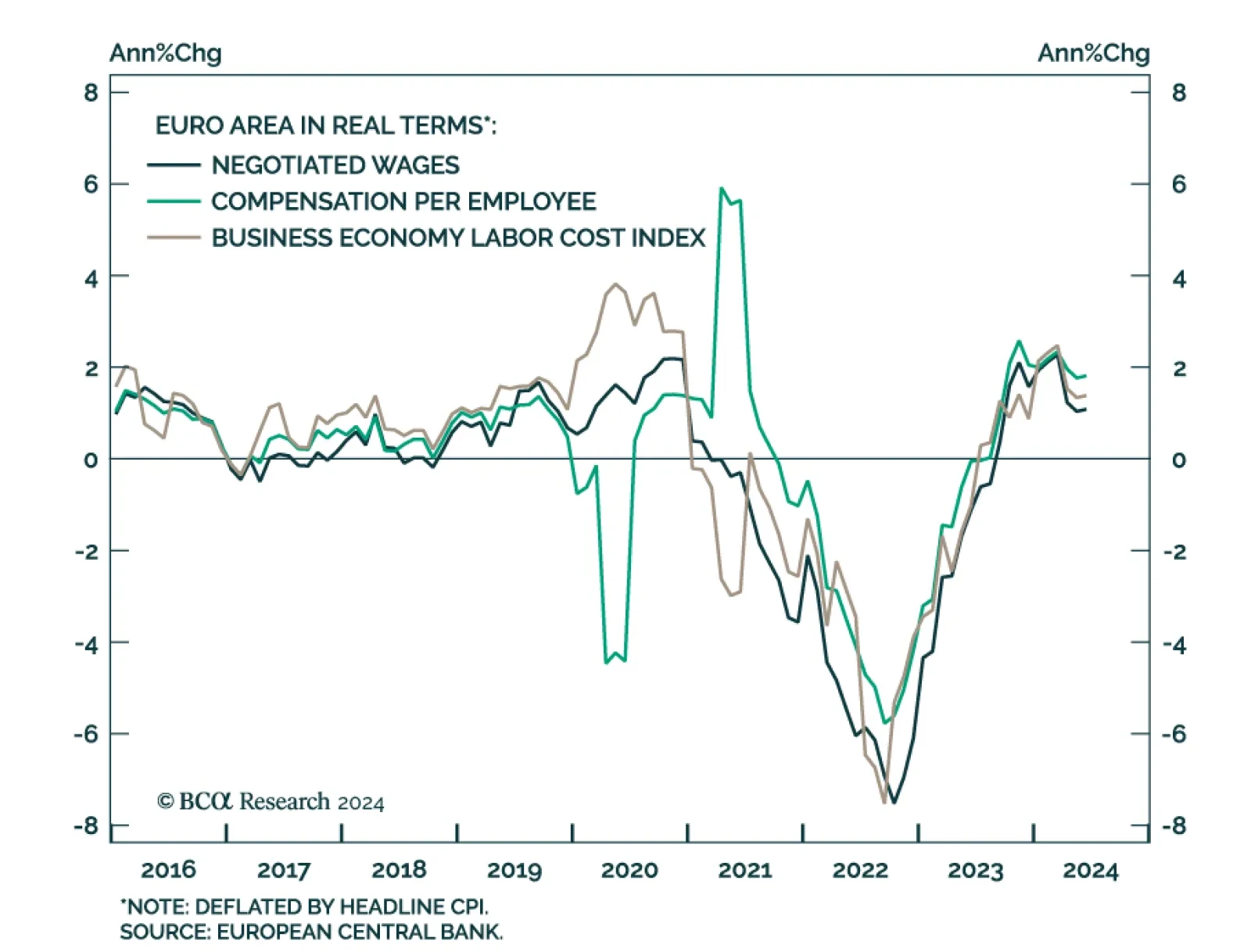

Eurozone GDP’s final estimate indicates that growth was slower than expected in Q2. Output grew 0.2% q/q in Q2, compared to 0.3% previously reported. A significant downward revision to capex (2.2% contraction against 1.8%…

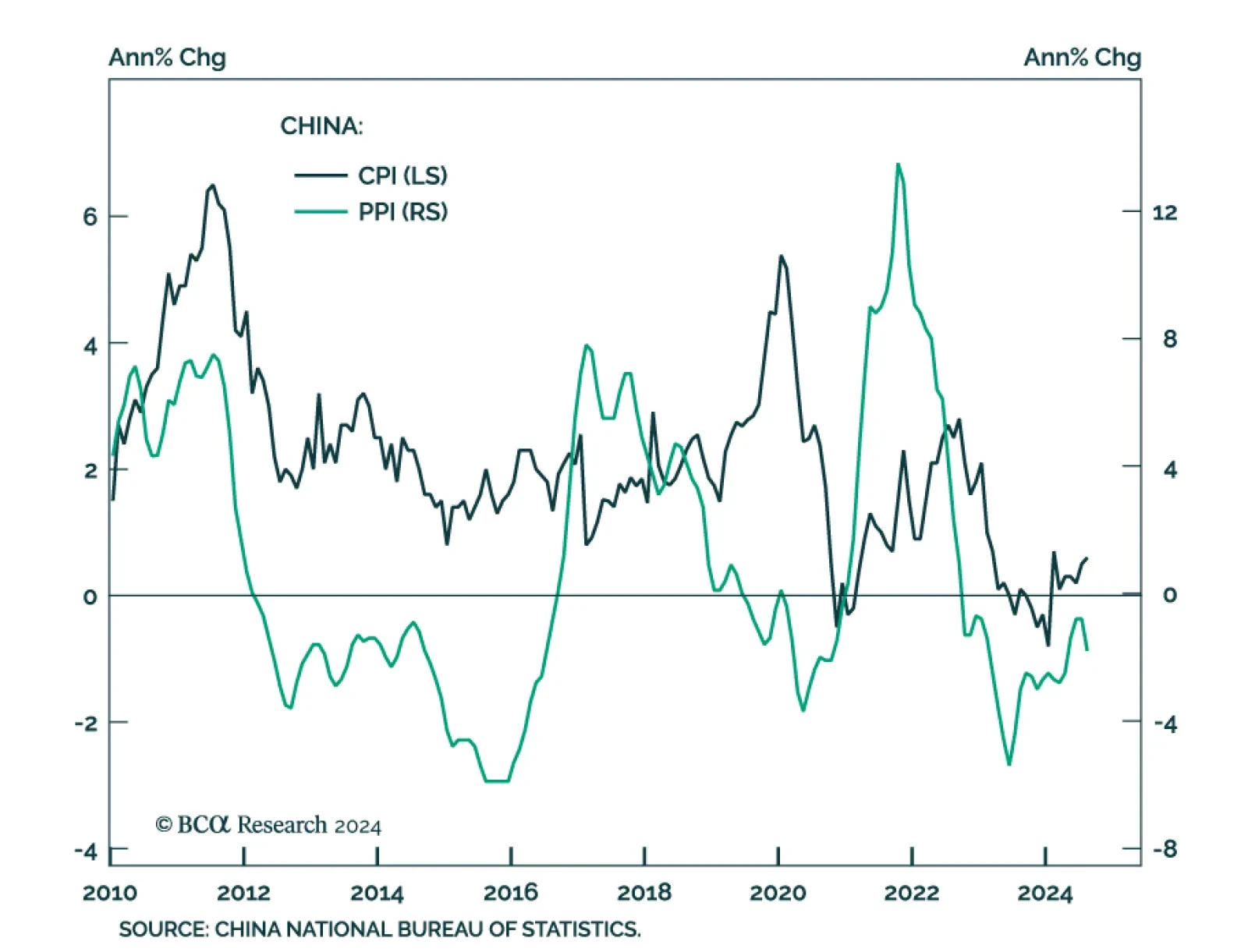

China’s CPI and PPI both surprised to the downside in August. Consumer prices grew from 0.5% y/y to 0.6%, below the 0.7% anticipated. However, a 2.8% y/y surge in food prices (the fastest pace so far this year)…

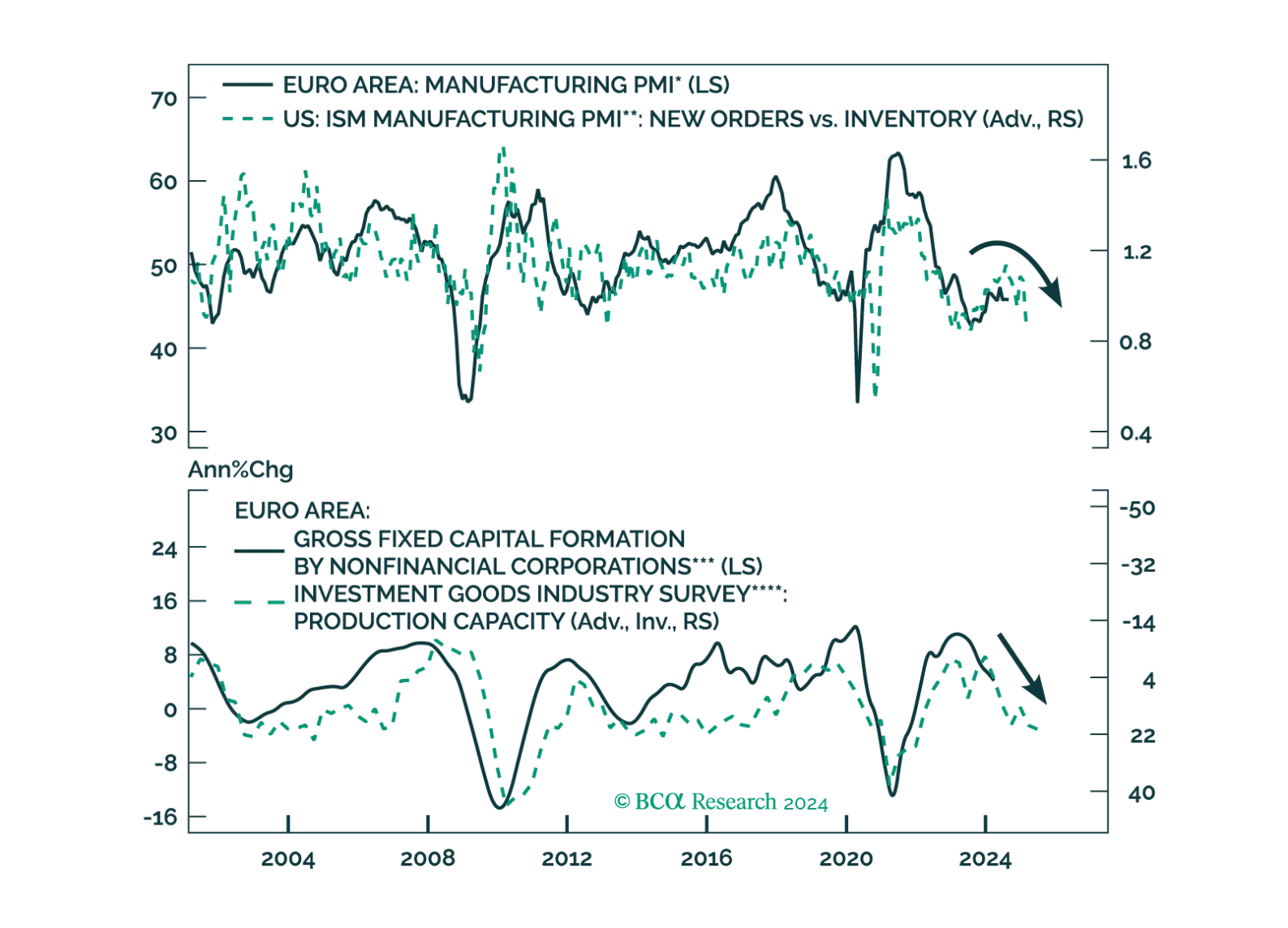

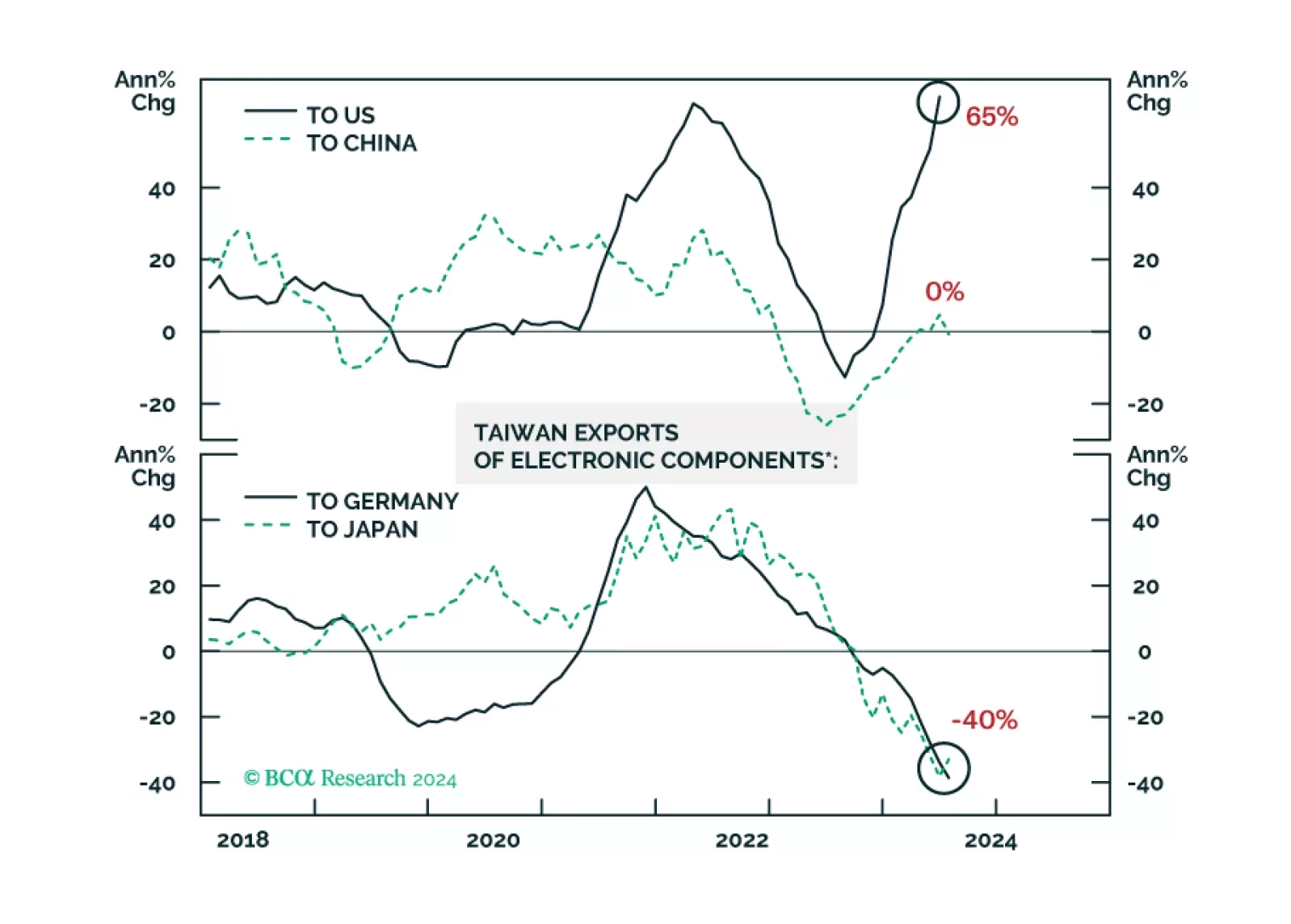

Crucial leading indicators of the global and European economies continue to deteriorate. How should investors position their European portfolios to benefit from these trends?

The Fed’s Beige Book compiles qualitative input sourced from business and other organizational contacts in each of its 12 Districts. It precedes FOMC meetings by a couple of weeks and is meant to help participants trace the…

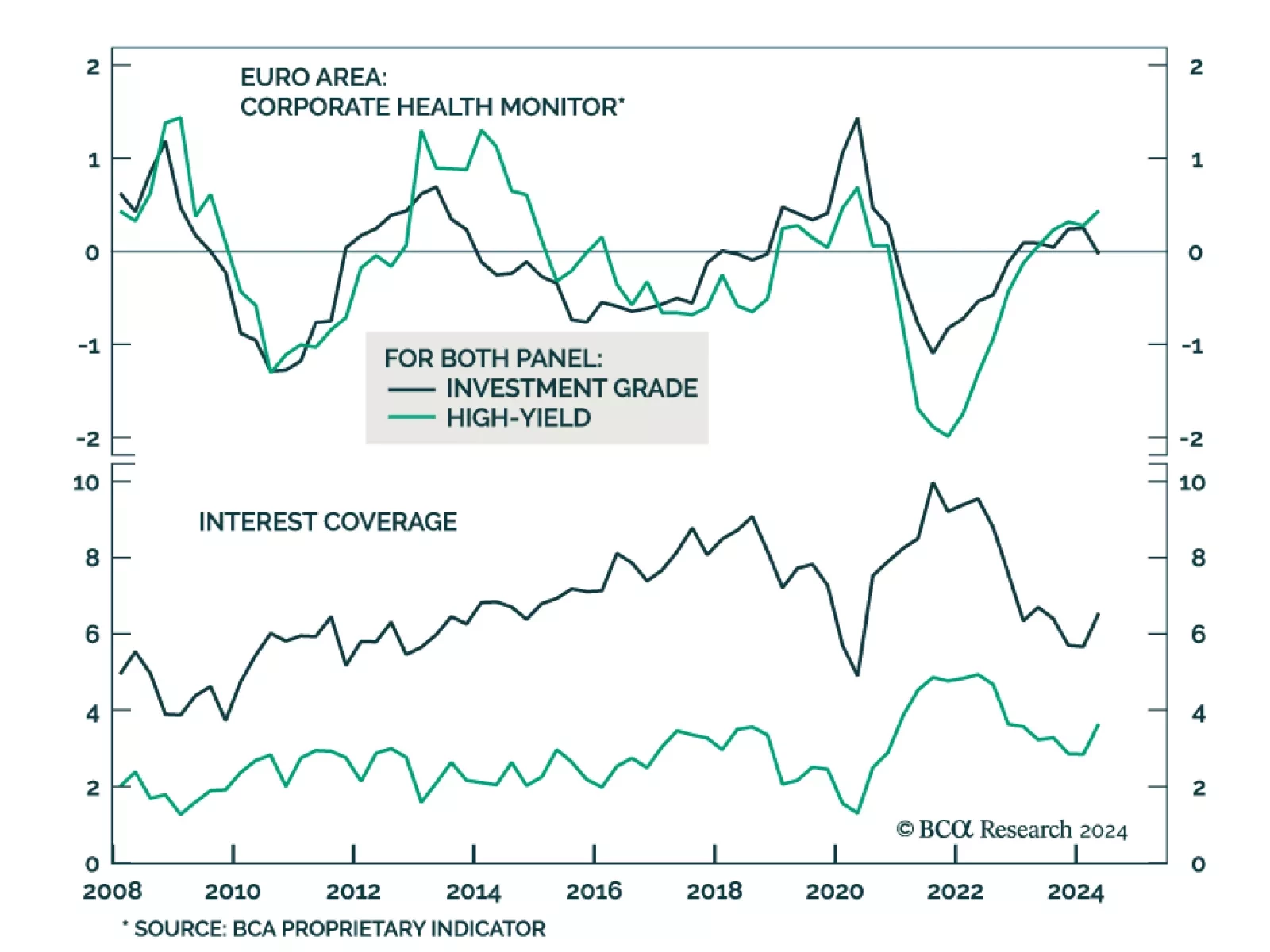

According to BCA Research’s European Investment Strategy service, an increase in borrowing costs will further weaken vulnerable corporate balance sheets. As suggested by their Corporate Health Monitors (CHMs), the health of…

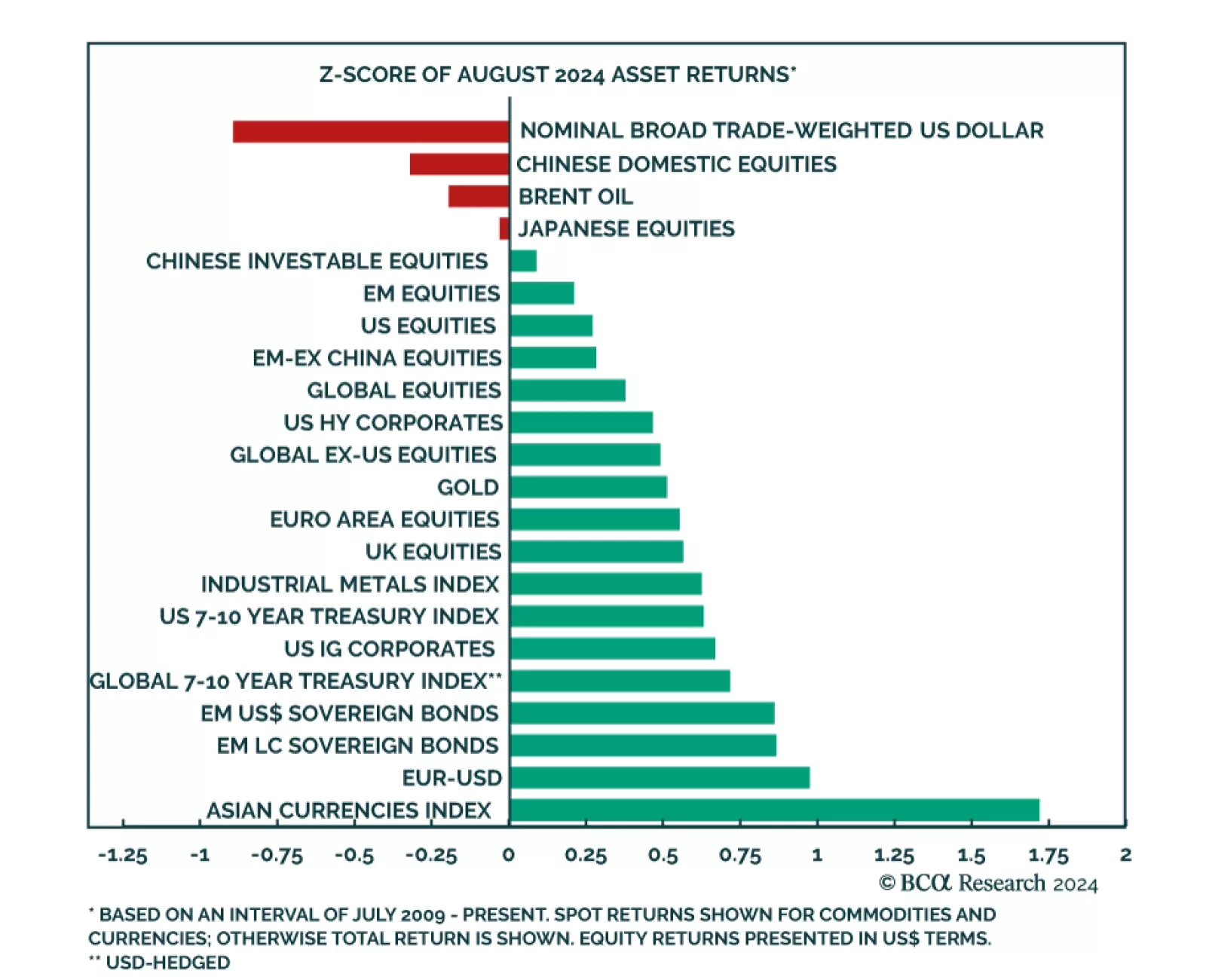

The risk-on soft-landing narrative dominated investors’ psyche last month and pro-cyclical assets topped the August return ranking. Asian currencies led the pack by a wide margin, while the dollar was the largest laggard…

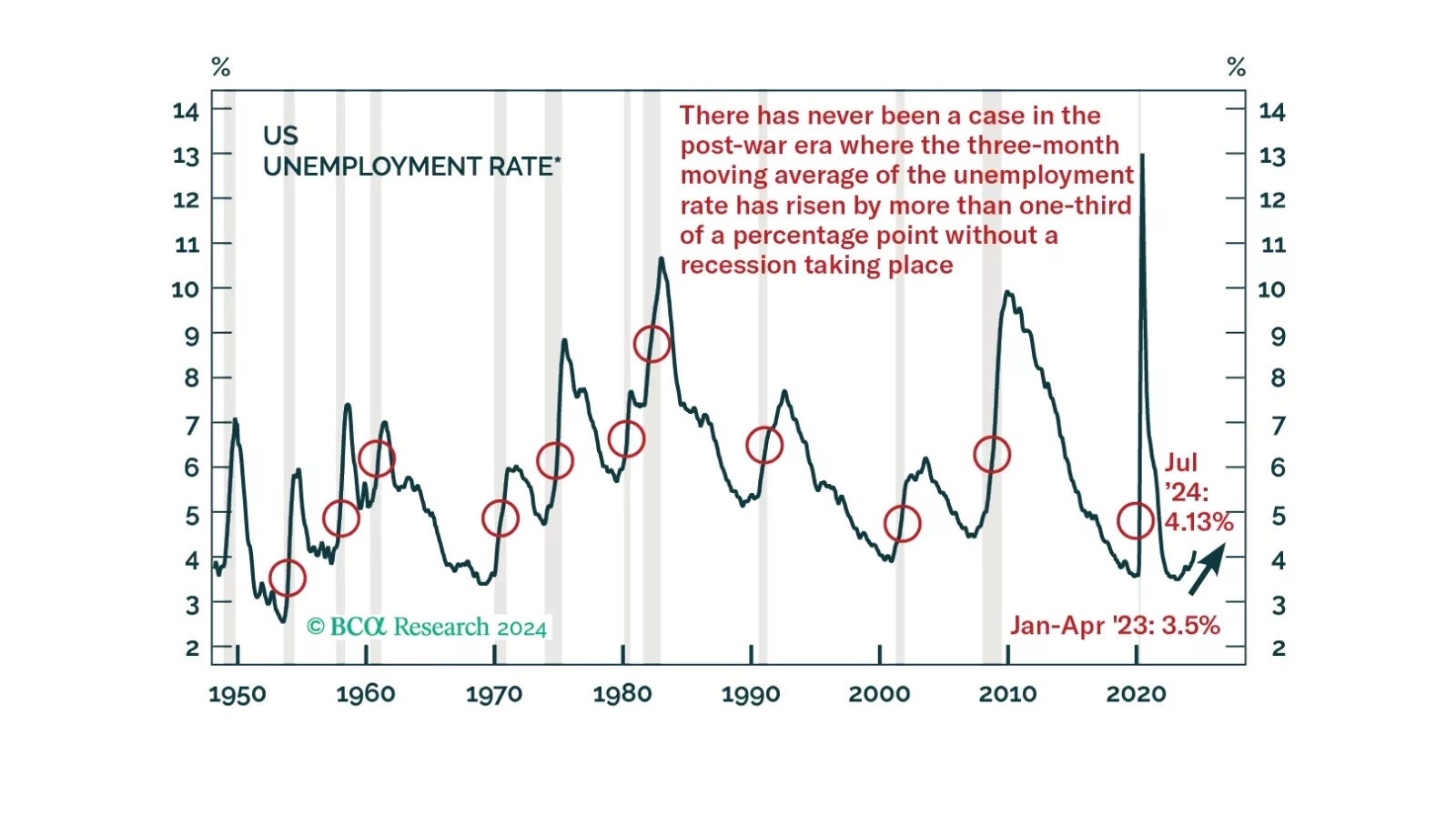

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

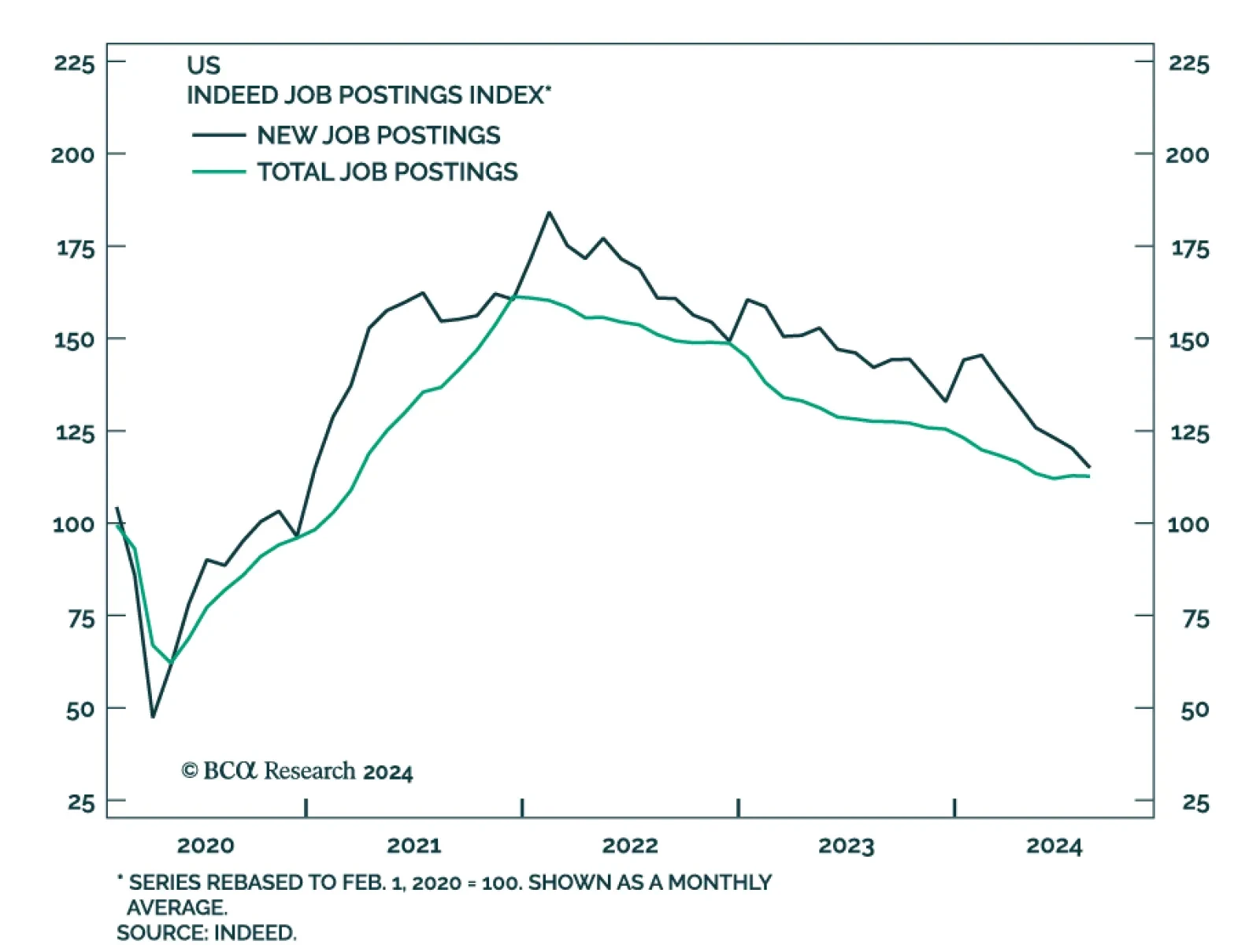

Our annual end-of-summer chartbook report traces the labor market deterioration that led us to downgrade equities at the beginning of August. It also highlights the soft-landing expectations that the credit and equity markets are…

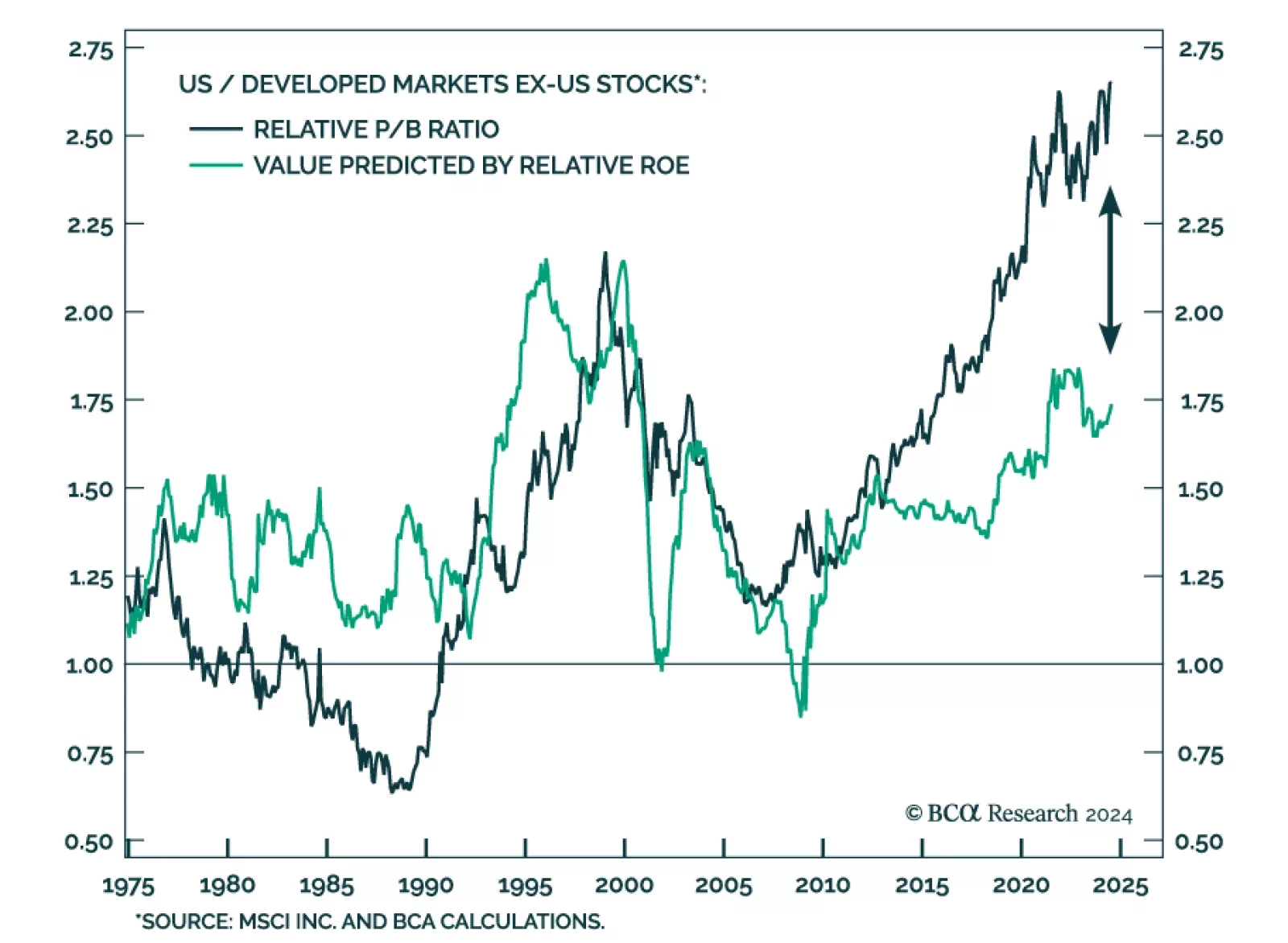

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…