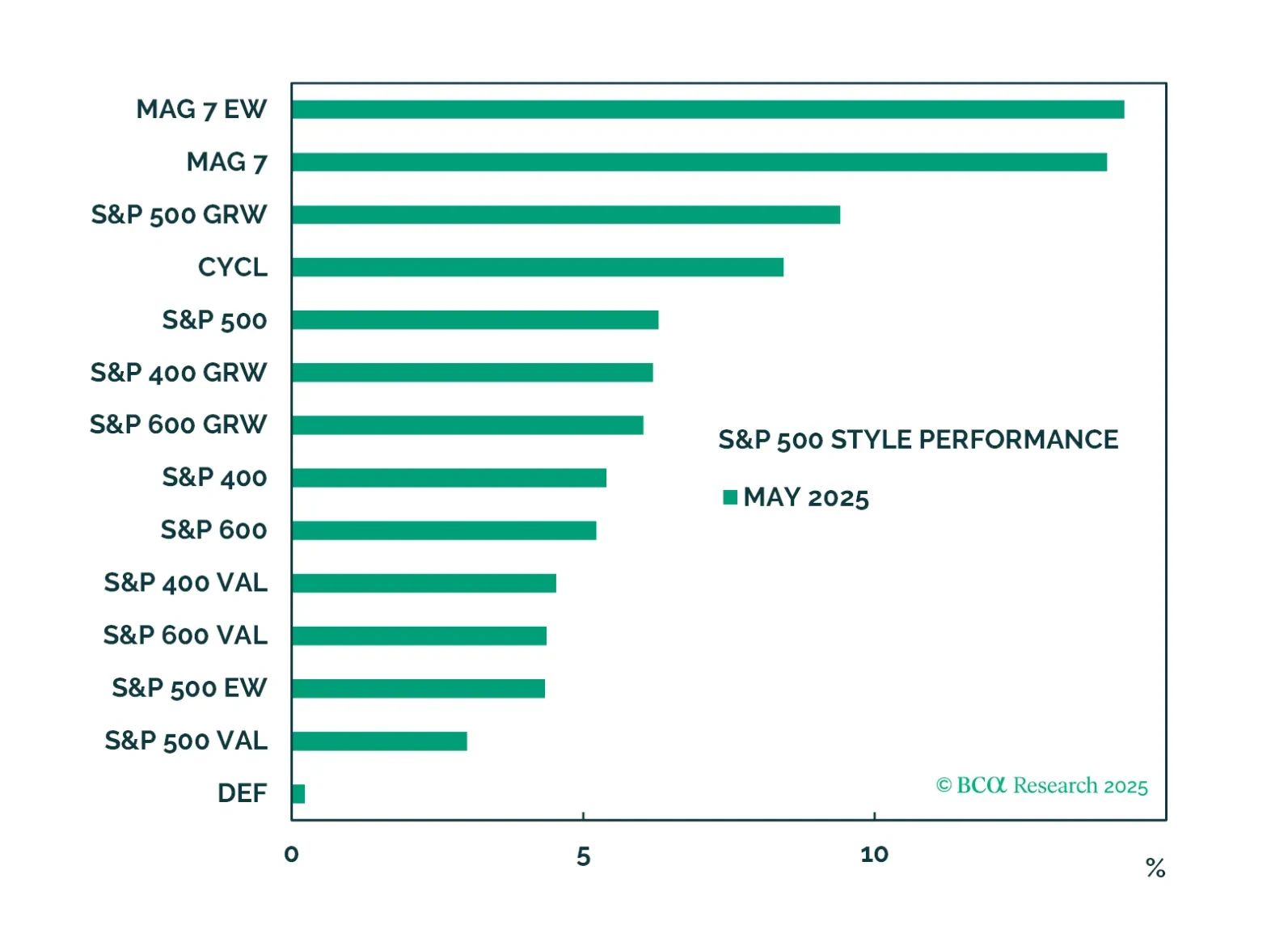

In the front section of the chart pack, we review May’s performance and adjust our portfolio positioning.

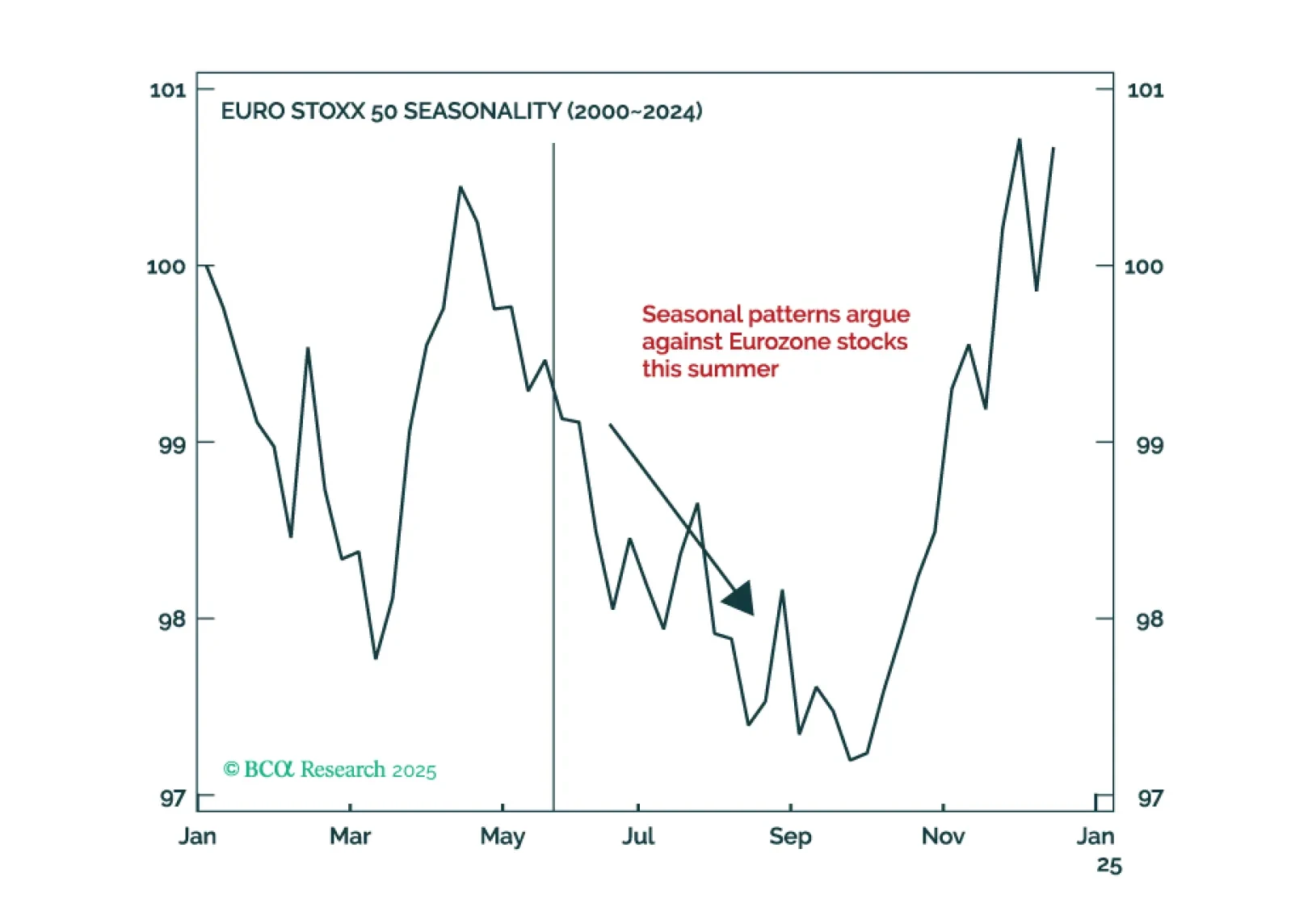

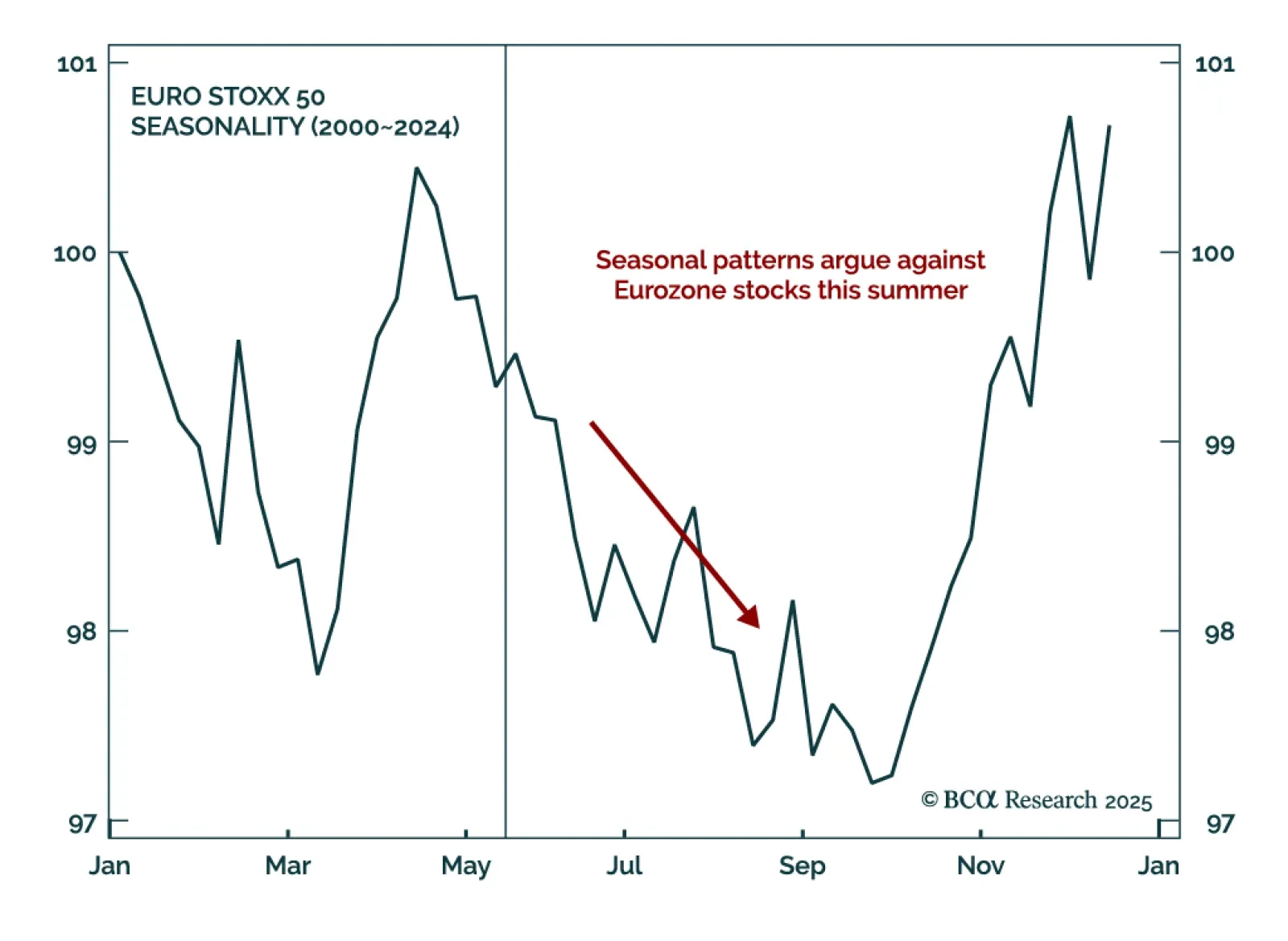

Our European strategists expect the EURO STOXX 50 to remain rangebound between 4750 and 5500 this summer, creating a punishing environment for buy-and-hold investors. With the index near the top of its range, they recommend trimming…

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

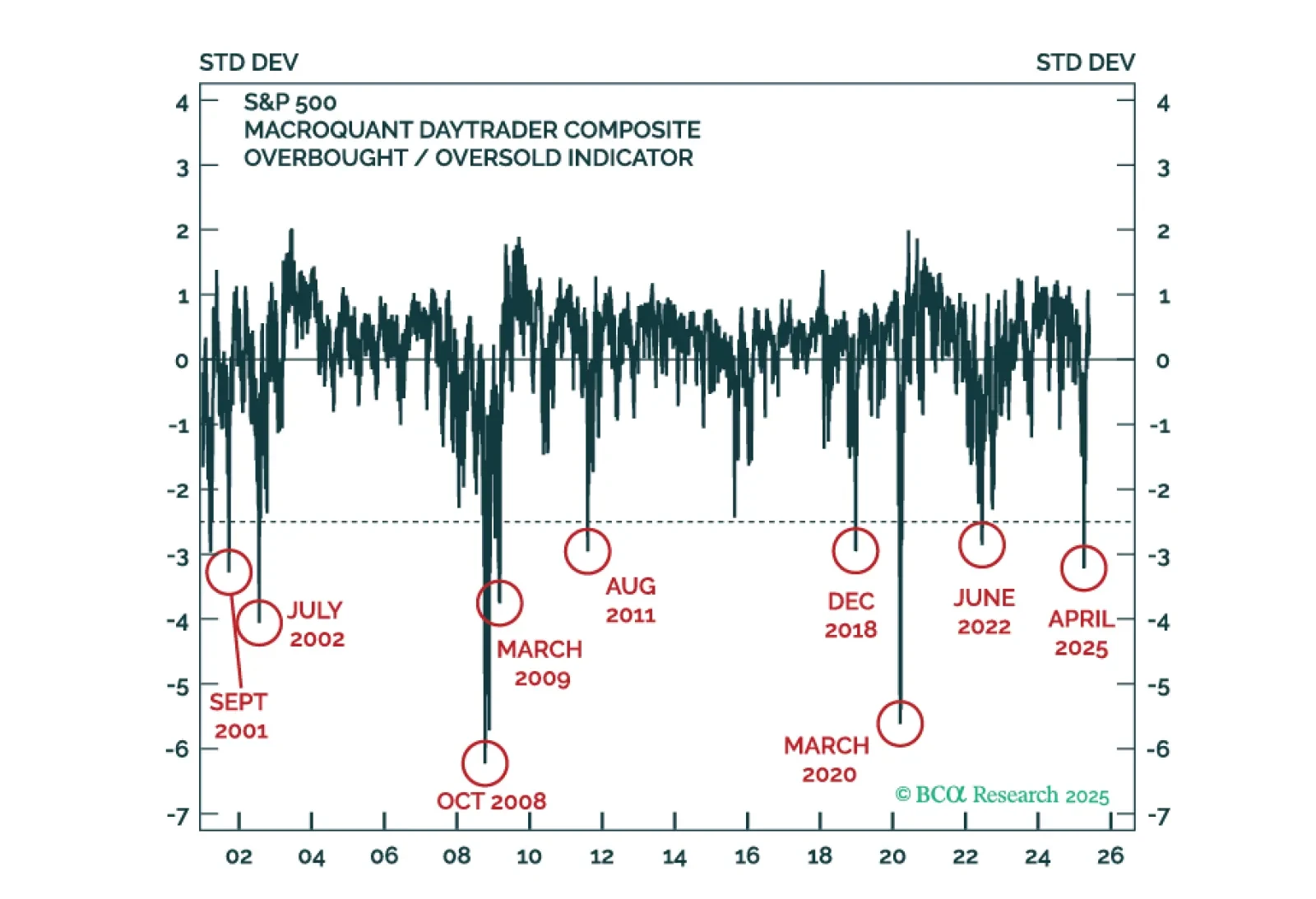

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

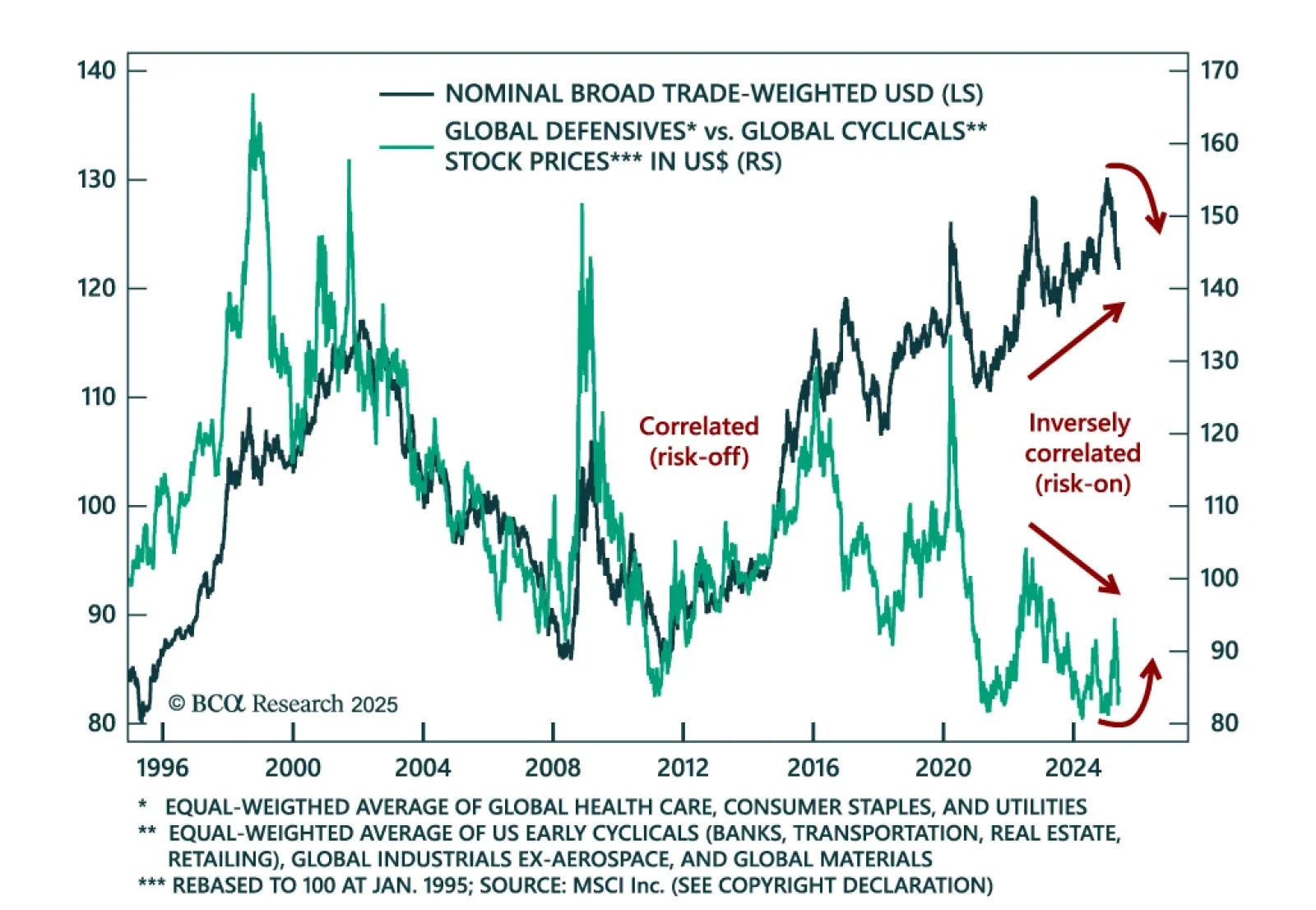

Global exchange rates are undergoing a regime shift, as the US dollar will likely become a risk-on currency, especially compared to DM exchange rates. Going forward, current-account dynamics will become the key…

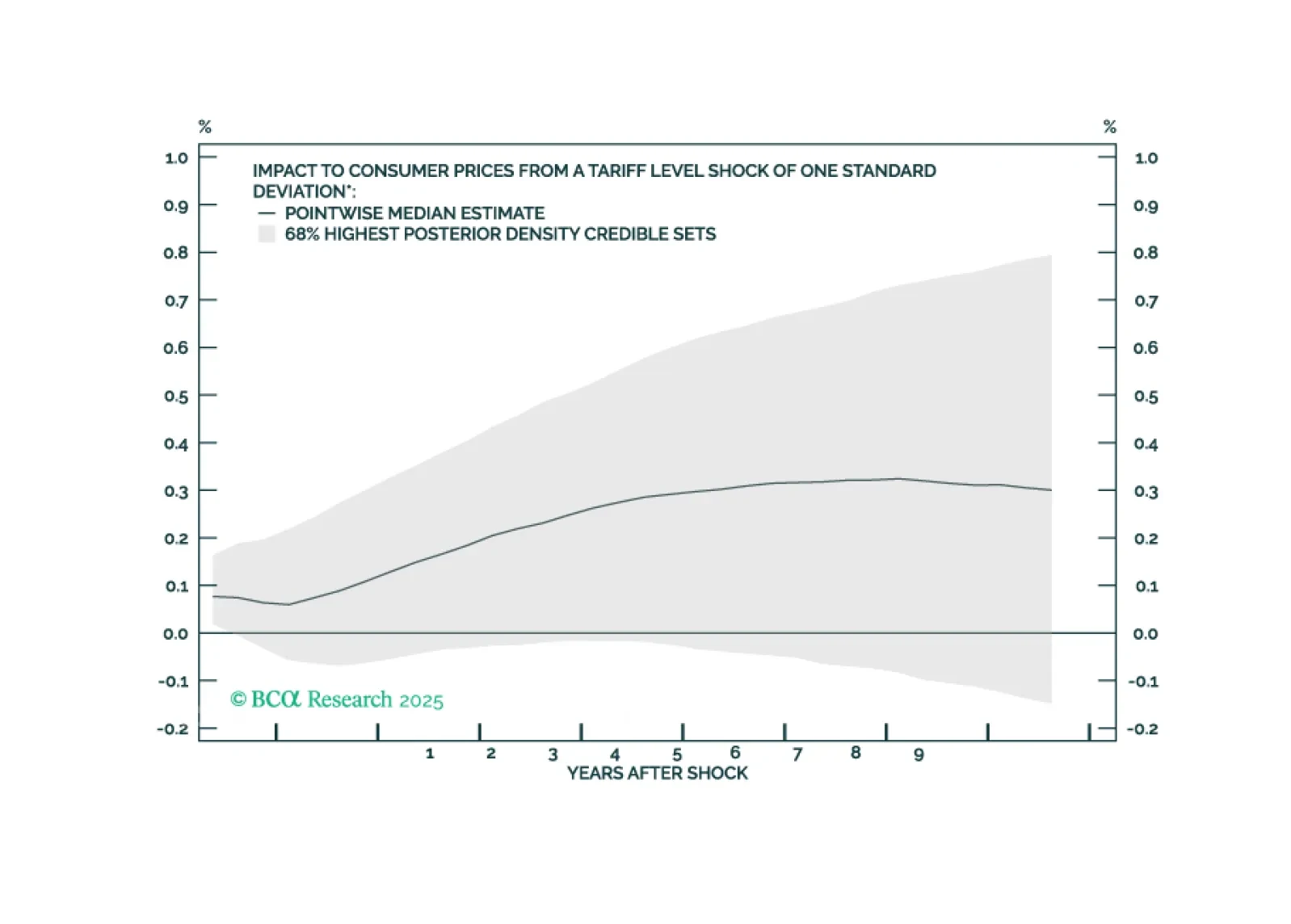

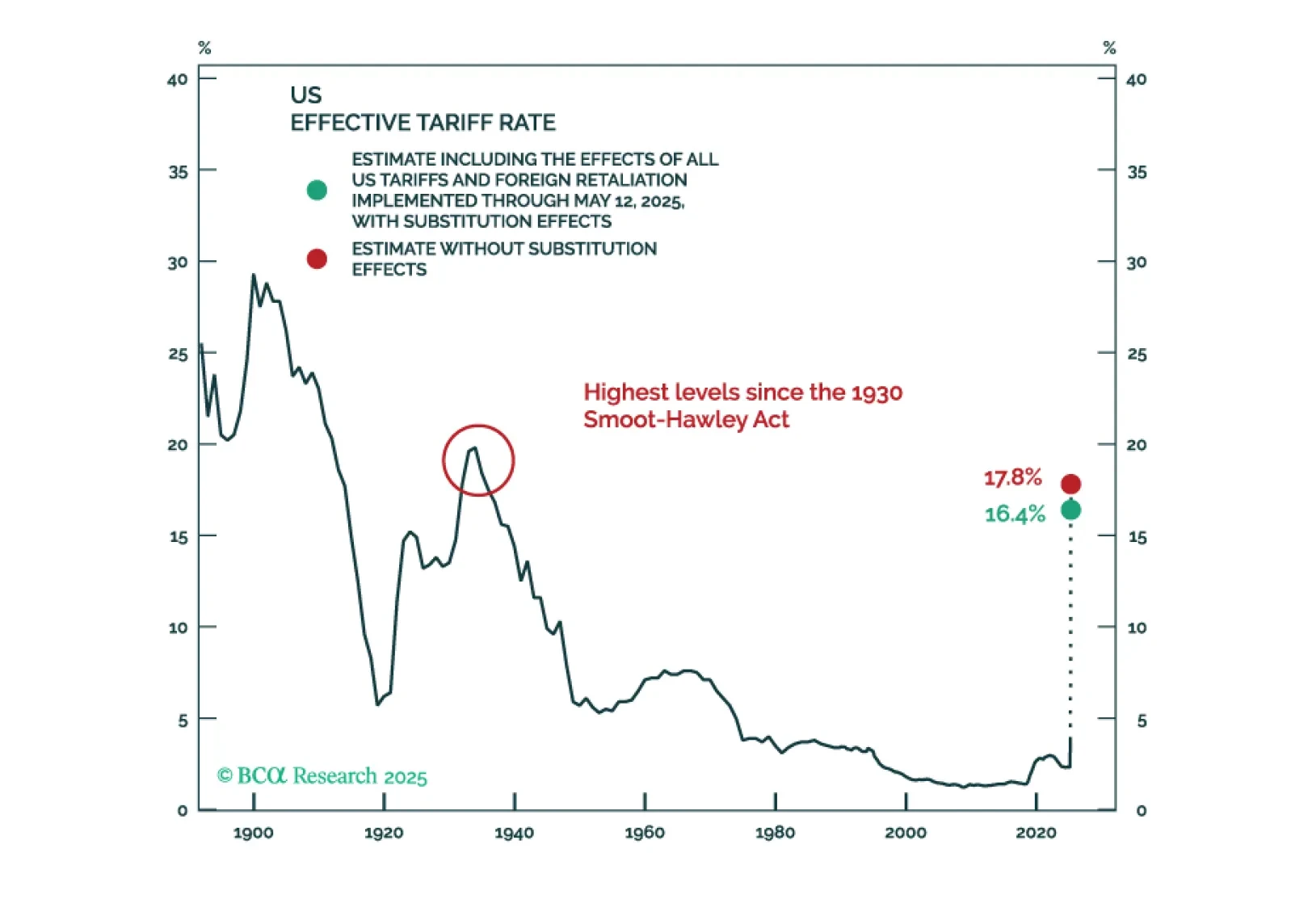

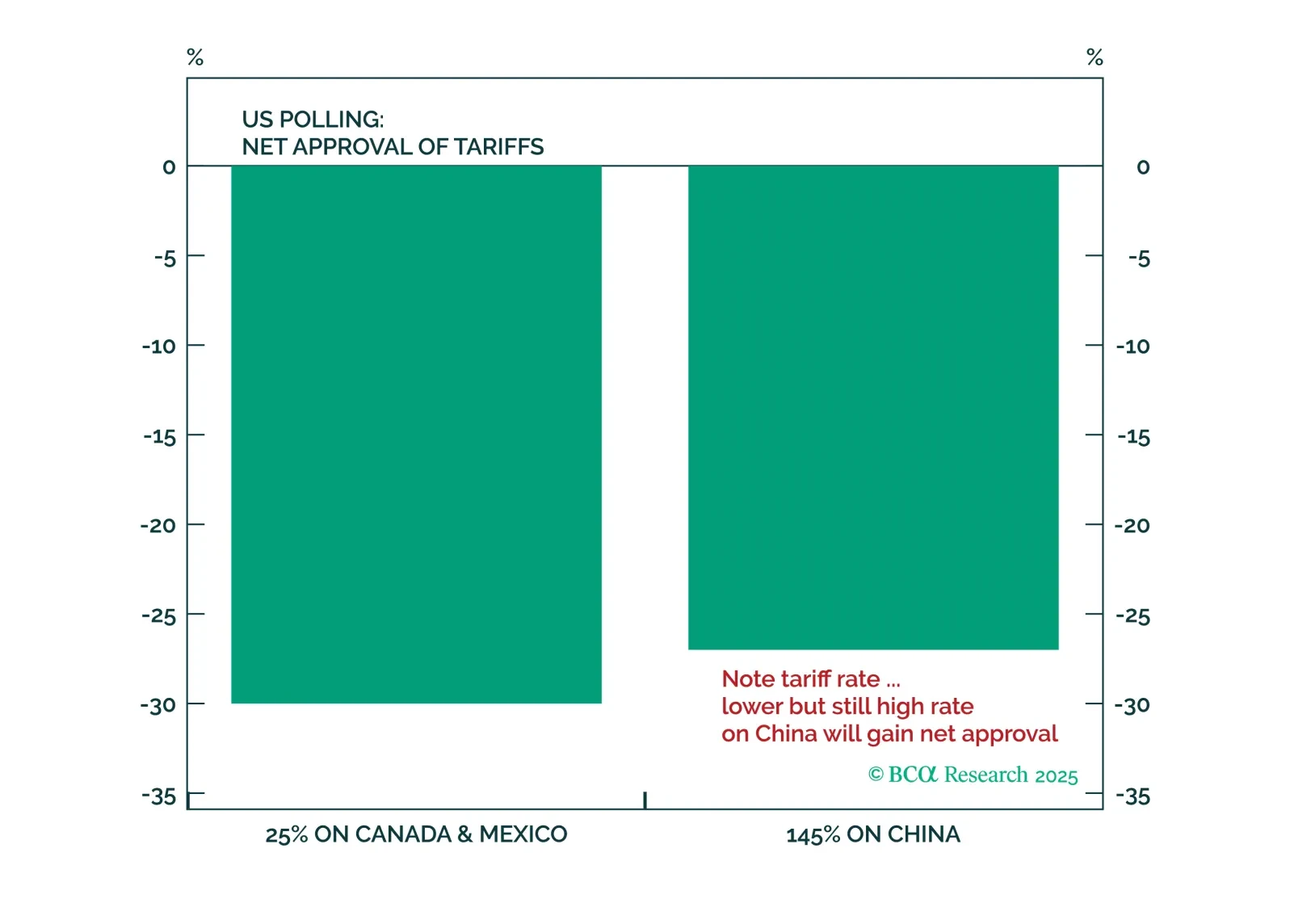

In Section I, Doug warns that US trade policy may produce a considerably worse outcome than investors currently expect. The administration’s apparent 10% tariff baseline is likely to be negative for the US economy and particularly…

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

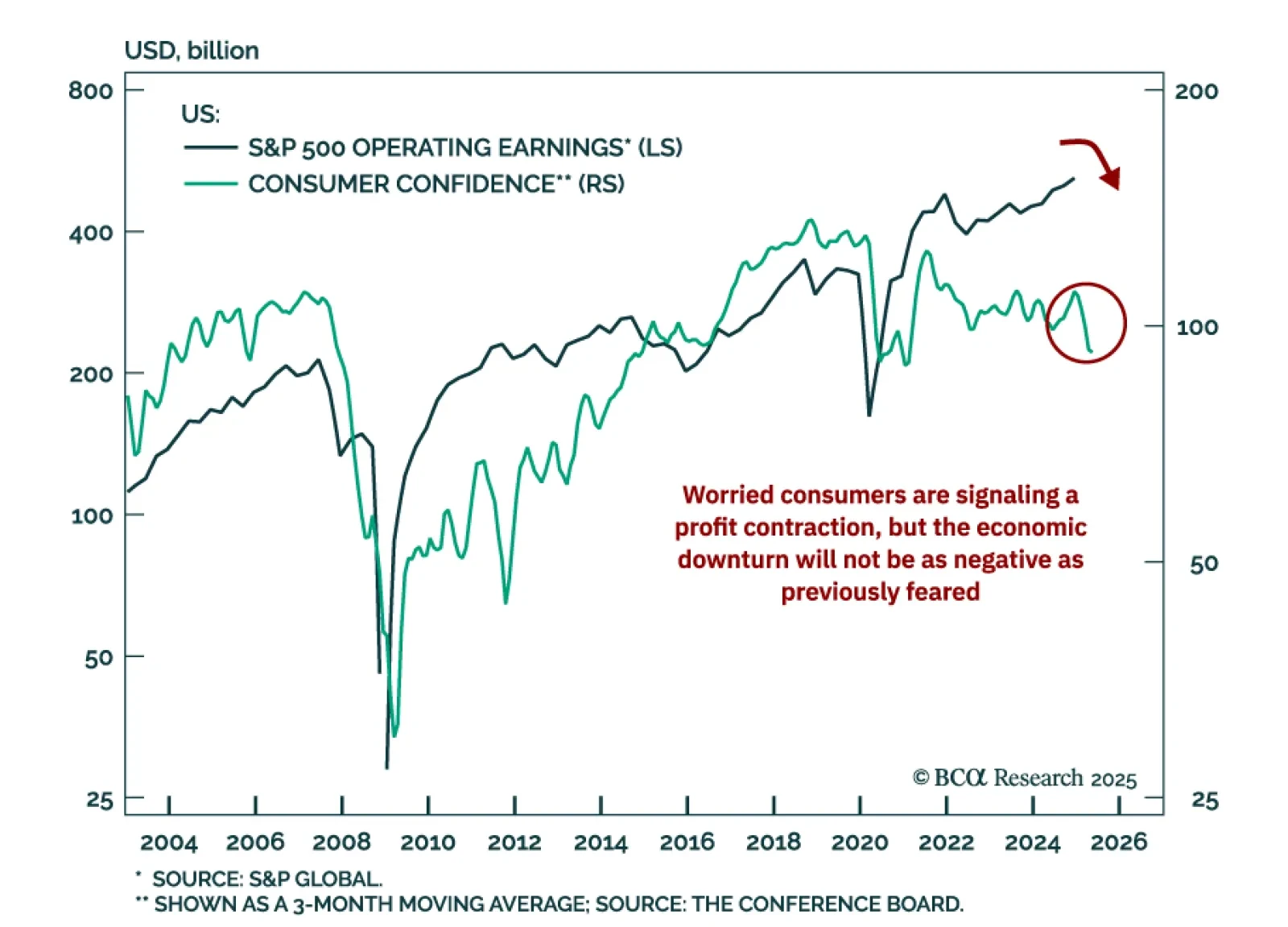

First quarter US earnings have outperformed expectations. A deteriorating economy will eventually weigh on profits, but for now, the worst-case scenario is averted. Our US Equity strategists reviewed the recent earnings season.A…