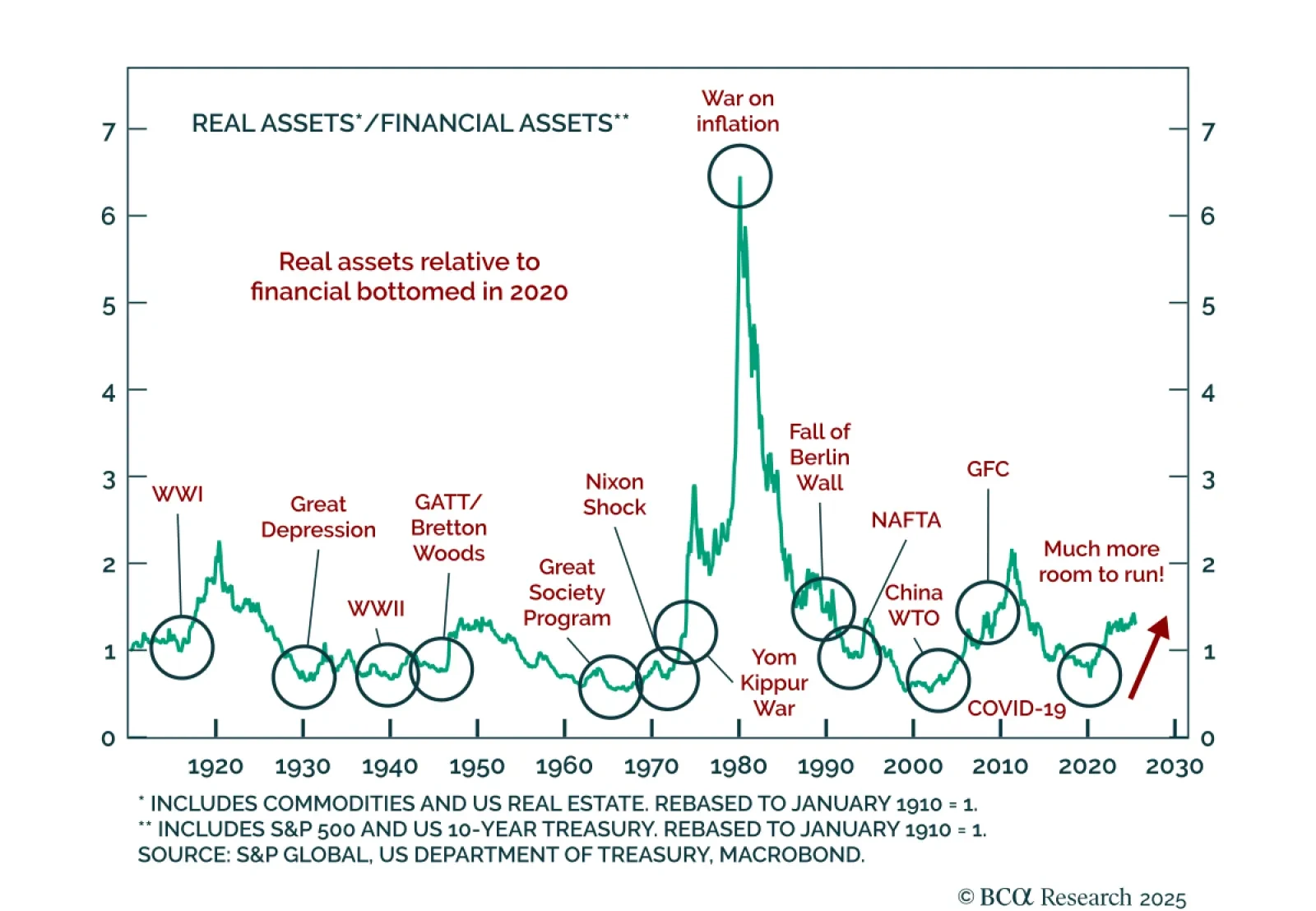

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

In global markets, speculative forces have intertwined with the sound fundamentals of specific equity segments, perplexing investors. This report aims to distinguish between excessive price run-ups and healthy fundamentals…

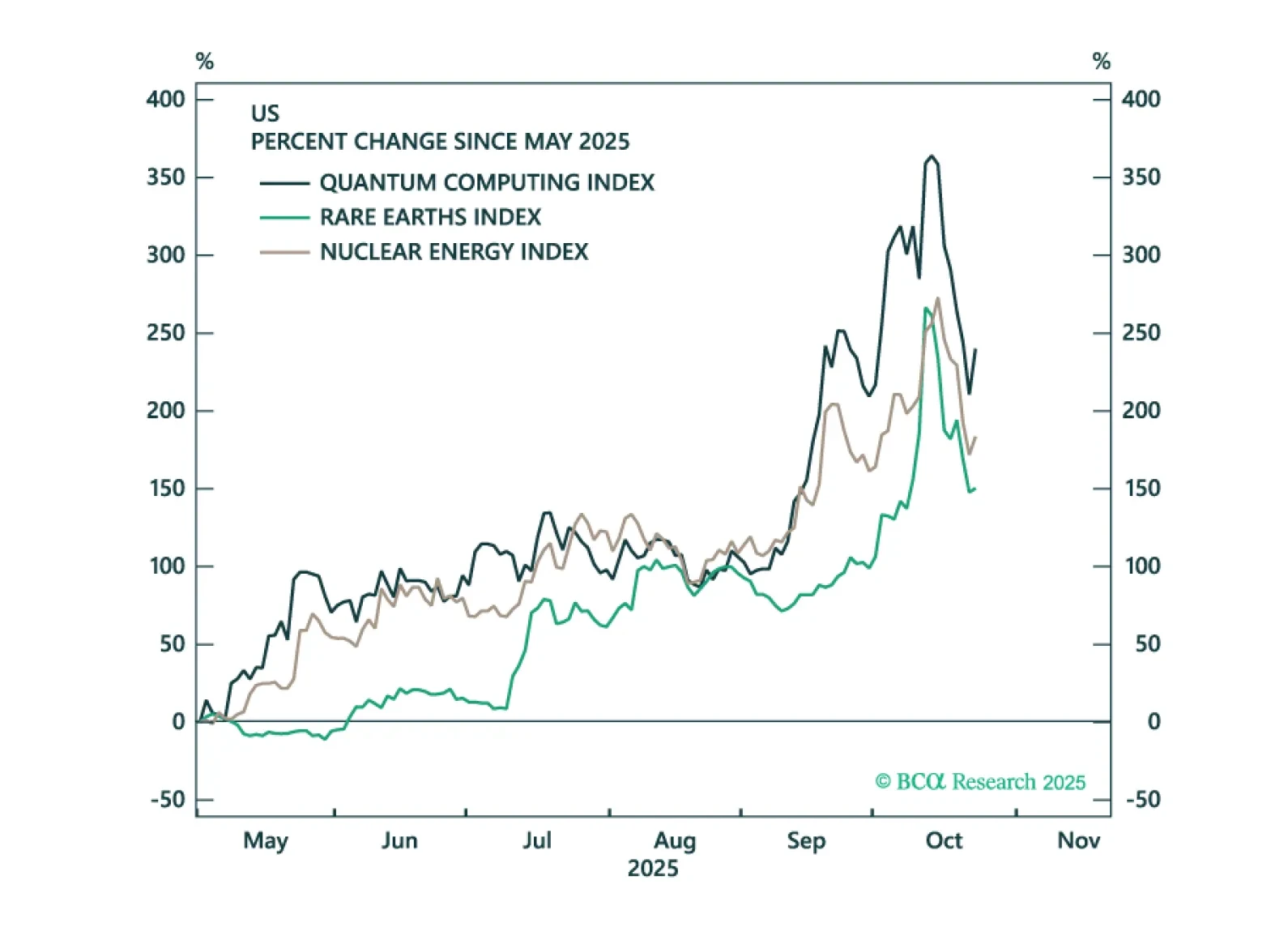

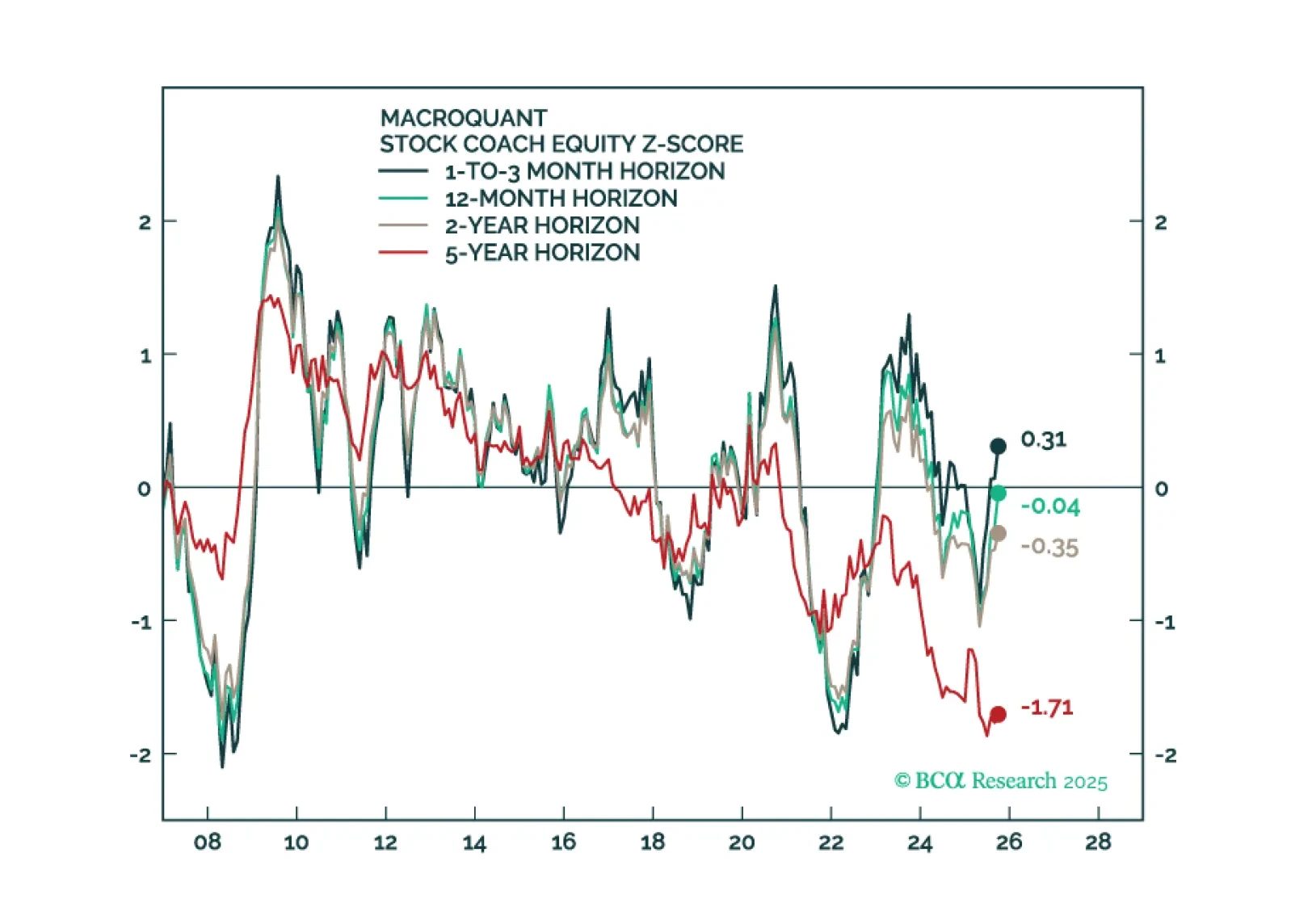

Our GeoMacro strategists remain overweight equities and bonds for now but warn that markets will soon test their “melt-up” thesis, as the cycle transitions from cash- to leverage-driven growth. The dominant theme of 2025 is not AI,…

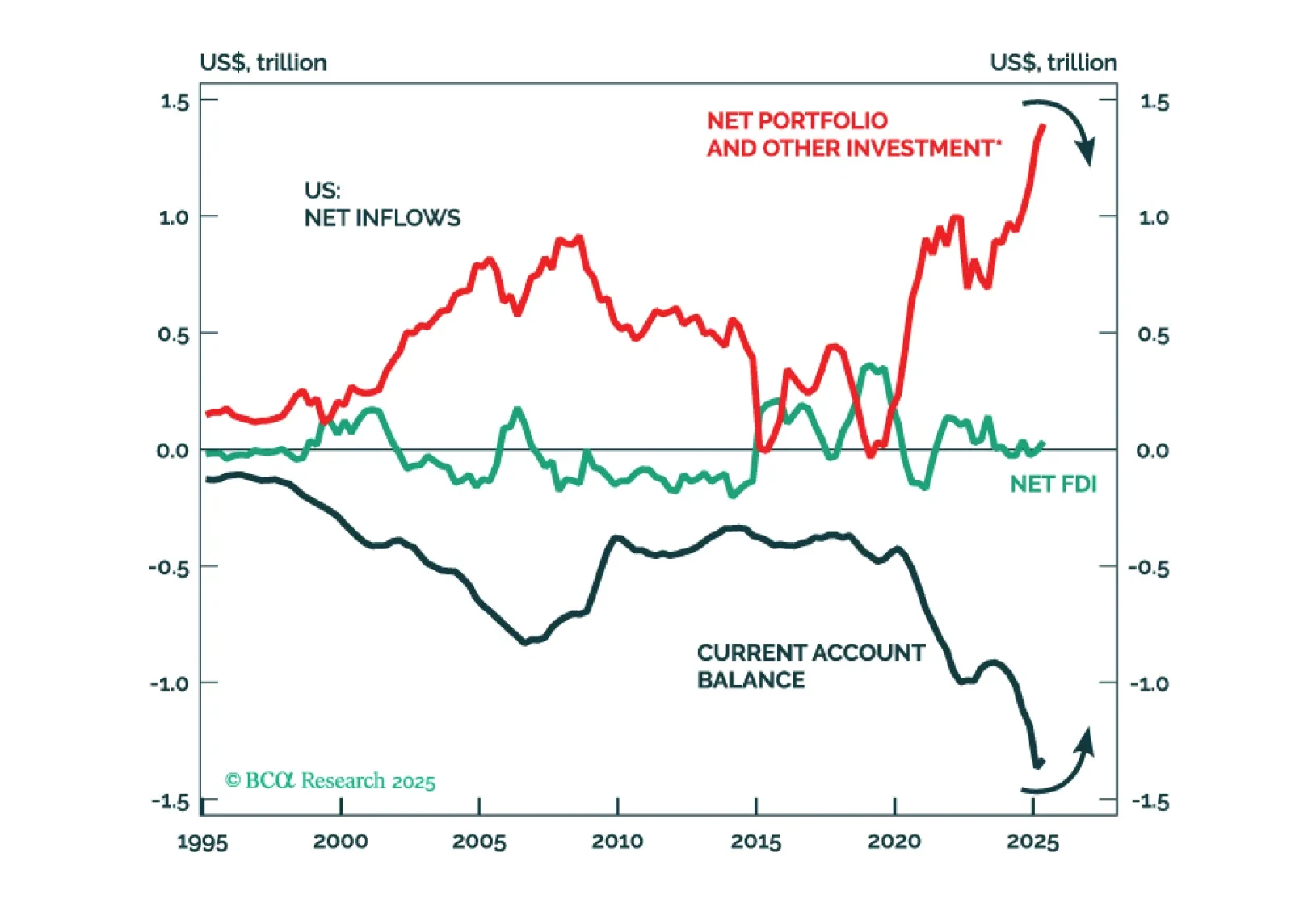

The belief that net portfolio outflows out of the US will fuel EM assets is a common but misguided narrative. If the US starts experiencing net capital outflows, it would need to run a current account surplus. A shift in the US…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

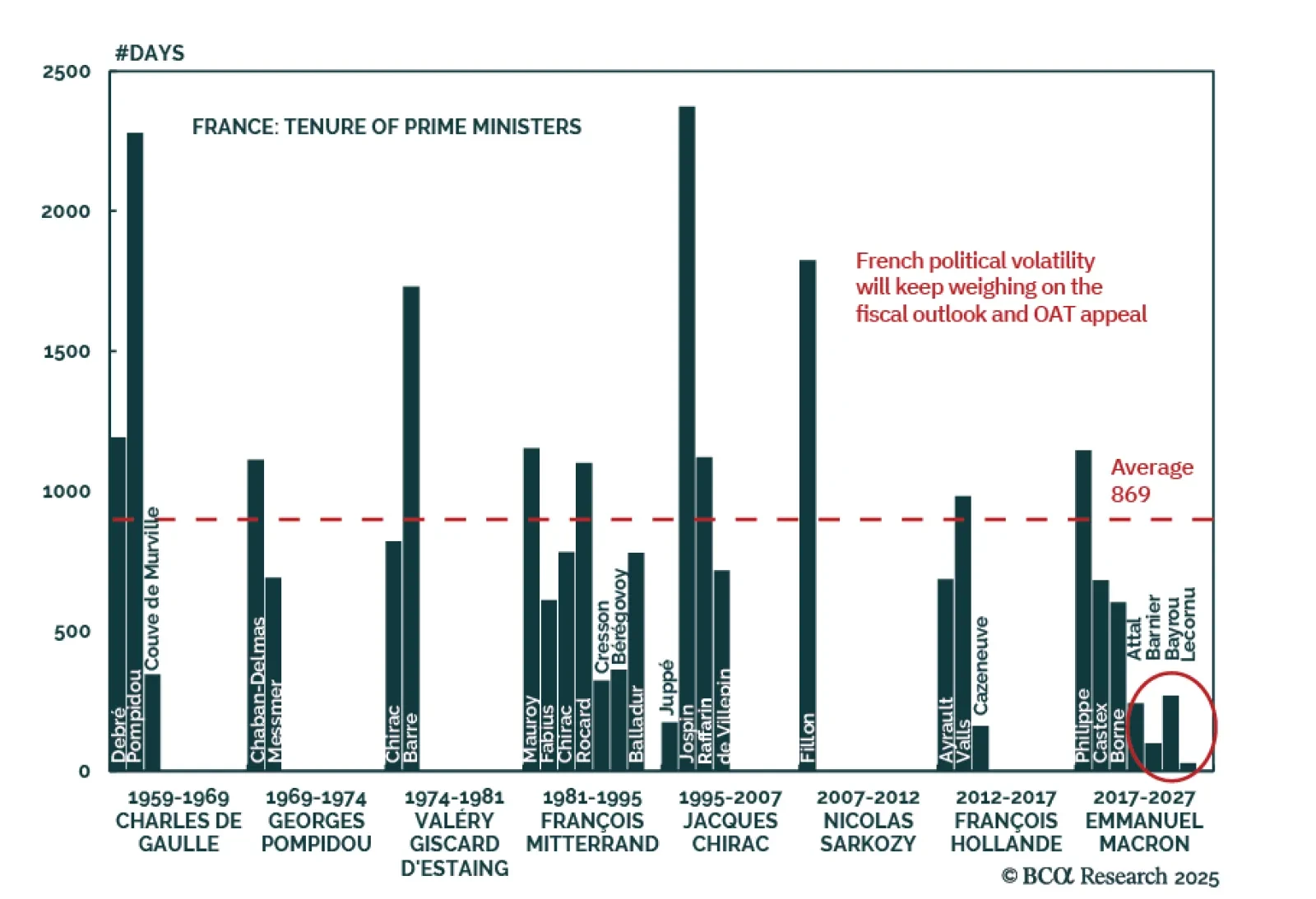

French markets woke up Monday to fresh political turmoil, with Prime Minister Sébastien Lecornu resigning just 27 days into office, marking the shortest tenure in modern French history. The CAC 40 dropped over 2%, the euro slid 0.7%…

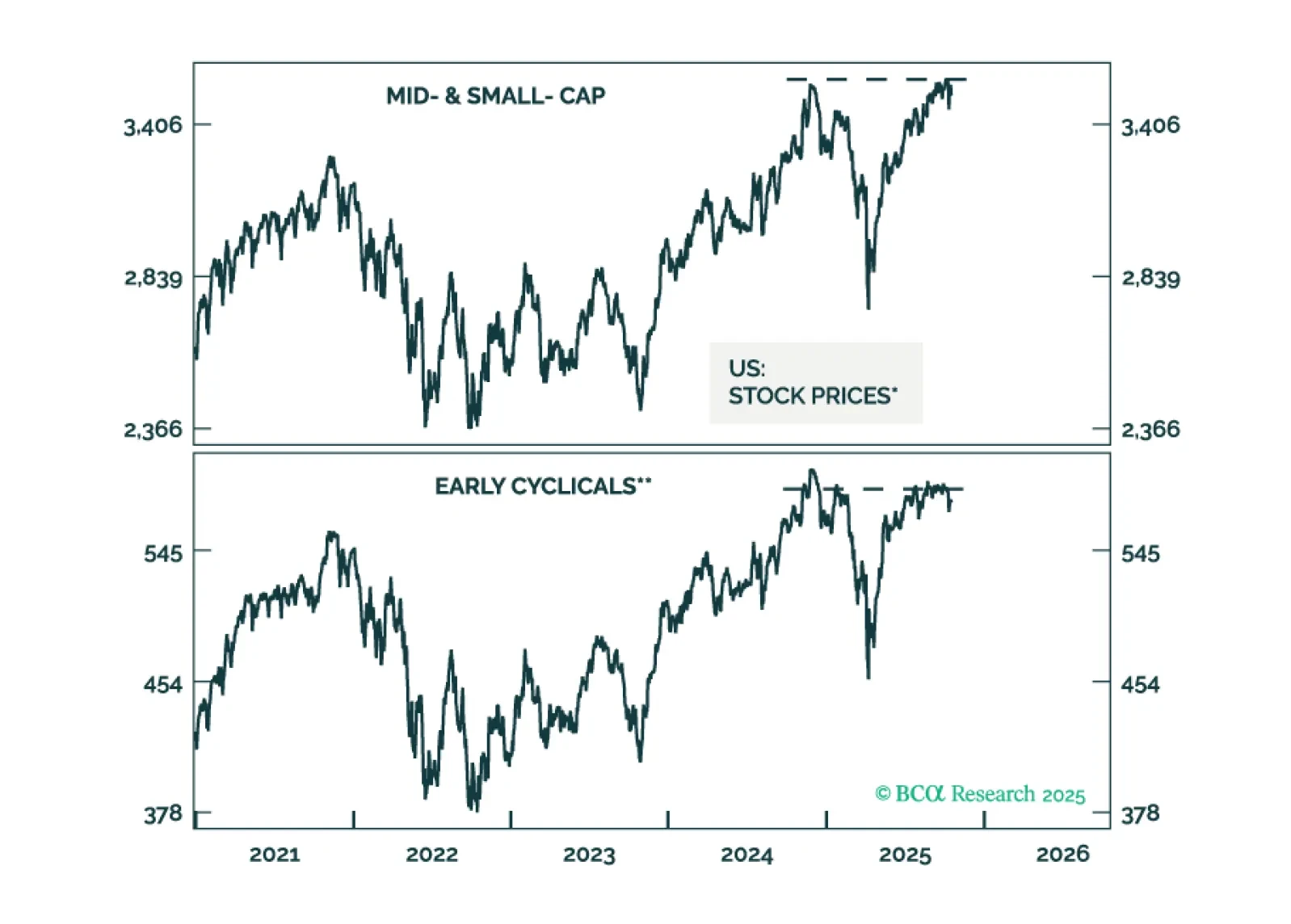

The economy remains resilient despite a softening labor market. As the economy shifts from labor toward capital, we may be in the early stages of a “jobless boom.” Our bull case for equities rests on strong earnings growth,…

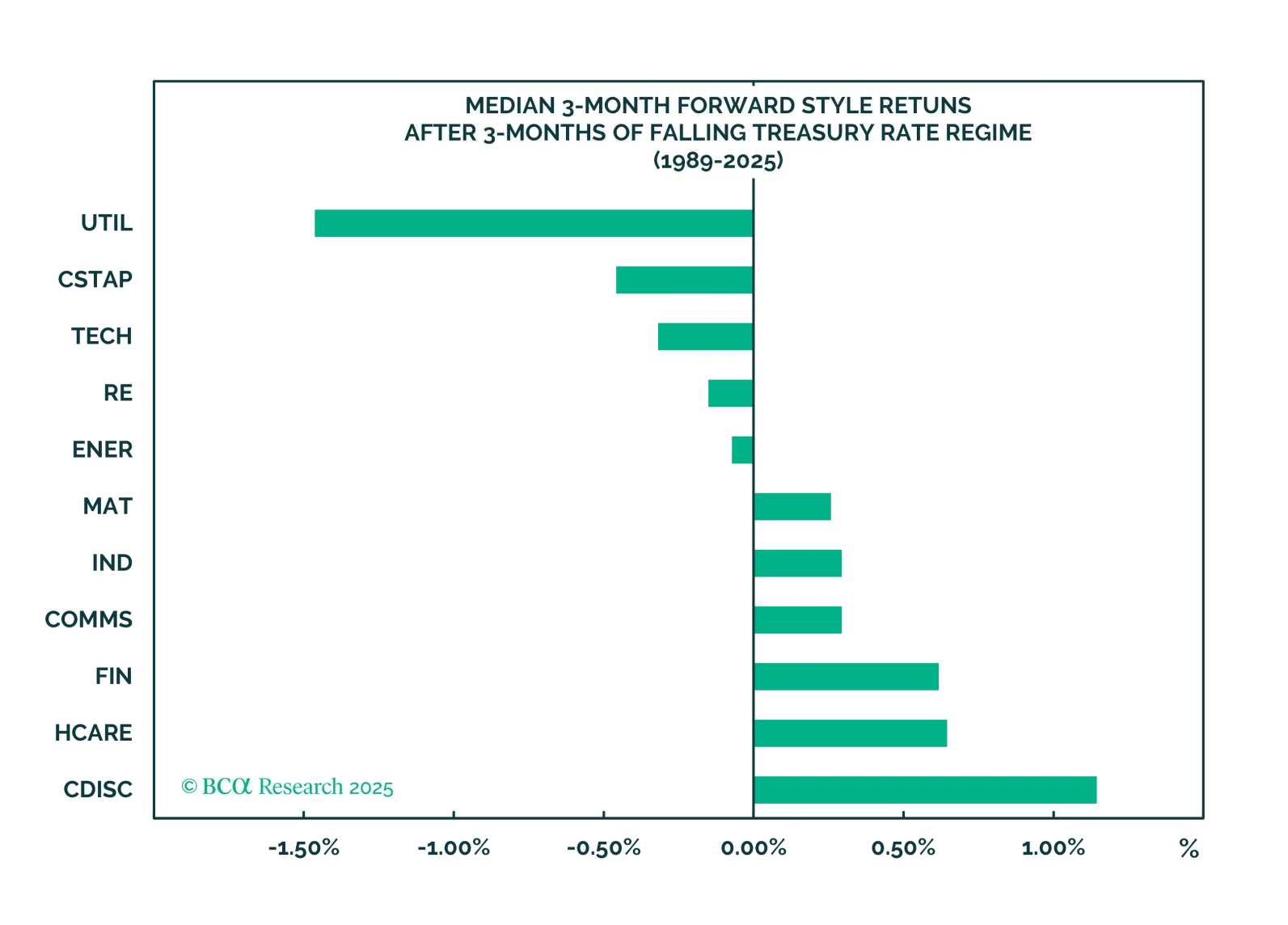

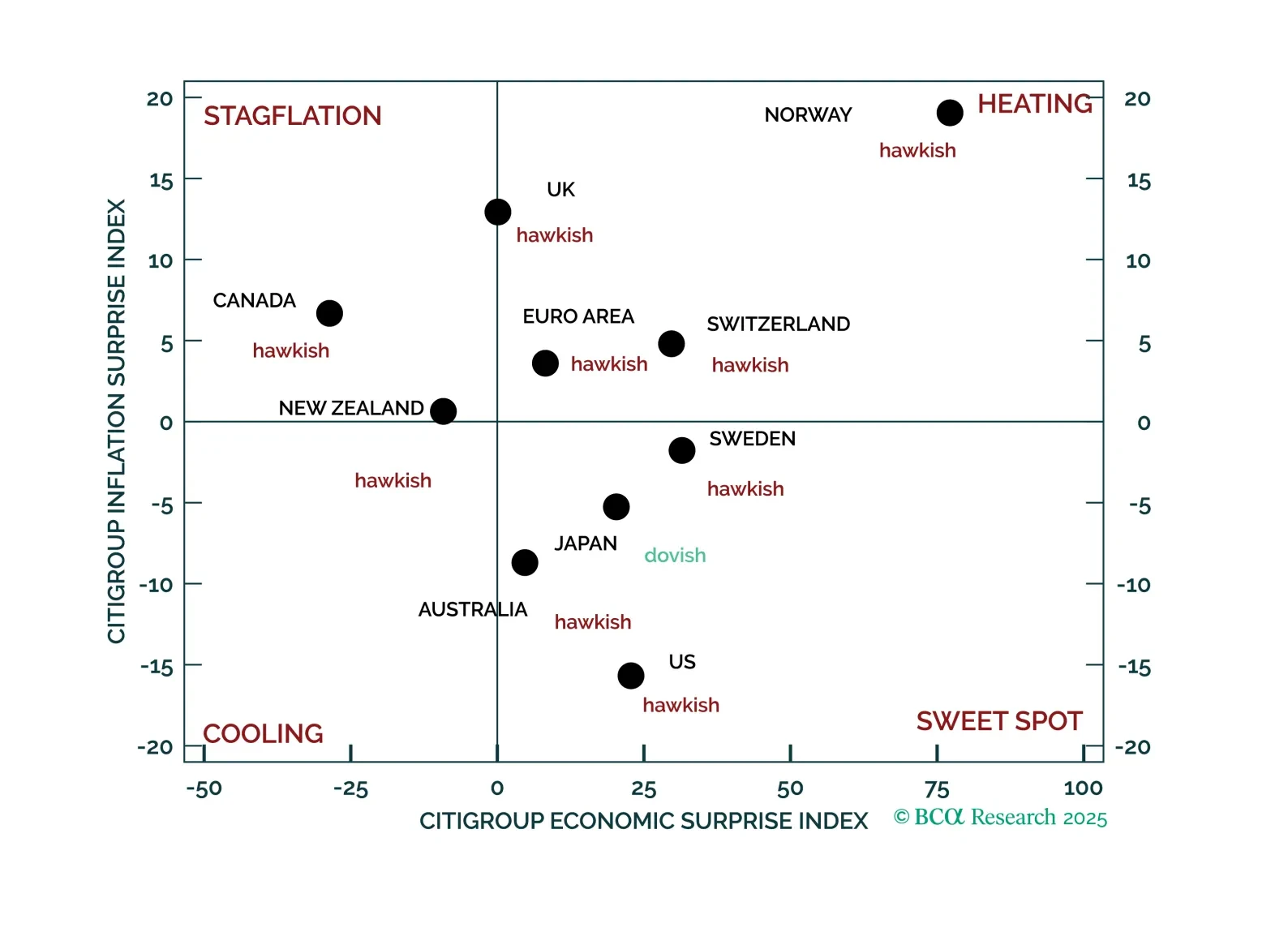

In this update, we apply our Macro Surprises framework to equities for the first time. Overall, the message is broadly consistent with our current equity views: Investors should favor Eurozone equities and continue to overweight…

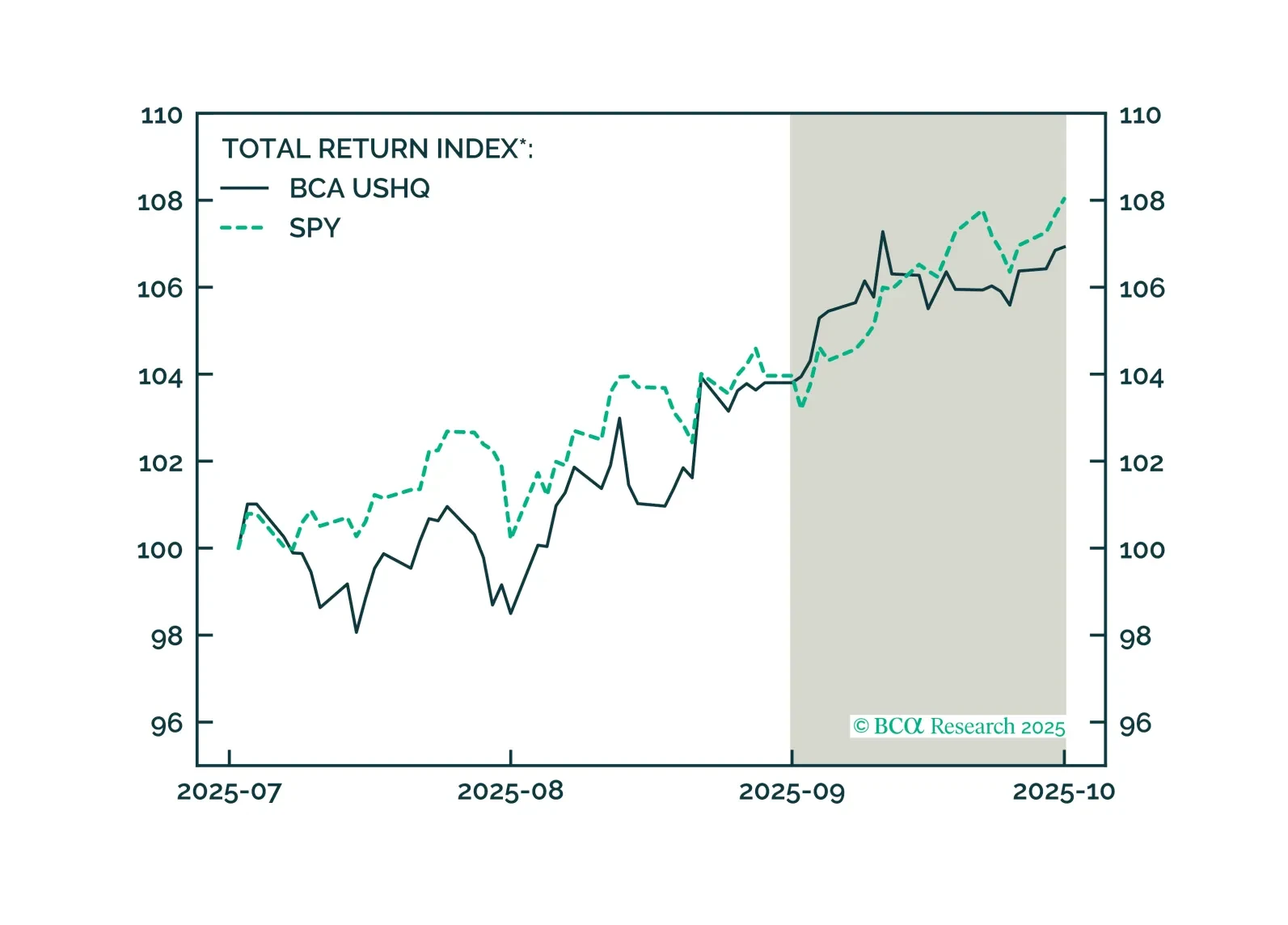

The US High Quality (USHQ) portfolio underperformed its benchmark through September, returning 3.01%, whilst its SPY benchmark returned 3.91%. However, our US High Quality SMID (USHQ SMID) portfolio continues to show strength, with…

Our US and Geopolitical strategists see 50% odds of a shutdown that lasts beyond three weeks. Investors continue to wonder whether the US federal government shutdown will last long enough, or involve large enough layoffs, to affect…