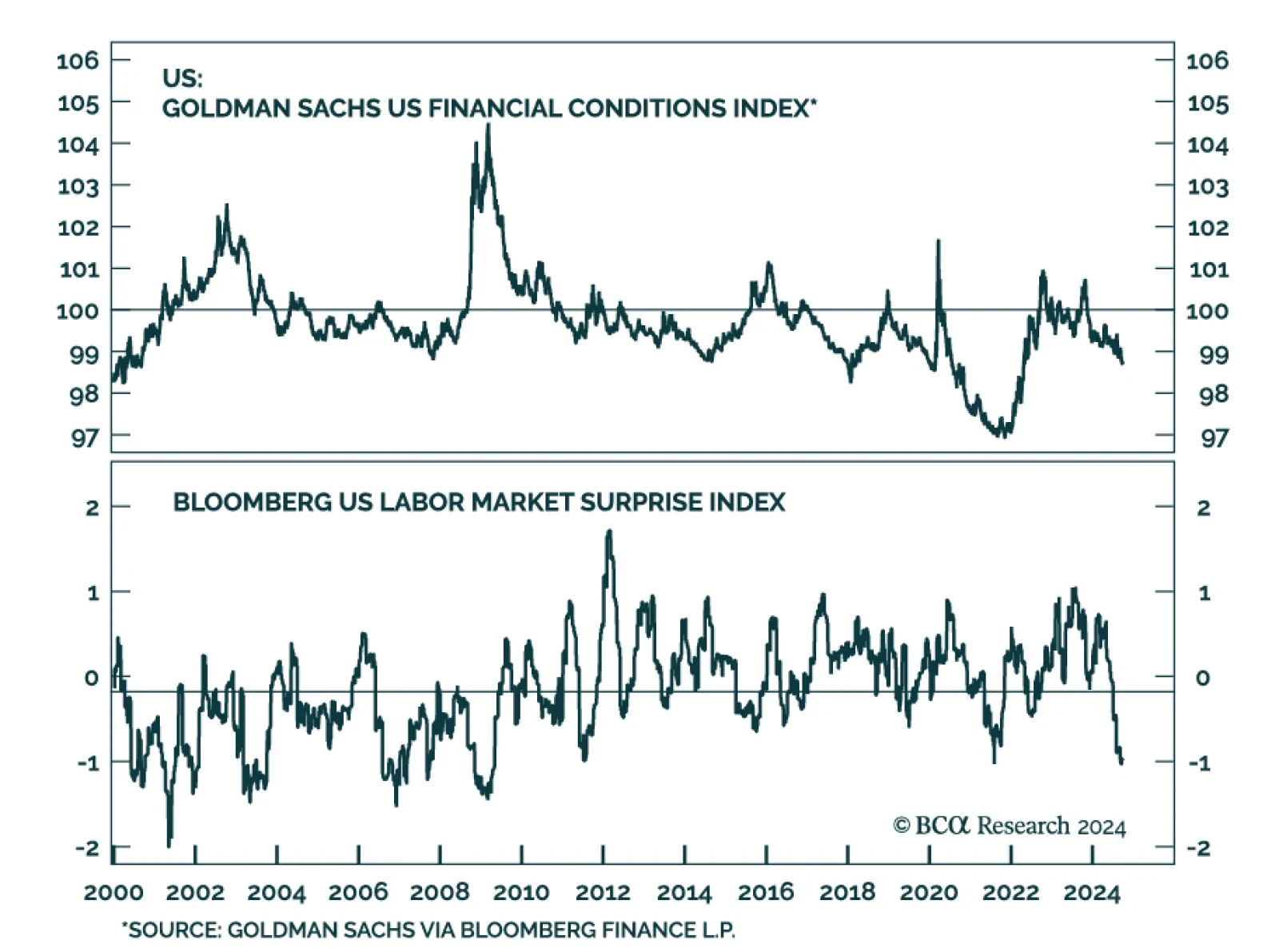

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…

Our expectation that a looming US recession will morph into a global recession remains intact. US monetary easing will only take effect with a lag and current deteriorating economic conditions are the product of past…

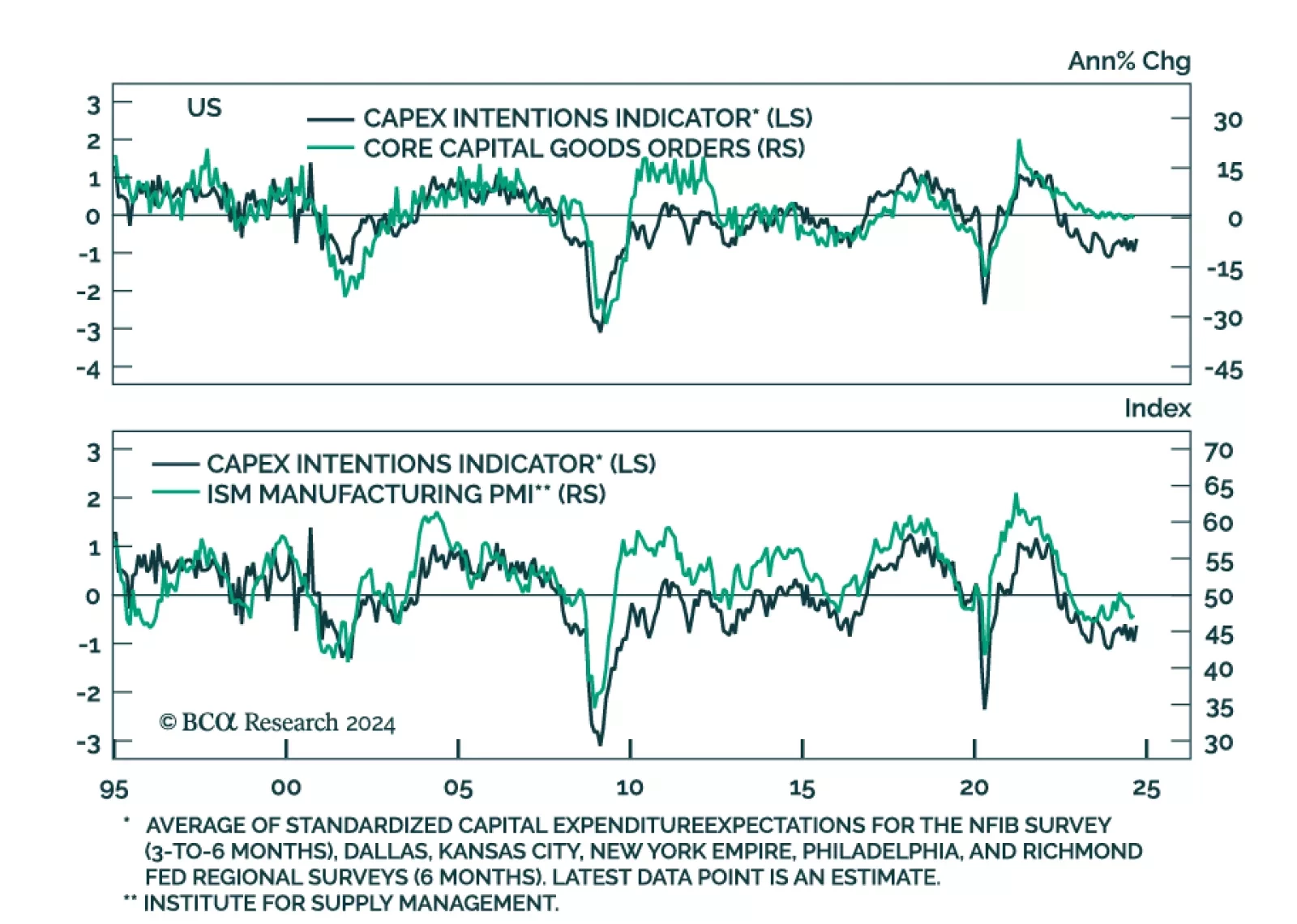

Preliminary estimates suggested that US durable goods orders stagnated in August after having surged 9.9% m/m in July, and beating expectations they would decline. Excluding the volatile transportation component, however, durable…

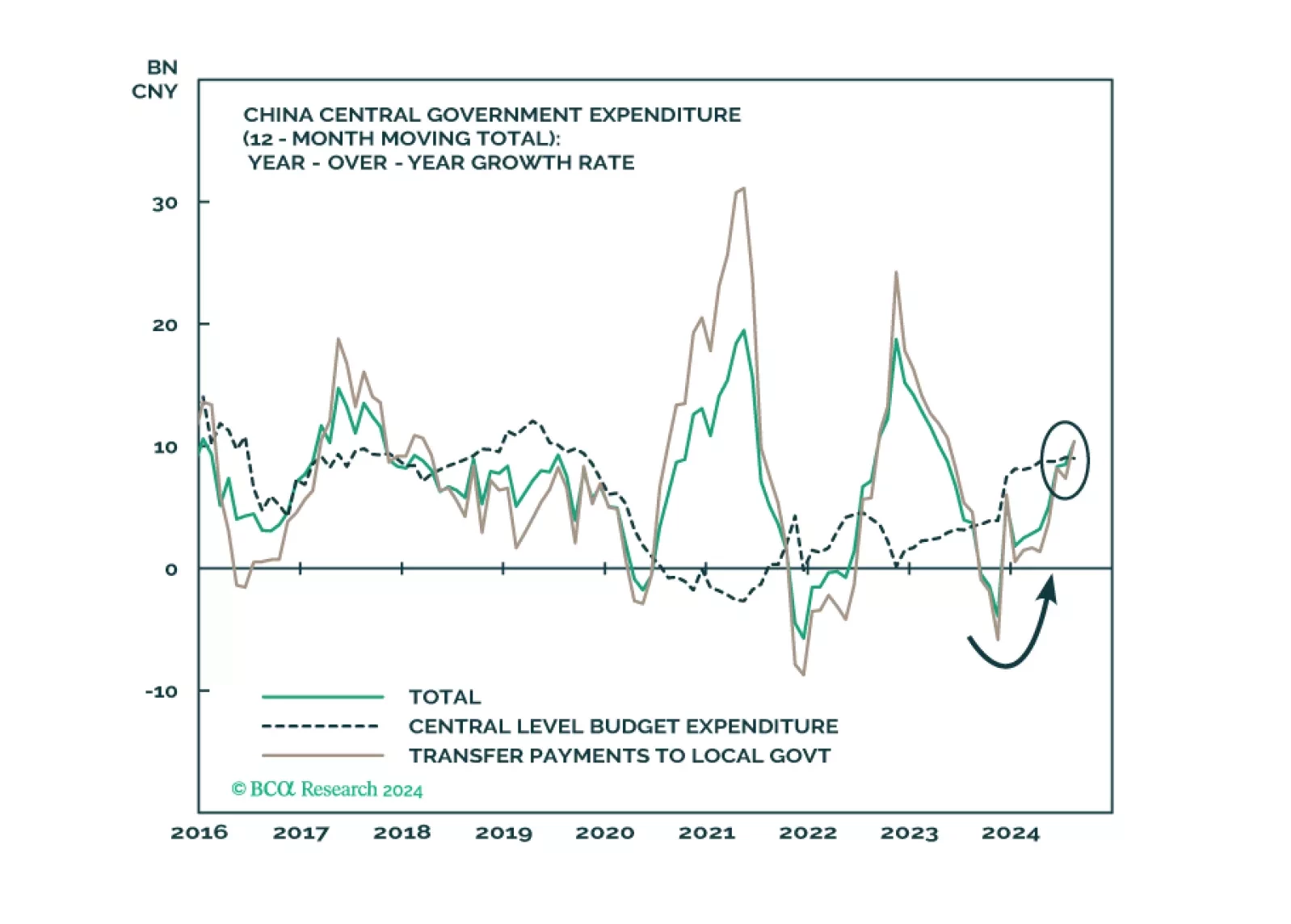

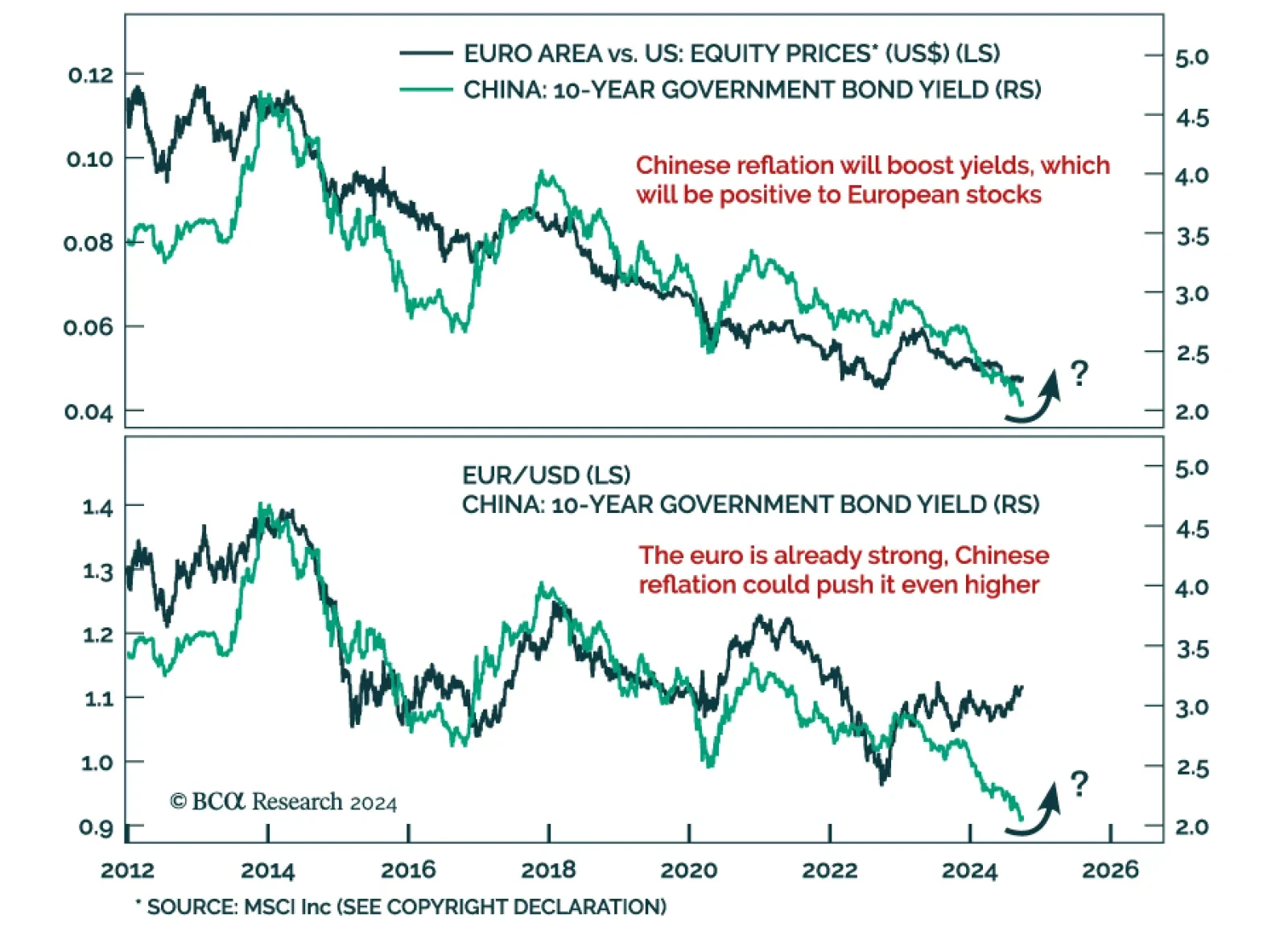

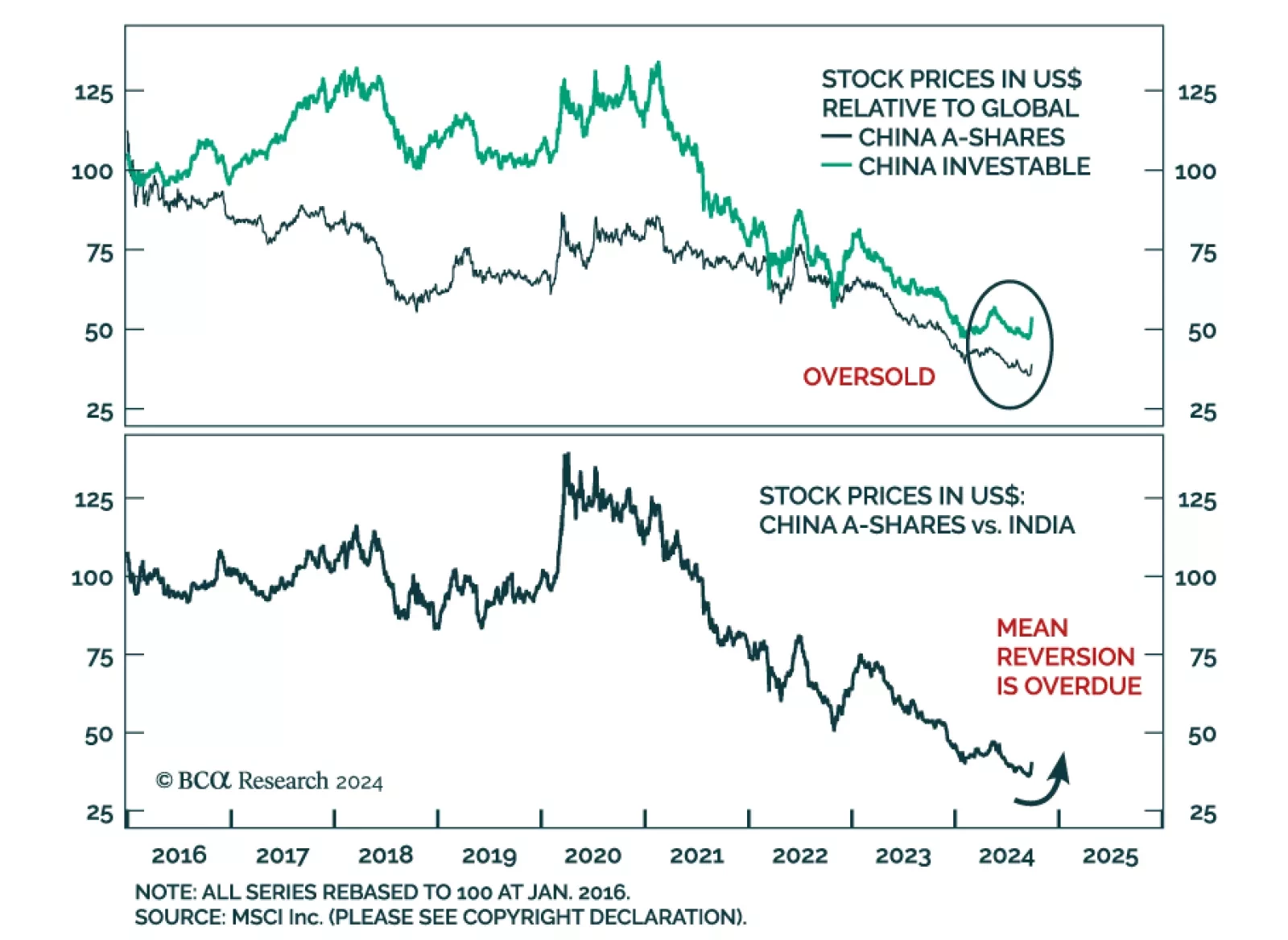

According to BCA Research’s European Investment Strategy service, the surprise fiscal announcement from China’s Politburo is a very different animal from previous stimulus attempts. Although the details are still…

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

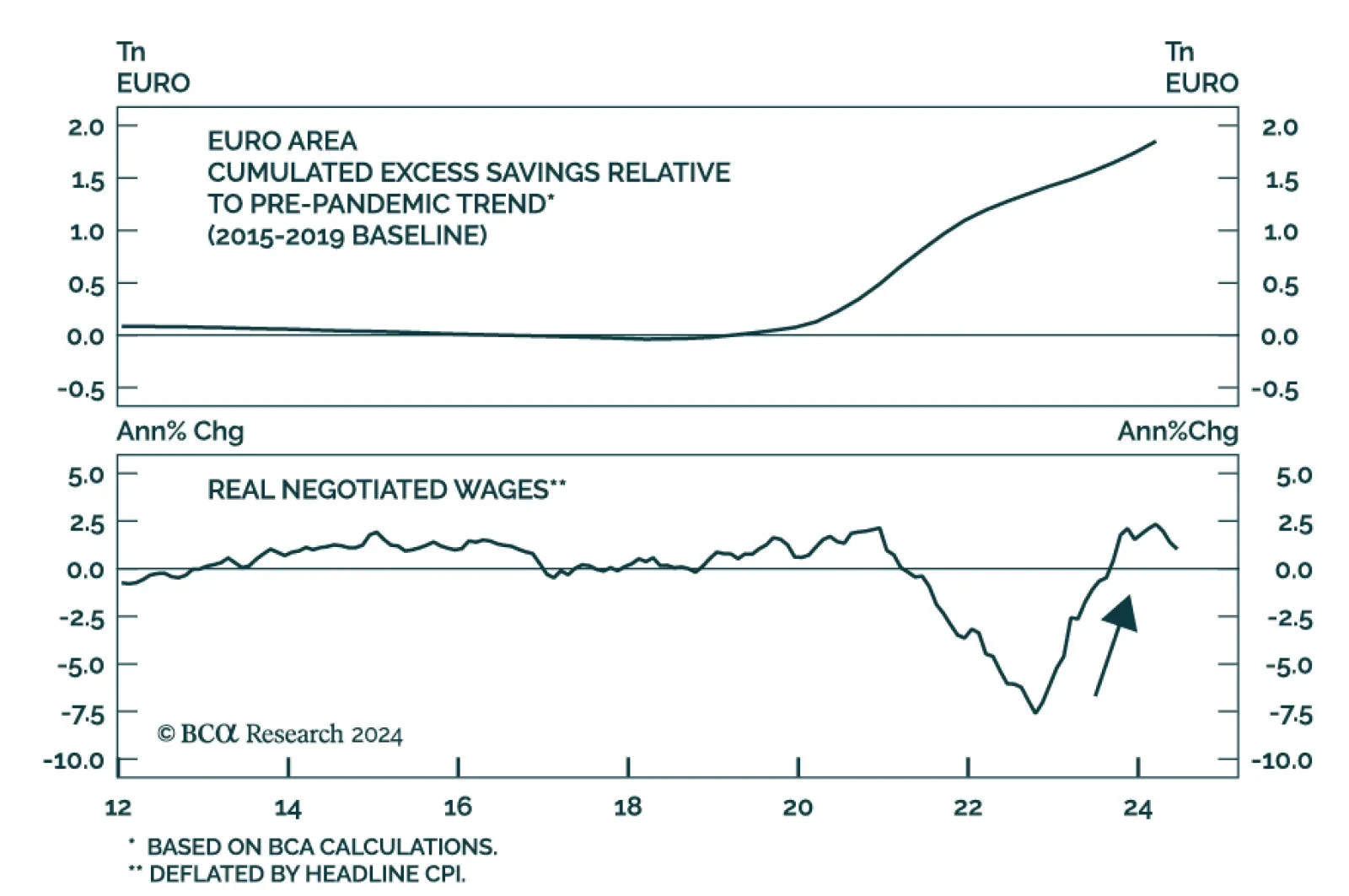

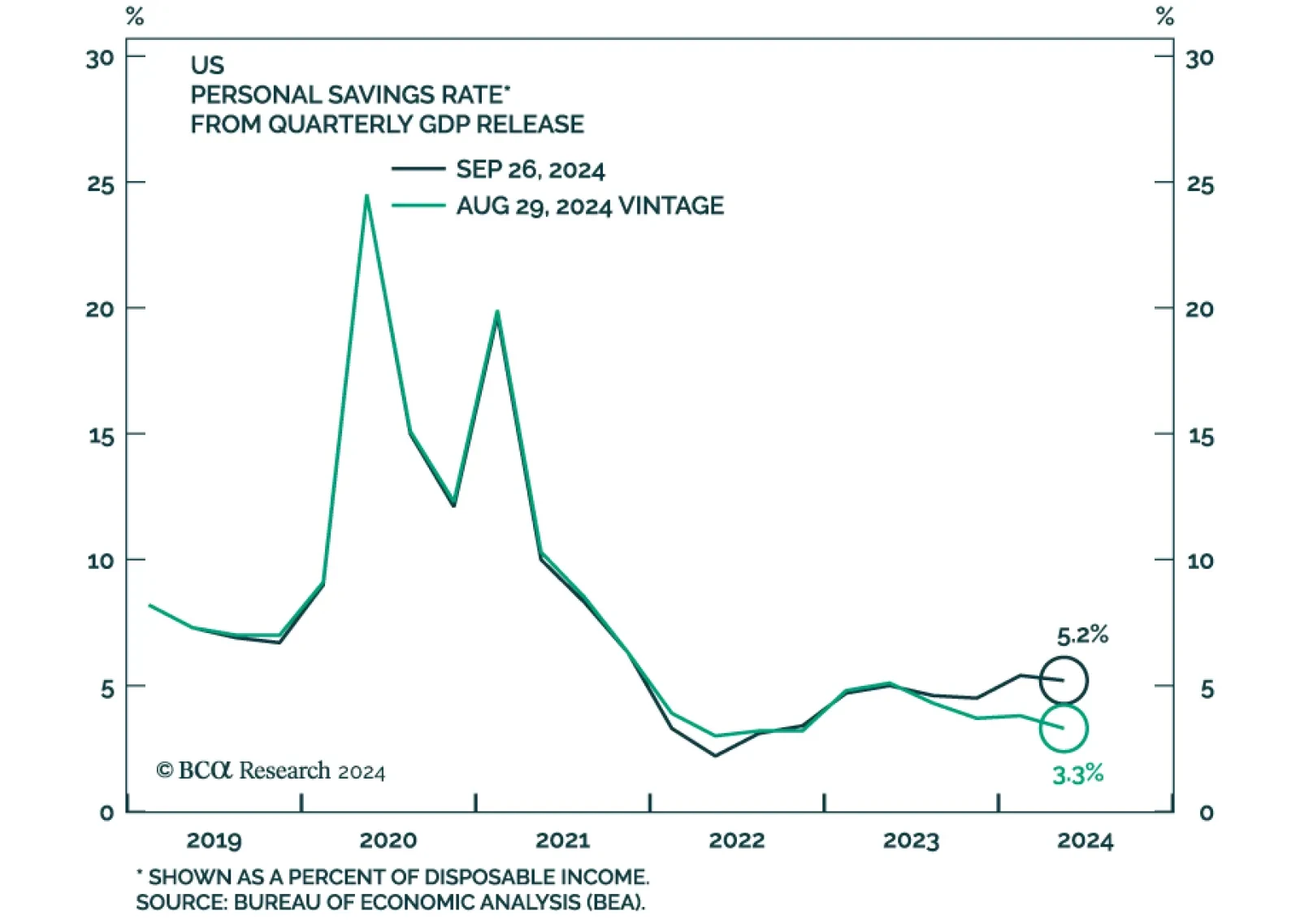

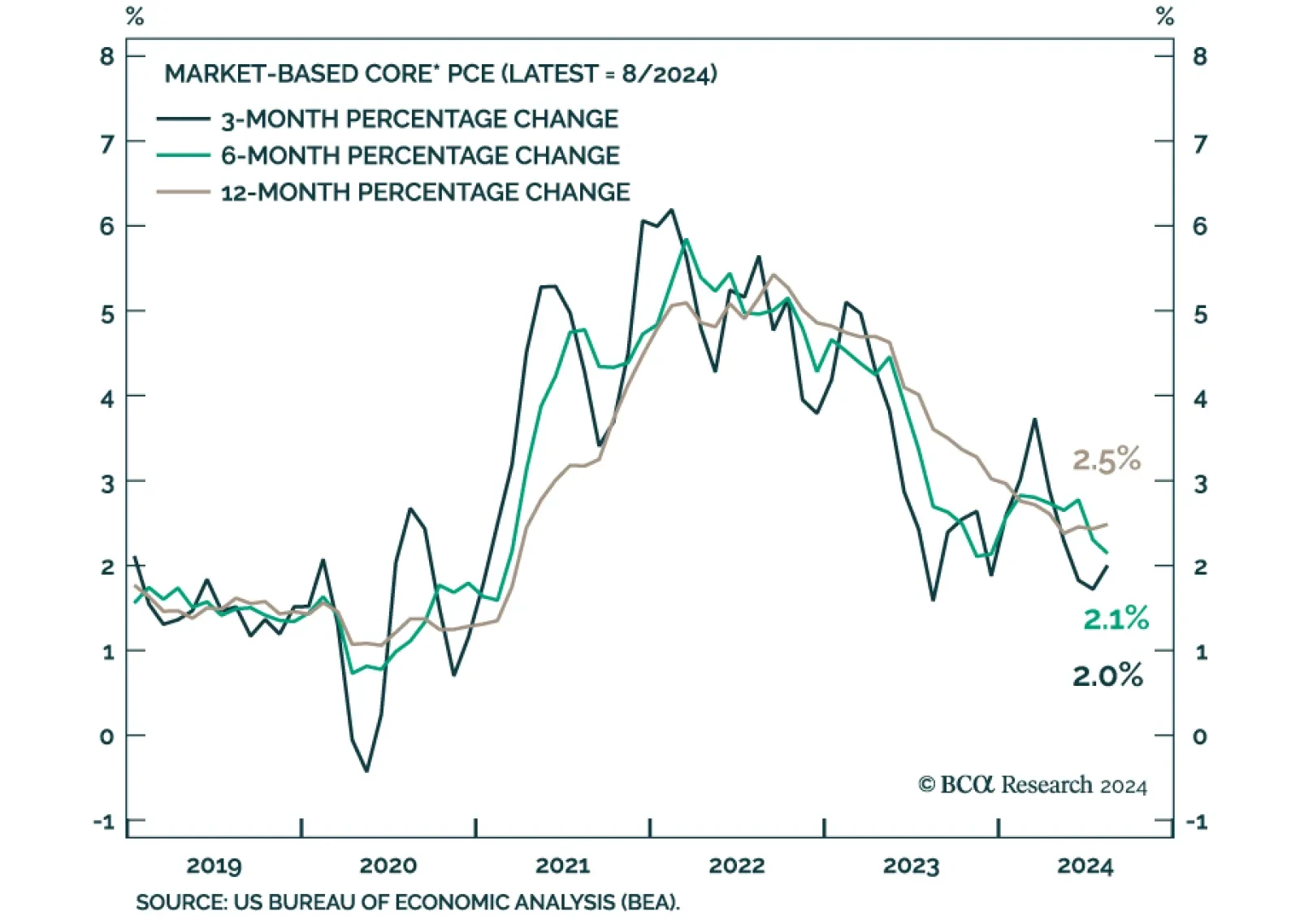

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

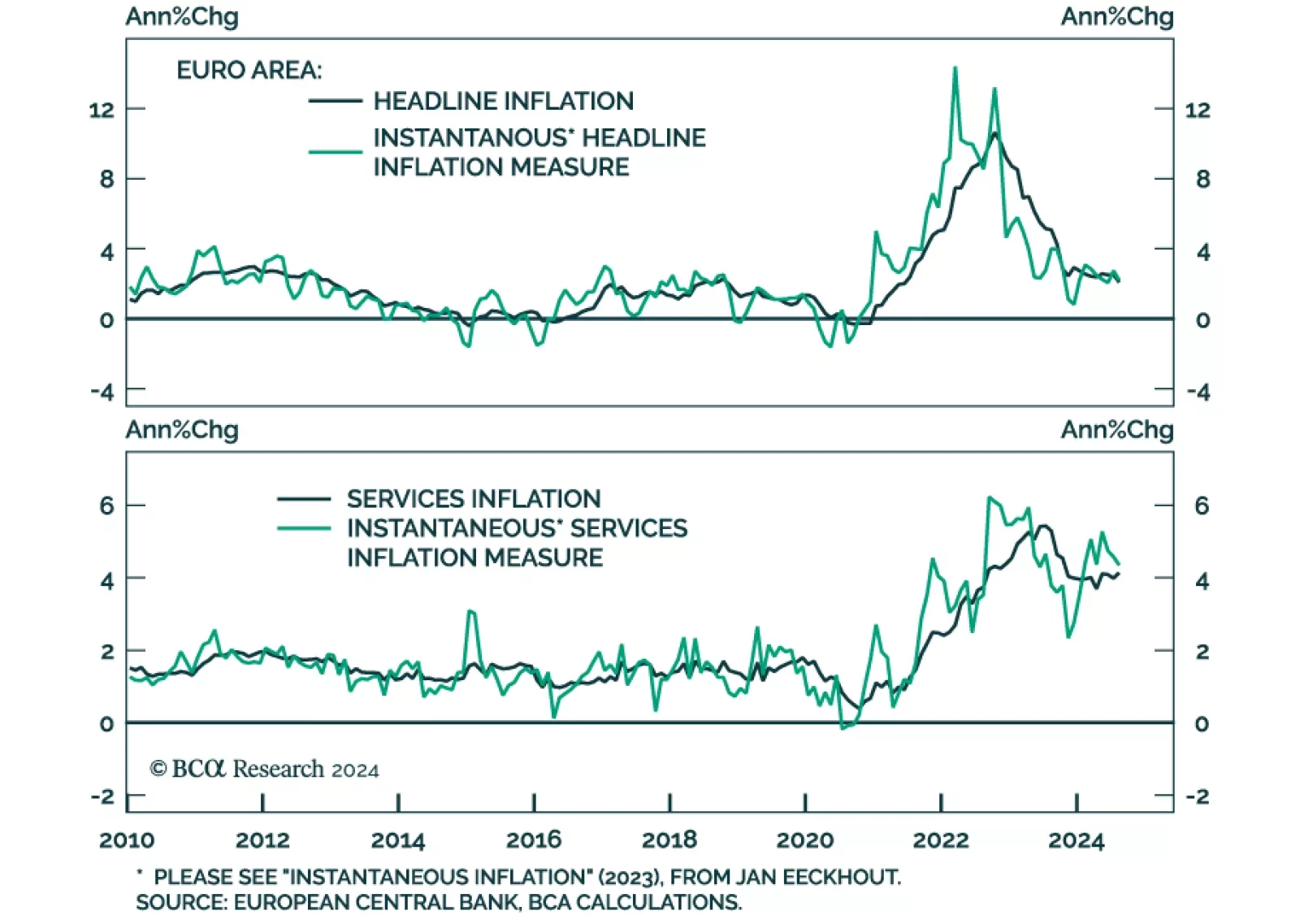

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

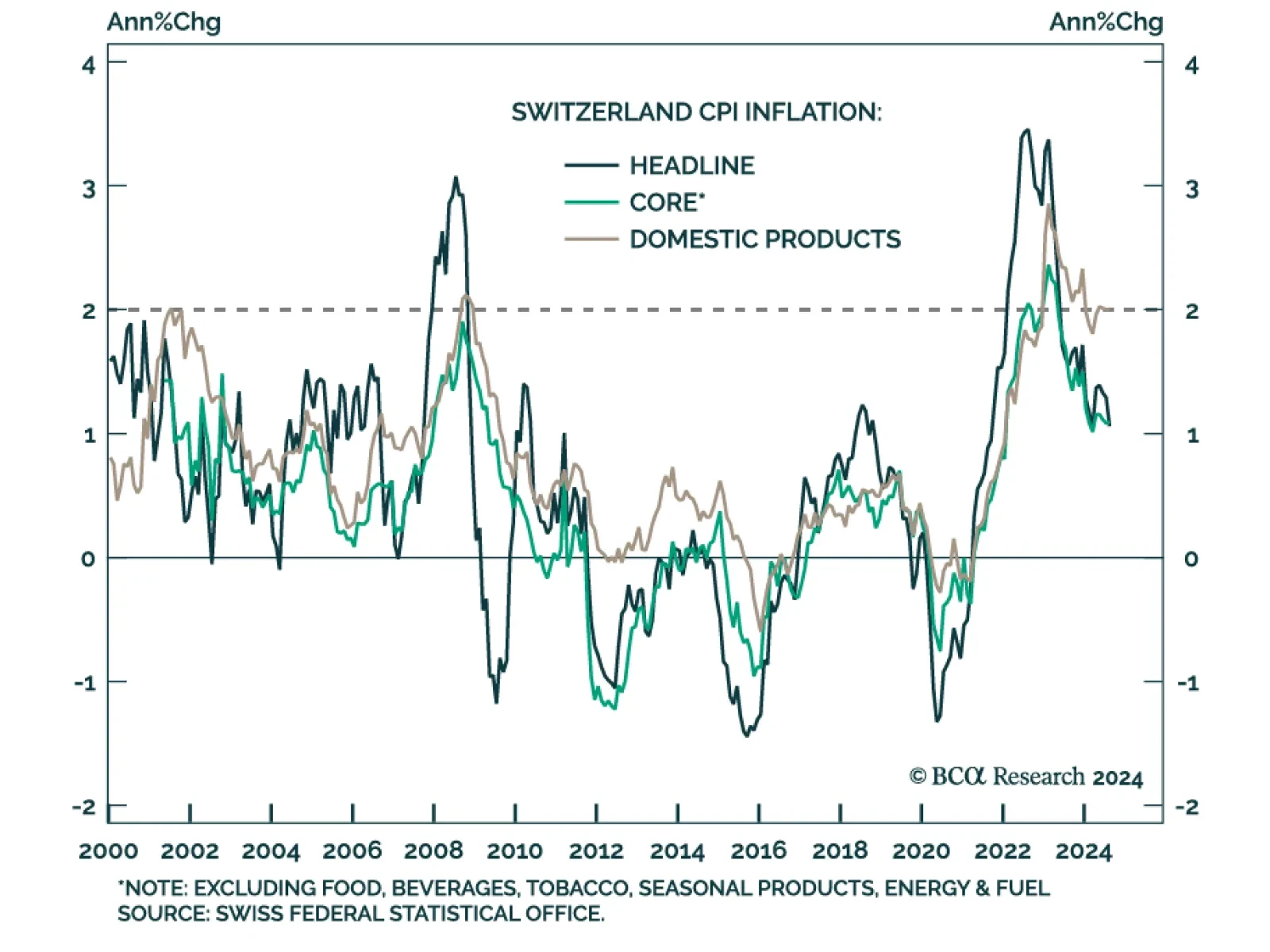

In a widely expected move, the Swiss National Bank (SNB) cut its policy rate for a third consecutive meeting on Thursday, from 1.25% to 1.00%. The move marked President Thomas Jordan’s final policy decision and his incoming…