Equities

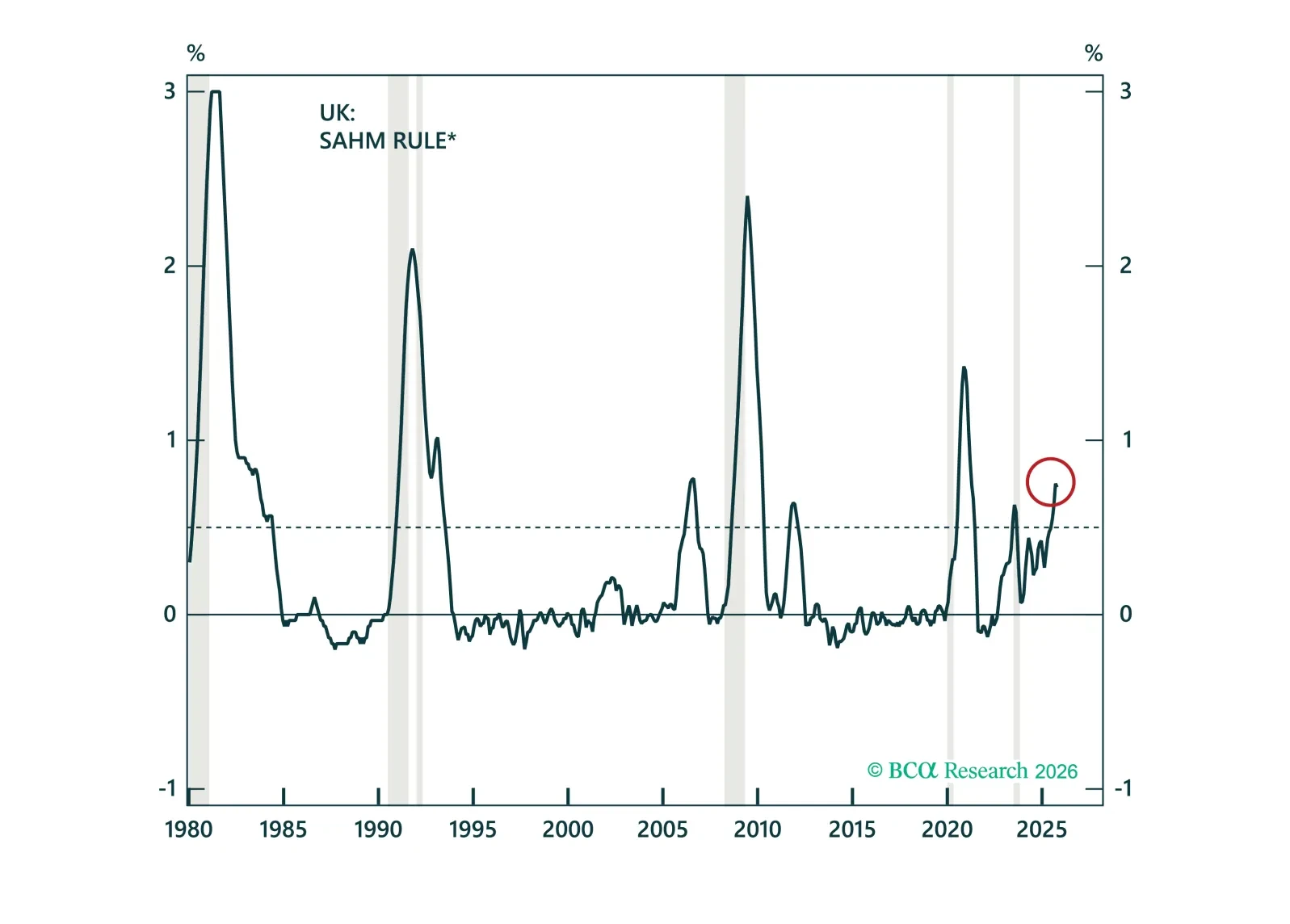

Recession risks in the UK are clearly rising. In this Special Report, we unpack why labor market deterioration, falling wage growth, and normalizing inflation support deeper BoE cuts ahead. We then discuss how to position across gilts, the pound, and UK equities.

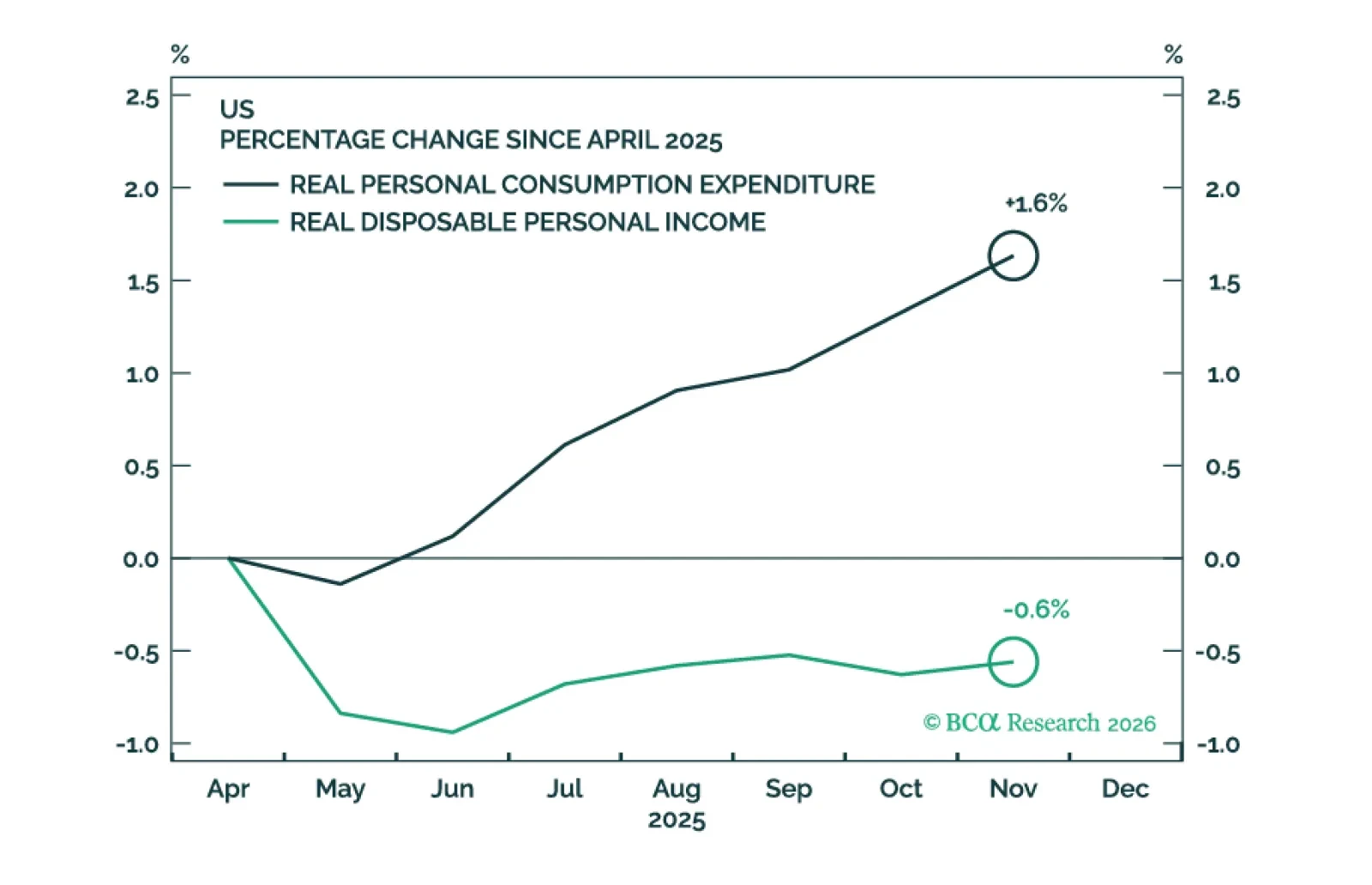

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026 price target for the S&P 500 to 6375 from 6200.

US Treasury yields require a higher premium for both geopolitical risk and inflation risk, but higher bond yields are not necessarily bad for stocks.

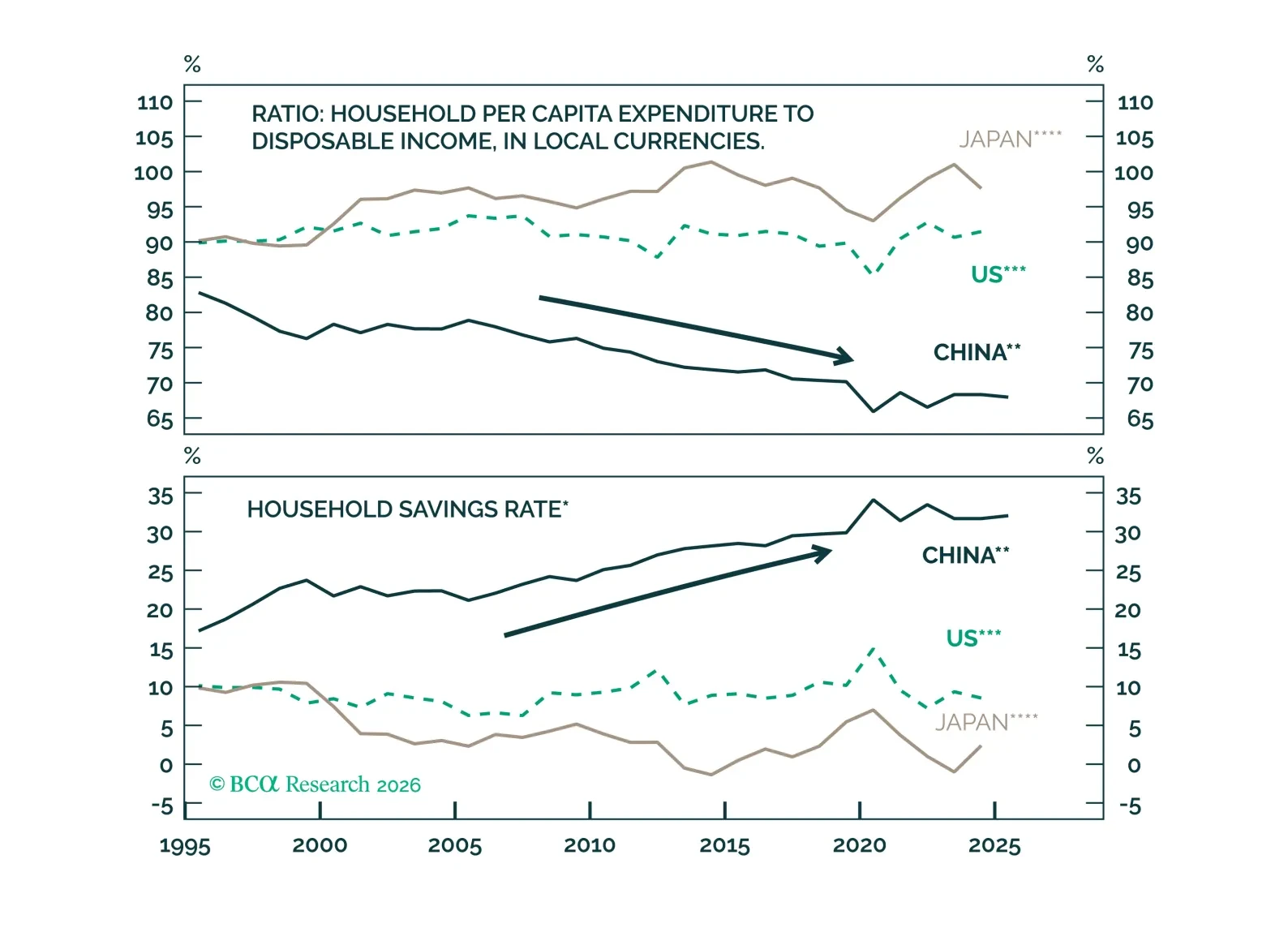

This report analyzes the structural and cyclical factors driving service spending in Chinese households and highlights sectors with promising investment opportunities for the next 6 to 12 months.

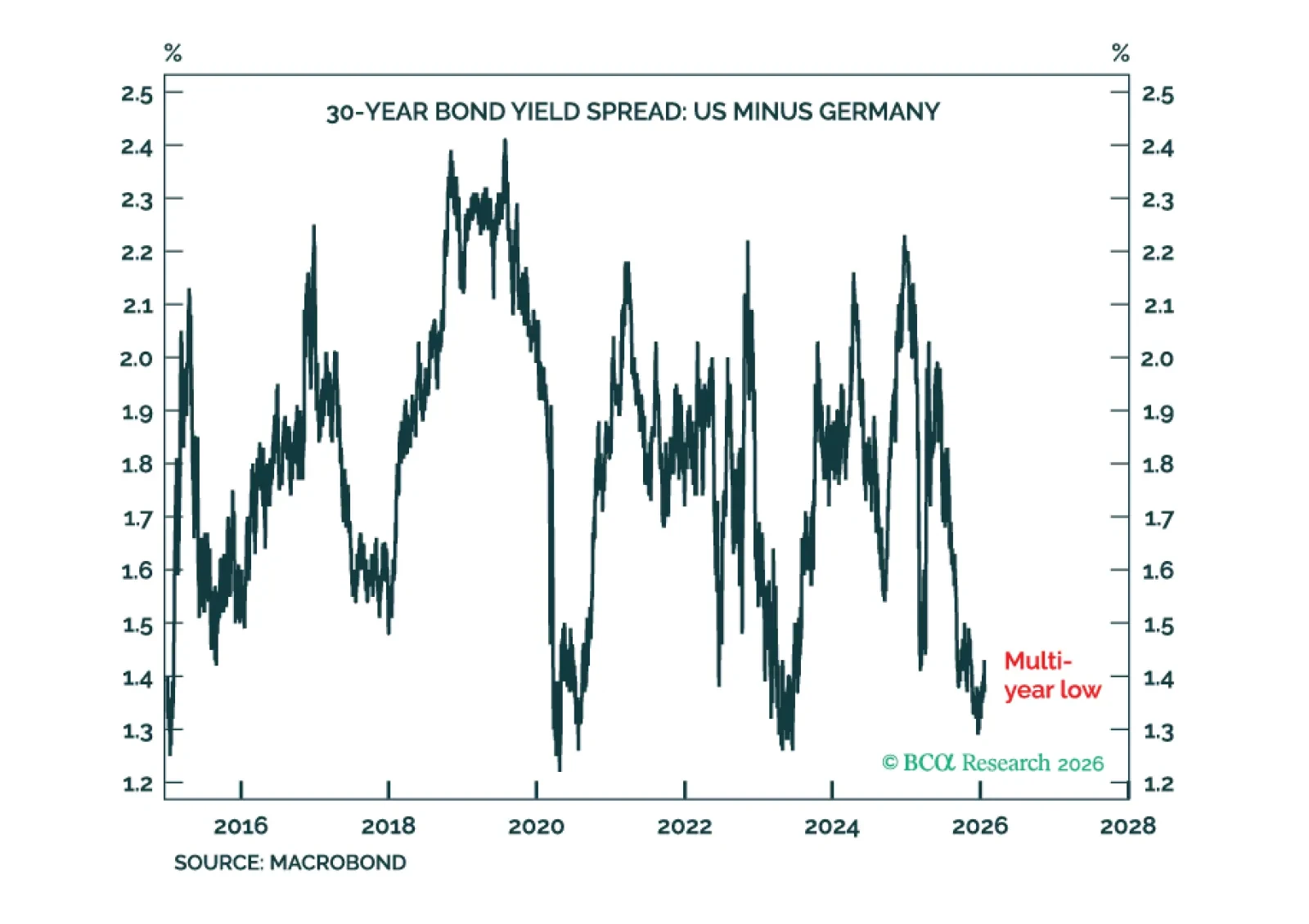

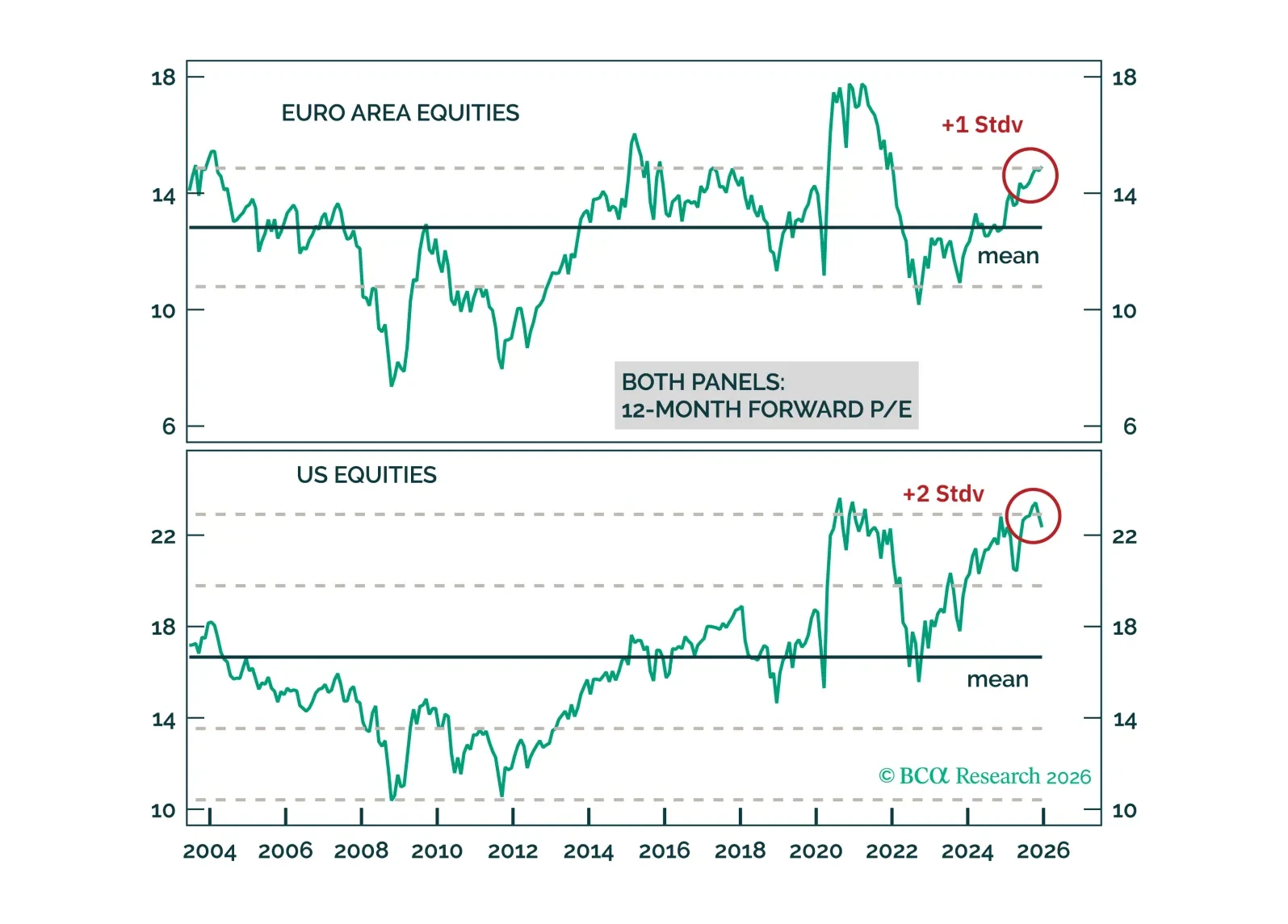

Europe is in a geopolitical sweet spot. Exaggerated fears of Russian military aggression and abandonment by the United States, as well as increased competition from China, create a geopolitical imperative to stimulate, reflate, and reform. Taken together with fading cyclical headwinds, it suggests that European risk assets can continue to outperform US ones on a cyclical investment time horizon. Remain long European stocks, in particular industrials, and EUR/USD.

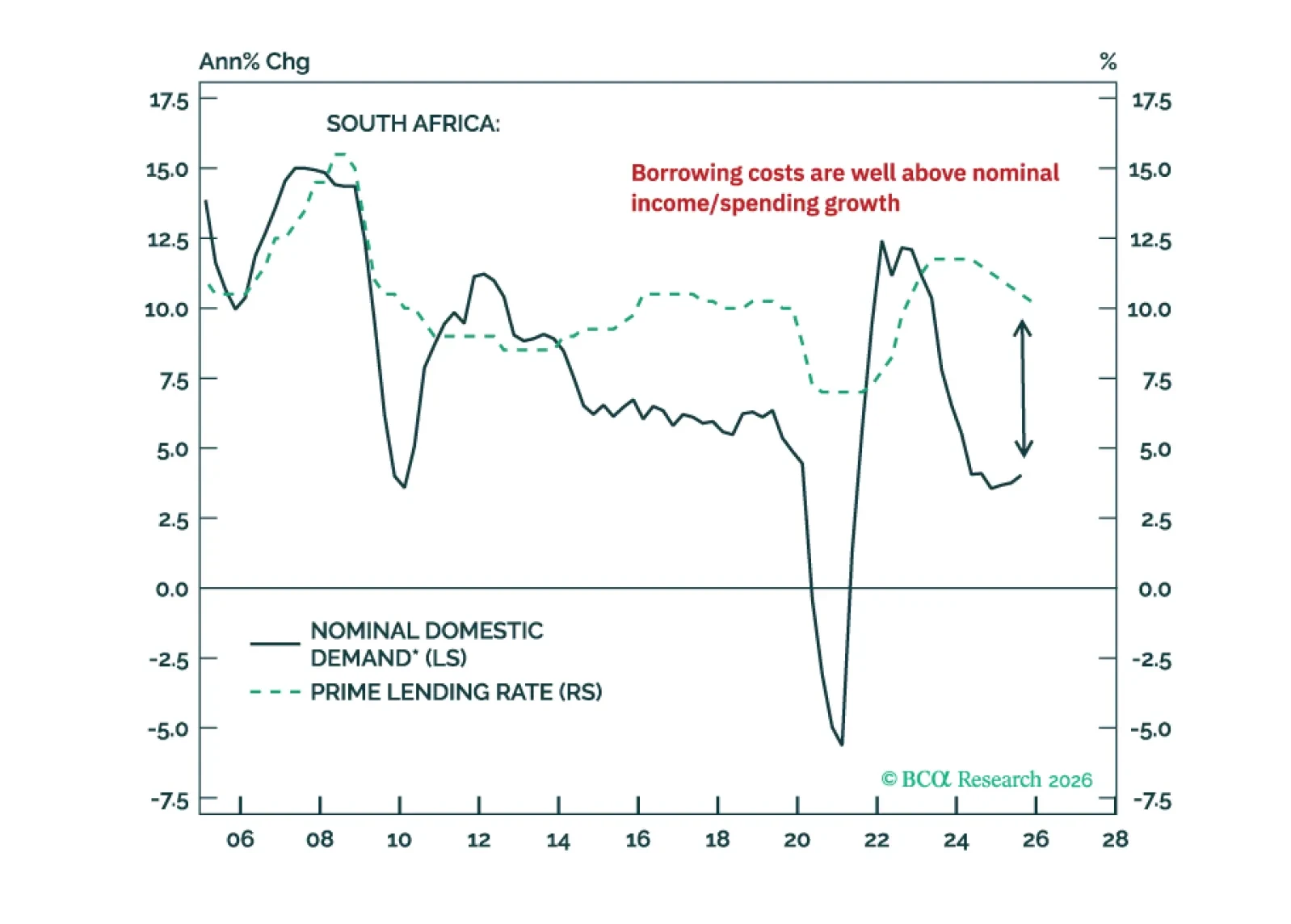

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

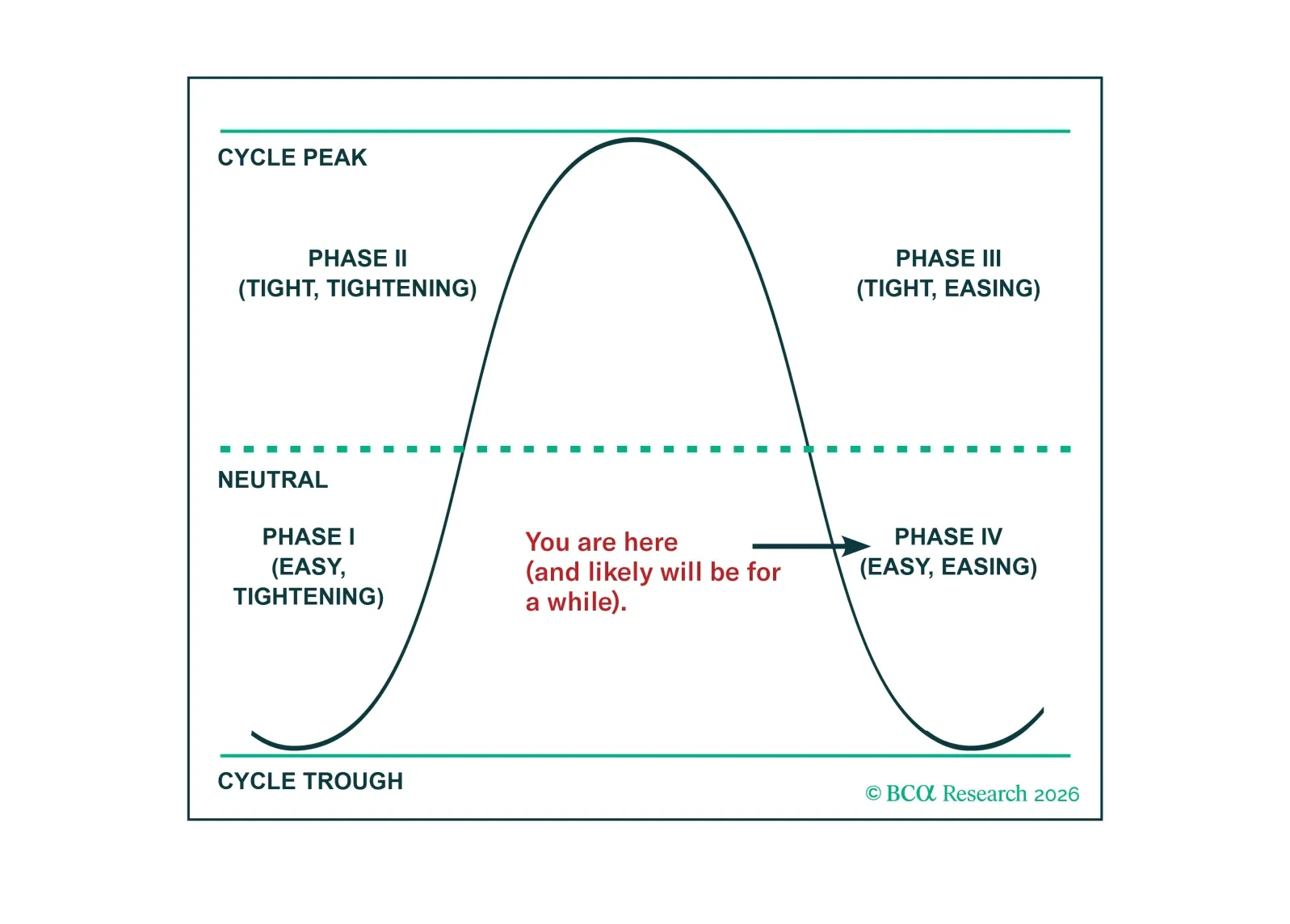

With the Fed looming larger on investors’ radar screens, we revisit our fed funds rate cycle analysis. We expect that the current easing-while-already-easy phase will be less rewarding than normal for the S&P 500 because multiples have already expanded to very elevated levels.

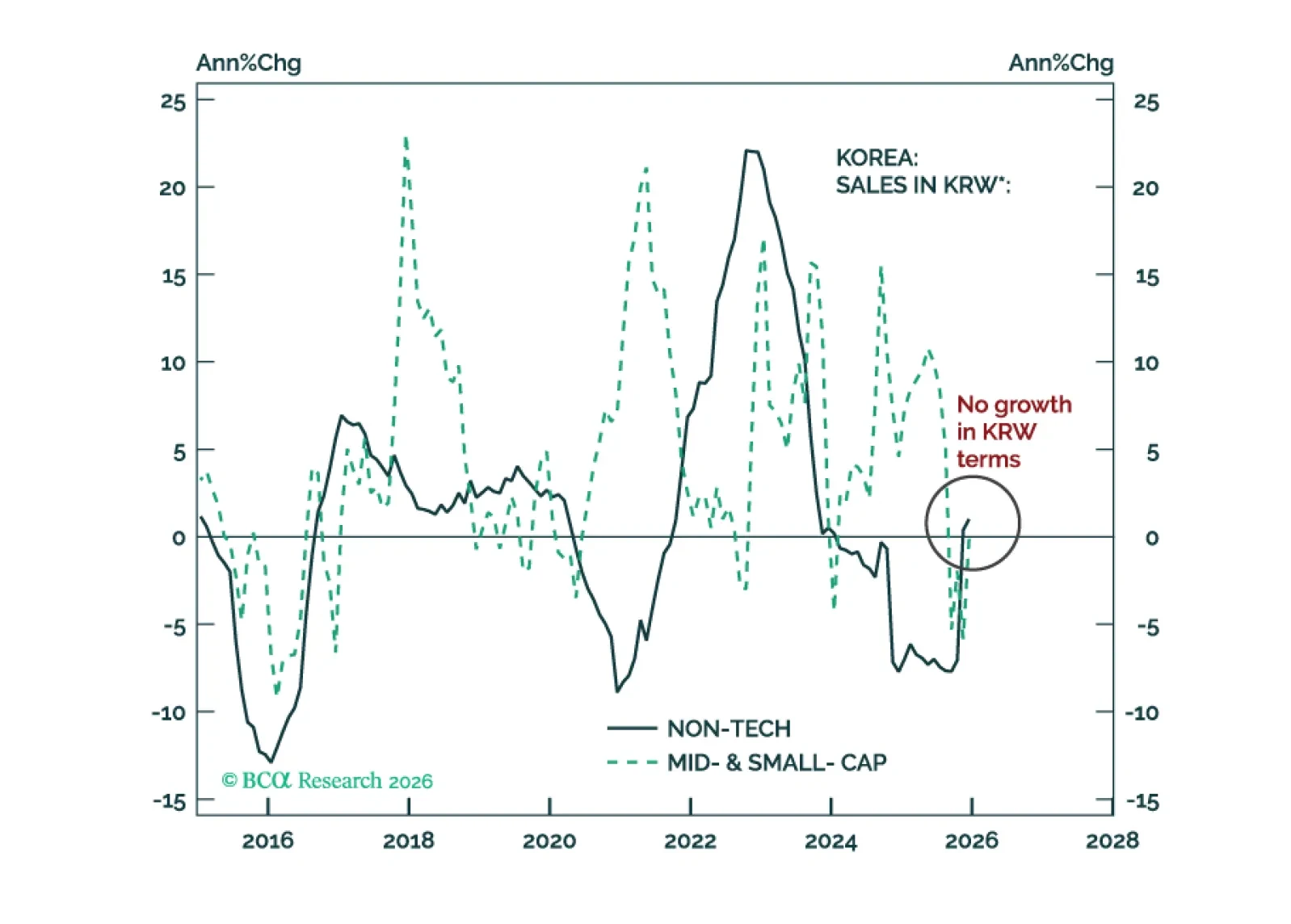

Go long KRW versus USD. Within an EM equity portfolio, overweight Korean tech and stay neutral on Korean non-tech. However, we are not bullish on the Korean bourse's absolute performance.

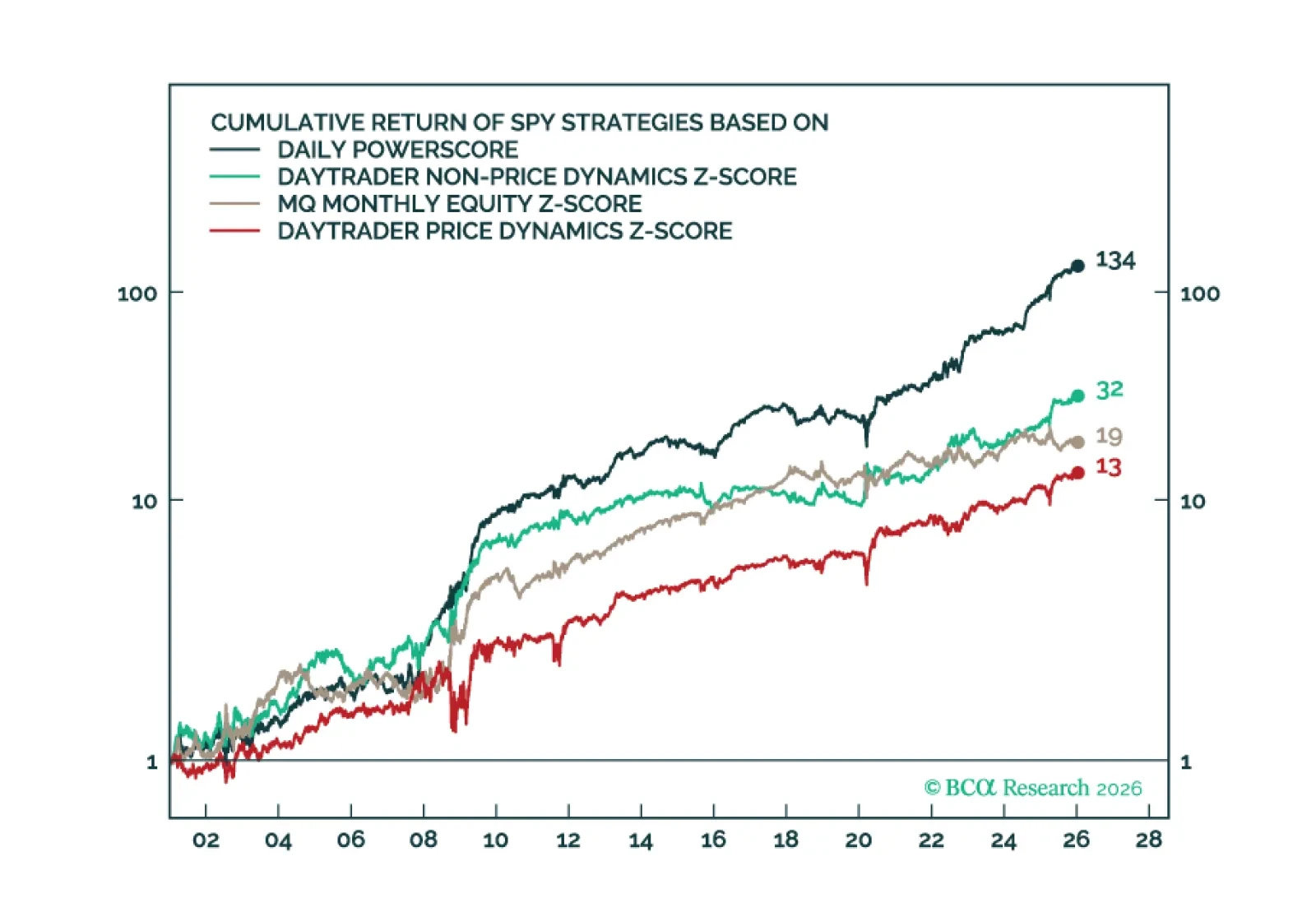

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term direction of the S&P 500 and long-term Treasuries.

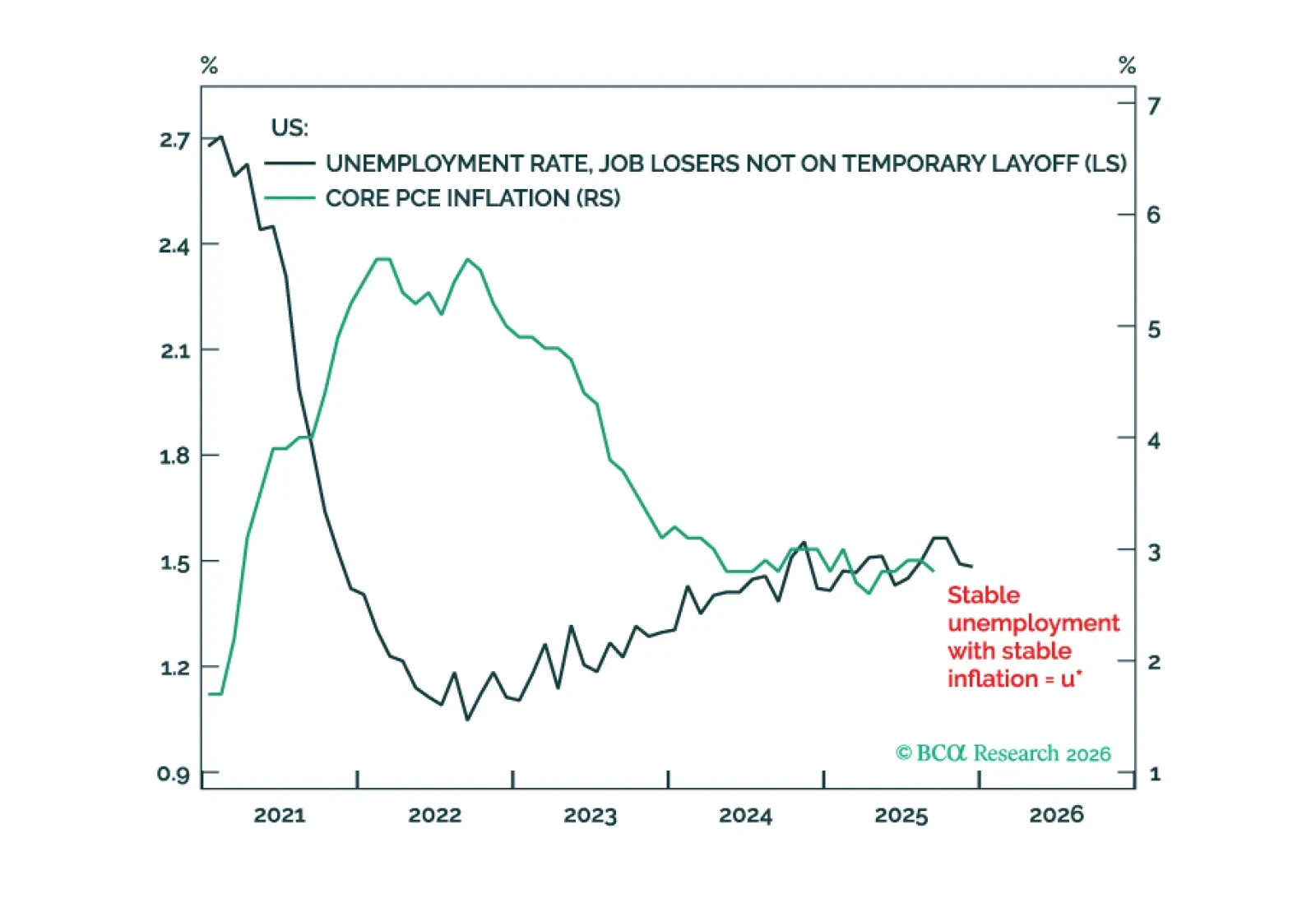

With the US unemployment rate and interest rate close to the ‘neutral’ u-star and r-star respectively, further Fed rate cuts risk pushing up inflation and long-term inflation expectations. This is bad for bonds but good for stocks. Plus, two new trades are: short TOPIX versus DAX; and short CAT versus SPX.