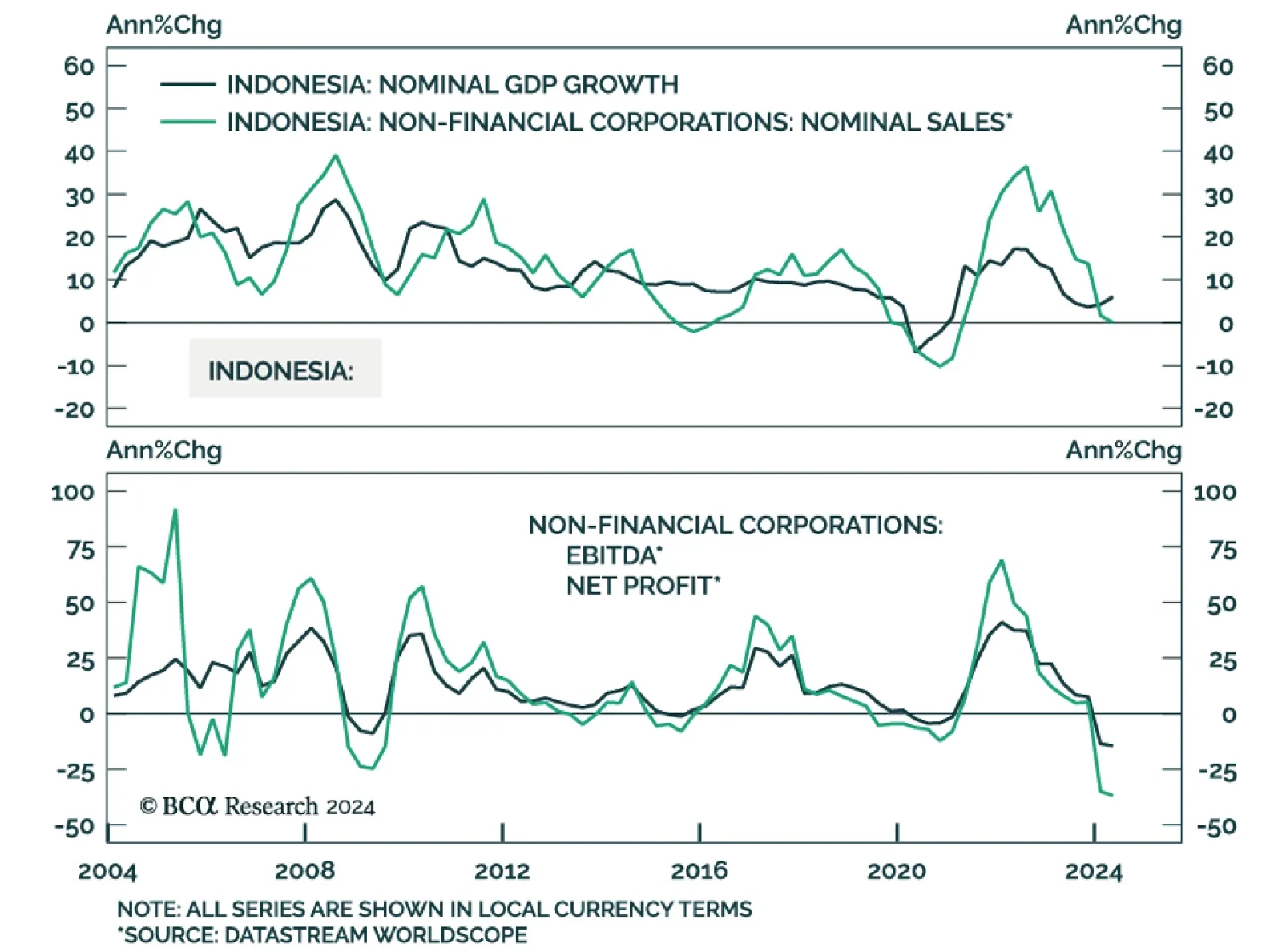

Indonesian stocks have sold off sharply and underperformed their EM and emerging Asian peers – both in local currency and in common currency terms – despite the nation’s 5.1% real GDP growth rate (the highest…

According to BCA Research’s European Investment Strategy service, investors should fade the rebound in European equities and bond yields as the euro is also at risk. Last week’s bounce in global equities is…

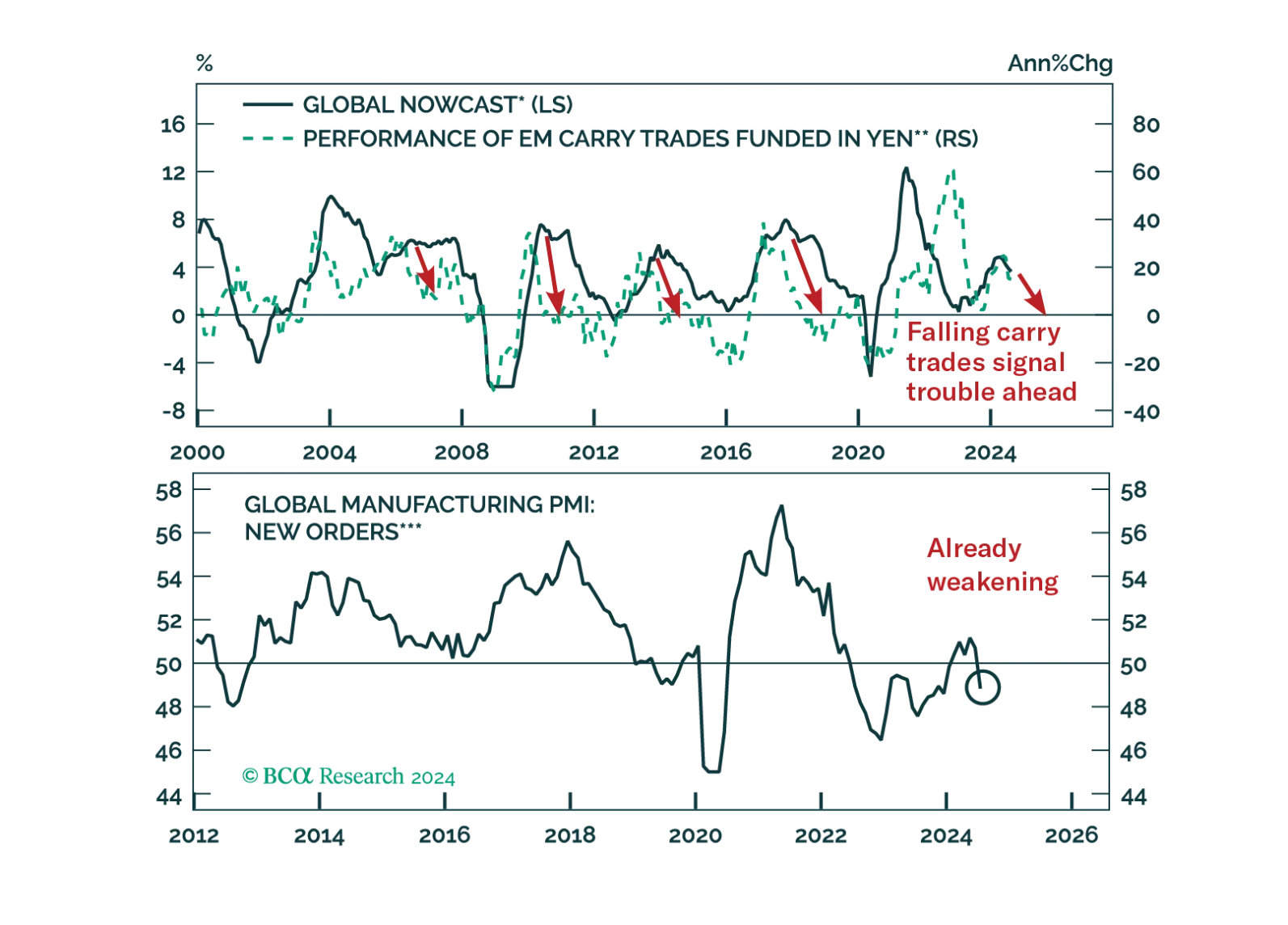

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?

The market backdrop changed a lot between the preparation and the publication of our equity downgrade report. We publish this companion Insight to help investors navigate the new environment.

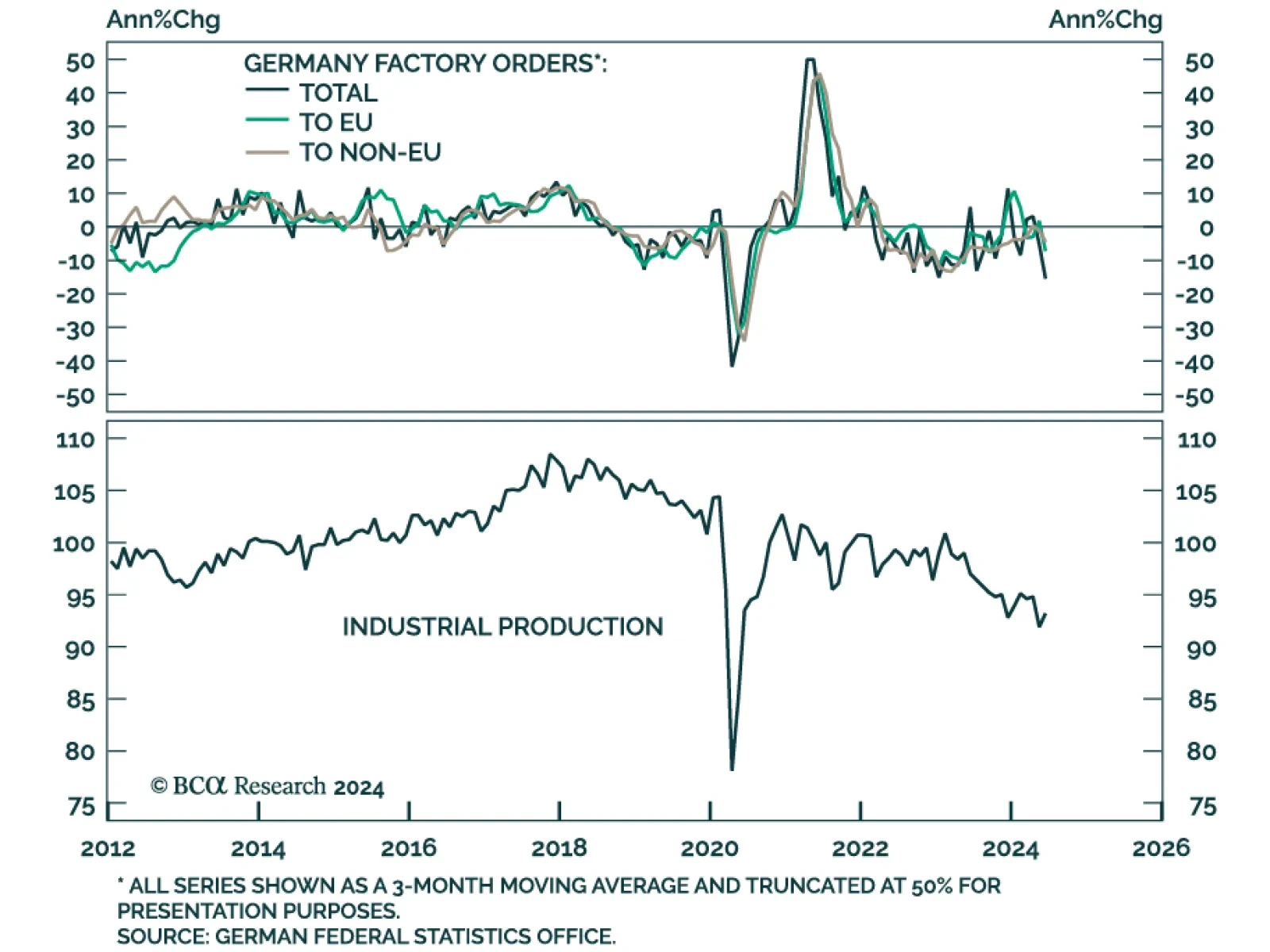

German Industrial production and factory orders continued their slump in June. The usual powerhouse of the Euro Area economy has been trailing its peers throughout 2024. While both industrial production and factory orders…

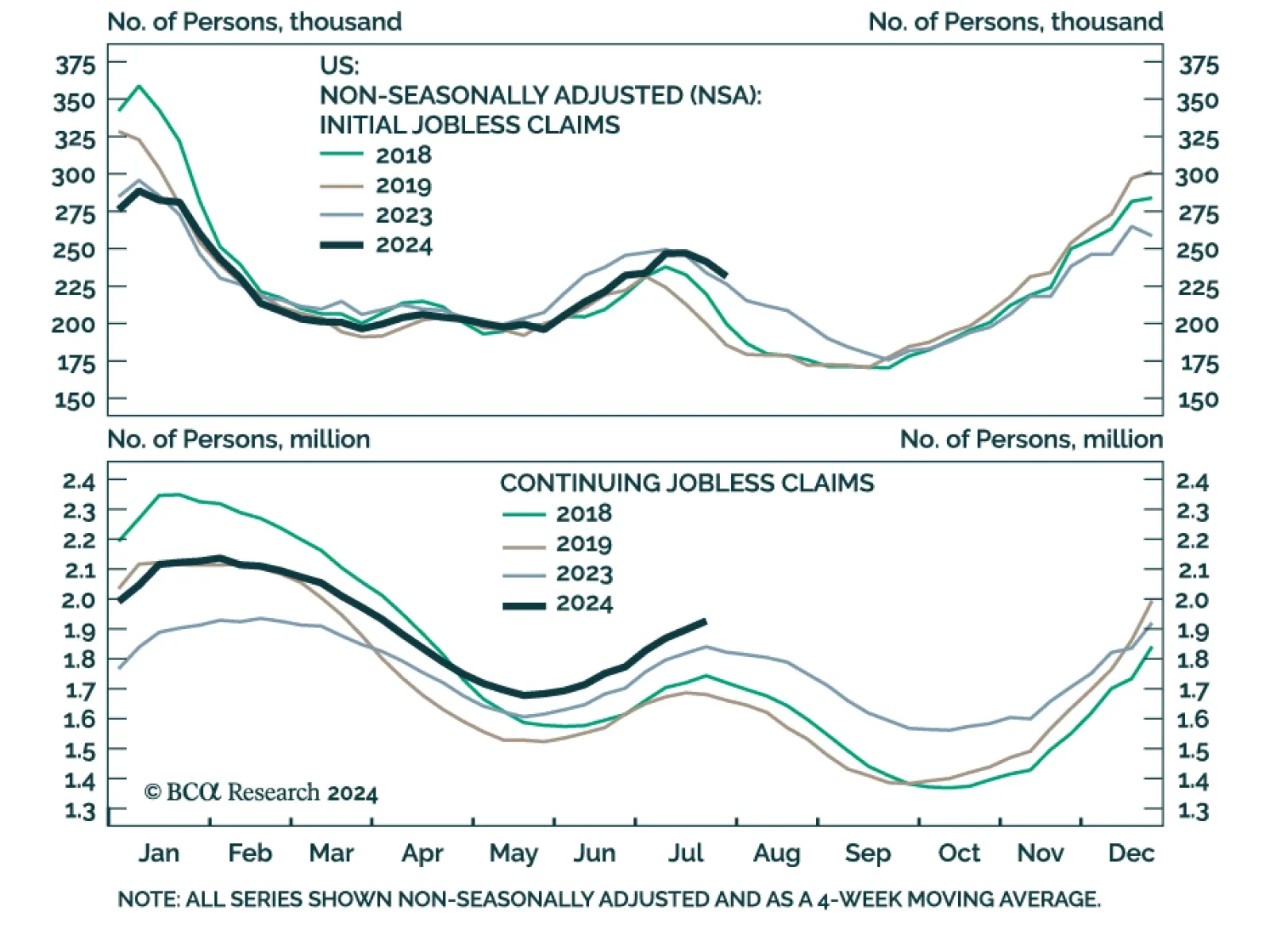

There has been no shortage of twists since last Friday’s employment situation report. On Monday, the July ISM Services PMI release dissipated some of the risk-off mood that dominated markets. On Thursday, positive…

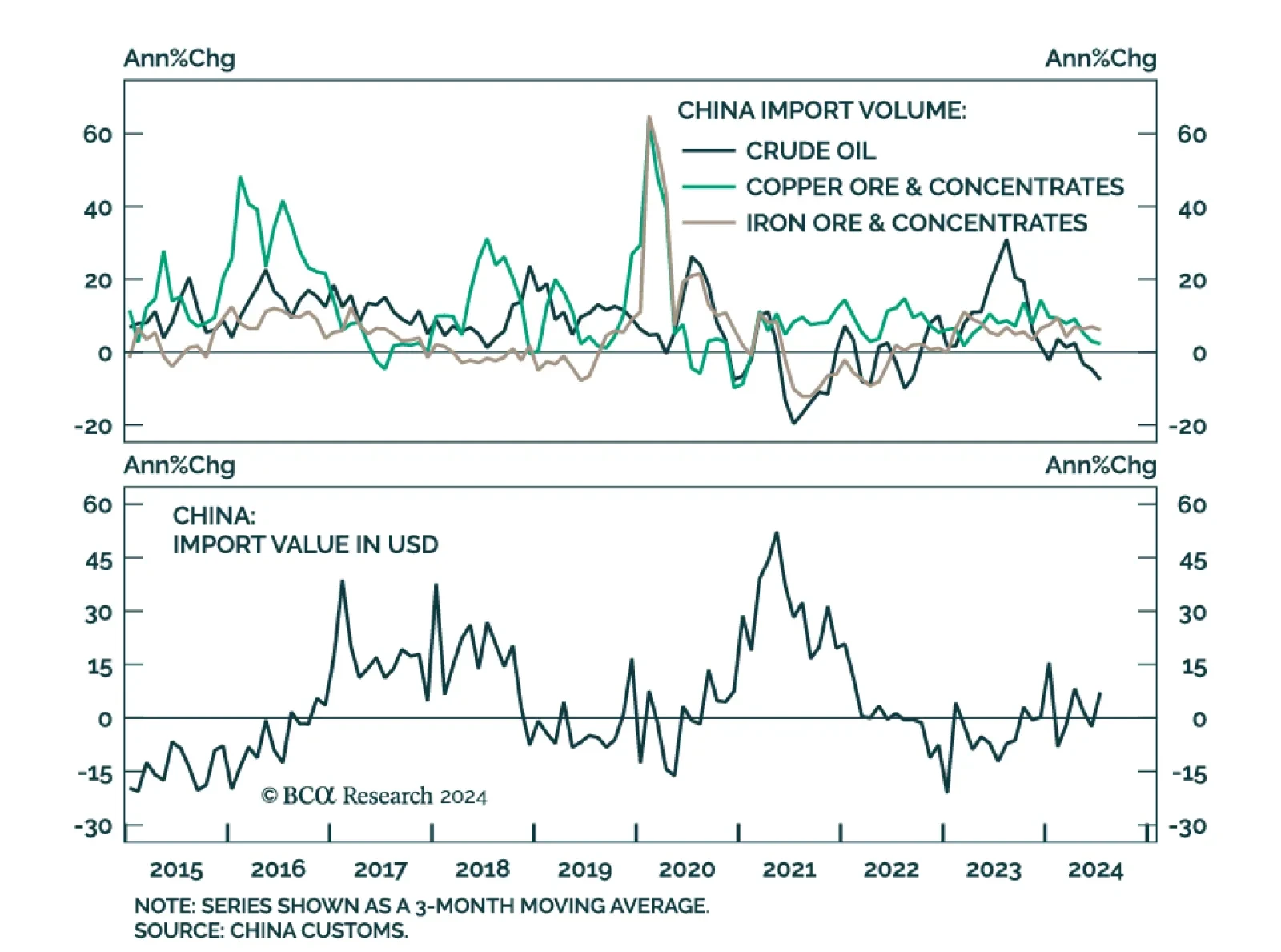

Chinese exports in USD terms missed expectations in July, growing by 7.0% y/y, down from 8.6% in June. Conversely, imports rebounded smartly from a 2.3% contraction, rising by 7.2% in July and upending expectations of 3.2%.…

China's cyclical and structural headwinds will likely undermine Beijing’s initiative to accelerate urban migration over the next five years.

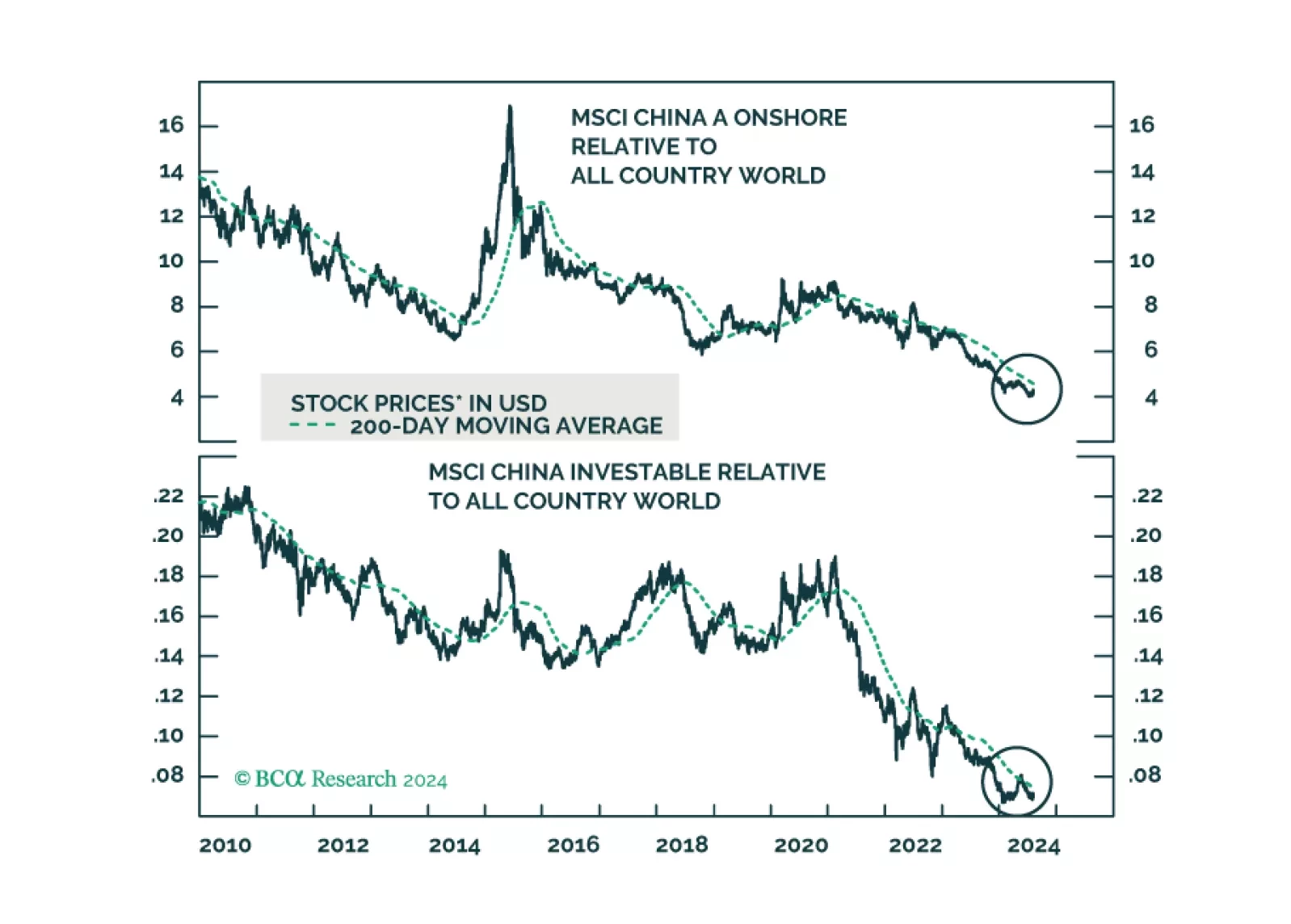

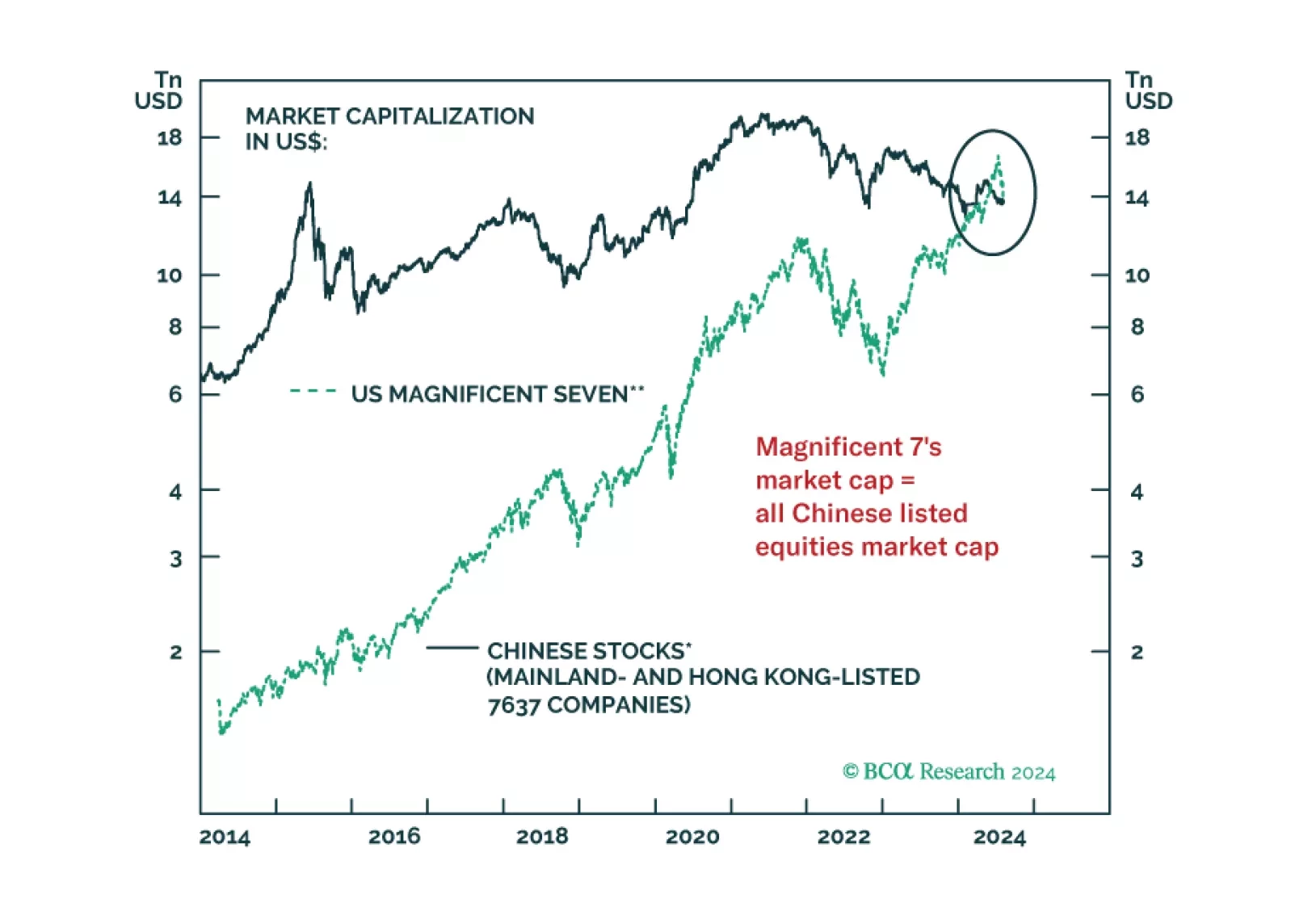

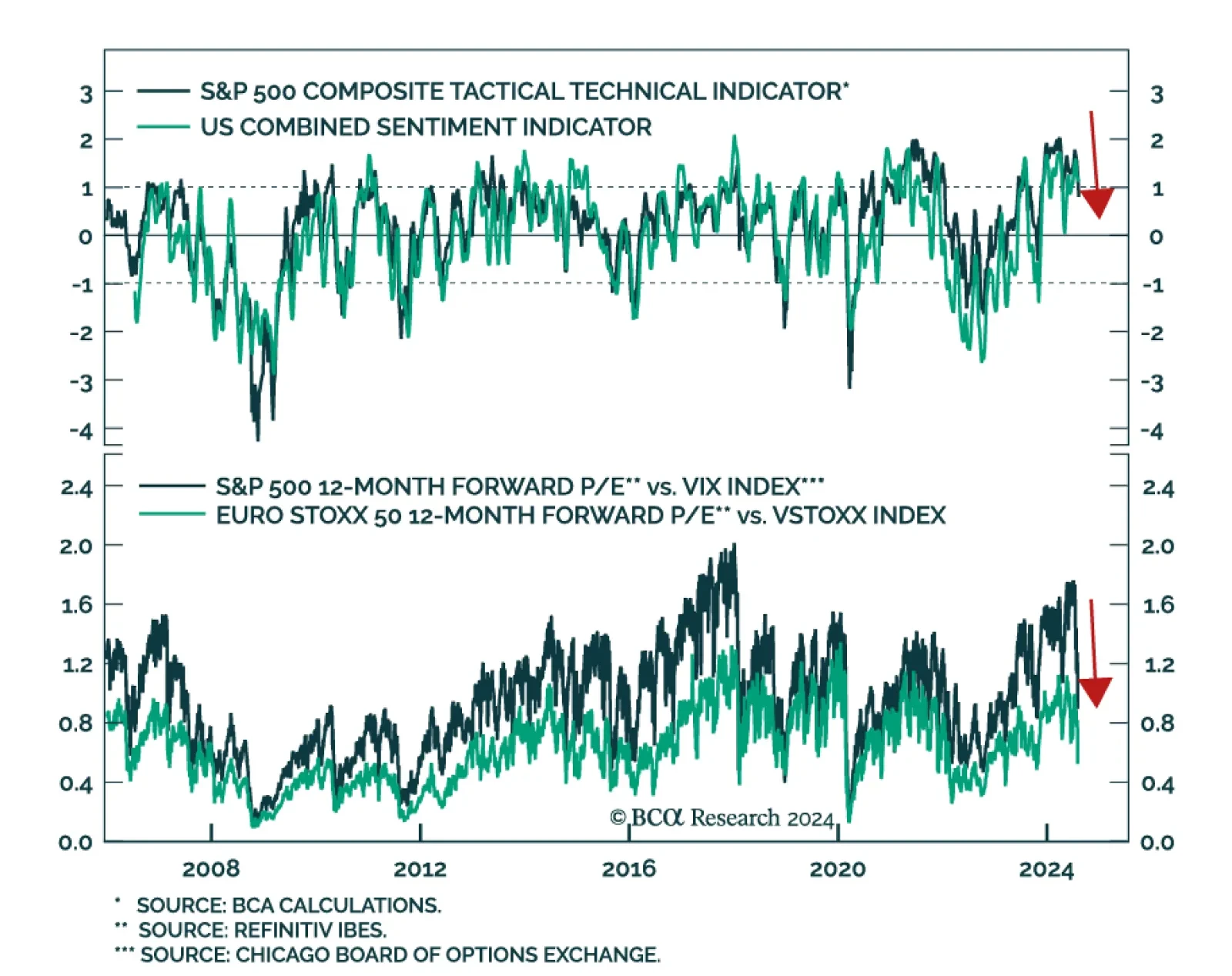

The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…

The risk-off mood that dominated markets on Thursday, Friday and the early stages of Monday’s trading amid dismal payrolls, tech earnings and manufacturing PMIs seems to have dissipated for the time being. The positive…