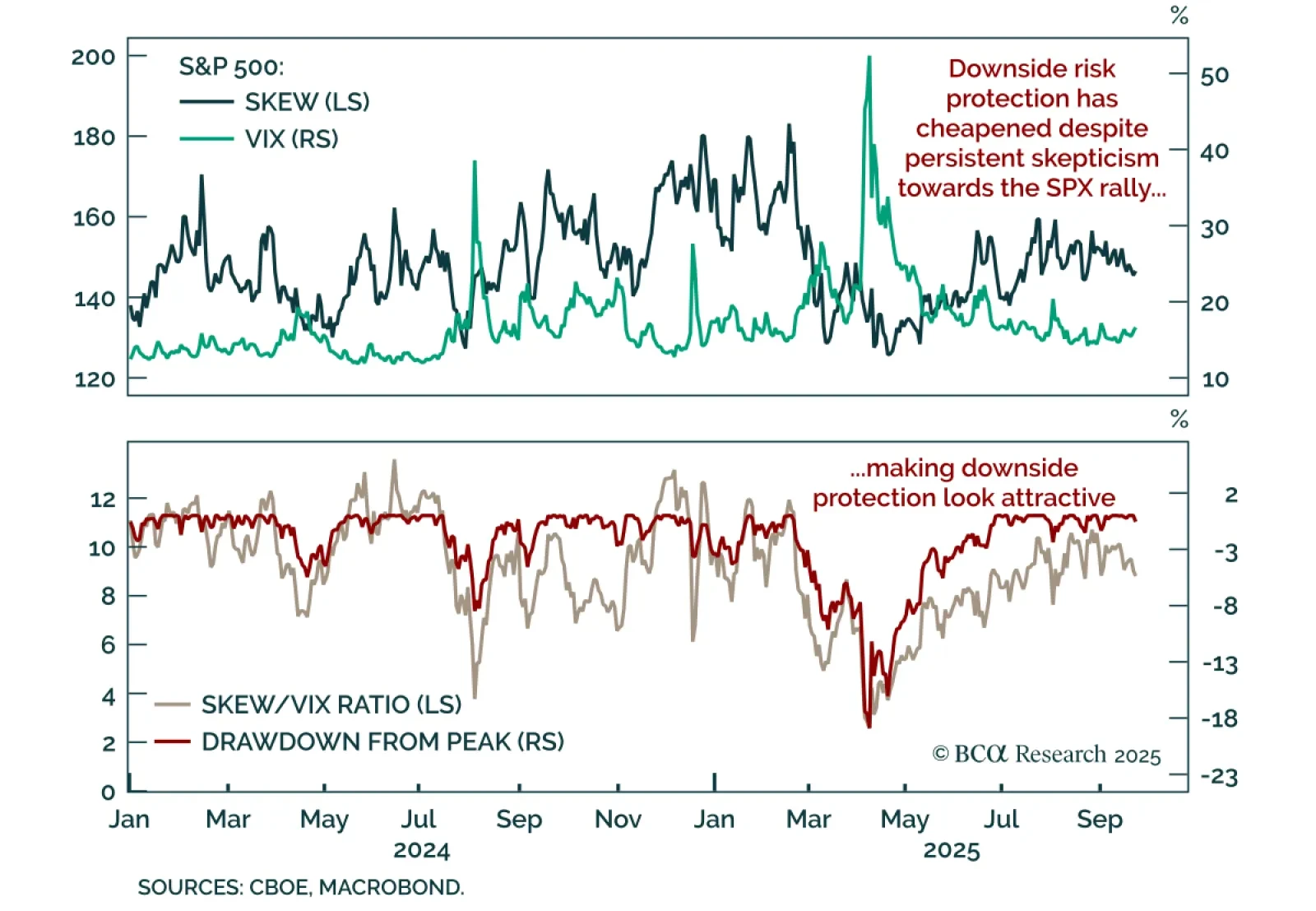

Despite talk of September seasonality, the S&P 500 has not pulled back, and the pain trade remains higher. The sell-off many expected failed to materialize. Positioning is not stretched, and in an environment where dip-buying…

Low rates volatility has been a key tailwind for equities, but the fragile equilibrium leaves markets exposed to AI sentiment and inflation risks. Rates volatility, measured by the MOVE index, has drifted to multi-year lows and sits…

Our US Political Strategists give a one-third probability of a federal government shutdown before November. The odds could increase after that. But the market impacts are limited. The source of the disagreement is the enhanced…

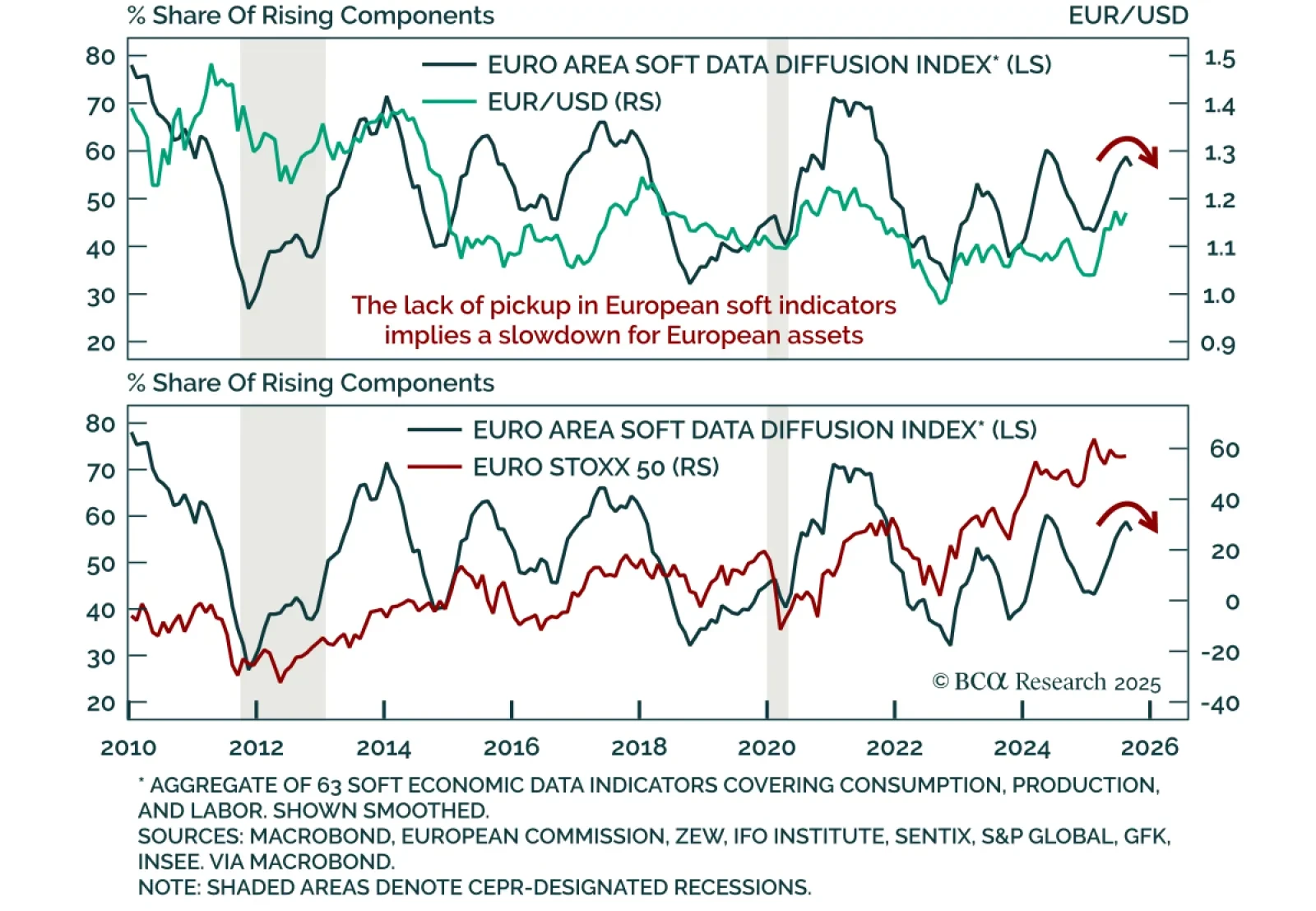

European sentiment indicators weakened again in August and September, reinforcing tactical US outperformance. While the September flash consumer confidence print beat expectations, it is still sluggish. Surveys such as Sentix and ZEW…

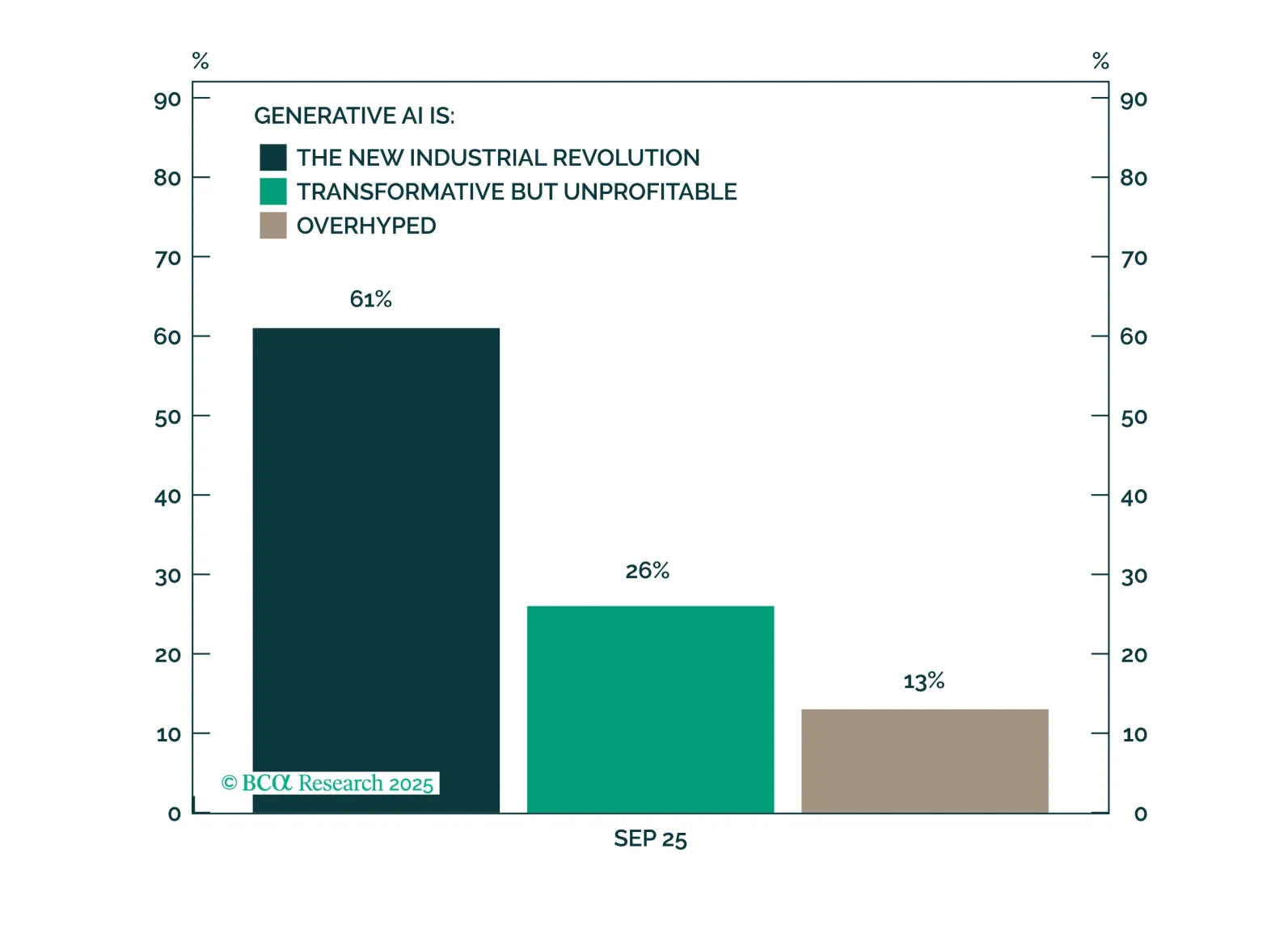

According to our latest client poll, most respondents are optimistic about the Generative AI's potential. Investors remain divided on whether current equity valuations reflect a bubble. Economic concerns continue to center on bond…

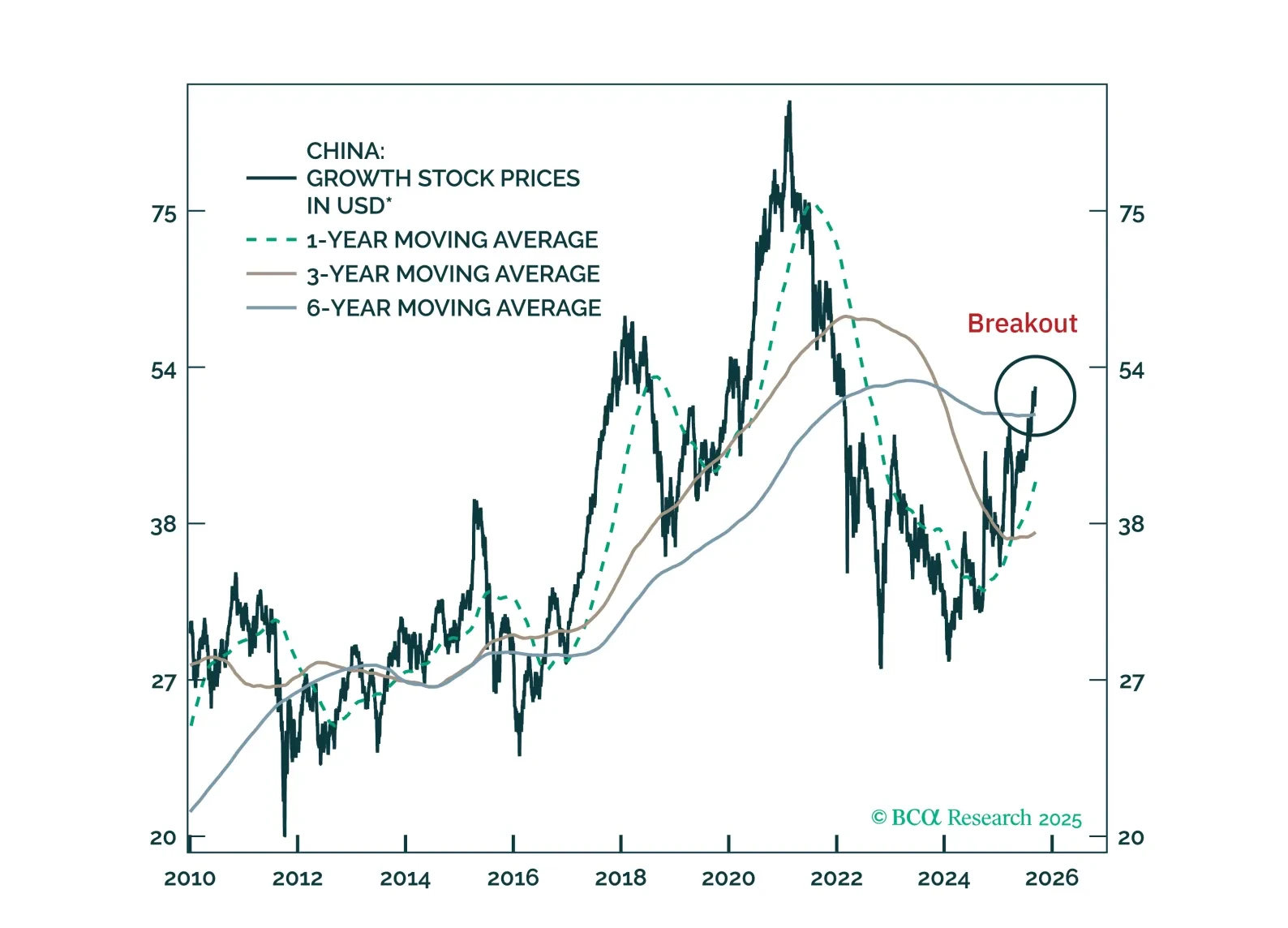

We are turning more constructive on Chinese internet stocks after several years of caution. We recommend going long offshore internet equities in absolute terms and upgrading MSCI China to overweight in a global equity portfolio.

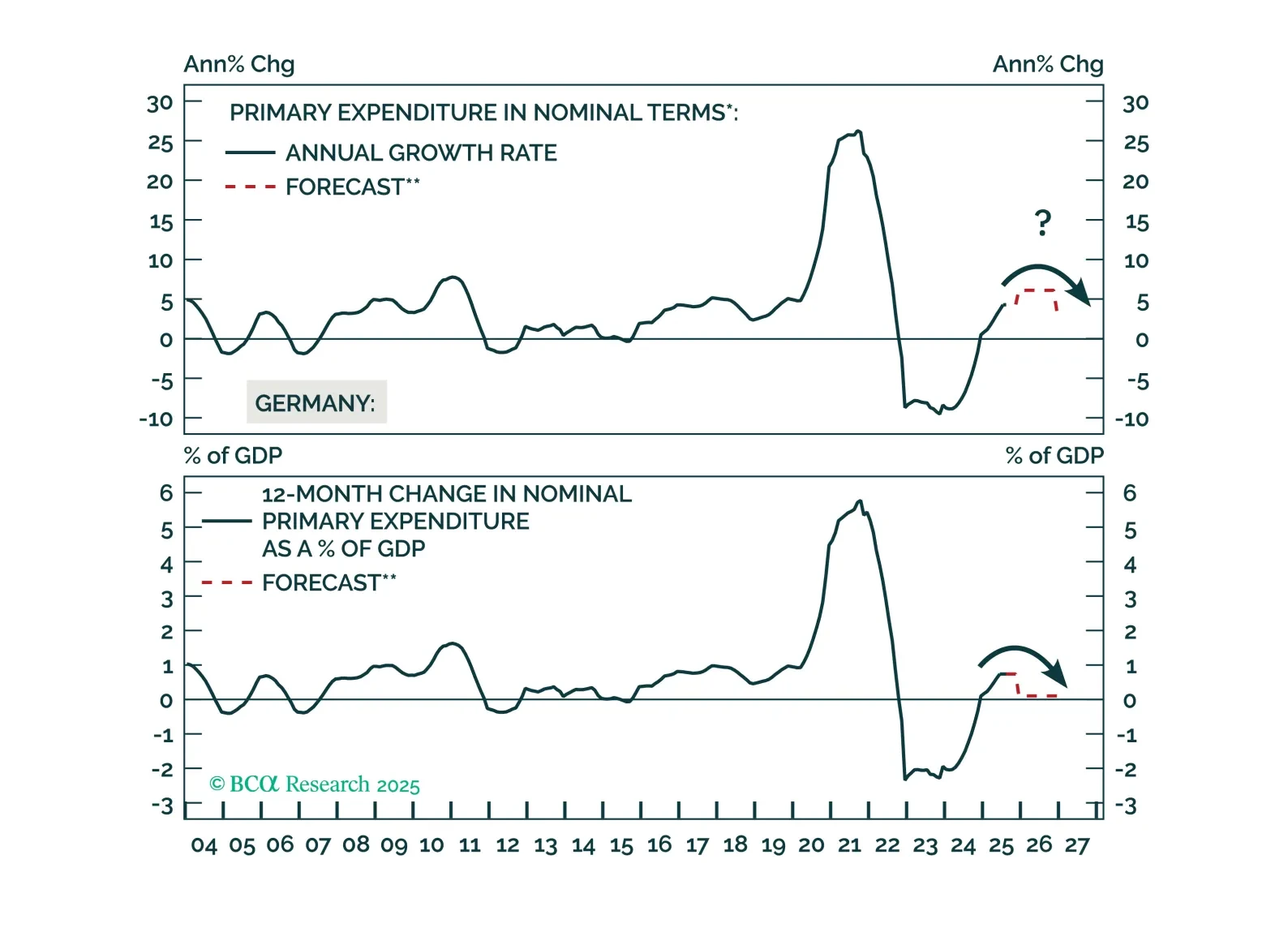

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

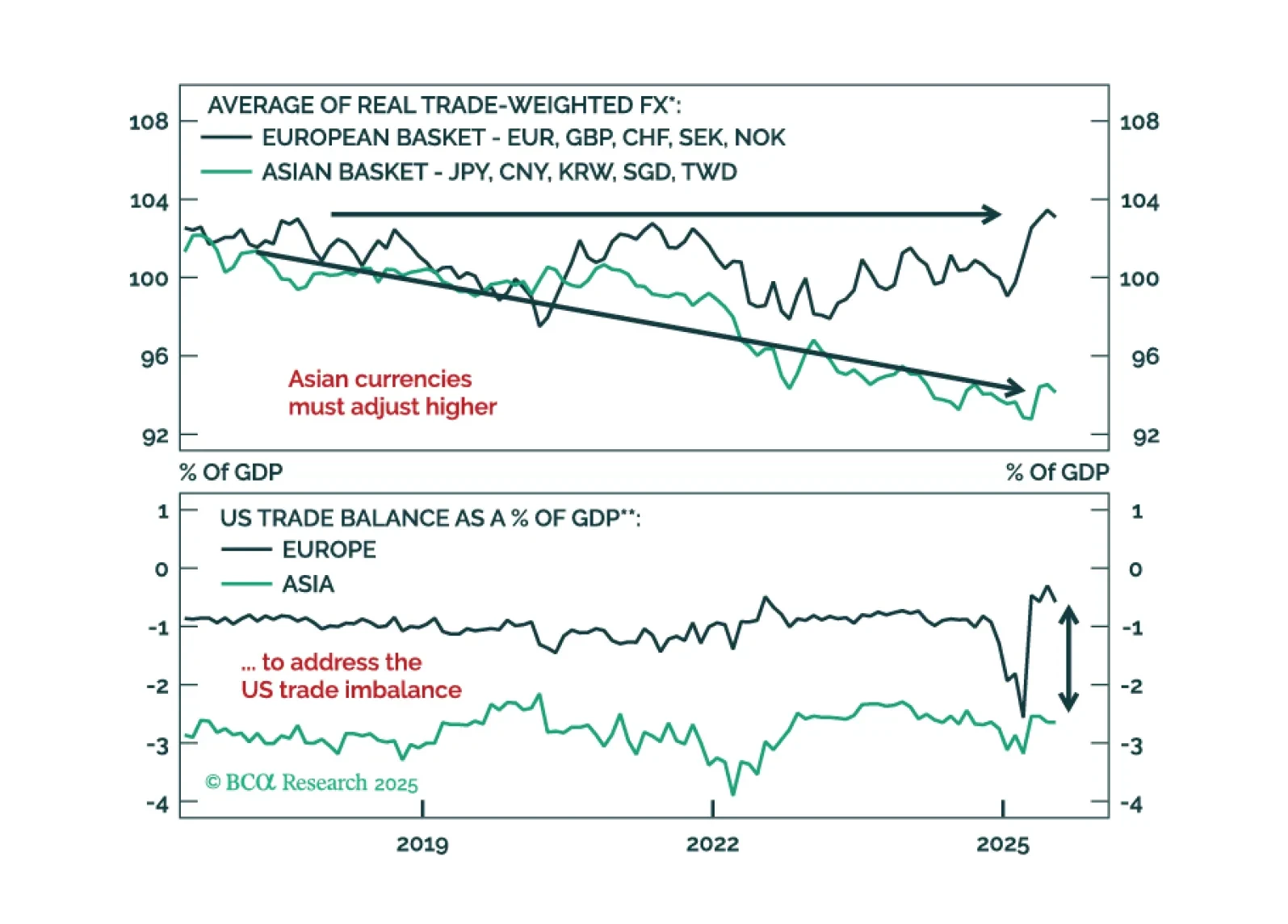

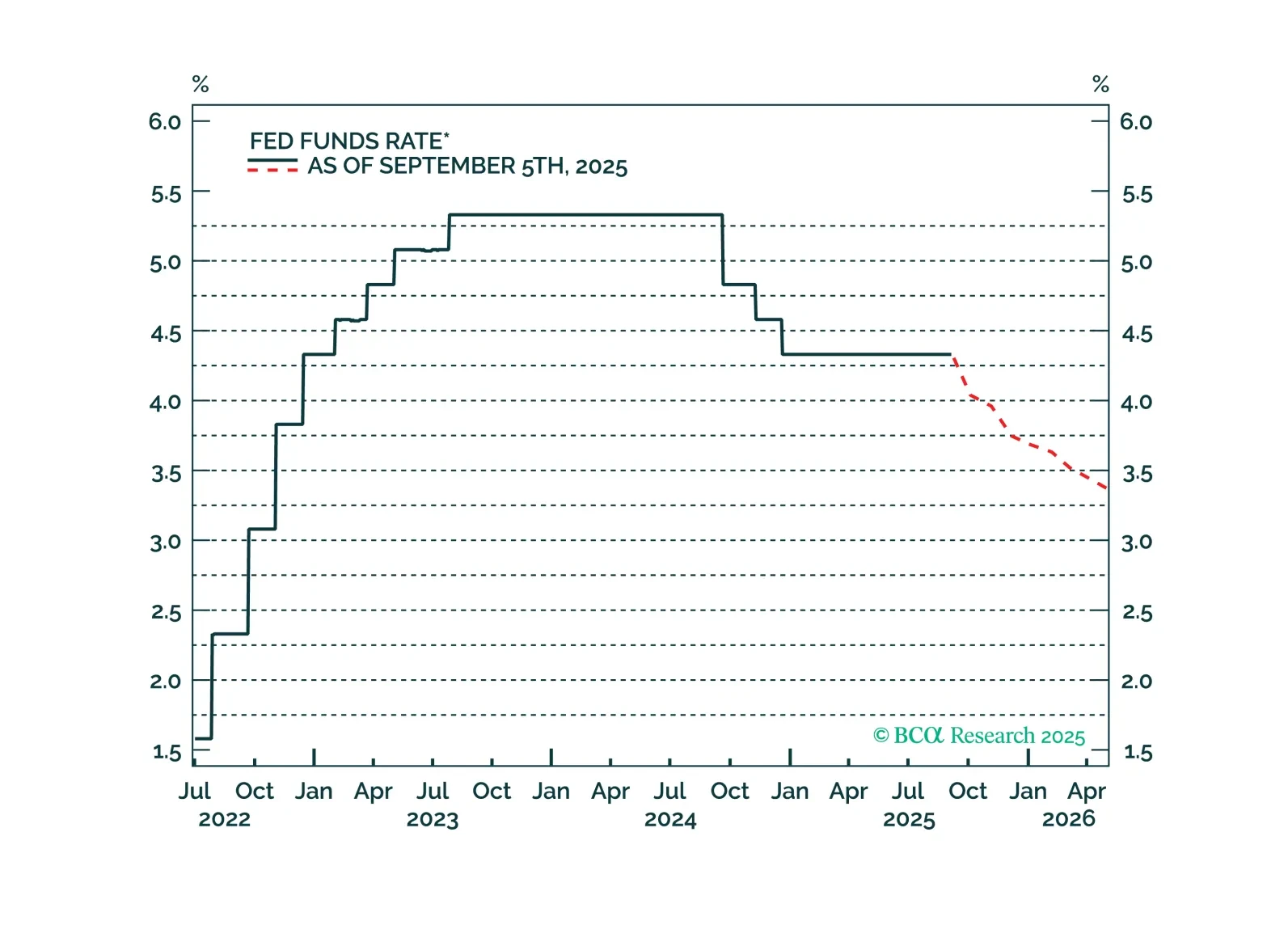

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

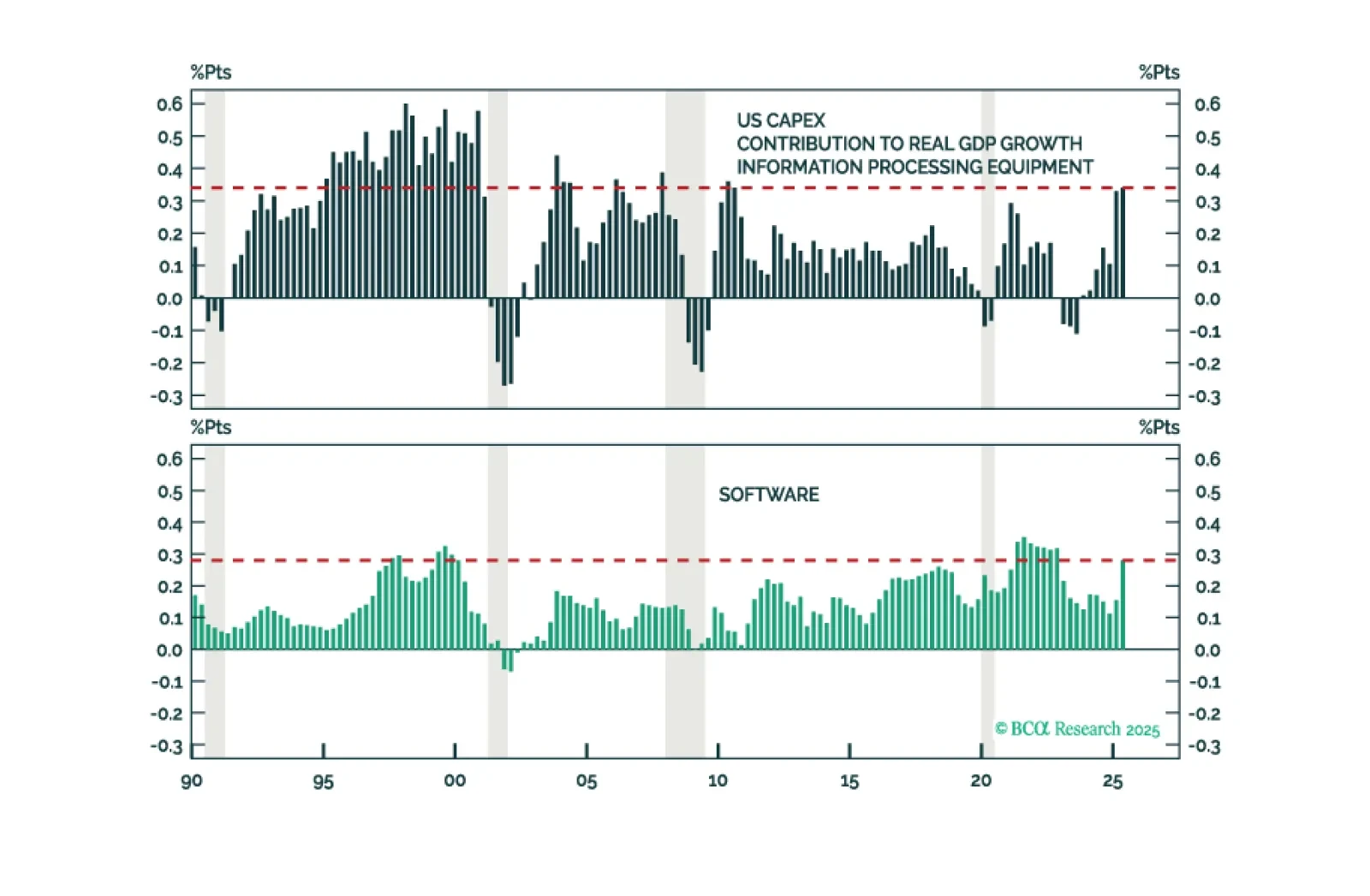

The economy is slowing, but not collapsing, and monetary easing is imminent — a backdrop that will benefit equities. We remain strategically bullish, with a close eye on GenAI and resilient earnings, even amid numerous risks. However…