Equities

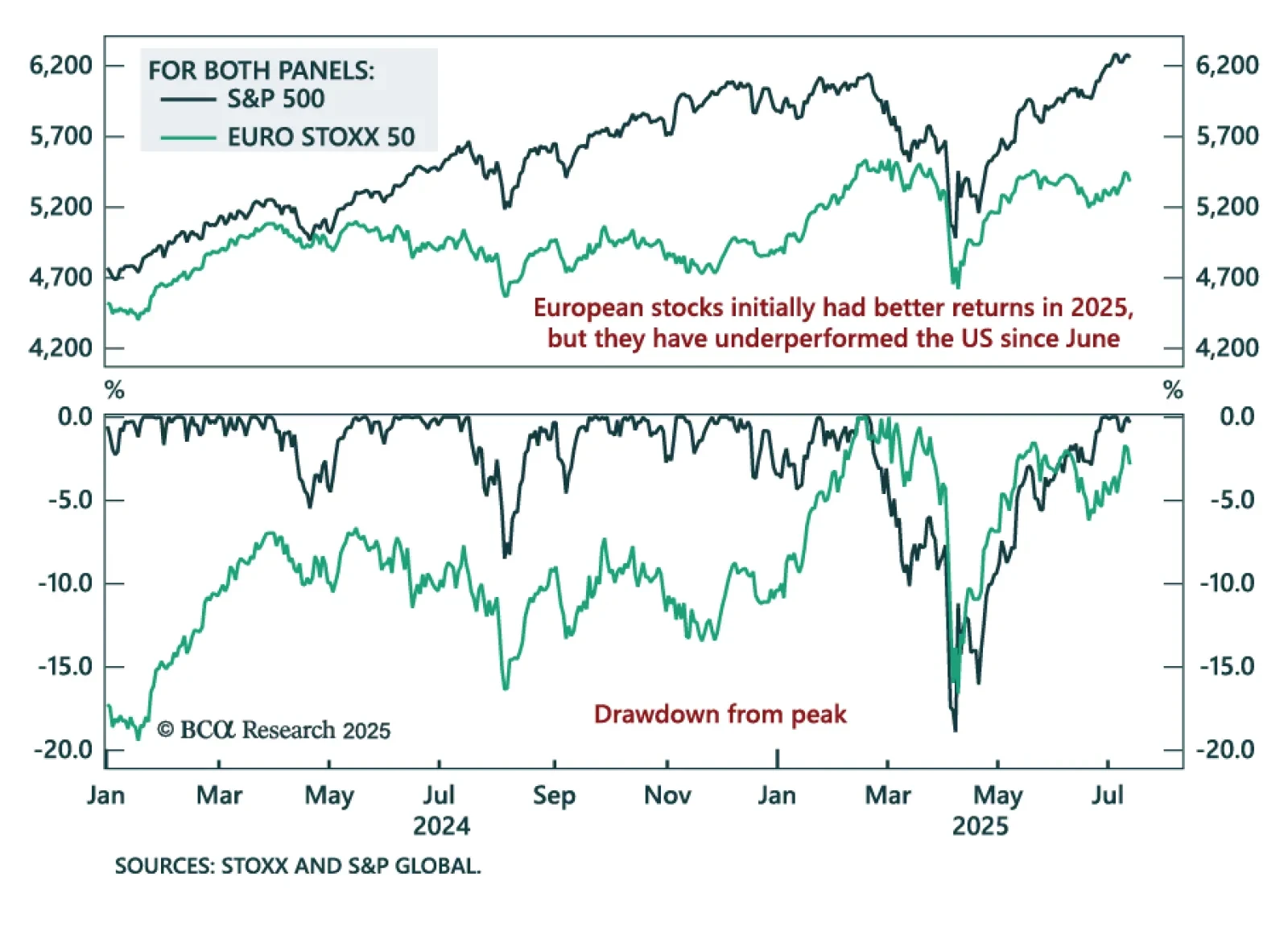

SX5E Fails to Break Out as Financial Conditions Tighten…

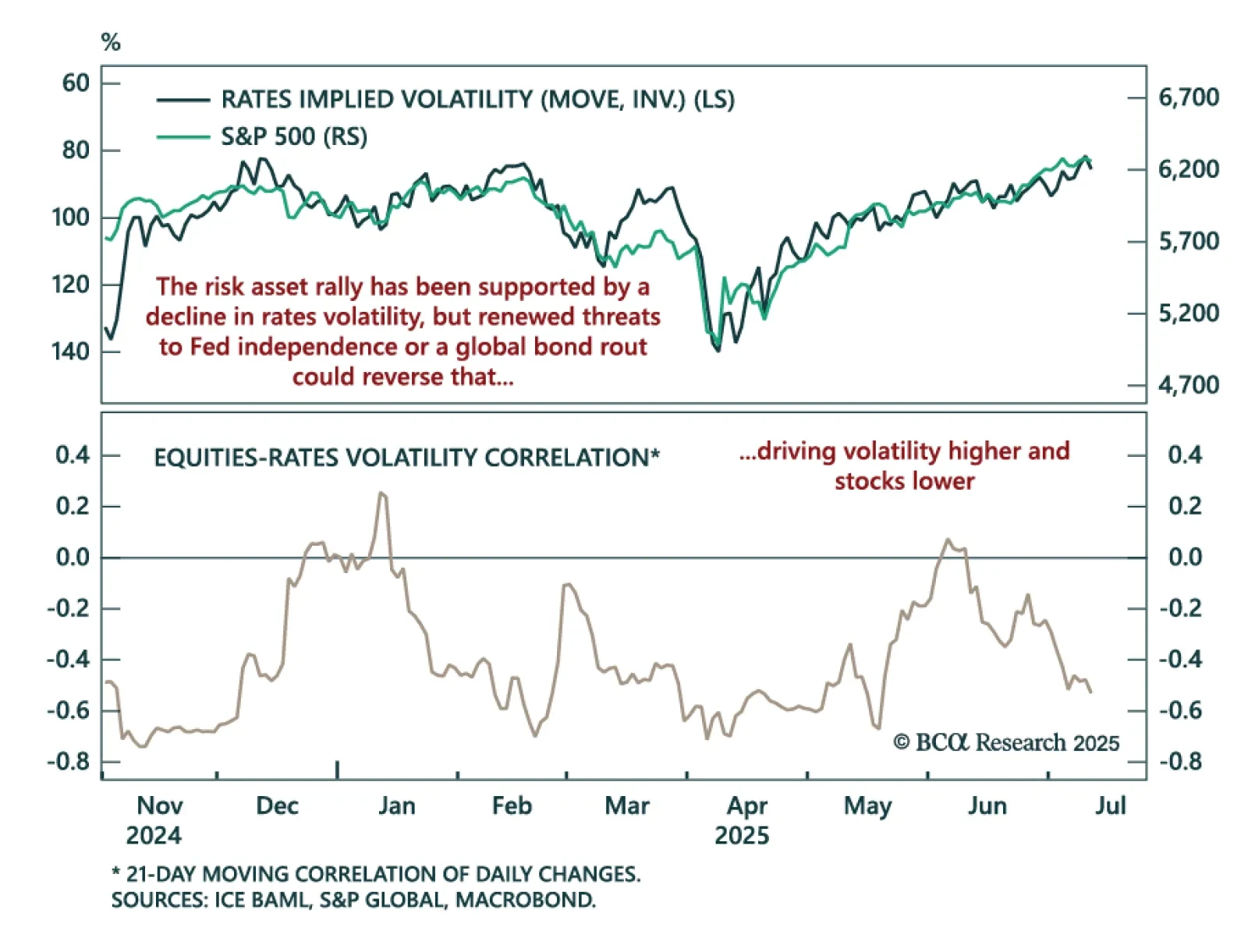

Risk Assets Face Negative Convexity…

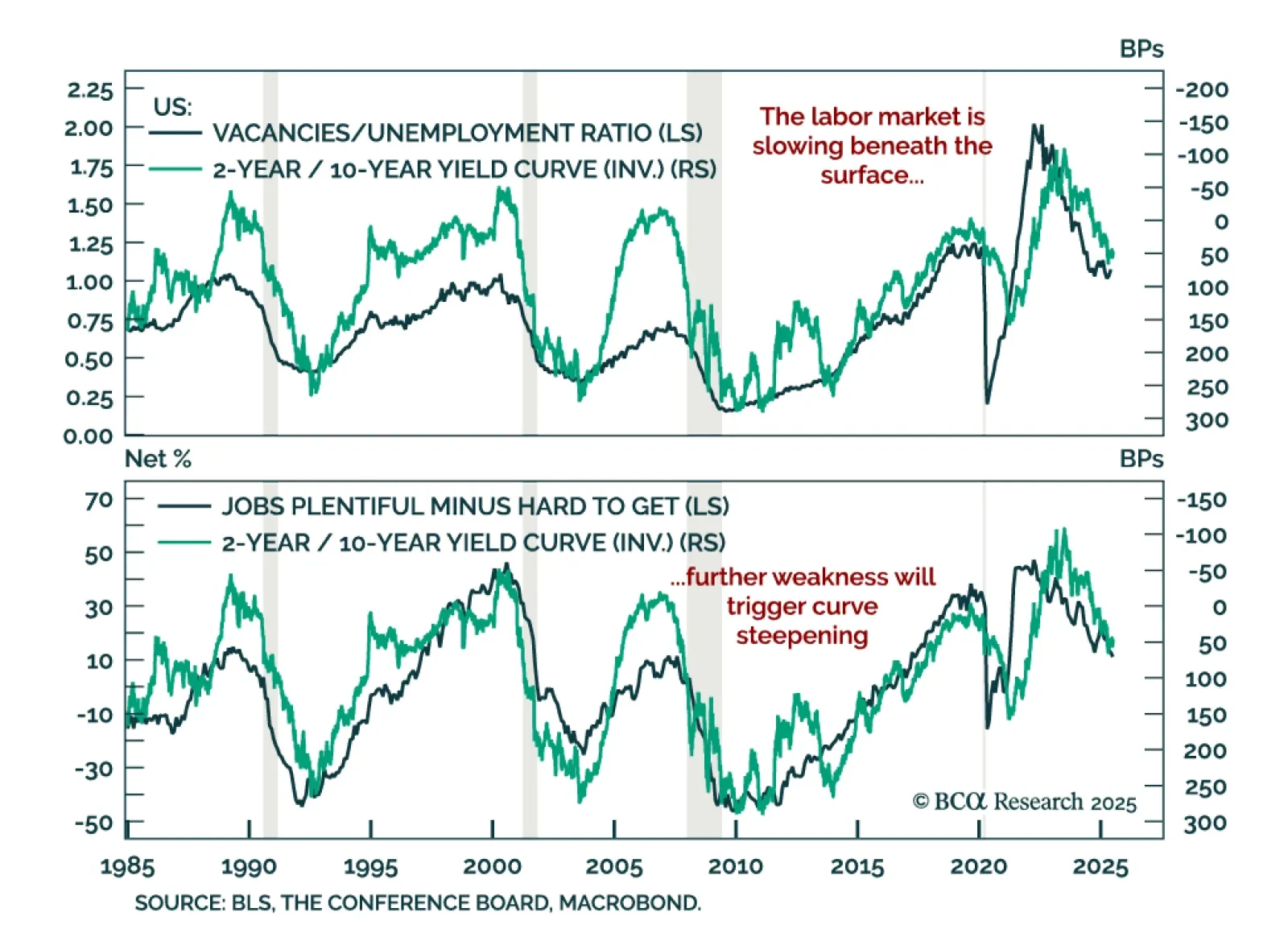

We still believe a recession looms, but it has yet to rear its ugly head. We continue to recommend investors position defensively, but we will change tack if clear signs of a recession don’t emerge soon.

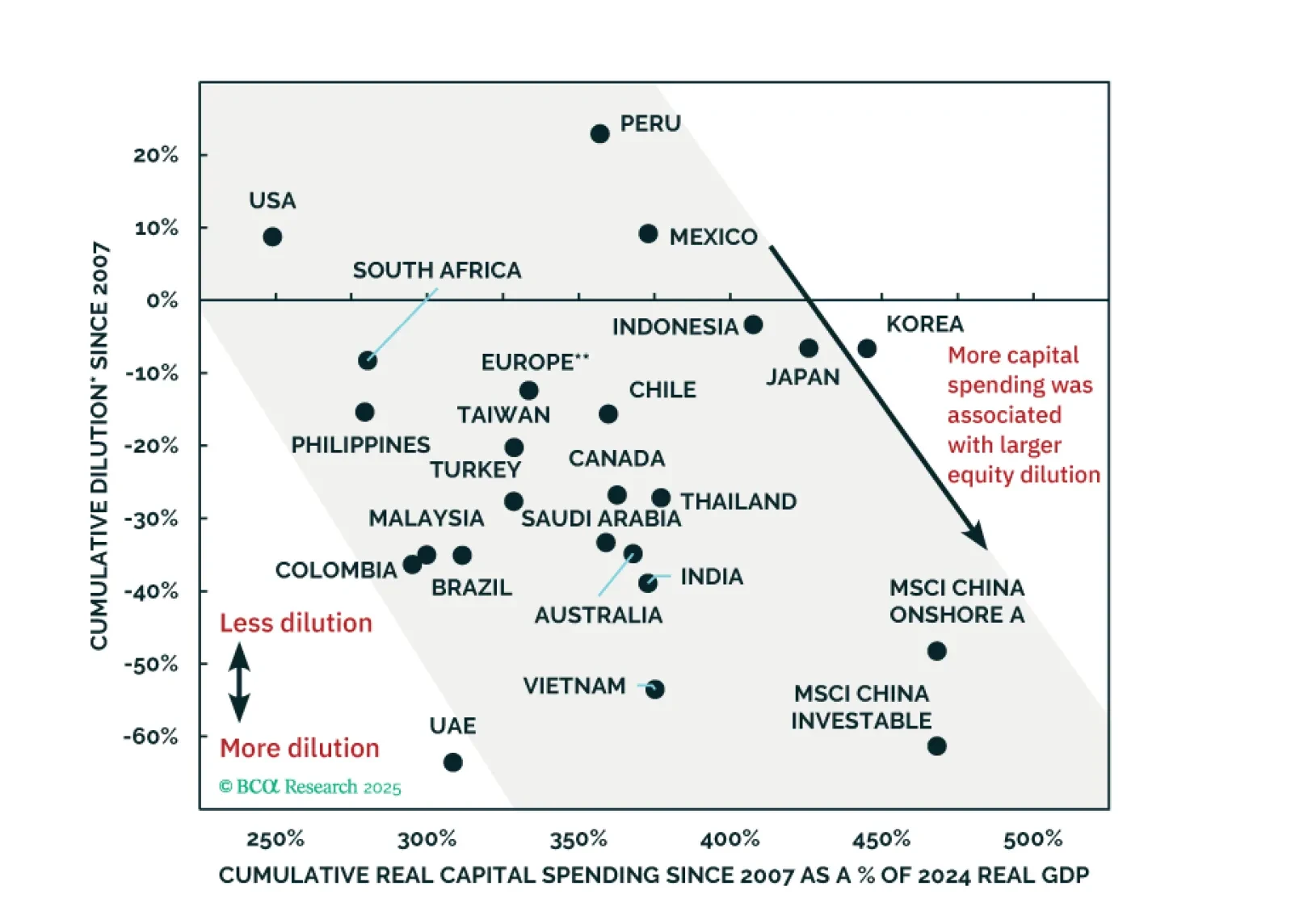

Economic growth and rapid expansions do not always translate into higher EPS and shareholder returns. One of the key reasons is dilution. We offer a typology of dilution: (1) “offensive”, (2) “defensive”, (3) corporate governance-linked, and (4) idiosyncratic cases.

1

DIN250708PMA…

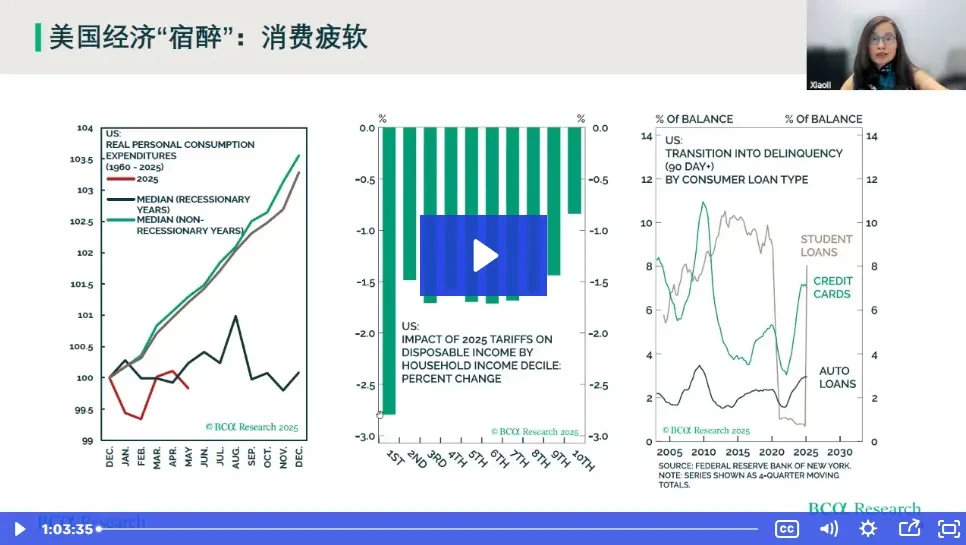

全球市场正从疫情后的刺激与错配中走出。“宿醉” 初醒,各类资产进入新一轮定价周期。在结构变化加速之际,小莉将讨论如何在全球 “宿醉期” 中稳健前行、寻找超额回报。