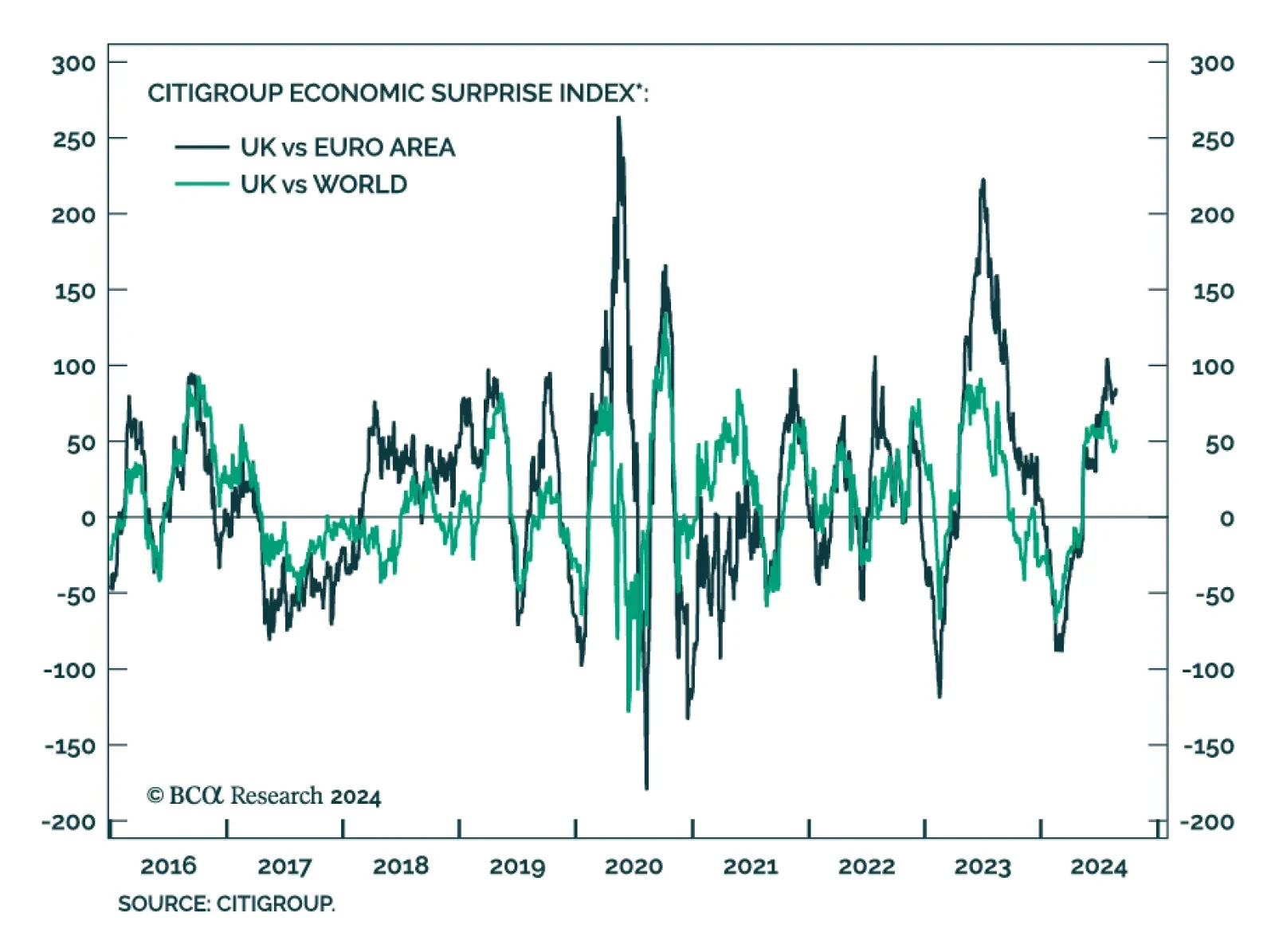

UK GDP growth accelerated to 0.6% in the second quarter, and the latest PMI data underscores contrasts with its DM counterparts (see The Numbers). Several tailwinds are supporting the UK economy. Two-year Gilt yields have…

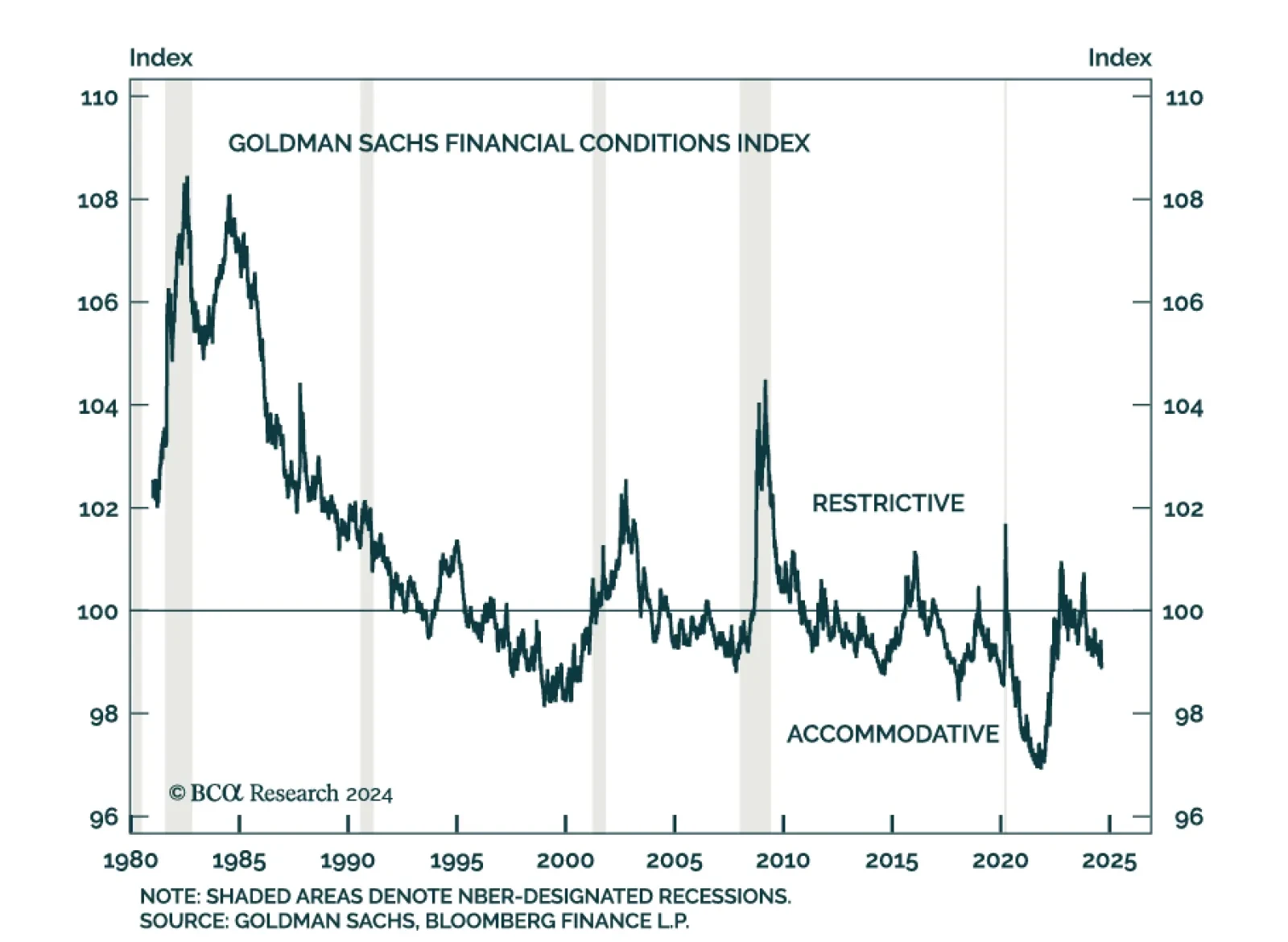

According to Goldman Sachs’ Financial Conditions Index (FCI) financial conditions have become considerably more supportive since the fall of 2023. More recently, the index ticked noticeably lower from 99.4 earlier in August…

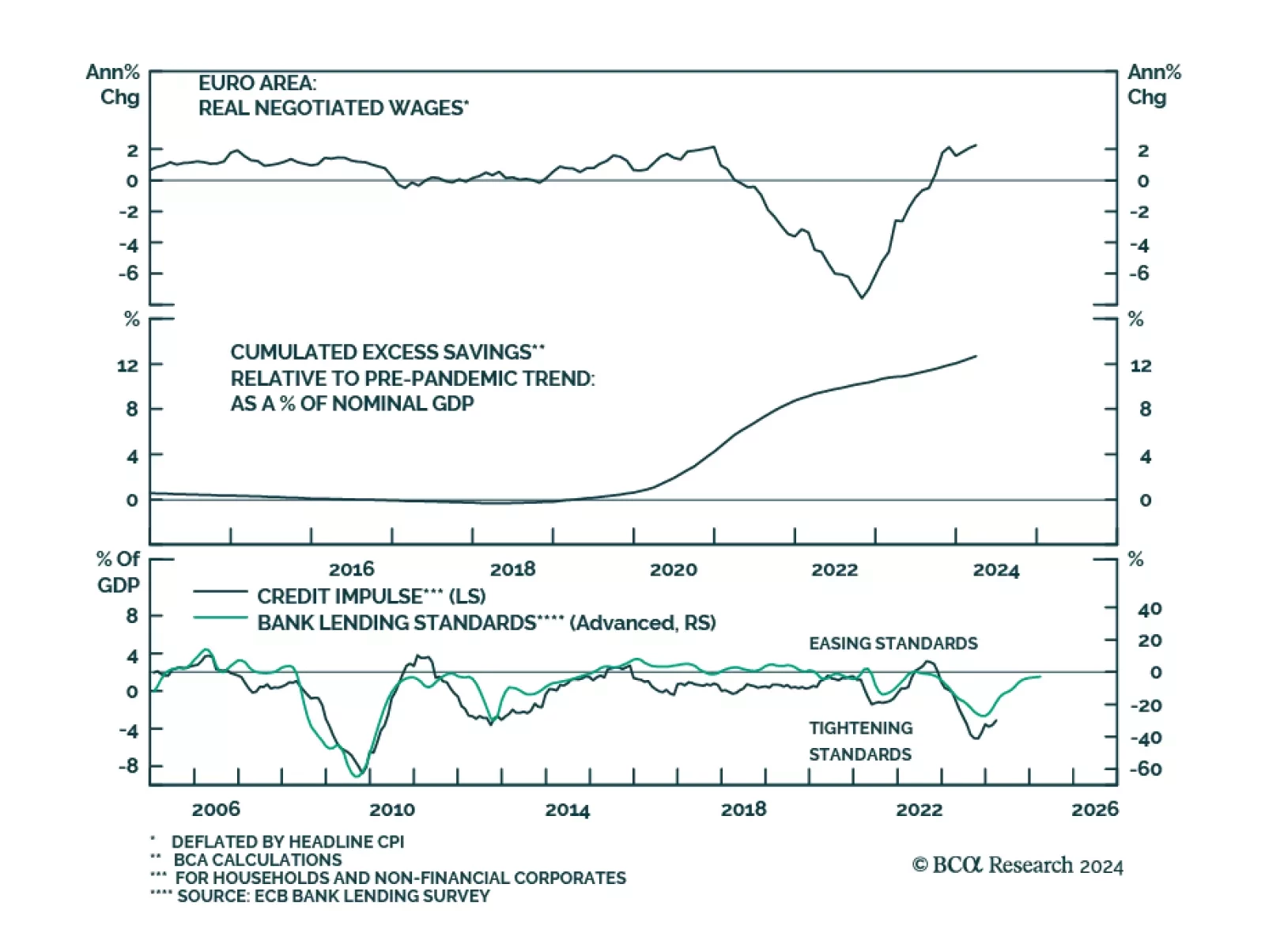

We’ve highlighted that continued deterioration in consumer fundamentals will tip the US economy into a recession. Slower compensation growth, tighter lending standards for consumer loans and dwindling excess savings will…

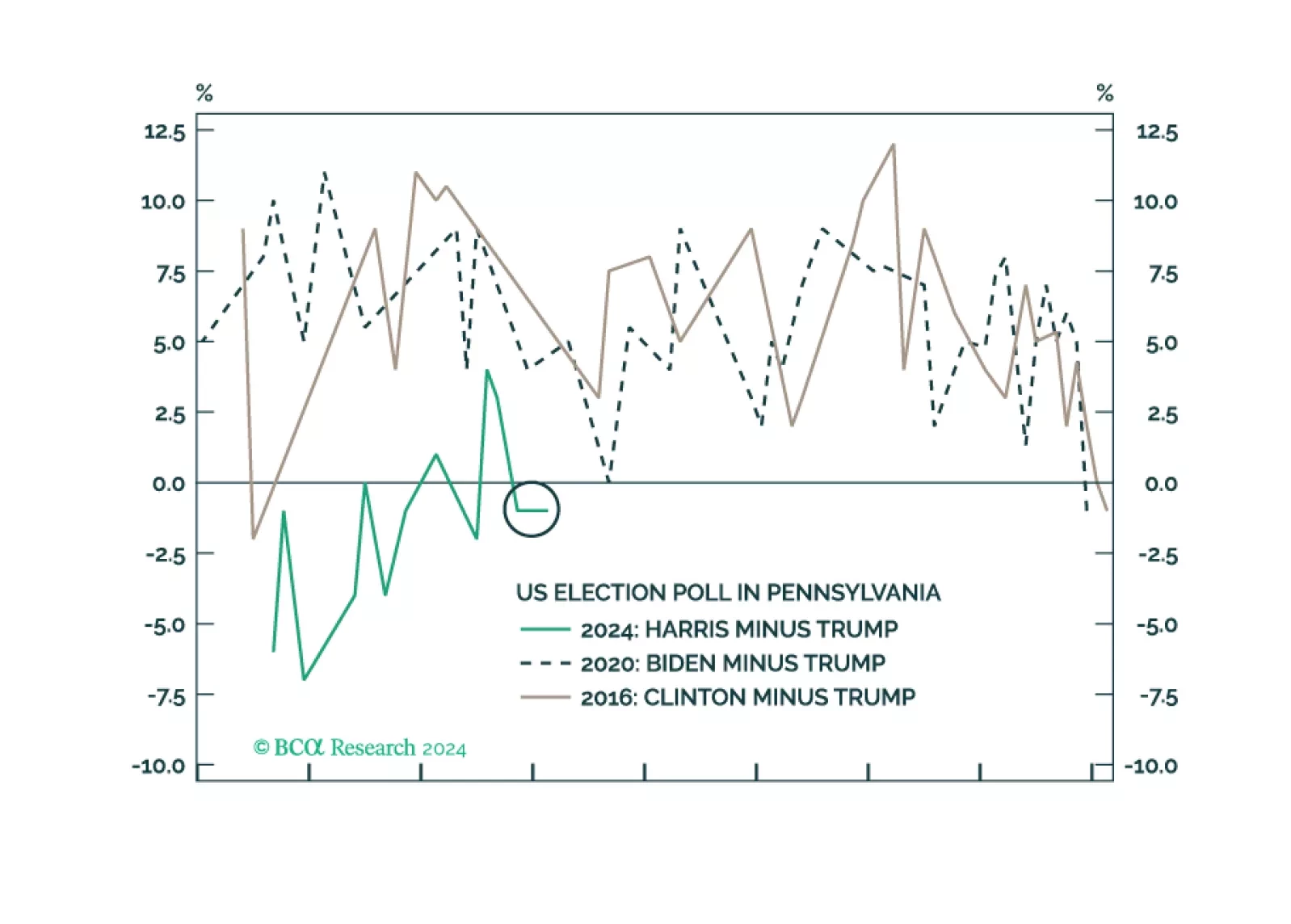

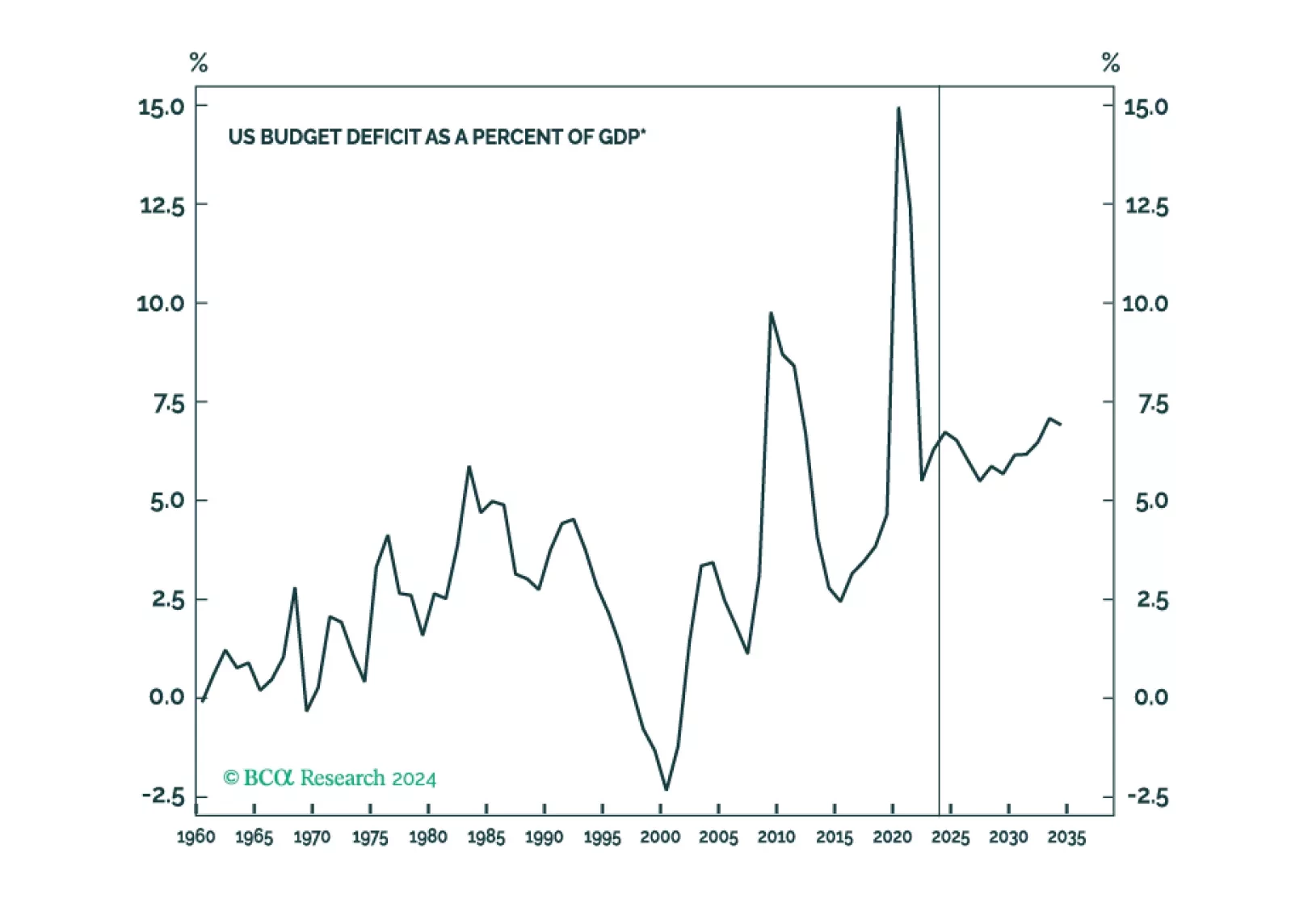

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

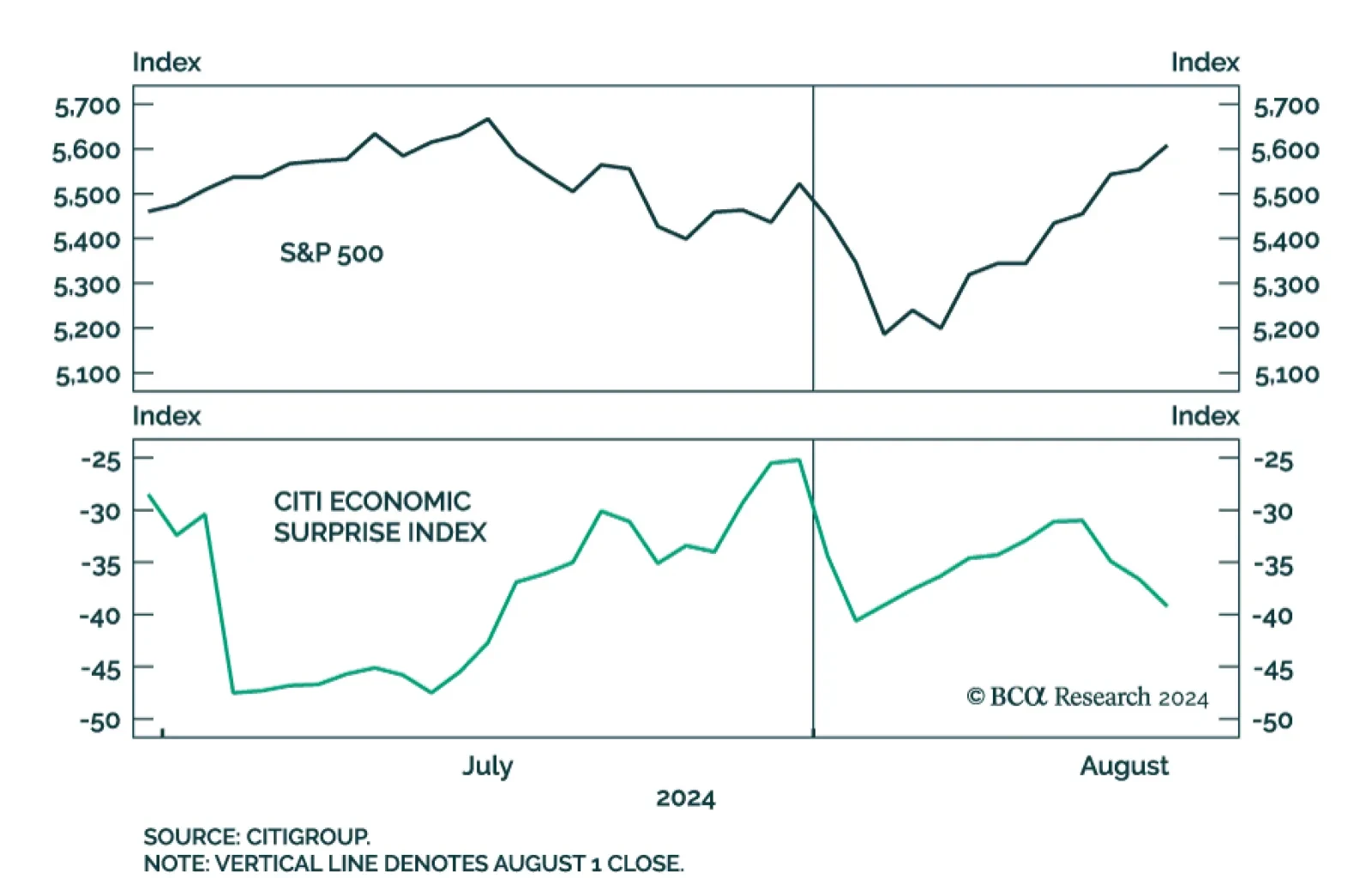

It didn't take long for markets to utterly shrug off the surprise rise in July's unemployment rate. On Tuesday, the S&P 500 closed higher than it was the day before the July Employment Situation report was released…

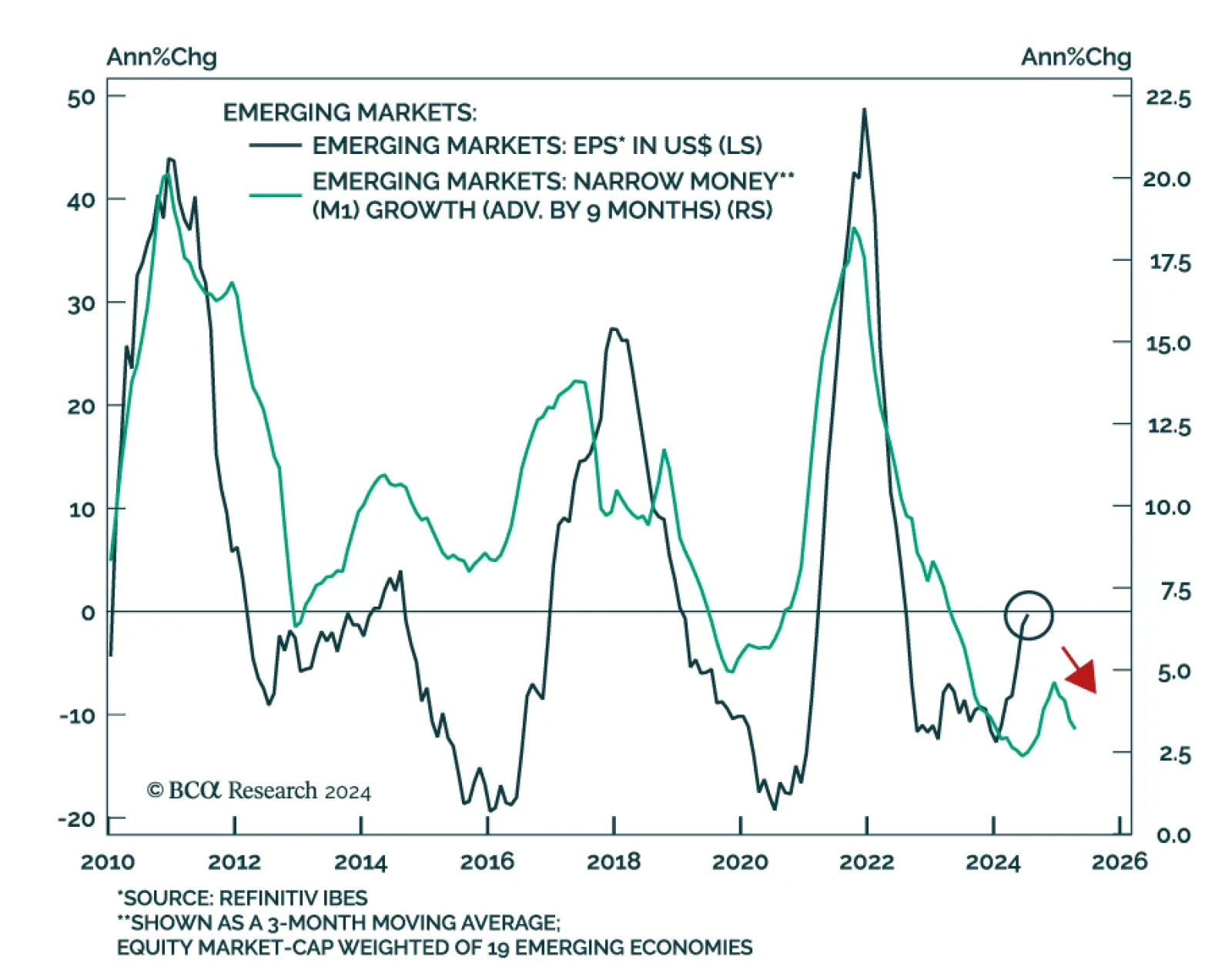

EM equities have dramatically underperformed their US and Eurozone peers in USD terms over the past 15 years. The inability of EM and EM Asia companies to grow their EPS largely explains EM equities “lost decade” (and…

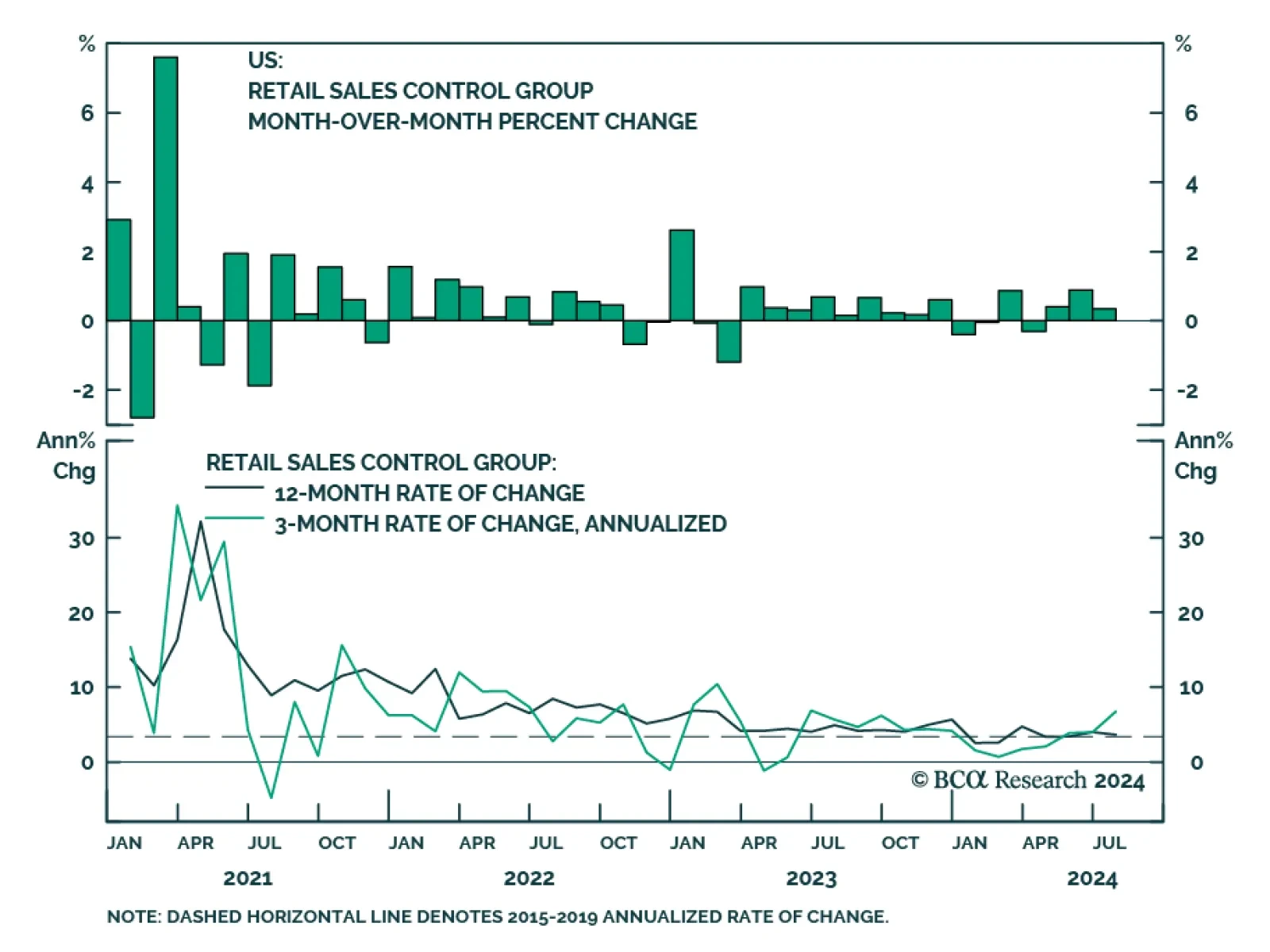

Preliminary estimates suggest that US retail sales surprised to the upside in July. They grew by 1.0% m/m from a 0.2% monthly contraction in June, exceeding expectations of a slower 0.4% pace of growth. Sales of vehicles and…

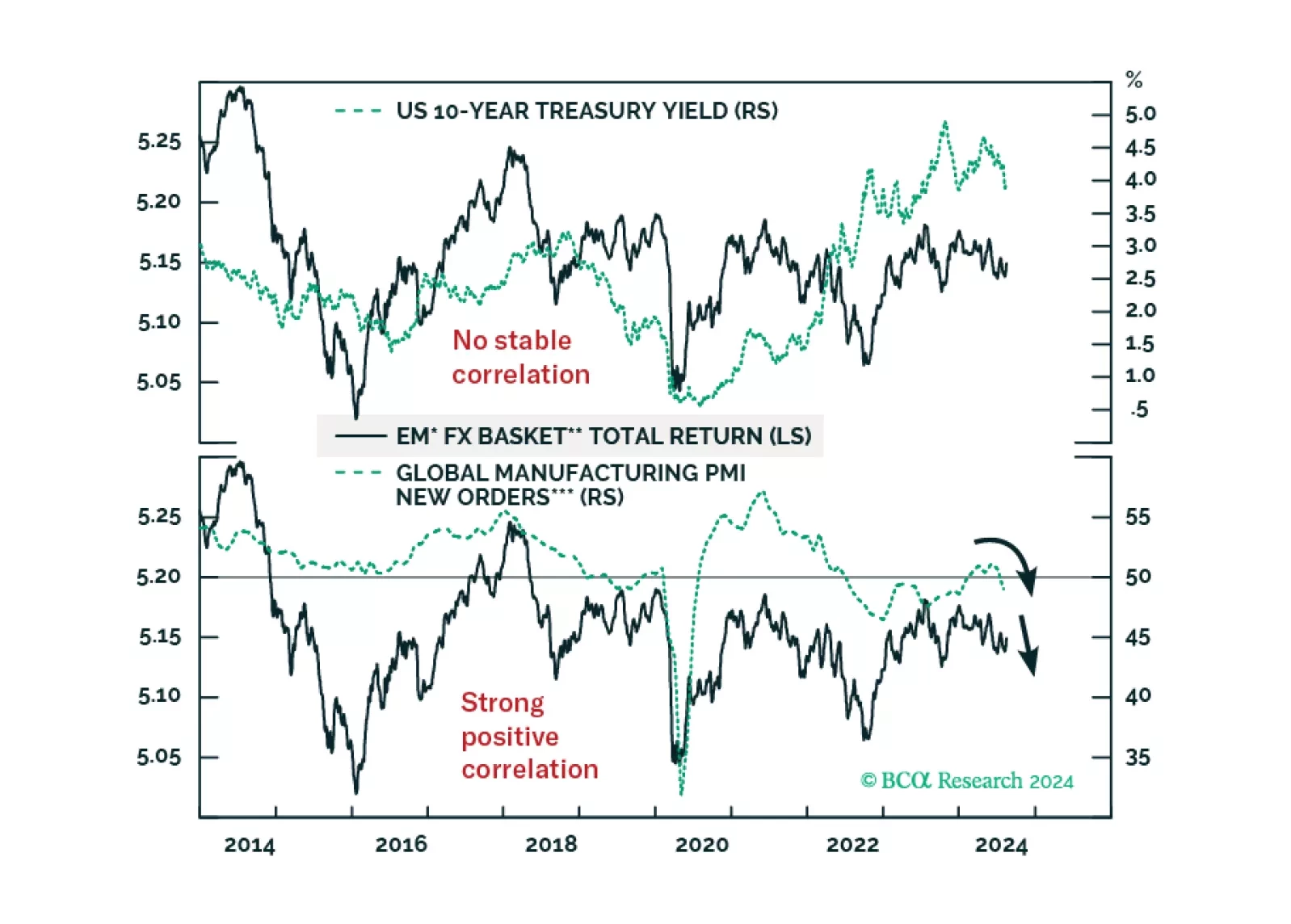

The current Fed easing cycle will likely be a “buy the rumor, sell the news” phenomenon. The basis is our expectation that the US economy is heading into a rough landing. The primary driver of EM currencies is not US interest rates…