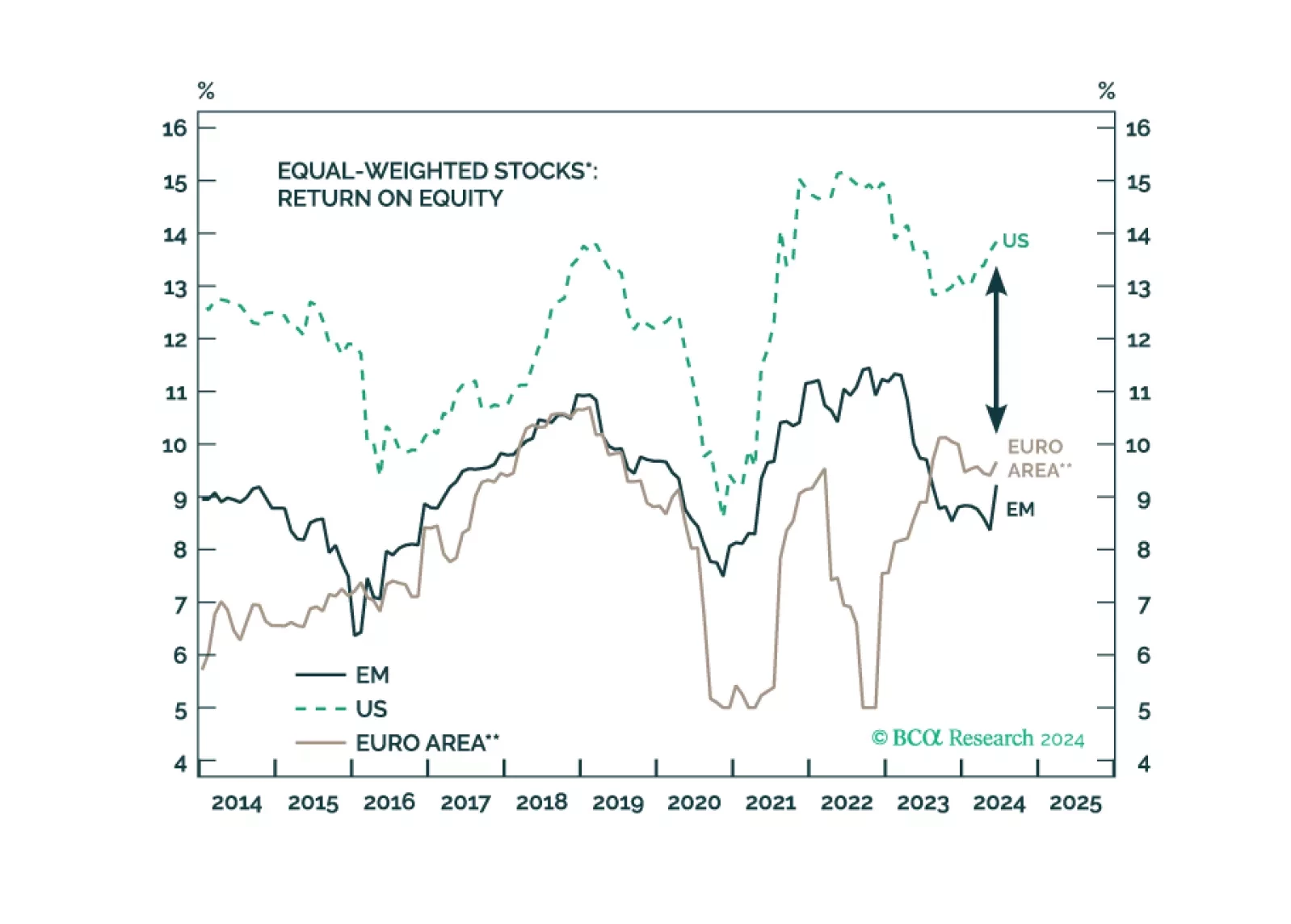

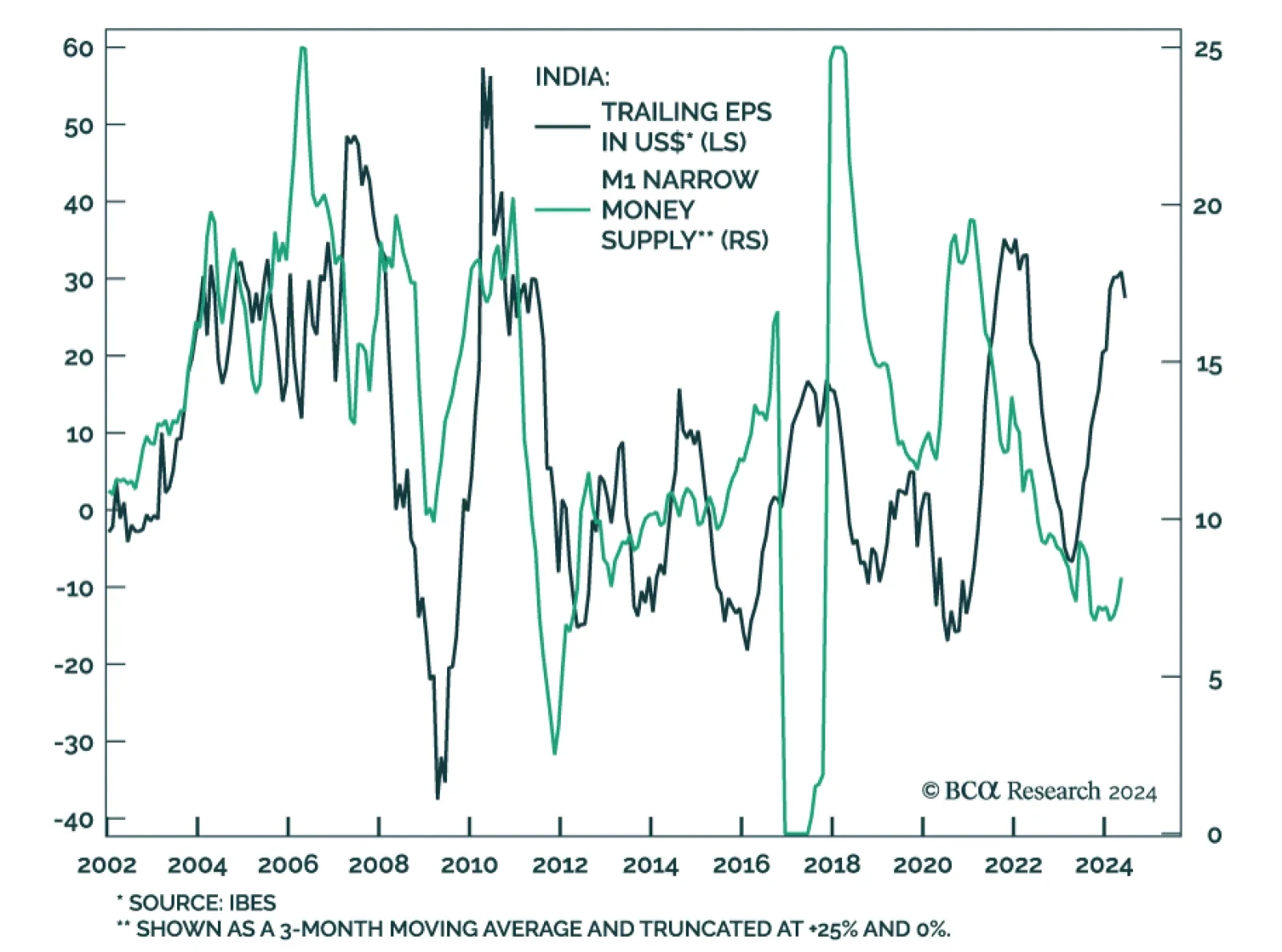

Our colleagues from the Emerging Markets Strategy team argue that investors should brace for a significant correction in Indian stocks in the coming months. They posit that the pillar of Indian corporations' sustained profit…

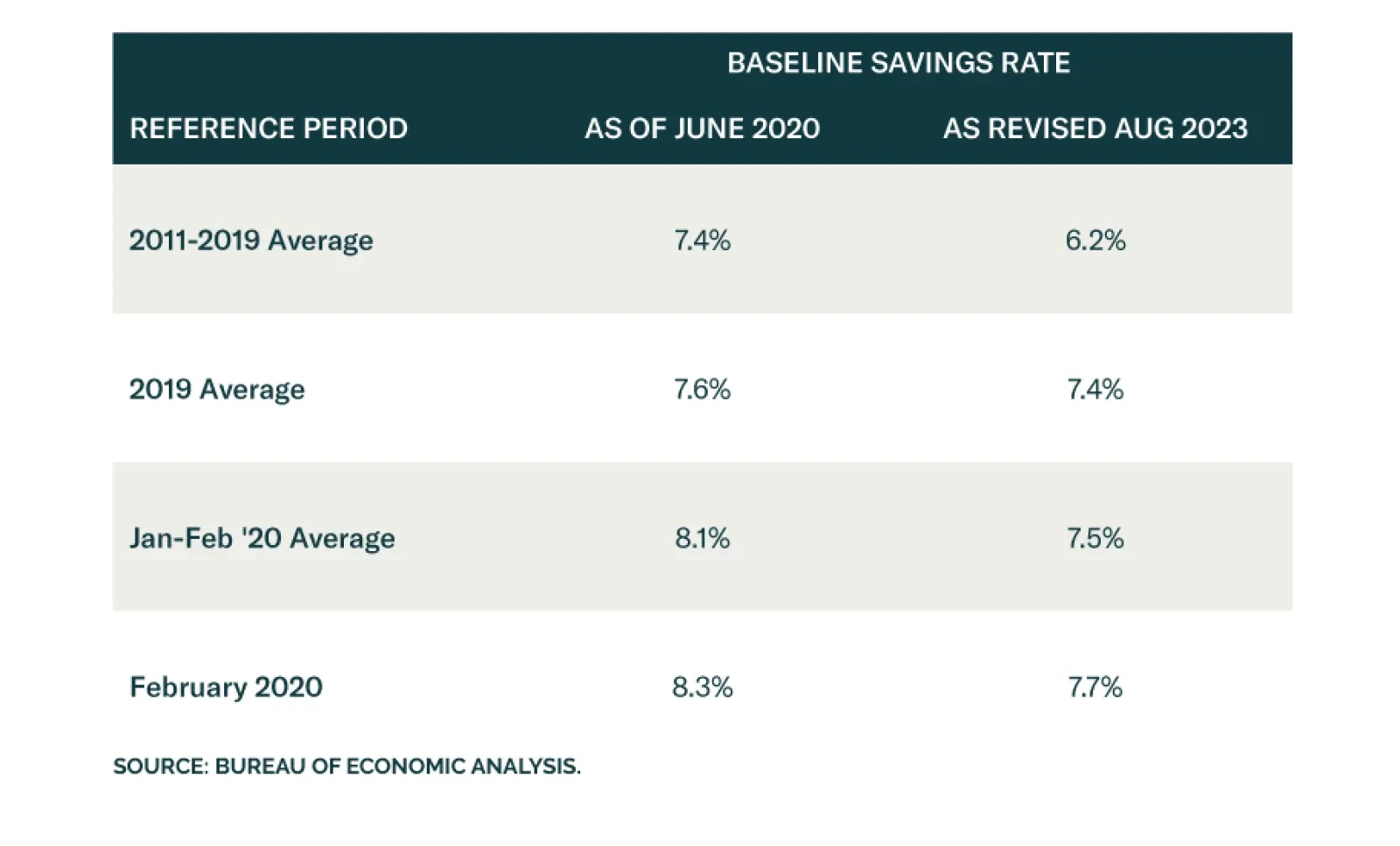

Our US Investment strategists define excess savings as the difference between what households saved beginning in March 2020 and what they might have saved had the pandemic not occurred. To estimate the latter, they assumed that…

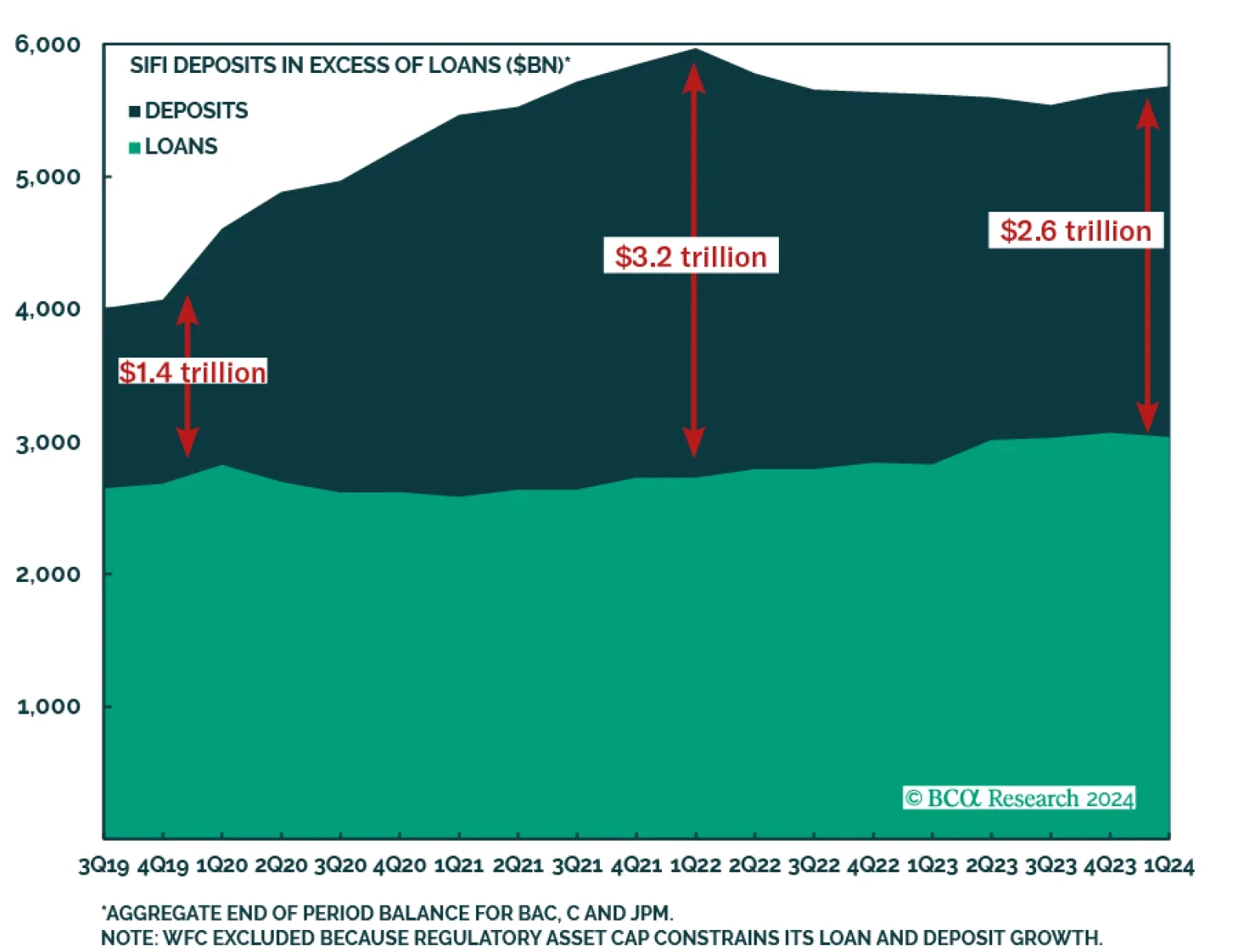

Second-quarter earnings season unofficially kicks off before the open on Friday, when Citigroup (C), JPMorgan (JPM) and Wells Fargo (WFC) report their results for the June 30 quarter. Bank of America (BAC), the other commercial…

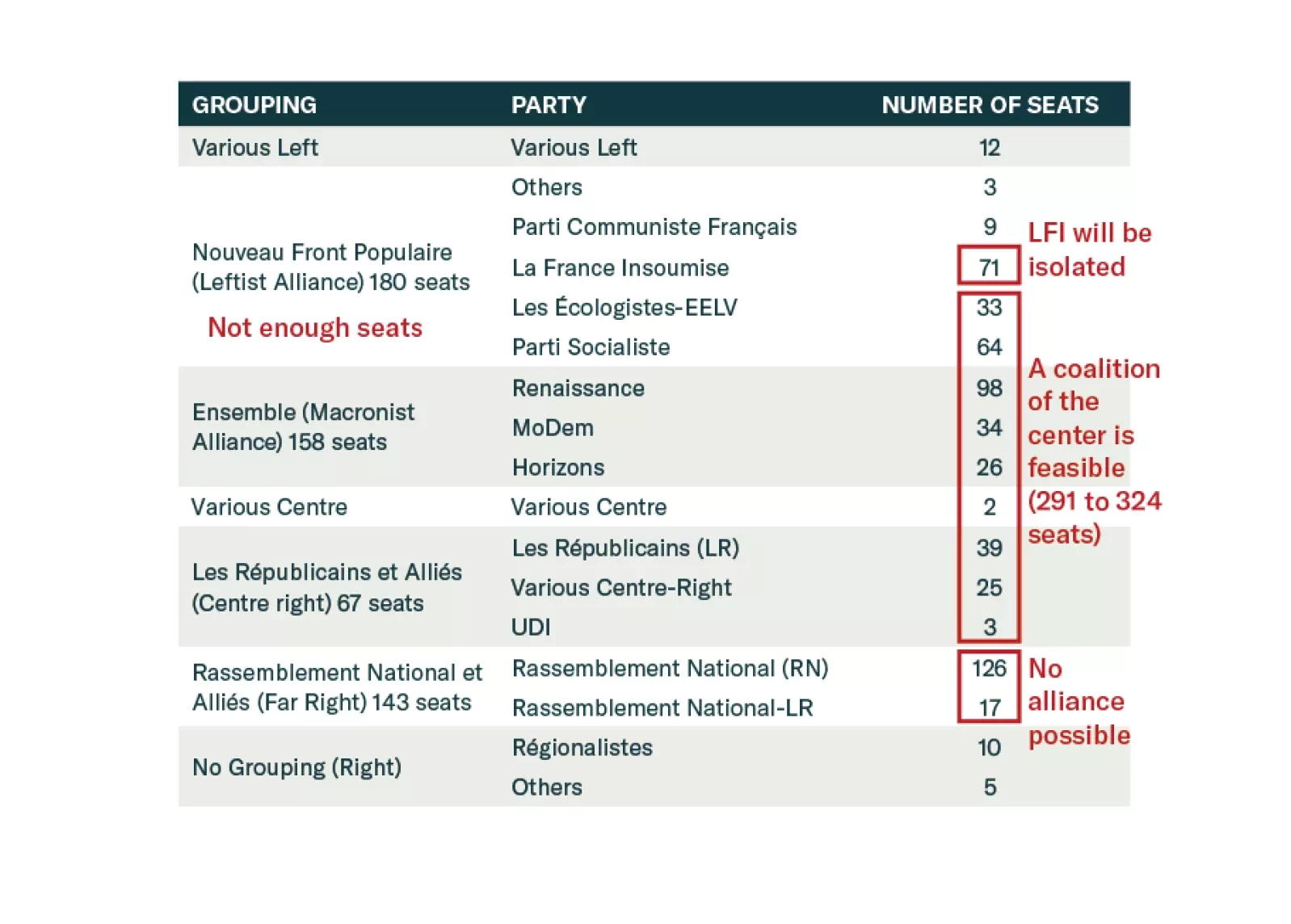

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

Although we ticked a second box on our checklist, the incoming data still do not indicate that a recession is imminent. We remain tactically equal weight equities with a strong bias to underweight them, but we’re not exiting the…