Erdogan will most likely lose the Turkish election but it could go onto a second round. A strong opposition majority in the assembly would justify a tactical overweight in Turkish equities on a relative basis. For now, go long…

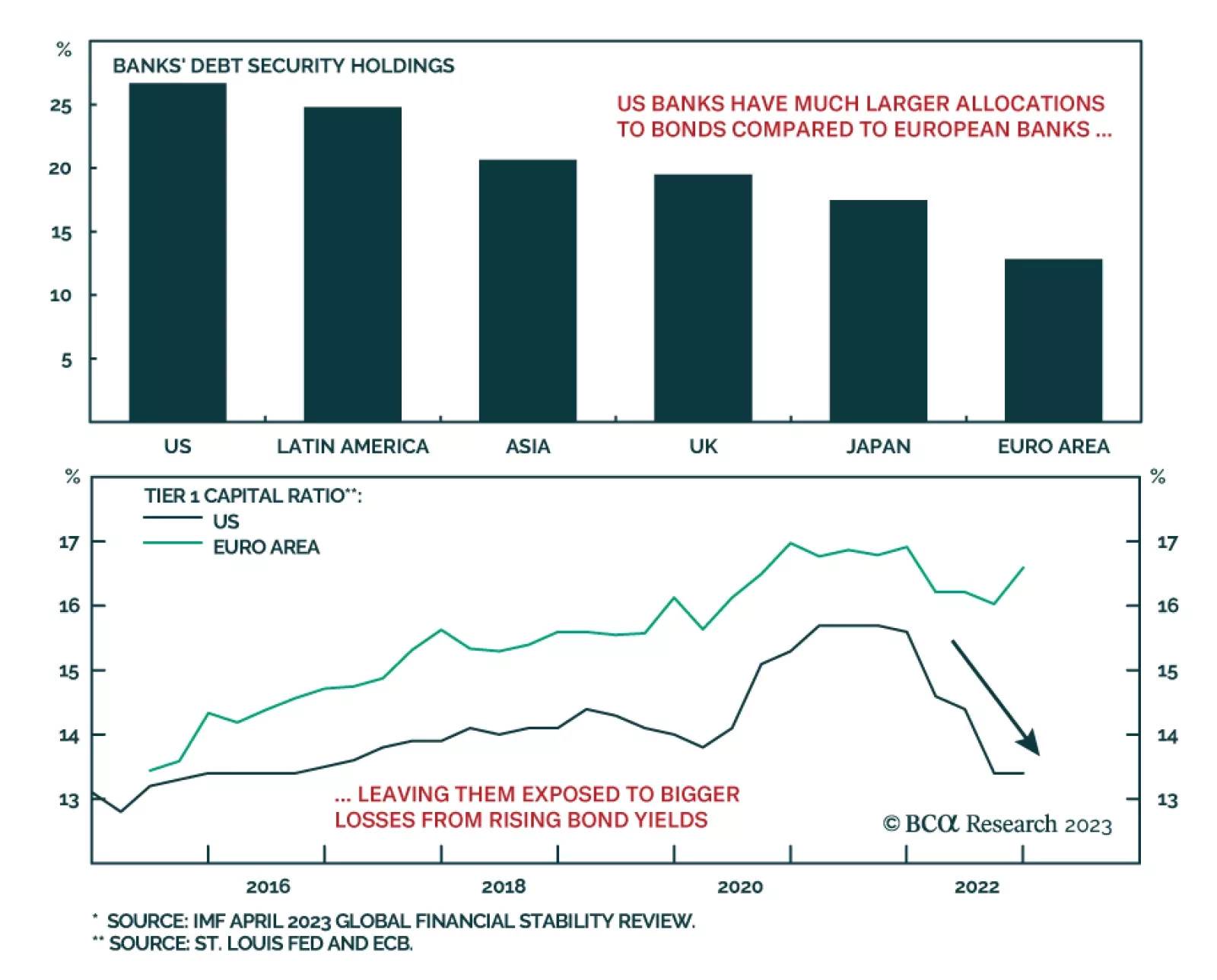

The turmoil within the US regional banks over the past two months has resulted in a notable, and widening, divergence in the performance of US and European bank shares. Since the beginning of March, just before the problems with…

There is a 50:50 chance of experiencing a major deflationary shock in the next two years, and an even greater likelihood on a longer timeframe. The good news is that several assets provide a good insurance against this risk, and that…

This week we are sending you a transcript of my conversation with one of China’s most prominent and influential pro-market economists. Topics raised during my conversation with this Chinese expert may offer our clients important…

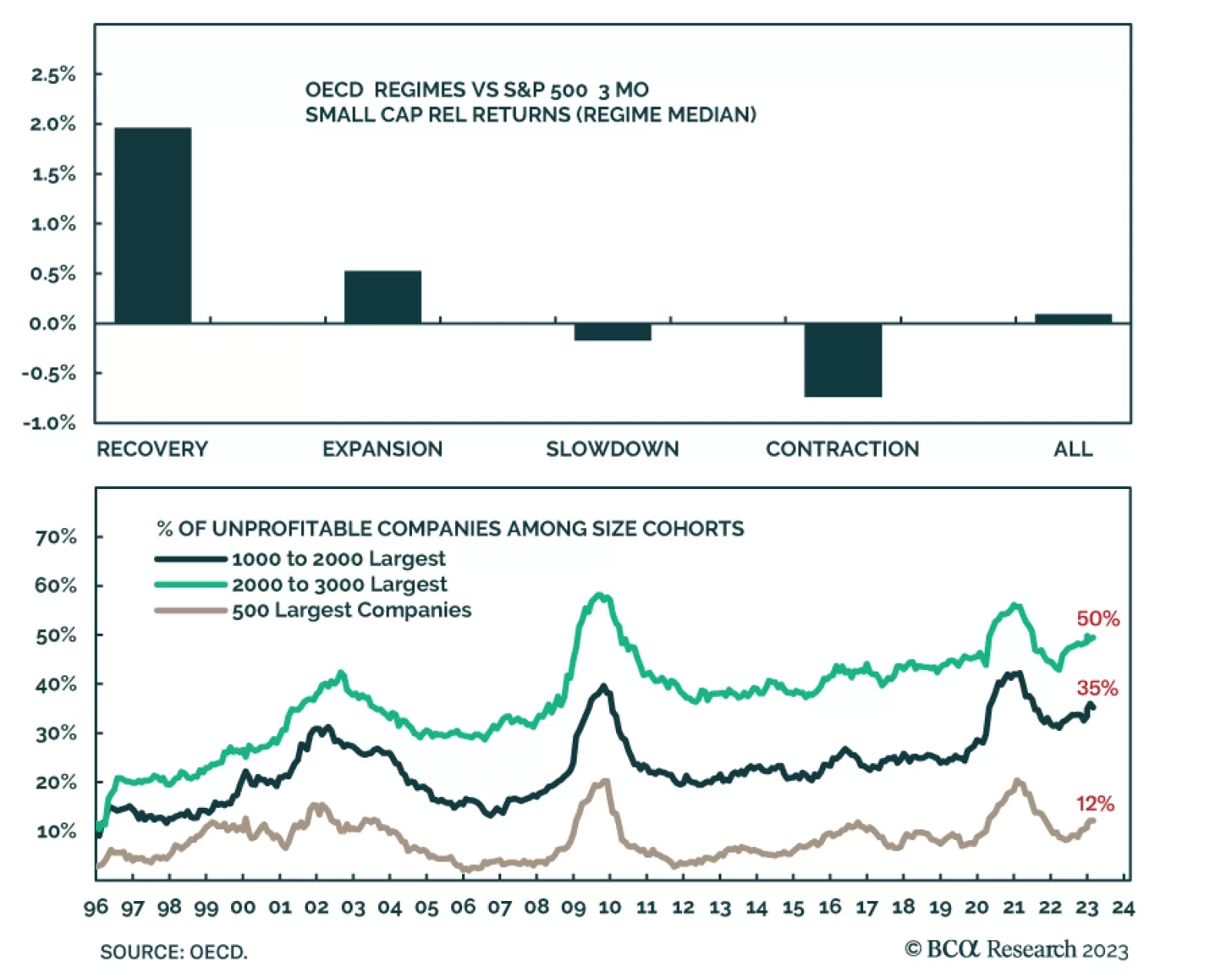

Small is out of investors’ favor yet again and is down 13% off its February 3rd peak. The S&P 600 is now unusually cheap and trades 13x forward earnings, a 25% discount to the S&P 500. According to the BCA Technical…

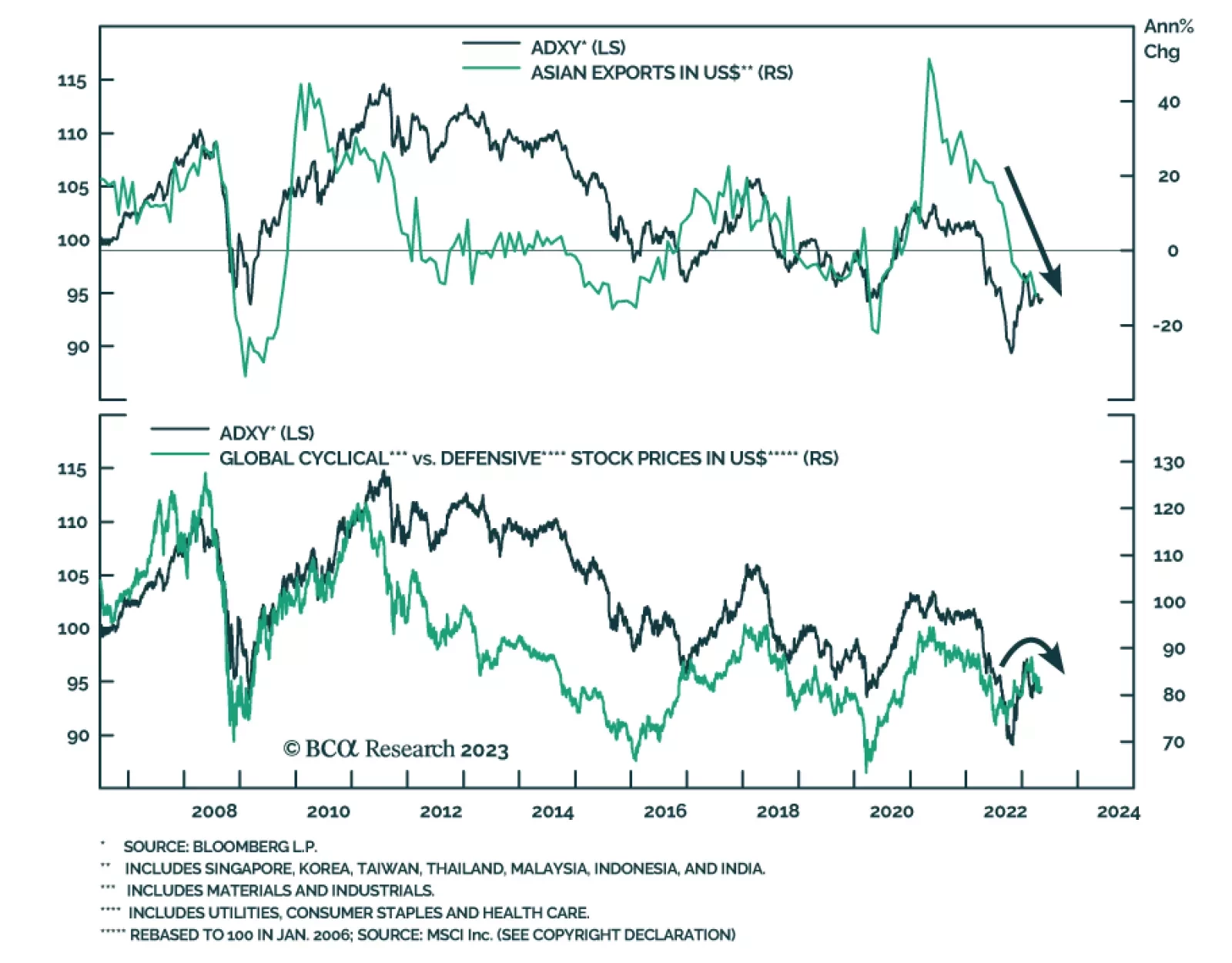

In an insight published a couple of weeks ago, we highlighted that the typically inverse relationship between the ADXY index of Asian currencies and the DXY recently broke down with both declining over the past few weeks. In…

Although our take has not changed yet, the immediate emergence of a second wave of banking system stresses poses a new threat to our constructive near-term economic and market views and will have to be monitored carefully.

If the recession begins this year, it is unlikely to be mild, because inflation will not have fallen by enough to allow the Fed to cut rates aggressively. In contrast, if the recession starts in 2024 or later, when inflation is…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

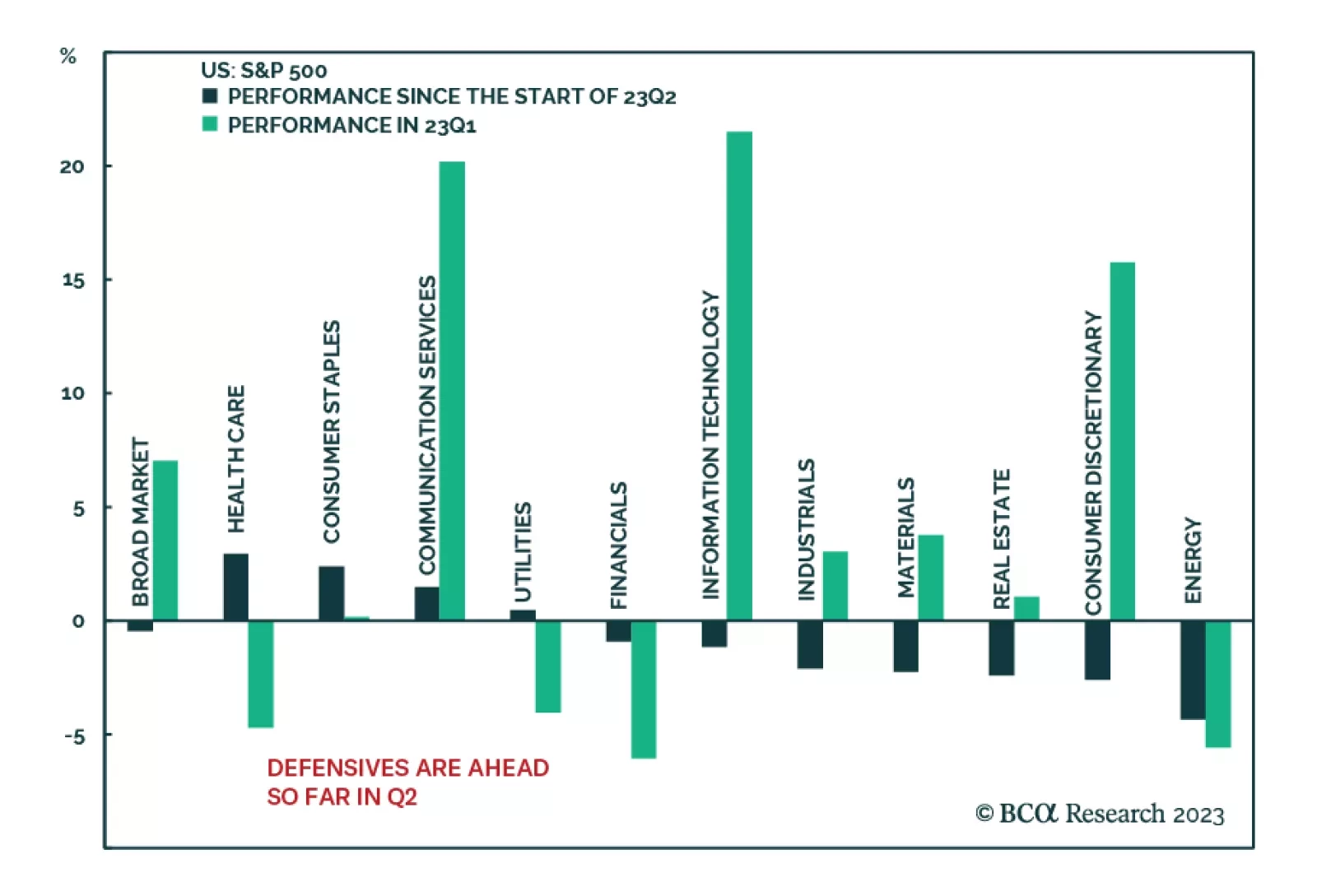

The S&P 500 is broadly unchanged from where it was at the end of Q1. It ended the day on Wednesday 0.5% below its level on the last day of March. However, the calm surface conceals some subterranean activity. Specifically…