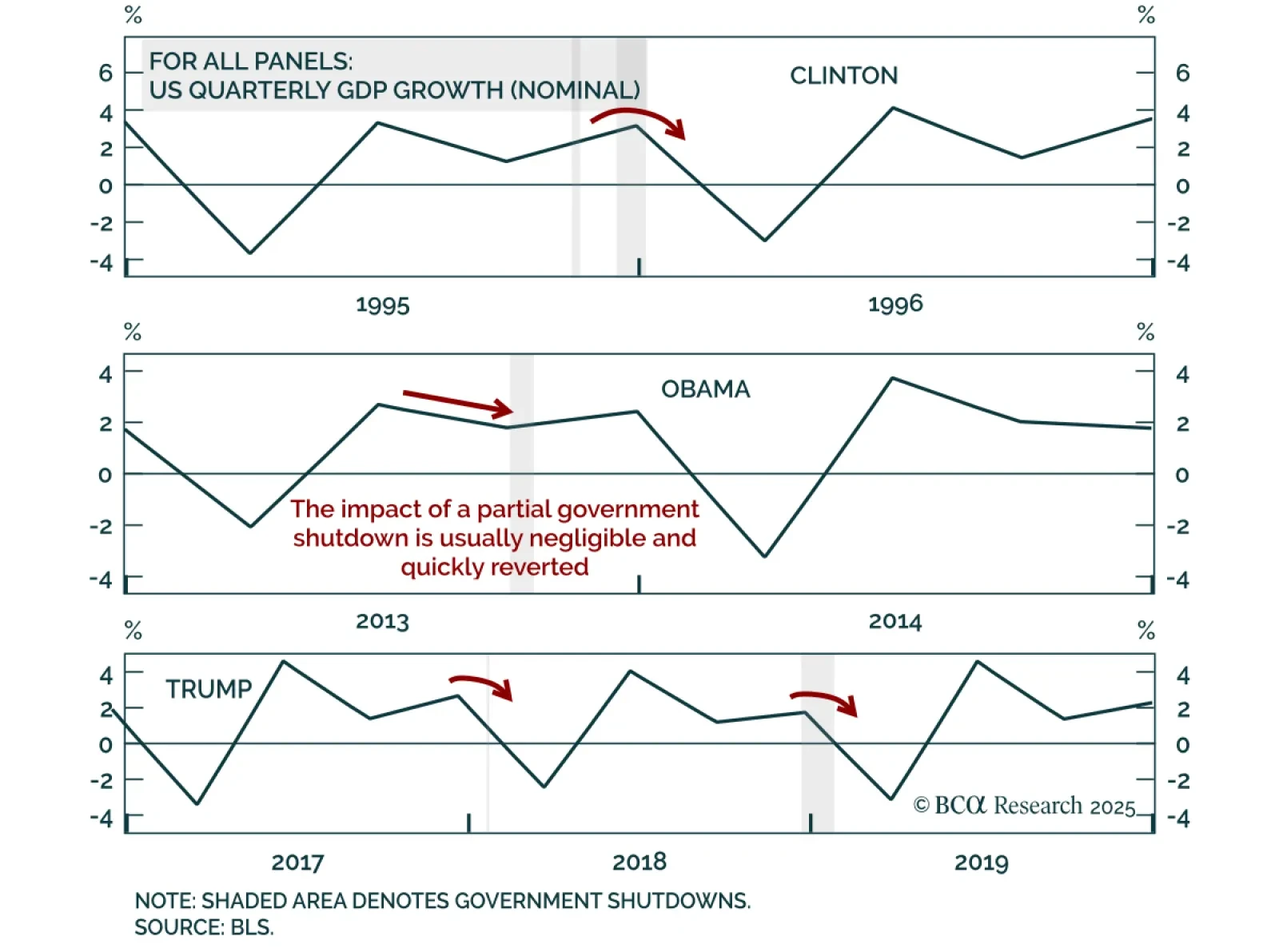

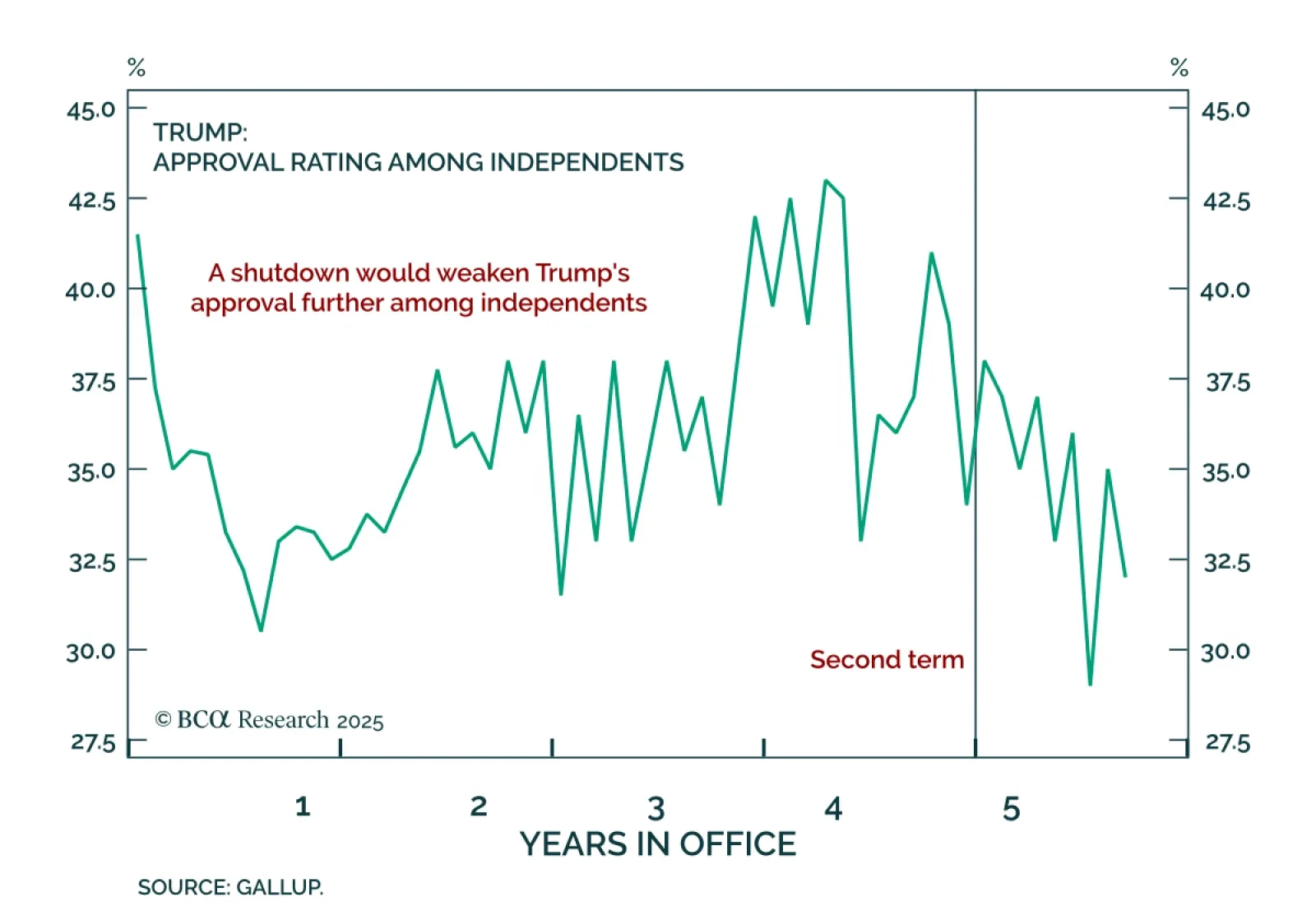

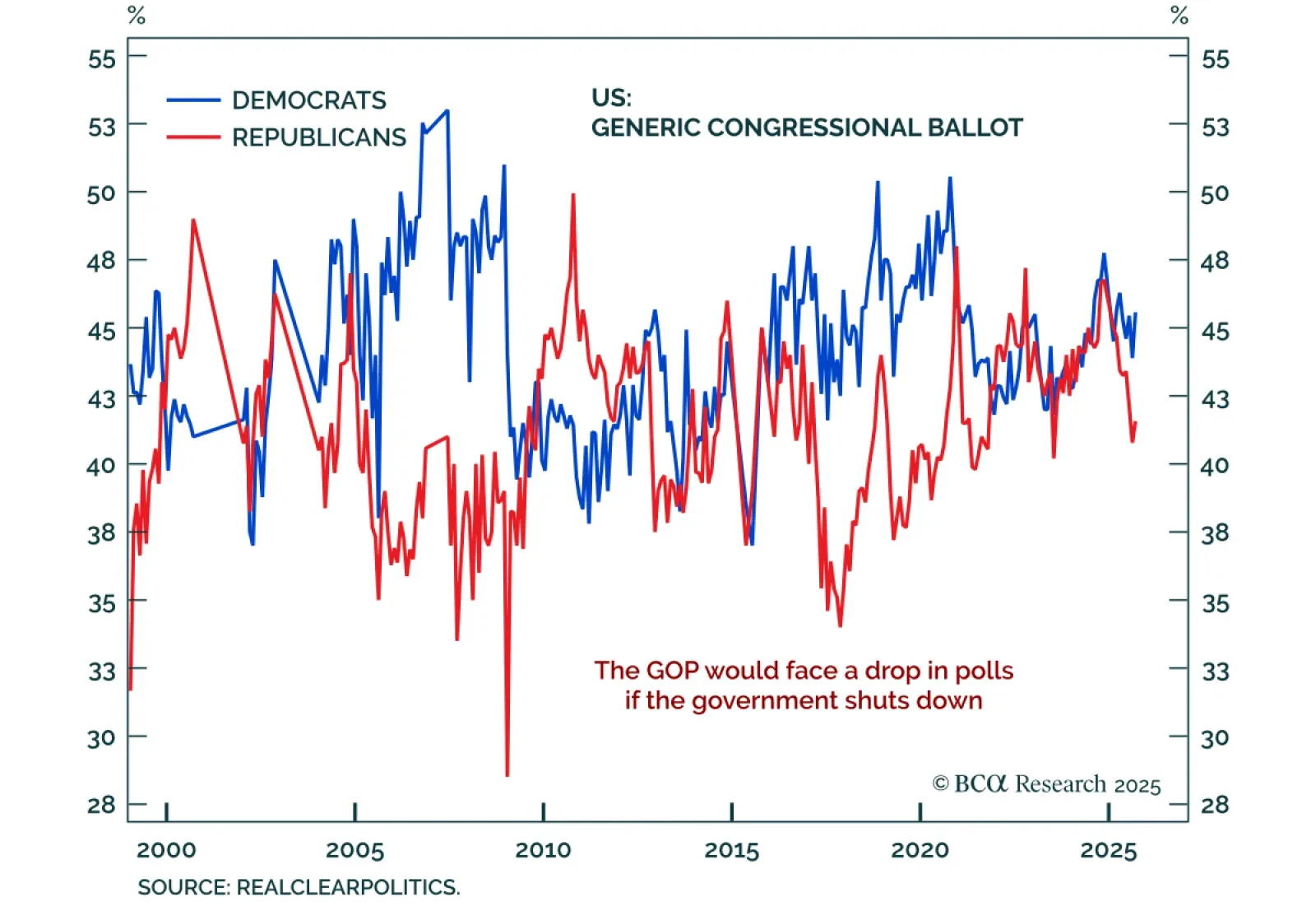

The October 1 partial US government shutdown risks denting near-term GDP and sentiment but should present a buying opportunity if it triggers equity weakness. The US federal government partly shutdown on October 1 after the…

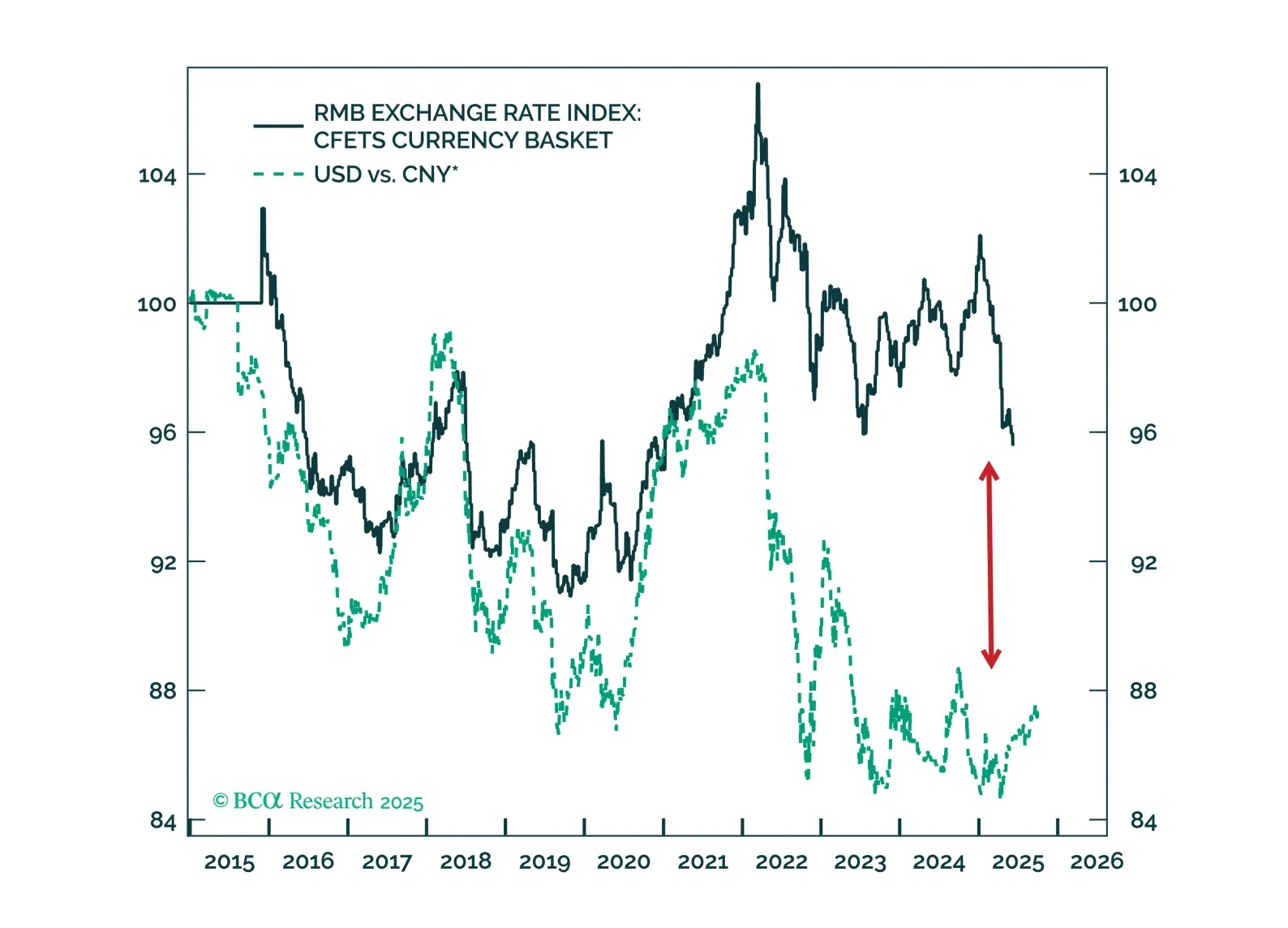

The CNY/USD has room to appreciate both cyclically and structurally, while nominal yields on China’s long-duration government bonds are set to fall. This combination supports Chinese equities.

President Trump said a partial federal government shutdown is "probably likely" late in the afternoon on September 30. Senators have until midnight to pass a continuing resolution already passed by the House that would keep the…

Will the US federal government shutdown on October 1? Congressional leaders are meeting with President Trump in the White House as we go to press. If eight Democratic senators do not vote with Republicans to pass a no-frills "…

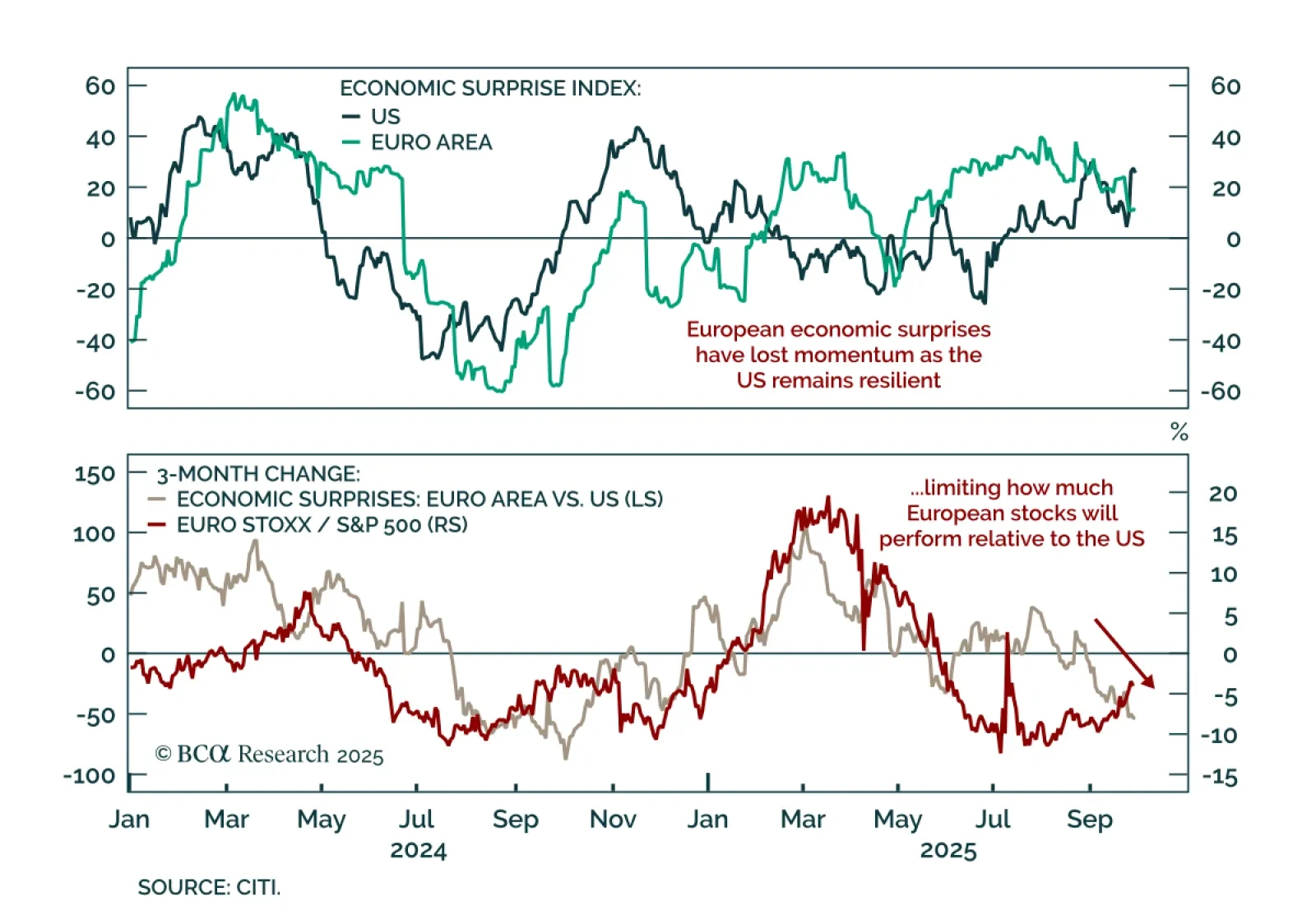

European sentiment surveys disappointed in September, pointing to a tactical headwind for assets even as the long-term outlook stays constructive. The flash consumer confidence print beat expectations but remained sluggish, while the…

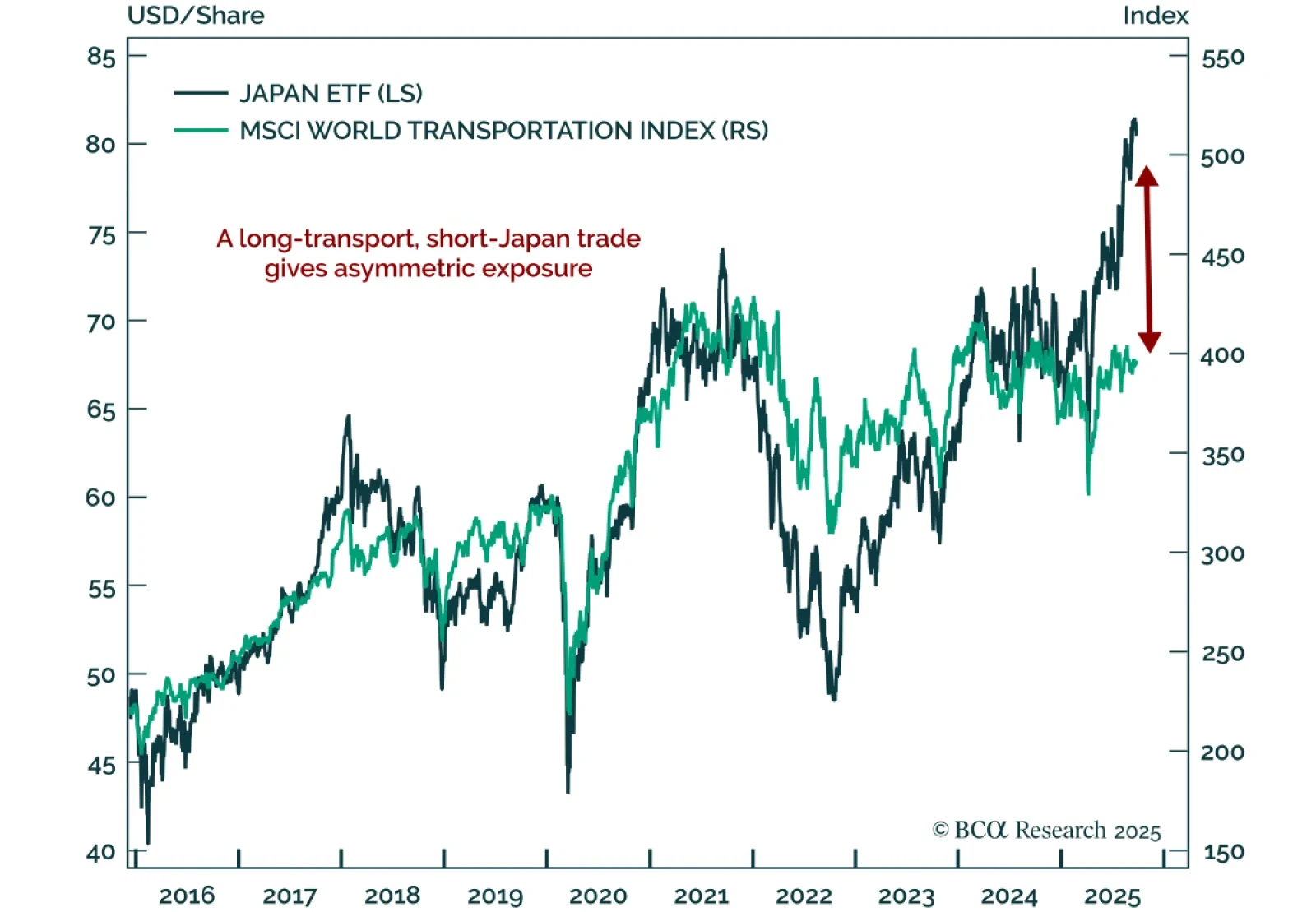

Sell Japanese equities and buy global transportation stocks to capture an overdue mean-reversion in trade-exposed assets. Our Chart Of The Week comes from Mathieu Savary, Chief DM ex. US Strategist. The post-Liberation Day…

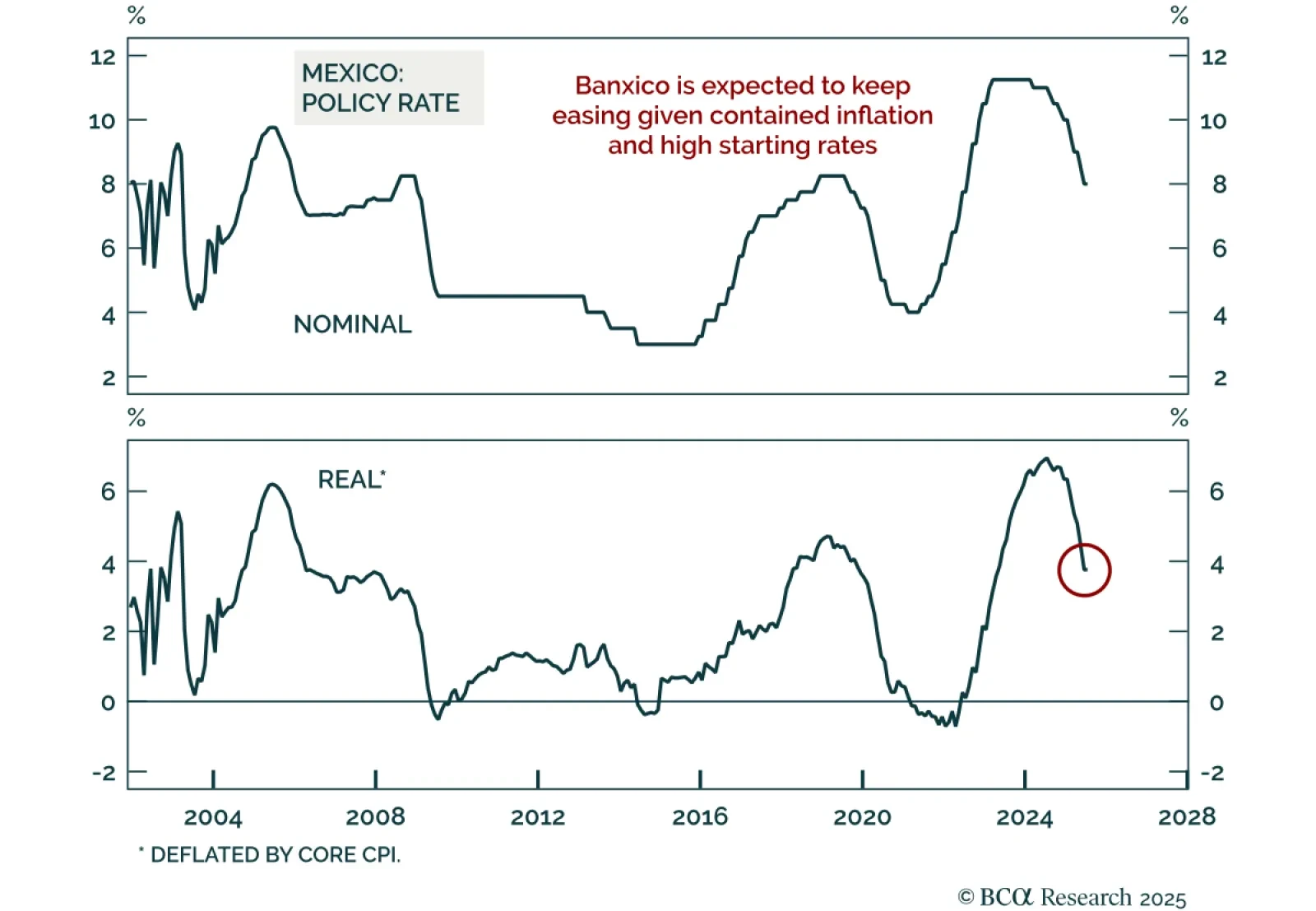

Banxico cut rates to 7.5%, reinforcing our call to go long Mexican local bonds and overweight Mexico across EM portfolios. Inflation is within target, giving policymakers space to ease. Sound fiscal management and strong external…

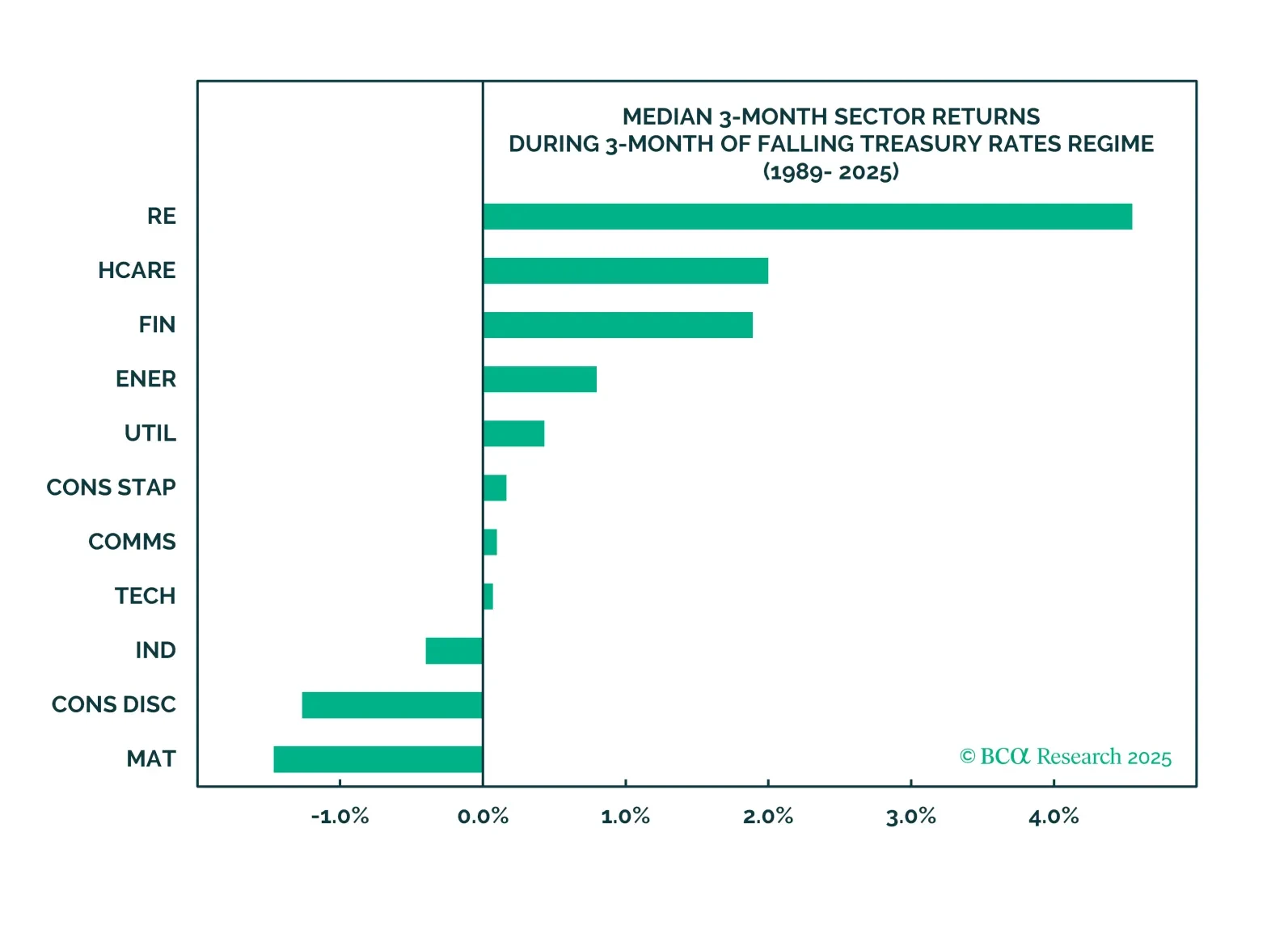

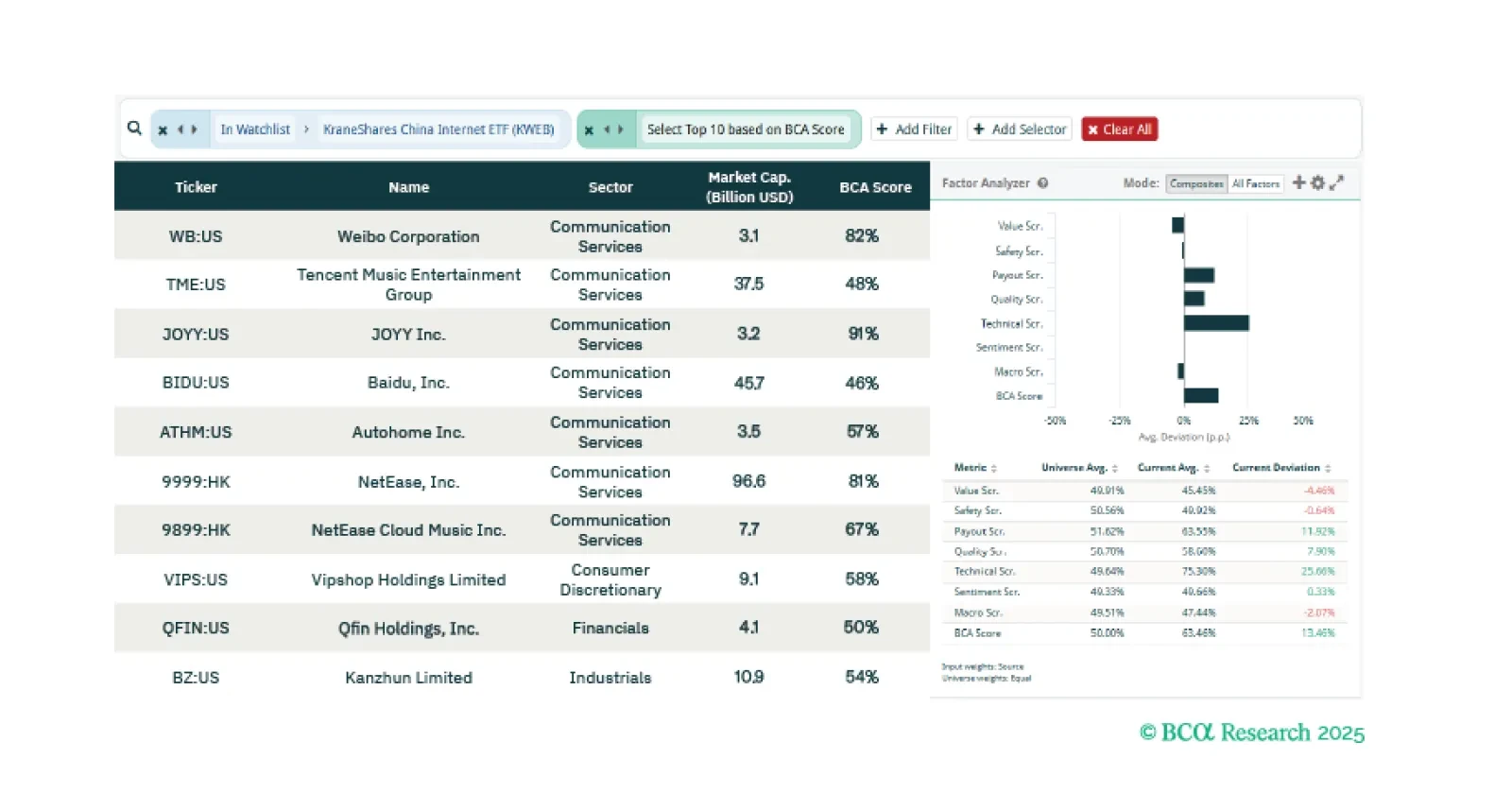

This week our screeners explore offshore Chinese internet stocks, US Healthcare equities, and sectoral opportunities in the Canadian bourse.

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets,…