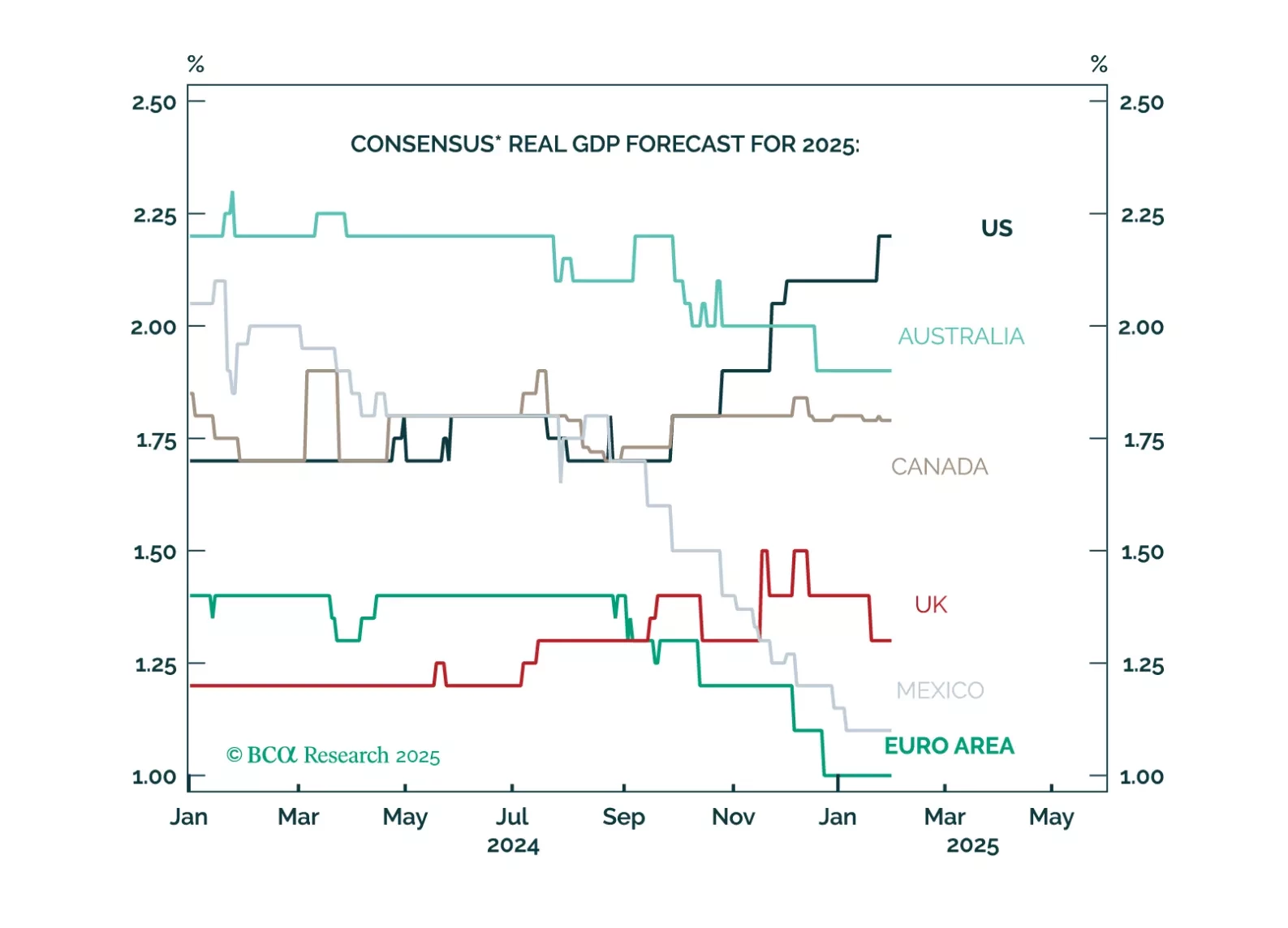

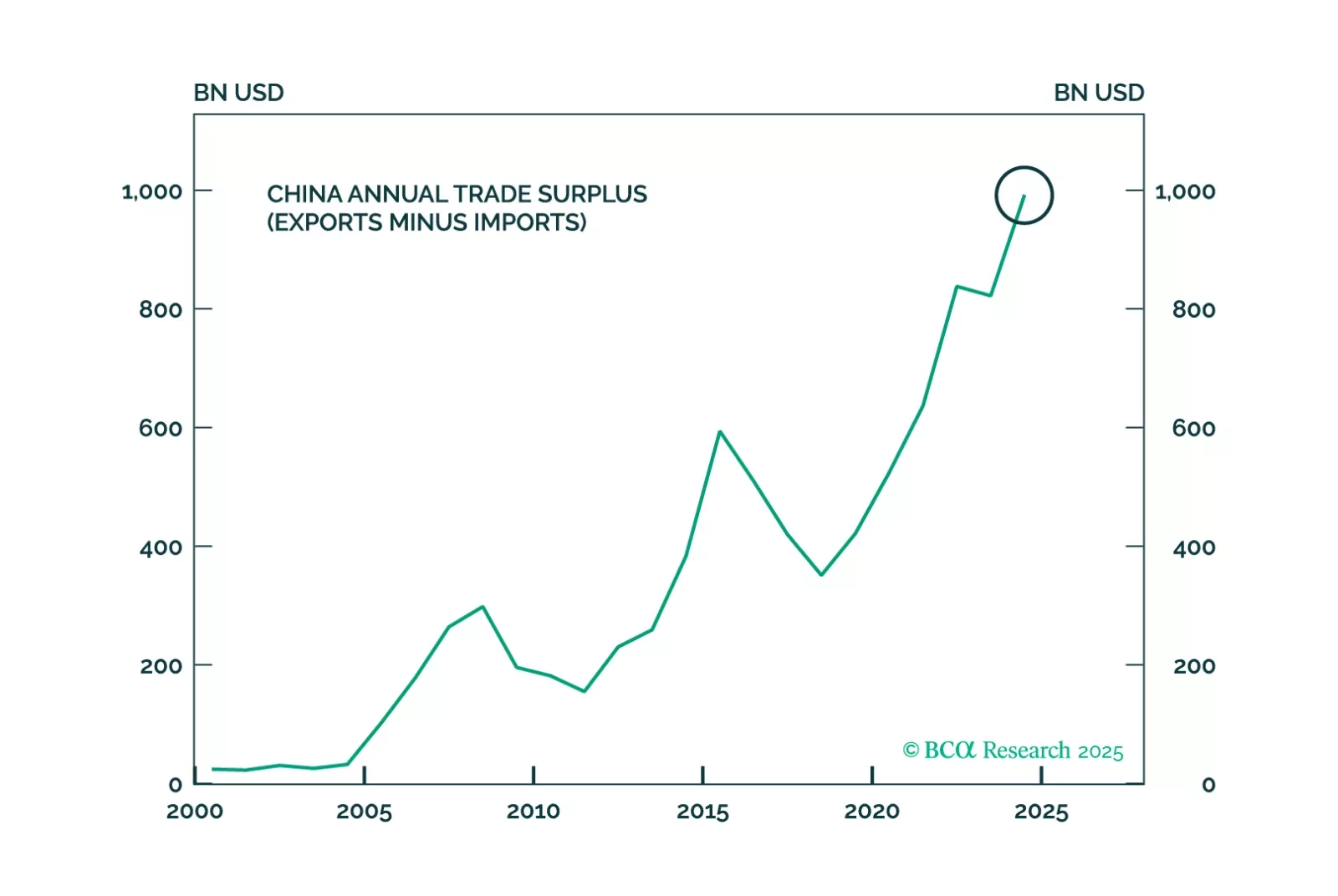

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

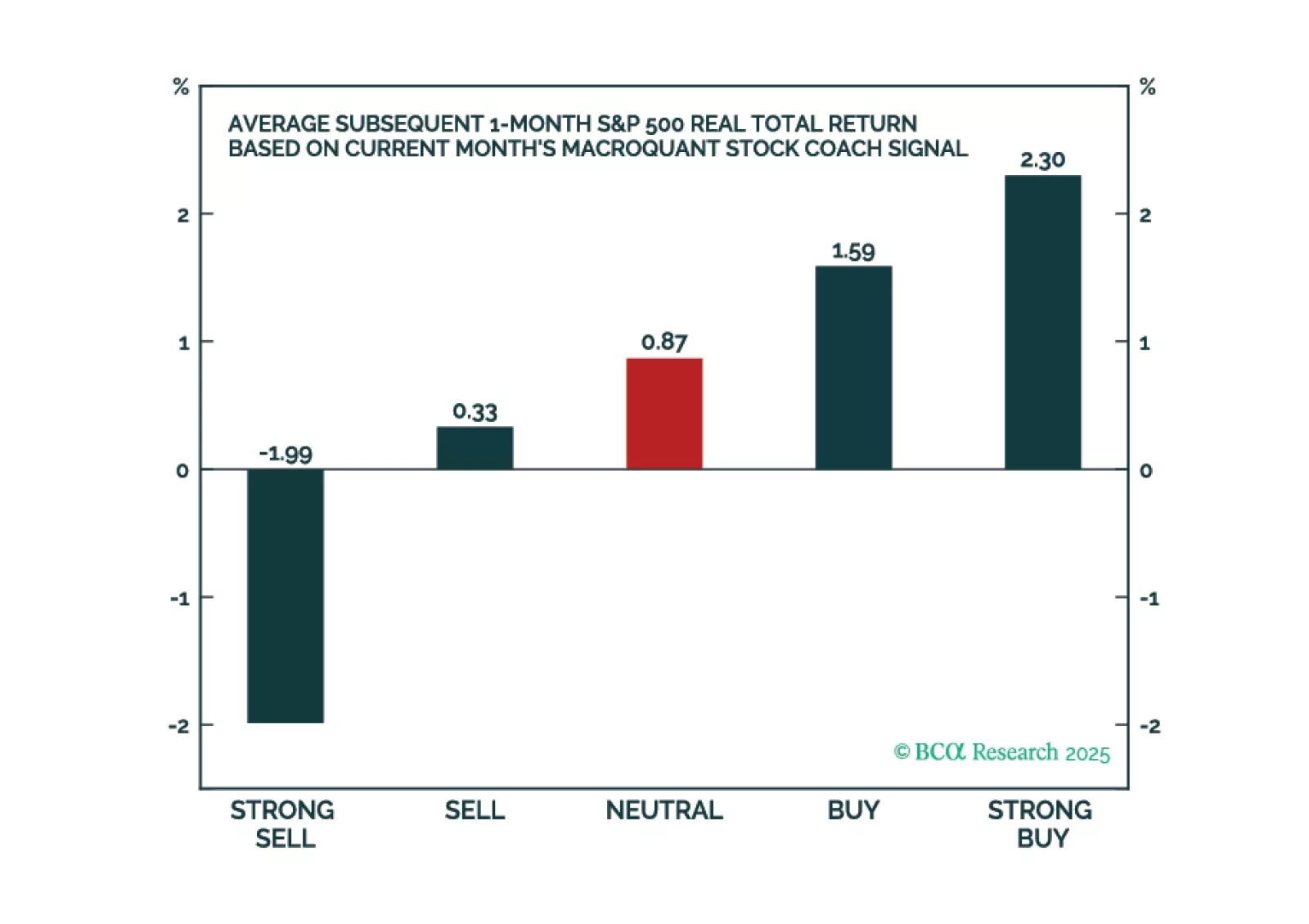

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

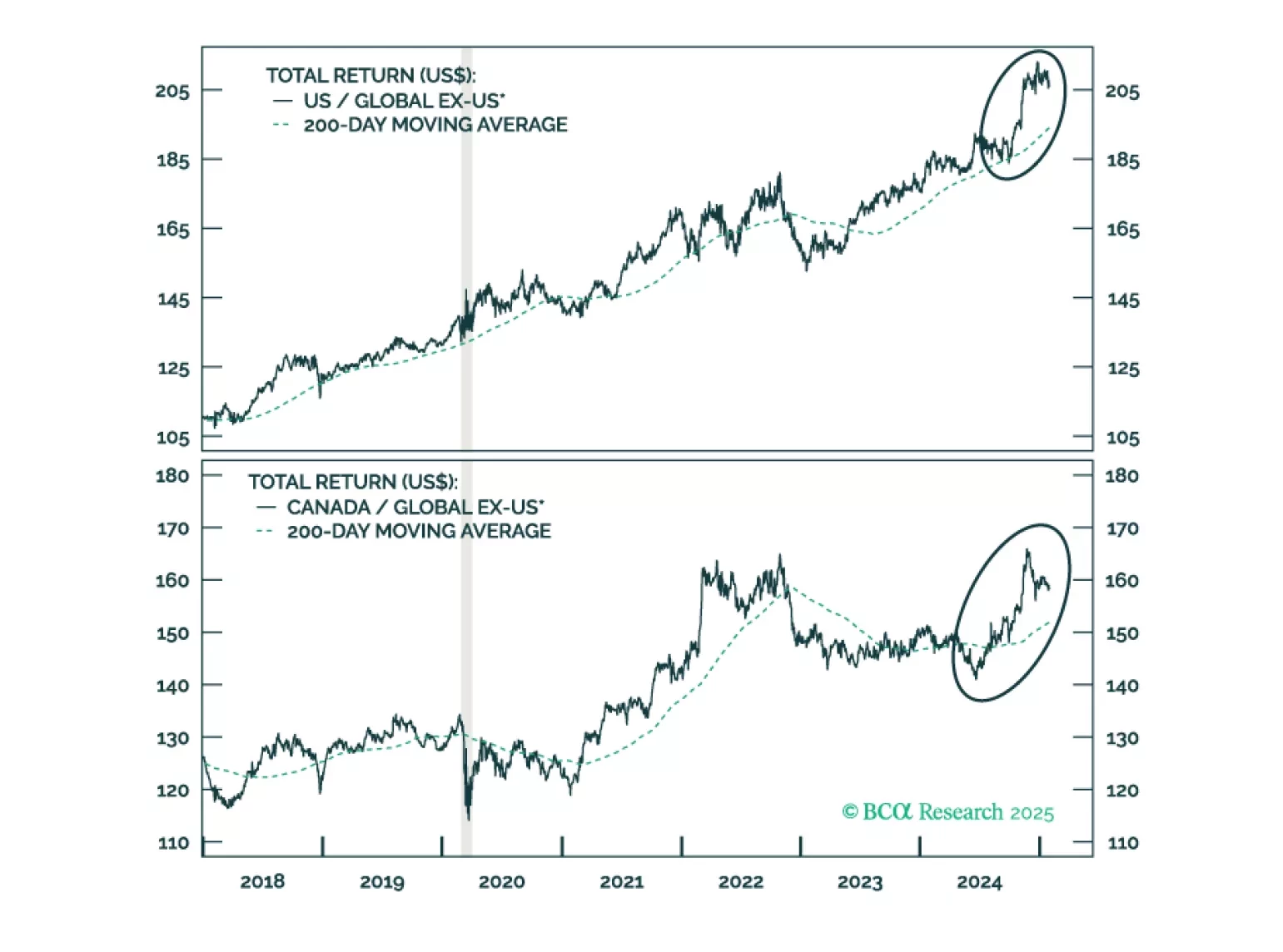

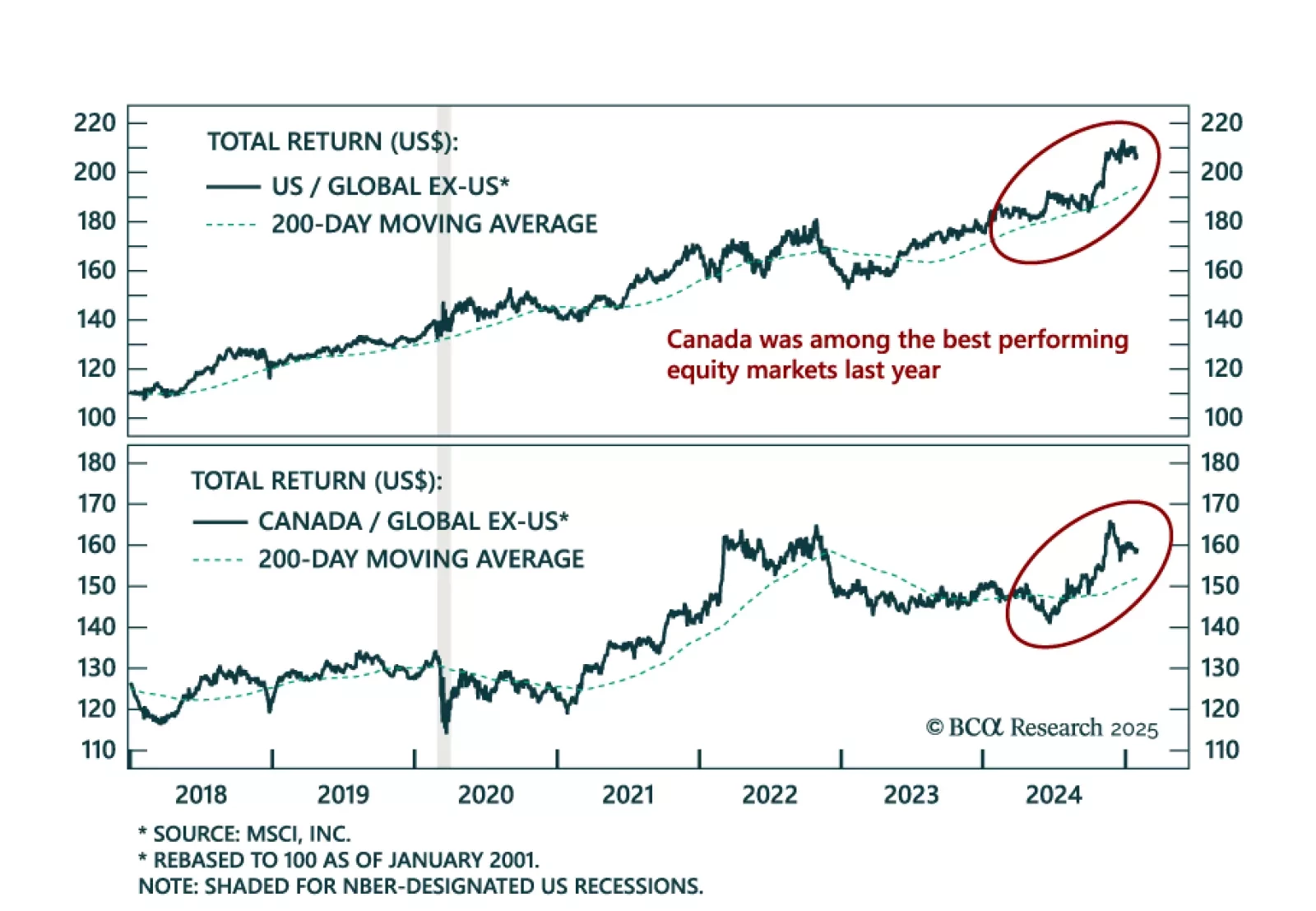

Our colleagues from The Bank Credit Analyst revisited the outlook for Canadian stocks after they outperformed global ex-US stocks in late 2024. The outperformance was driven by financials and tech. While Canadian tech gains were…

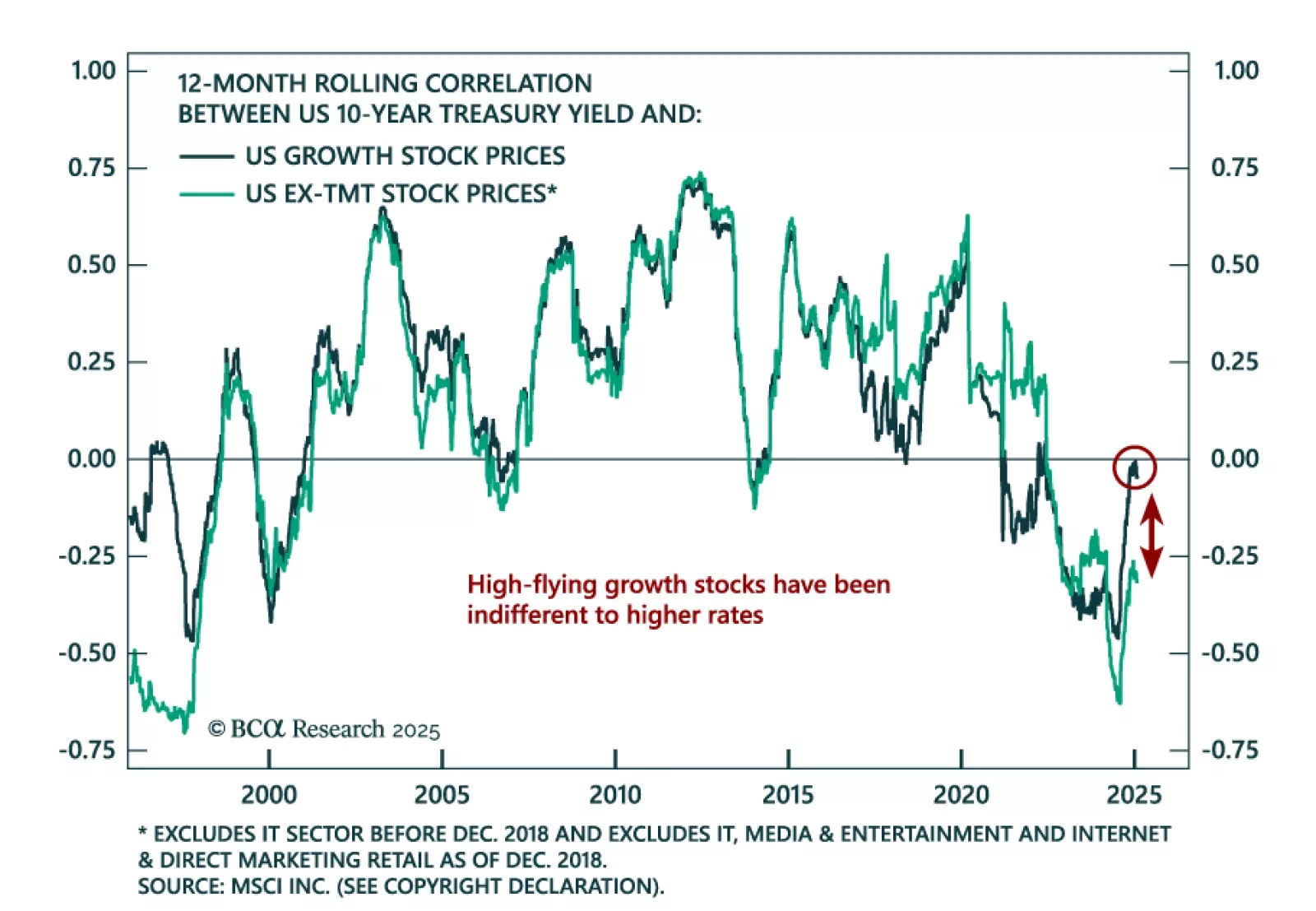

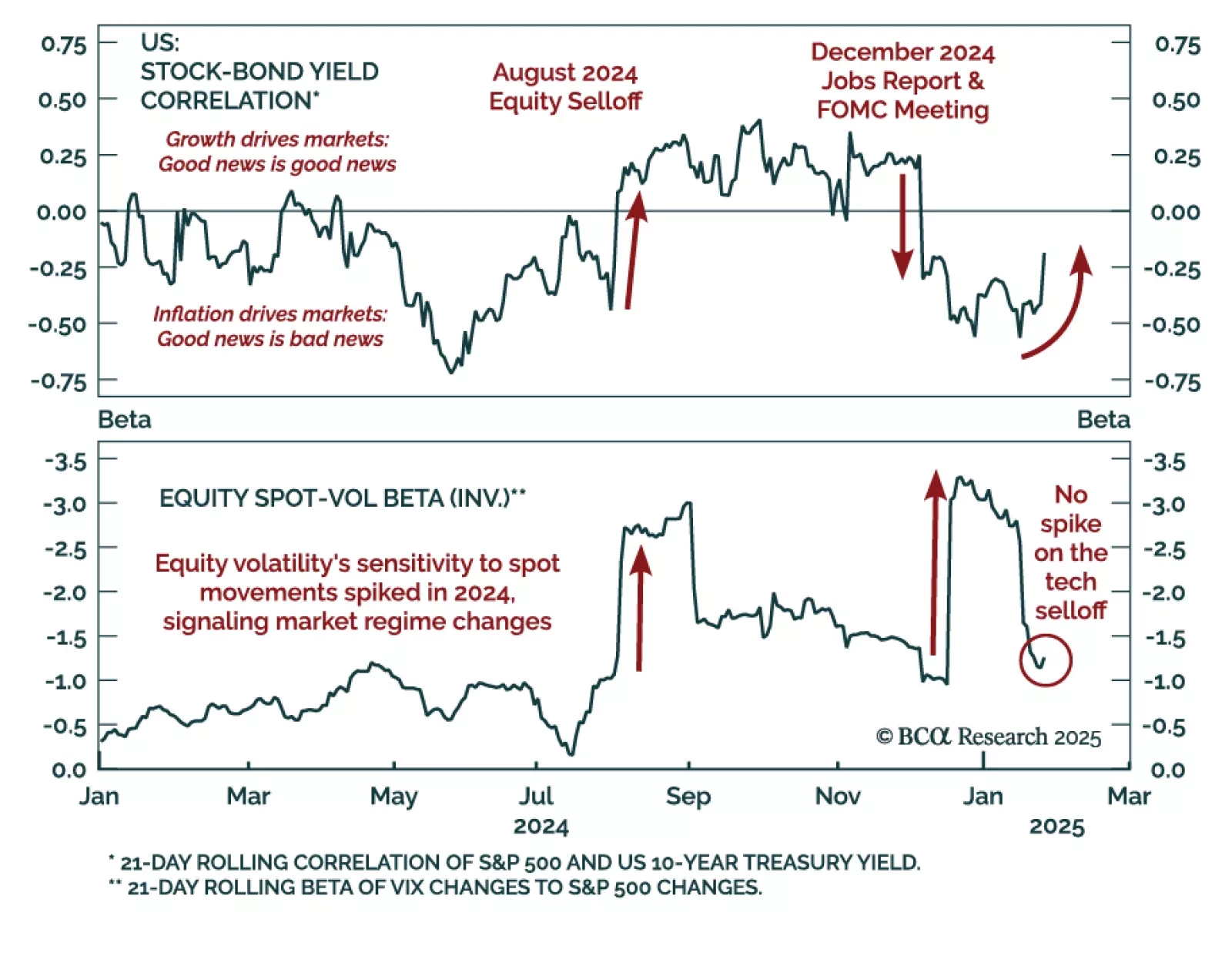

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist of our Emerging Markets and China Investment Strategy services. Arthur highlights an important dichotomy in the US stock-bond yield correlation. In the past 12…

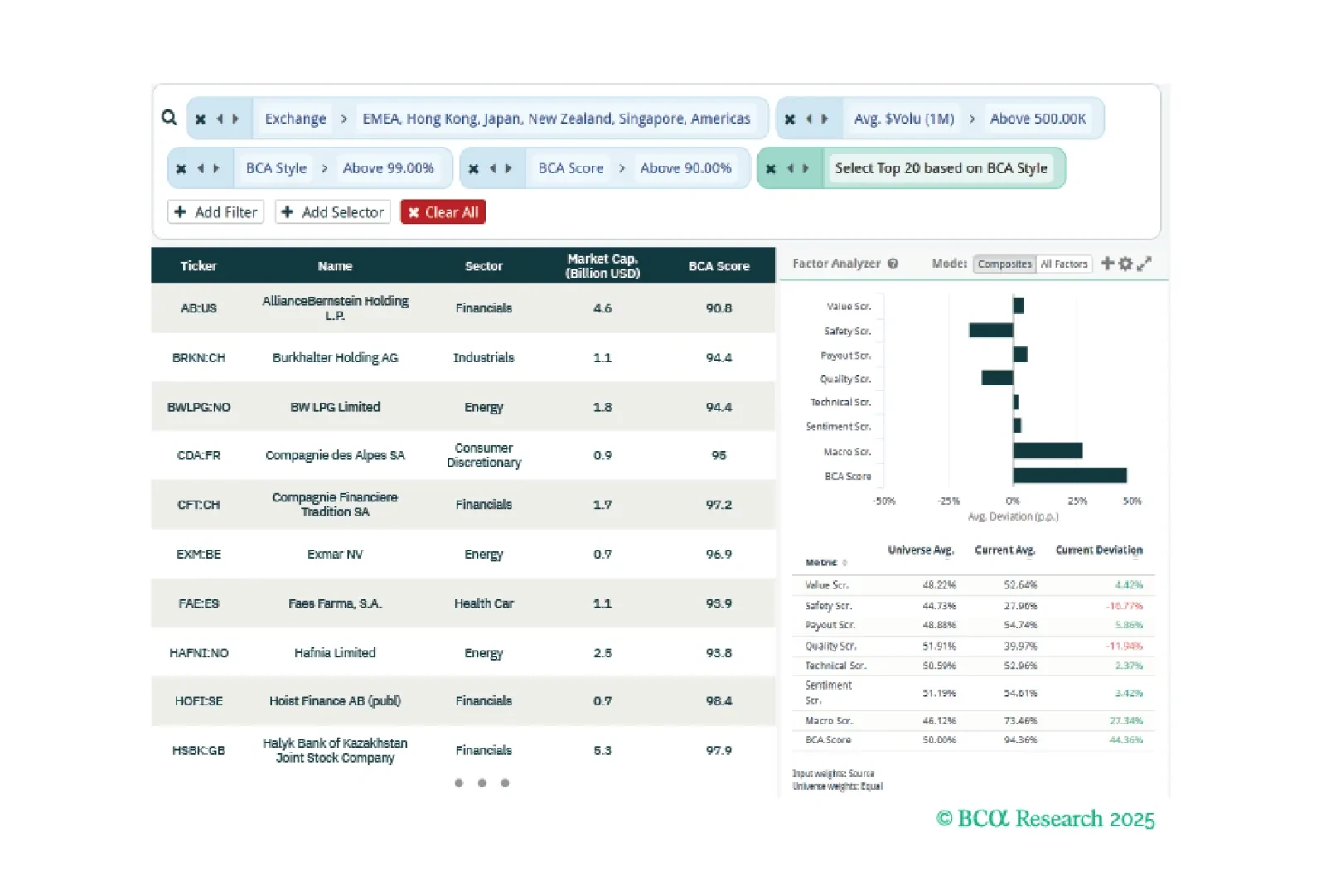

This week, our three screeners explore global small-cap value stocks, European equities, and BCA’s nuclear energy themed equity baskets.

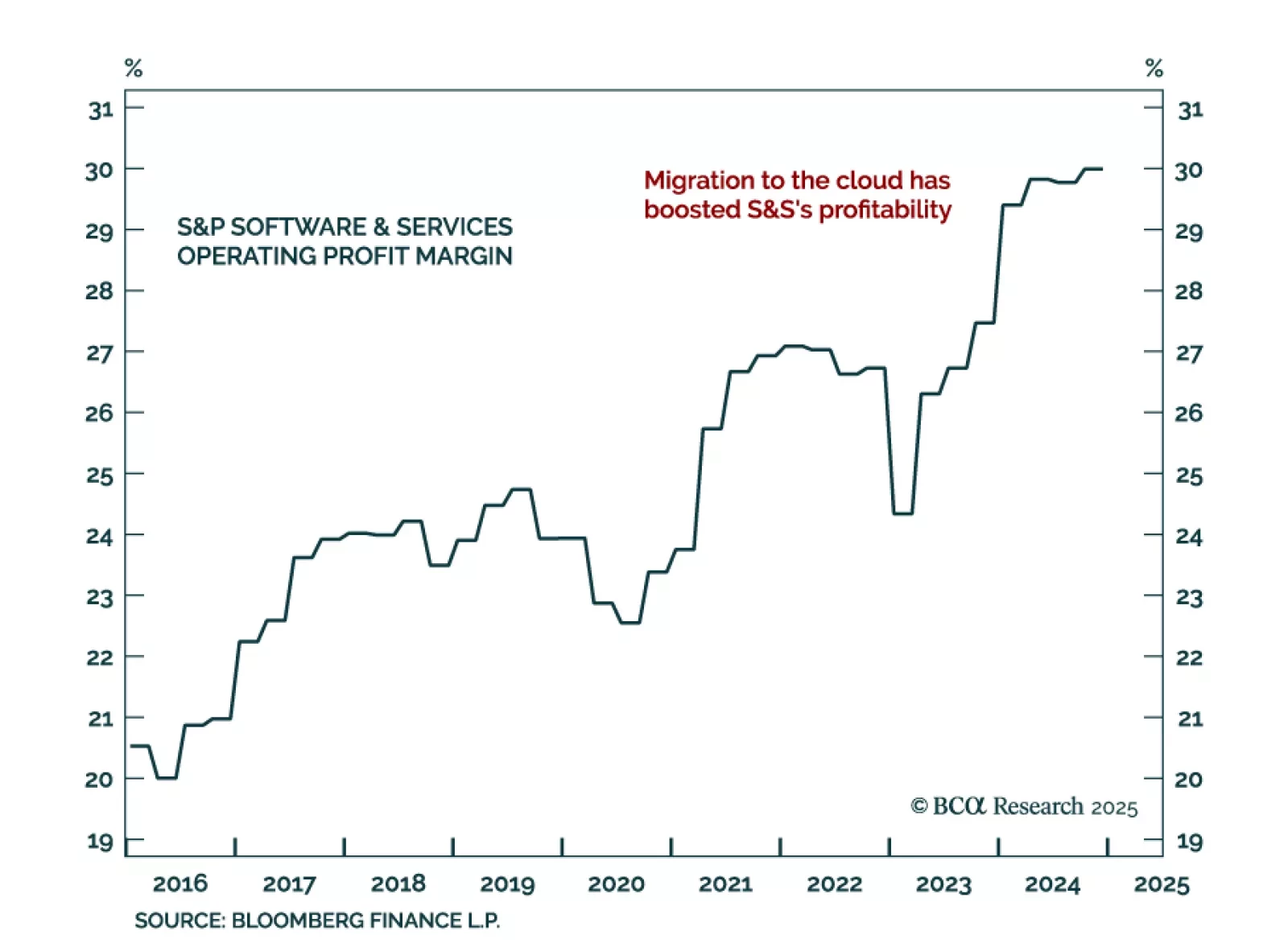

In the aftermath of Monday’s tech selloff, our US Equity strategists took a deep dive into the Software and Service (S&S) industry group. The S&S industry underperformed in 2024 as post-pandemic spending slowed, but…

Monday’s selloff was orderly and concentrated in the tech sector. The price action was a classic risk-off response, where both stock prices and bond yields decreased. While the VIX increased, the equity spot-vol beta, volatility’s…