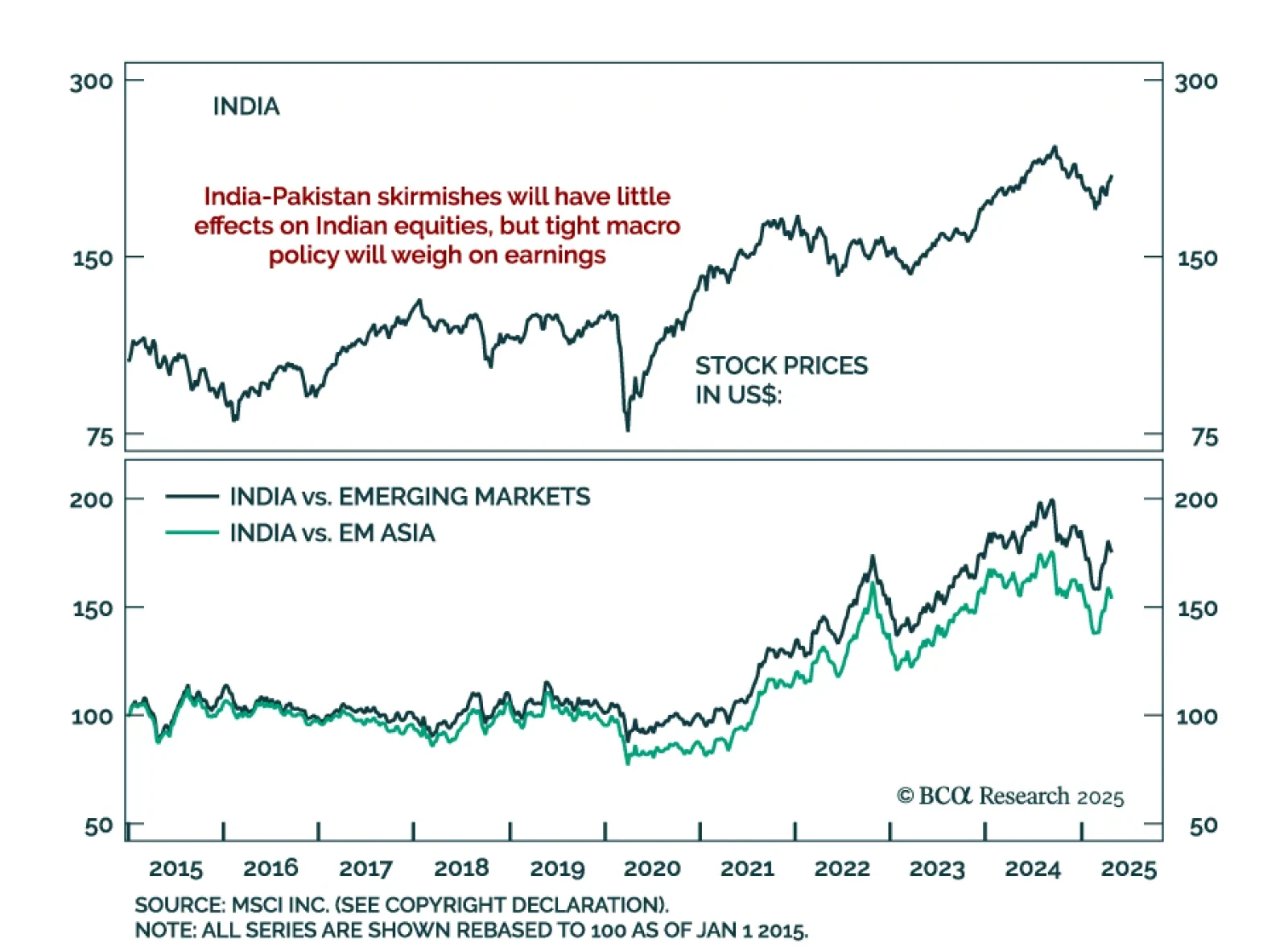

Indian equities remain resilient despite rising India-Pakistan tensions, but BCA’s EM strategists stay underweight India while favoring local-currency bonds. The latest flare-up follows Indian retaliation to last month’s terrorist…

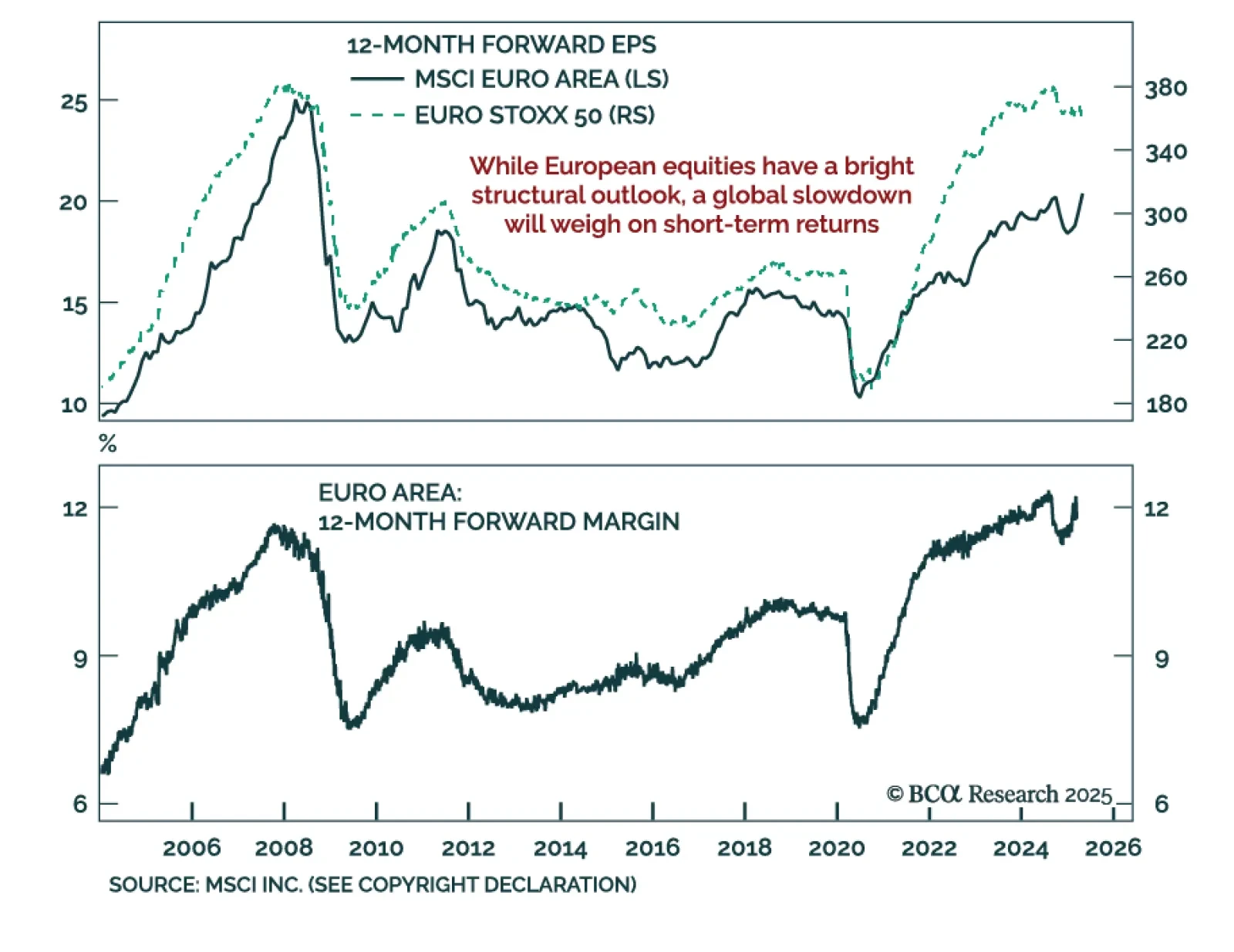

Germany's political transition supports long-term equity upside, but near-term growth risks justify caution. Friedrich Merz was narrowly elected Chancellor on Tuesday, but his fragile coalition and his decision to suspend the debt…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

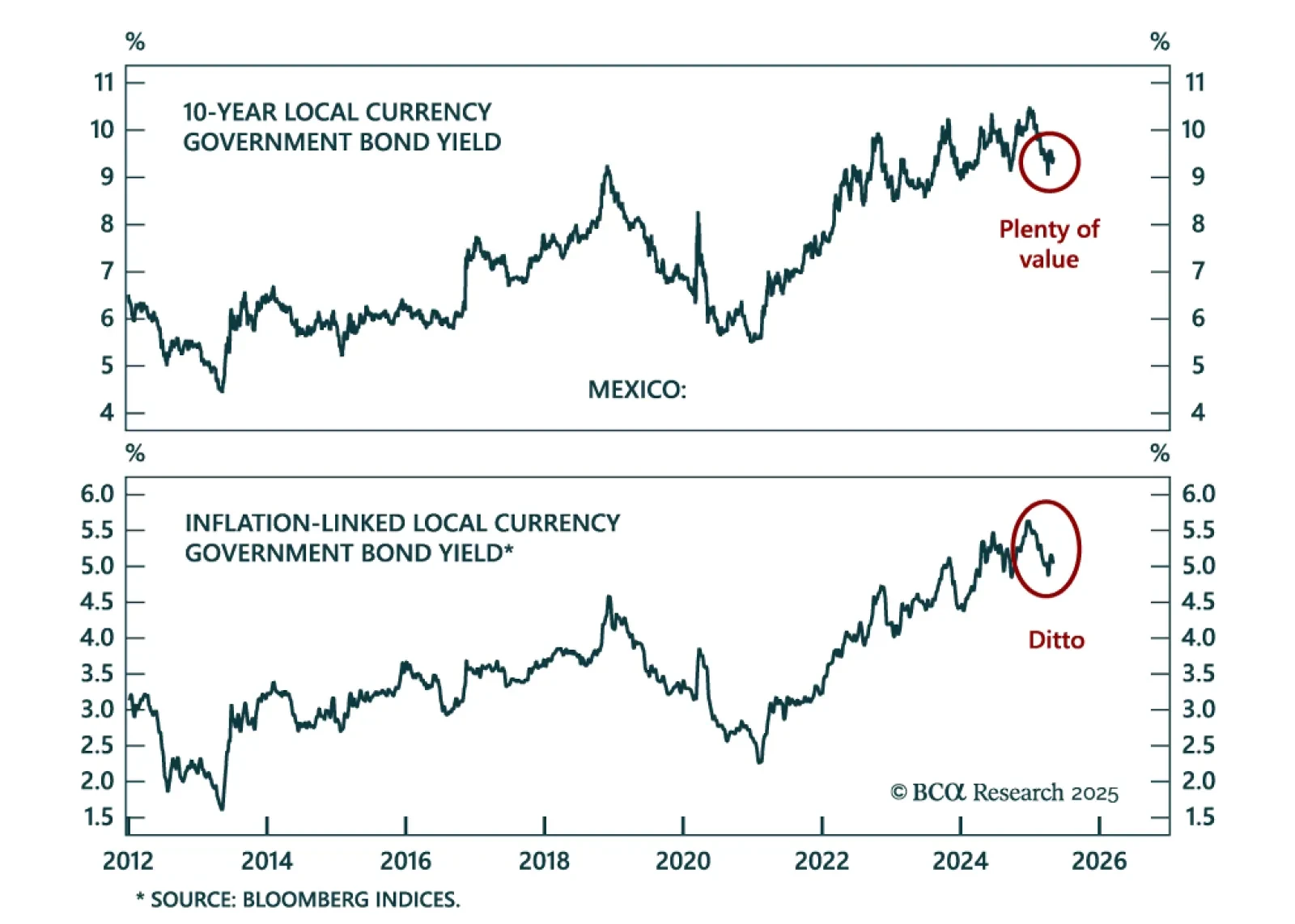

Mexico will be one of the biggest winners of the global trade war, creating a structural tailwind for its assets. Mexican risk assets and the peso are uniquely positioned to outperform while EM assets suffer as global growth slumps.…

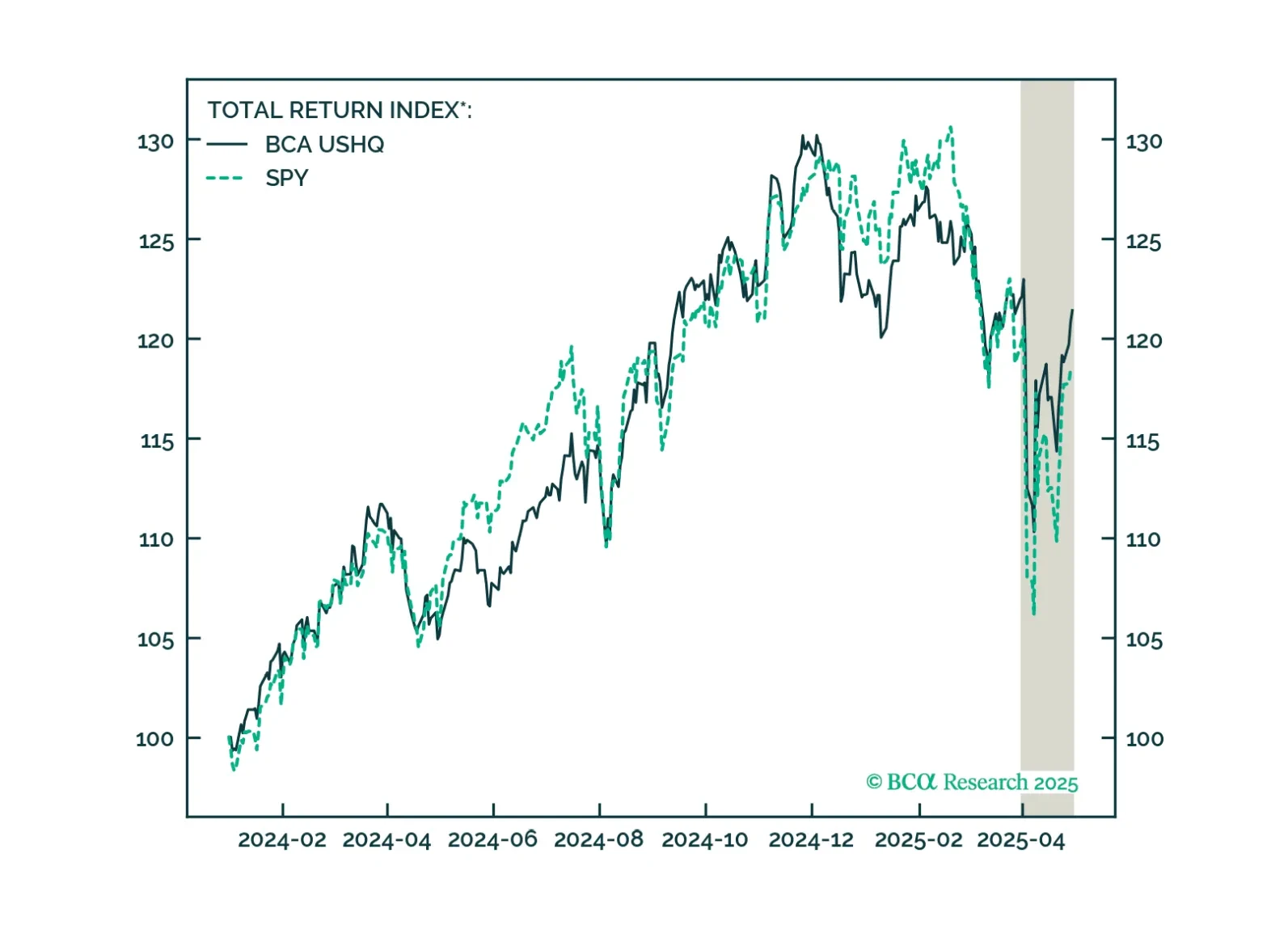

The US High Quality (USHQ) portfolio outperformed on the margin through April, returning -0.6%, whilst its SPY benchmark returned -1.2%. On a trailing three-month basis, performance remains robust vs. benchmark, with USHQ generating…

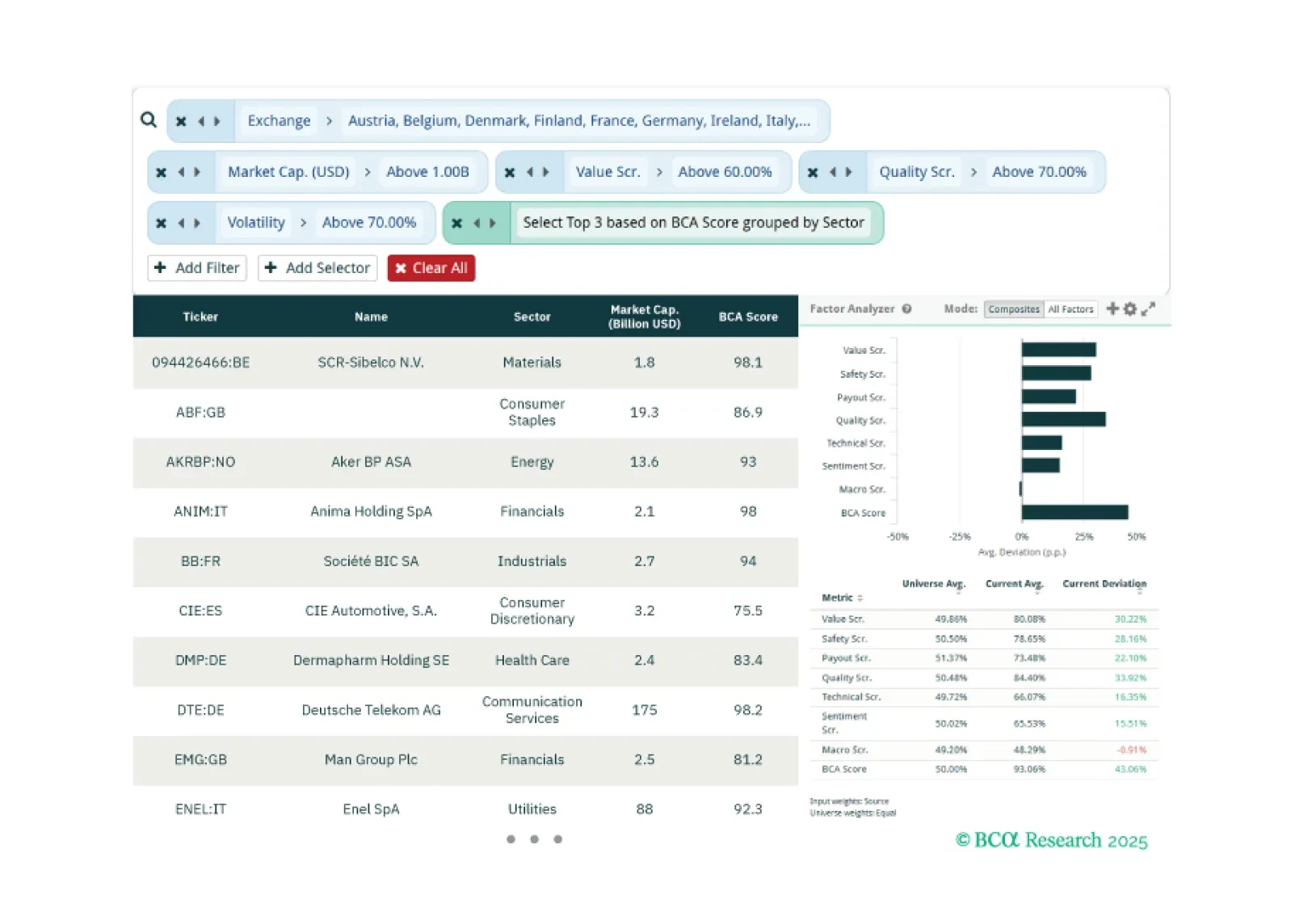

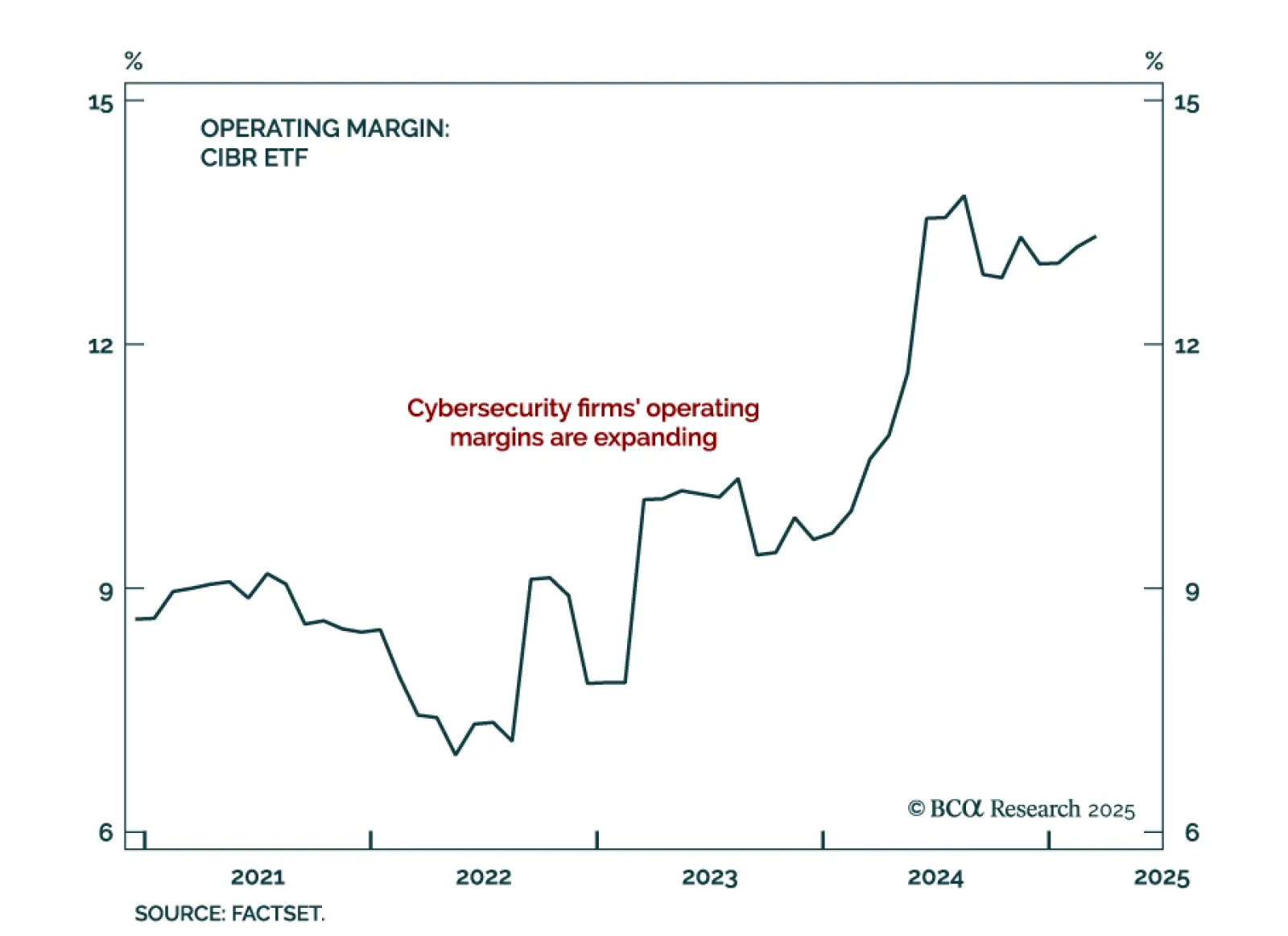

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.

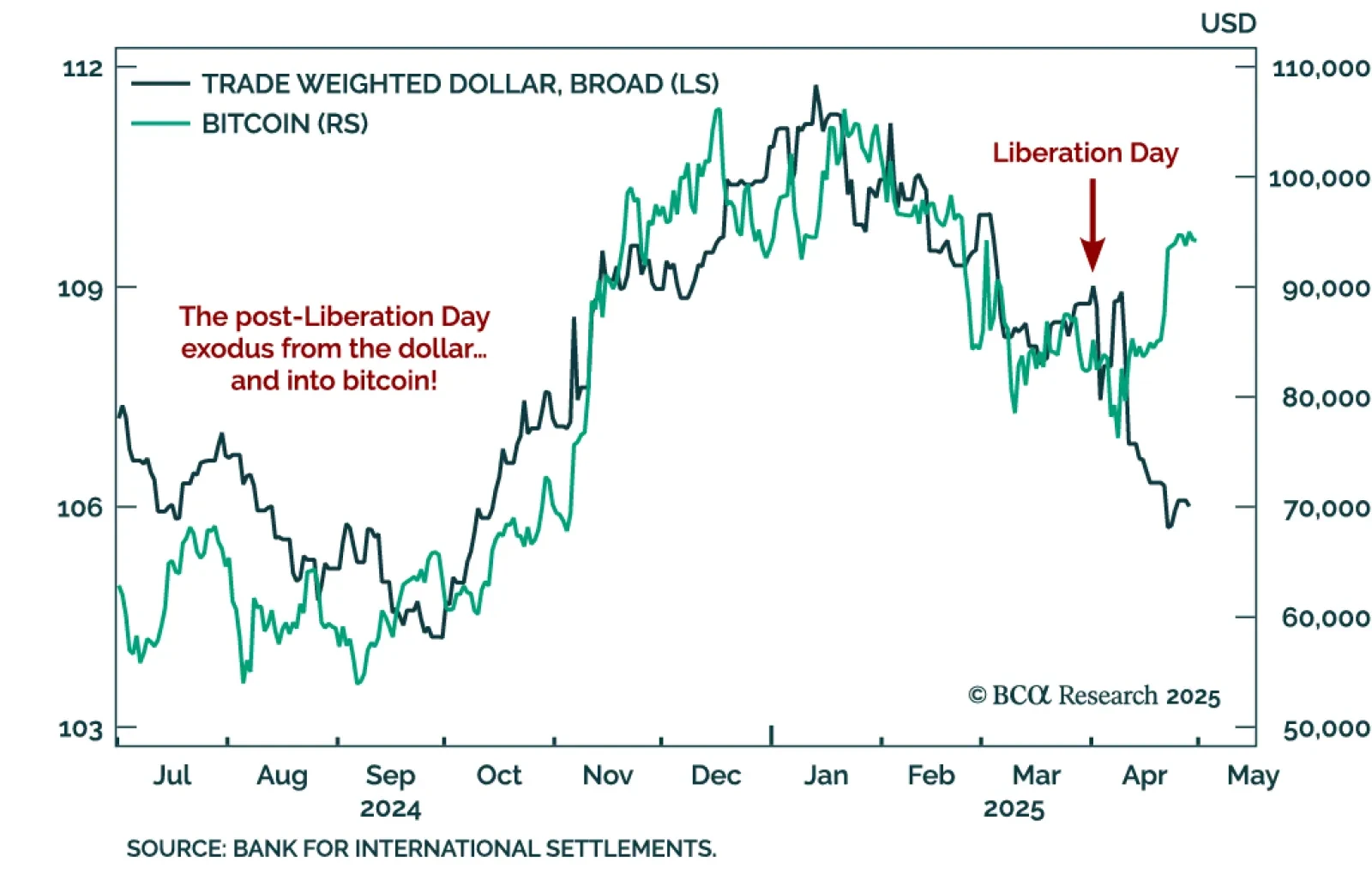

Our Counterpoint strategists overweigh Europe versus the US across both equities and bonds, and are structurally long bitcoin. Trump’s tariffs are deflationary for the world and inflationary for the US, prompting a sharp shift in…

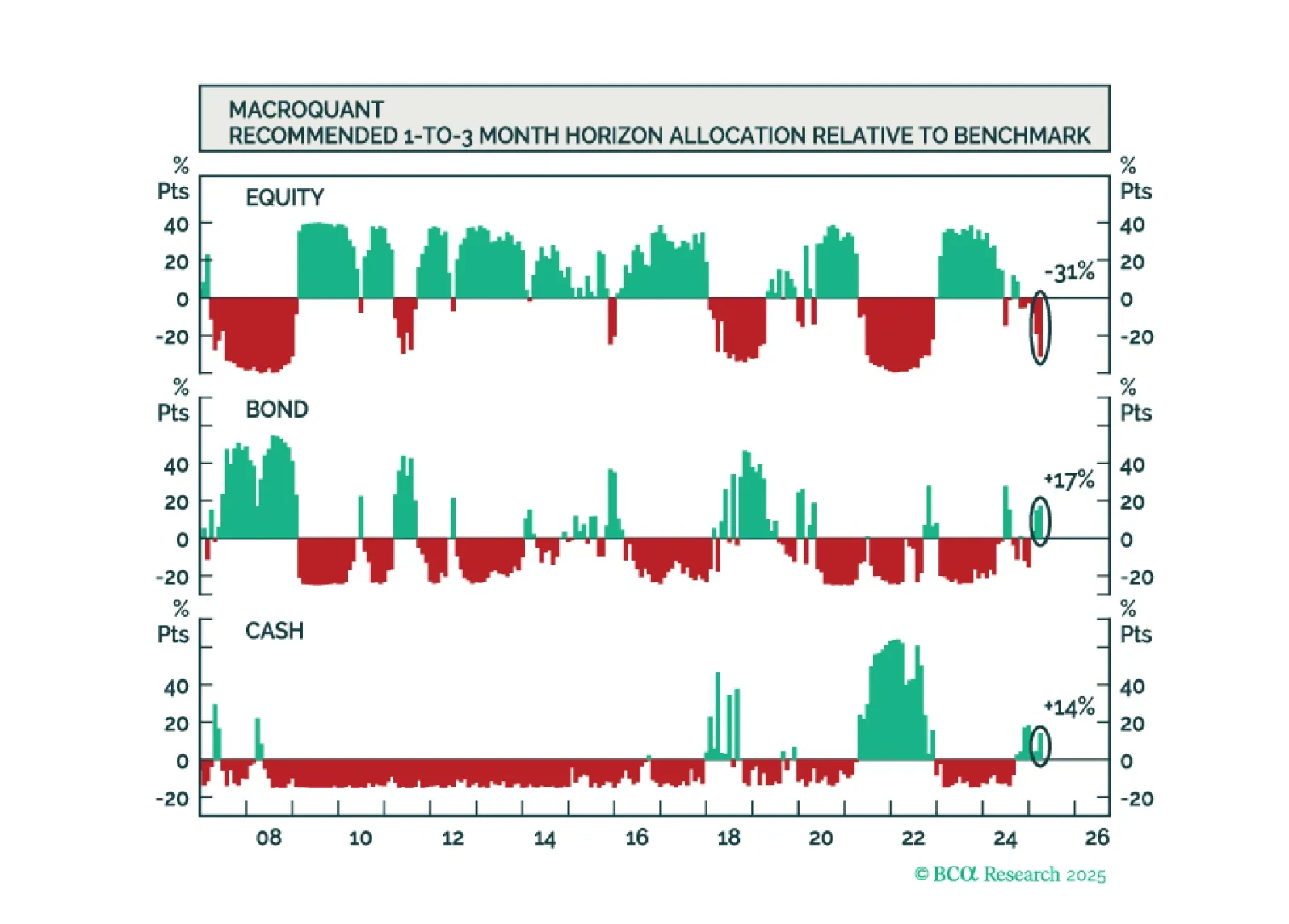

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

BCA’s US Equity strategists recommend building or adding to cybersecurity positions. The industry remains a strategic long-term theme with improving fundamentals and reduced valuation risk. The sector’s defensive characteristics,…