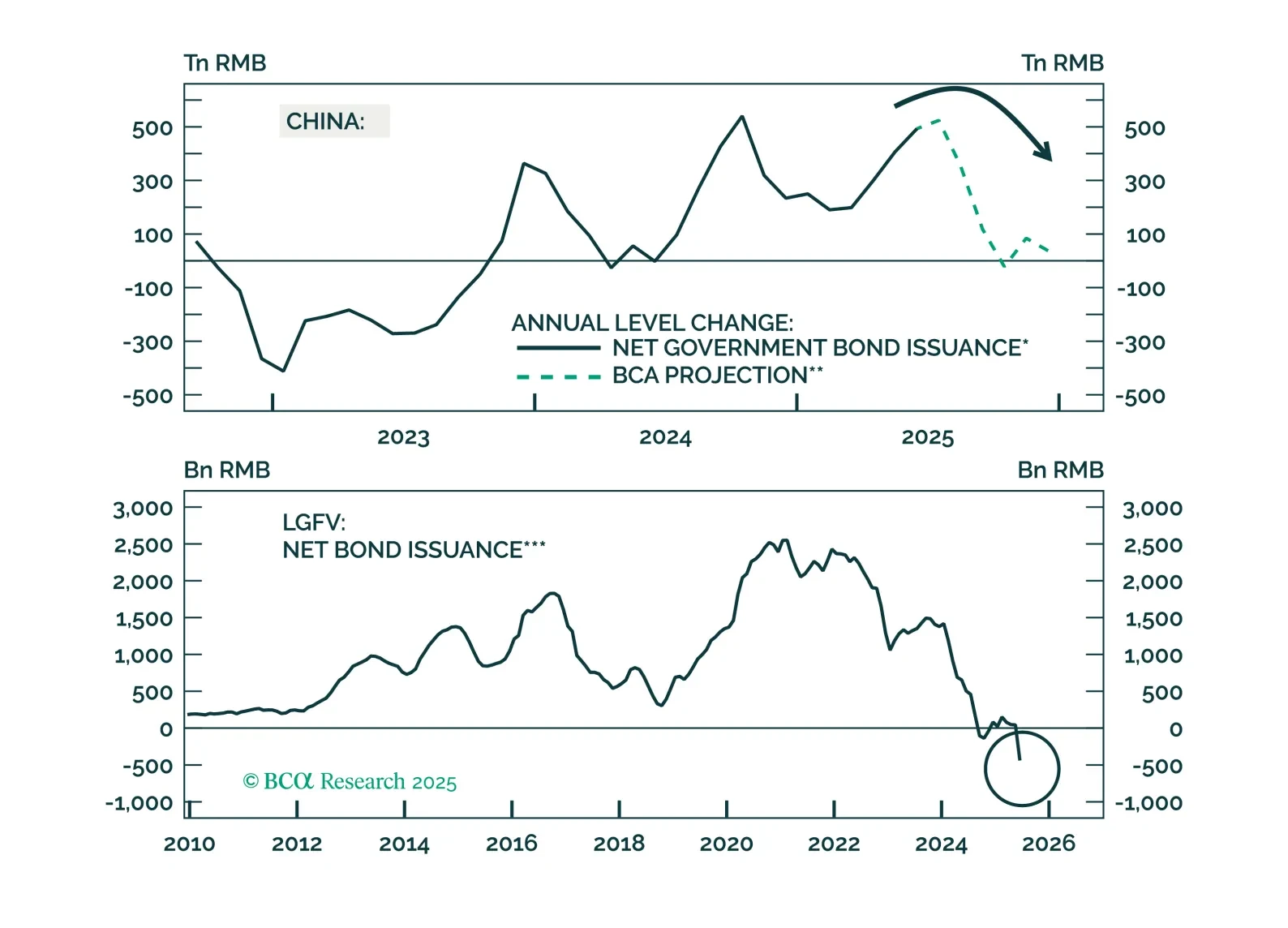

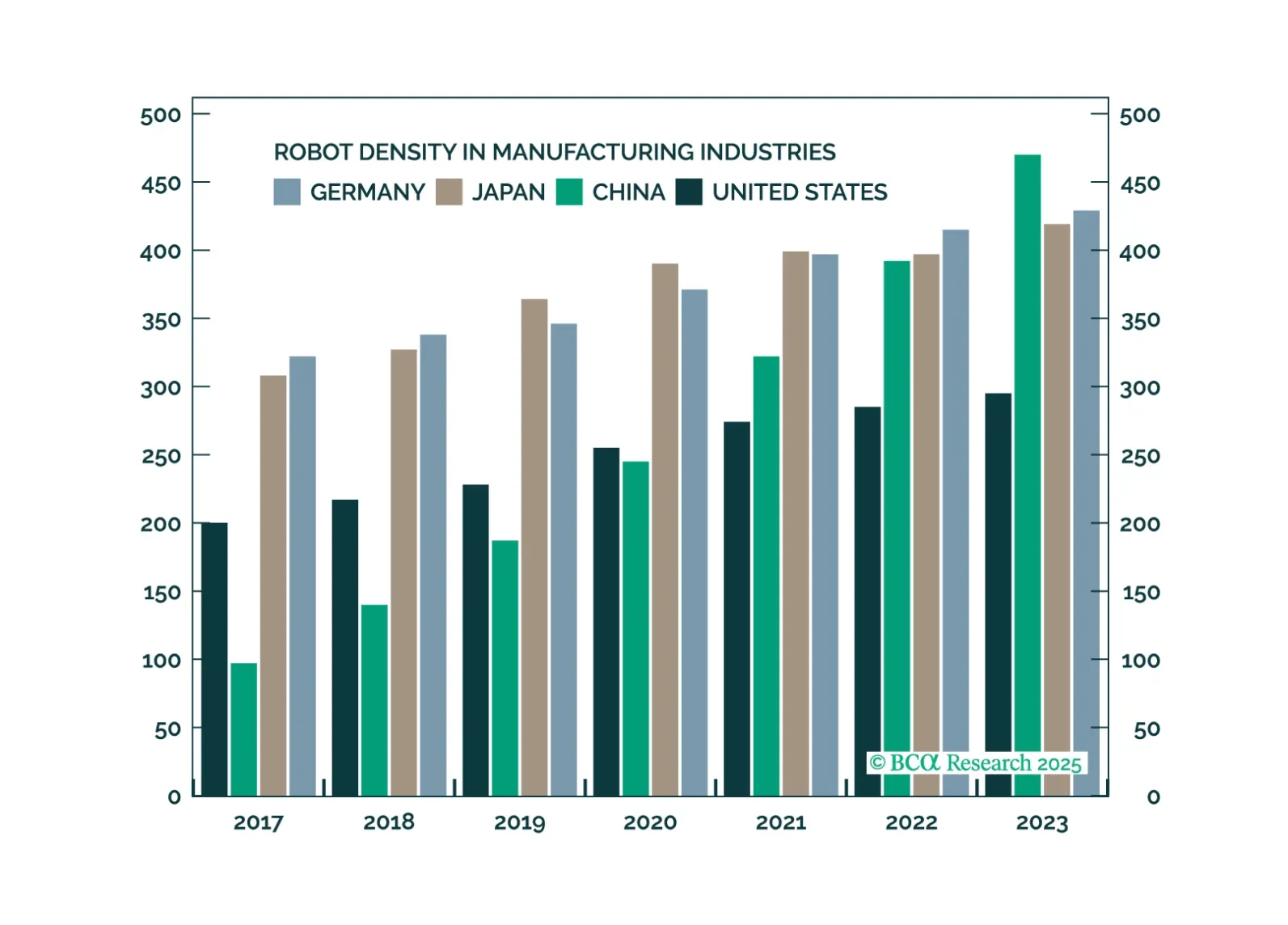

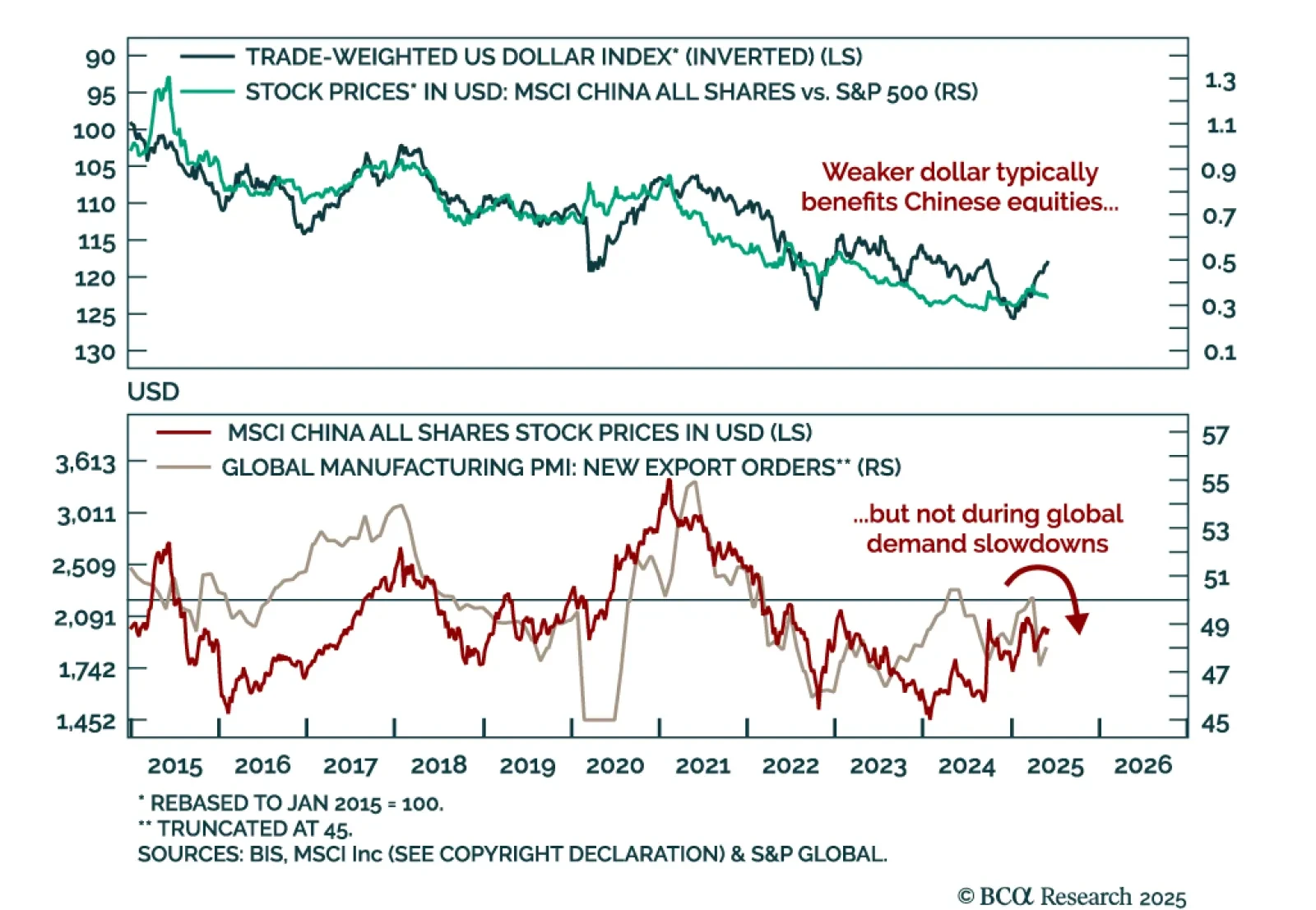

BCA’s China Investment strategists see limited upside for Chinese equities and favor bonds, as trade tensions ease but domestic headwinds persist. This week’s US-China trade talks in London lowered the risk of near-term escalation or…

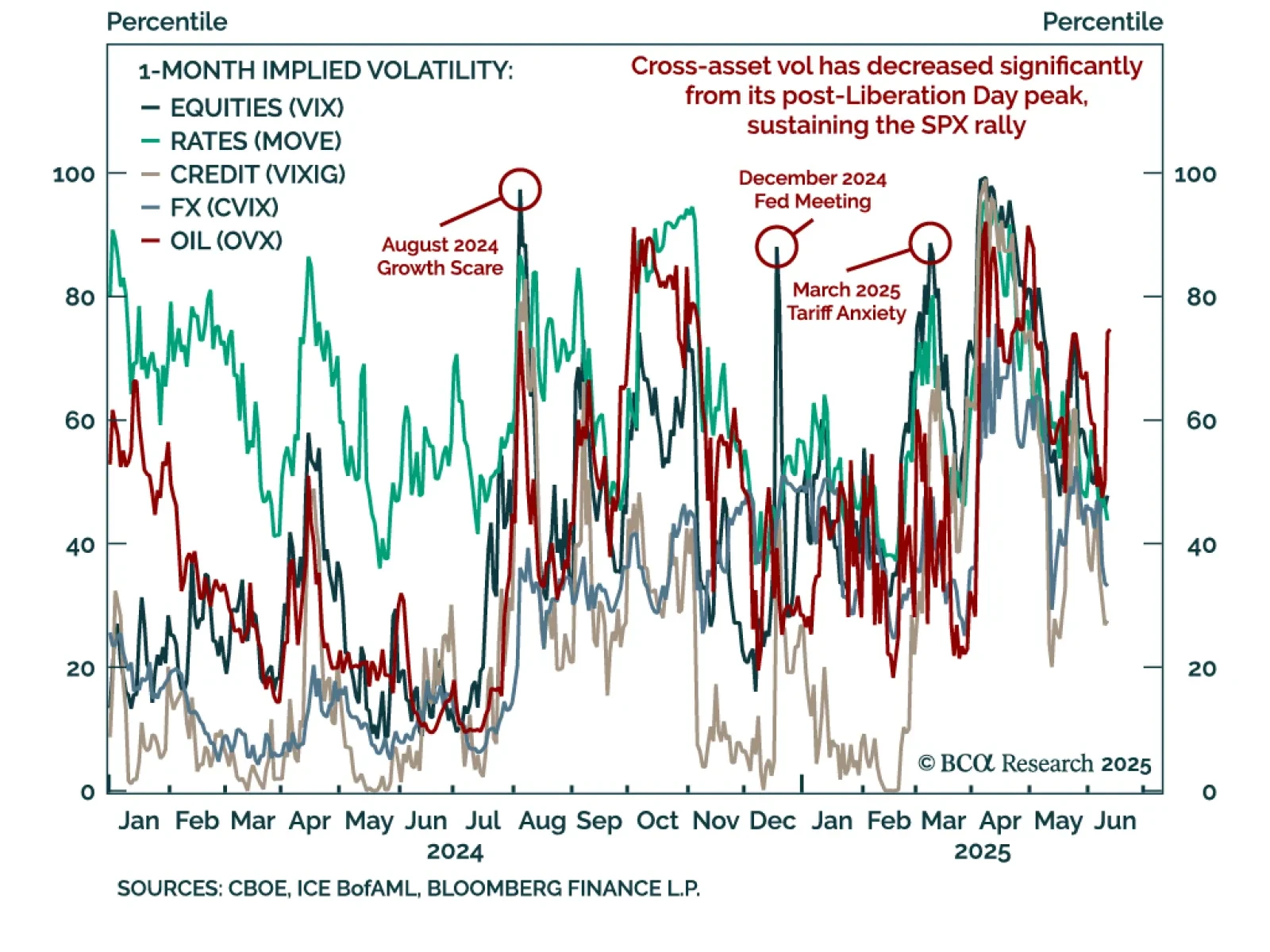

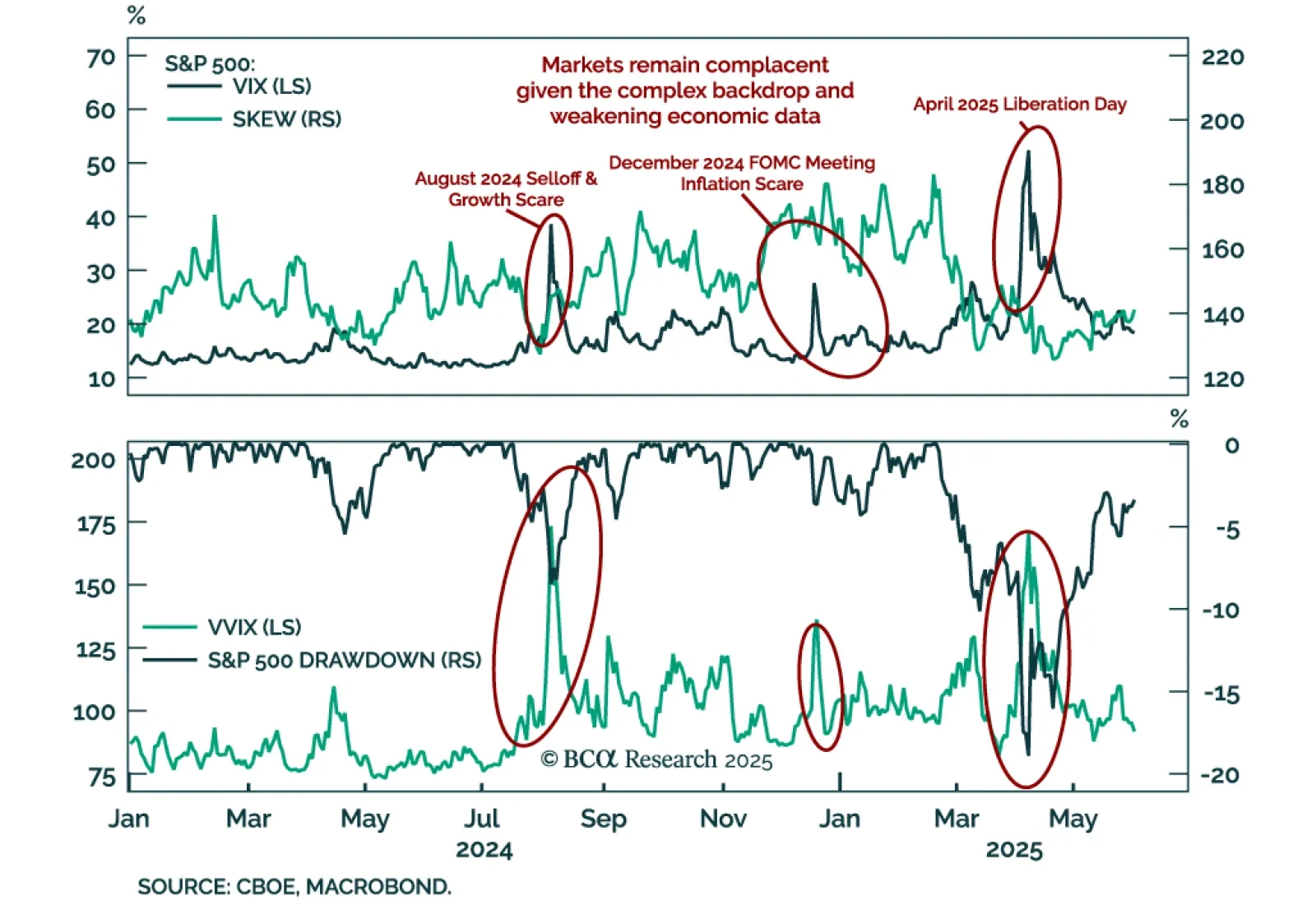

The S&P 500 has breached 6000 and may retest all-time highs, but we would not recommend chasing the rally. Risk assets have shrugged off recession fears, with stress indicators like the VIX, SKEW, and VVIX still subdued,…

The London Sino-US trade talks offered hope of de-escalation, but Chinese equities remain under pressure from deflationary headwinds and lack a clear macro catalyst to trend higher.

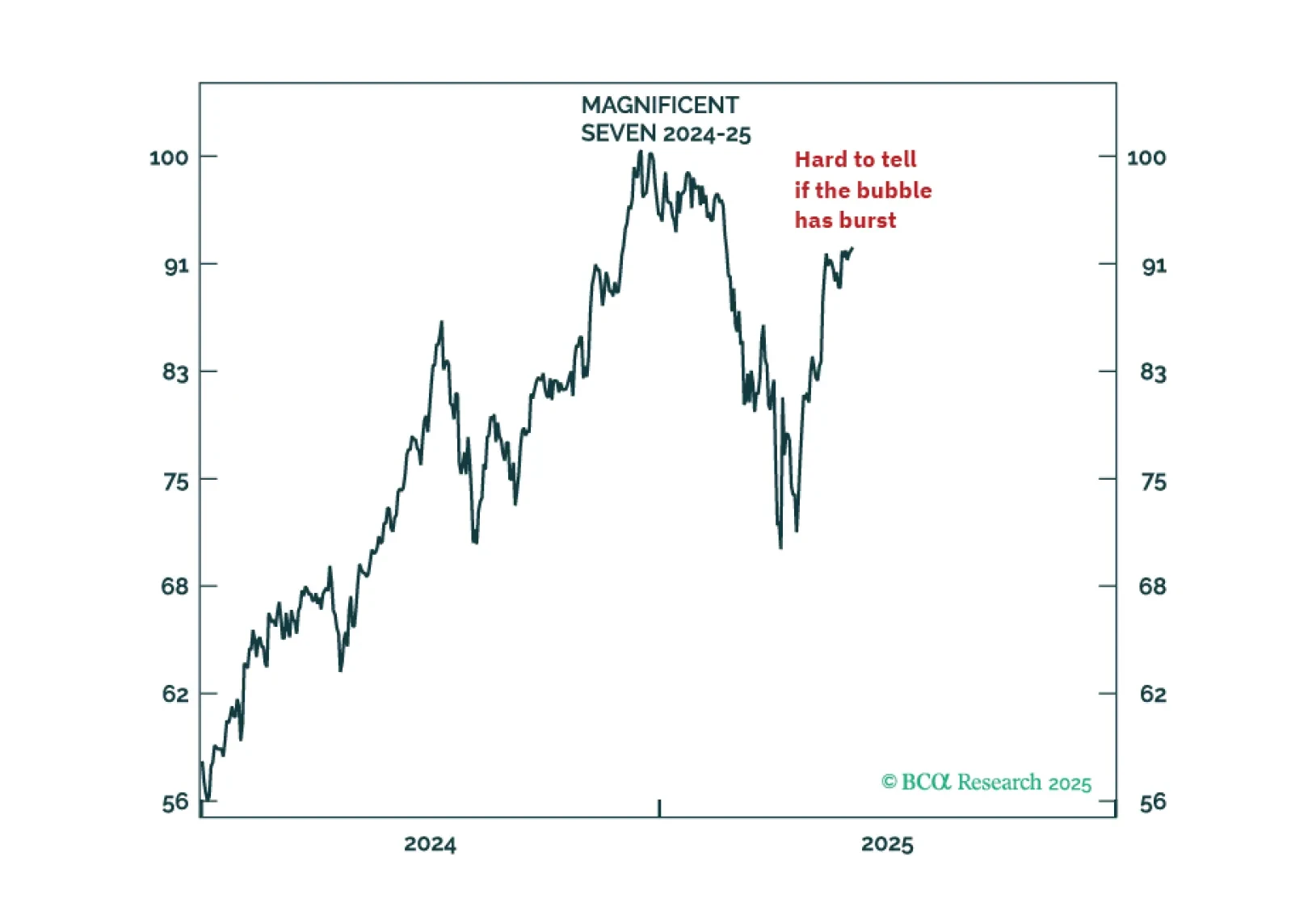

Our Counterpoint Strategists see no signs of recession or market fragility but remain skeptical of US superstar stocks. Winners of past tech cycles rarely lead the next, making Web 2.0 firms unlikely beneficiaries of the AI-driven…

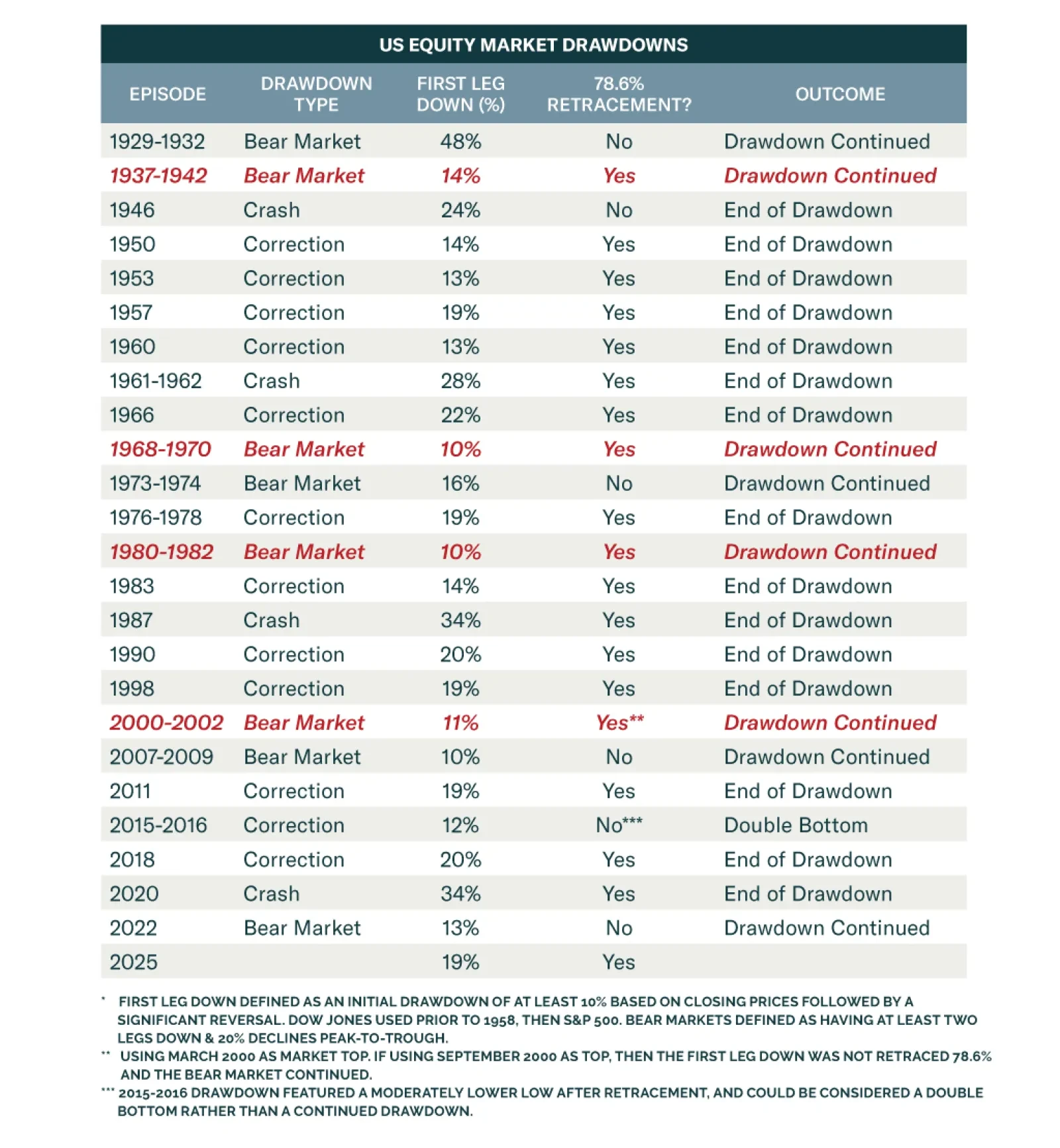

Despite a strong rebound in equities, we remain defensively positioned as recession risks persist and market history warns against premature optimism. The S&P 500 has retraced 78.6% of its initial drawdown, a level that typically…

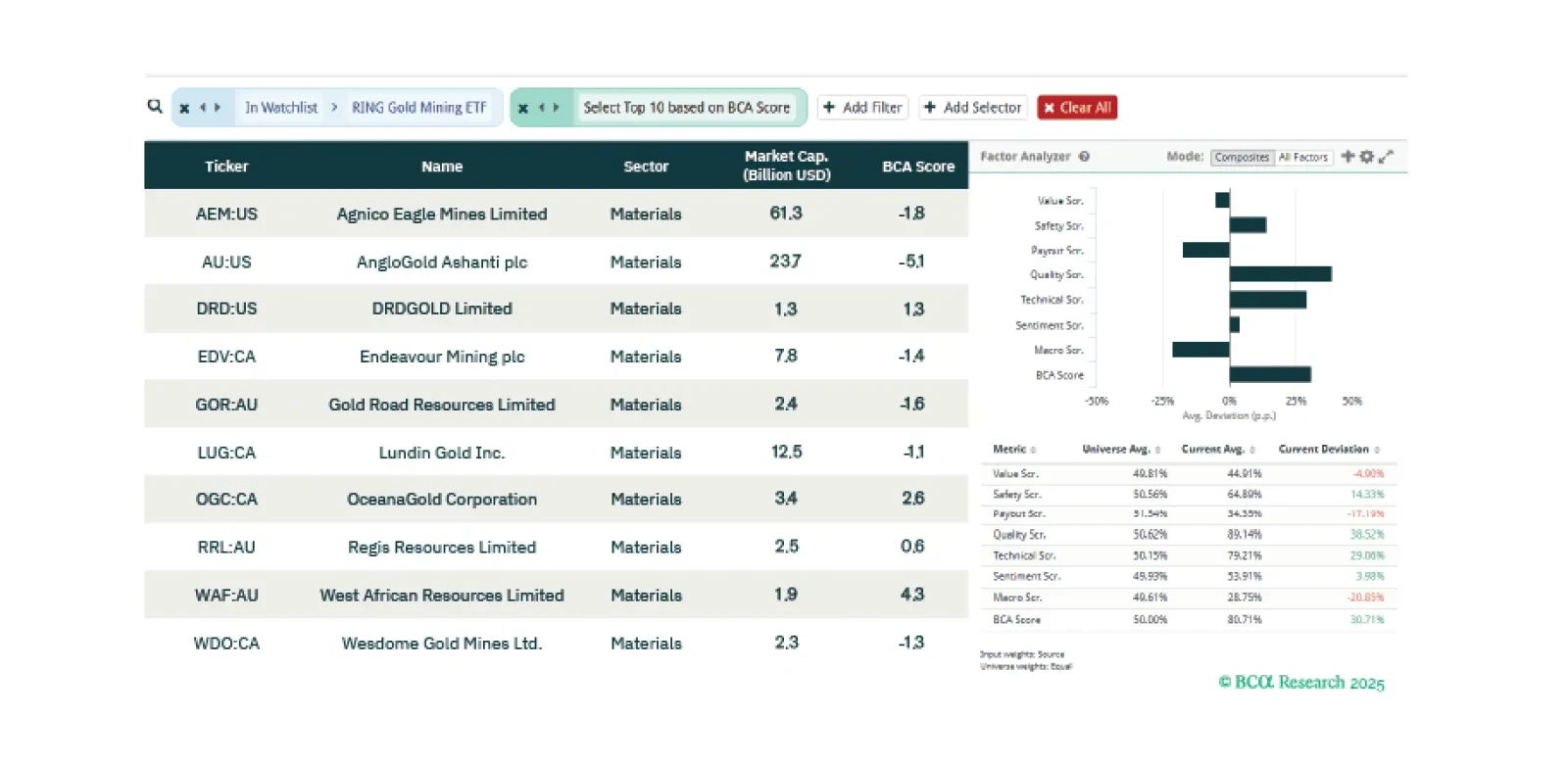

This week our three screeners explore equity trades in gold mining stocks, European banks, and US stocks ex-Tech should a recession not be imminent.

I am a structural disbeliever in the US superstar stocks because these winners of the previous technology, Web 2.0, are unlikely all to be the winners of the latest technology, AI. But I would suspend my disbelief if the Magnificent-…

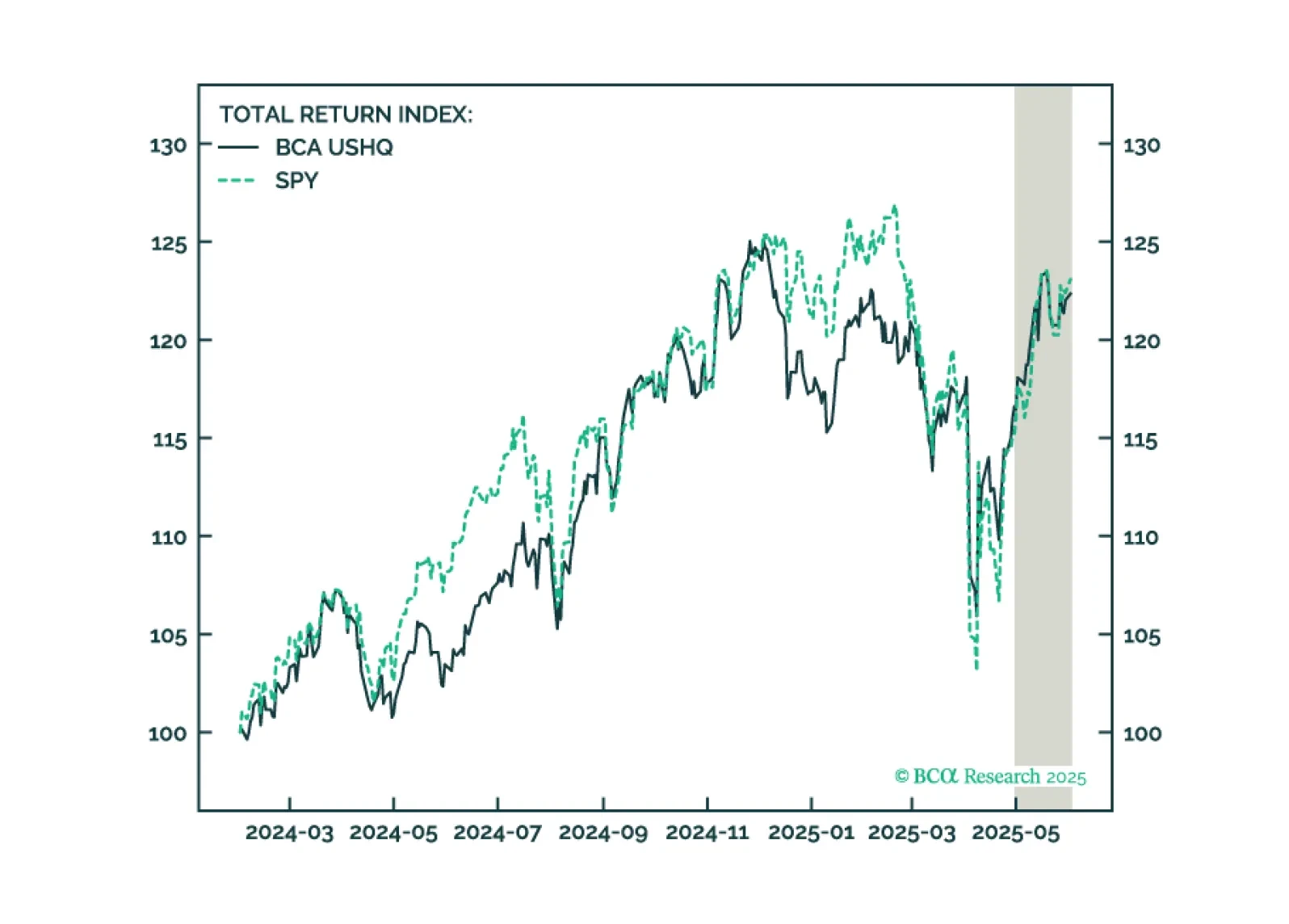

The US High Quality (USHQ) portfolio underperformed its benchmark through May, returning 5.1%, whilst its SPY benchmark returned 6.1%. On a trailing three-month basis, performance is also slightly weaker vs. benchmark, with USHQ…

The S&P 500’s rebound has outpaced fundamentals, and with the index back at the top of its range, investors shouldn’t chase the rally. Stocks are once again flirting with all-time highs after a 19.8% post-Liberation Day…