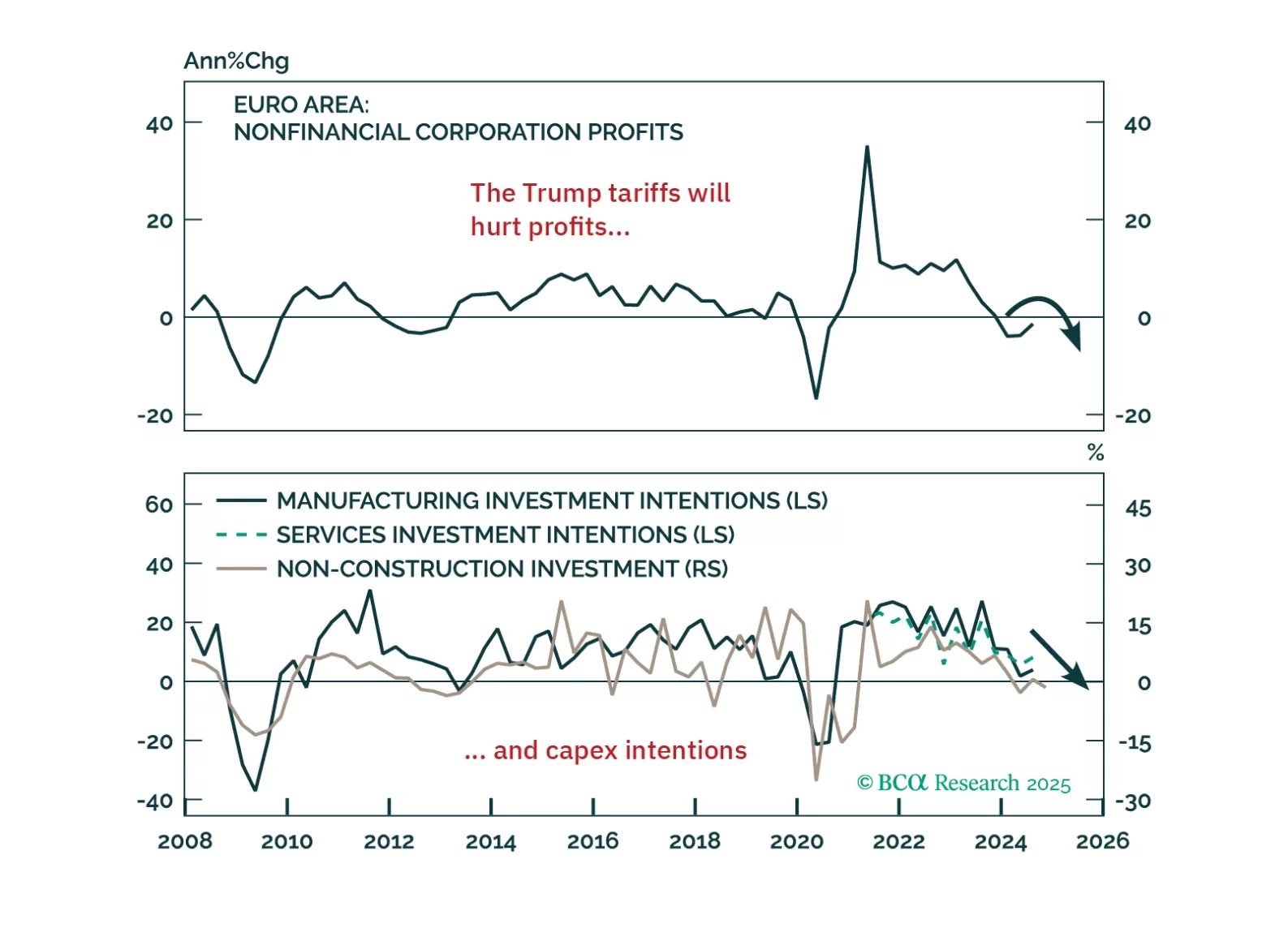

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

Our Emerging Markets strategists recommend staying defensive and adding exposure to EM local currency bonds, which will benefit from US dollar depreciation over the medium and long term. While tariffs are deflationary for US trading…

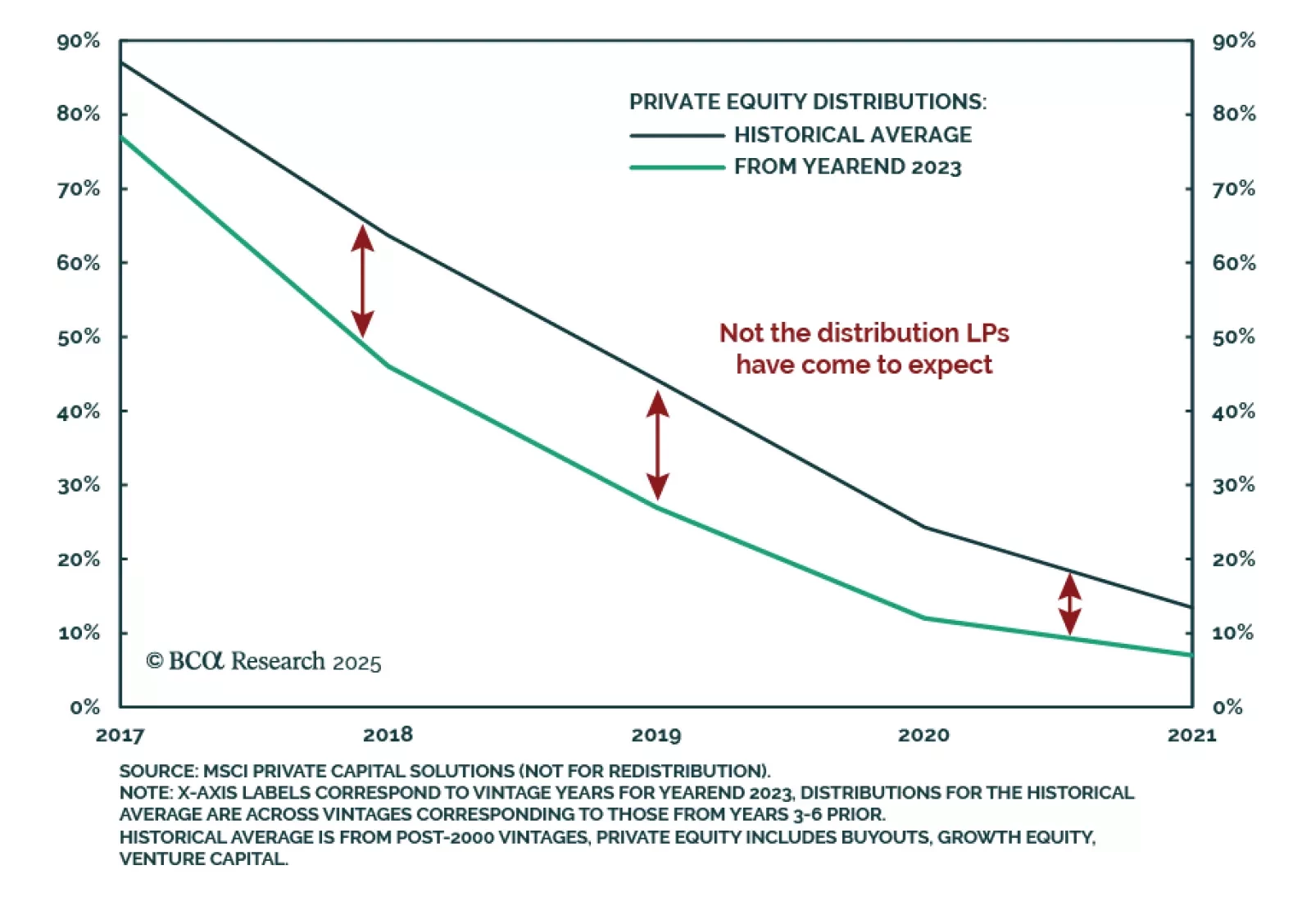

Private Equity’s cash flow problem is showing up in the job market. In August 2024, our Chief Private Markets & Alternatives Strategist Brian Payne highlighted how hard it had become for Private Equity firms to return money to…

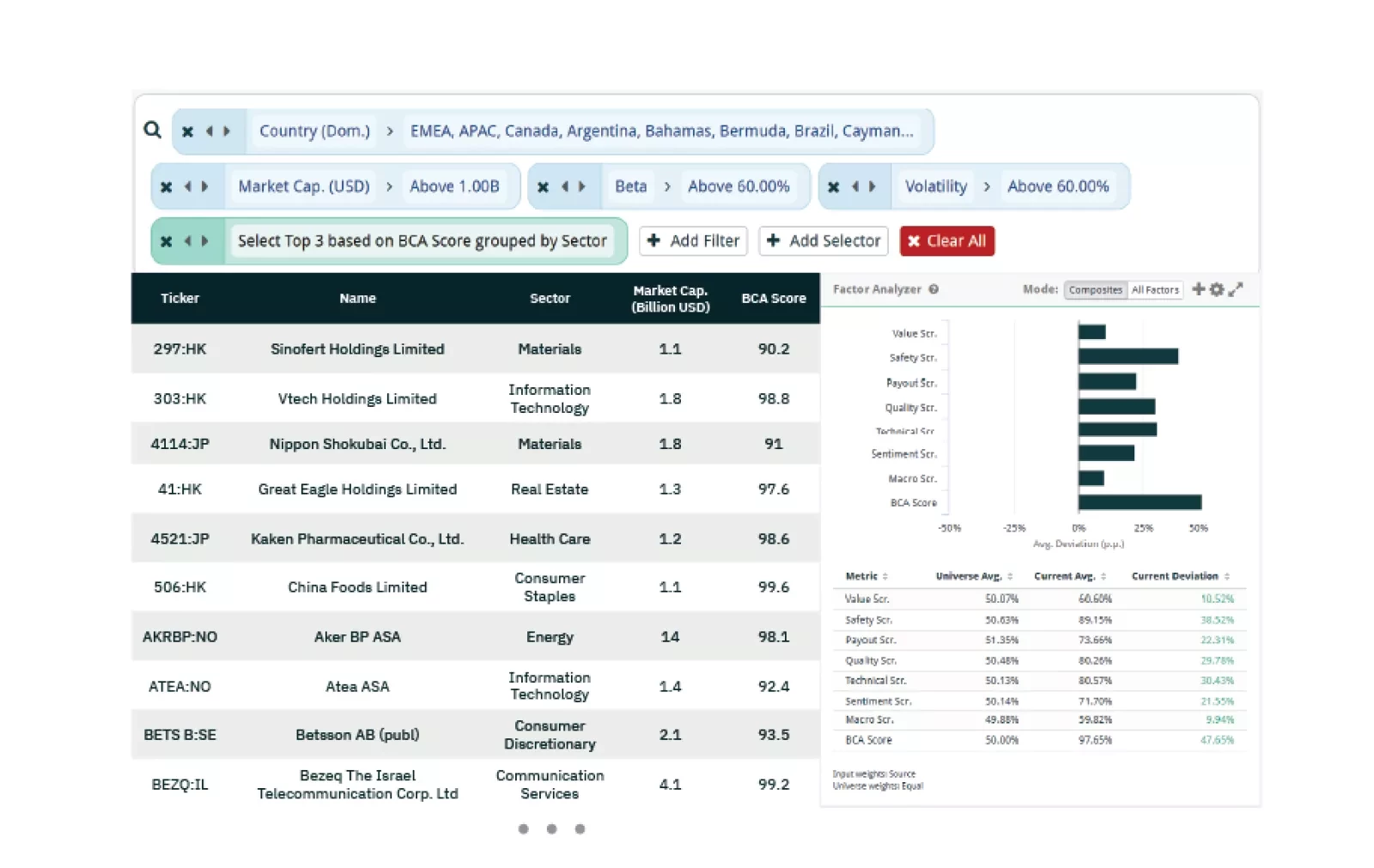

This week, our three screeners cover: Equity plays in Low Vol & Low Beta outside the US; Chinese stocks; and stocks that are buys according to the PEG ratio.

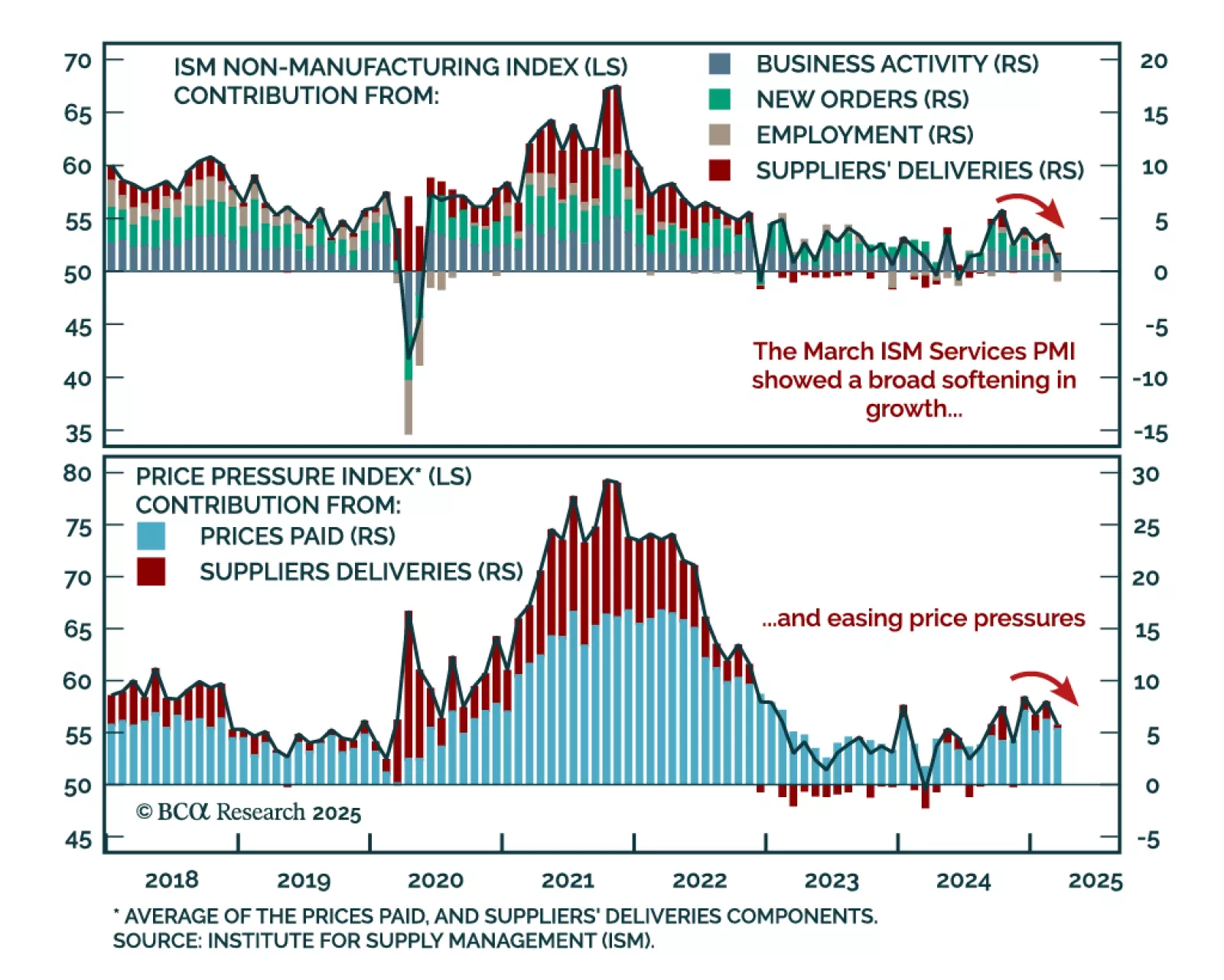

The March ISM Services report sent a recessionary signal, supporting our defensive positioning. The headline index fell sharply to 50.8 from 53.5, missing expectations. New orders dropped to 50.2, while employment collapsed to 46.2…

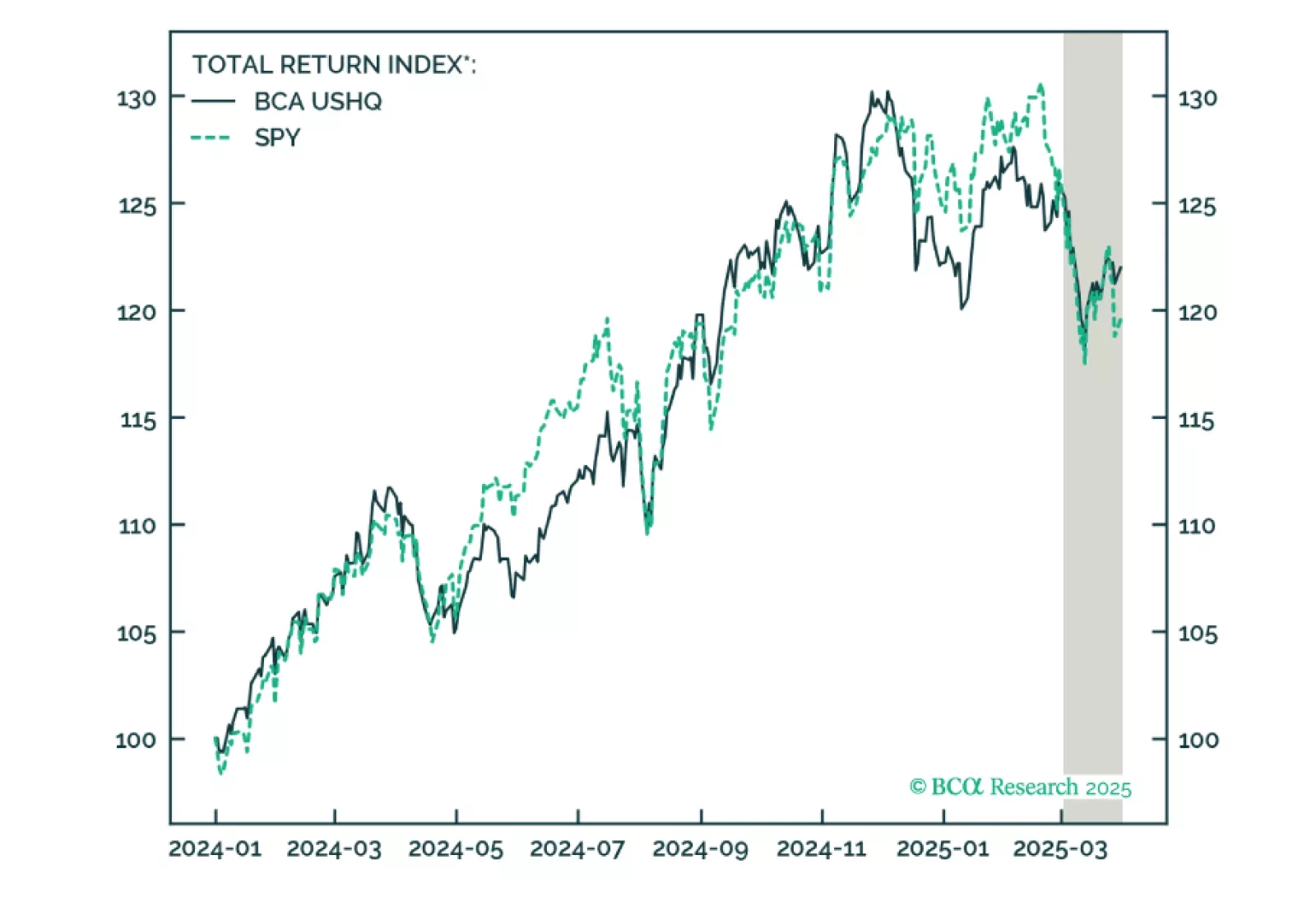

The US High Quality (USHQ) portfolio outperformed its benchmark in March, despite realizing a negative return. USHQ returned -2.6%, whilst its SPY benchmark returned -3.9%. Over a trailing-quarter basis, USHQ posted meaningful…

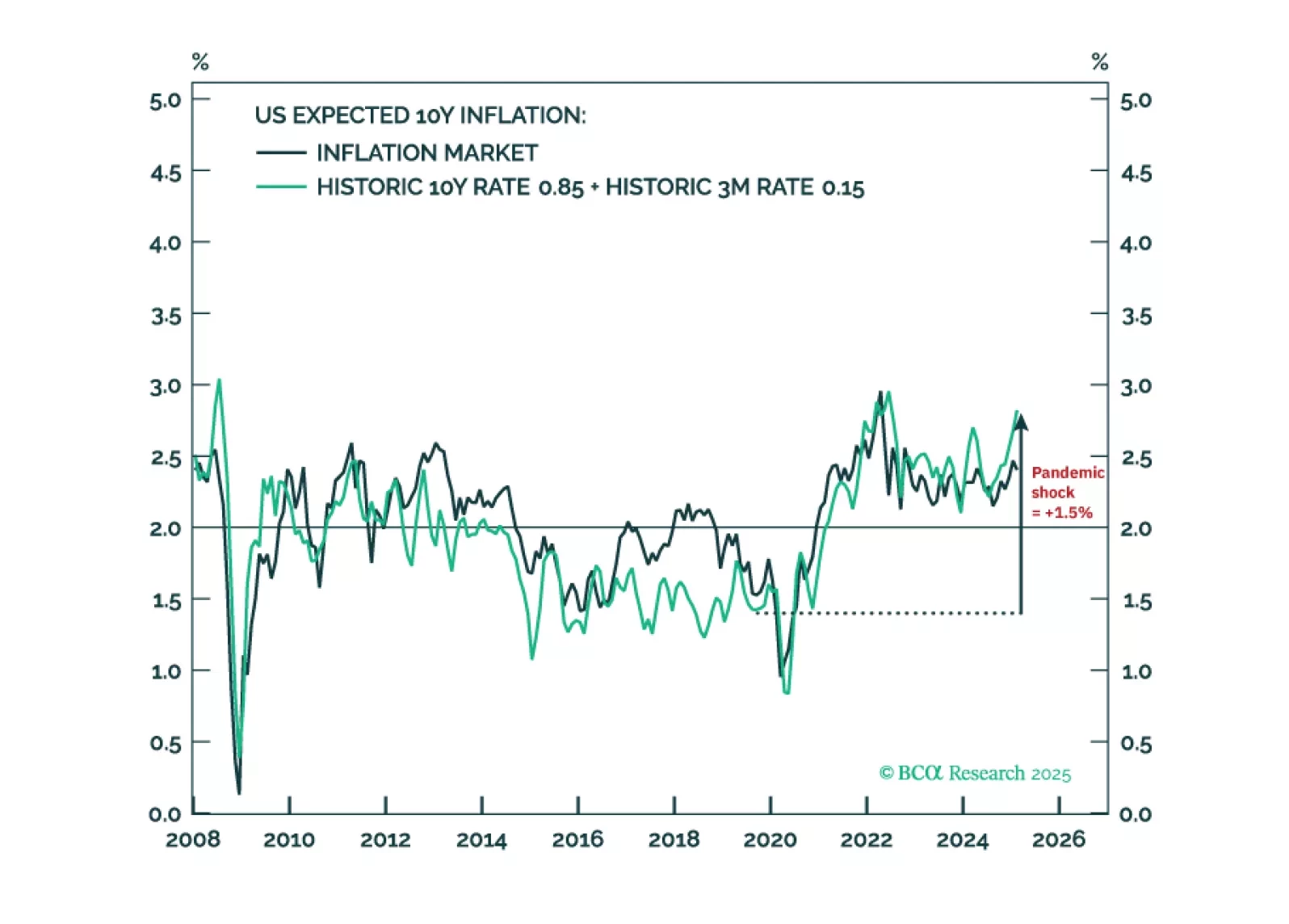

Tariffs will make a difficult job almost impossible. Hitting and sustaining a precise 2 percent inflation target is more about luck than judgement. It requires both the starting point for inflation expectations and any inflation/…

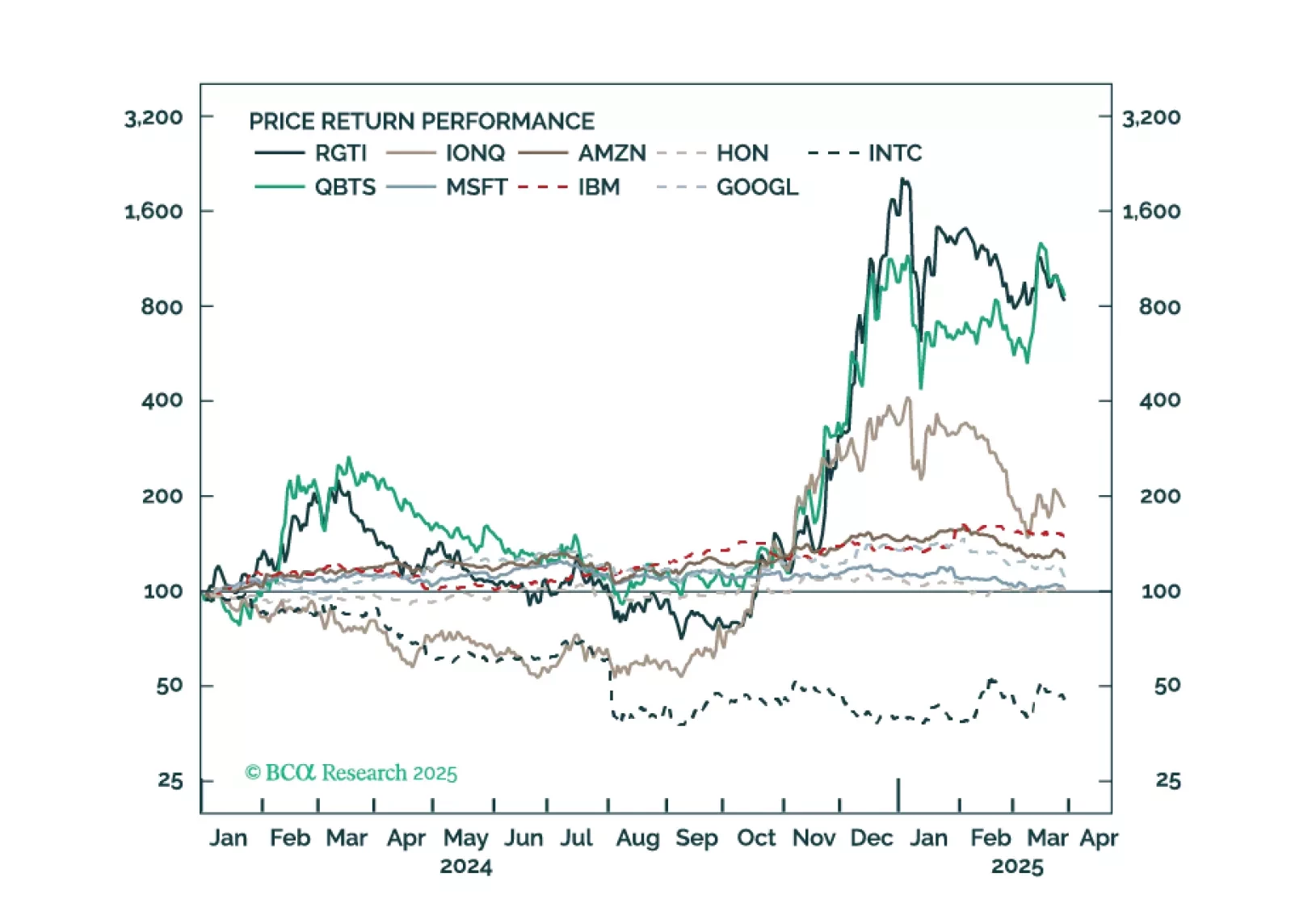

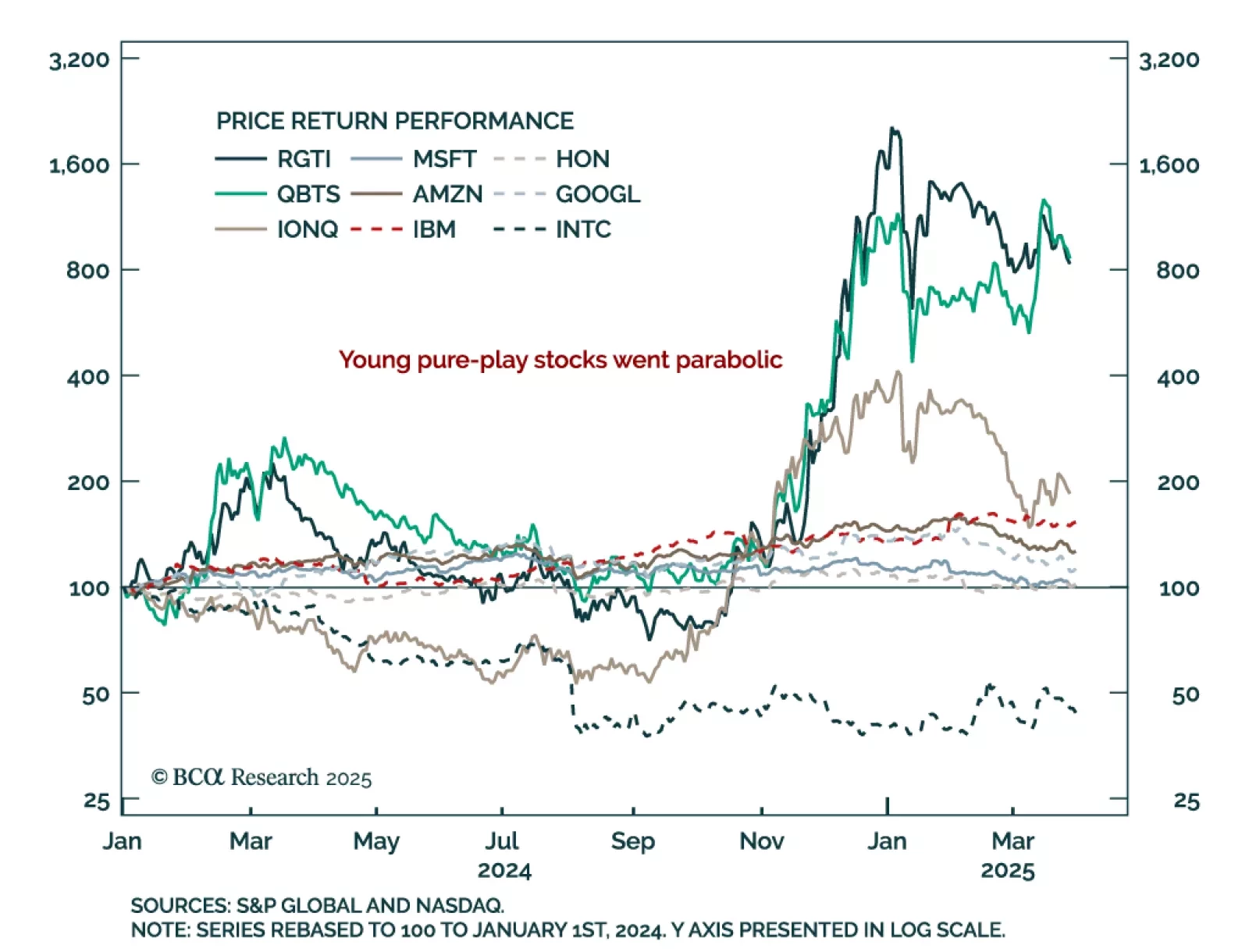

Our US Equity strategists recommend caution on quantum computing, as the industry is still too early-stage for reliable investment exposure. Although quantum computing (QC) is on the verge of major breakthroughs, pure-play QC stocks…

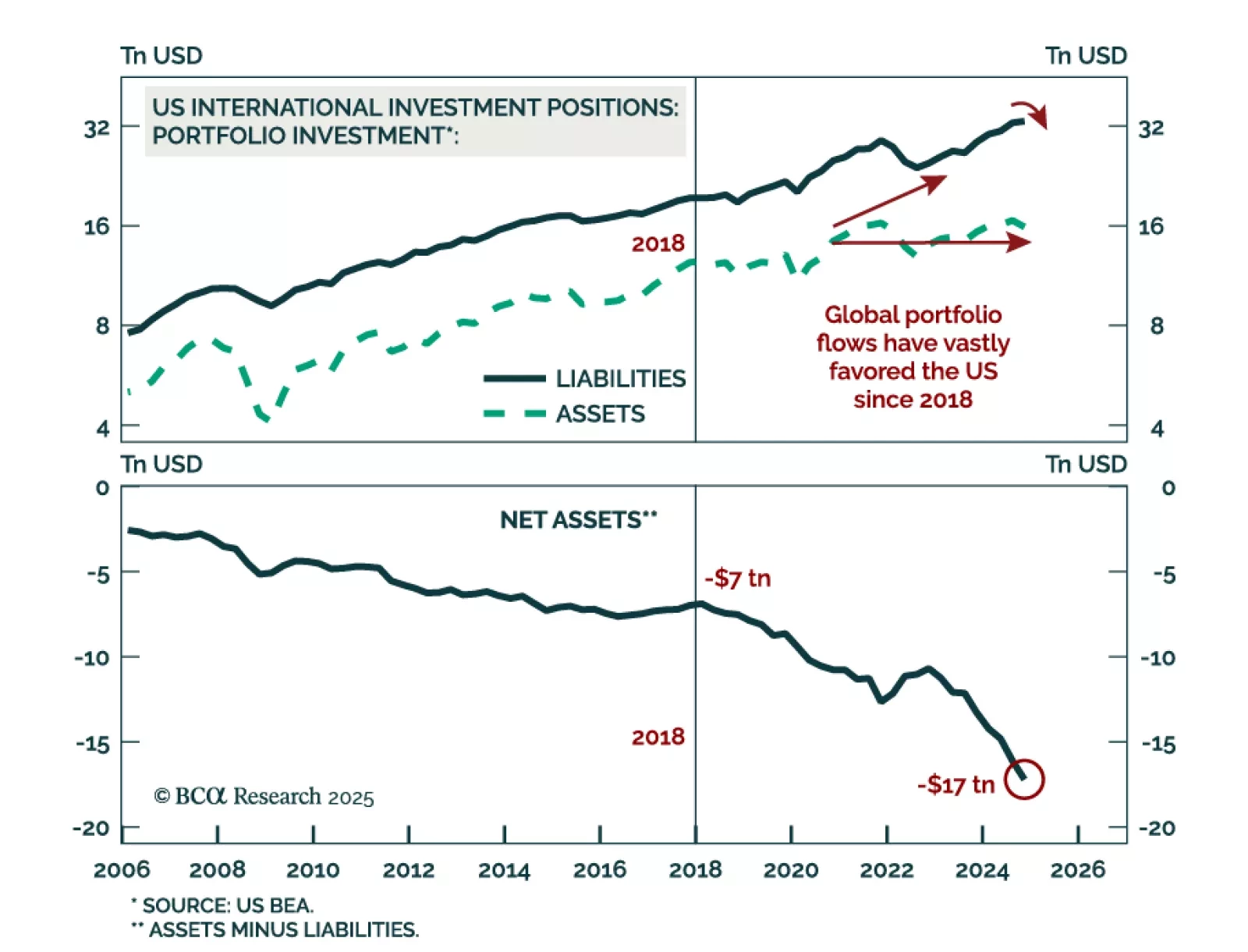

Low correlations and regional dispersion are shaping market dynamics, creating selective opportunities outside the US even as near-term risks remain. Asset classes tend to become highly correlated during crisis episodes, limiting…