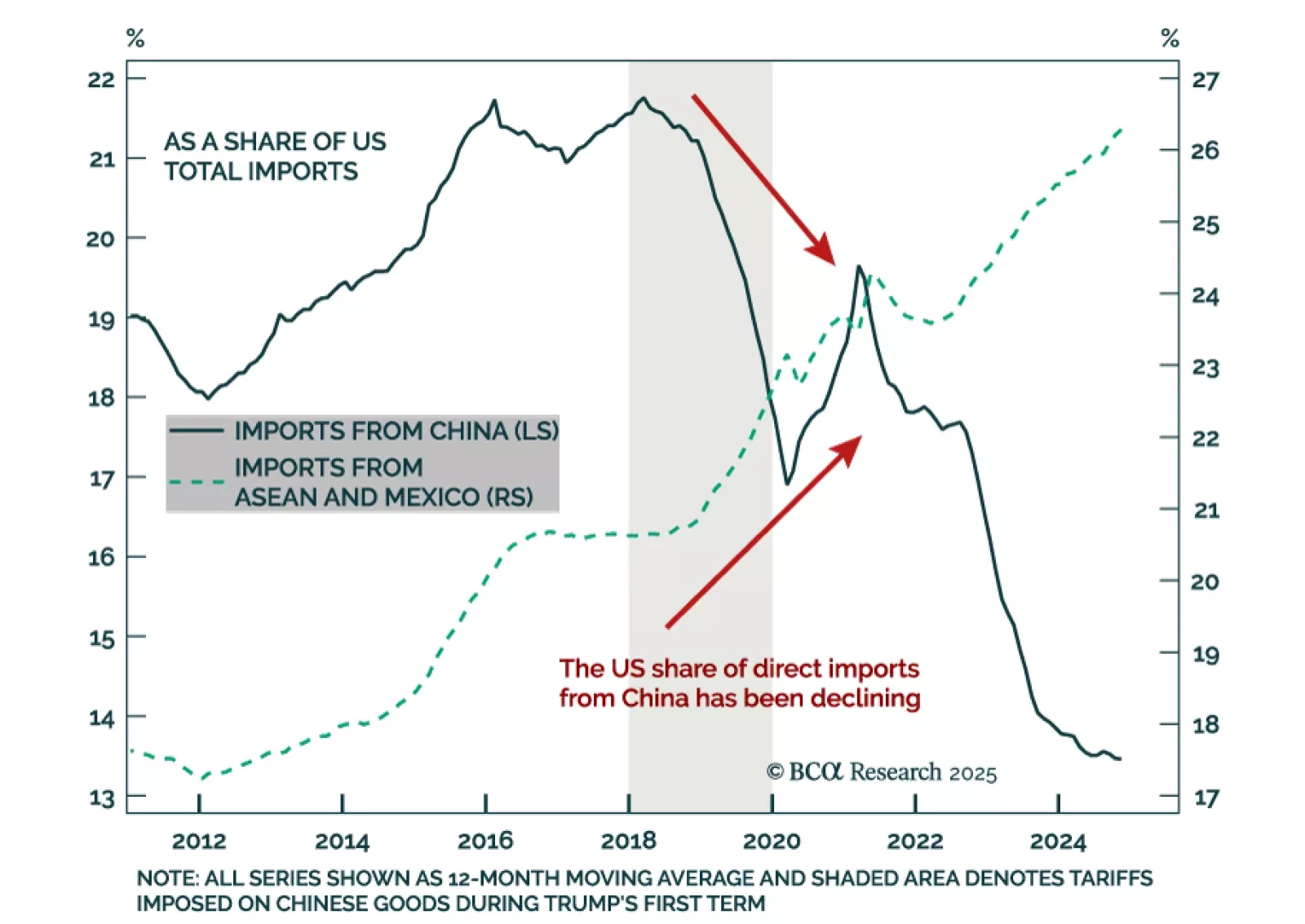

Our China Investment Strategy team explored how the costs of higher tariffs might be distributed among foreign suppliers, US importers, and consumers. The inflationary impact of new US tariffs is likely to remain modest unless…

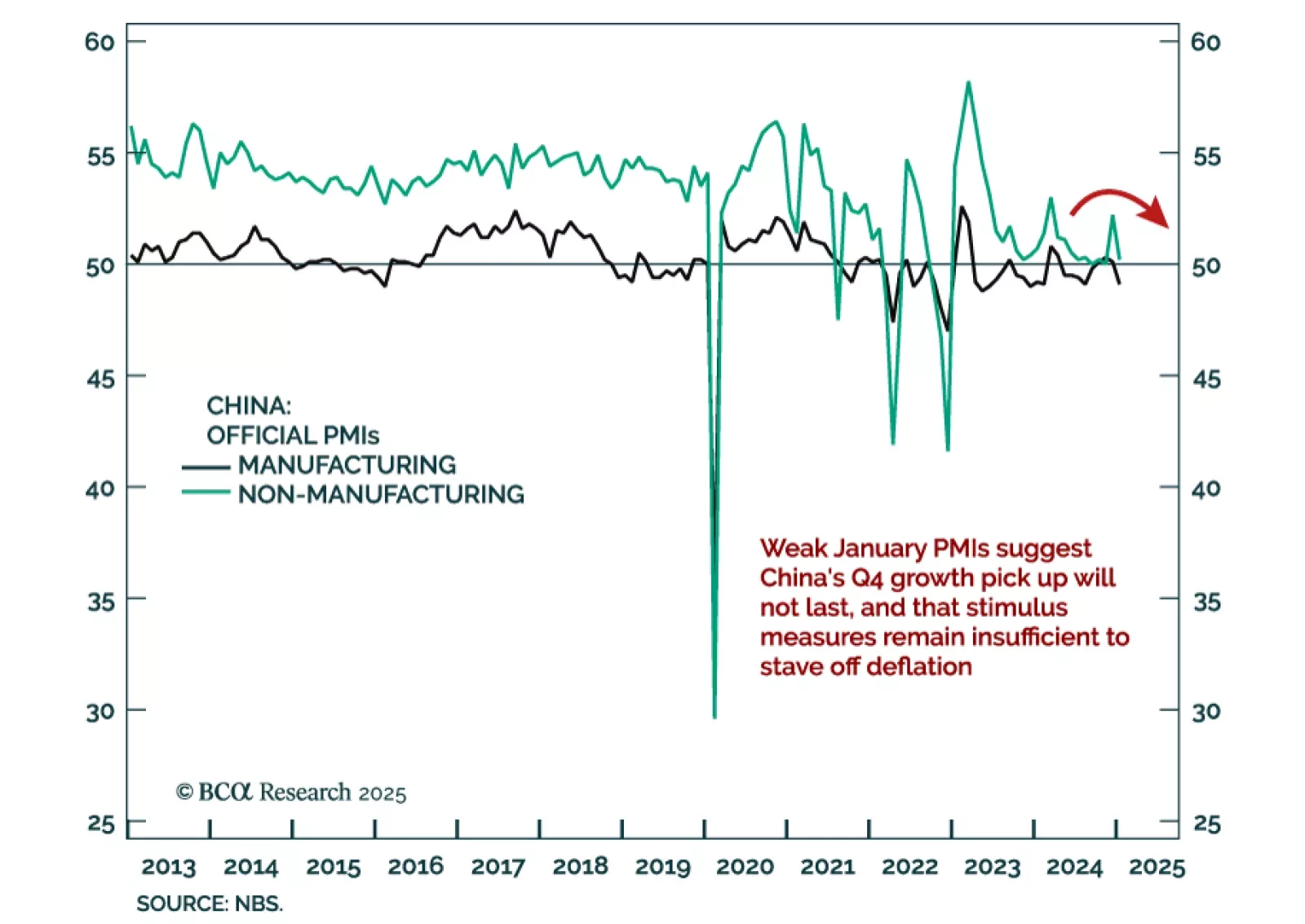

China’s official January PMIs disappointed, with the composite ticking down to 50.1 from 52.2. The decrease was driven by both the manufacturing and non-manufacturing components, with the former indicating contraction, and the latter…

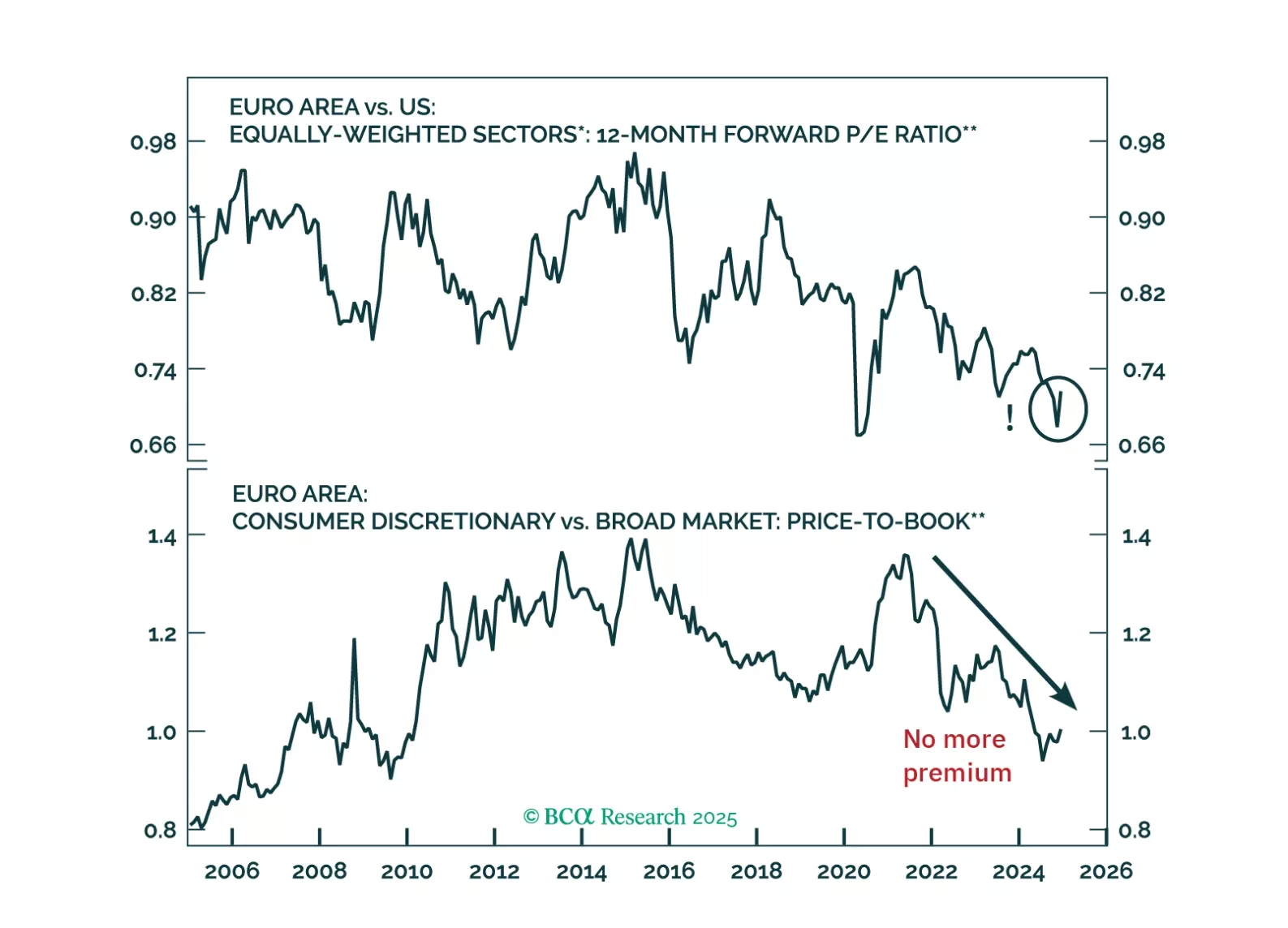

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

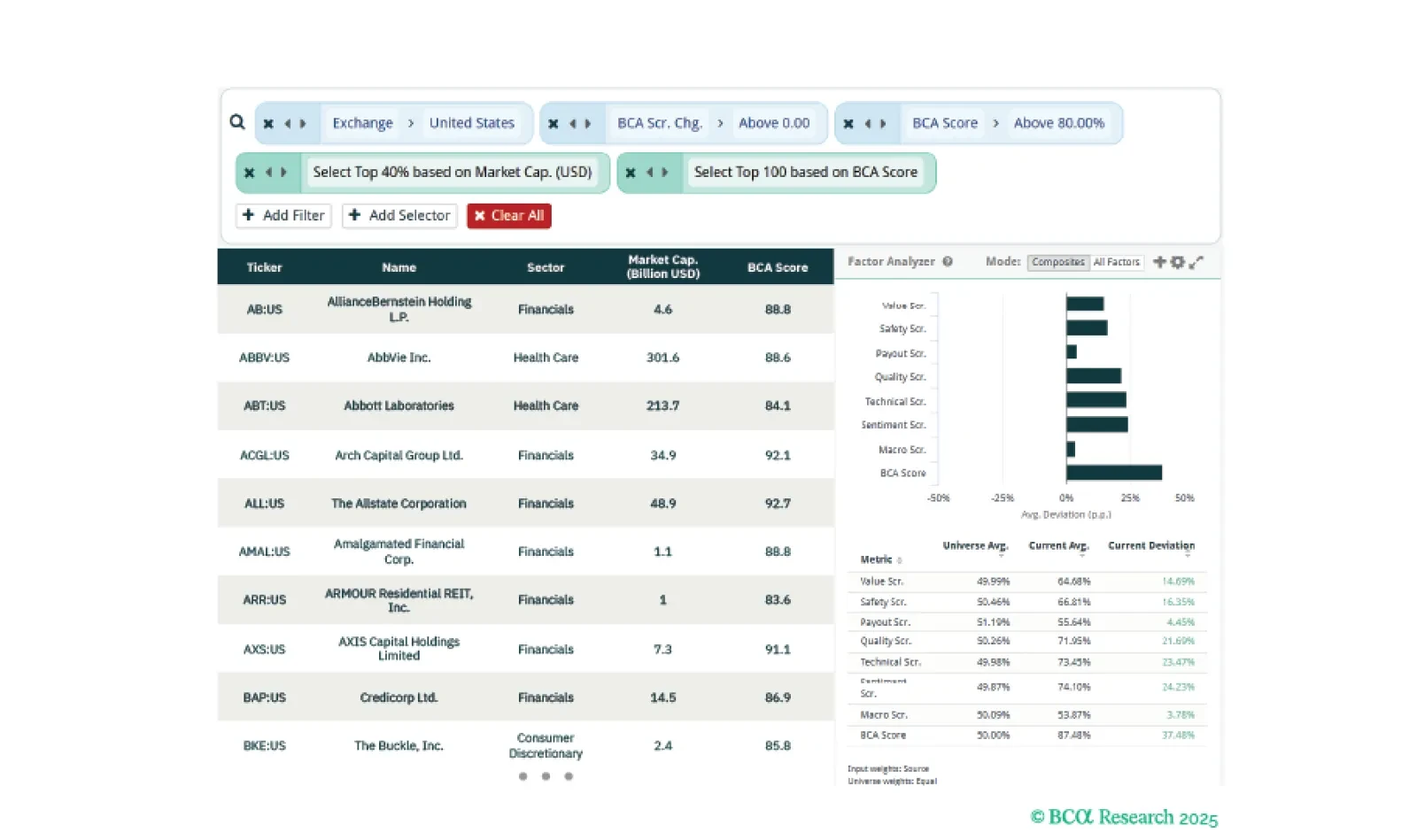

This week, our three screeners show you how to setup easy monitoring of the BCA Score, take advantage of earnings season in the US, and seek out global stocks that are cheap and high quality.

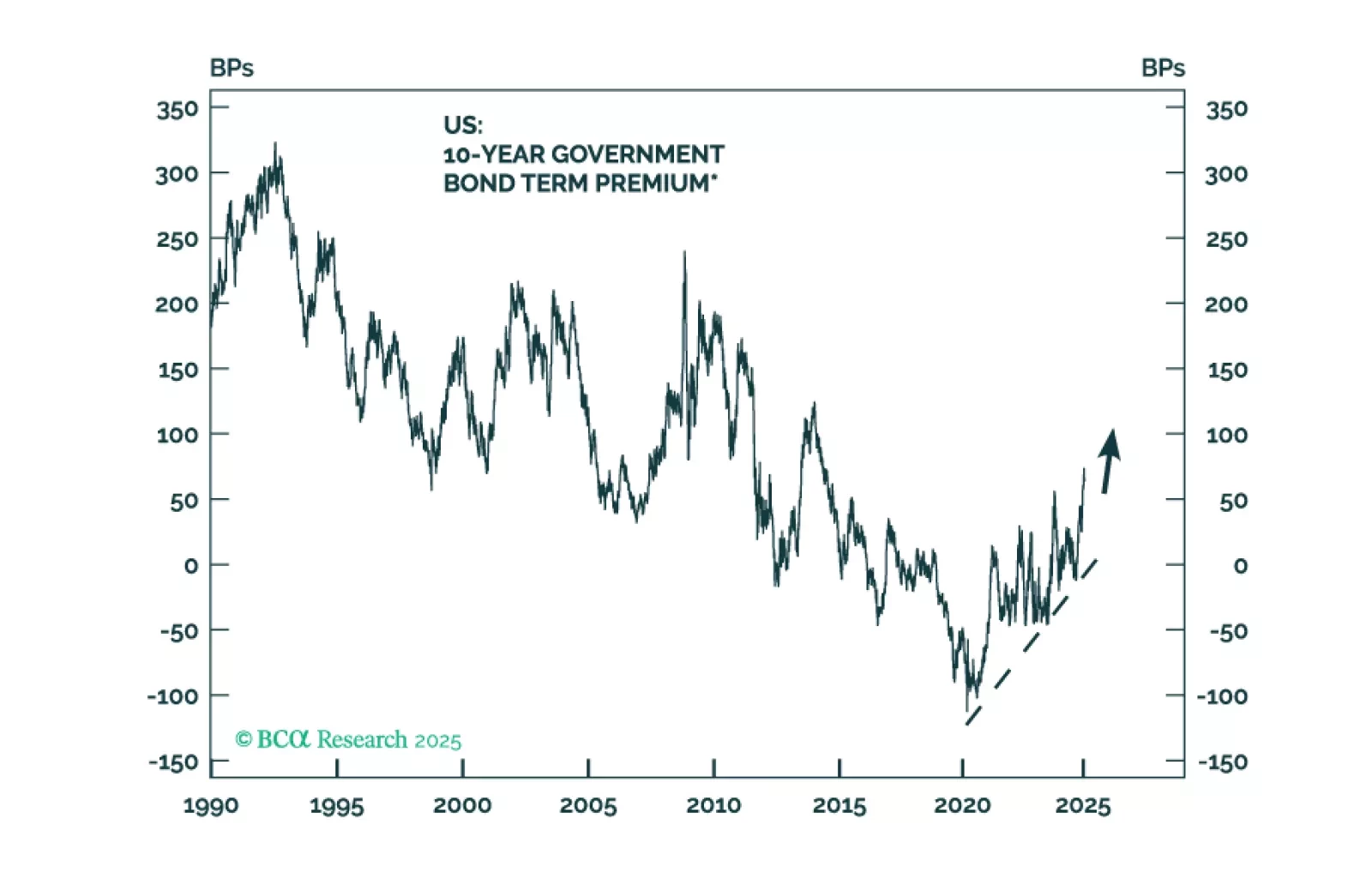

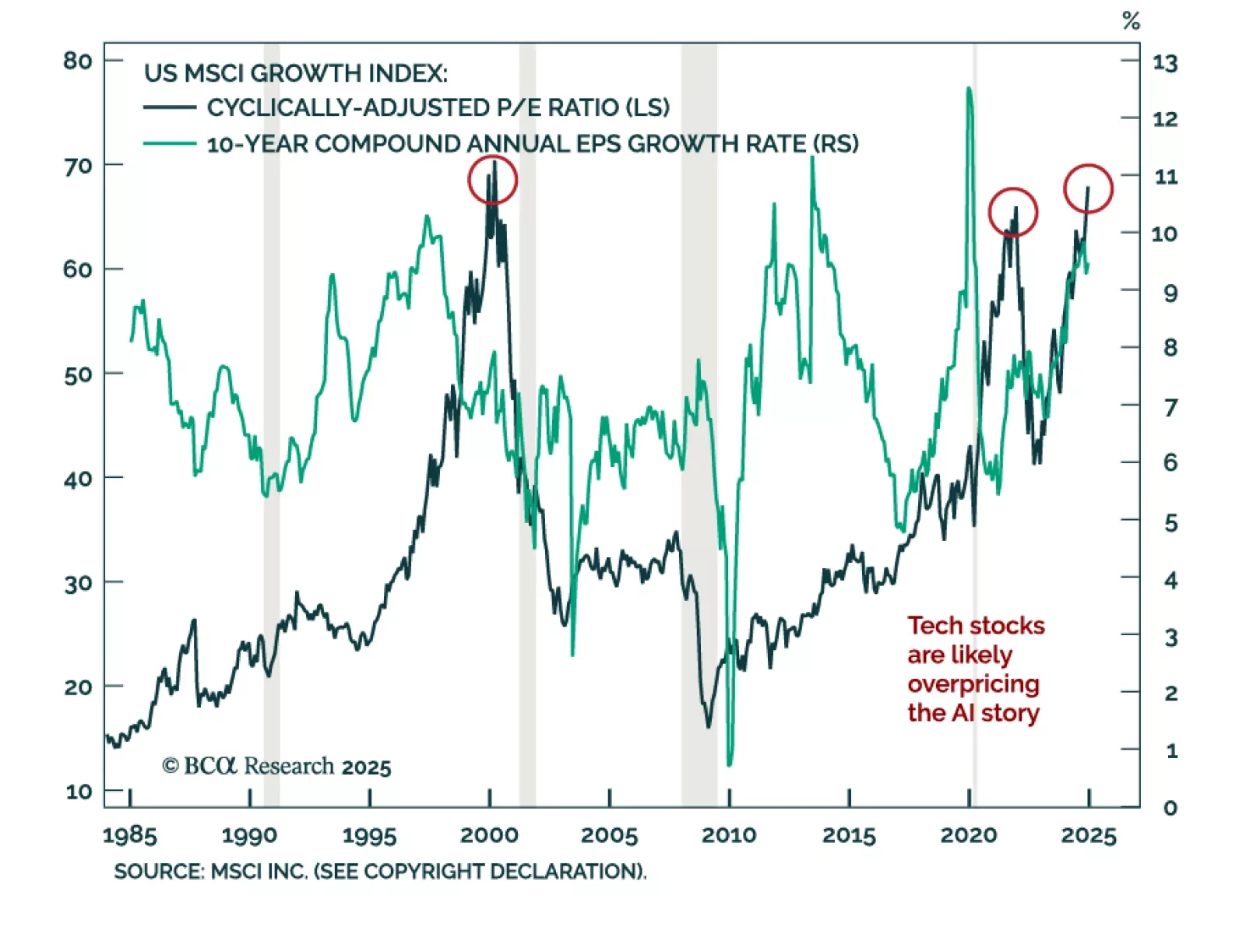

The Magnificent 7 have a leg up on AI investments over the rest of the market. Although the future impact of AI on productivity and profits is still debated, current tech stocks valuations reflect great optimism that AI indeed will…

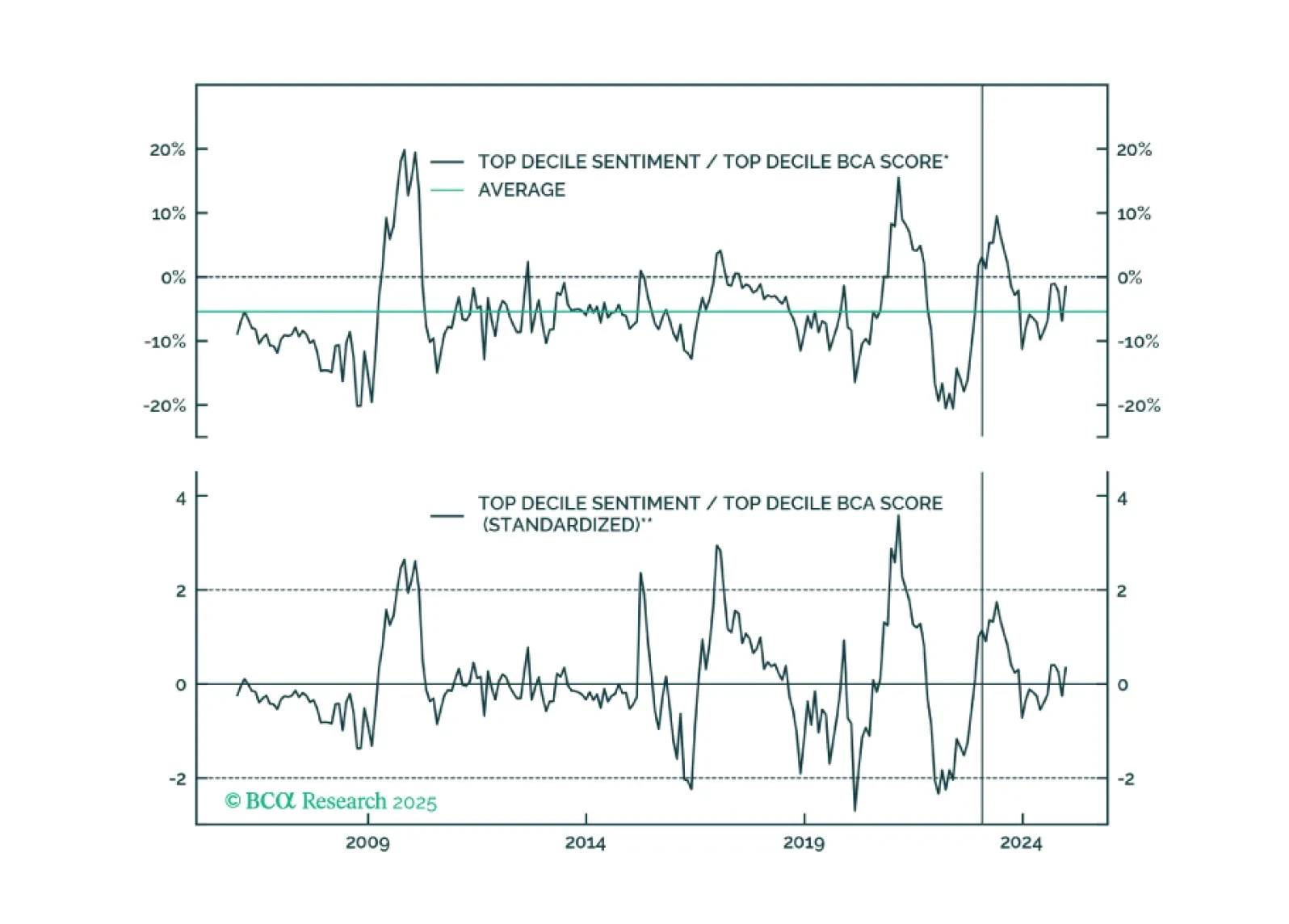

Despite the choppy price action of the last few weeks, equity sentiment remains elevated. Surveys of investor sentiment remain at the top end of the bullish spectrum, and the S&P 500 is trading over 22x forward earnings, levels…

Sentiment will stay positive for now, but downside risks are rising. Investors should proceed cautiously in stock picking and portfolio construction at this juncture, given rising economic and policy uncertainty, which threaten…

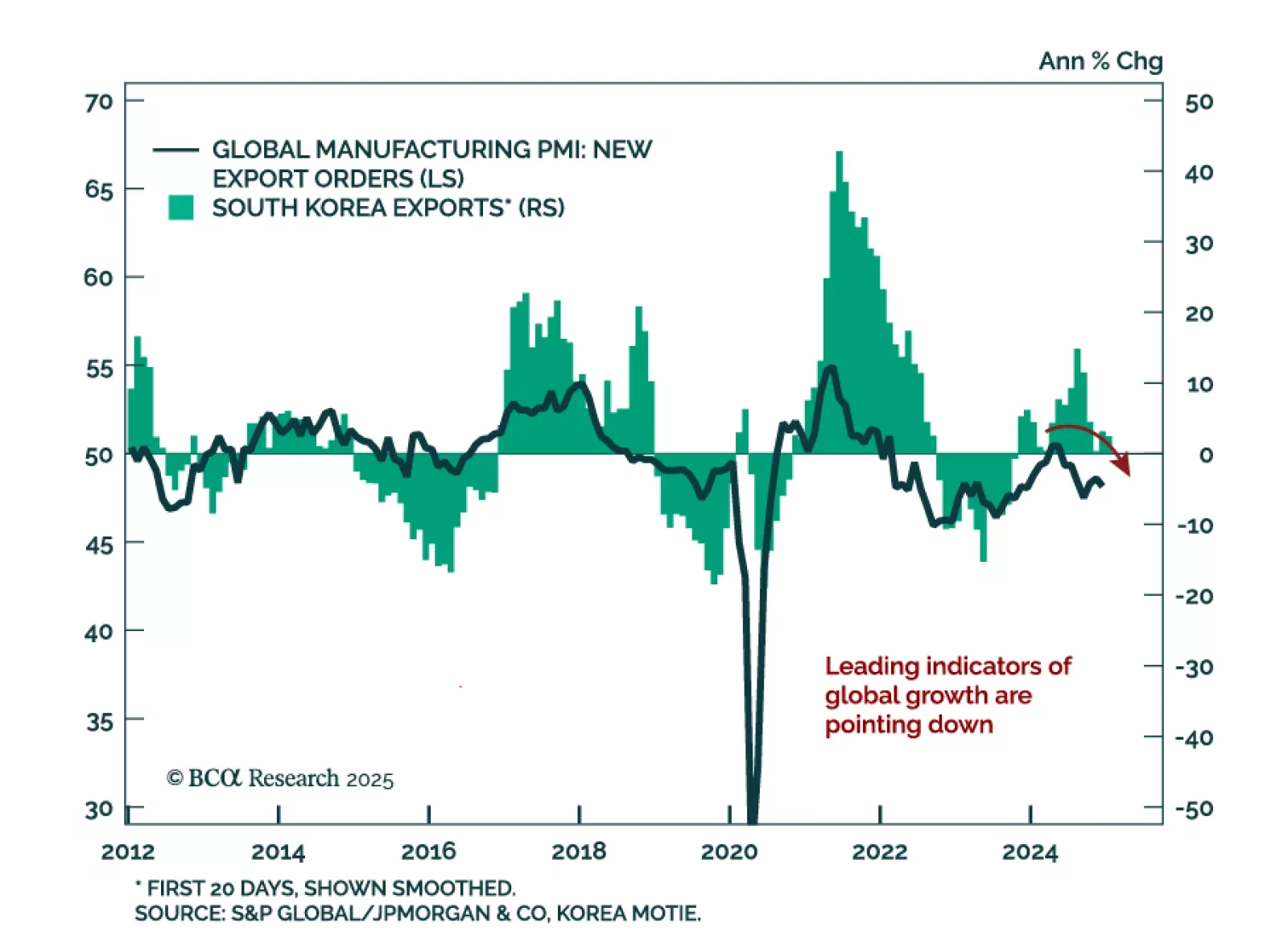

East Asian trade data was mixed in December and January. Taiwanese export orders for December were stronger than expected, rebounding to 20.8% y/y from 3.3% in November. On the other hand, Korean exports for the first 20 days of…

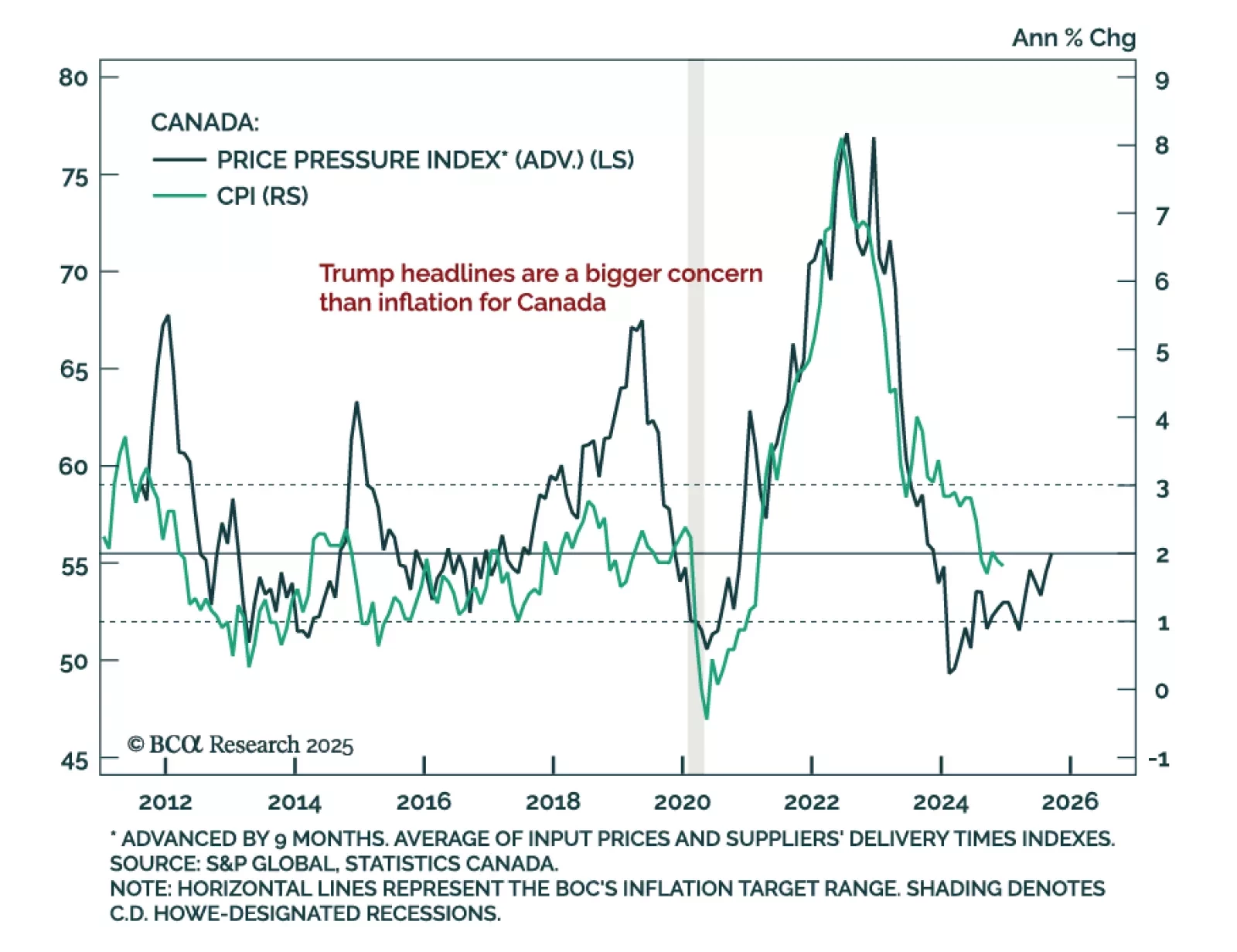

The December Canadian CPI was roughly in line with estimates, with headline inflation ticking down to 1.8% y/y from 1.9% in November. The BoC’s core inflation measures, median and trim, also decreased from 2.6% to 2.4% and 2.5%,…