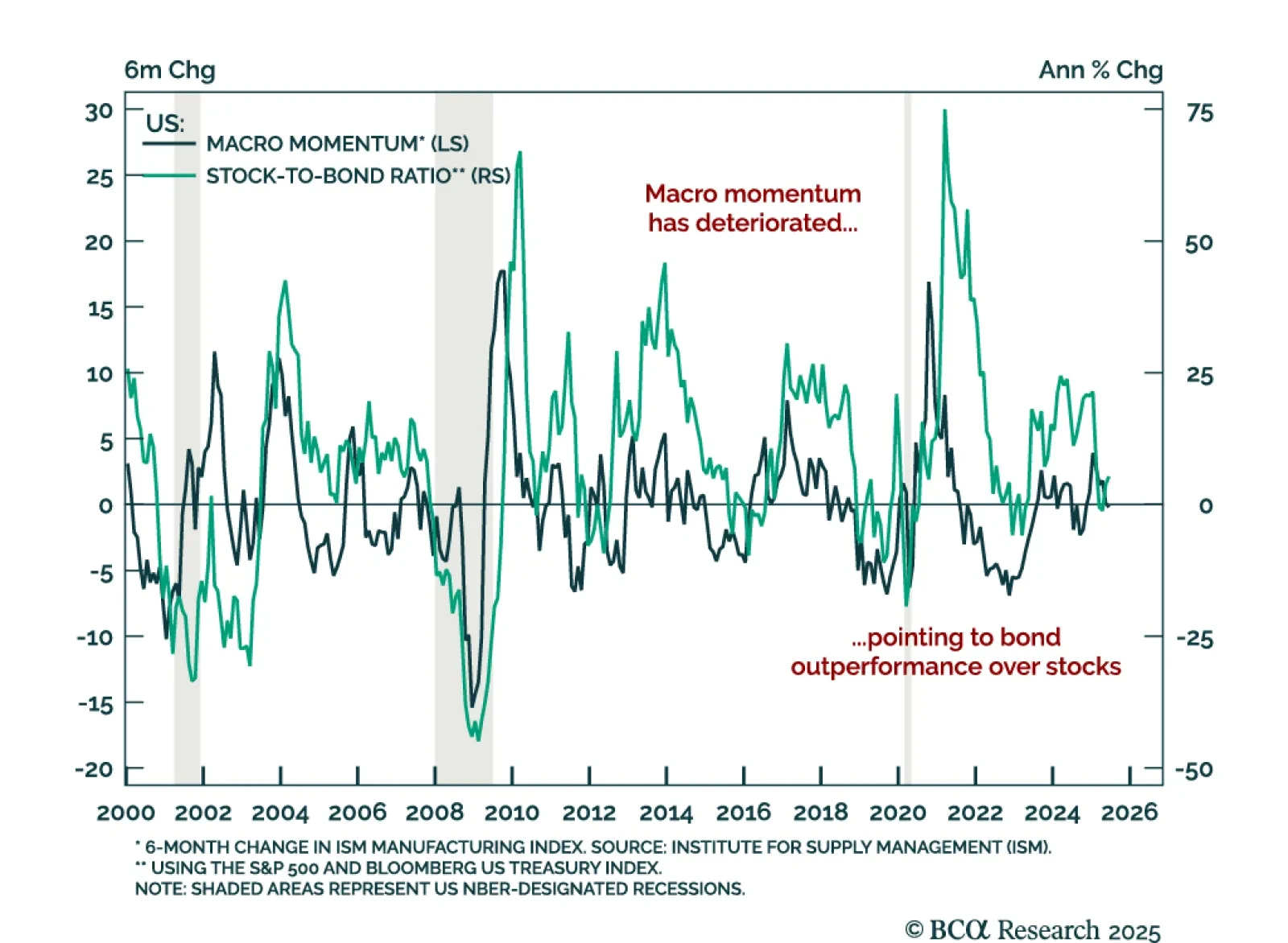

Deteriorating macro momentum supports a defensive asset allocation stance as hard data deteriorates. Last week’s ISM Manufacturing and Services PMIs confirmed that growth is slowing and price pressures are easing from a high level.…

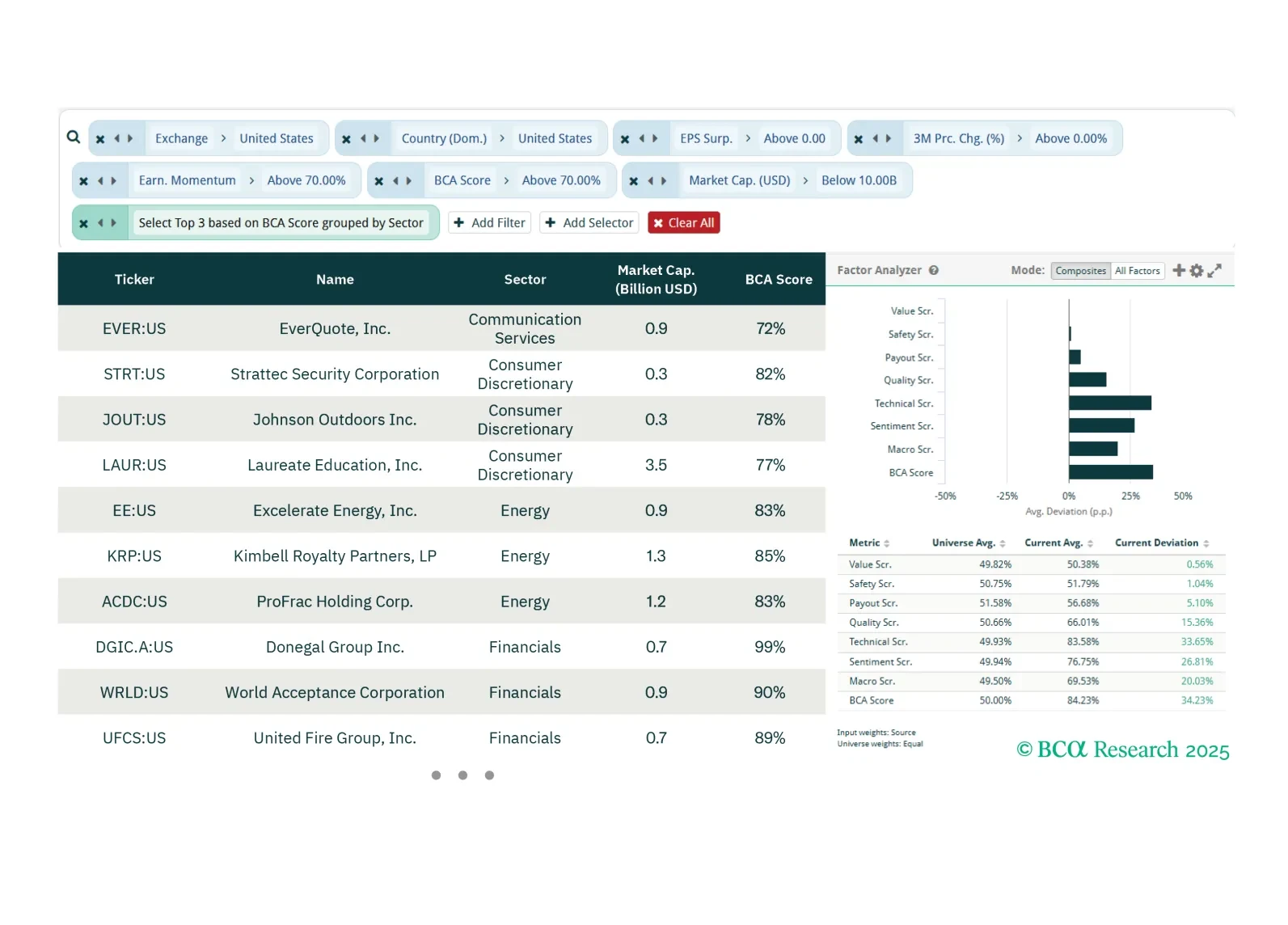

This week our three screeners identify stocks that are likely to keep delivering deliver earnings surprises in the US, European small caps that are high quality and mean reverting, and Japanese large caps picks across GICS 1 sectors…

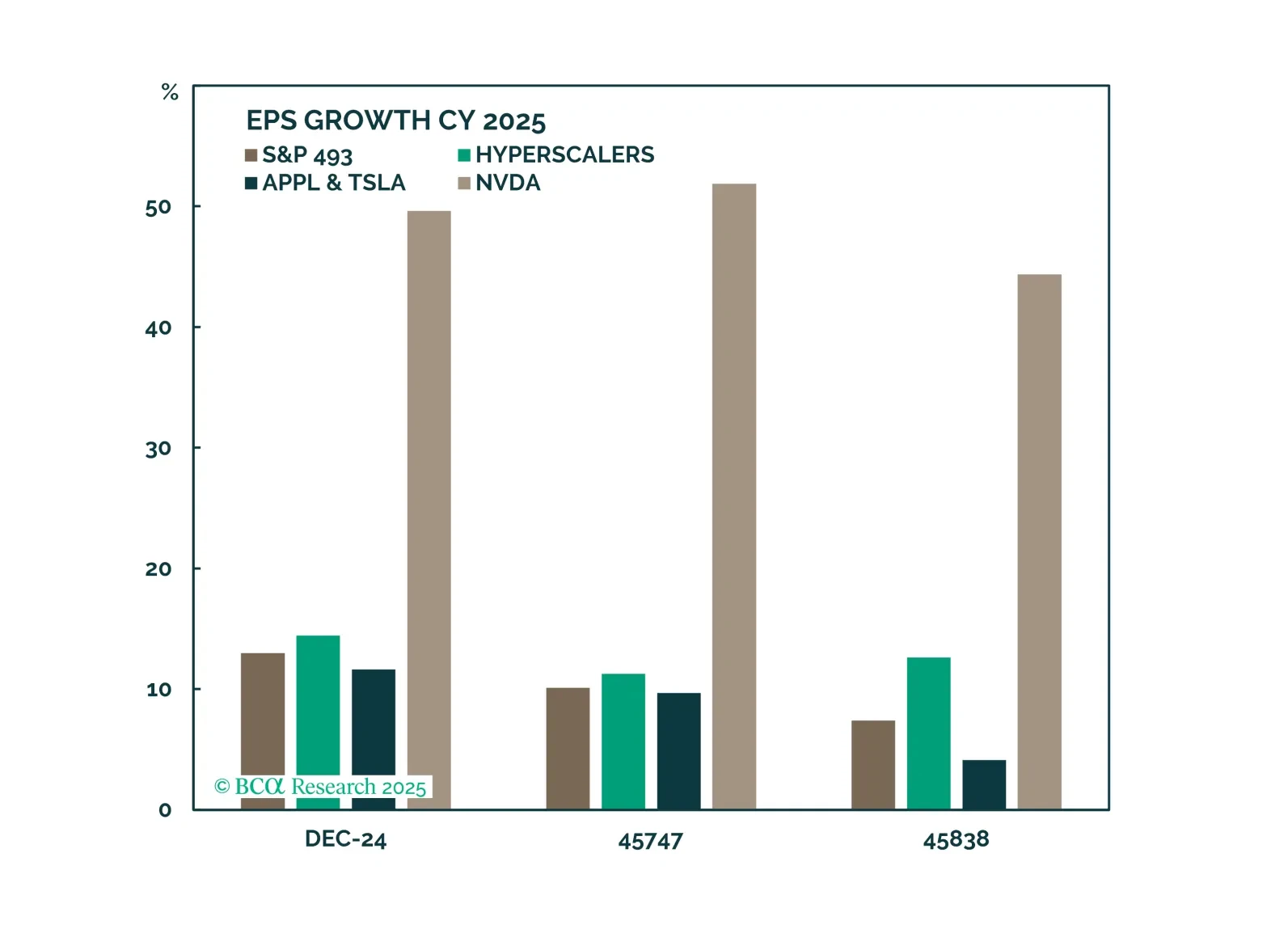

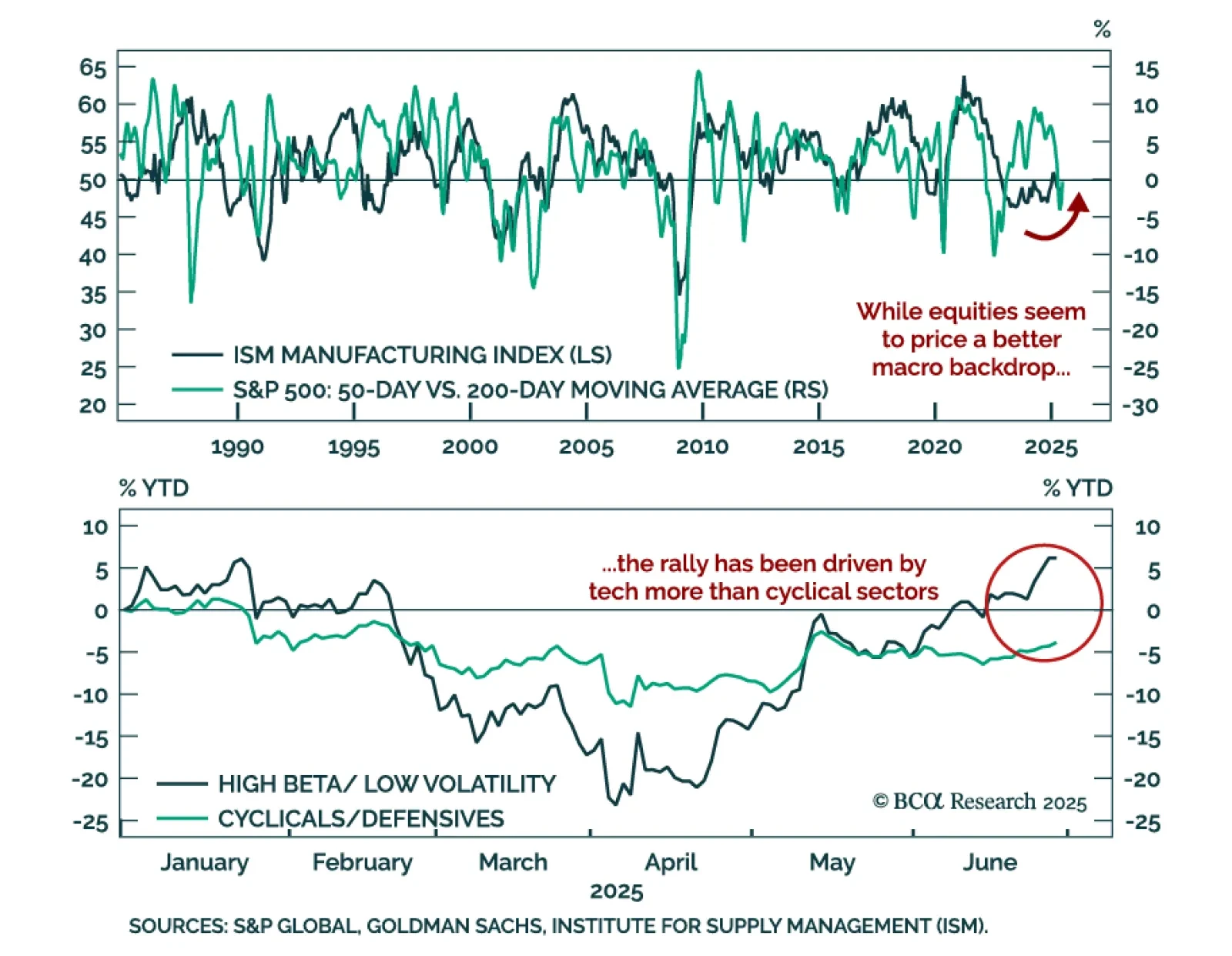

Earnings growth should continue to support equity performance this year. However, after blockbuster gains, some profit-taking is likely. We recommend booking profits and increasing exposure to Defensives.

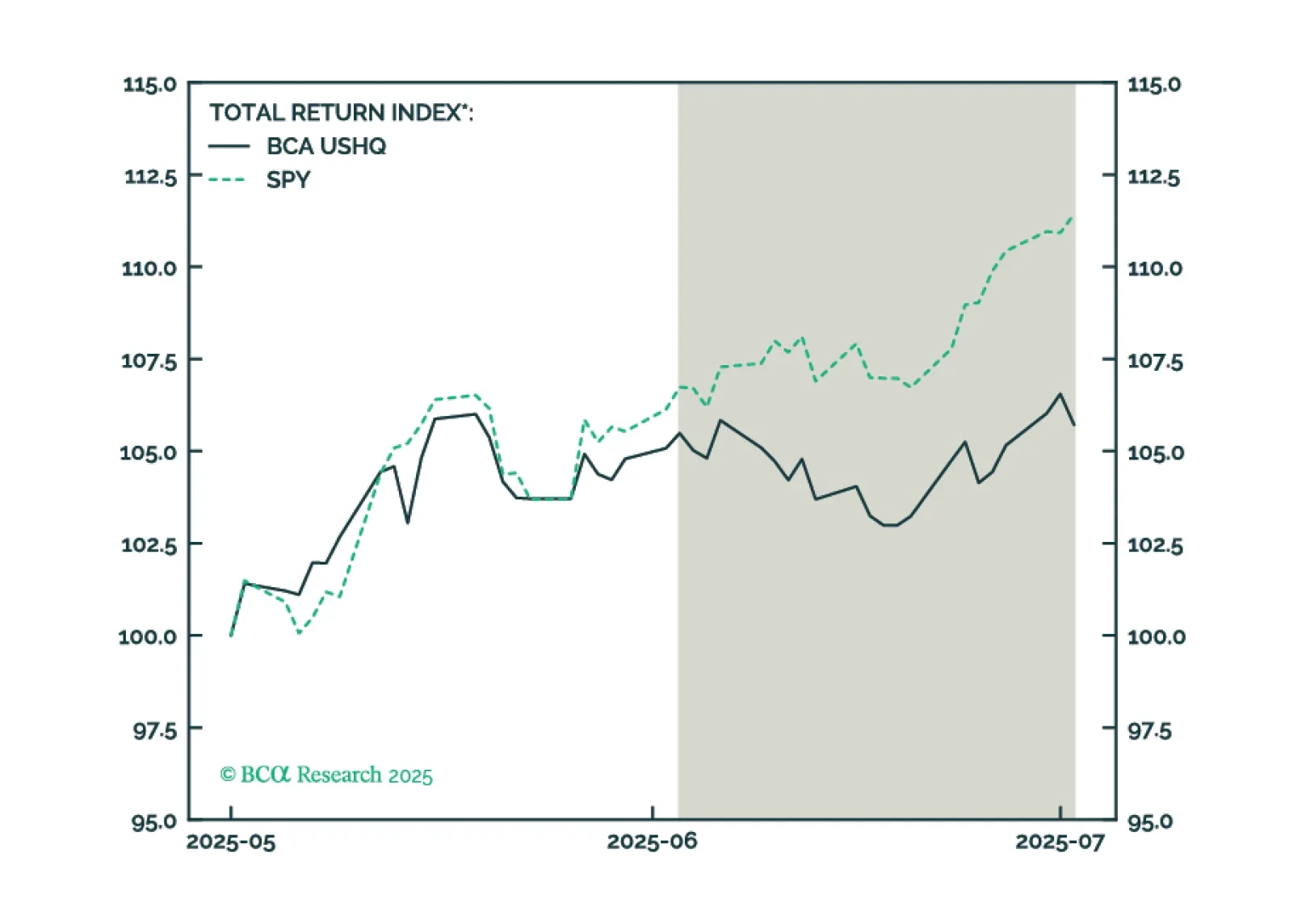

The US High Quality (USHQ) portfolio underperformed its benchmark through June, returning 1.2%, whilst its SPY benchmark returned 5.1%. On a trailing three-month basis, performance was notably weak vs. benchmark, with USHQ…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

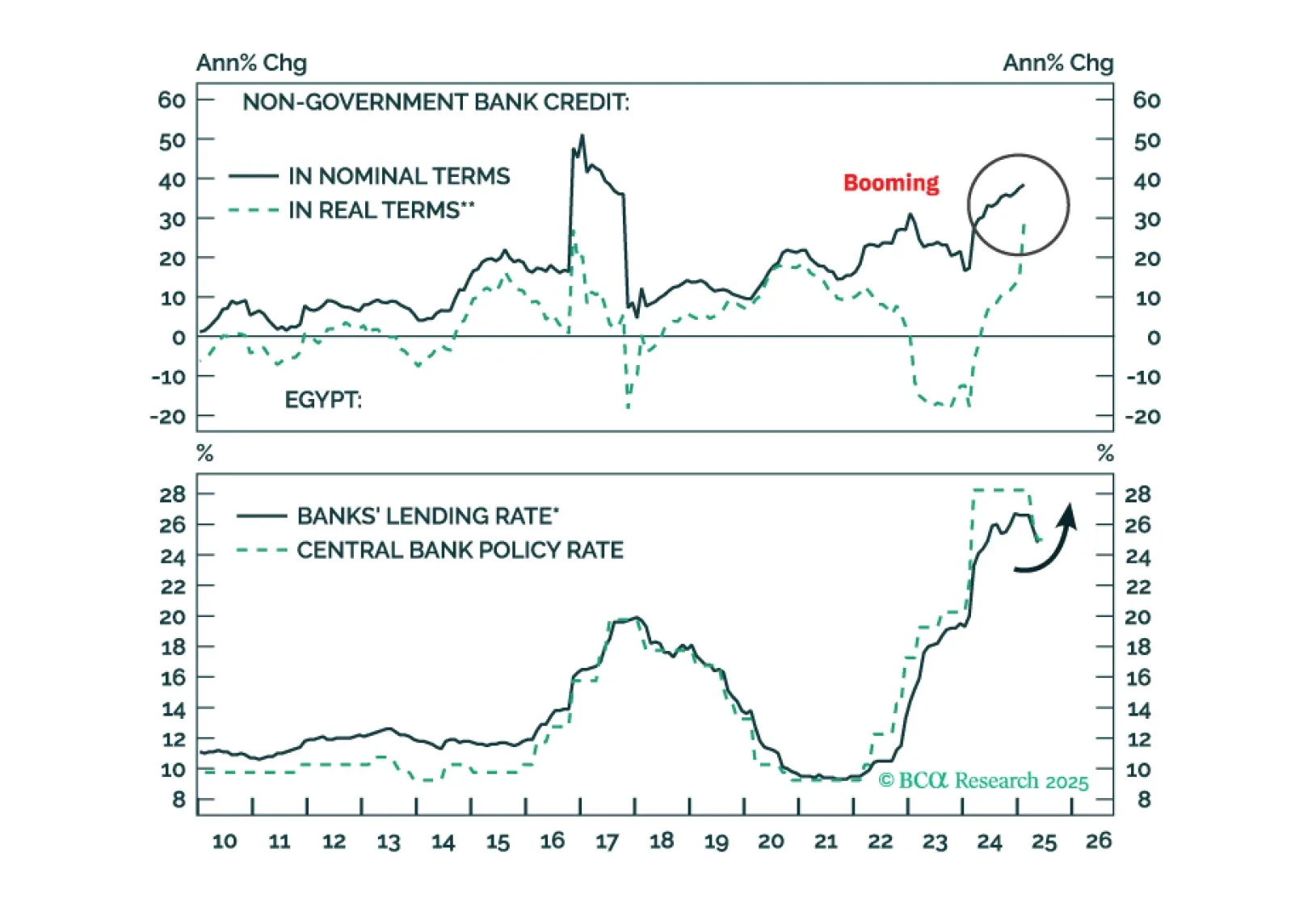

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

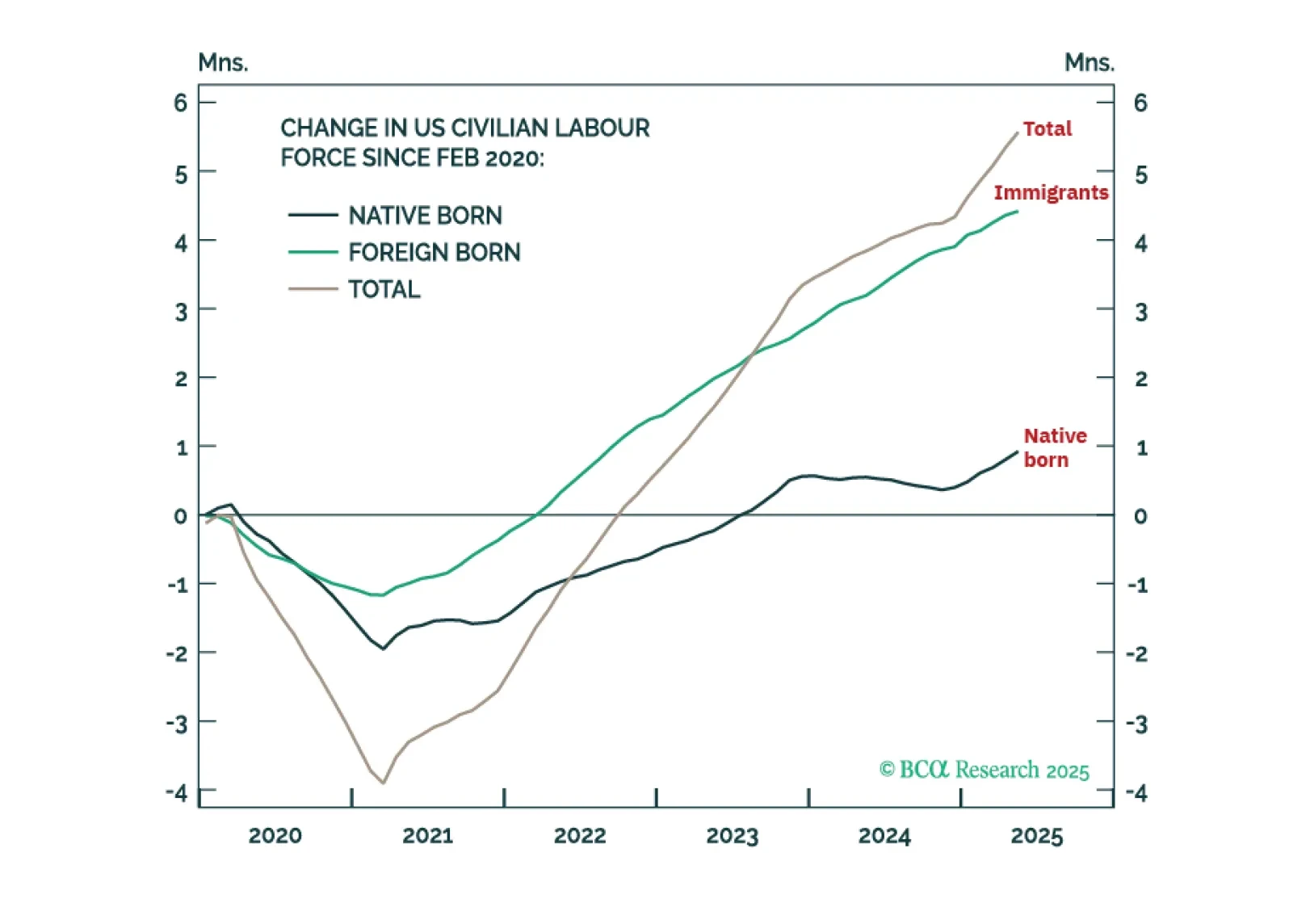

Trump’s immigration policies are protecting the US economy from a sharp rise in unemployment but steering it into a ‘mini stagflation’. Plus: a new tactical trade is to underweight global technology (IXN).

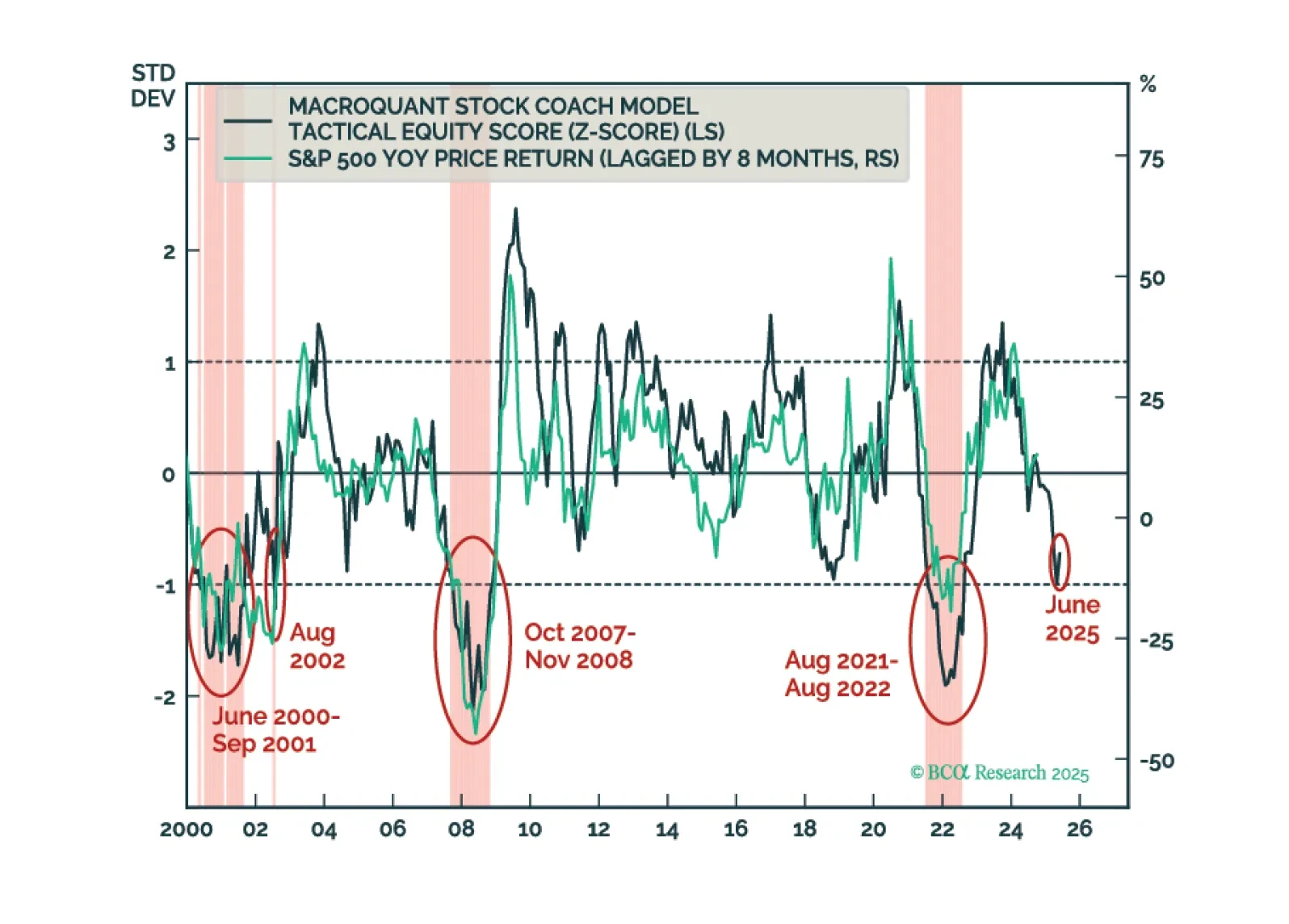

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Regional Fed surveys confirm sluggish US manufacturing and tame inflation, supporting long duration positioning outside the US. The June Dallas Fed Manufacturing survey missed expectations, rising to -12.7 from -15.3, still deep in…

Tech-led momentum is driving the S&P 500 to new highs despite weak growth and rising cyclical risks. The rally has accelerated following a de-escalation in geopolitical tensions and ongoing hopes for positive trade developments.…