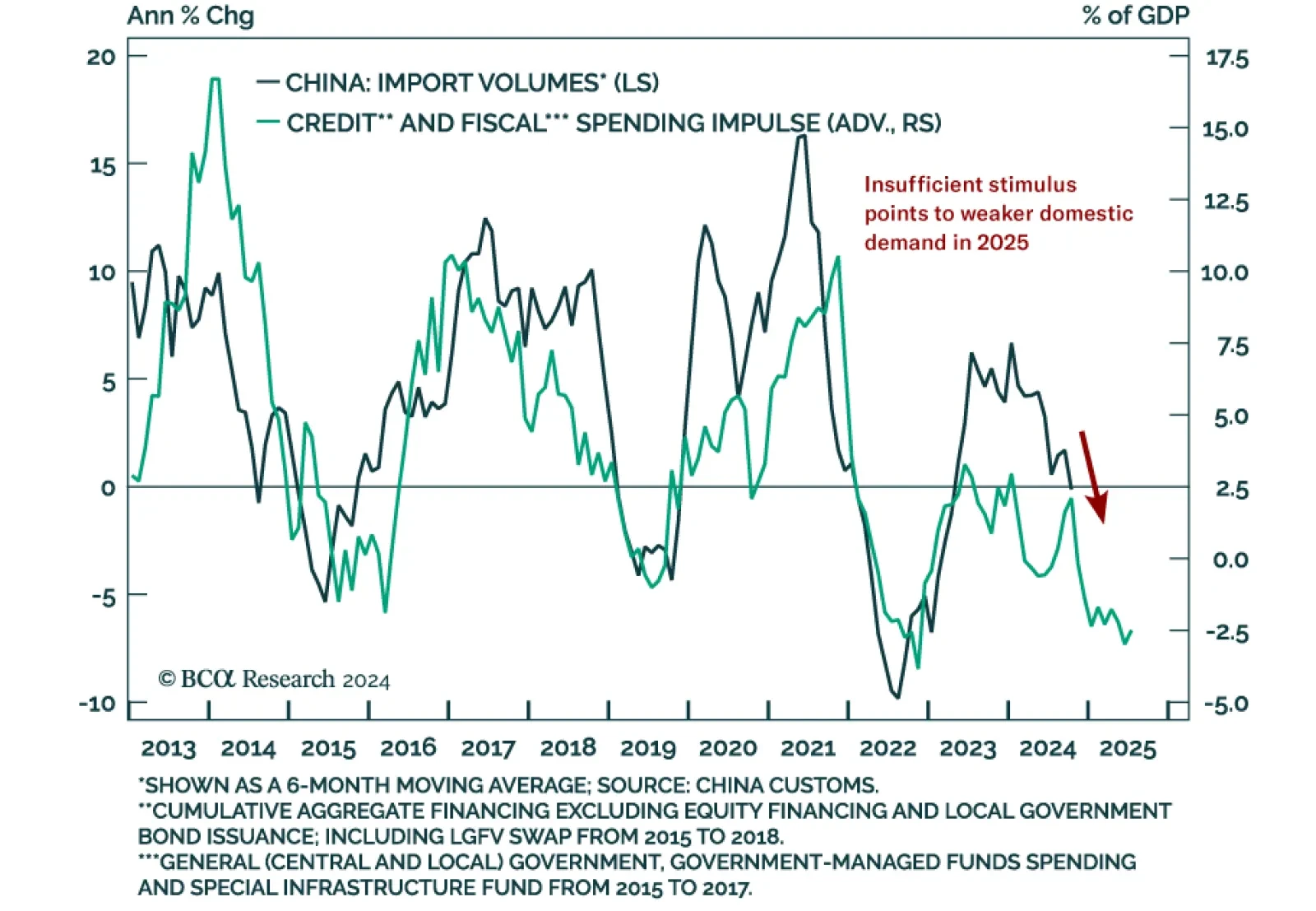

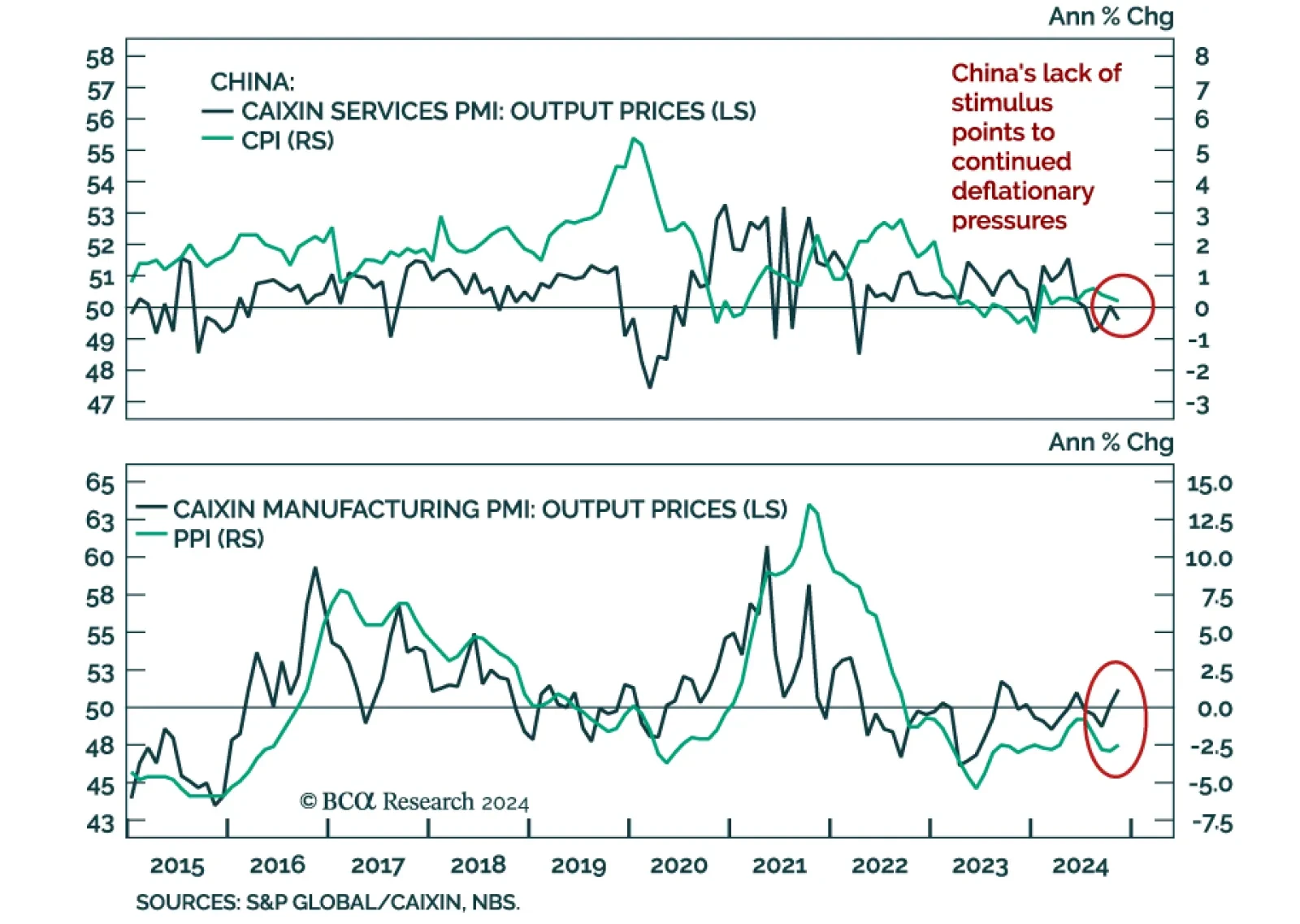

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth…

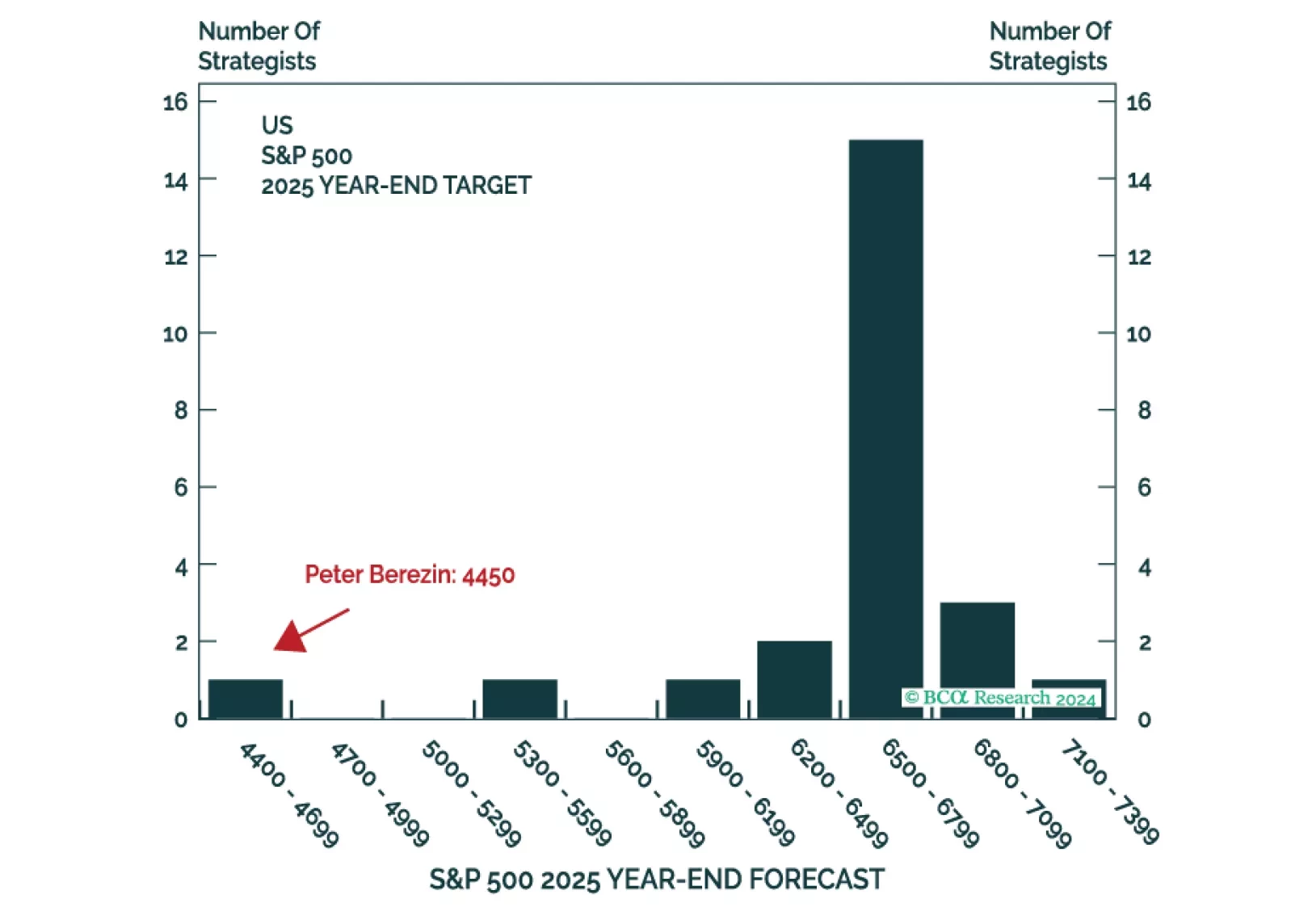

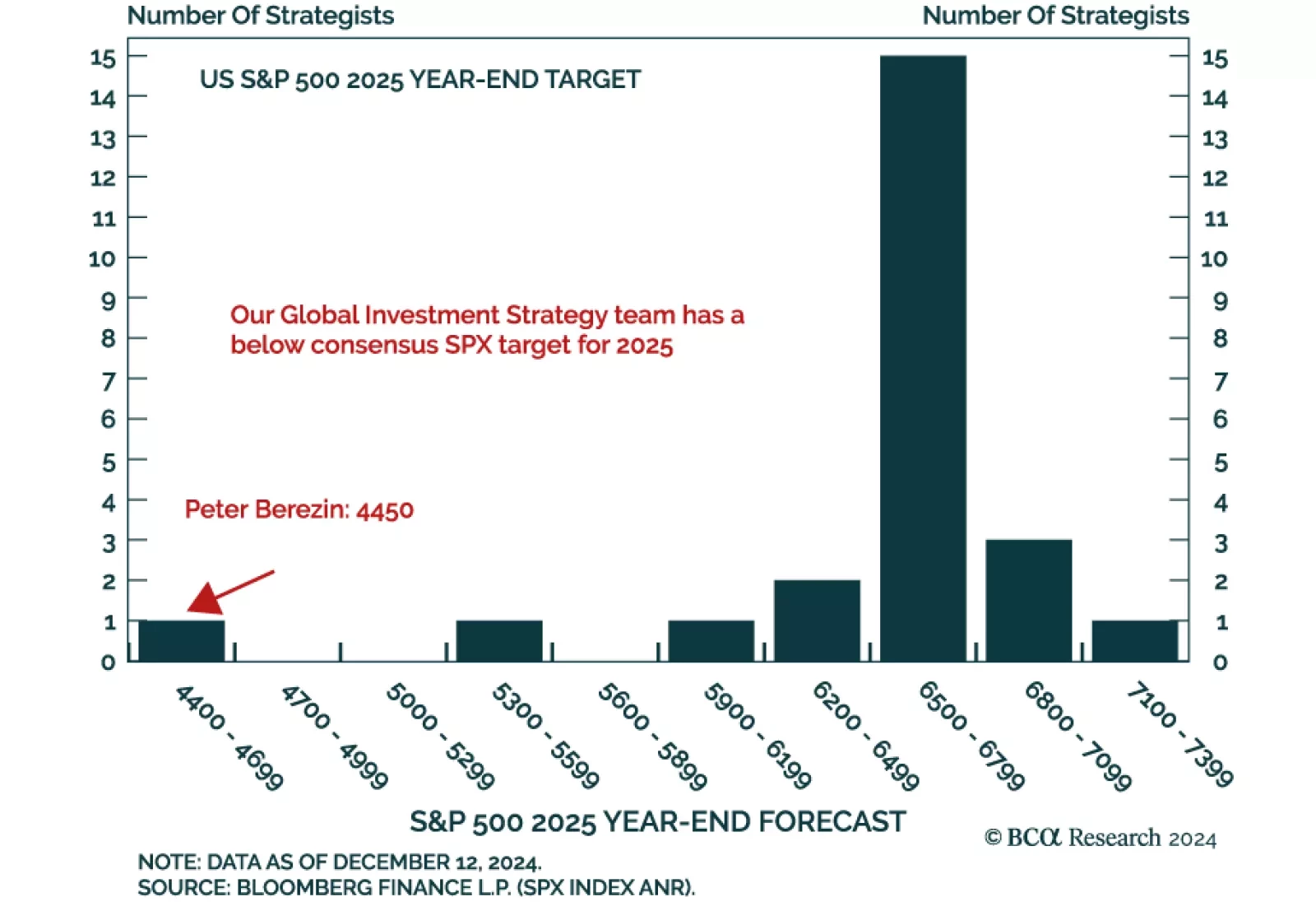

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

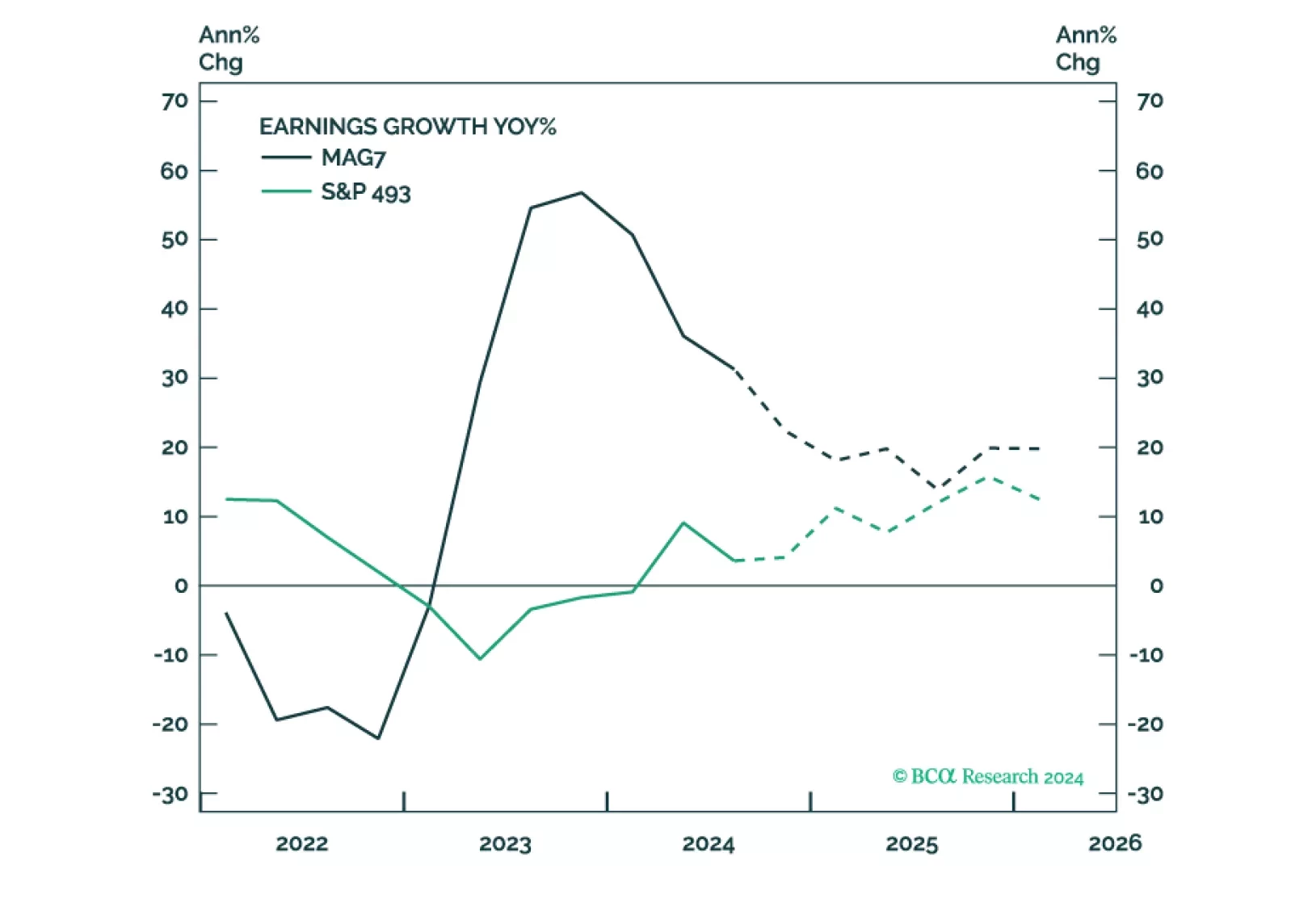

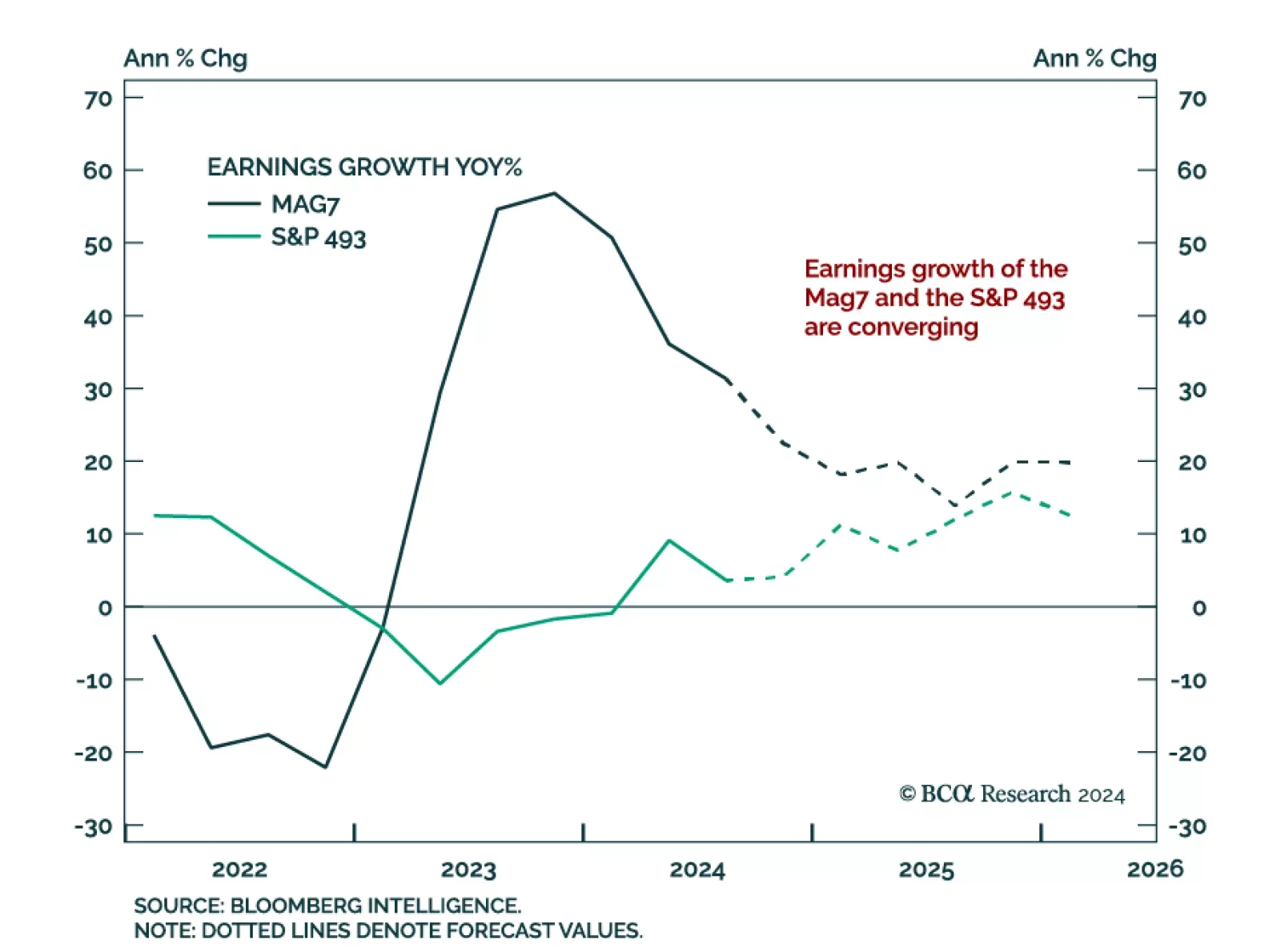

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

Our US equity strategists just published their annual outlook, where they discuss the environment and rotation they foresee in 2025, which is more bullish than our House View. Our colleagues see Trump 2.0 policies…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

Chinese deflationary pressures intensified in November, with CPI ticking down to 0.2% y/y from 0.3% in October. Producer prices deflation eased, with prices falling 2.5% y/y, less than -2.9% y/y a month prior. The weak data…

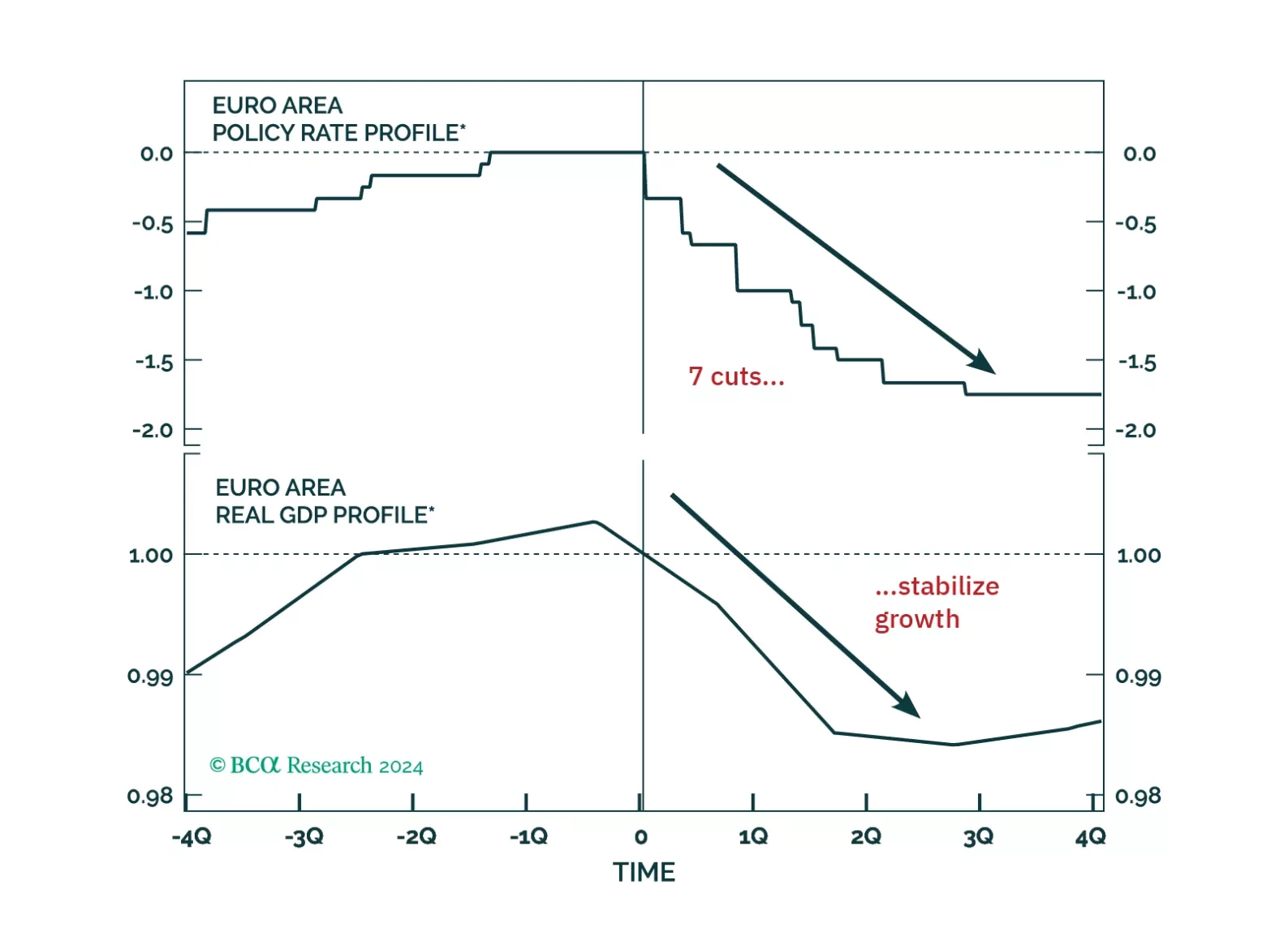

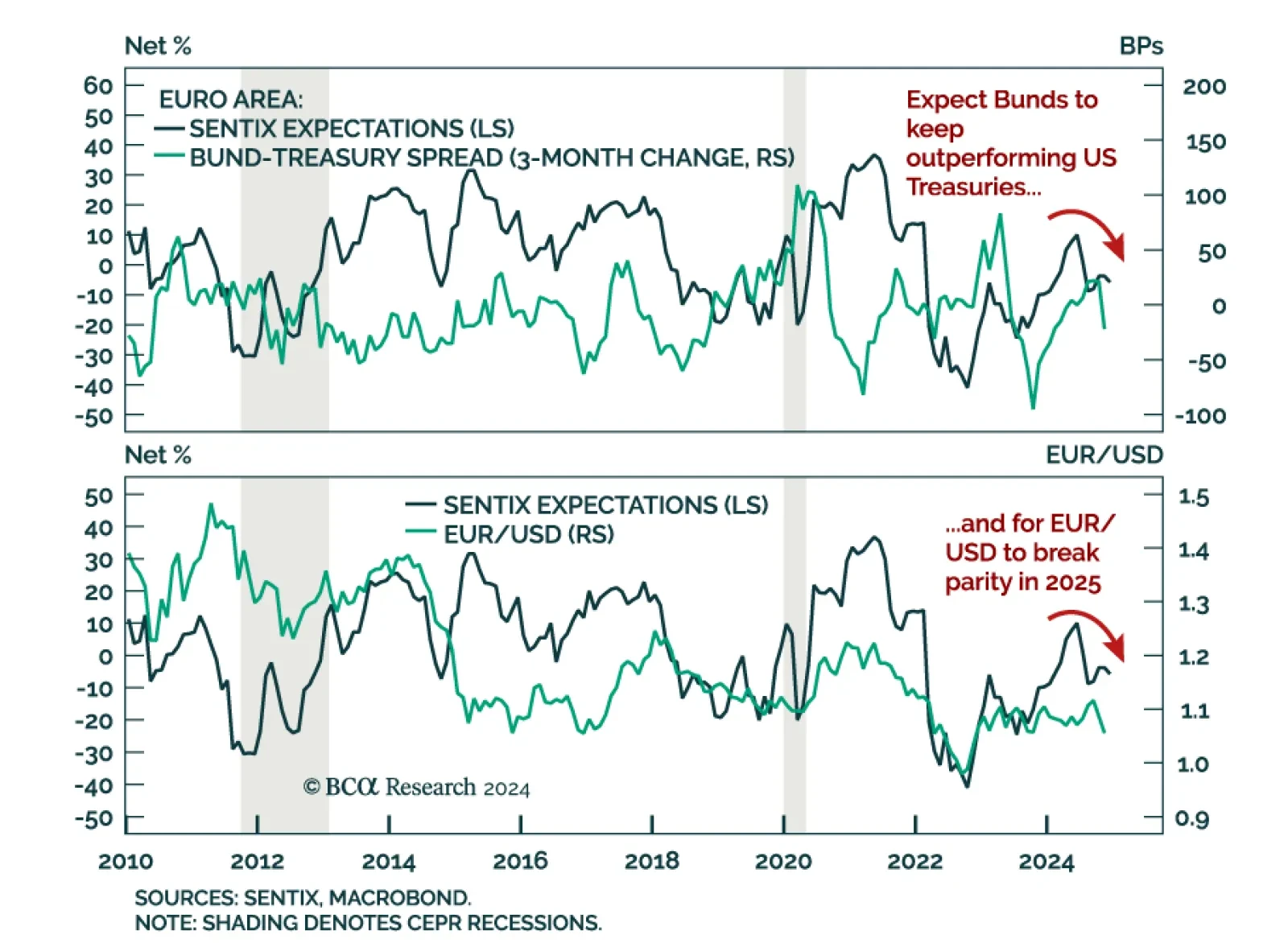

The December Sentix Economic Index for the Euro Area missed expectations, declining to -17.5 vs. -12.8 in November. Both the current situation and expectations components declined. As the first sentiment indicator for…

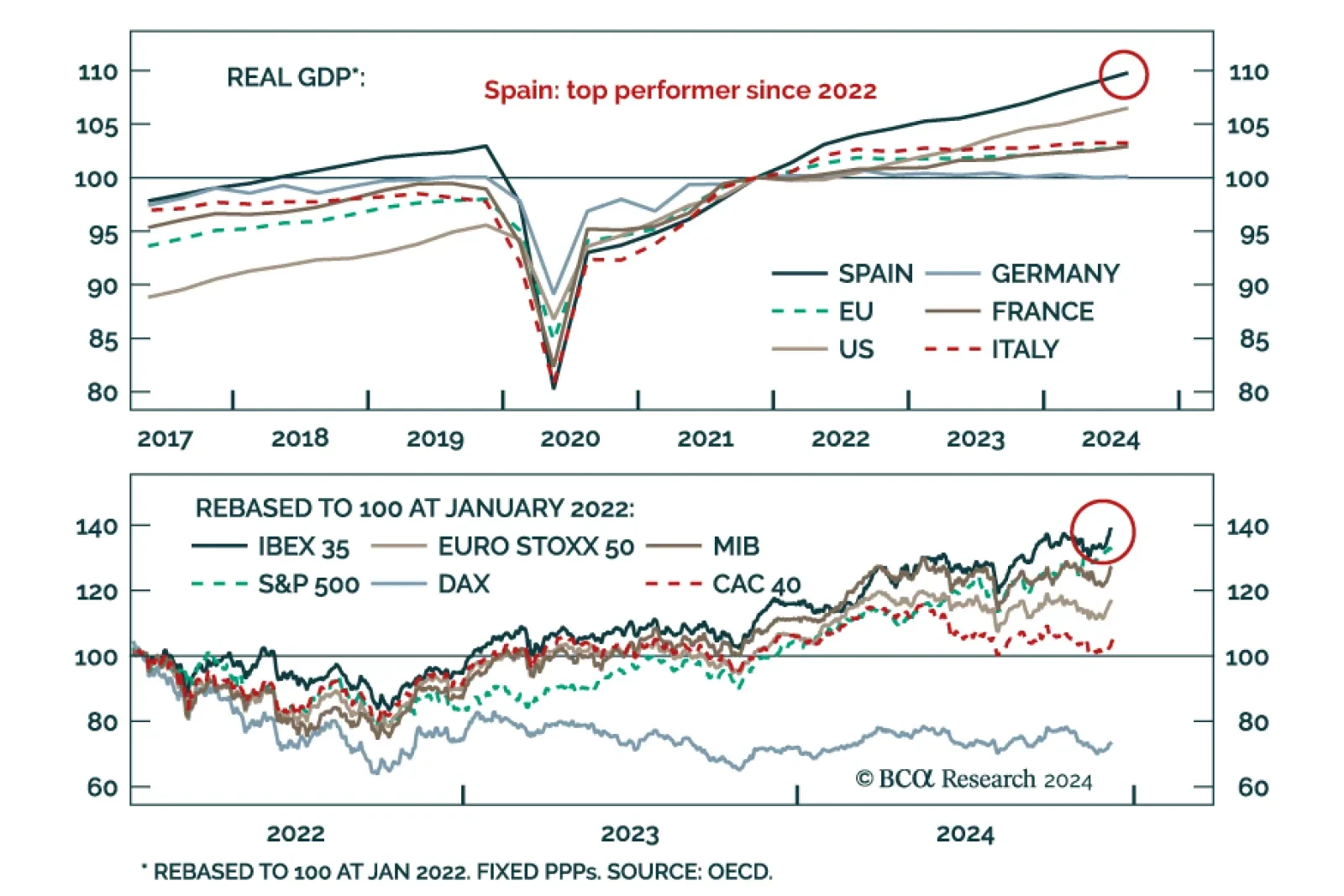

In the final installment of their “PIGS Have Wings” special series, our European investment strategists took a deep dive into the Spanish economy and financial assets. Spain outperformed most developed markets…