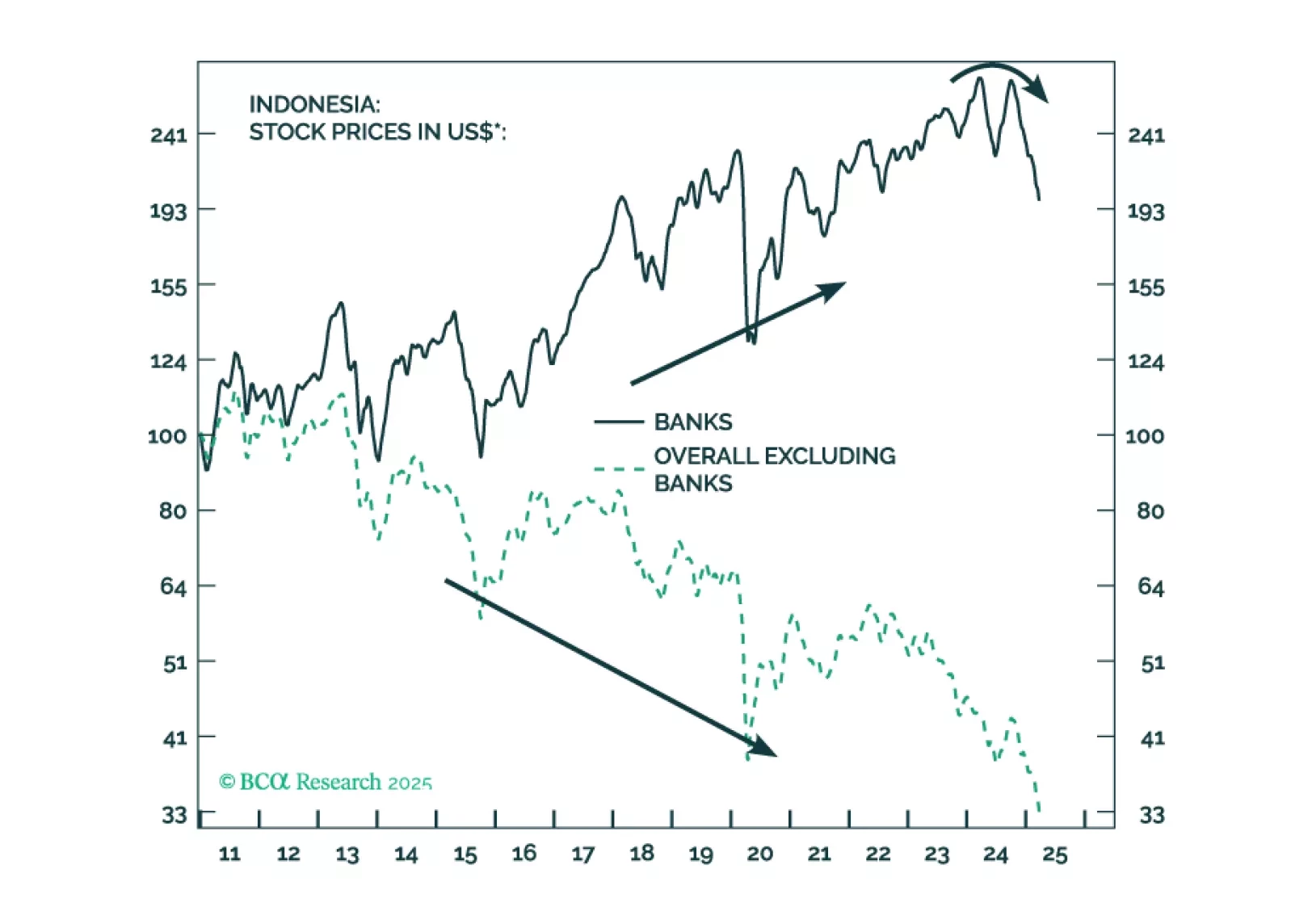

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

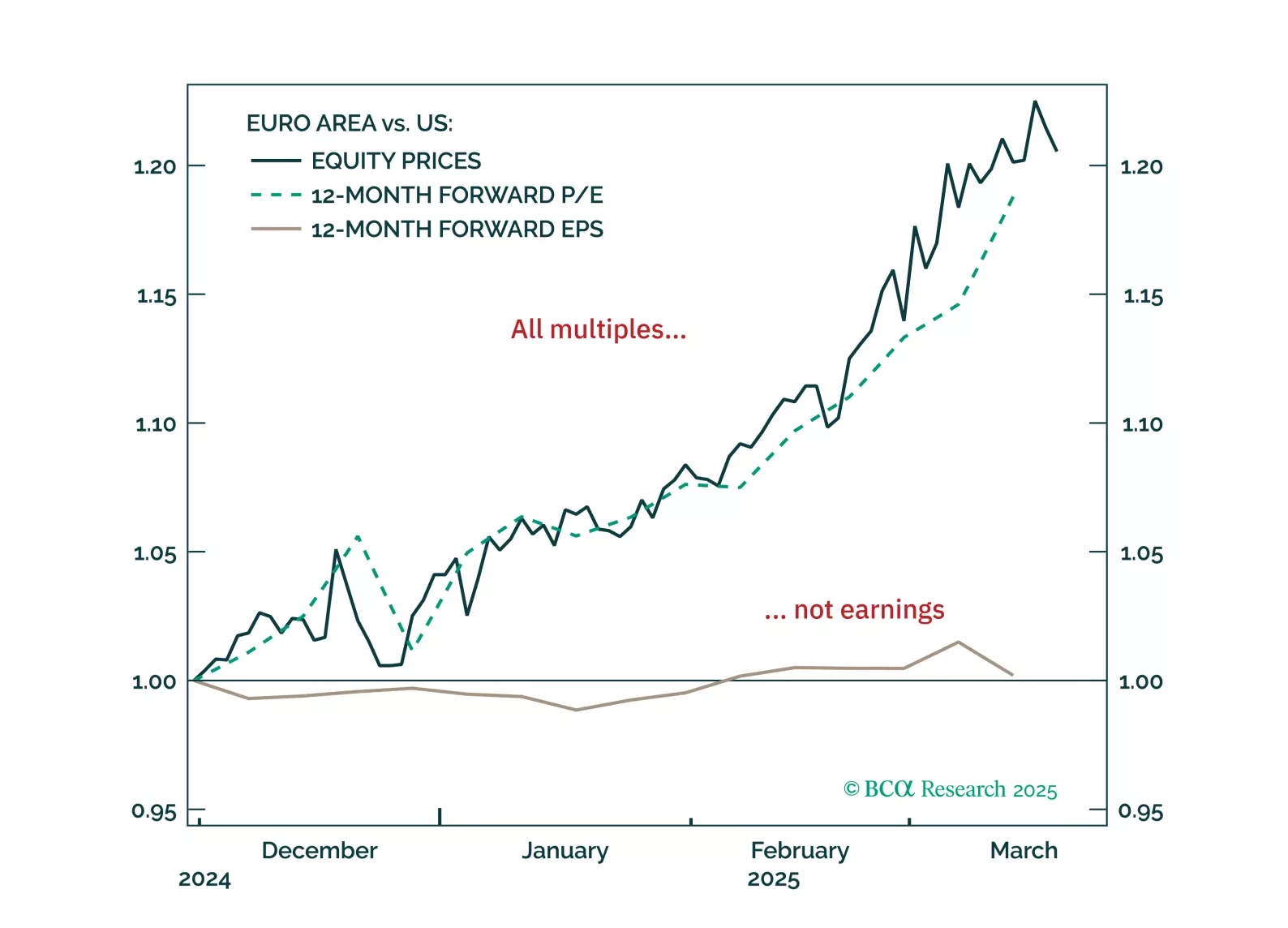

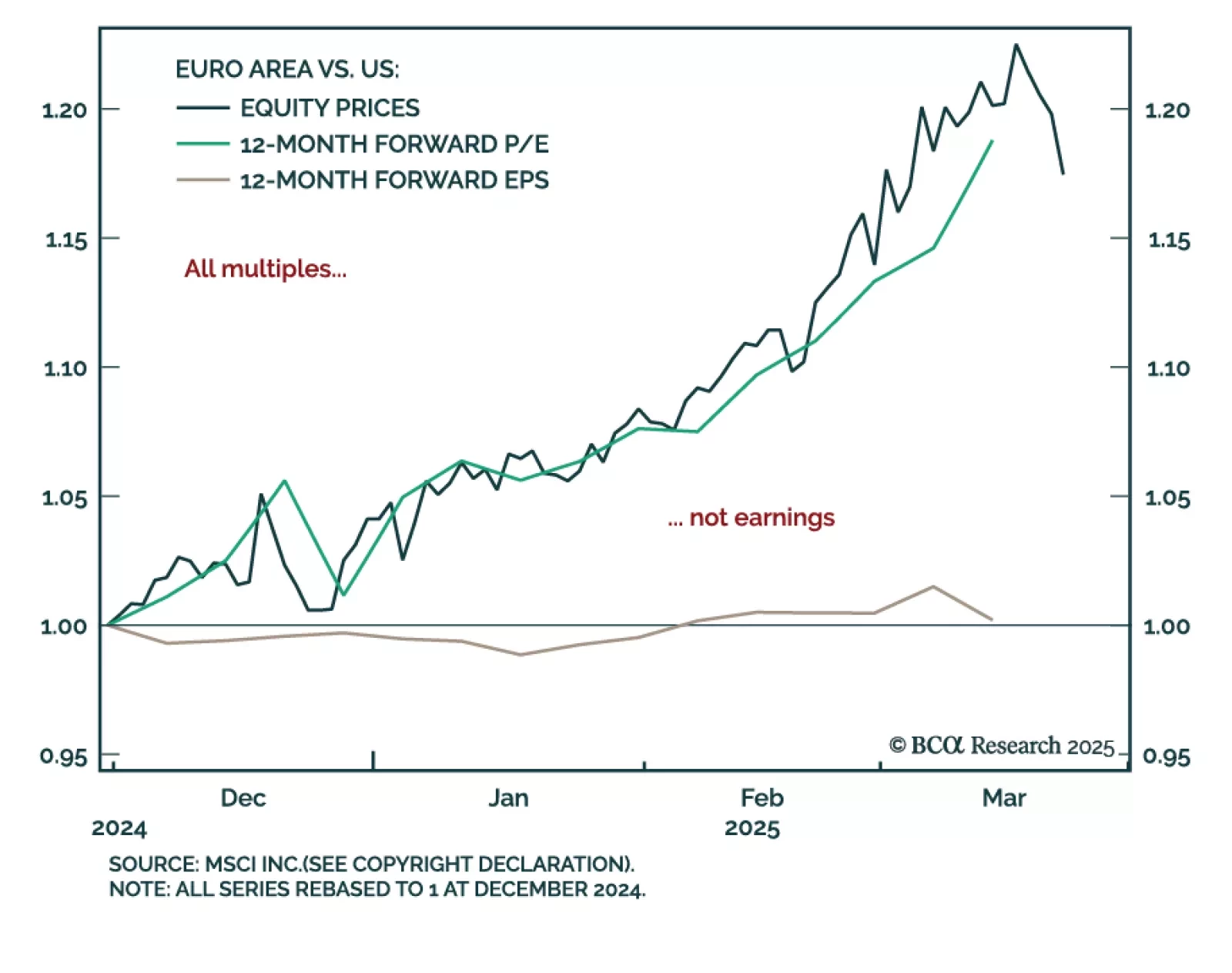

Our European investment strategists recommend underweighting European equities over the next three-to-six months, favoring defensives like telecoms, which may also benefit from reform potential. The rally in European equities…

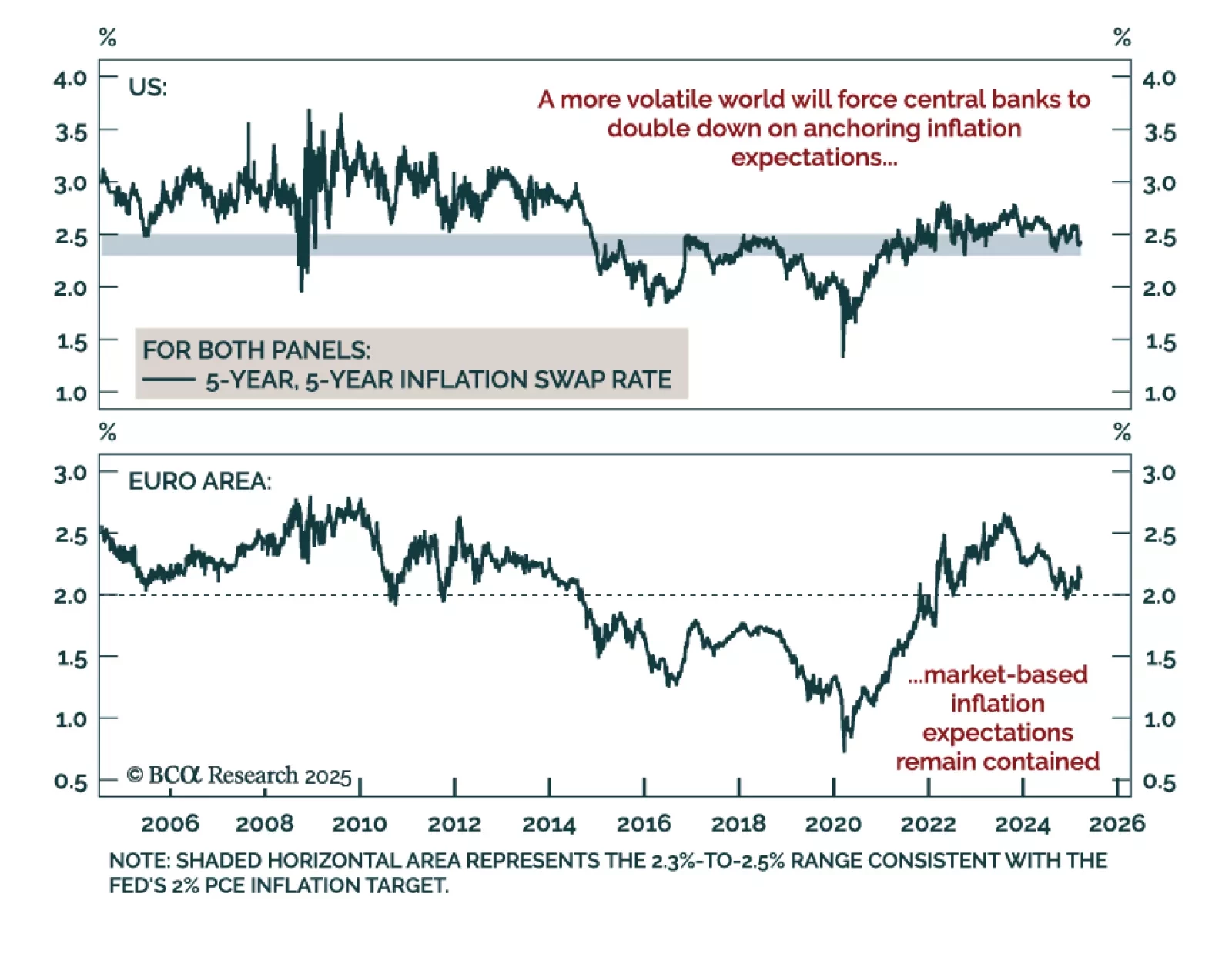

The years ahead will be more complex for investors. Inflation expectations and its leading indicators will matter as much as realized inflation, and rates volatility is likely to remain structurally higher. This calls for increasing…

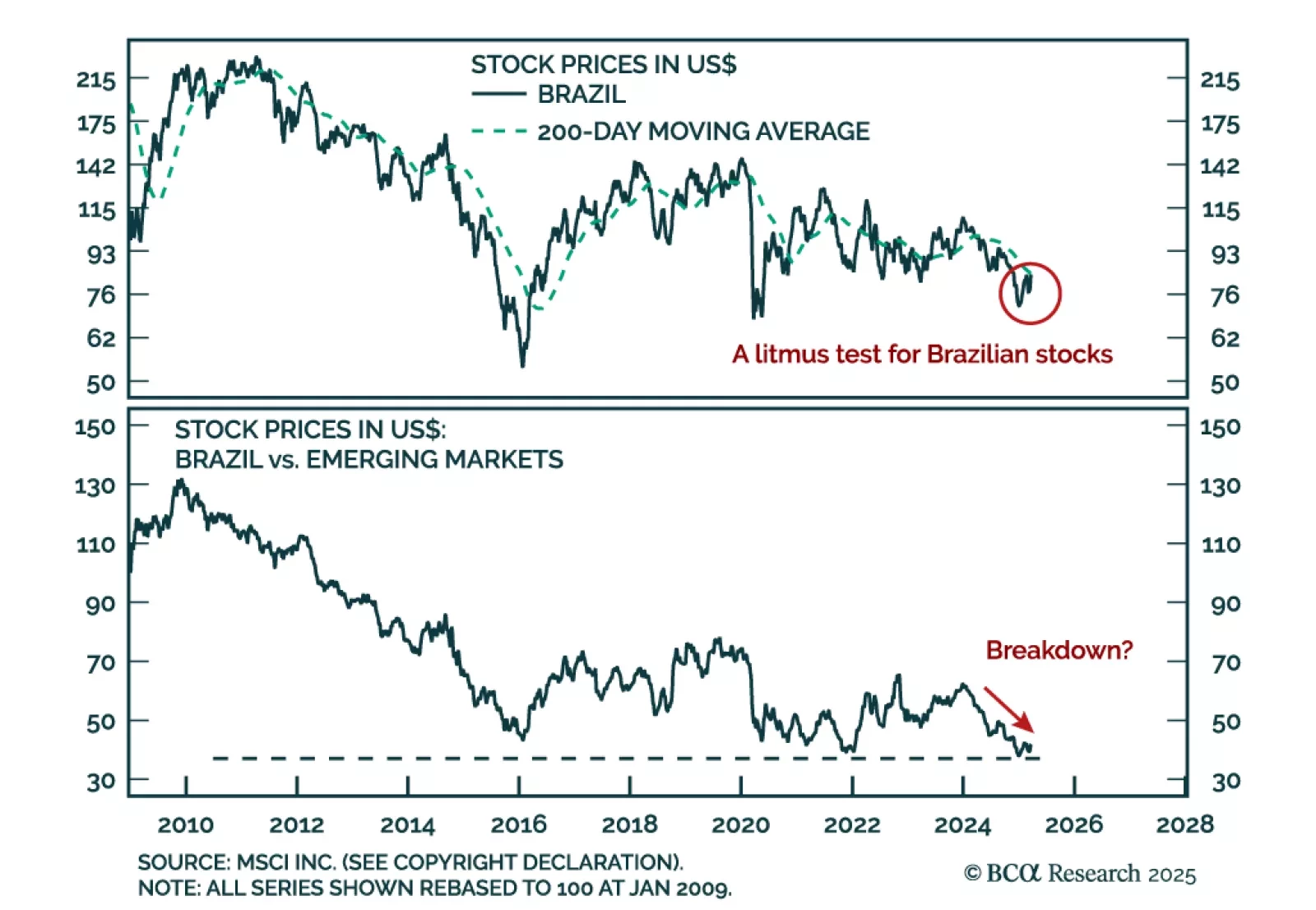

Our Emerging Market strategists downgraded Brazilian equities as public debt dynamics deteriorate and macro fundamentals weaken. While they previously maintained a neutral stance despite being bearish on the Bovespa, the risks have…

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

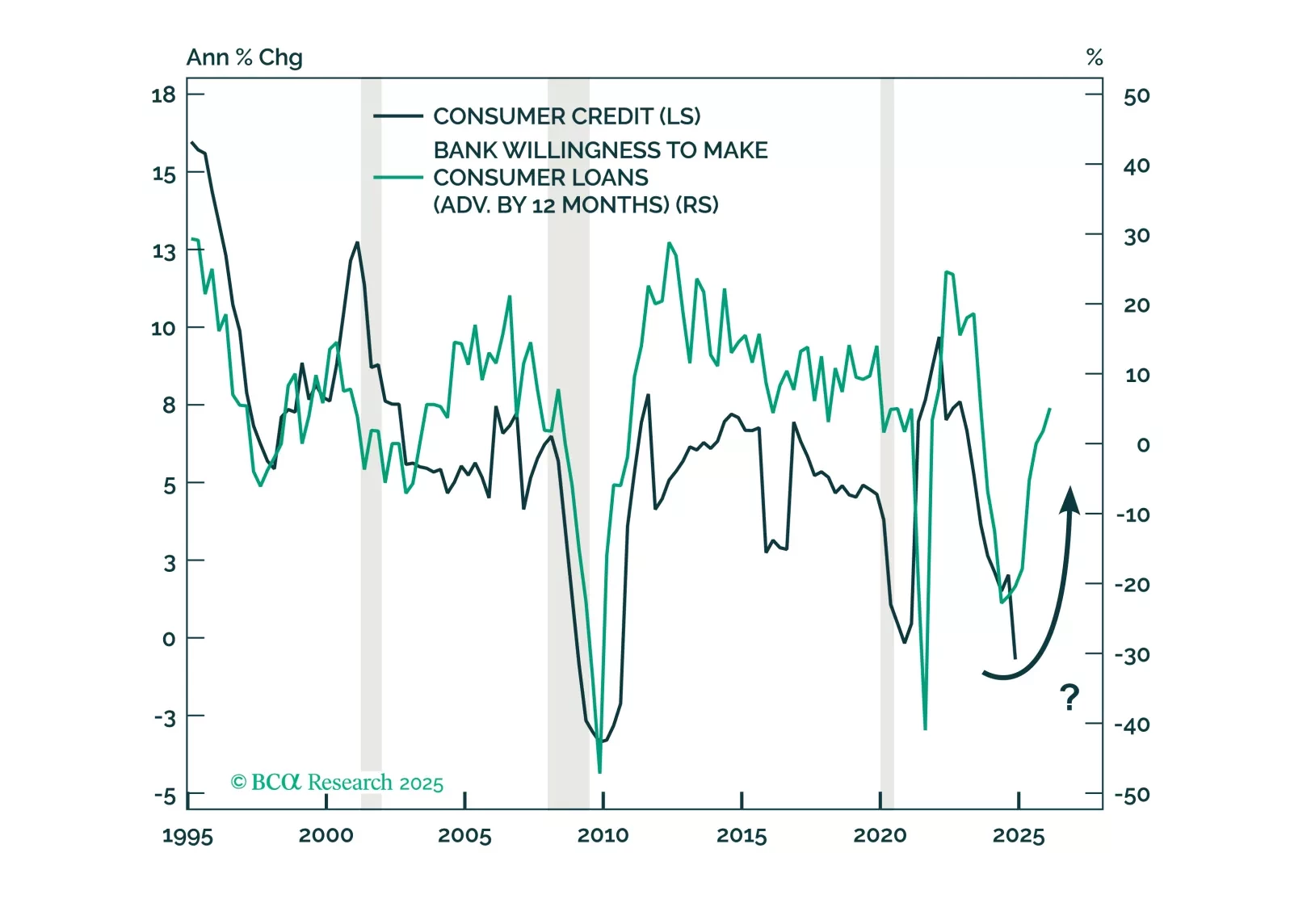

Households’ healthy balance sheets do not square with the rise in credit cards and auto loans delinquencies. The tailwinds that have supported higher-income cohorts’ spending have faded, presaging broad-based deterioration in credit…

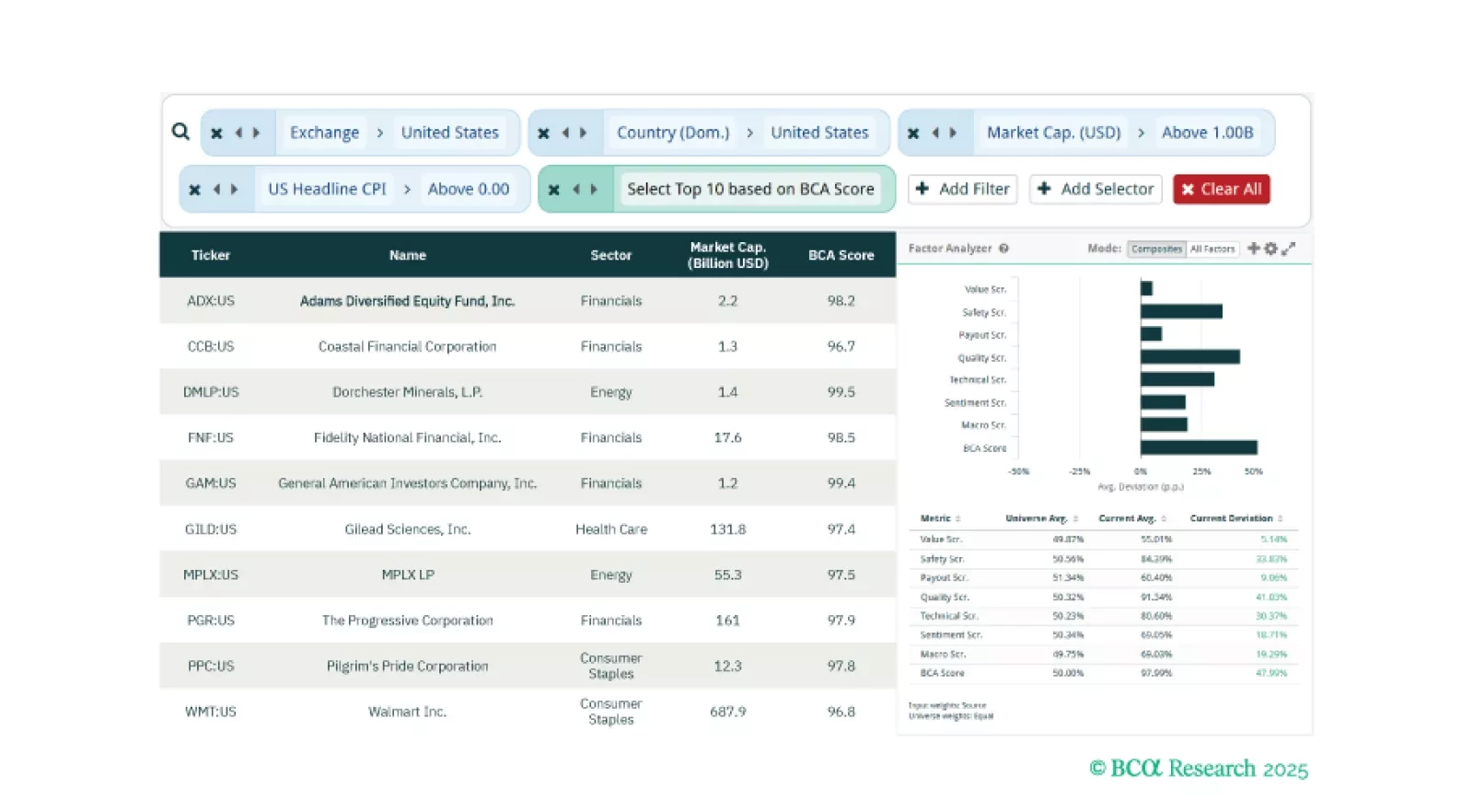

Weekly Screeners: “Transitory” Inflation 2.0, European Aerospace & Defense, And Buffett’s Philosophy

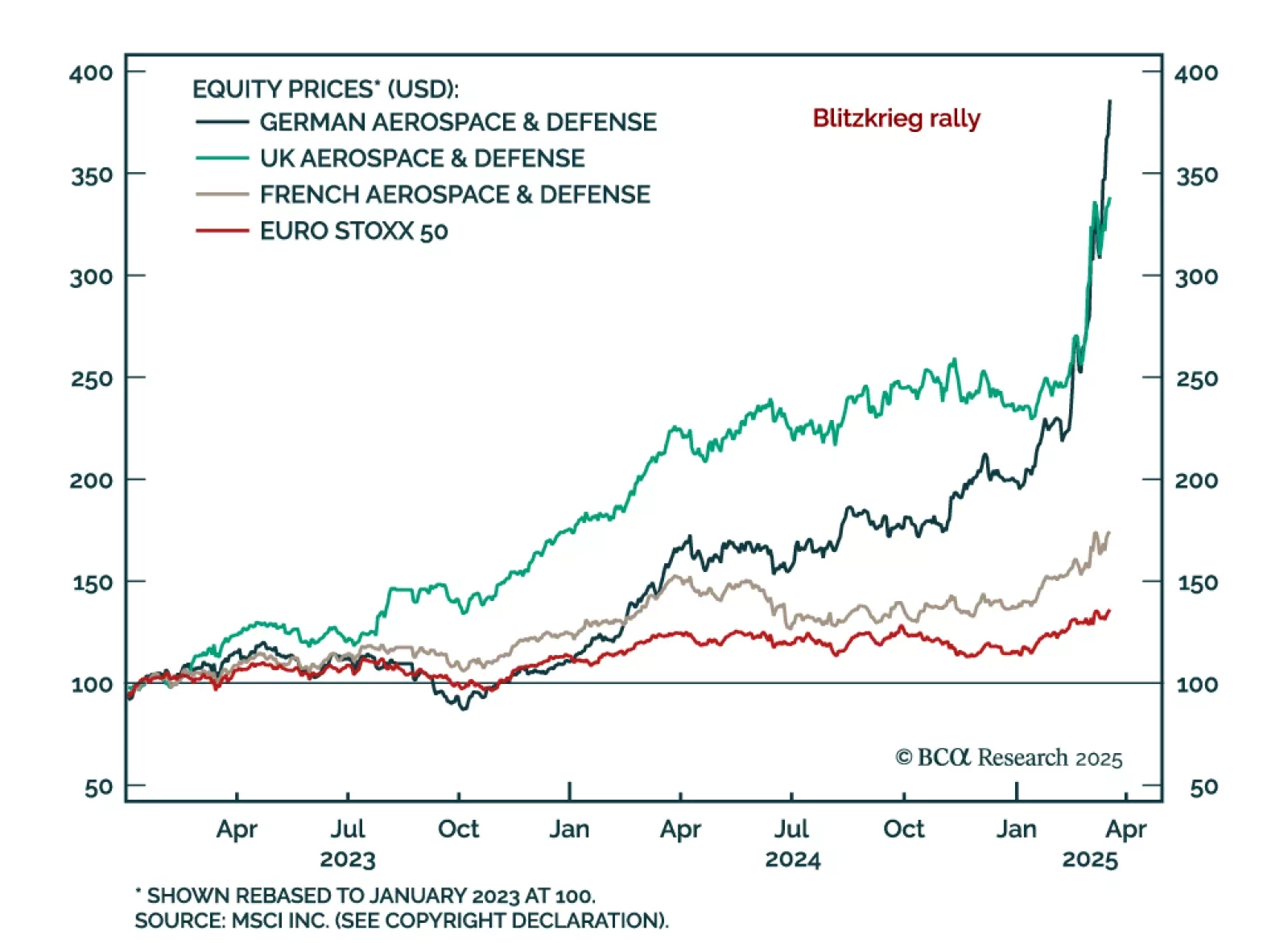

This week, our three screeners cover equity plays for “transitory” inflation impacts from US tariffs, a correction in sentiment within the European Aerospace and Defense industry, and Value Investor, Warren Buffett’s Philosophy.…

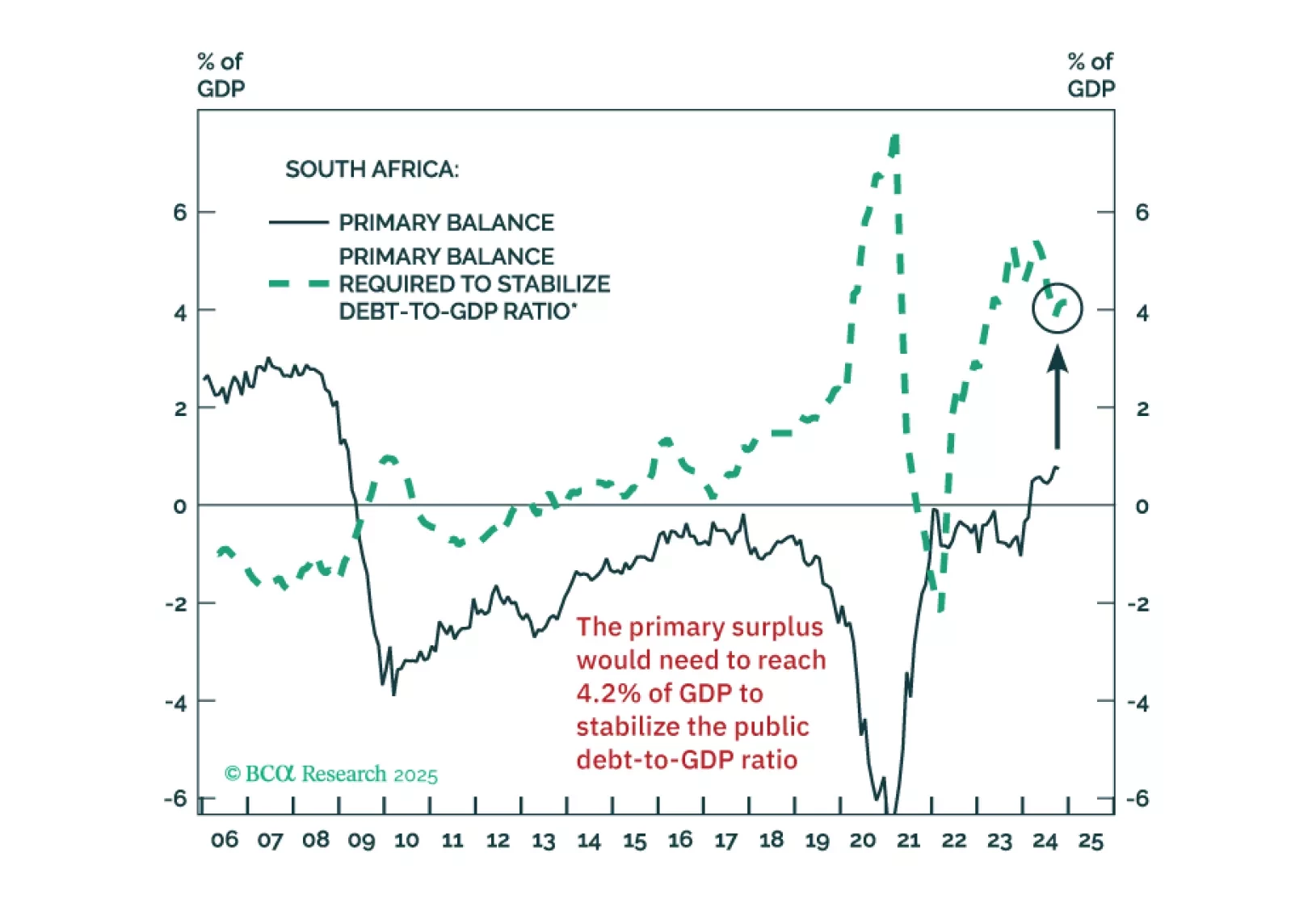

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

Our European strategists looked at the European defense sector after the massive rally following Germany’s fiscal turnaround. The rally in European defense stocks, up over 100% since their March 2023 recommendation, is…

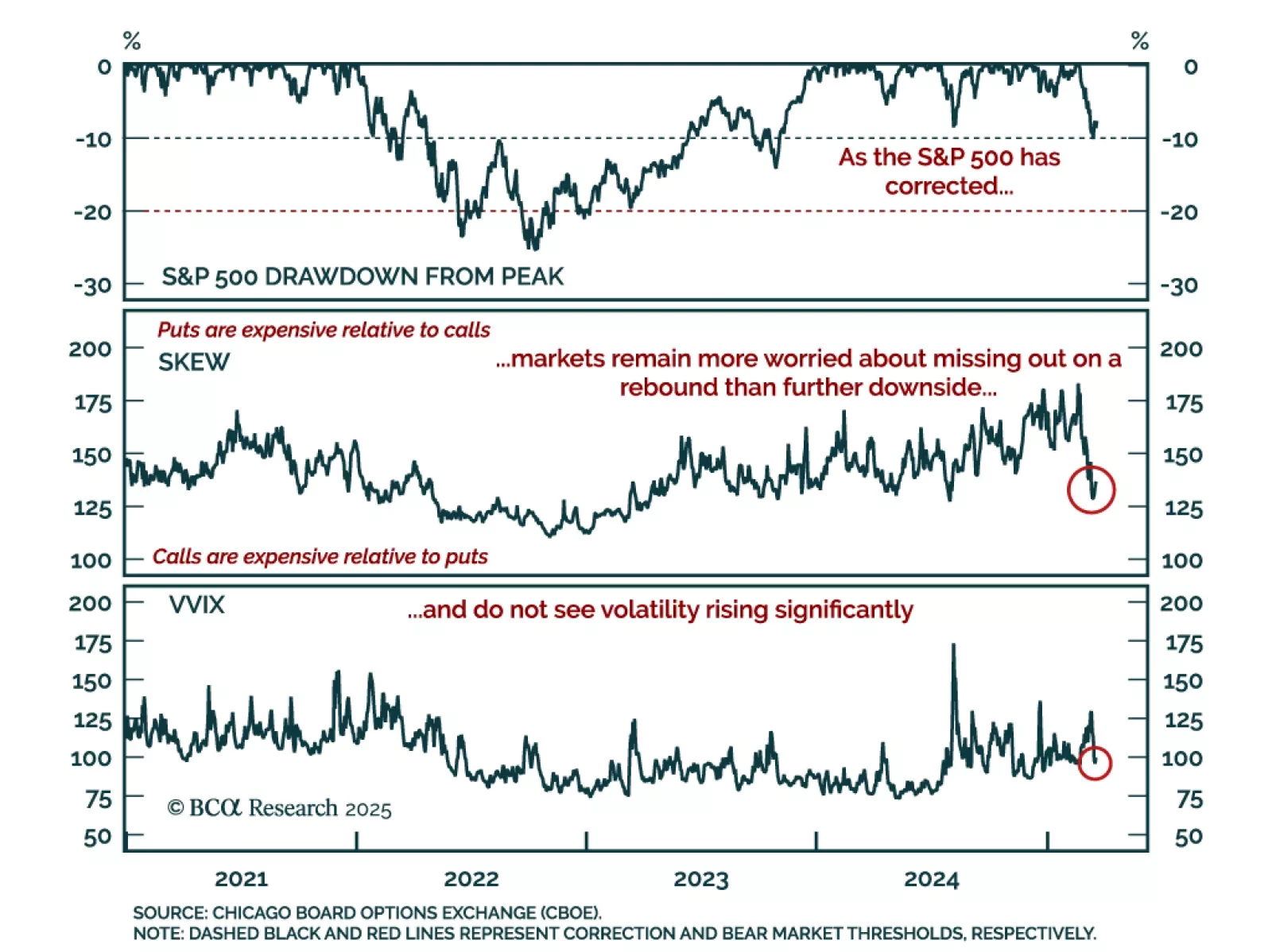

Recent years were marked by US equities rebounding from each drawdown to re-test all-time highs. The best absolute-return strategy has been to “buy the dip” and close your eyes. Is it still the case? The short answer is no, as…