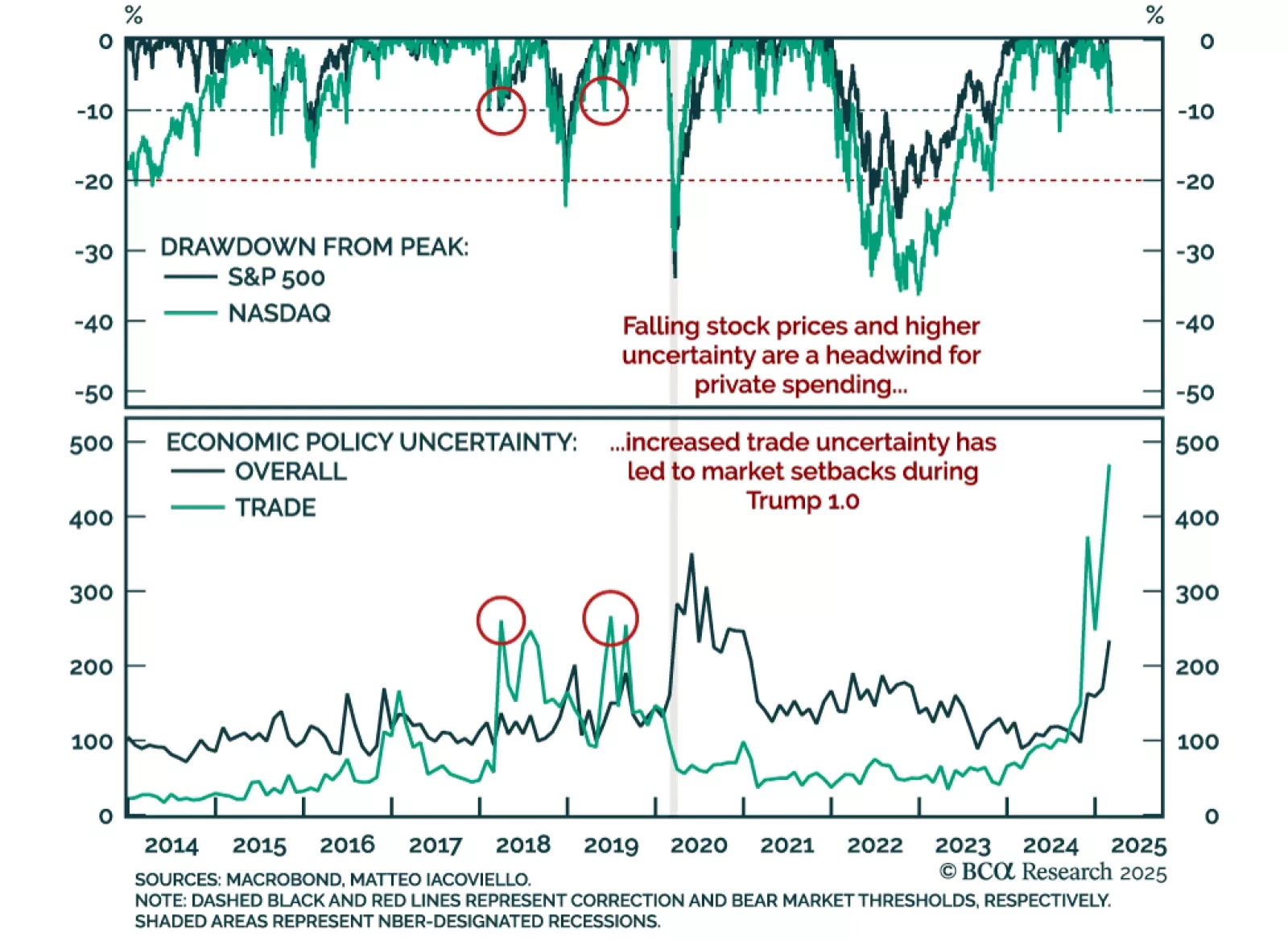

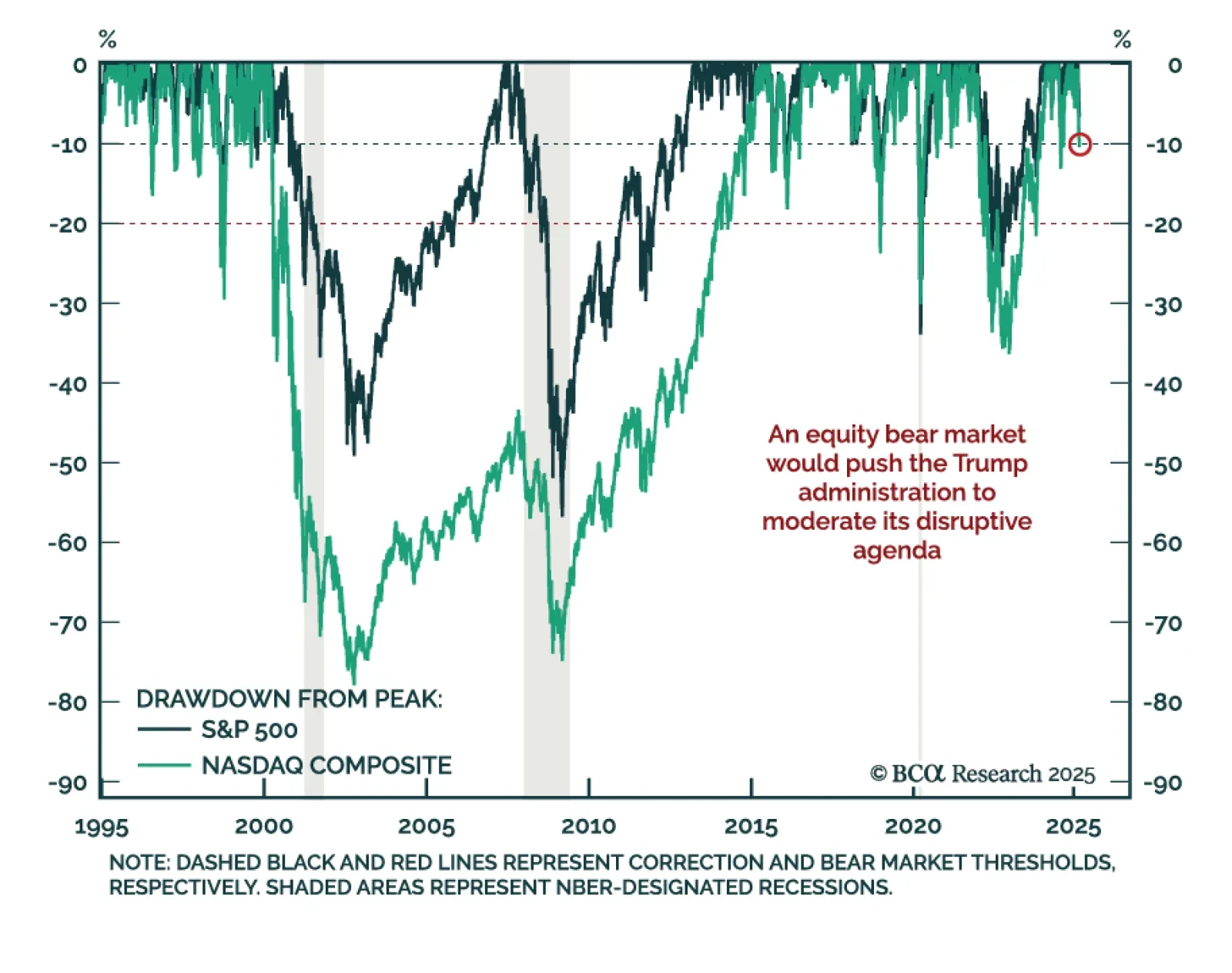

After affirming he does not look at the stock market, President Trump said he cannot exclude the possibility of a recession as he rushes to implement his agenda before the 2026 midterms. Could a President willingly start a recession…

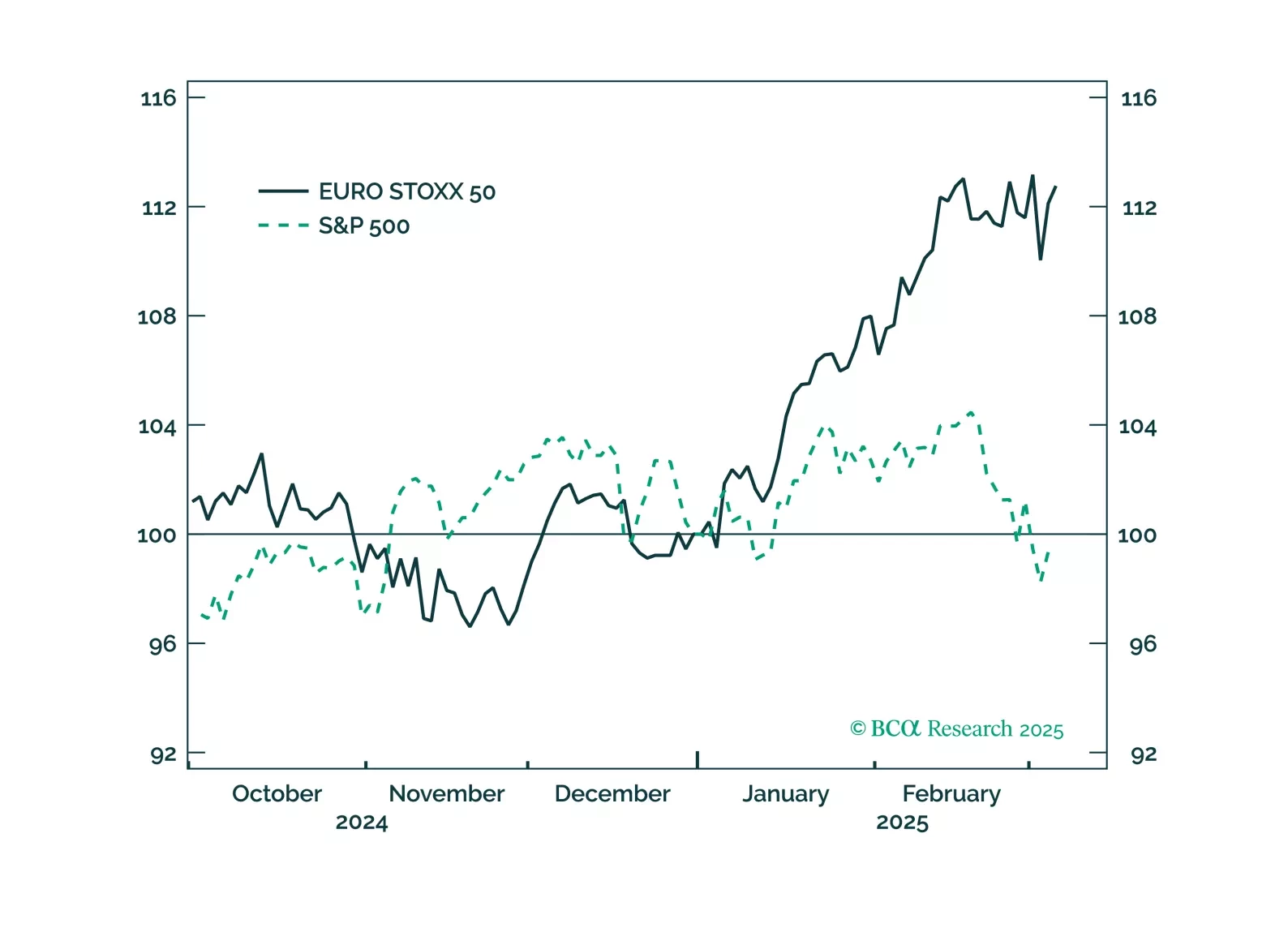

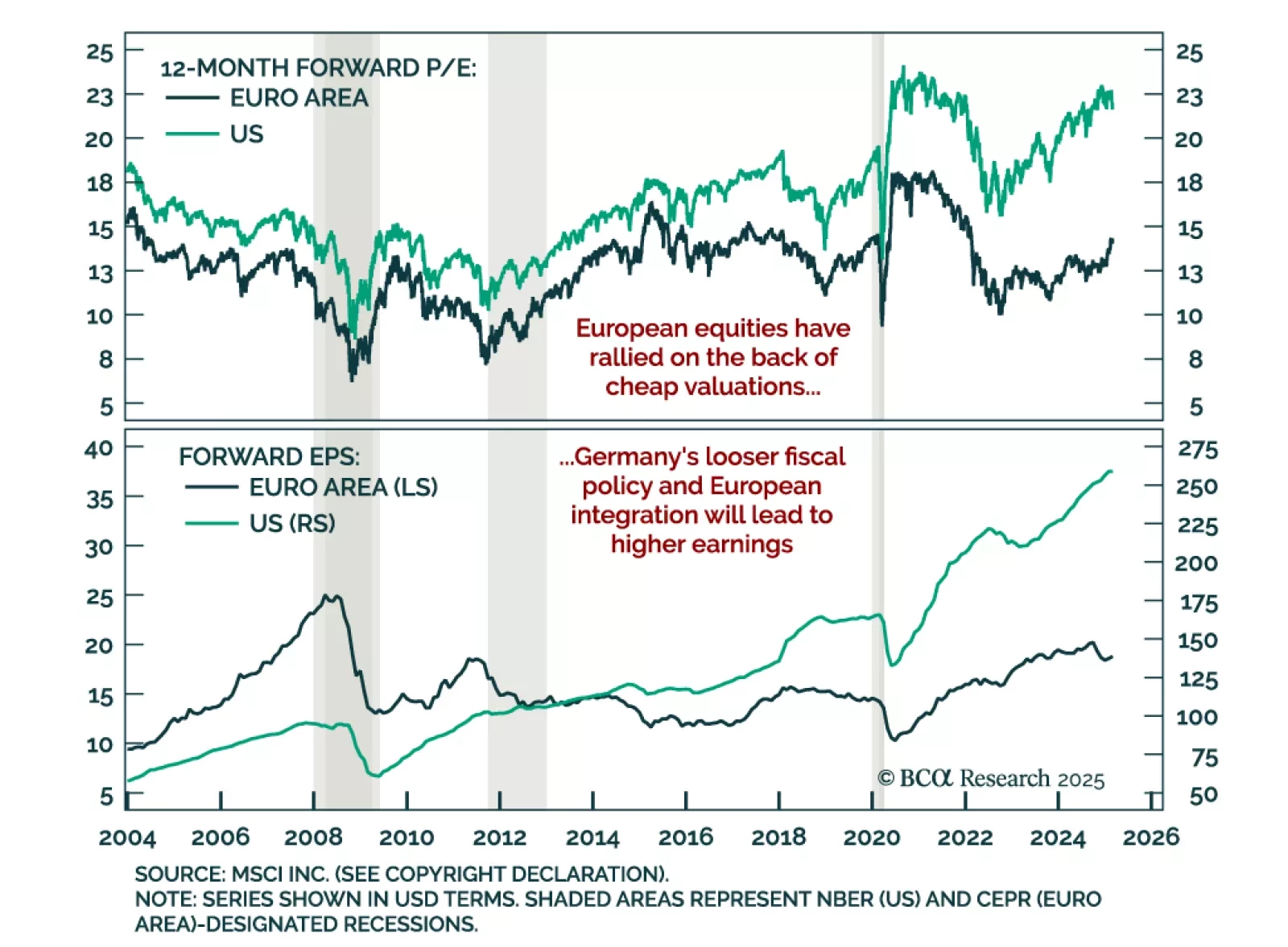

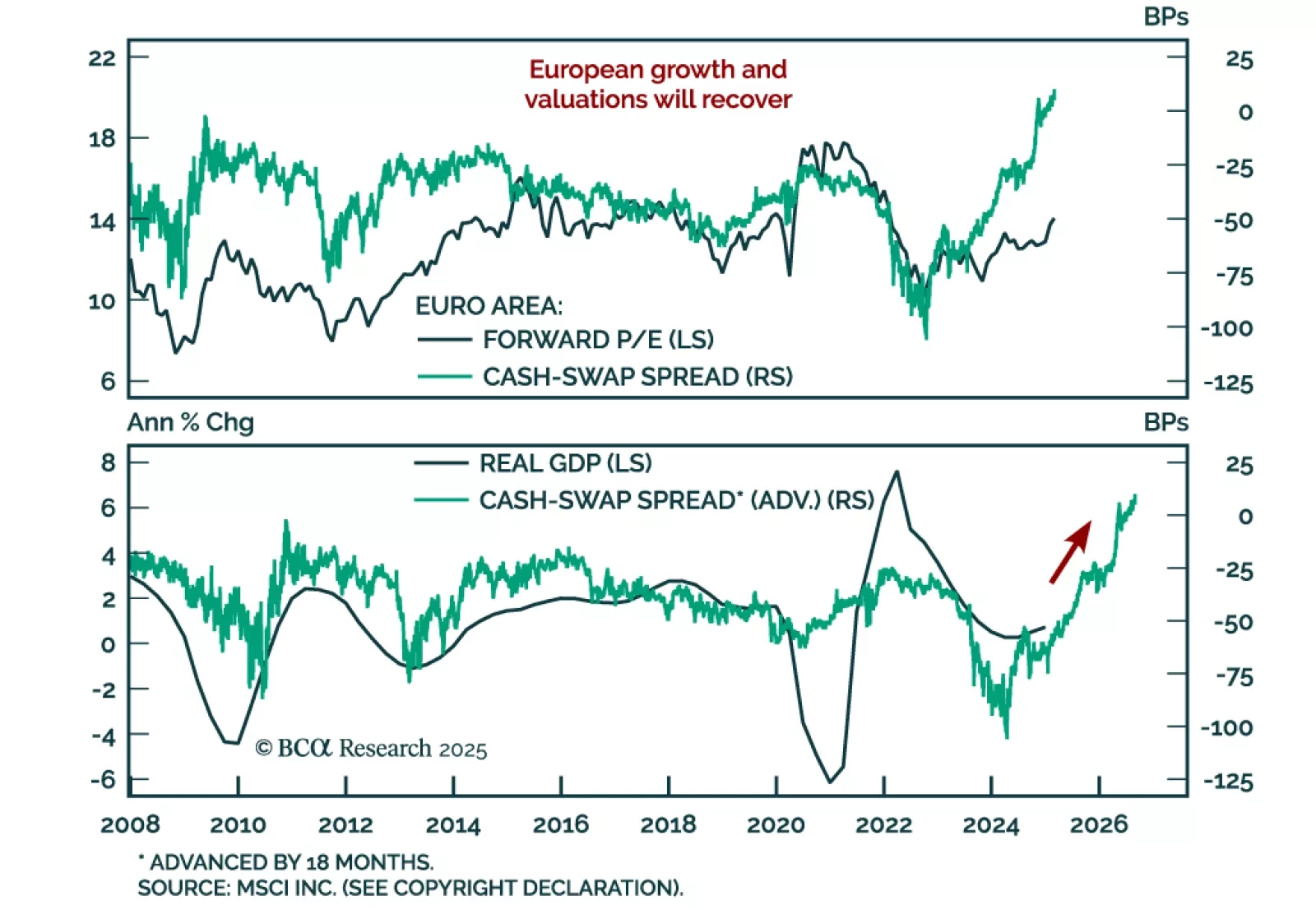

After entering 2025 with depressed growth expectations, measures of European sentiment have seemingly bottomed, and European assets rallied. However, given the changing geopolitical order and Europe’s forceful response thus far, are…

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

There is an alternative to investing in US stocks: Do it via Europe (DIVE). Allocate to European sectors or stocks that are highly and positively correlated with the Magnificent 7 but do not suffer stretched valuations.

Treasury Secretary Scott Bessent said there is no “Trump put”, and acknowledged the administration’s policy could create short-term pain to achieve long-term gains. The concept of a “market put” implies policymakers would aim to put…

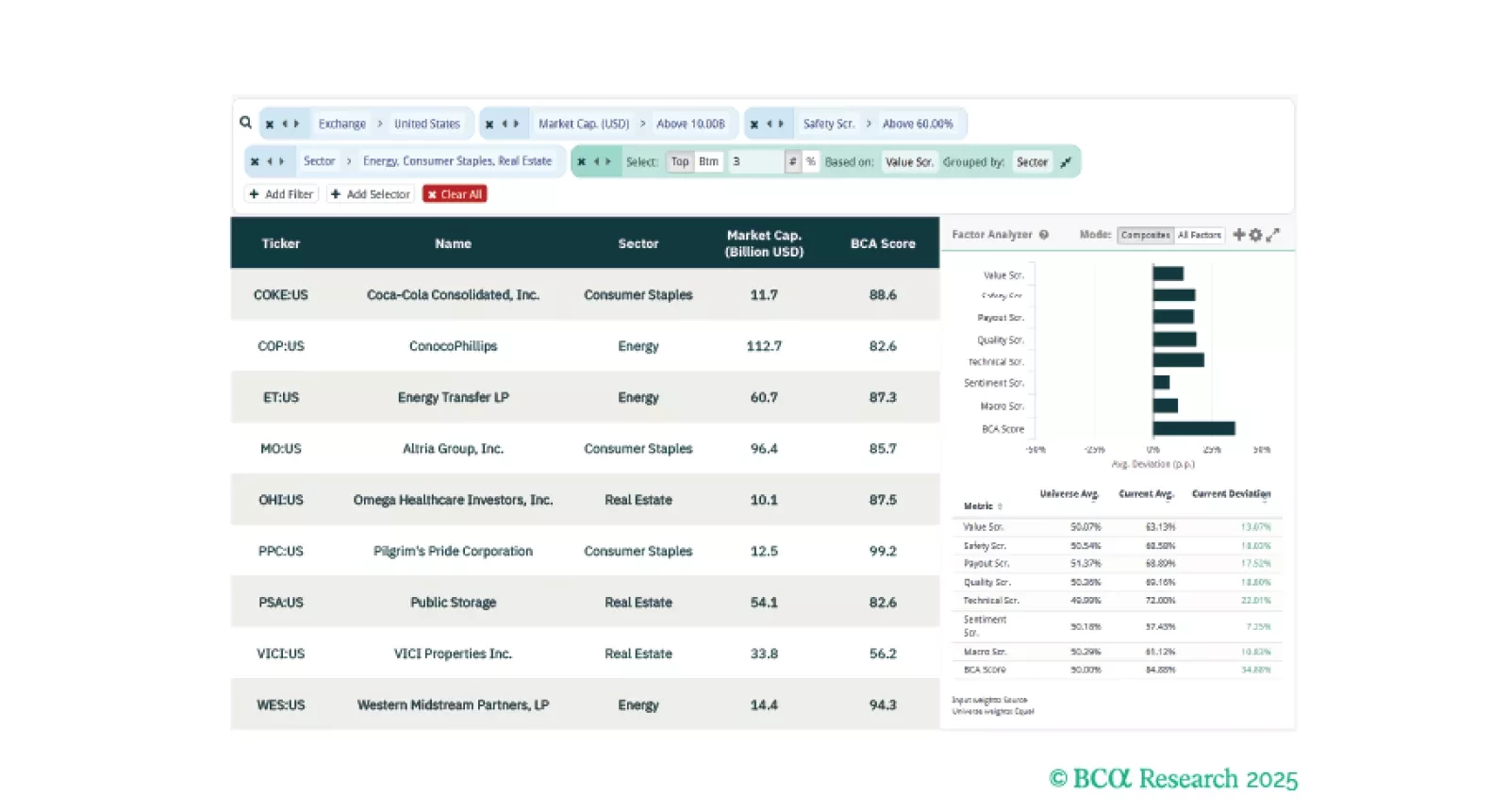

This week, our three screeners cover equity plays in US defensives, US Tech, and European Small Cap Value.

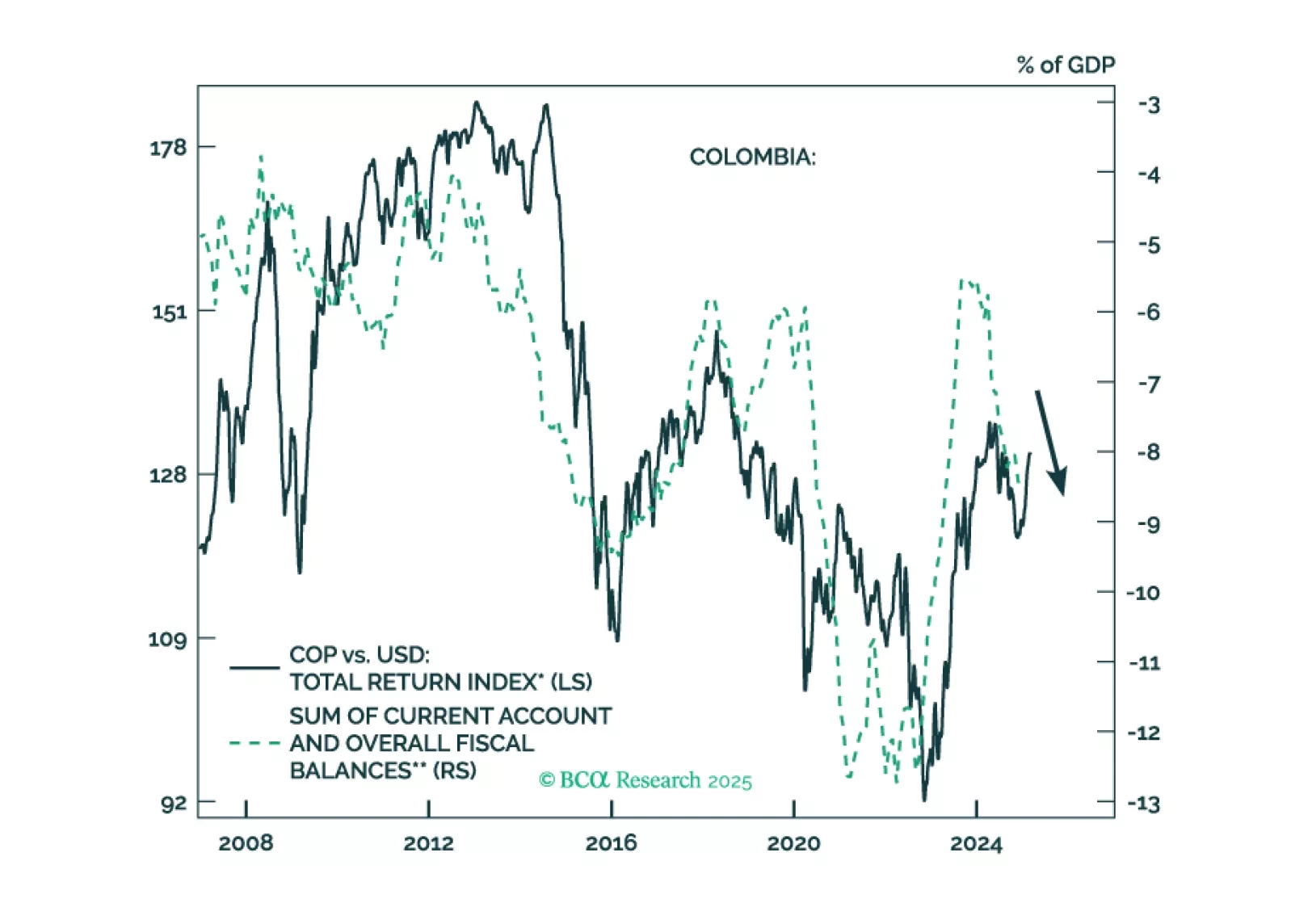

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

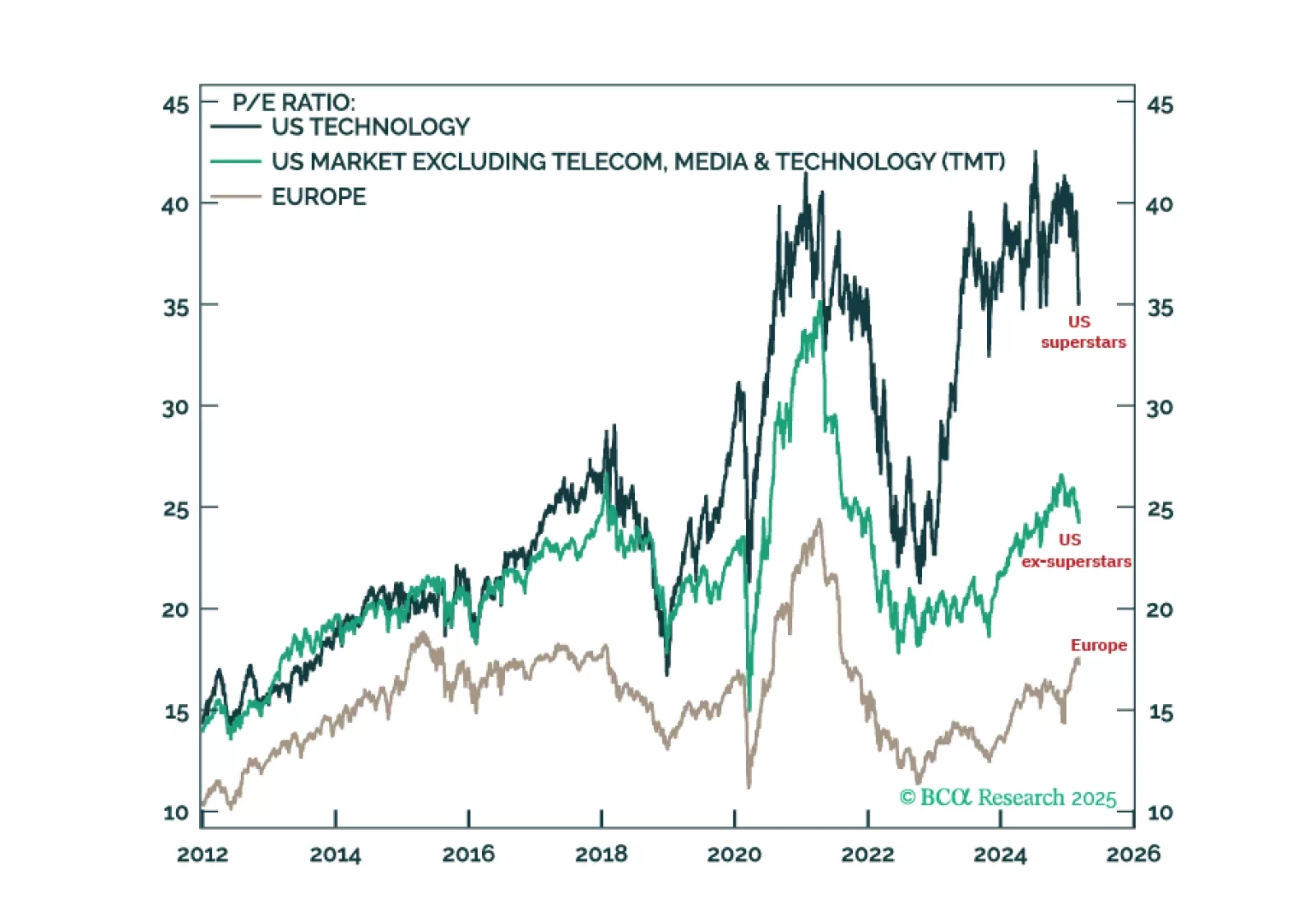

US stock market outperformance has been driven entirely by the 0.0002 percent of US superstar companies. But this superstar outperformance is based on two highly questionable assumptions: that all productivity gains from the…

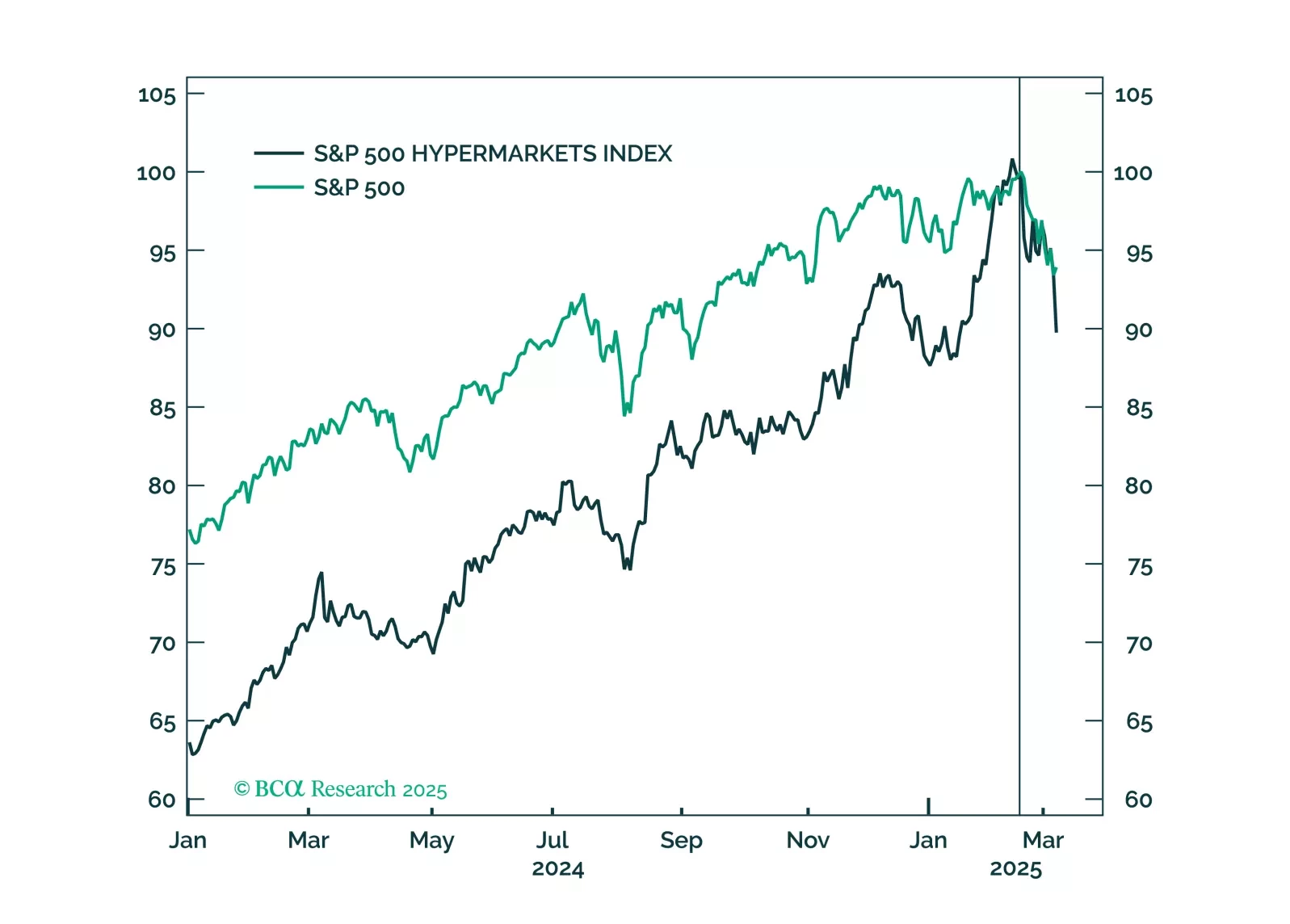

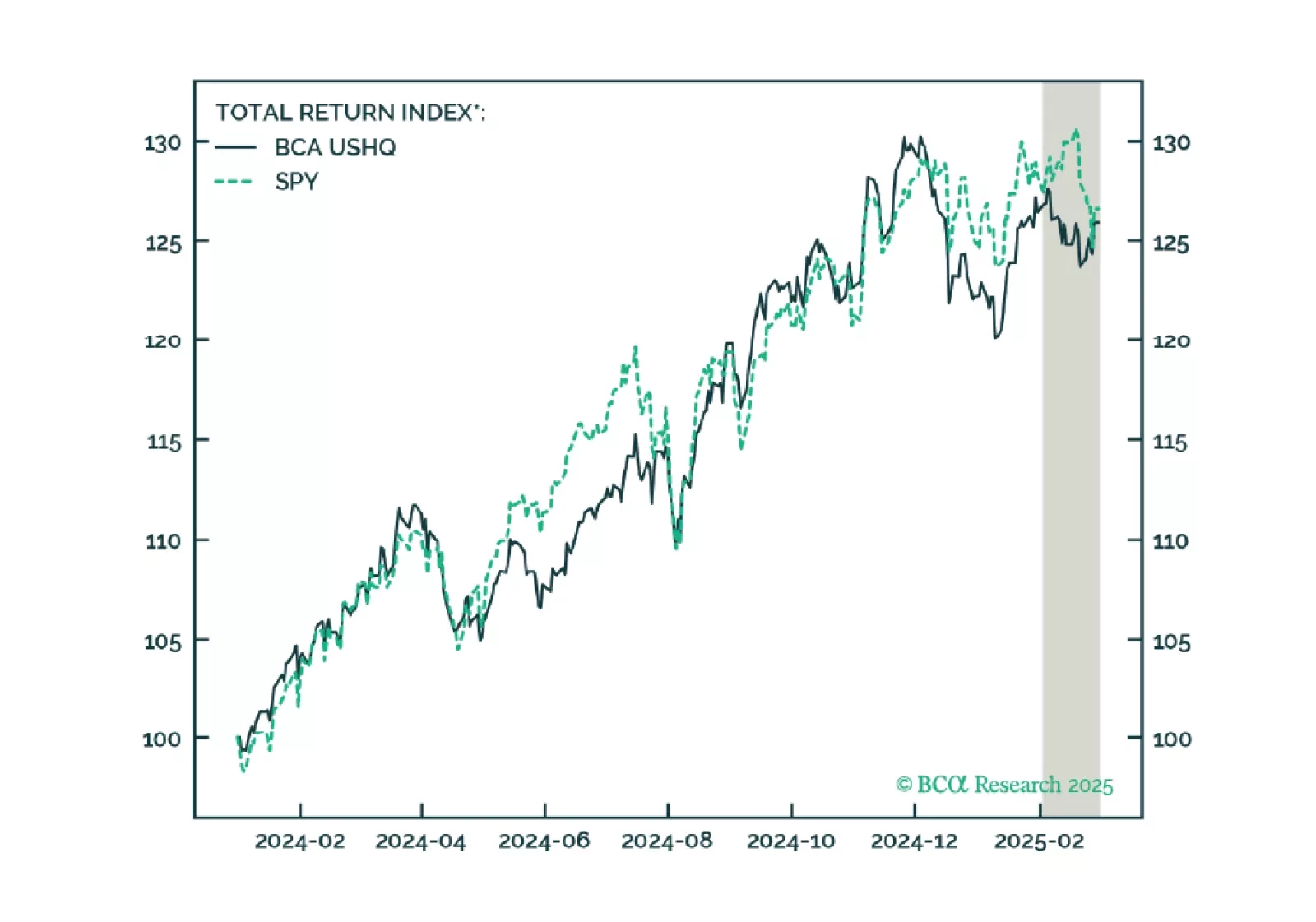

The US High Quality (USHQ) portfolio slightly underperformed in February, returning -0.7%, whilst its SPY benchmark returned -0.6%. While we continue to monitor the portfolio monthly, over a quarter-on-quarter basis, USHQ posted…

Our European strategists see Europe escaping its liquidity trap, which will create a structural tailwind for European assets. Europe’s resilience amid global shocks is supported by a shift away from precautionary money demand,…