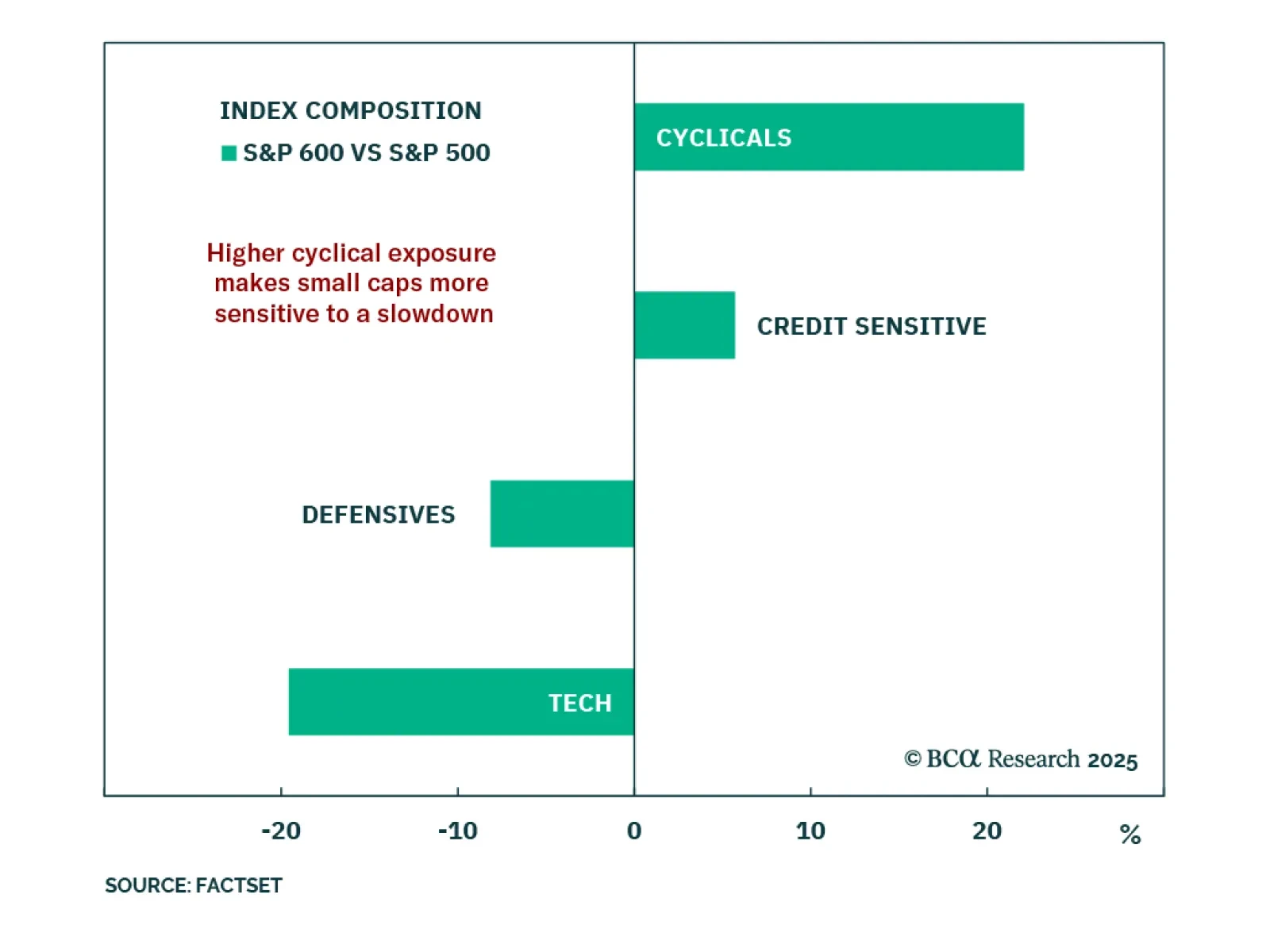

Our US Equity strategists remain cautious on small caps, as tariff exposure and slowing growth continue to weigh on this equity style. With the S&P 500 nearing its recent peak, some investors are rotating into riskier segments…

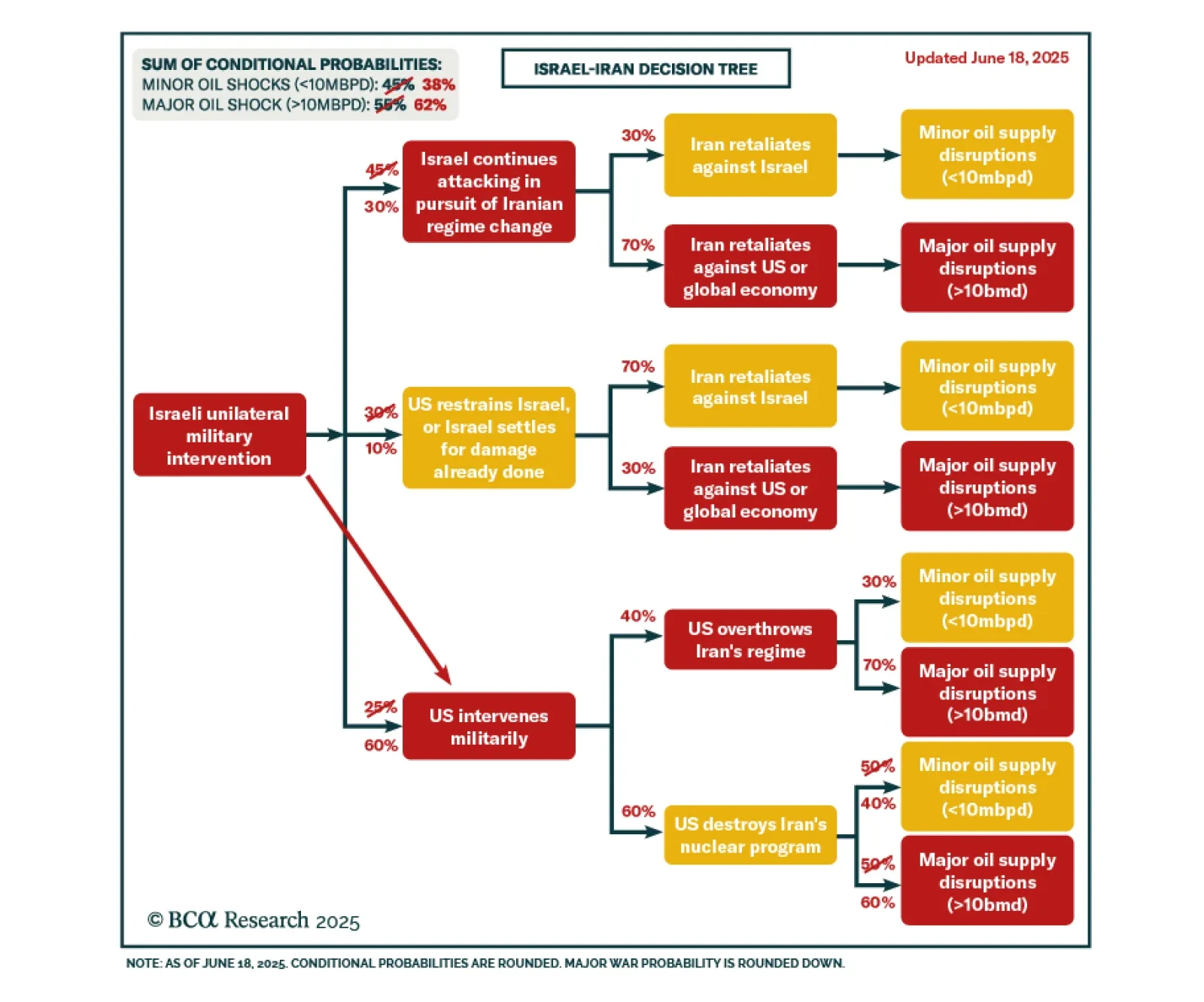

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

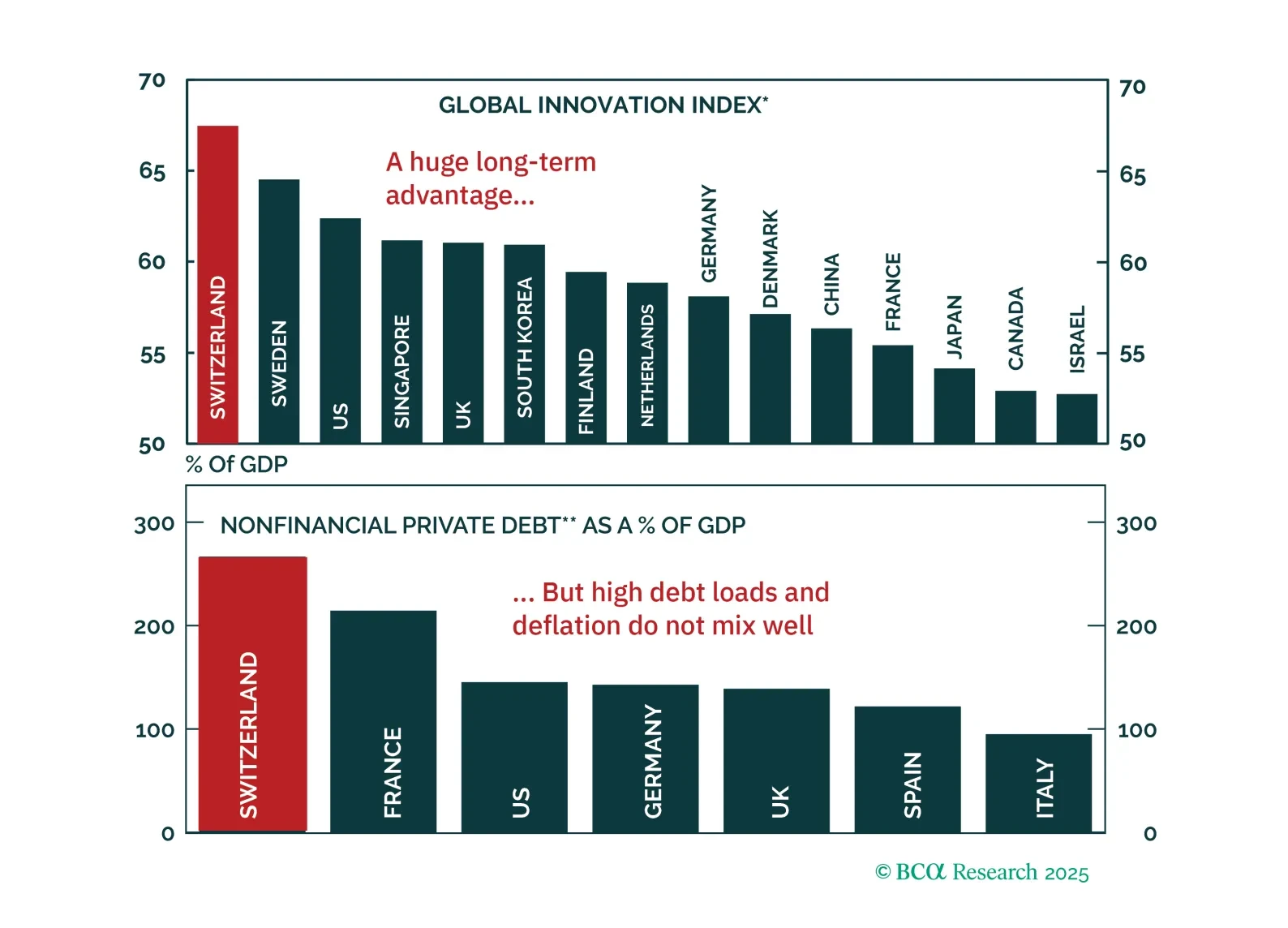

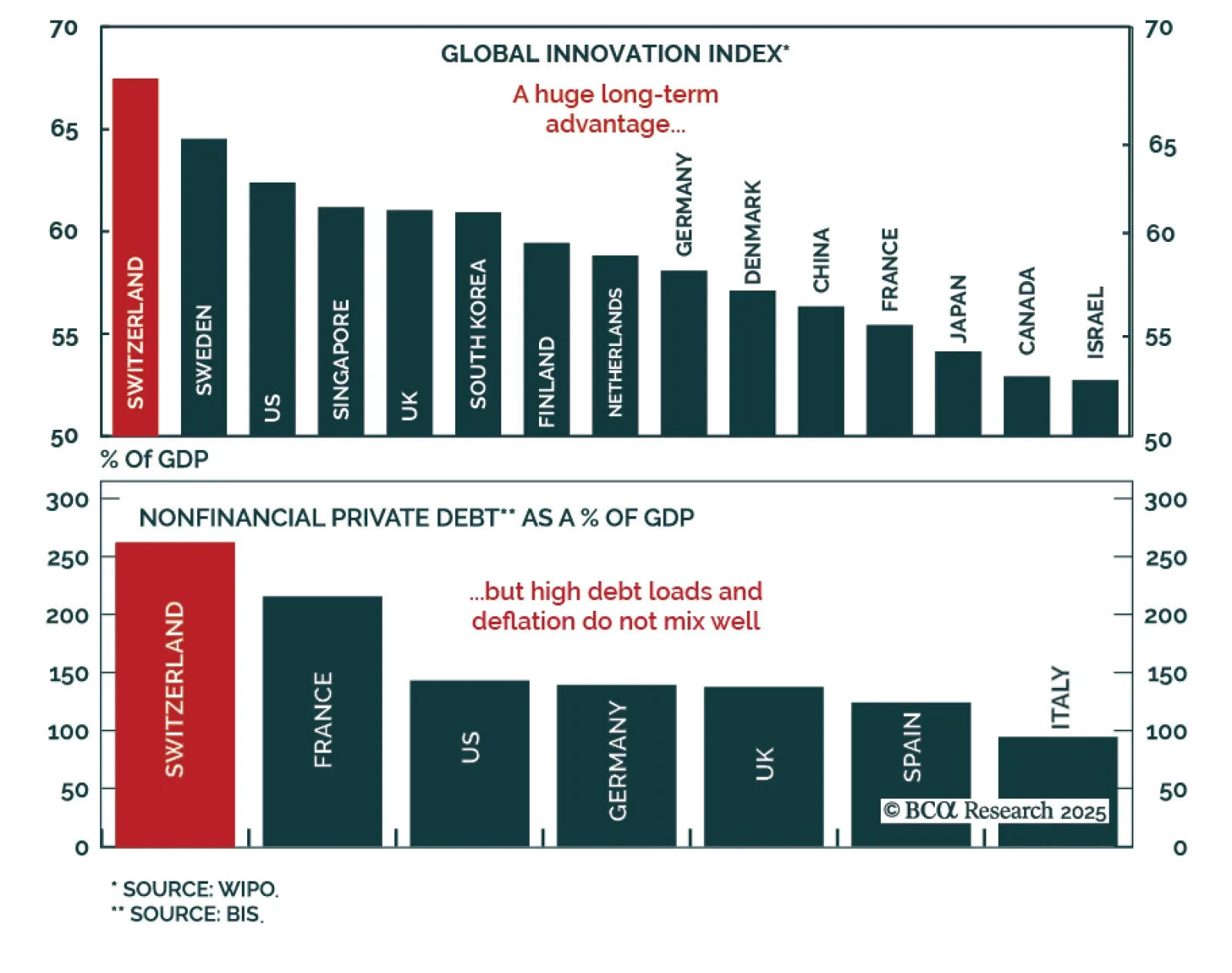

Our European Investment strategists believe Switzerland is no longer a tactical haven and recommend underweighting CHF and Swiss equities in favor of Swiss bonds. The country retains strong structural fundamentals: High productivity…

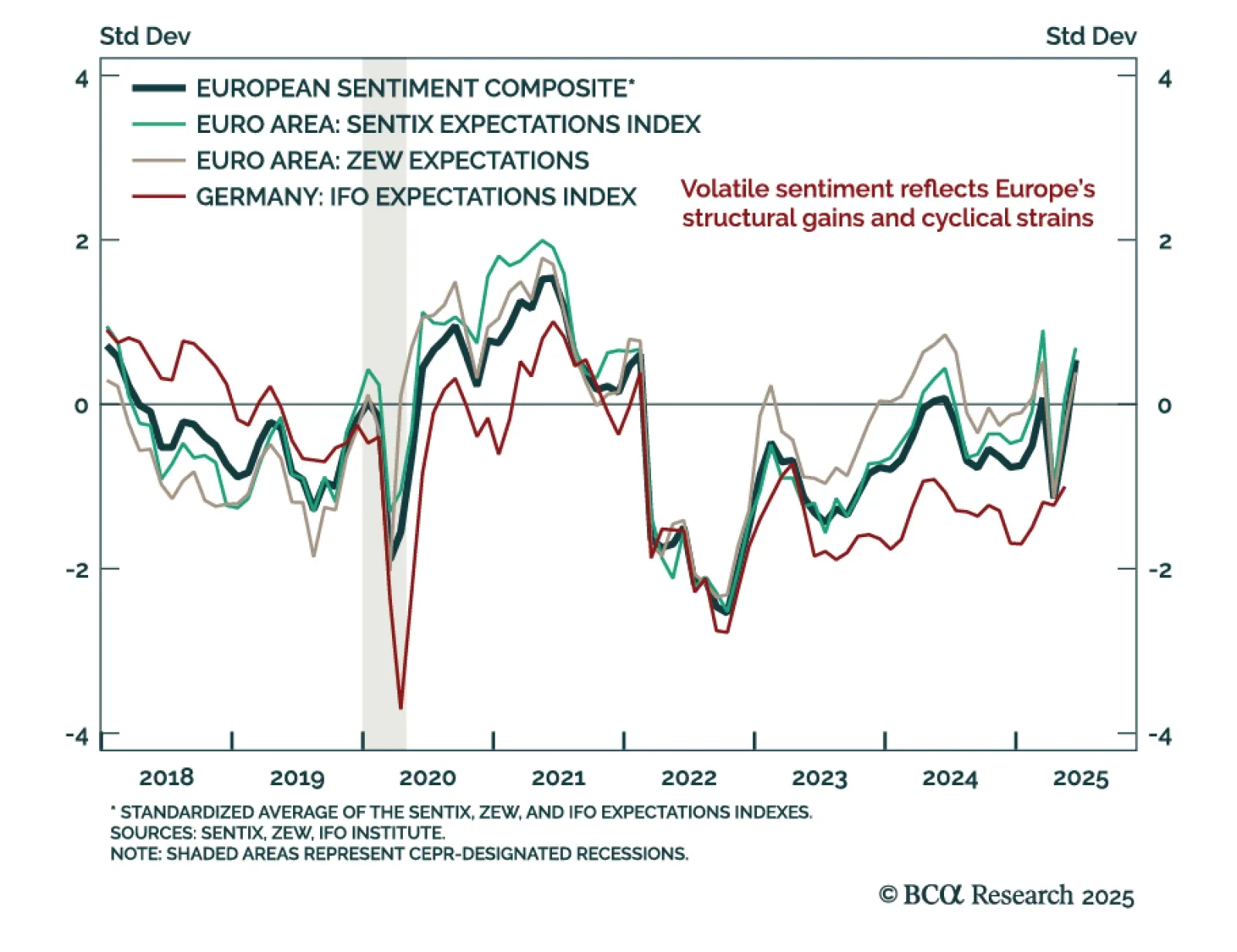

ZEW expectations jumped in May, but underlying macro fragility supports a cautious stance on eurozone assets. The ZEW expectations index for the euro area rose to 35.3 from 11.6, with Germany also beating expectations. The current…

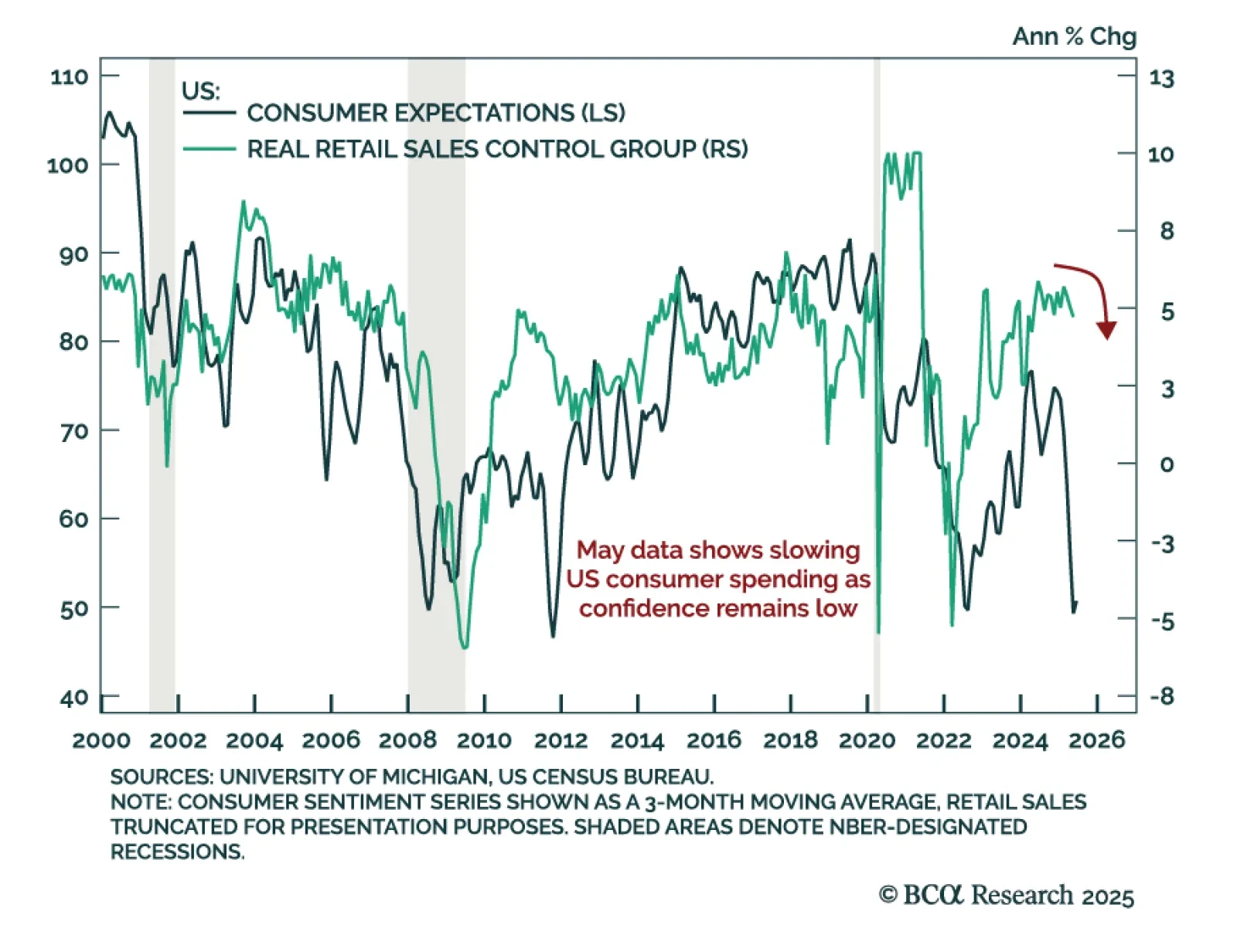

US May retail sales missed expectations, reinforcing our defensive allocation stance. Headline sales fell 0.9% m/m from a downwardly revised -0.1%. Core sales dropped 0.1%, while the control group rose 0.4%, beating estimates. Auto…

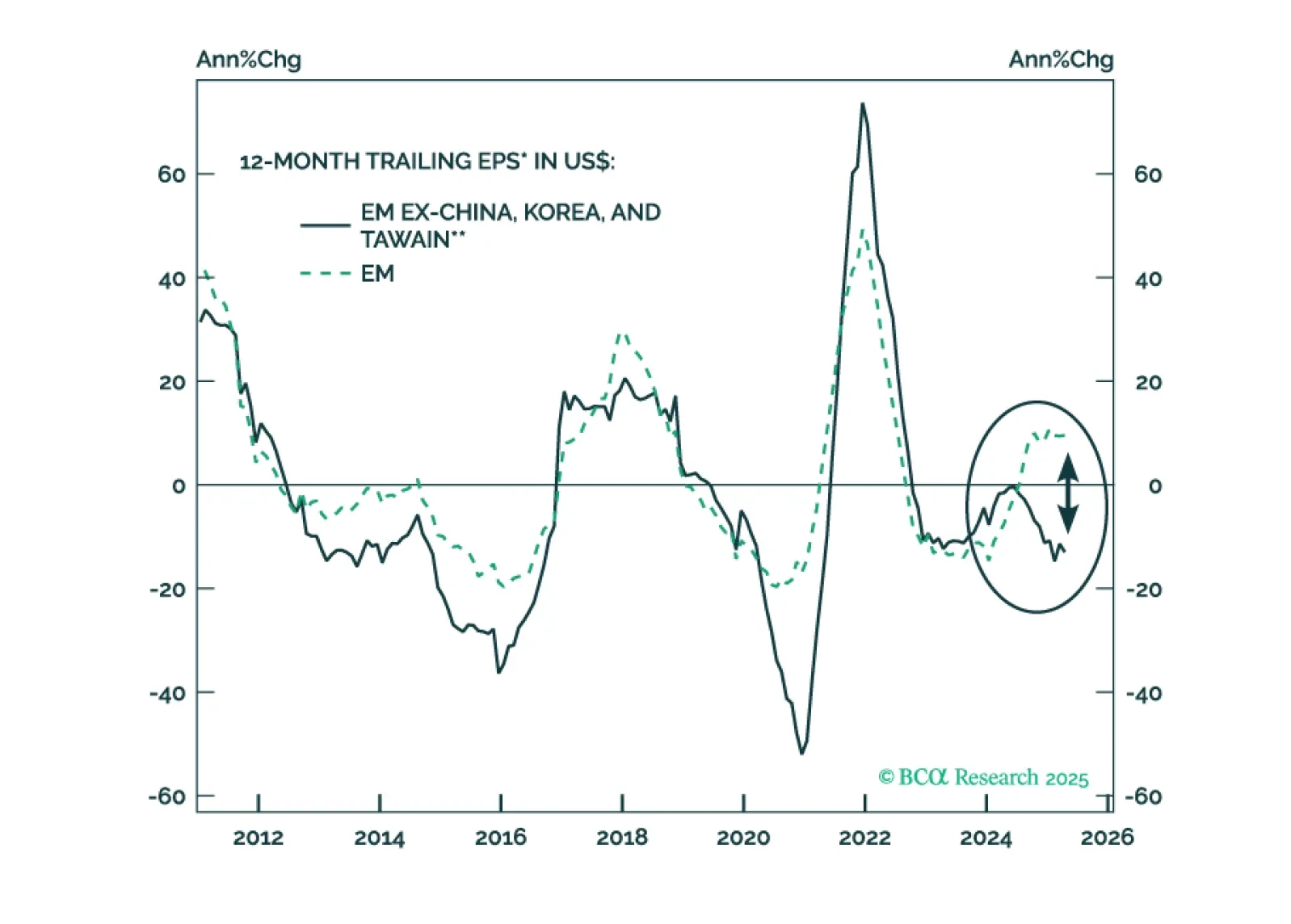

The EM EPS recovery has been narrow, solely driven by TMT stocks in China, Korea, and Taiwan. EM corporate profits are set to contract in the next six to nine months. Unlike in the past, US dollar weakness will be…

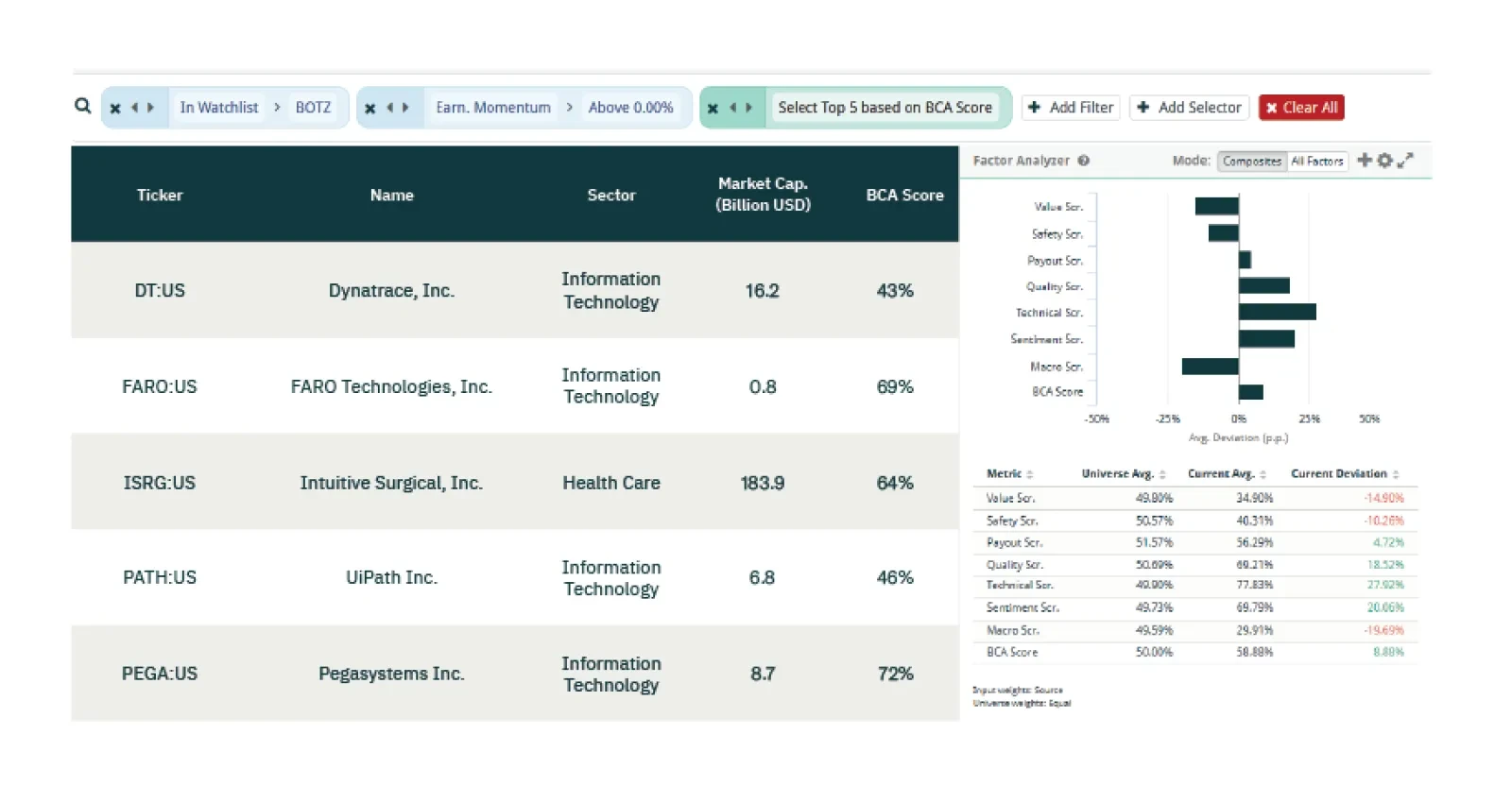

This week our three screeners explore equity trades in Robotics, European Quality and Technical, and Hong Kong.

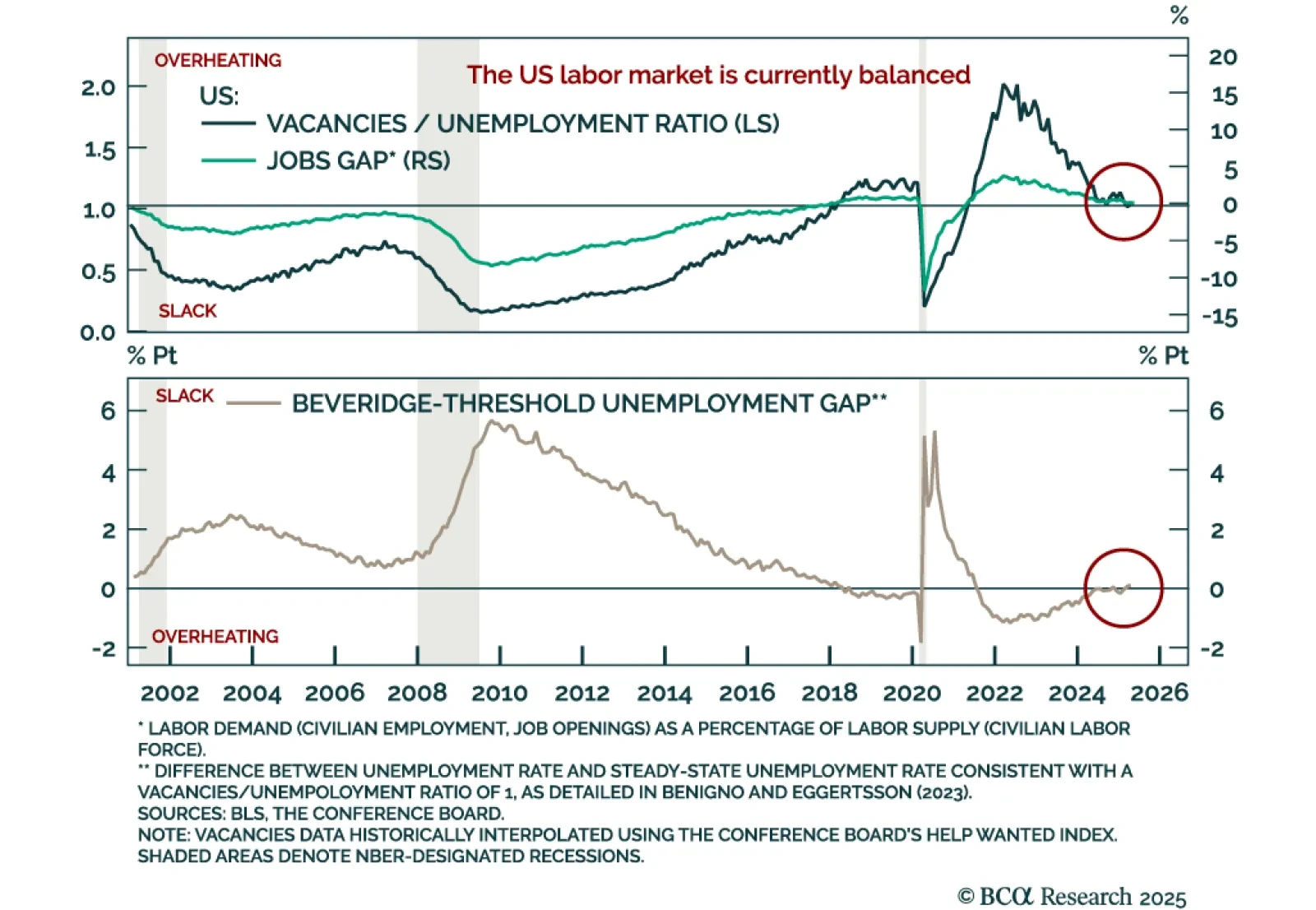

The US labor market appears balanced but at a pivotal point, with further weakness likely to prompt a shift to maximum defensiveness. After running the hottest since the 1960s, the labor market has gradually cooled. That rebalancing…

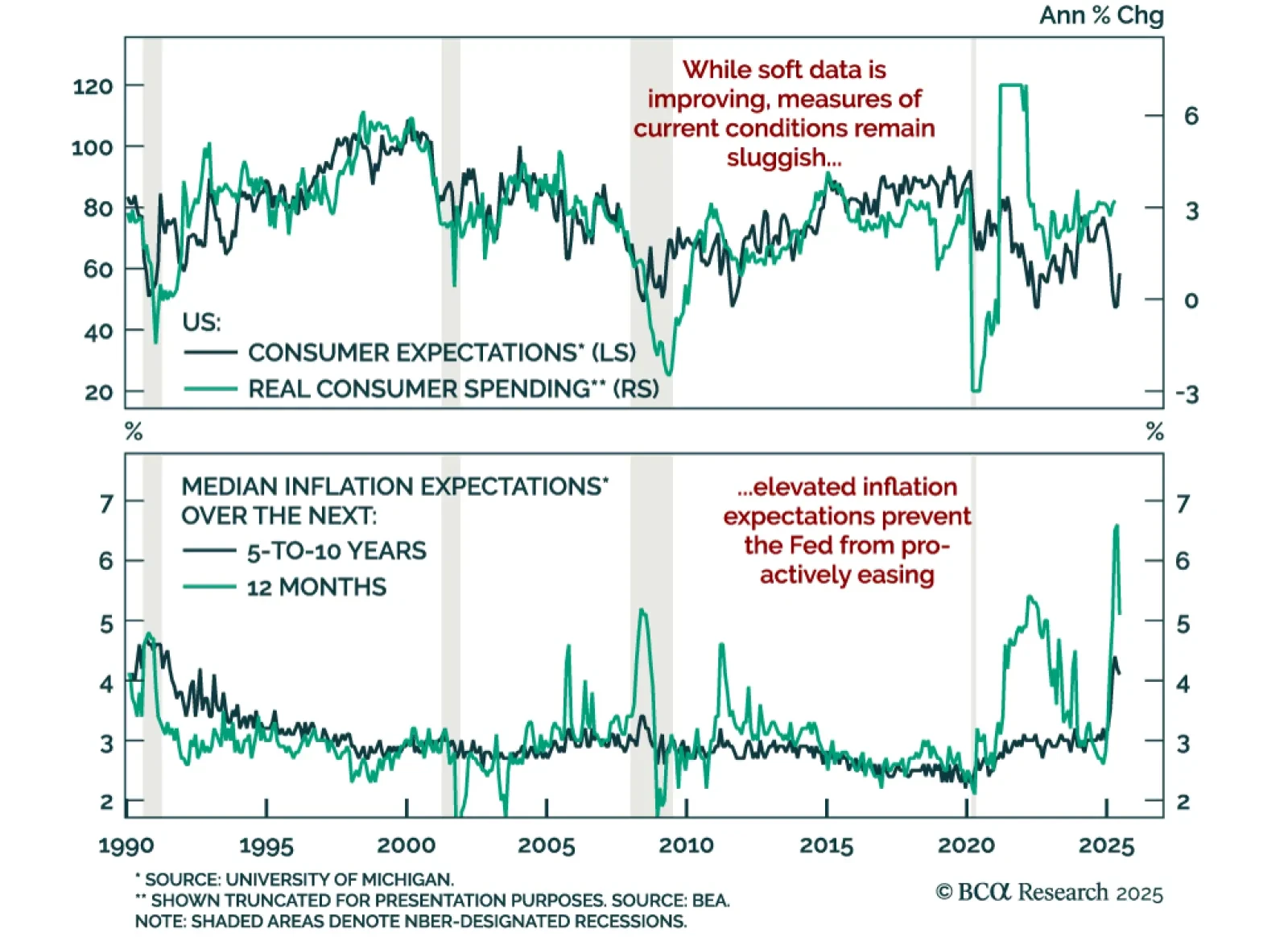

While consumer sentiment is rebounding, sticky inflation expectations and slowing growth warrant staying long duration and steepeners. The preliminary June University of Michigan Consumer Sentiment Index surprised to the upside,…